Go Back

Last Updated :

Last Updated :

Nov 17, 2025

Nov 17, 2025

What You Need to Know About Business Tax Compliance

Staying compliant with business tax rules isn’t just about filing returns. It’s about reporting income accurately, paying the right amount of tax, and hitting every regulatory deadline. For founders and small business owners, missing any of these steps creates real risk—penalties stack, audits expand, and operations slow down when your team can’t afford the distraction.

Tax laws change often, and requirements vary by entity type and state. This guide breaks down the core parts of business tax compliance, how to manage it efficiently, and how expert support keeps your company audit-ready year-round.

What Is Business Tax Compliance?

Business tax compliance means filing accurate, on-time returns and paying the taxes your company owes. It signals financial transparency—something investors, regulators, and customers expect from any credible business.

Compliance matters because it:

Protects the business during audits

Reduces penalty exposure

Supports clean, board-ready financials

Builds trust with customers and partners

Non-compliance brings penalties, interest, and reputational damage. A disciplined approach prevents those issues and creates a stable foundation for growth.

The Pillars of Tax Compliance Management

Every compliant business consistently:

Files accurate, on-time tax returns

Keeps organized financial records and receipts

Pays the correct tax amount for each reporting period

Meets jurisdiction-specific obligations

Maintains transparency in financial disclosures

Intentional evasion or misreporting can result in severe penalties. A disciplined approach to tax compliance management ensures operational stability and financial credibility.

Common Business Tax Obligations

Each business faces multiple tax types depending on its structure and location. Understanding the essentials helps you stay ahead of deadlines and avoid unnecessary risk.

Business Income Tax Compliance

Businesses must report income and expenses to calculate taxable profit.

Filing frequency: Usually annual, though some entities file quarterly.

Entity impact: Sole proprietors report on personal returns, while LLCs, corporations, and partnerships file separately.

Jurisdictional differences: If your company operates in multiple states or countries, you may owe taxes in each one.

Estimated Taxes and IRS Filing Deadlines

Unlike employees with automatic withholdings, most business owners must make quarterly estimated tax payments. These payments cover income and self-employment taxes. Missing them can lead to penalties—even if you pay in full later.

Payroll Tax Compliance

Employers must withhold and remit taxes tied to wages and benefits, including:

FICA: Funds Social Security and Medicare

FUTA: Supports federal unemployment benefits

SUTA and SDI: State-level unemployment and disability programs

Accurate payroll reporting is crucial for compliance and employee trust.

Sales and Use Tax Obligations

Sales tax applies to goods or services sold in specific jurisdictions, while use tax applies to out-of-state purchases. Rates and rules differ by state, so registration and diligent tracking are key.

Property and Excise Taxes

Property tax: Applies to real estate or physical assets based on assessed value.

Excise tax: Applies to specific goods (fuel, alcohol, tobacco, and others), usually tied to quantity or value.

The Cost of Non-Compliance for Small Businesses

Failing to maintain small business tax compliance can drain both time and capital. According to the Kansas City Business Journal, small businesses spend an average of $12,000 annually on regulatory compliance. Fines for mistakes or missed filings can exceed $30,000—a figure that threatens early-stage startups.

Beyond penalties, non-compliance invites audits and disrupts operations. The IRS can review up to six years of past returns, so consistent record-keeping is vital protection.

Choosing the Right Business Structure for Corporate Tax Filing

Your business structure determines how—and when—you pay taxes. Selecting the right one reduces future complications:

Structure | Key Traits | Tax Considerations |

Sole Proprietorship | Simple setup; one owner assumes all liability. | Income taxed on personal return; minimal filings. |

Partnership | Two or more owners share profits and decisions. | Requires a partnership return (Form 1065); income passes through to partners. |

LLC (Limited Liability Company) | Hybrid structure offering flexibility and protection. | Can elect to be taxed as a corporation or pass-through entity. |

Corporation (C or S) | Separate legal entity with shareholders. | C Corps face double taxation; S Corps allow income pass-through. |

Choosing incorrectly can lead to unnecessary taxes or compliance gaps later. Consult a qualified accountant before registering or restructuring your business.

IRS Filing Deadlines and the Importance of Timely Payments

Late or inaccurate filings are among the most common compliance issues. Each business type follows a specific filing calendar:

S Corporations & Partnerships: 15th day of the third month after fiscal year-end (e.g., March 15 for calendar-year entities).

C Corporations: 15th day of the fourth month after year-end (e.g., April 15 for calendar-year companies).

Quarterly Estimated Payments: April 15, June 15, September 15, and January 15 (of the following year).

Missing these dates triggers both penalties and compounding interest. Automating reminders or using accounting software minimizes this risk.

Practical Tax Compliance Tips for Small Businesses

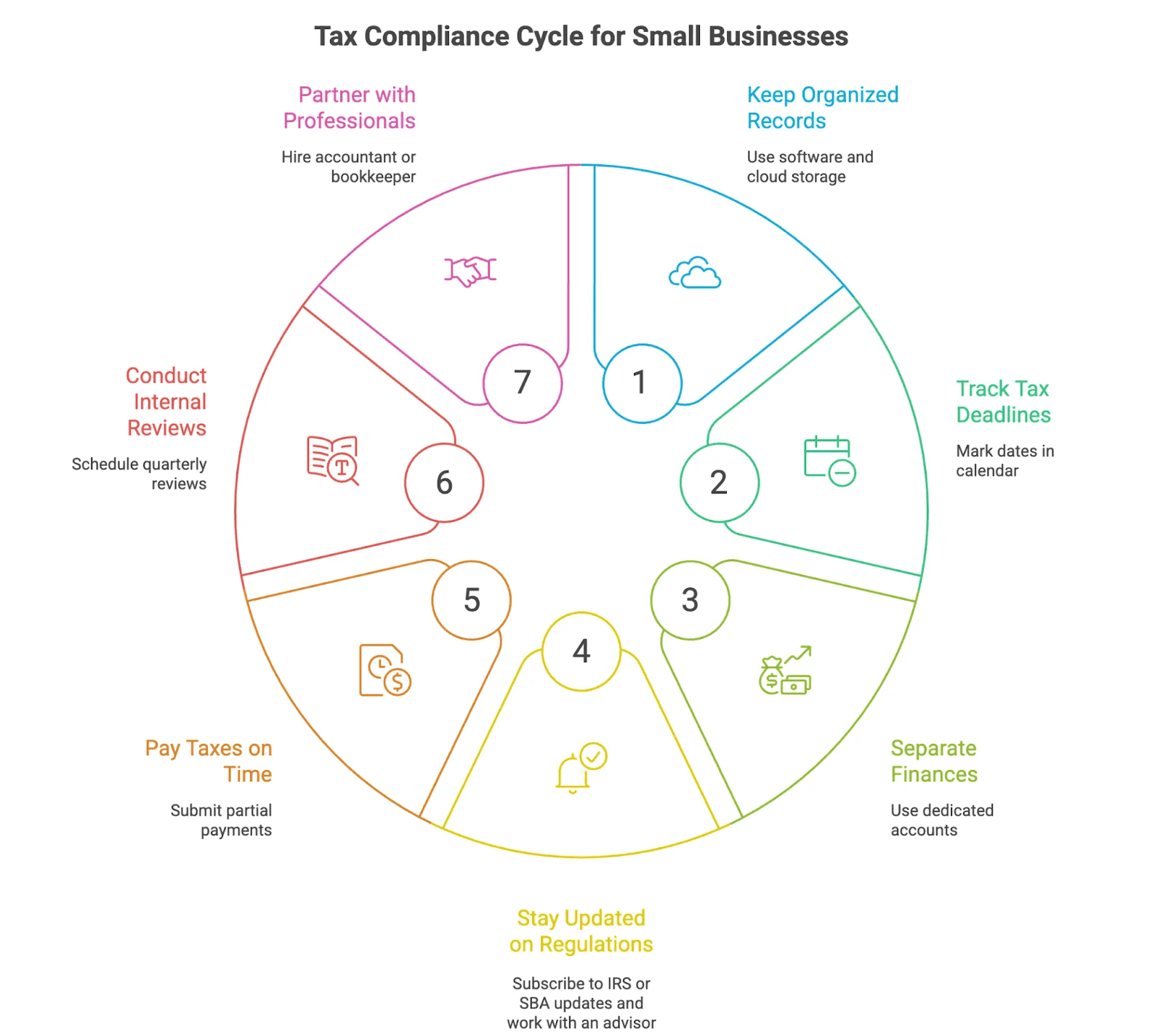

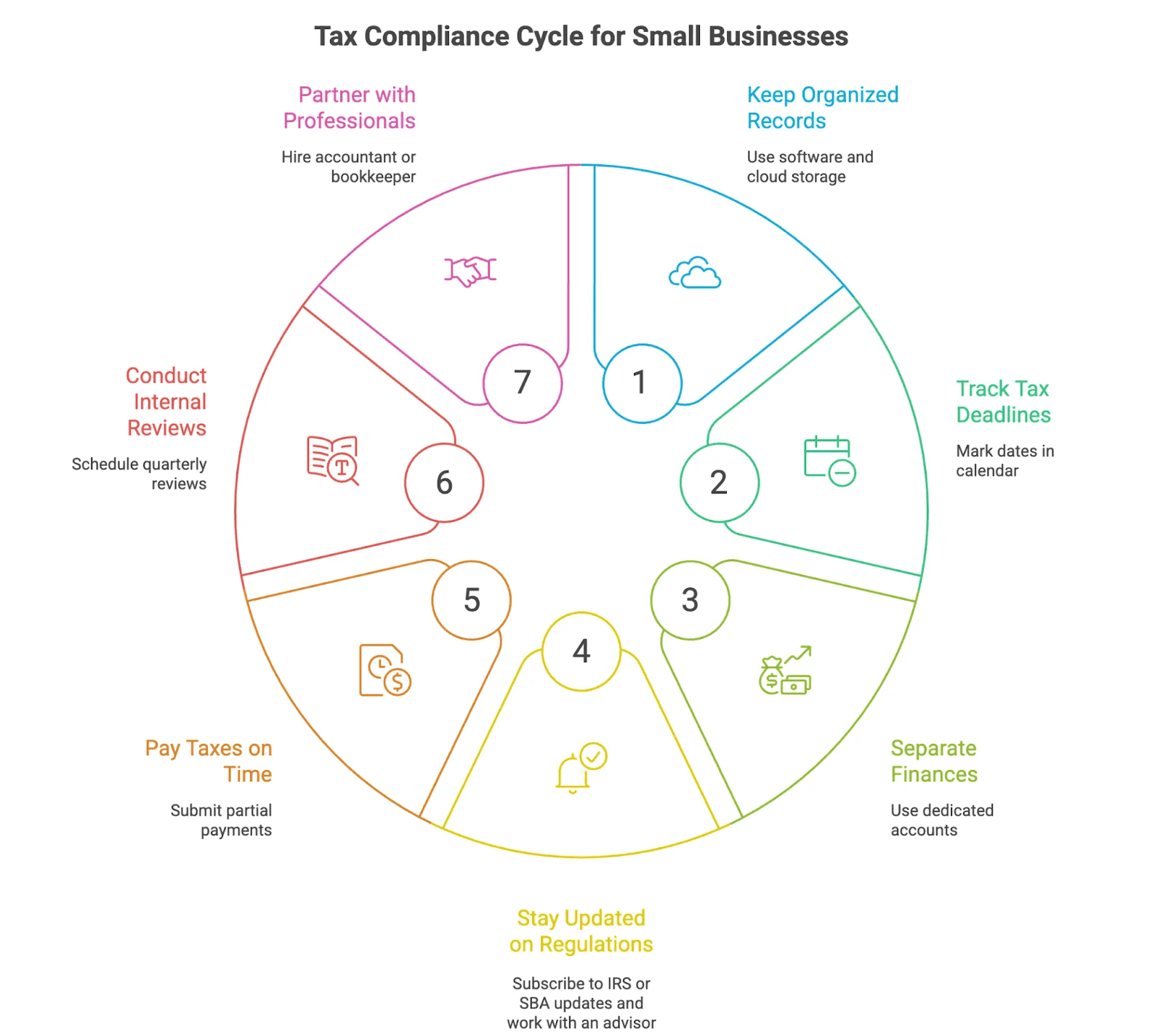

The foundation for correct tax compliance is keeping your digital records organized, which reduces errors and makes audits easier. From there, tracking every deadline with automated reminders helps prevent missed payments, while separating business and personal finances keeps your books clean.

Staying updated on rule changes ensures accurate filings, and paying on time—even partially—limits interest and protects your standing. Regular reviews catch issues early, and having an experienced accounting partner brings all of this together so you stay compliant and capture every deduction available.

Turn Tax Compliance Into a Growth Advantage

Business tax compliance doesn’t have to be overwhelming. With clear systems, disciplined record-keeping, and expert support, you can reduce risk, avoid costly penalties, and build a financial foundation that supports long-term growth.

How Haven Helps Founders Simplify Business Tax Compliance

Haven’s founder-focused accounting services keep your startup or small business fully compliant while freeing your time to focus on growth. Our CPA-led team handles everything from:

Daily bookkeeping and payroll

Federal and state tax filing

R&D credit support and advisory

Fractional CFO guidance for scaling operations

Join 400+ businesses that have saved thousands in compliance costs and never missed a filing deadline — all with real-time support via Slack.

Staying compliant with business tax rules isn’t just about filing returns. It’s about reporting income accurately, paying the right amount of tax, and hitting every regulatory deadline. For founders and small business owners, missing any of these steps creates real risk—penalties stack, audits expand, and operations slow down when your team can’t afford the distraction.

Tax laws change often, and requirements vary by entity type and state. This guide breaks down the core parts of business tax compliance, how to manage it efficiently, and how expert support keeps your company audit-ready year-round.

What Is Business Tax Compliance?

Business tax compliance means filing accurate, on-time returns and paying the taxes your company owes. It signals financial transparency—something investors, regulators, and customers expect from any credible business.

Compliance matters because it:

Protects the business during audits

Reduces penalty exposure

Supports clean, board-ready financials

Builds trust with customers and partners

Non-compliance brings penalties, interest, and reputational damage. A disciplined approach prevents those issues and creates a stable foundation for growth.

The Pillars of Tax Compliance Management

Every compliant business consistently:

Files accurate, on-time tax returns

Keeps organized financial records and receipts

Pays the correct tax amount for each reporting period

Meets jurisdiction-specific obligations

Maintains transparency in financial disclosures

Intentional evasion or misreporting can result in severe penalties. A disciplined approach to tax compliance management ensures operational stability and financial credibility.

Common Business Tax Obligations

Each business faces multiple tax types depending on its structure and location. Understanding the essentials helps you stay ahead of deadlines and avoid unnecessary risk.

Business Income Tax Compliance

Businesses must report income and expenses to calculate taxable profit.

Filing frequency: Usually annual, though some entities file quarterly.

Entity impact: Sole proprietors report on personal returns, while LLCs, corporations, and partnerships file separately.

Jurisdictional differences: If your company operates in multiple states or countries, you may owe taxes in each one.

Estimated Taxes and IRS Filing Deadlines

Unlike employees with automatic withholdings, most business owners must make quarterly estimated tax payments. These payments cover income and self-employment taxes. Missing them can lead to penalties—even if you pay in full later.

Payroll Tax Compliance

Employers must withhold and remit taxes tied to wages and benefits, including:

FICA: Funds Social Security and Medicare

FUTA: Supports federal unemployment benefits

SUTA and SDI: State-level unemployment and disability programs

Accurate payroll reporting is crucial for compliance and employee trust.

Sales and Use Tax Obligations

Sales tax applies to goods or services sold in specific jurisdictions, while use tax applies to out-of-state purchases. Rates and rules differ by state, so registration and diligent tracking are key.

Property and Excise Taxes

Property tax: Applies to real estate or physical assets based on assessed value.

Excise tax: Applies to specific goods (fuel, alcohol, tobacco, and others), usually tied to quantity or value.

The Cost of Non-Compliance for Small Businesses

Failing to maintain small business tax compliance can drain both time and capital. According to the Kansas City Business Journal, small businesses spend an average of $12,000 annually on regulatory compliance. Fines for mistakes or missed filings can exceed $30,000—a figure that threatens early-stage startups.

Beyond penalties, non-compliance invites audits and disrupts operations. The IRS can review up to six years of past returns, so consistent record-keeping is vital protection.

Choosing the Right Business Structure for Corporate Tax Filing

Your business structure determines how—and when—you pay taxes. Selecting the right one reduces future complications:

Structure | Key Traits | Tax Considerations |

Sole Proprietorship | Simple setup; one owner assumes all liability. | Income taxed on personal return; minimal filings. |

Partnership | Two or more owners share profits and decisions. | Requires a partnership return (Form 1065); income passes through to partners. |

LLC (Limited Liability Company) | Hybrid structure offering flexibility and protection. | Can elect to be taxed as a corporation or pass-through entity. |

Corporation (C or S) | Separate legal entity with shareholders. | C Corps face double taxation; S Corps allow income pass-through. |

Choosing incorrectly can lead to unnecessary taxes or compliance gaps later. Consult a qualified accountant before registering or restructuring your business.

IRS Filing Deadlines and the Importance of Timely Payments

Late or inaccurate filings are among the most common compliance issues. Each business type follows a specific filing calendar:

S Corporations & Partnerships: 15th day of the third month after fiscal year-end (e.g., March 15 for calendar-year entities).

C Corporations: 15th day of the fourth month after year-end (e.g., April 15 for calendar-year companies).

Quarterly Estimated Payments: April 15, June 15, September 15, and January 15 (of the following year).

Missing these dates triggers both penalties and compounding interest. Automating reminders or using accounting software minimizes this risk.

Practical Tax Compliance Tips for Small Businesses

The foundation for correct tax compliance is keeping your digital records organized, which reduces errors and makes audits easier. From there, tracking every deadline with automated reminders helps prevent missed payments, while separating business and personal finances keeps your books clean.

Staying updated on rule changes ensures accurate filings, and paying on time—even partially—limits interest and protects your standing. Regular reviews catch issues early, and having an experienced accounting partner brings all of this together so you stay compliant and capture every deduction available.

Turn Tax Compliance Into a Growth Advantage

Business tax compliance doesn’t have to be overwhelming. With clear systems, disciplined record-keeping, and expert support, you can reduce risk, avoid costly penalties, and build a financial foundation that supports long-term growth.

How Haven Helps Founders Simplify Business Tax Compliance

Haven’s founder-focused accounting services keep your startup or small business fully compliant while freeing your time to focus on growth. Our CPA-led team handles everything from:

Daily bookkeeping and payroll

Federal and state tax filing

R&D credit support and advisory

Fractional CFO guidance for scaling operations

Join 400+ businesses that have saved thousands in compliance costs and never missed a filing deadline — all with real-time support via Slack.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026