Go Back

Last Updated :

Last Updated :

Nov 17, 2025

Nov 17, 2025

How to File Taxes When One Spouse Owns a Business: Guide for Couples

Filing taxes can become significantly more complex when one or both spouses earn business income. Whether you run a small business, freelance full-time, or operate through an LLC or corporation, the way you report that income affects your household’s total tax liability. This tax filing guide for married couples with business income explains how to choose the best filing status, manage deductions, and plan your taxes efficiently as a couple.

At Haven, we help business owners and their partners simplify the tax process with bookkeeping, tax filing, and advisory support tailored to growing businesses.

Understanding How Business Income Affects Joint Tax Filing

When one spouse runs a business and the other earns W-2 wages, the IRS treats those income streams differently. Business income triggers self-employment tax and quarterly estimated payments. W-2 wages have tax withheld automatically.

Your filing status — joint or separate — determines how those two streams are combined and how much you owe.

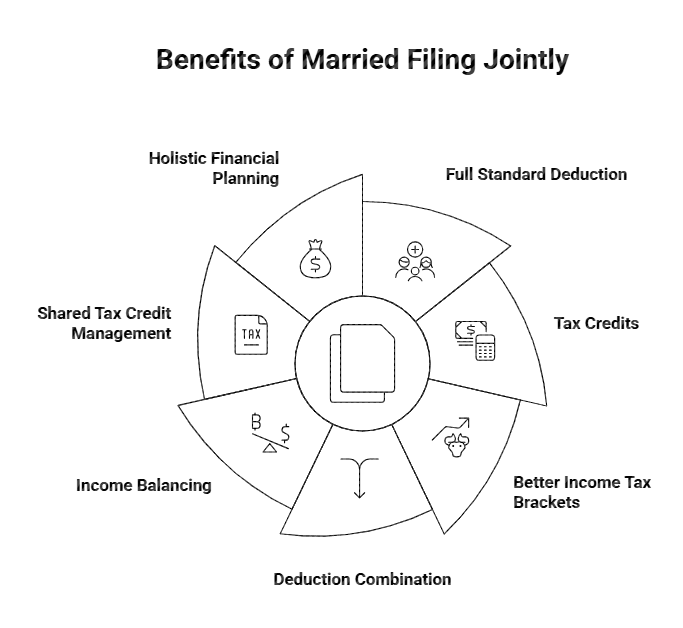

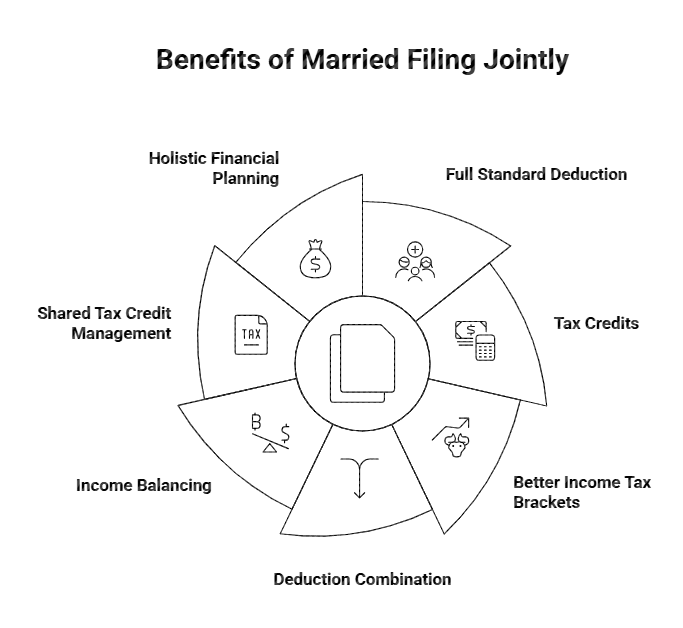

Married Filing Jointly (MFJ): The Most Common Approach

Most married couples choose to file jointly, and for good reason. This filing status generally results in a lower overall tax bill and provides access to the widest range of tax benefits, including:

The full standard deduction (double that of single filers)

Credits such as the Child Tax Credit, Earned Income Tax Credit, and education credits.

Better income tax brackets for combined income.

Benefits for Couples with Business Income

When one spouse earns self-employment income and the other has a regular job, joint filing lets you combine deductions and balance uneven income. For example, large business deductions from one spouse’s venture can reduce the couple’s total taxable income. It’s also easier to manage shared tax credits and plan household finances holistically.

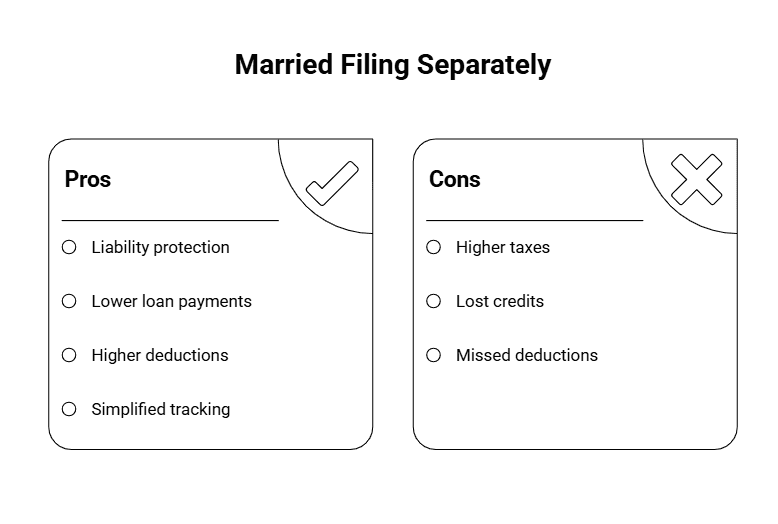

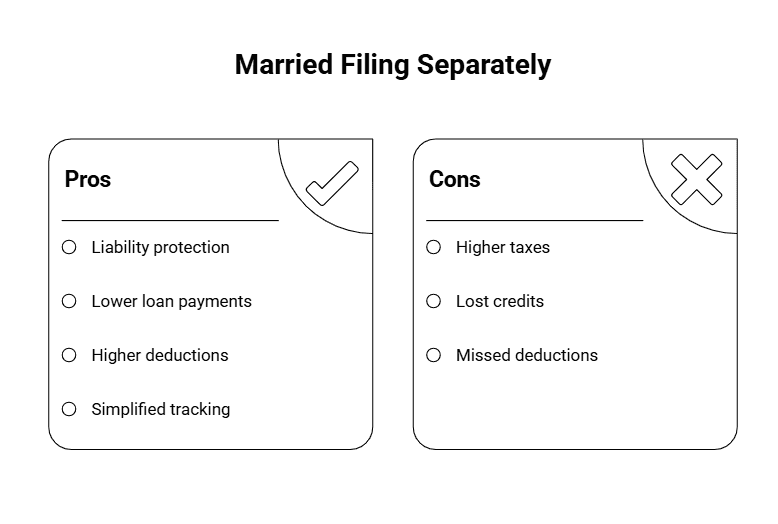

Married Filing Separately (MFS): When It Might Make Sense

Although filing separately often leads to higher taxes, there are cases where it’s beneficial:

Liability protection: If the business owner spouse faces audit risk or has unpaid taxes, filing separately keeps the other spouse from being jointly liable.

Student loan repayment: Filing separately can lower income-driven repayment amounts for federal loans.

High medical or itemized deductions: If one spouse has large deductible expenses, separating income can help them qualify for higher deductions.

Complex business finances: Separate returns can simplify tracking when one spouse owns a complex or high-risk business.

However, MFS filers lose eligibility for many credits, such as the Earned Income Tax Credit, education credits, and certain deductions for student loan interest. The tradeoff must be evaluated carefully — ideally with a CPA or tax advisor.

Choosing the Right Filing Status

For most couples with business income, filing jointly remains the most tax-efficient option. Still, if one spouse’s business carries unique liabilities or audit exposure, filing separately could be safer. A qualified tax professional can compare both scenarios to see which minimizes your overall tax bill and aligns with your goals.

How Business Structure Impacts Tax Filing

The legal structure of your business determines how income and deductions are reported:

Business Structure | How It’s Taxed | Key Filing Forms |

Sole Proprietorship | Income reported on Schedule C with Form 1040 | Schedule C, Schedule SE |

Partnership | Pass-through income reported via Schedule K-1 | Form 1065 + K-1 |

LLC | Can be taxed as sole proprietorship, partnership, or corporation | Varies based on election |

S Corporation | Pass-through income; owners may take salaries | Form 1120-S |

C Corporation | Separate entity taxed at corporate level | Form 1120 |

For married couples, pass-through entities like sole proprietorships, partnerships, and S Corps typically report income directly on your personal return — affecting your household’s total taxable income.

Reporting Business Income and Expenses

If your spouse operates a sole proprietorship or LLC taxed as one, all business income and deductions are reported on Schedule C attached to your joint or separate Form 1040.

Key documentation includes:

Receipts and invoices for deductible expenses

Payroll records (if applicable)

Business bank statements and mileage logs

Maintaining clear, organized records helps you claim every deduction and stay compliant in case of an audit.

Managing Self-Employment Tax and Deductions

Self-employed individuals must pay self-employment tax — 15.3% covering both the employer and employee portions of Social Security and Medicare. Half of this amount is deductible from adjusted gross income, helping reduce your total tax liability.

Key Business Deductions to Reduce Taxes

Common deductions for business owners include:

Office space or rent

Equipment and software

Insurance premiums (liability or professional)

Utilities, supplies, and materials

Travel and meals (50% deductible for business purposes)

If the business is home-based, you may also qualify for the home office deduction — claiming up to $5 per square foot (up to 300 sq ft) or actual expenses for the business portion of your home.

Estimated Taxes and Withholding Adjustments

Since self-employed income doesn’t have automatic withholding, you may need to pay quarterly estimated taxes using IRS Form 1040-ES. To balance household cash flow, the W-2-earning spouse can increase paycheck withholding through Form W-4, helping cover the couple’s total liability.

Staying current on estimated payments prevents underpayment penalties and avoids cash-flow shocks at year-end.

Understanding How Combined Income Affects Credits

When filing jointly, the IRS calculates eligibility for credits and deductions based on combined income. Adding business profits may push you into a higher bracket or reduce access to benefits such as:

Earned Income Tax Credit (EITC)

Child Tax Credit

Education credits like the Lifetime Learning or American Opportunity Credit

Strategic timing of business deductions and retirement contributions can help manage adjusted gross income (AGI) to preserve these credits.

Tax Planning Tips for Couples with Business Income

Work with a CPA or tax professional early

A qualified advisor helps determine the most advantageous filing status, estimate quarterly payments, and plan deductions proactively.Review your filing status each year

Life and income circumstances change. Re-evaluate whether joint or separate filing offers the best tax outcome annually.Stay organized with bookkeeping tools

Accurate records simplify filing, support deductions, and help you stay audit-ready. Consider cloud-based systems like QuickBooks or Xero.Leverage tax-advantaged accounts

Contributions to retirement plans (SEP IRA, Solo 401(k)) or HSAs can reduce taxable income while building long-term savings.

When to Seek Professional Help

Self-employment taxes, joint income reporting, and state-specific rules can quickly become overwhelming. Working with a small business tax advisor ensures compliance, maximizes deductions, and minimizes risk.

At Haven, we specialize in helping founders and growing businesses streamline bookkeeping and tax filing — from quarterly estimated taxes to full-service year-end reporting.

Simplify Tax Season with Expert Guidance

Filing taxes as a married couple with business income requires thoughtful planning and accurate reporting. Understanding your business structure, tracking deductions, and choosing the right filing status all play a role in minimizing tax liability and protecting your finances.

Haven offers startup-native accounting and tax services to help couples stay compliant, capture every deduction, and focus on building their business with confidence.

Let us handle your taxes — so you can focus on growth, not paperwork.

Filing taxes can become significantly more complex when one or both spouses earn business income. Whether you run a small business, freelance full-time, or operate through an LLC or corporation, the way you report that income affects your household’s total tax liability. This tax filing guide for married couples with business income explains how to choose the best filing status, manage deductions, and plan your taxes efficiently as a couple.

At Haven, we help business owners and their partners simplify the tax process with bookkeeping, tax filing, and advisory support tailored to growing businesses.

Understanding How Business Income Affects Joint Tax Filing

When one spouse runs a business and the other earns W-2 wages, the IRS treats those income streams differently. Business income triggers self-employment tax and quarterly estimated payments. W-2 wages have tax withheld automatically.

Your filing status — joint or separate — determines how those two streams are combined and how much you owe.

Married Filing Jointly (MFJ): The Most Common Approach

Most married couples choose to file jointly, and for good reason. This filing status generally results in a lower overall tax bill and provides access to the widest range of tax benefits, including:

The full standard deduction (double that of single filers)

Credits such as the Child Tax Credit, Earned Income Tax Credit, and education credits.

Better income tax brackets for combined income.

Benefits for Couples with Business Income

When one spouse earns self-employment income and the other has a regular job, joint filing lets you combine deductions and balance uneven income. For example, large business deductions from one spouse’s venture can reduce the couple’s total taxable income. It’s also easier to manage shared tax credits and plan household finances holistically.

Married Filing Separately (MFS): When It Might Make Sense

Although filing separately often leads to higher taxes, there are cases where it’s beneficial:

Liability protection: If the business owner spouse faces audit risk or has unpaid taxes, filing separately keeps the other spouse from being jointly liable.

Student loan repayment: Filing separately can lower income-driven repayment amounts for federal loans.

High medical or itemized deductions: If one spouse has large deductible expenses, separating income can help them qualify for higher deductions.

Complex business finances: Separate returns can simplify tracking when one spouse owns a complex or high-risk business.

However, MFS filers lose eligibility for many credits, such as the Earned Income Tax Credit, education credits, and certain deductions for student loan interest. The tradeoff must be evaluated carefully — ideally with a CPA or tax advisor.

Choosing the Right Filing Status

For most couples with business income, filing jointly remains the most tax-efficient option. Still, if one spouse’s business carries unique liabilities or audit exposure, filing separately could be safer. A qualified tax professional can compare both scenarios to see which minimizes your overall tax bill and aligns with your goals.

How Business Structure Impacts Tax Filing

The legal structure of your business determines how income and deductions are reported:

Business Structure | How It’s Taxed | Key Filing Forms |

Sole Proprietorship | Income reported on Schedule C with Form 1040 | Schedule C, Schedule SE |

Partnership | Pass-through income reported via Schedule K-1 | Form 1065 + K-1 |

LLC | Can be taxed as sole proprietorship, partnership, or corporation | Varies based on election |

S Corporation | Pass-through income; owners may take salaries | Form 1120-S |

C Corporation | Separate entity taxed at corporate level | Form 1120 |

For married couples, pass-through entities like sole proprietorships, partnerships, and S Corps typically report income directly on your personal return — affecting your household’s total taxable income.

Reporting Business Income and Expenses

If your spouse operates a sole proprietorship or LLC taxed as one, all business income and deductions are reported on Schedule C attached to your joint or separate Form 1040.

Key documentation includes:

Receipts and invoices for deductible expenses

Payroll records (if applicable)

Business bank statements and mileage logs

Maintaining clear, organized records helps you claim every deduction and stay compliant in case of an audit.

Managing Self-Employment Tax and Deductions

Self-employed individuals must pay self-employment tax — 15.3% covering both the employer and employee portions of Social Security and Medicare. Half of this amount is deductible from adjusted gross income, helping reduce your total tax liability.

Key Business Deductions to Reduce Taxes

Common deductions for business owners include:

Office space or rent

Equipment and software

Insurance premiums (liability or professional)

Utilities, supplies, and materials

Travel and meals (50% deductible for business purposes)

If the business is home-based, you may also qualify for the home office deduction — claiming up to $5 per square foot (up to 300 sq ft) or actual expenses for the business portion of your home.

Estimated Taxes and Withholding Adjustments

Since self-employed income doesn’t have automatic withholding, you may need to pay quarterly estimated taxes using IRS Form 1040-ES. To balance household cash flow, the W-2-earning spouse can increase paycheck withholding through Form W-4, helping cover the couple’s total liability.

Staying current on estimated payments prevents underpayment penalties and avoids cash-flow shocks at year-end.

Understanding How Combined Income Affects Credits

When filing jointly, the IRS calculates eligibility for credits and deductions based on combined income. Adding business profits may push you into a higher bracket or reduce access to benefits such as:

Earned Income Tax Credit (EITC)

Child Tax Credit

Education credits like the Lifetime Learning or American Opportunity Credit

Strategic timing of business deductions and retirement contributions can help manage adjusted gross income (AGI) to preserve these credits.

Tax Planning Tips for Couples with Business Income

Work with a CPA or tax professional early

A qualified advisor helps determine the most advantageous filing status, estimate quarterly payments, and plan deductions proactively.Review your filing status each year

Life and income circumstances change. Re-evaluate whether joint or separate filing offers the best tax outcome annually.Stay organized with bookkeeping tools

Accurate records simplify filing, support deductions, and help you stay audit-ready. Consider cloud-based systems like QuickBooks or Xero.Leverage tax-advantaged accounts

Contributions to retirement plans (SEP IRA, Solo 401(k)) or HSAs can reduce taxable income while building long-term savings.

When to Seek Professional Help

Self-employment taxes, joint income reporting, and state-specific rules can quickly become overwhelming. Working with a small business tax advisor ensures compliance, maximizes deductions, and minimizes risk.

At Haven, we specialize in helping founders and growing businesses streamline bookkeeping and tax filing — from quarterly estimated taxes to full-service year-end reporting.

Simplify Tax Season with Expert Guidance

Filing taxes as a married couple with business income requires thoughtful planning and accurate reporting. Understanding your business structure, tracking deductions, and choosing the right filing status all play a role in minimizing tax liability and protecting your finances.

Haven offers startup-native accounting and tax services to help couples stay compliant, capture every deduction, and focus on building their business with confidence.

Let us handle your taxes — so you can focus on growth, not paperwork.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026