Go Back

Last Updated :

Last Updated :

Nov 24, 2025

Nov 24, 2025

Small Business Tax Prep Checklist: What to Gather, What to File, and When

Tax season can sneak up on small business owners. Between running your day-to-day operations, managing customers, and keeping your team supported, sorting through forms and deadlines is probably the last thing you want to think about.

But with the right preparation, tax season doesn’t have to be stressful. This guide breaks everything down in plain English—what taxes you owe, what forms you need, what documents to gather, and how to stay ahead of deadlines. Use it as your go-to small business tax preparation checklist to stay organized all year.

Understanding Small Business Tax Requirements

Small business taxes aren’t one-size-fits-all. What you owe depends on factors like your business structure, where you operate, and whether you have employees.

At a high level, business taxes fall into two buckets:

Personal taxes (filed annually)

Business taxes (often paid quarterly)

Staying ahead of the quarterly payments is especially important—they help you avoid penalties and keep cash flow predictable.

What Shapes Your Tax Obligations

A few big things determine what you owe:

Your business structure (sole prop, LLC, S-Corp, C-Corp)

Your location (state and local rules vary)

What deductions or credits you qualify for

Understanding these early will save you time—and headaches—when it’s time to file.

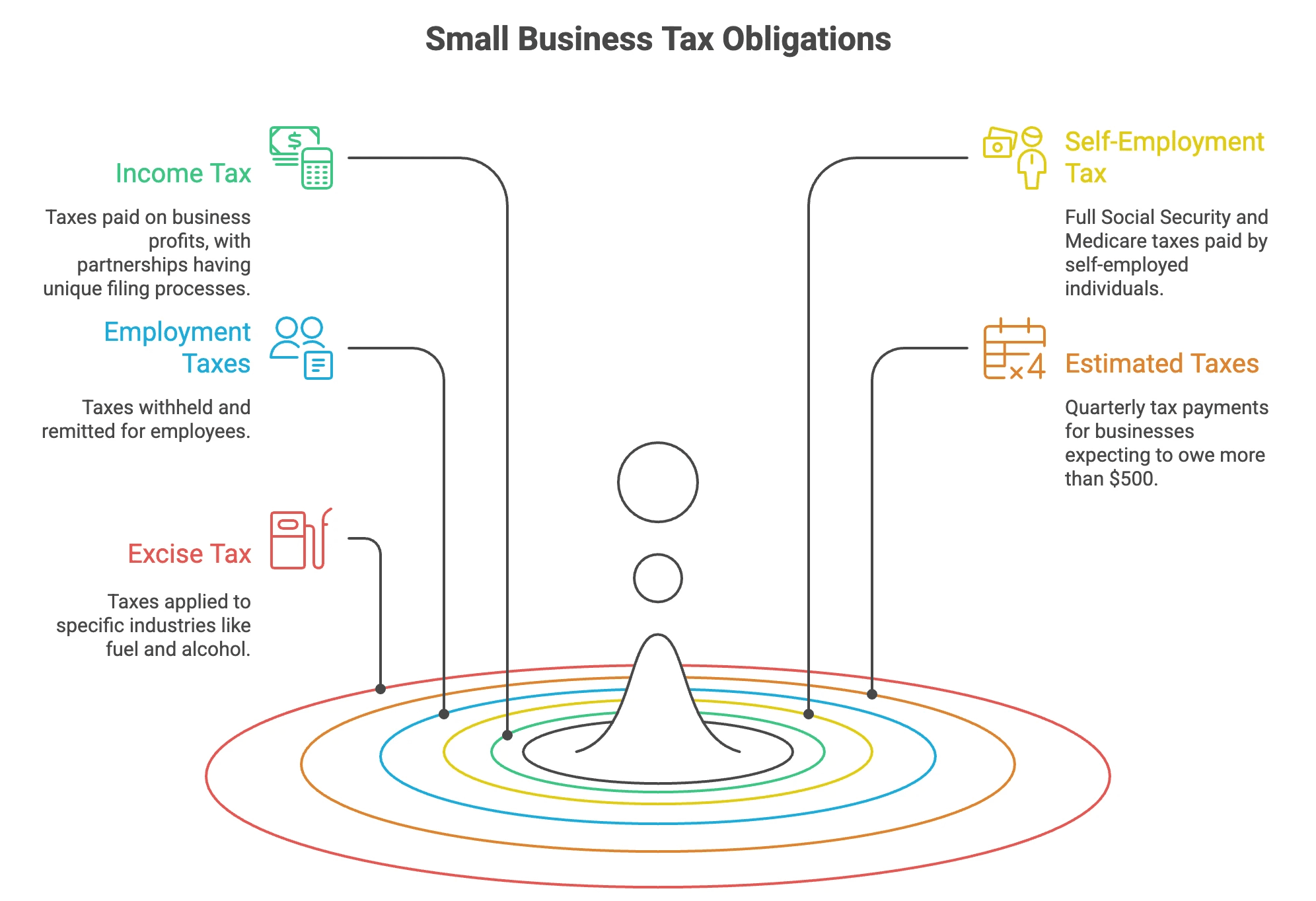

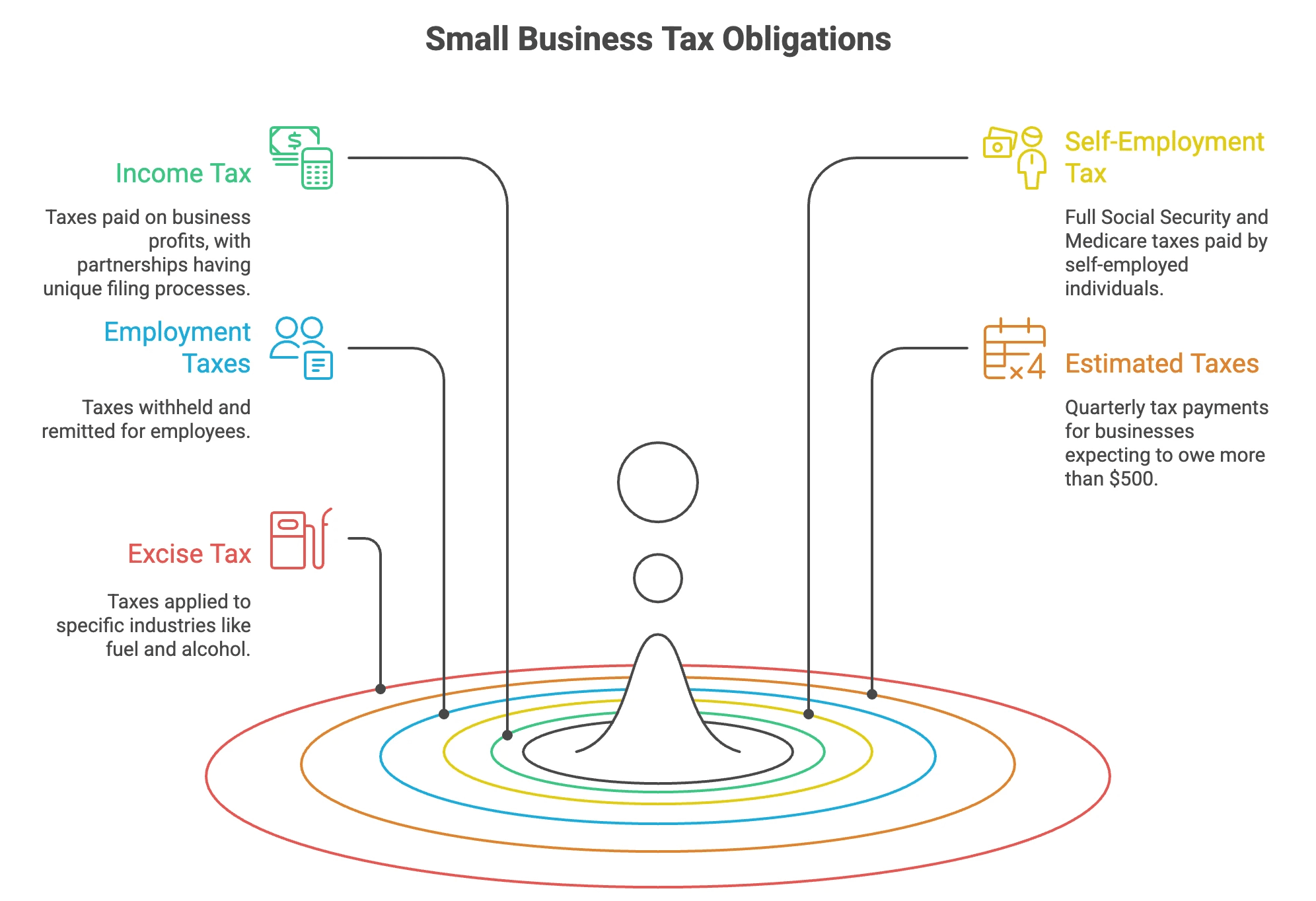

Federal Taxes Most Small Businesses Deal With

Income tax – What your business pays on profits. Partnerships file differently, but the income still flows to partners’ personal returns.

Self-employment tax – If you’re self‑employed, you pay the full 15.3% toward Social Security and Medicare.

Employment taxes – If you have employees, you’re responsible for withholding and remitting taxes on their behalf.

Estimated taxes – If you expect to owe more than $500, you’ll pay quarterly.

Excise tax – Only applies to specific industries (fuel, alcohol, tobacco, etc.).

State & Local Taxes to Know

Depending on where you operate, you may also owe:

State income tax

Sales tax

Property tax

Local business licenses or fees

Every state runs things a little differently, so be sure to check your local rules.

How Business Structure Impacts Your Taxes

Here’s the quick version:

Sole proprietors report business income on their personal return.

LLCs can be taxed like sole proprietors, partnerships, or corporations.

C‑Corps file their own return and pay corporate tax.

S‑Corps pass income through to owners but have special eligibility rules.

If you have employees, you’ll also withhold payroll taxes and file payroll reports.

Your Small Business Tax Preparation Checklist

This checklist helps you get everything ready before you file.

1. Confirm Your Business Structure

Your structure determines your tax rate, what forms you need, and which deductions you qualify for. It’s worth double-checking that the IRS has you classified correctly.

2. Gather All Financial Documents

This step saves the most time—and prevents missed deductions.

Gather:

Profit and loss statements

Expense receipts

Bank and credit card statements

Payroll records

Invoices

1099 forms (received or issued)

Loan interest statements

If you use bookkeeping software, a lot of this should already be organized.

3. Figure Out Which IRS Forms Apply to You

Here are the most common ones:

Schedule C: Sole proprietors

Schedule K-1: Partnerships and S‑Corps

1099-NEC: Contractors you’ve paid

1099-MISC: Rent, legal payments, prizes

Form 1120: C‑Corps

Form 1120-S: S‑Corps

Form 1065: Partnerships

Form 720: Excise taxes

A CPA can confirm which apply to your business, especially if you operate in multiple states.

4. Track All Income Sources

Don’t wait until January to figure this out. Track:

Sales revenue

Service income

Subscription or recurring revenue

Investment income

Any income that will appear on 1099 forms

Your books should reflect income as it happens—not months later.

5. Organize Business Expenses

Deductible expenses reduce your taxable income. Save receipts and categorize:

Rent and utilities

Software and tools

Office supplies

Marketing and advertising

Travel

Insurance

Home office expenses

Work-from-home founders can often deduct a portion of rent or mortgage.

6. Calculate Quarterly Estimated Taxes

Expect to owe more than $500? You’ll need to pay quarterly.

Quarterly due dates:

April 15

June 15

September 15

January 15

7. Understand Self-Employment Taxes

Self-employed business owners pay both the employer and employee portions of Social Security and Medicare, totaling 15.3%.

Factor this into your quarterly payments.

8. Manage Payroll Taxes (If You Have Employees)

Your payroll responsibilities include:

Withholding the right taxes

Paying employer-side FICA

Filing quarterly payroll forms

Classifying workers correctly

Misclassifying employees as contractors is a common mistake—one that can be expensive to fix.

9. Look for Tax Deductions and Credits

Deductions you may qualify for:

Health insurance premiums

Retirement contributions

Marketing costs

Business-related education

You may also qualify for certain credits, depending on your location and industry.

10. Double-Check Employment Tax Compliance

Make sure you’re using the right forms:

W‑4 for employees

1099‑NEC for contractors

11. Consider Working With a Tax Professional

A CPA who understands small business taxes can:

Prevent mistakes

Help you avoid penalties

Catch deductions you might overlook

Save you hours (and stress)

12. Plan Ahead for Next Year

Set up bookkeeping systems now to make next year easier:

Track expenses monthly

Keep digital receipts

Regularly update your accounting software

Good financial hygiene today makes tax season faster, cheaper, and less stressful.

Key Small Business Tax Deadlines

Here are the dates most small business owners need to watch.

Annual Filing Deadlines (2025)

April 15 – Most small businesses

April 17 – Maine and Massachusetts

May 1 – Disaster-area extensions

June 16 – U.S. citizens abroad

Quarterly Estimated Tax Deadlines

January 15, 2025 – Final 2024 payment

April 15, 2025 – Q1

June 16, 2025 – Q2

September 15, 2025 – Q3

LLC Filing Deadlines

LLCs taxed as sole proprietors: April 15

LLCs taxed as corporations: April 15, or the 15th day of the fourth month after fiscal year end

Employment Tax Deadlines

Monthly deposits: 15th of each month

Semiweekly deposits: based on payroll timing

January 31: W‑2s, Forms 940/943

March 31: Electronic 1094/1095 filings

April 30, July 31, Oct 31, Jan 31: Quarterly payroll returns (Form 941)

Extensions

Need more time? File Form 4868 for an automatic 6‑month extension. Just remember: you still need to pay any taxes owed by the original deadline.

Haven: Financial Ops for Small Businesses, Handled

Let your business take flight while Haven manages your financial runway. We handle bookkeeping, payroll, tax prep, and credits—so you can focus on serving customers instead of sorting through forms.

More than 400 businesses rely on Haven to stay compliant, save hours each month, and avoid costly mistakes.

Book a call and get financial ops that move as fast as you do.

Tax season can sneak up on small business owners. Between running your day-to-day operations, managing customers, and keeping your team supported, sorting through forms and deadlines is probably the last thing you want to think about.

But with the right preparation, tax season doesn’t have to be stressful. This guide breaks everything down in plain English—what taxes you owe, what forms you need, what documents to gather, and how to stay ahead of deadlines. Use it as your go-to small business tax preparation checklist to stay organized all year.

Understanding Small Business Tax Requirements

Small business taxes aren’t one-size-fits-all. What you owe depends on factors like your business structure, where you operate, and whether you have employees.

At a high level, business taxes fall into two buckets:

Personal taxes (filed annually)

Business taxes (often paid quarterly)

Staying ahead of the quarterly payments is especially important—they help you avoid penalties and keep cash flow predictable.

What Shapes Your Tax Obligations

A few big things determine what you owe:

Your business structure (sole prop, LLC, S-Corp, C-Corp)

Your location (state and local rules vary)

What deductions or credits you qualify for

Understanding these early will save you time—and headaches—when it’s time to file.

Federal Taxes Most Small Businesses Deal With

Income tax – What your business pays on profits. Partnerships file differently, but the income still flows to partners’ personal returns.

Self-employment tax – If you’re self‑employed, you pay the full 15.3% toward Social Security and Medicare.

Employment taxes – If you have employees, you’re responsible for withholding and remitting taxes on their behalf.

Estimated taxes – If you expect to owe more than $500, you’ll pay quarterly.

Excise tax – Only applies to specific industries (fuel, alcohol, tobacco, etc.).

State & Local Taxes to Know

Depending on where you operate, you may also owe:

State income tax

Sales tax

Property tax

Local business licenses or fees

Every state runs things a little differently, so be sure to check your local rules.

How Business Structure Impacts Your Taxes

Here’s the quick version:

Sole proprietors report business income on their personal return.

LLCs can be taxed like sole proprietors, partnerships, or corporations.

C‑Corps file their own return and pay corporate tax.

S‑Corps pass income through to owners but have special eligibility rules.

If you have employees, you’ll also withhold payroll taxes and file payroll reports.

Your Small Business Tax Preparation Checklist

This checklist helps you get everything ready before you file.

1. Confirm Your Business Structure

Your structure determines your tax rate, what forms you need, and which deductions you qualify for. It’s worth double-checking that the IRS has you classified correctly.

2. Gather All Financial Documents

This step saves the most time—and prevents missed deductions.

Gather:

Profit and loss statements

Expense receipts

Bank and credit card statements

Payroll records

Invoices

1099 forms (received or issued)

Loan interest statements

If you use bookkeeping software, a lot of this should already be organized.

3. Figure Out Which IRS Forms Apply to You

Here are the most common ones:

Schedule C: Sole proprietors

Schedule K-1: Partnerships and S‑Corps

1099-NEC: Contractors you’ve paid

1099-MISC: Rent, legal payments, prizes

Form 1120: C‑Corps

Form 1120-S: S‑Corps

Form 1065: Partnerships

Form 720: Excise taxes

A CPA can confirm which apply to your business, especially if you operate in multiple states.

4. Track All Income Sources

Don’t wait until January to figure this out. Track:

Sales revenue

Service income

Subscription or recurring revenue

Investment income

Any income that will appear on 1099 forms

Your books should reflect income as it happens—not months later.

5. Organize Business Expenses

Deductible expenses reduce your taxable income. Save receipts and categorize:

Rent and utilities

Software and tools

Office supplies

Marketing and advertising

Travel

Insurance

Home office expenses

Work-from-home founders can often deduct a portion of rent or mortgage.

6. Calculate Quarterly Estimated Taxes

Expect to owe more than $500? You’ll need to pay quarterly.

Quarterly due dates:

April 15

June 15

September 15

January 15

7. Understand Self-Employment Taxes

Self-employed business owners pay both the employer and employee portions of Social Security and Medicare, totaling 15.3%.

Factor this into your quarterly payments.

8. Manage Payroll Taxes (If You Have Employees)

Your payroll responsibilities include:

Withholding the right taxes

Paying employer-side FICA

Filing quarterly payroll forms

Classifying workers correctly

Misclassifying employees as contractors is a common mistake—one that can be expensive to fix.

9. Look for Tax Deductions and Credits

Deductions you may qualify for:

Health insurance premiums

Retirement contributions

Marketing costs

Business-related education

You may also qualify for certain credits, depending on your location and industry.

10. Double-Check Employment Tax Compliance

Make sure you’re using the right forms:

W‑4 for employees

1099‑NEC for contractors

11. Consider Working With a Tax Professional

A CPA who understands small business taxes can:

Prevent mistakes

Help you avoid penalties

Catch deductions you might overlook

Save you hours (and stress)

12. Plan Ahead for Next Year

Set up bookkeeping systems now to make next year easier:

Track expenses monthly

Keep digital receipts

Regularly update your accounting software

Good financial hygiene today makes tax season faster, cheaper, and less stressful.

Key Small Business Tax Deadlines

Here are the dates most small business owners need to watch.

Annual Filing Deadlines (2025)

April 15 – Most small businesses

April 17 – Maine and Massachusetts

May 1 – Disaster-area extensions

June 16 – U.S. citizens abroad

Quarterly Estimated Tax Deadlines

January 15, 2025 – Final 2024 payment

April 15, 2025 – Q1

June 16, 2025 – Q2

September 15, 2025 – Q3

LLC Filing Deadlines

LLCs taxed as sole proprietors: April 15

LLCs taxed as corporations: April 15, or the 15th day of the fourth month after fiscal year end

Employment Tax Deadlines

Monthly deposits: 15th of each month

Semiweekly deposits: based on payroll timing

January 31: W‑2s, Forms 940/943

March 31: Electronic 1094/1095 filings

April 30, July 31, Oct 31, Jan 31: Quarterly payroll returns (Form 941)

Extensions

Need more time? File Form 4868 for an automatic 6‑month extension. Just remember: you still need to pay any taxes owed by the original deadline.

Haven: Financial Ops for Small Businesses, Handled

Let your business take flight while Haven manages your financial runway. We handle bookkeeping, payroll, tax prep, and credits—so you can focus on serving customers instead of sorting through forms.

More than 400 businesses rely on Haven to stay compliant, save hours each month, and avoid costly mistakes.

Book a call and get financial ops that move as fast as you do.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026