Go Back

Last Updated :

Last Updated :

Nov 17, 2025

Nov 17, 2025

Business Tax Returns: A Complete Guide for Business Owners

Tax season can be particularly stressful for founders and small business owners. Between receipts, deductions, and past filings, managing business tax returns requires organization and attention to detail. Beyond staying compliant, maintaining accurate records protects you in the event of an audit and supports long-term financial clarity.

This guide explains how long to keep business tax returns, what records to maintain, and how to organize your files effectively — so you’re always audit-ready and confident in your compliance.

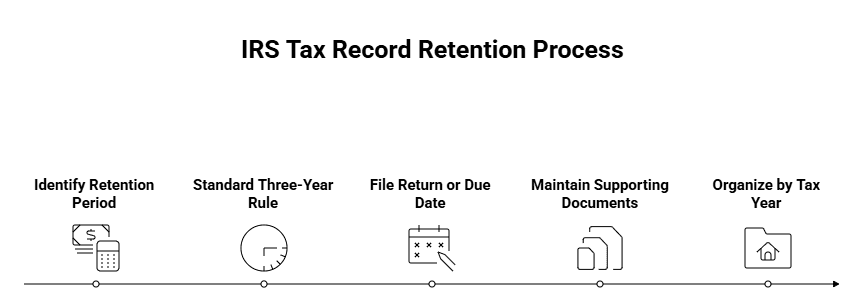

How Long to Keep Business Tax Returns (IRS Tax Record Retention Rules)

The IRS offers clear guidance on tax record-keeping for small business owners. The retention period depends on the period of limitations — the window in which you can amend a return or the IRS can assess additional tax.

Standard Rule: The Three-Year Guideline

Keep all business tax returns and supporting documents for at least three years from either:

The date you filed the return, or

The return’s due date — whichever is later.

This three-year period aligns with the IRS’s standard statute of limitations for audits.

Supporting Documents to Keep

Maintain all records that support entries on your return, including receipts, invoices, payroll records, and expense reports. Organize them by tax year to simplify amendments or audits.

When to Keep Tax Records Longer

Some situations require retaining small business tax records beyond three years:

Underreported Income: If income was understated by more than 25%, the IRS may audit up to six years after filing.

Unfiled or Fraudulent Returns: If a return was never filed or filed fraudulently, keep records indefinitely.

Payroll Records: Maintain employment tax documentation for at least four years after the tax is due or paid.

Complex Filings or Major Deductions: For large depreciation schedules or credits, retain supporting documents for seven years or more.

Federal vs. State Retention

Federal rules are standard, but states may require longer retention. Some recommend seven years to accommodate extended audit periods or differing local statutes. Always confirm your state’s specific requirements.

Factors That Affect Record Retention Time

Underreporting and the Six-Year Rule

If your business underreports income by more than 25% (for example, reporting $100,000 instead of $126,000), the IRS can audit returns up to six years later. Keep all related documentation for that period.

Fraudulent or Unfiled Returns

There is no statute of limitations for fraudulent or unfiled returns. Keep documentation permanently to protect your business if issues arise.

Worthless Securities or Bad Debts

When claiming deductions for worthless securities or bad debts, retain documentation for seven years. These deductions require detailed proof, and the IRS allows extra time for review.

Employment and Payroll Tax Compliance

Businesses with employees must maintain payroll tax compliance records for at least four years after the tax is due or paid. Keep wage documentation, employment tax filings, and proof of deposits.

Property and Asset Records

If you own property or long-term assets, keep all documents until the statute of limitations expires for the year of sale or disposal. These records establish cost basis, depreciation, and capital gains or losses.

Types of Business Tax Records to Retain

Organized record keeping supports both compliance and smarter decision-making. The IRS outlines several categories of records every company should maintain.

Gross Receipts

Evidence of income received, such as:

Cash register tapes

Deposit information for cash or credit sales

Receipt books and invoices

Forms 1099-MISC

Purchases

If you resell items or produce goods, keep proof of all purchases — payee, amount, payment method, and date.

Examples include:

Invoices

Canceled checks or bank transfers

Credit card statements

Expenses

Document operational costs that support deductions:

Receipts and invoices

Account or card statements

Proof of payment

Each record should show the business purpose and amount.

Travel, Entertainment, and Gift Expenses

For deductions on travel or client entertainment, maintain documentation per IRS Publication 463, showing purpose, date, and cost.

Assets

For assets like machinery, furniture, or vehicles, records should include:

Purchase price and improvements

Depreciation taken

Sale price and related costs

These establish gain or loss at the time of sale.

Best Practices for Organizing and Storing Tax Records

1. Organize by Tax Year

Set up a filing system before tax season begins. Create clearly labeled folders for each year — physical or digital — separating returns, receipts, and correspondence. This approach simplifies future audits and amendments.

2. Secure Storage and Backups

Protect corporate tax returns and records from loss or theft.

For paper: use lockable cabinets or safes.

For digital: store in encrypted cloud systems with password protection.

Always keep backups in case of hardware failure or damage.

3. Safe Disposal of Expired Records

Once retention periods pass, dispose of documents securely.

Paper: shred using a cross-cut shredder.

Digital: permanently delete using data-wiping tools to prevent recovery.

This step minimizes the risk of identity theft or data breaches.

4. Consult a Tax Professional

Because retention rules vary by entity and state, working with an accountant helps ensure your system aligns with both IRS and state-level requirements. A professional can also advise on retention for business tax filing involving depreciation, stock, or complex deductions.

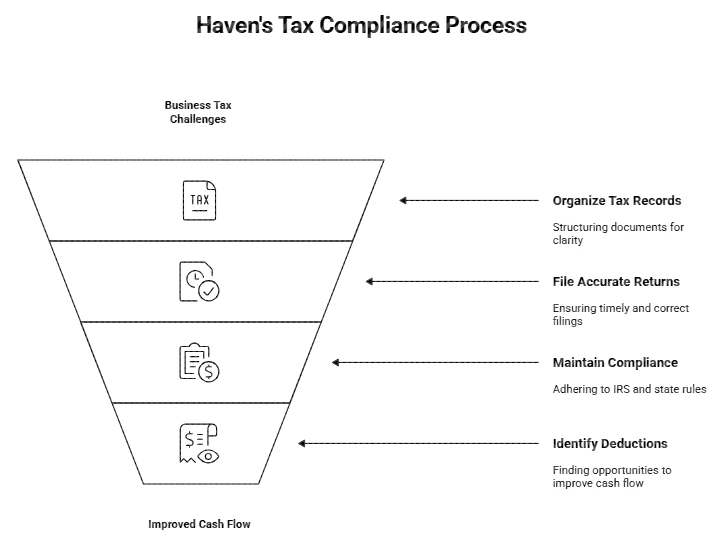

How Haven Simplifies Tax Record Keeping and Compliance

At Haven, we understand how challenging it can be to manage business tax returns while running a company. Our CPA-led team helps founders and small businesses:

Organize tax documentation and digital records

File accurate corporate tax returns on time

Stay compliant with both IRS and state retention requirements

Identify deductions and credits that improve cash flow

Join 400+ startups who rely on Haven for proactive bookkeeping, tax filing, and R&D credit support — all managed through transparent, real-time collaboration on Slack.

Stay Audit-Ready With Smart Tax Record Management

Maintaining accurate small business tax records isn’t just about compliance — it’s a strategic move that protects your business and builds credibility. By understanding IRS tax record retention rules, organizing your documentation, and working with experts, you’ll simplify tax season and prevent costly mistakes.

At Haven, we help founders master bookkeeping and business tax filing so they can focus on growth, not paperwork.

Tax season can be particularly stressful for founders and small business owners. Between receipts, deductions, and past filings, managing business tax returns requires organization and attention to detail. Beyond staying compliant, maintaining accurate records protects you in the event of an audit and supports long-term financial clarity.

This guide explains how long to keep business tax returns, what records to maintain, and how to organize your files effectively — so you’re always audit-ready and confident in your compliance.

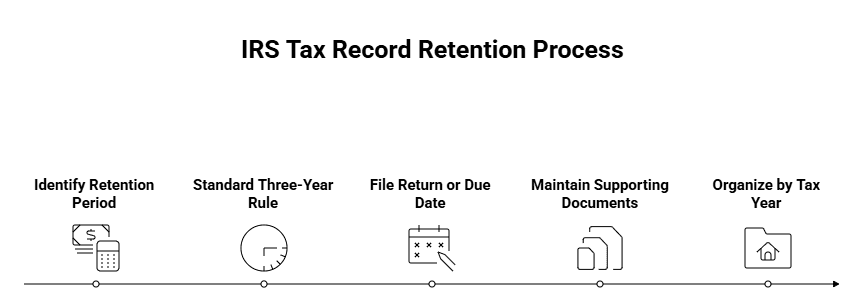

How Long to Keep Business Tax Returns (IRS Tax Record Retention Rules)

The IRS offers clear guidance on tax record-keeping for small business owners. The retention period depends on the period of limitations — the window in which you can amend a return or the IRS can assess additional tax.

Standard Rule: The Three-Year Guideline

Keep all business tax returns and supporting documents for at least three years from either:

The date you filed the return, or

The return’s due date — whichever is later.

This three-year period aligns with the IRS’s standard statute of limitations for audits.

Supporting Documents to Keep

Maintain all records that support entries on your return, including receipts, invoices, payroll records, and expense reports. Organize them by tax year to simplify amendments or audits.

When to Keep Tax Records Longer

Some situations require retaining small business tax records beyond three years:

Underreported Income: If income was understated by more than 25%, the IRS may audit up to six years after filing.

Unfiled or Fraudulent Returns: If a return was never filed or filed fraudulently, keep records indefinitely.

Payroll Records: Maintain employment tax documentation for at least four years after the tax is due or paid.

Complex Filings or Major Deductions: For large depreciation schedules or credits, retain supporting documents for seven years or more.

Federal vs. State Retention

Federal rules are standard, but states may require longer retention. Some recommend seven years to accommodate extended audit periods or differing local statutes. Always confirm your state’s specific requirements.

Factors That Affect Record Retention Time

Underreporting and the Six-Year Rule

If your business underreports income by more than 25% (for example, reporting $100,000 instead of $126,000), the IRS can audit returns up to six years later. Keep all related documentation for that period.

Fraudulent or Unfiled Returns

There is no statute of limitations for fraudulent or unfiled returns. Keep documentation permanently to protect your business if issues arise.

Worthless Securities or Bad Debts

When claiming deductions for worthless securities or bad debts, retain documentation for seven years. These deductions require detailed proof, and the IRS allows extra time for review.

Employment and Payroll Tax Compliance

Businesses with employees must maintain payroll tax compliance records for at least four years after the tax is due or paid. Keep wage documentation, employment tax filings, and proof of deposits.

Property and Asset Records

If you own property or long-term assets, keep all documents until the statute of limitations expires for the year of sale or disposal. These records establish cost basis, depreciation, and capital gains or losses.

Types of Business Tax Records to Retain

Organized record keeping supports both compliance and smarter decision-making. The IRS outlines several categories of records every company should maintain.

Gross Receipts

Evidence of income received, such as:

Cash register tapes

Deposit information for cash or credit sales

Receipt books and invoices

Forms 1099-MISC

Purchases

If you resell items or produce goods, keep proof of all purchases — payee, amount, payment method, and date.

Examples include:

Invoices

Canceled checks or bank transfers

Credit card statements

Expenses

Document operational costs that support deductions:

Receipts and invoices

Account or card statements

Proof of payment

Each record should show the business purpose and amount.

Travel, Entertainment, and Gift Expenses

For deductions on travel or client entertainment, maintain documentation per IRS Publication 463, showing purpose, date, and cost.

Assets

For assets like machinery, furniture, or vehicles, records should include:

Purchase price and improvements

Depreciation taken

Sale price and related costs

These establish gain or loss at the time of sale.

Best Practices for Organizing and Storing Tax Records

1. Organize by Tax Year

Set up a filing system before tax season begins. Create clearly labeled folders for each year — physical or digital — separating returns, receipts, and correspondence. This approach simplifies future audits and amendments.

2. Secure Storage and Backups

Protect corporate tax returns and records from loss or theft.

For paper: use lockable cabinets or safes.

For digital: store in encrypted cloud systems with password protection.

Always keep backups in case of hardware failure or damage.

3. Safe Disposal of Expired Records

Once retention periods pass, dispose of documents securely.

Paper: shred using a cross-cut shredder.

Digital: permanently delete using data-wiping tools to prevent recovery.

This step minimizes the risk of identity theft or data breaches.

4. Consult a Tax Professional

Because retention rules vary by entity and state, working with an accountant helps ensure your system aligns with both IRS and state-level requirements. A professional can also advise on retention for business tax filing involving depreciation, stock, or complex deductions.

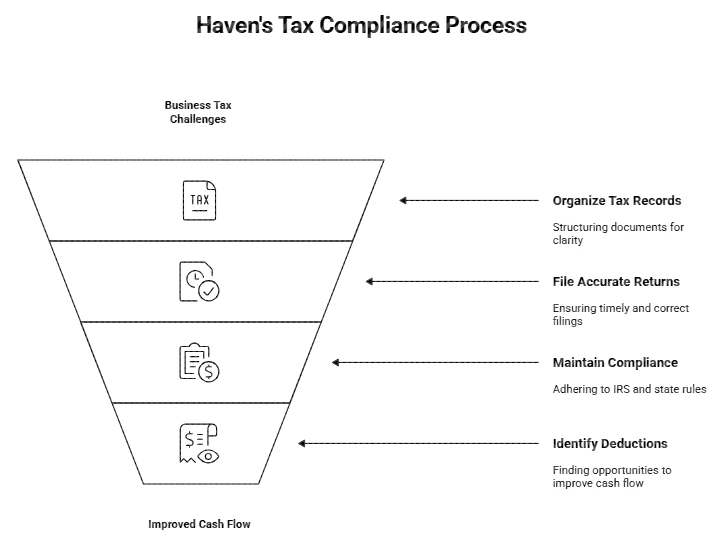

How Haven Simplifies Tax Record Keeping and Compliance

At Haven, we understand how challenging it can be to manage business tax returns while running a company. Our CPA-led team helps founders and small businesses:

Organize tax documentation and digital records

File accurate corporate tax returns on time

Stay compliant with both IRS and state retention requirements

Identify deductions and credits that improve cash flow

Join 400+ startups who rely on Haven for proactive bookkeeping, tax filing, and R&D credit support — all managed through transparent, real-time collaboration on Slack.

Stay Audit-Ready With Smart Tax Record Management

Maintaining accurate small business tax records isn’t just about compliance — it’s a strategic move that protects your business and builds credibility. By understanding IRS tax record retention rules, organizing your documentation, and working with experts, you’ll simplify tax season and prevent costly mistakes.

At Haven, we help founders master bookkeeping and business tax filing so they can focus on growth, not paperwork.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026