Go Back

Last Updated :

Last Updated :

Feb 6, 2026

Feb 6, 2026

Determining Revenue: Guide from Basics to Expert

For startup founders, COOs, and heads of finance, understanding how to determine revenue is a foundational skill that can drastically influence your business decision-making. Revenue — the top-line number on your financial statements — directly impacts your financing, growth strategy, and tax obligations. Yet startups, agencies, and e-commerce companies often face unique challenges in accurately identifying and calculating revenue across different business models.

This practical guide unpacks the nuances of revenue, clarifies key distinctions, and walks you through tailored strategies to accurately capture your business income. It’s specifically designed to give founders a clear, fast, and modern understanding so you can focus on growing your company with confidence.

What Is Revenue and Why Does It Matter to Founders?

At its simplest, revenue is the total amount your business earns from selling goods or services during a specific period. You’ll often hear it called the “top line” because it sits at the very top of your income statement (profit and loss statement) — before any expenses, taxes, or cost of goods sold (COGS) are deducted.

Why Accurate Revenue Tracking Is Crucial

Performance Tracking: Revenue is the baseline indicator of whether your business model and sales strategy are working.

Investor Relations: Investors and lenders scrutinize your top-line revenue to assess business viability.

Tax Reporting: Revenue figures serve as a key input for tax filings and help in maximizing eligible credits like R&D.

Growth Strategy: Understanding revenue streams influences pricing, marketing investments, and product development budgets.

As you identify and calculate your business revenue, you must bring clarity to what counts as revenue — especially across different industries and sales scenarios.

Types of Revenue Models and Their Implications on Revenue Calculation

Business revenue is not one-size-fits-all. Your revenue recognition and calculation approach will vary depending on your company’s structure and sales methodology. The main types to consider include:

Revenue Model | Description | Example | Calculation Considerations |

Product Sales | Revenue earned from selling physical or digital products. | E-commerce retailer selling apparel | Total sales minus returns, discounts, and allowances |

Service Revenue | Income from providing services, consulting, or professional fees. | Digital marketing agency billing clients | Recognize revenue when services are delivered or milestones met |

Subscription Model | Recurring revenue from ongoing access or membership fees. | SaaS company charging monthly fees | Recognize revenue ratably over the subscription period |

Usage-Based Revenue | Charges based on consumption metrics such as API calls or data usage. | Cloud platform charging per GB storage | Track usage and bill accordingly, recognize revenue as earned |

Project-Based Revenue | Fixed price or milestone payments tied to deliverables. | Software implementation with stage payments | Recognize revenue as each milestone or deliverable is completed |

Understanding your revenue model is critical because it affects both the timing and total amount reported as revenue — not just the raw dollar intake.

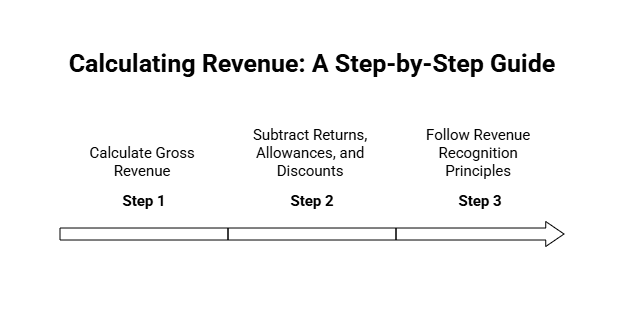

How to Determine Revenue: Core Calculation Methods

While methods vary by model, the baseline formula is: Revenue = Price × Quantity Sold. From there, adjustments account for returns, timing, and recognition standards.

Step 1: Calculate Gross Revenue

For product sales: number of units × sale price.

For services: billable hours × rate or invoiced fees.

For subscriptions: active subscribers × rate (prorated if needed).

Step 2: Subtract Returns, Allowances, and Discounts

Gross revenue isn’t the final amount you recognize. You must adjust for:

Returned products or canceled services

Promotional discounts and coupons

Allowances for damage or delivery issues

The resulting figure is your Net Revenue — a more accurate representation of recurring business income.

Step 3: Follow Revenue Recognition Principles

It’s essential for founders to understand accounting standards such as GAAP:

Recognize revenue when earned, not necessarily when cash is received.

Divide subscription revenue over the life of the agreement.

For long-term projects, adopt percentage-of-completion methods.

Always refer to the SBA’s guide on handling your business finances, which provides clear federal recommendations.

Industry-Specific Complexity: E-Commerce and Agencies

E-Commerce Revenue Specifics

E-commerce startups face complications like:

Multi-channel listings (Shopify, Amazon, Etsy)

Handling taxes and shipping fees in gross vs. net revenue

High return rates requiring frequent reconciliation

To keep e-commerce revenue accurate, implement integrations with payment platforms, automate refunds tracking, and categorize revenue by source.

Agencies and Service Firms

Agencies often juggle:

Fixed-fee, hourly, and bonus-based billing

Contract terms that span several months

Revenue attribution across deliverables or milestones

A clear project accounting system and calendar-based invoicing practices help avoid recognition errors.

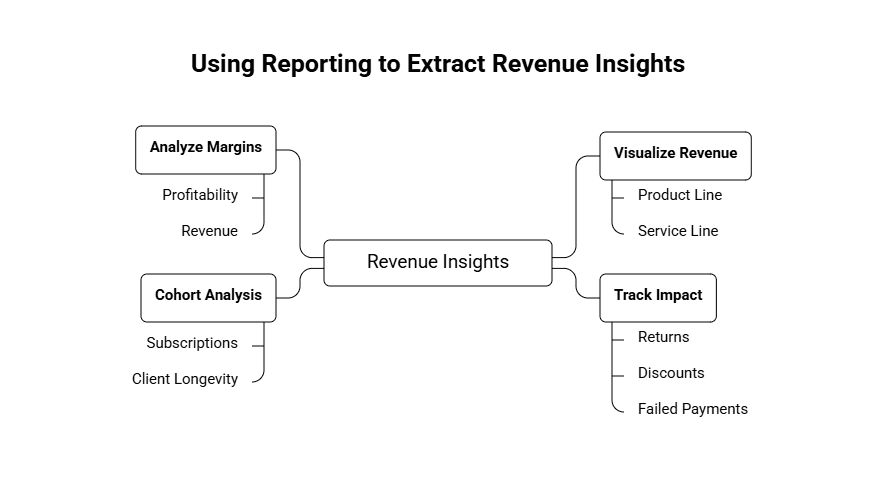

Using Reporting to Extract Revenue Insights

Revenue isn’t just a top-line stat — it’s a decision-making tool. Integrated reporting empowers you to:

Visualize revenue by product or service line

Track impact of returns, discounts, and failed payments

Perform cohort analysis for subscriptions or client longevity

Analyze margins to link revenue with profitability

Modern founders benefit from cloud dashboards that unify these insights. Consider financial services like Haven’s reporting solutions to scale smarter.

Pro Tips for Accurate Revenue and Strategic Growth

Define Revenue Consistently: Align your accounting and operations teams on definitions.

Automate Where Possible: Use accounting software with APIs for commerce platforms or CRMs.

Segment Channels: Track revenue by sales channel, customer type, or product offer.

Reconcile Regularly: Monthly checks ensure your reports reflect reality.

Assess Tax Implications: Your revenue impacts estimated quarterly taxes and R&D credits.

Watch for Non-Operating Income: Exclude loans, one-time gains, and grants from core revenue.

Consult Startup-Focused CPAs: They'll help ensure GAAP-compliance and audit readiness.

Lead With Confidence by Knowing Exactly How to Determine Revenue

For founders, mastering how to determine revenue goes beyond bookkeeping—it’s about making smarter growth decisions. With proper recognition aligned to your business model, smart adjustments for discounts and timing, and actionable reports, you'll avoid surprises and scale confidently with clarity.

Ready to align your startup revenue process with modern financial standards?

For startup founders, COOs, and heads of finance, understanding how to determine revenue is a foundational skill that can drastically influence your business decision-making. Revenue — the top-line number on your financial statements — directly impacts your financing, growth strategy, and tax obligations. Yet startups, agencies, and e-commerce companies often face unique challenges in accurately identifying and calculating revenue across different business models.

This practical guide unpacks the nuances of revenue, clarifies key distinctions, and walks you through tailored strategies to accurately capture your business income. It’s specifically designed to give founders a clear, fast, and modern understanding so you can focus on growing your company with confidence.

What Is Revenue and Why Does It Matter to Founders?

At its simplest, revenue is the total amount your business earns from selling goods or services during a specific period. You’ll often hear it called the “top line” because it sits at the very top of your income statement (profit and loss statement) — before any expenses, taxes, or cost of goods sold (COGS) are deducted.

Why Accurate Revenue Tracking Is Crucial

Performance Tracking: Revenue is the baseline indicator of whether your business model and sales strategy are working.

Investor Relations: Investors and lenders scrutinize your top-line revenue to assess business viability.

Tax Reporting: Revenue figures serve as a key input for tax filings and help in maximizing eligible credits like R&D.

Growth Strategy: Understanding revenue streams influences pricing, marketing investments, and product development budgets.

As you identify and calculate your business revenue, you must bring clarity to what counts as revenue — especially across different industries and sales scenarios.

Types of Revenue Models and Their Implications on Revenue Calculation

Business revenue is not one-size-fits-all. Your revenue recognition and calculation approach will vary depending on your company’s structure and sales methodology. The main types to consider include:

Revenue Model | Description | Example | Calculation Considerations |

Product Sales | Revenue earned from selling physical or digital products. | E-commerce retailer selling apparel | Total sales minus returns, discounts, and allowances |

Service Revenue | Income from providing services, consulting, or professional fees. | Digital marketing agency billing clients | Recognize revenue when services are delivered or milestones met |

Subscription Model | Recurring revenue from ongoing access or membership fees. | SaaS company charging monthly fees | Recognize revenue ratably over the subscription period |

Usage-Based Revenue | Charges based on consumption metrics such as API calls or data usage. | Cloud platform charging per GB storage | Track usage and bill accordingly, recognize revenue as earned |

Project-Based Revenue | Fixed price or milestone payments tied to deliverables. | Software implementation with stage payments | Recognize revenue as each milestone or deliverable is completed |

Understanding your revenue model is critical because it affects both the timing and total amount reported as revenue — not just the raw dollar intake.

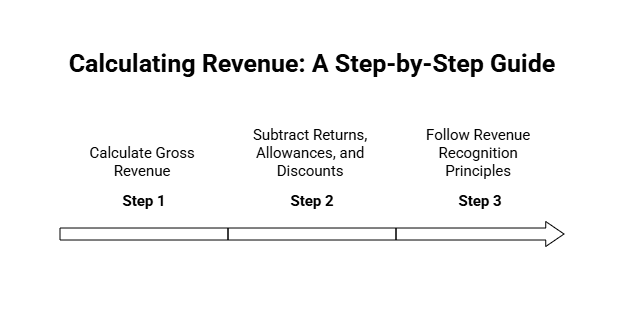

How to Determine Revenue: Core Calculation Methods

While methods vary by model, the baseline formula is: Revenue = Price × Quantity Sold. From there, adjustments account for returns, timing, and recognition standards.

Step 1: Calculate Gross Revenue

For product sales: number of units × sale price.

For services: billable hours × rate or invoiced fees.

For subscriptions: active subscribers × rate (prorated if needed).

Step 2: Subtract Returns, Allowances, and Discounts

Gross revenue isn’t the final amount you recognize. You must adjust for:

Returned products or canceled services

Promotional discounts and coupons

Allowances for damage or delivery issues

The resulting figure is your Net Revenue — a more accurate representation of recurring business income.

Step 3: Follow Revenue Recognition Principles

It’s essential for founders to understand accounting standards such as GAAP:

Recognize revenue when earned, not necessarily when cash is received.

Divide subscription revenue over the life of the agreement.

For long-term projects, adopt percentage-of-completion methods.

Always refer to the SBA’s guide on handling your business finances, which provides clear federal recommendations.

Industry-Specific Complexity: E-Commerce and Agencies

E-Commerce Revenue Specifics

E-commerce startups face complications like:

Multi-channel listings (Shopify, Amazon, Etsy)

Handling taxes and shipping fees in gross vs. net revenue

High return rates requiring frequent reconciliation

To keep e-commerce revenue accurate, implement integrations with payment platforms, automate refunds tracking, and categorize revenue by source.

Agencies and Service Firms

Agencies often juggle:

Fixed-fee, hourly, and bonus-based billing

Contract terms that span several months

Revenue attribution across deliverables or milestones

A clear project accounting system and calendar-based invoicing practices help avoid recognition errors.

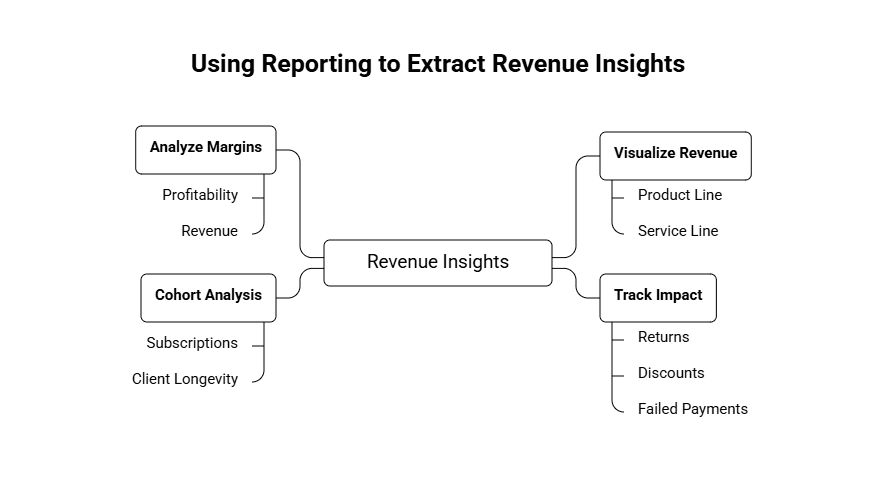

Using Reporting to Extract Revenue Insights

Revenue isn’t just a top-line stat — it’s a decision-making tool. Integrated reporting empowers you to:

Visualize revenue by product or service line

Track impact of returns, discounts, and failed payments

Perform cohort analysis for subscriptions or client longevity

Analyze margins to link revenue with profitability

Modern founders benefit from cloud dashboards that unify these insights. Consider financial services like Haven’s reporting solutions to scale smarter.

Pro Tips for Accurate Revenue and Strategic Growth

Define Revenue Consistently: Align your accounting and operations teams on definitions.

Automate Where Possible: Use accounting software with APIs for commerce platforms or CRMs.

Segment Channels: Track revenue by sales channel, customer type, or product offer.

Reconcile Regularly: Monthly checks ensure your reports reflect reality.

Assess Tax Implications: Your revenue impacts estimated quarterly taxes and R&D credits.

Watch for Non-Operating Income: Exclude loans, one-time gains, and grants from core revenue.

Consult Startup-Focused CPAs: They'll help ensure GAAP-compliance and audit readiness.

Lead With Confidence by Knowing Exactly How to Determine Revenue

For founders, mastering how to determine revenue goes beyond bookkeeping—it’s about making smarter growth decisions. With proper recognition aligned to your business model, smart adjustments for discounts and timing, and actionable reports, you'll avoid surprises and scale confidently with clarity.

Ready to align your startup revenue process with modern financial standards?

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026