Go Back

Last Updated :

Last Updated :

Nov 24, 2025

Nov 24, 2025

Ecommerce Sales Tax: Compliance Tips for Growing Businesses

Running an ecommerce business means juggling inventory, marketing, customer experience, and order fulfillment. But as you grow across channels and states, one responsibility becomes unavoidable: ecommerce sales tax compliance.

Sales tax for online businesses is no longer simple. States have different rules, thresholds change annually, and marketplace platforms only solve part of the problem. If you sell across Shopify, Amazon, Etsy, or multiple fulfillment networks, the tax complexity scales as fast as your revenue.

This guide breaks down what ecommerce founders need to know—how sales tax works, when you owe it, how ecommerce sales tax software helps, and how to avoid penalties as your business scales.

What Ecommerce Sales Tax Actually Means

Sales tax is a state-level tax charged on the sale of taxable goods and some services. For ecommerce companies, this includes most physical goods, many digital goods, and even certain subscription products, depending on the state.

The key thing founders often miss is this: sales tax is a trust tax. You collect it from customers on the state’s behalf. If you collect the wrong amount—or fail to remit it—you’re still responsible for paying it, even if your margins are tight.

And unlike income tax, which you pay once a year, sales tax is ongoing. You must track where your customers are located, understand what’s taxable, calculate the correct rate, and file returns on time.

It’s not fun, but it’s the reality of selling nationally.

Why Ecommerce Sales Tax Became So Complex

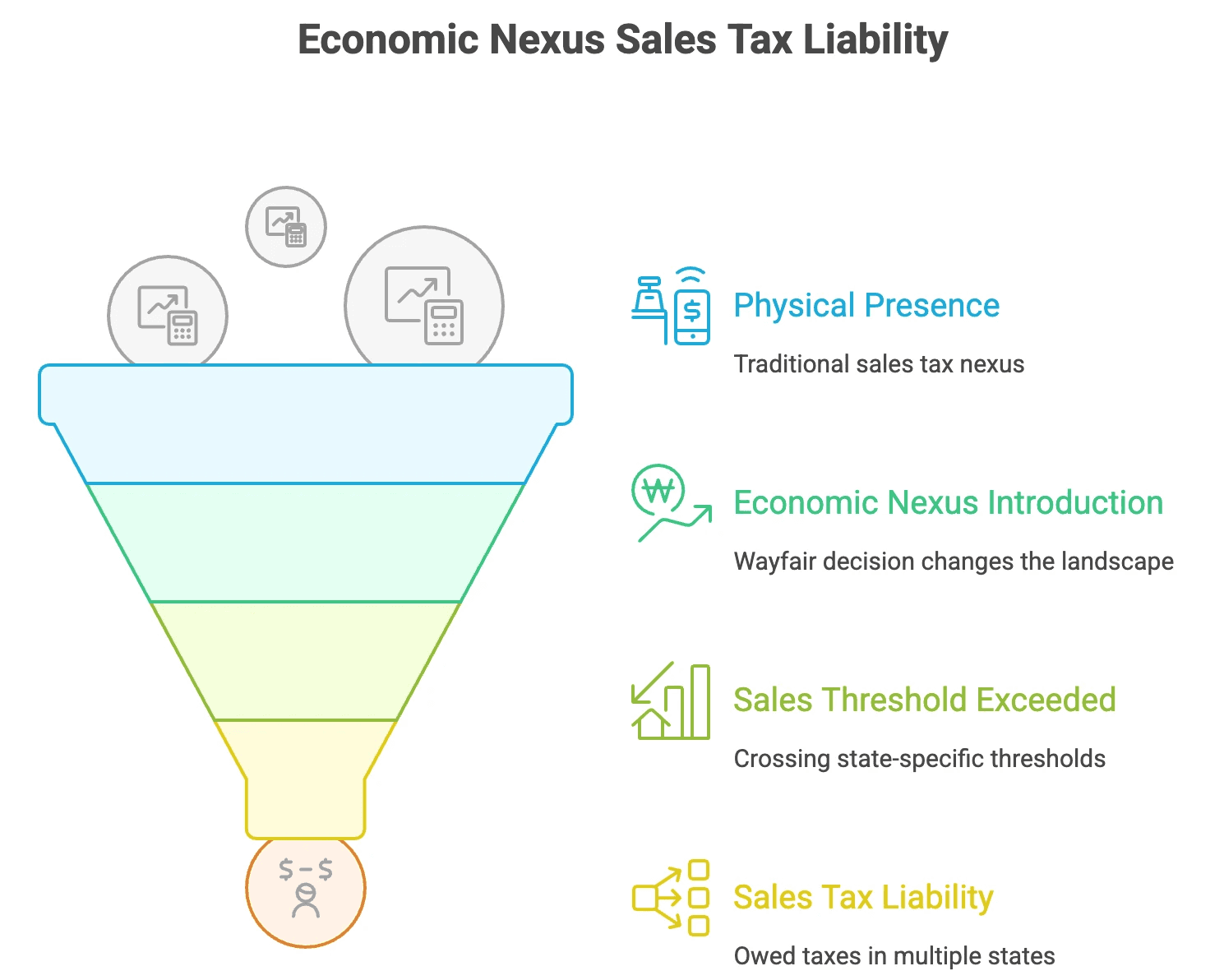

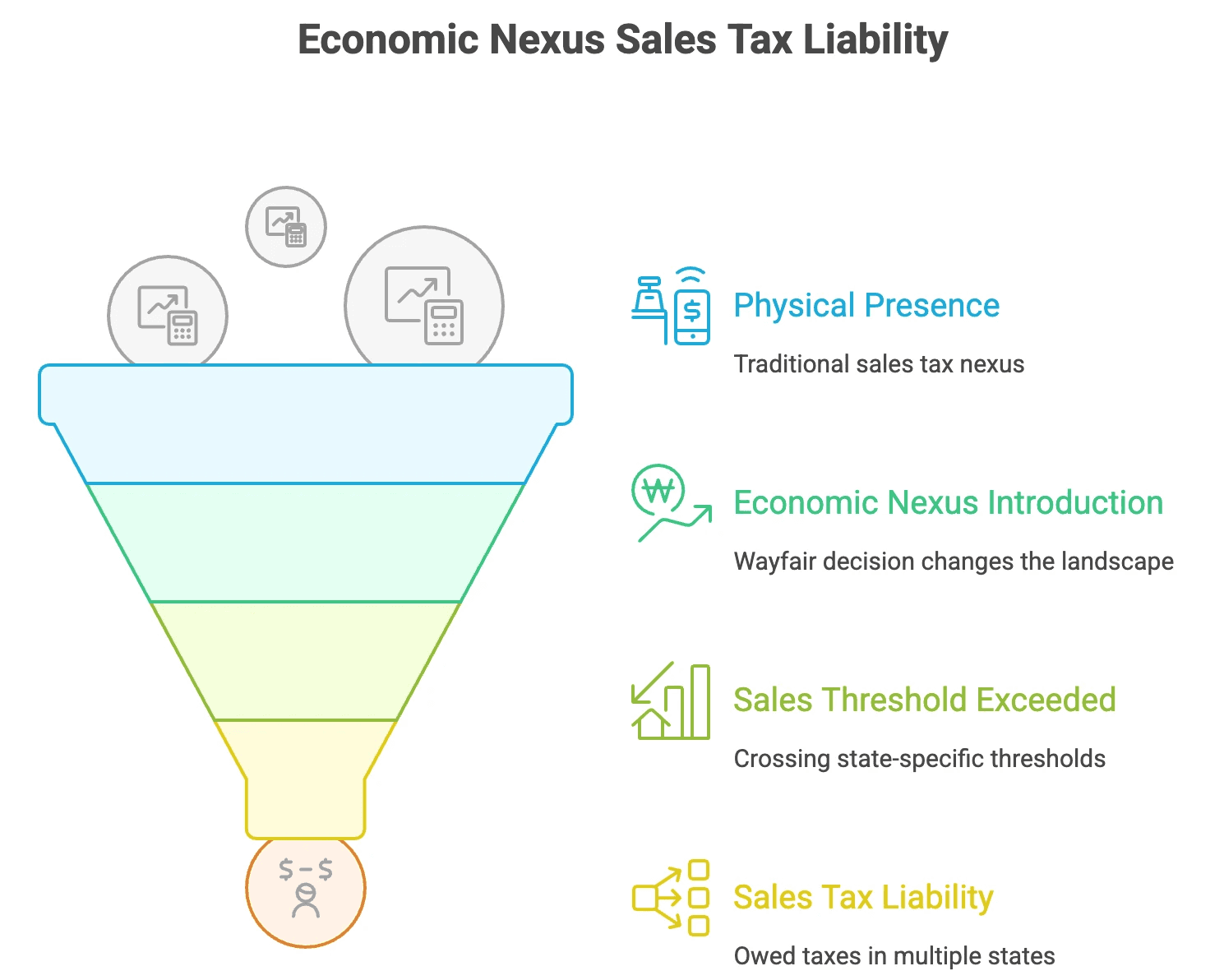

Prior to 2018, you generally only owed sales tax in states where you had a physical presence—like an office, warehouse, employees, or inventory. Then came the South Dakota v. Wayfair Supreme Court decision.

The ruling introduced economic nexus, which lets states require businesses to collect sales tax even with no physical presence.

That means you can owe sales tax in a state:

Even if you’ve never visited

Even if you have no property there

Even if you only shipped products into the state

For ecommerce brands, this changed everything. You now owe sales tax in any state where your sales or transaction count exceeds a state’s threshold—usually around $100,000 in sales or 200 transactions.

This is why founders discover they owe tax in far more states than expected—and often months after they’ve crossed a threshold.

Economic Nexus: The Rule That Drives Everything

Economic nexus is the heart of ecommerce sales tax. It’s also where most founders get tripped up.

Every state sets its own threshold. Some use revenue only, some use transaction counts, and some use both. Many ecommerce brands cross thresholds simply by growing on Shopify or Amazon, but only find out after the fact.

Once you cross a threshold, your responsibilities change immediately: you must register for a sales tax permit, begin collecting tax, and start filing returns on that state’s schedule.

This is why monthly monitoring—not once-a-year review—is essential. Most ecommerce businesses expand into new states faster than they realize.

Marketplace Facilitator Laws: Helpful, but Not a Free Pass

Platforms like Amazon, Etsy, Walmart, and eBay are required under “marketplace facilitator laws” to collect and remit sales tax on your behalf. That sounds simple—until you look at the details.

Here’s the nuance ecommerce founders need to know.

Marketplaces only collect tax on their transactions

They don’t take responsibility for your Shopify, WooCommerce, or wholesale orders

They don’t track your economic nexus thresholds

They don’t file returns for you in states where you still owe them

You still have to report marketplace sales in most states

In other words, marketplaces help—but they don’t replace recordkeeping or compliance.

Many ecommerce brands mistakenly assume “Amazon handles it” and only discover the gaps when a state sends a notice.

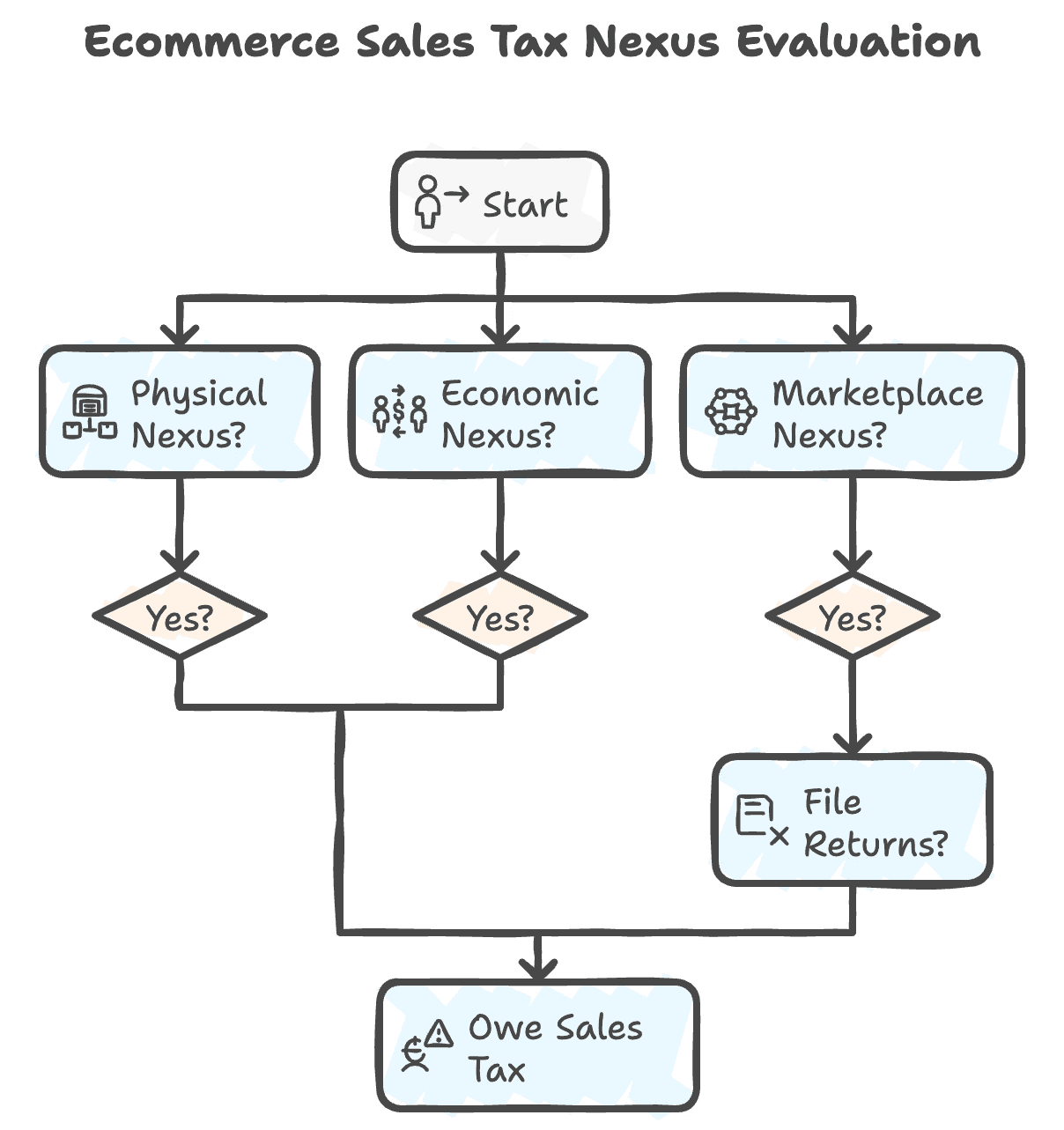

When Ecommerce Businesses Owe Sales Tax

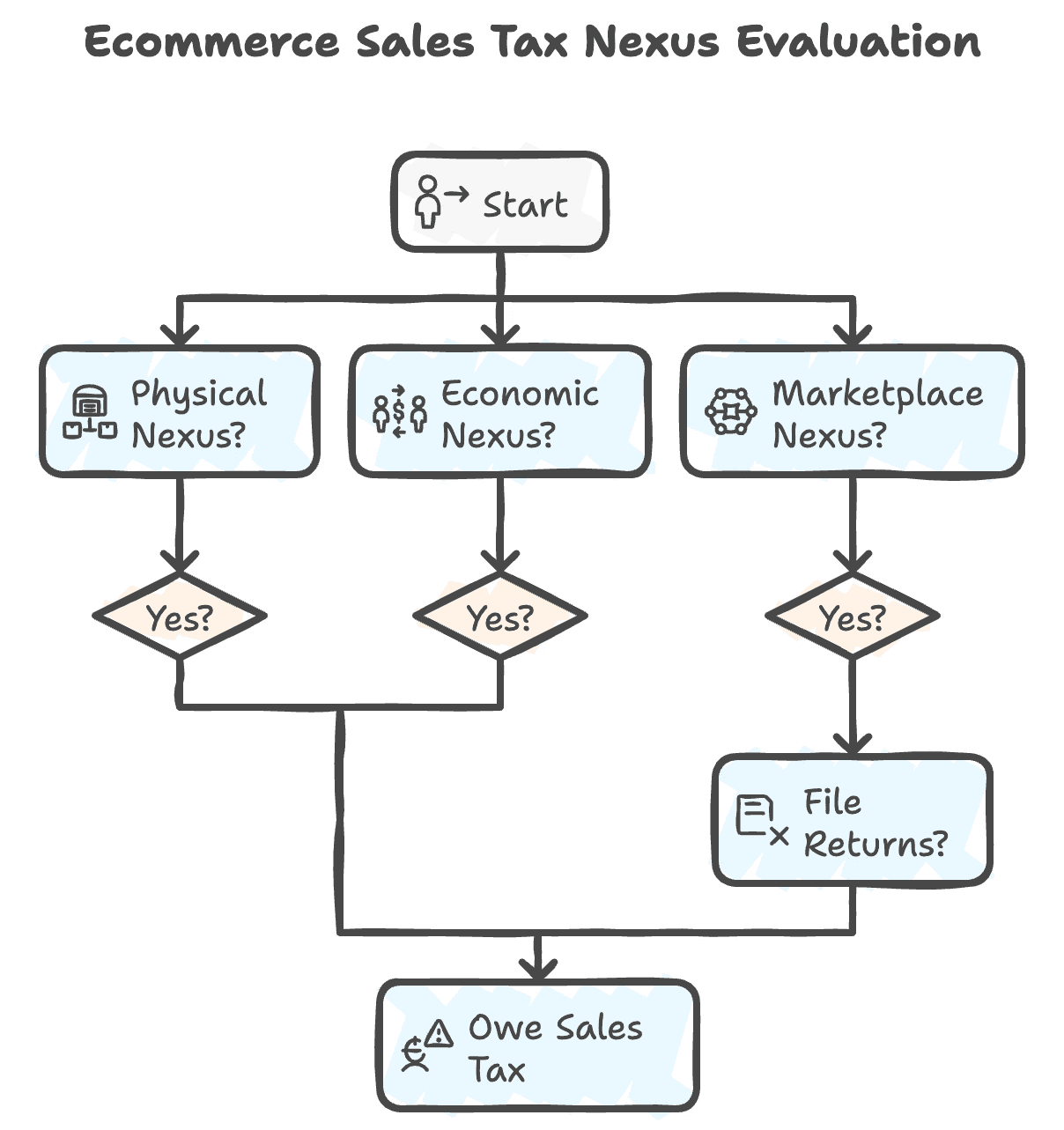

To know where you owe sales tax, you must evaluate three types of “nexus”:

1. Physical Nexus

If you have a warehouse, office, staff, or even inventory stored in an Amazon FBA warehouse, you likely owe sales tax in that state.

2. Economic Nexus

If you exceed a state’s annual sales or transaction threshold, you trigger a tax obligation—even without physical presence.

3. Marketplace Nexus

Platforms like Amazon may collect tax on your behalf, but you still may need to file returns.

The takeaway: don’t assume your tax obligations are limited to your home state.

Why Ecommerce Sales Tax Software Matters

Given how quickly obligations multiply, most ecommerce brands rely on ecommerce sales tax software to stay compliant. These tools integrate directly with your platforms (Shopify, Amazon, WooCommerce, etc.) and automate the most time-consuming work:

Tracking economic nexus thresholds

Calculating accurate tax rates by state, city, and ZIP code

Mapping products to correct tax categories

Managing marketplace vs. direct sales

Filing and remitting tax automatically

Preparing state-by-state reports

Tools like Avalara, TaxJar, and the newer tape of ecommerce-specific platforms help reduce risk dramatically. But they aren’t "set and forget." You still need accurate settings, correct tax codes, state registrations, and CPA oversight.

Software handles the math; humans handle the judgment.

Filing Ecommerce Sales Tax Returns (The Part No One Warns You About)

Once registered, states assign you a filing frequency—monthly, quarterly, or annually. As your sales grow, many states automatically shift you to more frequent filings, sometimes without notice.

Most founders don’t realize:

You must still file a return even if all sales were through Amazon

Marketplace sales still count toward nexus thresholds

You may need to file “zero returns”

Missing a filing often triggers automatic penalties

States still send most notices through physical mail

This is why ecommerce businesses get notices even when they think they’re doing everything right.

Common Ecommerce Sales Tax Mistakes

There are a handful of mistakes we see repeatedly when ecommerce founders come to Haven for help:

Assuming Shopify or Amazon handles all tax obligations

They only handle issues that occur on their platform.

Missing economic nexus thresholds.

Thresholds reset yearly and can change mid-year.Incorrect product tax mapping.

Digital goods, supplements, and apparel all have inconsistent rules across states.Not separating the marketplace and direct sales in reports.

Most states require transparent reporting of both.Missing state notices or logins.

A single missed letter can result in penalties or an account hold.

These are all solvable problems—but they require structure, software, and proper CPA review.

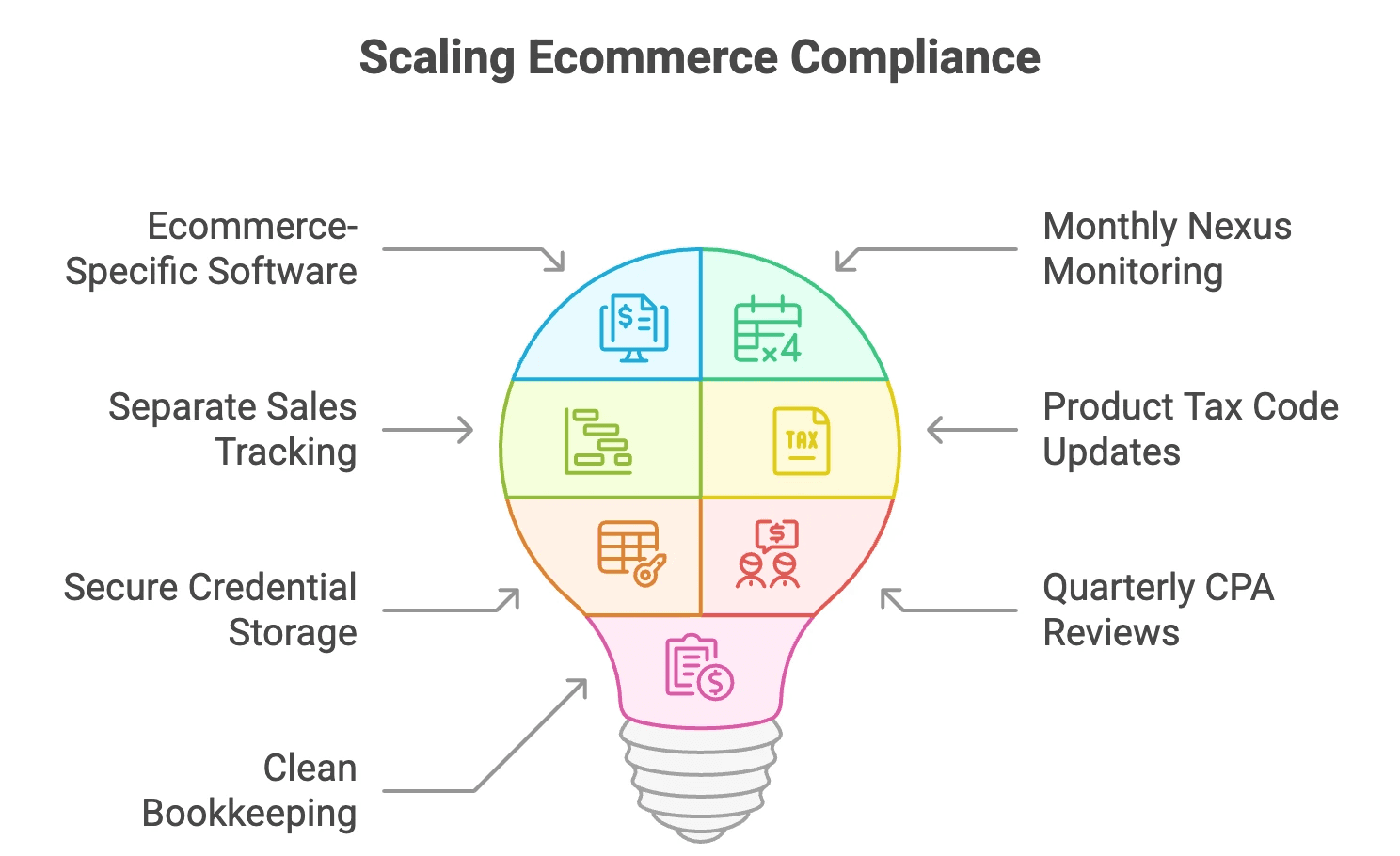

How to Stay Compliant as Your Ecommerce Business Scales

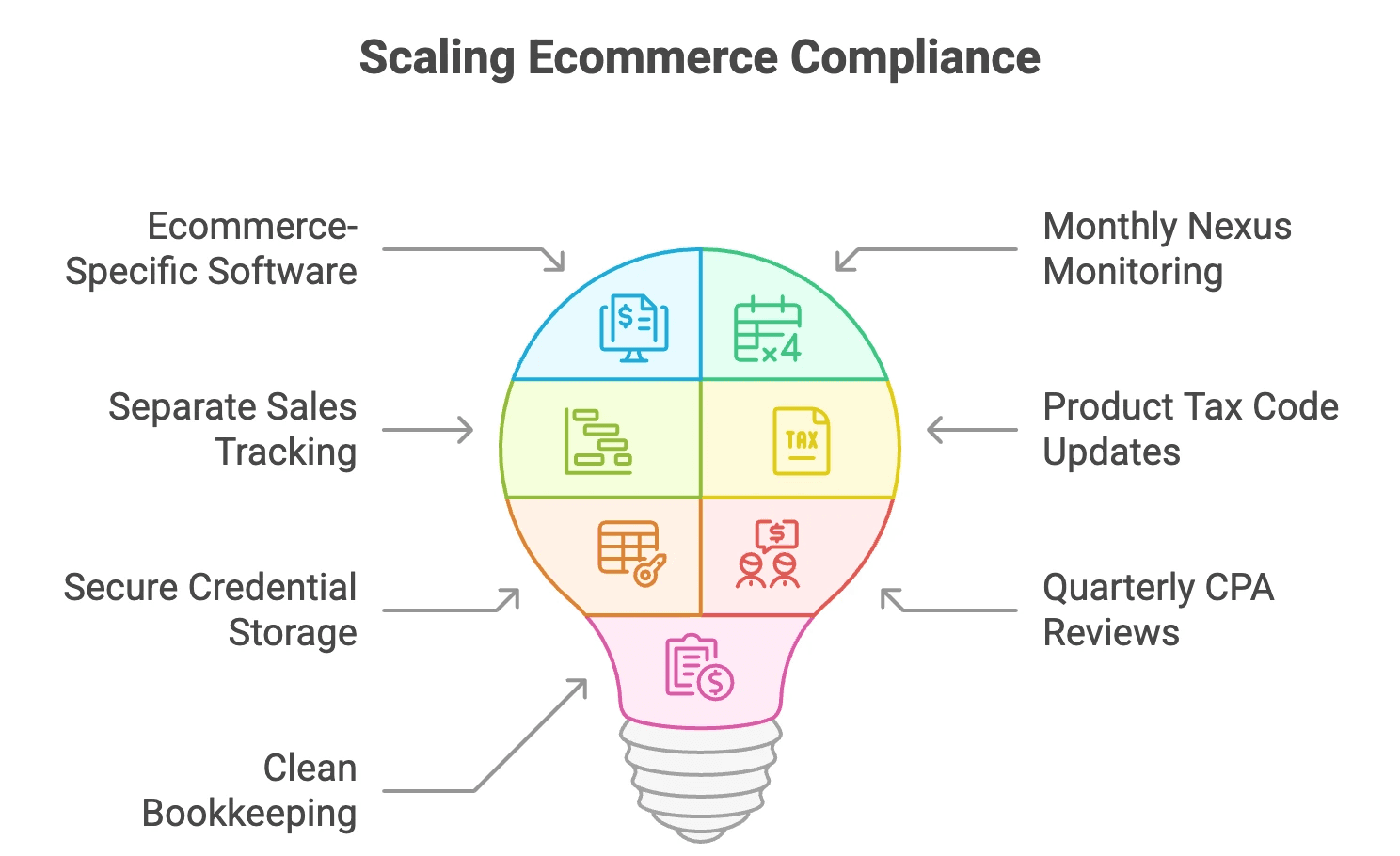

The best approach combines software and human oversight. Here’s how fast-growing brands stay ahead:

Use ecommerce-specific sales tax software

Monitor nexus monthly, not yearly

Keep marketplace and direct sales tracked separately

Refresh product tax codes whenever you add or change items

Save all state credentials in one secure system

Conduct quarterly reviews with your CPA

Keep your books clean so errors show up early

Sales tax doesn't get simpler as you grow—so your compliance processes need to grow with you.

How Haven Helps Ecommerce Founders Stay Compliant

Haven’s CPA-led team works directly with ecommerce brands selling across multiple states and platforms. We integrate with the tools you already use, clean up your reporting, and manage sales tax from end to end.

Here’s what Haven handles:

Nexus monitoring across all 50 states

Registration for new state permits

Set up and optimization of ecommerce sales tax software

Monthly or quarterly sales tax filing

Reconciliation of marketplace vs. direct sales

Notice handling and audit support

Slack-based communication with real CPAs

You focus on growth—we handle the compliance that protects it.

Running an ecommerce business means juggling inventory, marketing, customer experience, and order fulfillment. But as you grow across channels and states, one responsibility becomes unavoidable: ecommerce sales tax compliance.

Sales tax for online businesses is no longer simple. States have different rules, thresholds change annually, and marketplace platforms only solve part of the problem. If you sell across Shopify, Amazon, Etsy, or multiple fulfillment networks, the tax complexity scales as fast as your revenue.

This guide breaks down what ecommerce founders need to know—how sales tax works, when you owe it, how ecommerce sales tax software helps, and how to avoid penalties as your business scales.

What Ecommerce Sales Tax Actually Means

Sales tax is a state-level tax charged on the sale of taxable goods and some services. For ecommerce companies, this includes most physical goods, many digital goods, and even certain subscription products, depending on the state.

The key thing founders often miss is this: sales tax is a trust tax. You collect it from customers on the state’s behalf. If you collect the wrong amount—or fail to remit it—you’re still responsible for paying it, even if your margins are tight.

And unlike income tax, which you pay once a year, sales tax is ongoing. You must track where your customers are located, understand what’s taxable, calculate the correct rate, and file returns on time.

It’s not fun, but it’s the reality of selling nationally.

Why Ecommerce Sales Tax Became So Complex

Prior to 2018, you generally only owed sales tax in states where you had a physical presence—like an office, warehouse, employees, or inventory. Then came the South Dakota v. Wayfair Supreme Court decision.

The ruling introduced economic nexus, which lets states require businesses to collect sales tax even with no physical presence.

That means you can owe sales tax in a state:

Even if you’ve never visited

Even if you have no property there

Even if you only shipped products into the state

For ecommerce brands, this changed everything. You now owe sales tax in any state where your sales or transaction count exceeds a state’s threshold—usually around $100,000 in sales or 200 transactions.

This is why founders discover they owe tax in far more states than expected—and often months after they’ve crossed a threshold.

Economic Nexus: The Rule That Drives Everything

Economic nexus is the heart of ecommerce sales tax. It’s also where most founders get tripped up.

Every state sets its own threshold. Some use revenue only, some use transaction counts, and some use both. Many ecommerce brands cross thresholds simply by growing on Shopify or Amazon, but only find out after the fact.

Once you cross a threshold, your responsibilities change immediately: you must register for a sales tax permit, begin collecting tax, and start filing returns on that state’s schedule.

This is why monthly monitoring—not once-a-year review—is essential. Most ecommerce businesses expand into new states faster than they realize.

Marketplace Facilitator Laws: Helpful, but Not a Free Pass

Platforms like Amazon, Etsy, Walmart, and eBay are required under “marketplace facilitator laws” to collect and remit sales tax on your behalf. That sounds simple—until you look at the details.

Here’s the nuance ecommerce founders need to know.

Marketplaces only collect tax on their transactions

They don’t take responsibility for your Shopify, WooCommerce, or wholesale orders

They don’t track your economic nexus thresholds

They don’t file returns for you in states where you still owe them

You still have to report marketplace sales in most states

In other words, marketplaces help—but they don’t replace recordkeeping or compliance.

Many ecommerce brands mistakenly assume “Amazon handles it” and only discover the gaps when a state sends a notice.

When Ecommerce Businesses Owe Sales Tax

To know where you owe sales tax, you must evaluate three types of “nexus”:

1. Physical Nexus

If you have a warehouse, office, staff, or even inventory stored in an Amazon FBA warehouse, you likely owe sales tax in that state.

2. Economic Nexus

If you exceed a state’s annual sales or transaction threshold, you trigger a tax obligation—even without physical presence.

3. Marketplace Nexus

Platforms like Amazon may collect tax on your behalf, but you still may need to file returns.

The takeaway: don’t assume your tax obligations are limited to your home state.

Why Ecommerce Sales Tax Software Matters

Given how quickly obligations multiply, most ecommerce brands rely on ecommerce sales tax software to stay compliant. These tools integrate directly with your platforms (Shopify, Amazon, WooCommerce, etc.) and automate the most time-consuming work:

Tracking economic nexus thresholds

Calculating accurate tax rates by state, city, and ZIP code

Mapping products to correct tax categories

Managing marketplace vs. direct sales

Filing and remitting tax automatically

Preparing state-by-state reports

Tools like Avalara, TaxJar, and the newer tape of ecommerce-specific platforms help reduce risk dramatically. But they aren’t "set and forget." You still need accurate settings, correct tax codes, state registrations, and CPA oversight.

Software handles the math; humans handle the judgment.

Filing Ecommerce Sales Tax Returns (The Part No One Warns You About)

Once registered, states assign you a filing frequency—monthly, quarterly, or annually. As your sales grow, many states automatically shift you to more frequent filings, sometimes without notice.

Most founders don’t realize:

You must still file a return even if all sales were through Amazon

Marketplace sales still count toward nexus thresholds

You may need to file “zero returns”

Missing a filing often triggers automatic penalties

States still send most notices through physical mail

This is why ecommerce businesses get notices even when they think they’re doing everything right.

Common Ecommerce Sales Tax Mistakes

There are a handful of mistakes we see repeatedly when ecommerce founders come to Haven for help:

Assuming Shopify or Amazon handles all tax obligations

They only handle issues that occur on their platform.

Missing economic nexus thresholds.

Thresholds reset yearly and can change mid-year.Incorrect product tax mapping.

Digital goods, supplements, and apparel all have inconsistent rules across states.Not separating the marketplace and direct sales in reports.

Most states require transparent reporting of both.Missing state notices or logins.

A single missed letter can result in penalties or an account hold.

These are all solvable problems—but they require structure, software, and proper CPA review.

How to Stay Compliant as Your Ecommerce Business Scales

The best approach combines software and human oversight. Here’s how fast-growing brands stay ahead:

Use ecommerce-specific sales tax software

Monitor nexus monthly, not yearly

Keep marketplace and direct sales tracked separately

Refresh product tax codes whenever you add or change items

Save all state credentials in one secure system

Conduct quarterly reviews with your CPA

Keep your books clean so errors show up early

Sales tax doesn't get simpler as you grow—so your compliance processes need to grow with you.

How Haven Helps Ecommerce Founders Stay Compliant

Haven’s CPA-led team works directly with ecommerce brands selling across multiple states and platforms. We integrate with the tools you already use, clean up your reporting, and manage sales tax from end to end.

Here’s what Haven handles:

Nexus monitoring across all 50 states

Registration for new state permits

Set up and optimization of ecommerce sales tax software

Monthly or quarterly sales tax filing

Reconciliation of marketplace vs. direct sales

Notice handling and audit support

Slack-based communication with real CPAs

You focus on growth—we handle the compliance that protects it.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026