Go Back

Last Updated :

Last Updated :

Nov 24, 2025

Nov 24, 2025

A Step-by-Step Guide on How to Do Business Taxes for Startups

Tax season hits harder for founders. Between entity choices, quarterly deadlines, payroll obligations, and state-by-state rules, taxes can quickly turn into a time sink that pulls you away from product and customers.

This guide shows you how to do business taxes the right way—clear steps, direct explanations, and startup-specific tactics to keep your burn rate clean and your filings compliant.

Understanding Different Types of Entities

Your legal structure drives how you’re taxed, what forms you file, and how investors evaluate you. Most startups choose between five options: sole proprietorship, partnership, LLC, S-Corp, and C-Corp.

Sole Proprietorship: Simple, but Not Scalable

If you’re freelancing or building prototypes solo, a sole proprietorship works temporarily. There’s no formal setup and no corporate tax. But you’re personally liable, fundraising is nearly impossible, and separating business vs. personal finances becomes messy.

General Partnership: Built for Early Experiments, Not Growth

Two or more founders can operate as a partnership without forming a separate entity. Variants include LPs and LLPs. They’re fine for testing ideas but break down fast under liability, hiring, and fundraising demands.

LLC: Flexible and Founder-Friendly (Until Investors Enter)

LLCs offer liability protection and tax flexibility. They’re ideal for bootstrapped or lifestyle businesses. But VCs rarely invest in LLCs. Equity issuance is harder, tax flows complicate cap tables, and you’ll likely convert to a C-Corp anyway.

S-Corp: Tax-Friendly, Operationally Restrictive

S-Corps avoid corporate tax, but founders face major constraints:

One class of stock

Max 100 shareholders

Only U.S. individuals can own shares

This makes S-Corps a mismatch for venture-backed tech.

C-Corp: The Default for Startups

If your goal is raising capital, issuing equity, and scaling, form a C-Corp—typically in Delaware. Benefits include:

Multiple stock classes

No shareholder limit

Clean equity compensation

Familiar structure for VCs and legal teams

Changing structures later is possible, but creates friction. Start with the right foundation.

Your Business’s Tax Liability

All for-profit U.S. businesses owe taxes, but your rate and filing obligations depend on your entity’s tax election.

C-Corps vs. Pass-Through Entities

C-Corps: File Form 1120. Subject to the 21% federal corporate rate.

Pass-through entities: (LLCs, partnerships, sole proprietorships, S-Corps) Income flows to your personal return. You’ll file forms like 1065 or 1120-S, depending on the structure.

Federal Tax Changes

Congress must approve any tax code updates. Many TCJA provisions expire at the end of 2025, but the corporate tax at 21% is permanent unless changed by new legislation.

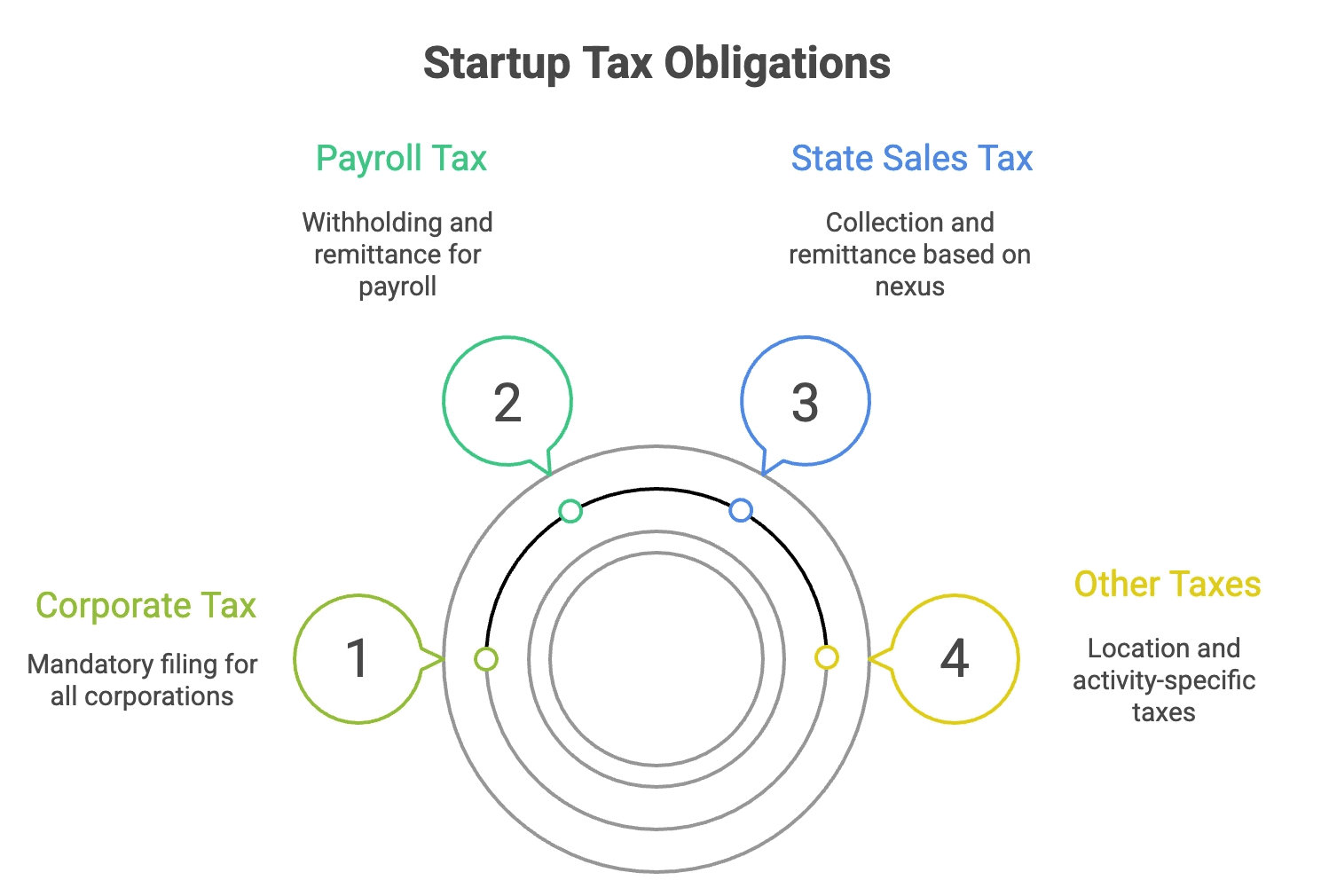

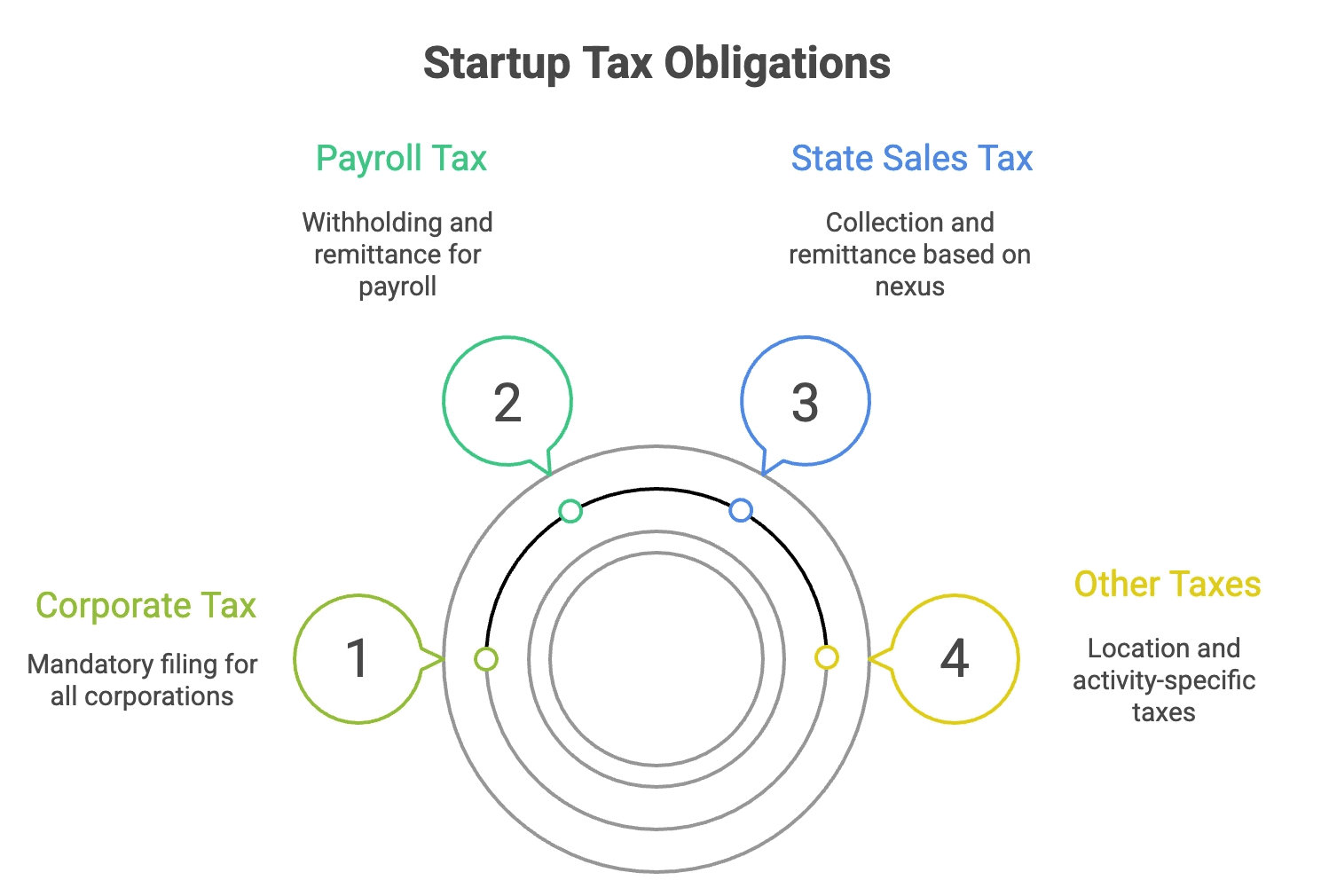

Key Tax Categories for Startups

Corporate Tax: All corporations must file Form 1120—even with zero profit.

Payroll Tax: If you run payroll, you must withhold:

Federal income tax

Social Security

Medicare

Federal unemployment (FUTA)

Missing payroll taxes is one of the fastest ways to trigger penalties.

State Sales Tax: You must collect and remit sales tax in states where you’ve established nexus—via physical presence, employees, or sales thresholds.

Other Taxes: Depending on location and activities, you may also owe:

Property tax

Excise tax

Franchise tax

Use tax

When Are Business Taxes Due?

Startups must pay taxes throughout the year. Federal estimated payments for calendar-year entities are due:

April 15

June 15

September 15

January 15

Fiscal-Year Businesses

If you operate on a fiscal year, your deadlines shift based on your start date.

Key Tax Deadlines for 2025

January 15, 2025: Q4 estimated payment

March 15, 2025: Partnership, multi-member LLC, and S-Corp returns (Forms 1065, 1120-S)

April 15, 2025: C-Corp returns (Form 1120) and individual returns

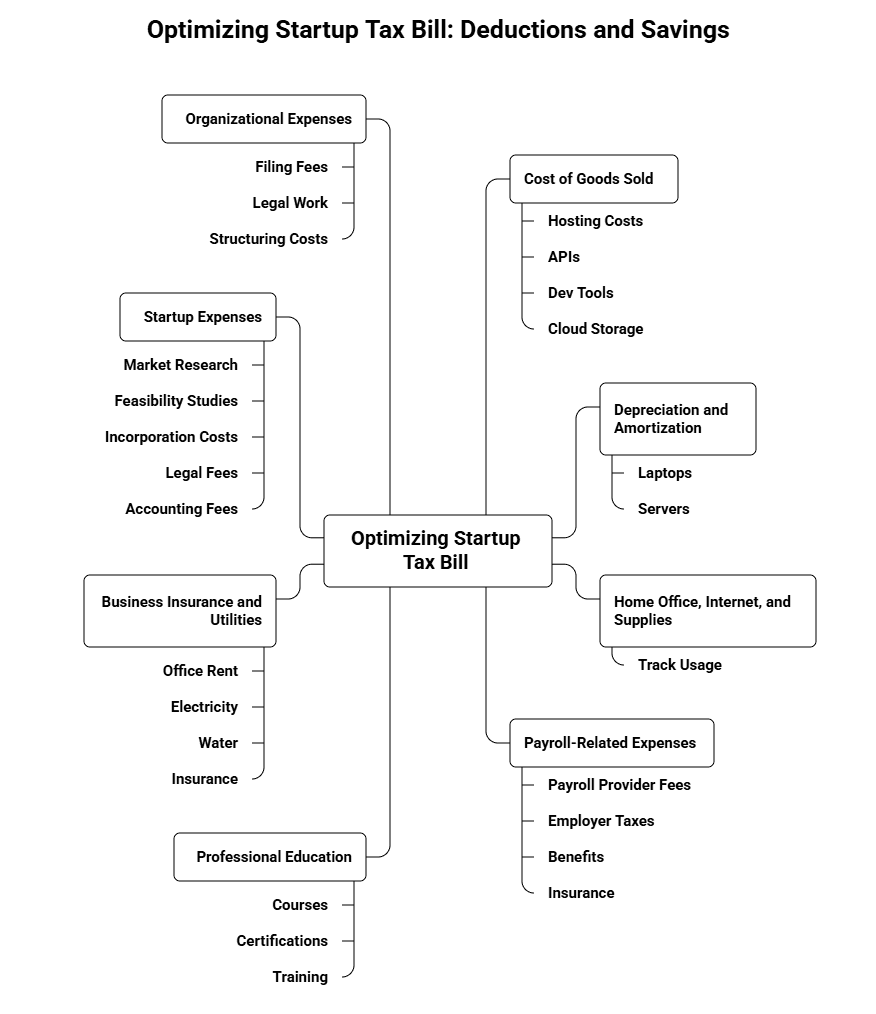

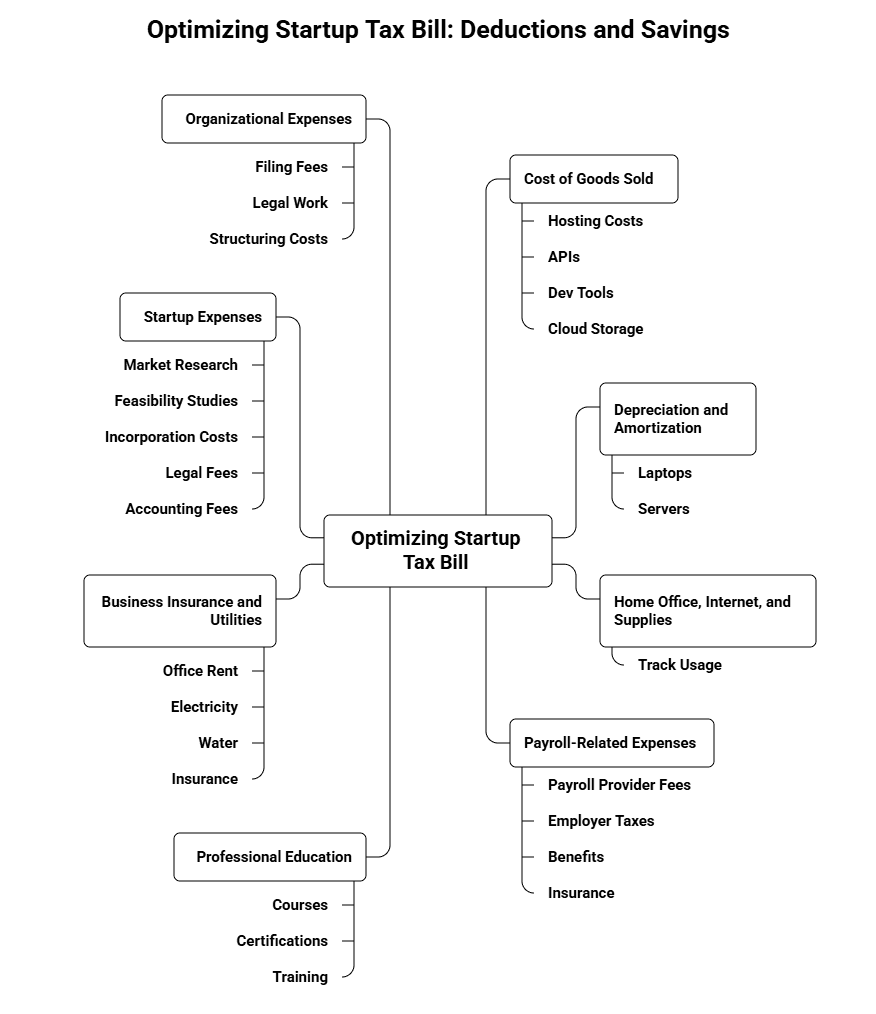

How to Optimize Your Startup's Tax Bill

Tech startups can deduct more than founders realize. Here’s where savings (and runway) come from.

Cost of Goods Sold (COGS)

Deduct expenses directly tied to building your product:

Hosting costs

APIs

Dev tools

Cloud storage

Depreciation and Amortization

Large purchases like laptops and servers may be deducted over time.

Home Office, Internet, and Supplies

Remote work creates legitimate deductions—as long as you track usage.

Payroll-Related Expenses

Payroll provider fees, employer taxes, benefits, and insurance are deductible.

Professional Education

Courses, certifications, and training tied to your business qualify.

Business Insurance and Utilities

Office rent, electricity, water, and insurance are all valid deductions.

Startup Expenses (First-Year Deductions)

You can deduct up to $5,000 of eligible startup costs if total startup expenses are under $50,000. This includes:

Market research

Feasibility studies

Incorporation costs

Early legal and accounting fees

Organizational Expenses

Forming a C-Corp or LLC? Filing fees, legal work, and structuring costs may be deductible.

Use the R&D Tax Credit (Most Tech Startups Qualify)

You can often claim the R&D tax credit, even if you’re pre-revenue. You may qualify if you’re:

Building new software

Improving an existing system

Developing algorithms

Conducting product testing

You must meet the four-part IRS test:

Permitted purpose

Technological in nature

Uncertainty at outset

Experimentation process

Startups can claim up to $500,000 in credits. You’ll file:

Form 6765 (partnerships, S-Corps)

Form 3800 (C-Corps)

Stay Organized and Work With a Startup CPA

Clean books are the foundation of a low tax bill. Keep:

Consistent accounting records

Receipts (digital or physical)

Categorized expenses

A CPA fluent in startups and software accounting will help you:

Capture all deductions

File the right federal and state forms

Model your next year’s tax liability

Tax planning isn’t a March activity—it’s a year-round strategy.

Haven: Financial Ops for Startups, Handled

Let your business take flight while Haven manages your financial runway. Built by founders for founders, we handle daily bookkeeping, tax filings, payroll, and R&D credits—plus fractional CFO support.

More than 400 startups rely on Haven to stay compliant, save hours each month, and avoid costly filing mistakes.

Book a call and get financial ops that move as fast as you do.

Tax season hits harder for founders. Between entity choices, quarterly deadlines, payroll obligations, and state-by-state rules, taxes can quickly turn into a time sink that pulls you away from product and customers.

This guide shows you how to do business taxes the right way—clear steps, direct explanations, and startup-specific tactics to keep your burn rate clean and your filings compliant.

Understanding Different Types of Entities

Your legal structure drives how you’re taxed, what forms you file, and how investors evaluate you. Most startups choose between five options: sole proprietorship, partnership, LLC, S-Corp, and C-Corp.

Sole Proprietorship: Simple, but Not Scalable

If you’re freelancing or building prototypes solo, a sole proprietorship works temporarily. There’s no formal setup and no corporate tax. But you’re personally liable, fundraising is nearly impossible, and separating business vs. personal finances becomes messy.

General Partnership: Built for Early Experiments, Not Growth

Two or more founders can operate as a partnership without forming a separate entity. Variants include LPs and LLPs. They’re fine for testing ideas but break down fast under liability, hiring, and fundraising demands.

LLC: Flexible and Founder-Friendly (Until Investors Enter)

LLCs offer liability protection and tax flexibility. They’re ideal for bootstrapped or lifestyle businesses. But VCs rarely invest in LLCs. Equity issuance is harder, tax flows complicate cap tables, and you’ll likely convert to a C-Corp anyway.

S-Corp: Tax-Friendly, Operationally Restrictive

S-Corps avoid corporate tax, but founders face major constraints:

One class of stock

Max 100 shareholders

Only U.S. individuals can own shares

This makes S-Corps a mismatch for venture-backed tech.

C-Corp: The Default for Startups

If your goal is raising capital, issuing equity, and scaling, form a C-Corp—typically in Delaware. Benefits include:

Multiple stock classes

No shareholder limit

Clean equity compensation

Familiar structure for VCs and legal teams

Changing structures later is possible, but creates friction. Start with the right foundation.

Your Business’s Tax Liability

All for-profit U.S. businesses owe taxes, but your rate and filing obligations depend on your entity’s tax election.

C-Corps vs. Pass-Through Entities

C-Corps: File Form 1120. Subject to the 21% federal corporate rate.

Pass-through entities: (LLCs, partnerships, sole proprietorships, S-Corps) Income flows to your personal return. You’ll file forms like 1065 or 1120-S, depending on the structure.

Federal Tax Changes

Congress must approve any tax code updates. Many TCJA provisions expire at the end of 2025, but the corporate tax at 21% is permanent unless changed by new legislation.

Key Tax Categories for Startups

Corporate Tax: All corporations must file Form 1120—even with zero profit.

Payroll Tax: If you run payroll, you must withhold:

Federal income tax

Social Security

Medicare

Federal unemployment (FUTA)

Missing payroll taxes is one of the fastest ways to trigger penalties.

State Sales Tax: You must collect and remit sales tax in states where you’ve established nexus—via physical presence, employees, or sales thresholds.

Other Taxes: Depending on location and activities, you may also owe:

Property tax

Excise tax

Franchise tax

Use tax

When Are Business Taxes Due?

Startups must pay taxes throughout the year. Federal estimated payments for calendar-year entities are due:

April 15

June 15

September 15

January 15

Fiscal-Year Businesses

If you operate on a fiscal year, your deadlines shift based on your start date.

Key Tax Deadlines for 2025

January 15, 2025: Q4 estimated payment

March 15, 2025: Partnership, multi-member LLC, and S-Corp returns (Forms 1065, 1120-S)

April 15, 2025: C-Corp returns (Form 1120) and individual returns

How to Optimize Your Startup's Tax Bill

Tech startups can deduct more than founders realize. Here’s where savings (and runway) come from.

Cost of Goods Sold (COGS)

Deduct expenses directly tied to building your product:

Hosting costs

APIs

Dev tools

Cloud storage

Depreciation and Amortization

Large purchases like laptops and servers may be deducted over time.

Home Office, Internet, and Supplies

Remote work creates legitimate deductions—as long as you track usage.

Payroll-Related Expenses

Payroll provider fees, employer taxes, benefits, and insurance are deductible.

Professional Education

Courses, certifications, and training tied to your business qualify.

Business Insurance and Utilities

Office rent, electricity, water, and insurance are all valid deductions.

Startup Expenses (First-Year Deductions)

You can deduct up to $5,000 of eligible startup costs if total startup expenses are under $50,000. This includes:

Market research

Feasibility studies

Incorporation costs

Early legal and accounting fees

Organizational Expenses

Forming a C-Corp or LLC? Filing fees, legal work, and structuring costs may be deductible.

Use the R&D Tax Credit (Most Tech Startups Qualify)

You can often claim the R&D tax credit, even if you’re pre-revenue. You may qualify if you’re:

Building new software

Improving an existing system

Developing algorithms

Conducting product testing

You must meet the four-part IRS test:

Permitted purpose

Technological in nature

Uncertainty at outset

Experimentation process

Startups can claim up to $500,000 in credits. You’ll file:

Form 6765 (partnerships, S-Corps)

Form 3800 (C-Corps)

Stay Organized and Work With a Startup CPA

Clean books are the foundation of a low tax bill. Keep:

Consistent accounting records

Receipts (digital or physical)

Categorized expenses

A CPA fluent in startups and software accounting will help you:

Capture all deductions

File the right federal and state forms

Model your next year’s tax liability

Tax planning isn’t a March activity—it’s a year-round strategy.

Haven: Financial Ops for Startups, Handled

Let your business take flight while Haven manages your financial runway. Built by founders for founders, we handle daily bookkeeping, tax filings, payroll, and R&D credits—plus fractional CFO support.

More than 400 startups rely on Haven to stay compliant, save hours each month, and avoid costly filing mistakes.

Book a call and get financial ops that move as fast as you do.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026