Go Back

Last Updated :

Last Updated :

Nov 17, 2025

Nov 17, 2025

The Best Accounting Software for Small Businesses in 2025

The right accounting software for small businesses should make decisions faster, not add noise. Yet comparing features, pricing pages, and trial limits across dozens of tools can drag on longer than it should.

We’ve done the work for you. In this guide, you’ll find the top 5 accounting software for small businesses in 2025, along with what each platform does best and how much it costs. By the end, you’ll know which one fits your goals — and which may not be worth your time.

Quick Comparison: Best Accounting Software 2025

Here’s a quick overview before we dive deeper into each option:

Software | Starting Price | Key Features | Best For |

Haven | From $300/month (service + software) | Dedicated accountant + real-time dashboard for P&L, cash flow, runway, and tax handling. Startup-specific accounting and Slack-first support. | Startups and SMBs that want expert accounting, not another DIY tool. |

Xero | From $25/month | Cloud-based with unlimited users, automated bank feeds, invoicing, and 1,000+ integrations. | Small teams or international businesses that want collaboration and automation. |

QuickBooks | From $38/month | All-in-one accounting with invoicing, payroll, inventory, and AI automation via Intuit Assist. | Small to medium businesses that need reliable automation. |

Zoho Books | Free plan available; paid from $15/month | Affordable and automation-driven with invoicing, projects, and full Zoho ecosystem integration. | Founders who want smart features on a budget. |

Sage 50 | From ~$62/month (billed annually) | Desktop reliability + cloud backups, detailed reporting, and job costing. | Product-based or multi-entity businesses needing robust accounting. |

1. Haven

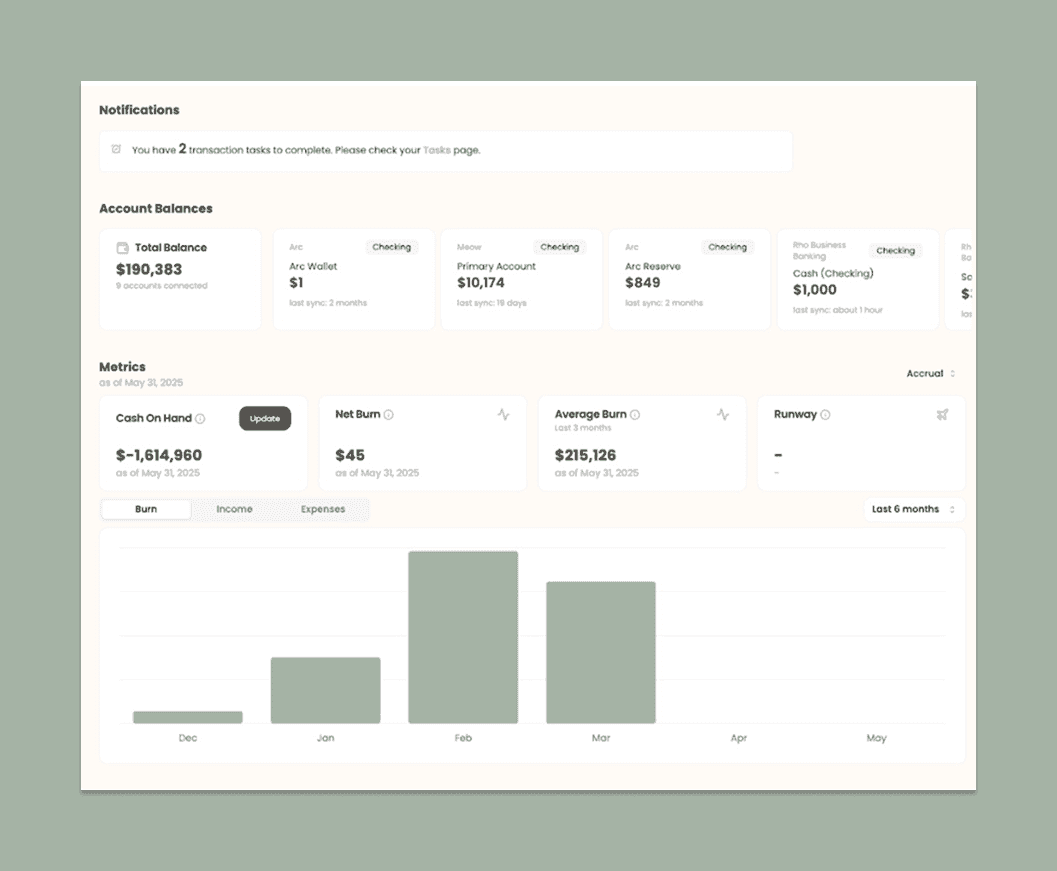

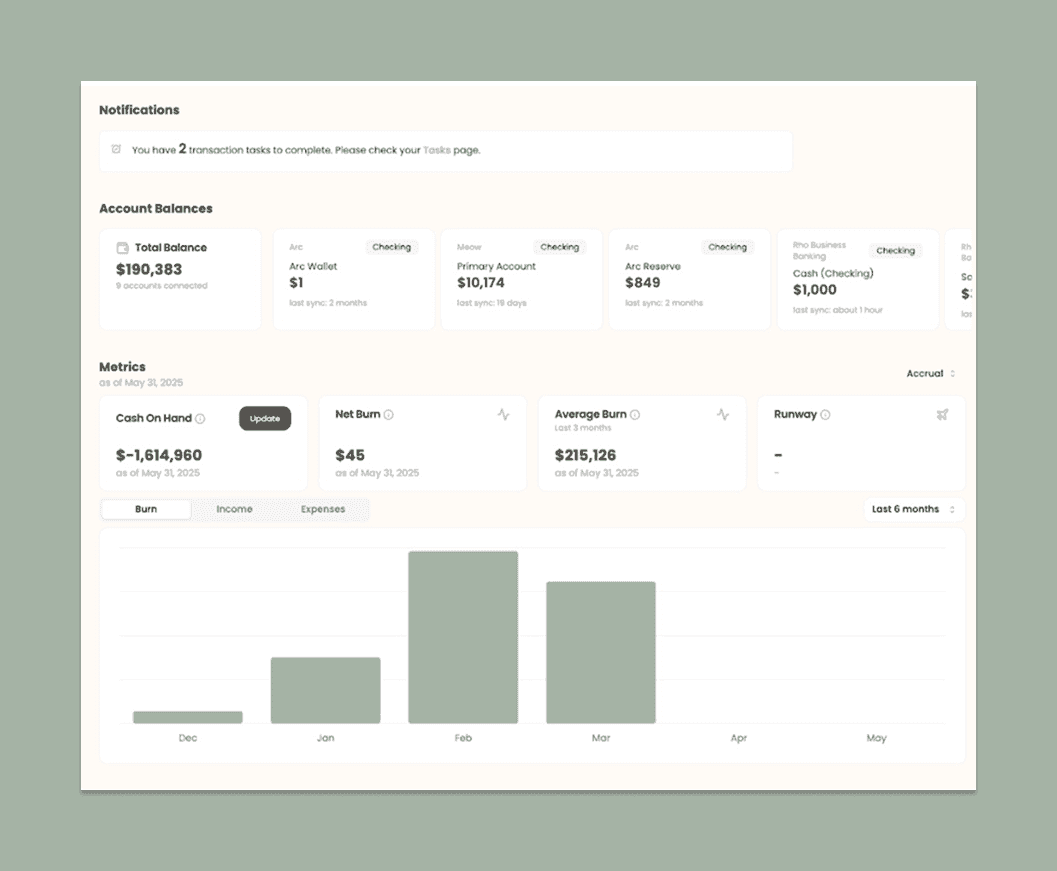

Haven is more than bookkeeping software for startups — it’s a modern accounting partner built for founders. Combining AI-driven systems with real accountants, Haven automates repetitive tasks like expense categorization and reconciliations while keeping human oversight at every step.

What You Get with Haven

End-to-end bookkeeping: Monthly reconciliations, tax prep, and financial reports handled for you.

AI-assisted accuracy: Proprietary systems use automation to speed up document processing and data extraction.

Dedicated accountant: You always have a professional reviewing your books for accuracy.

Slack-first support: Get answers instantly, no waiting or support tickets.

Startup-specific accounting: Handle deferred revenue, accruals, and SaaS metrics easily.

Haven gives you the clarity of top-tier software with the reliability of expert oversight.

Pricing

Plans start around $300/month for businesses spending roughly $20K monthly. Pricing scales based on complexity (multi-entity, crypto, or inventory management). Every plan includes a dedicated accountant and complete financial reporting.

Book a free strategy call to see how Haven can simplify your finances and free up your time.

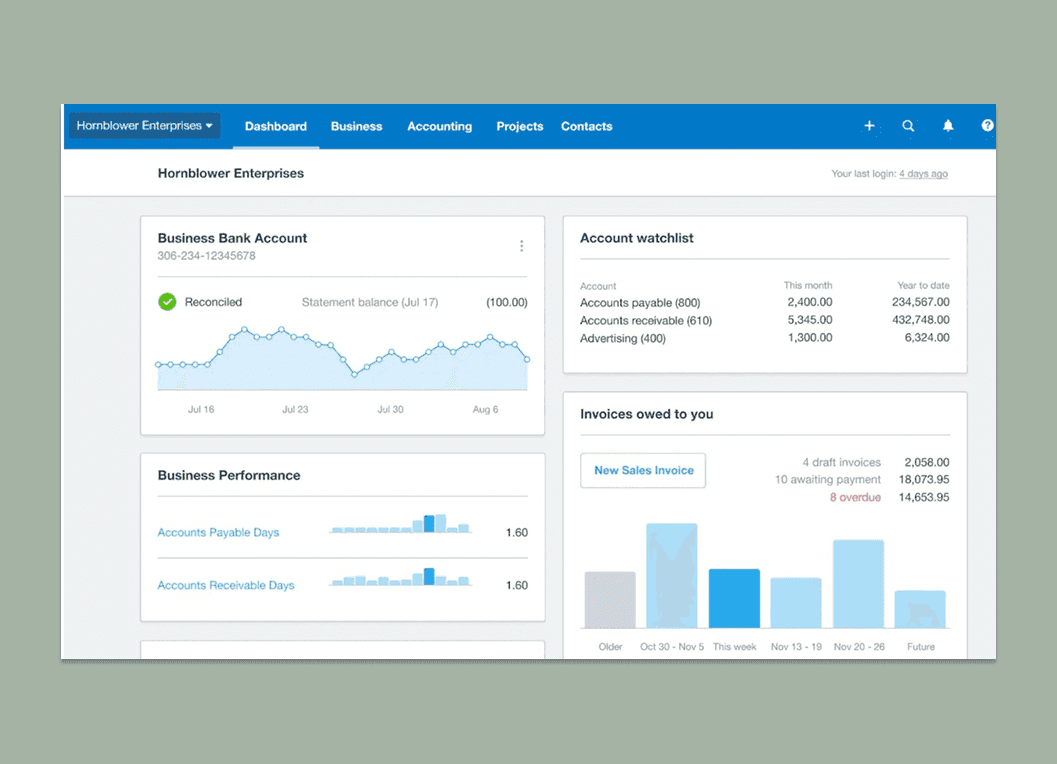

2. Xero

Xero is a favorite among small teams thanks to its intuitive interface and strong automation. It connects with over 1,000 apps — including Stripe, Shopify, and HubSpot — allowing businesses to manage everything from invoicing to payments in one place.

Key Features

Unlimited users across all plans (rare for accounting tools)

Multi-currency support for global operations

Project tracking and basic inventory management

Real-time collaboration with accountants or bookkeepers

Full mobile access for invoicing and expense tracking on the go

Pricing

Plans start at $25/month with a 30-day free trial. Xero often offers 90% off for the first three months, making it a great low-commitment way to test.

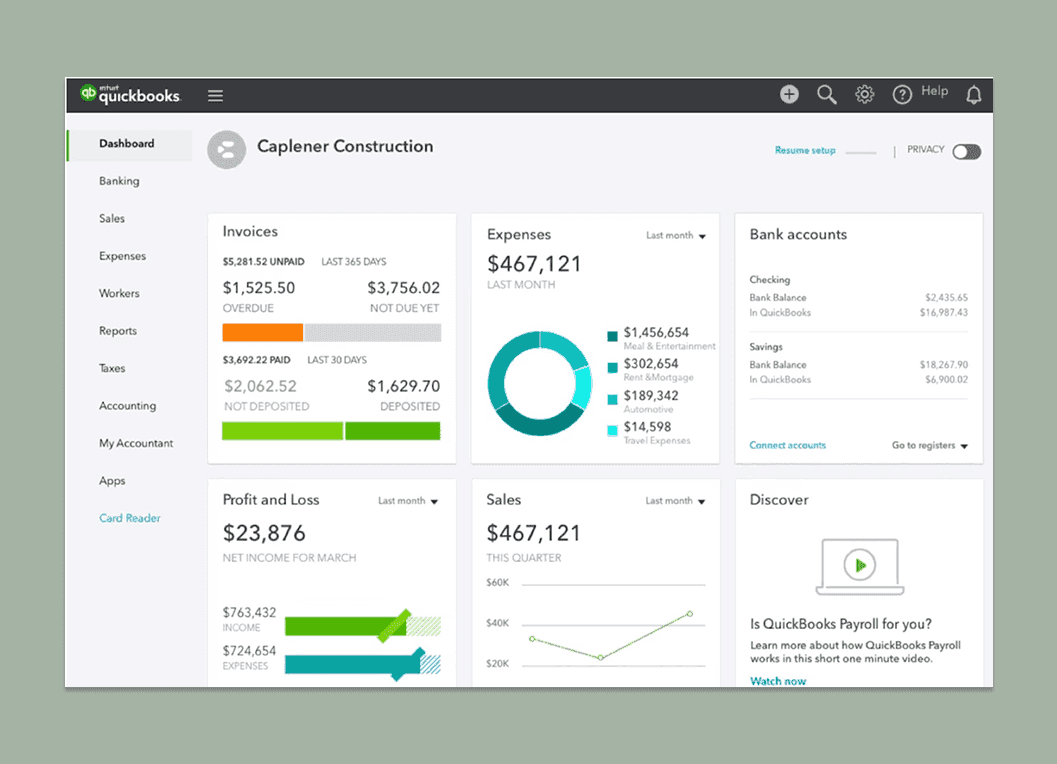

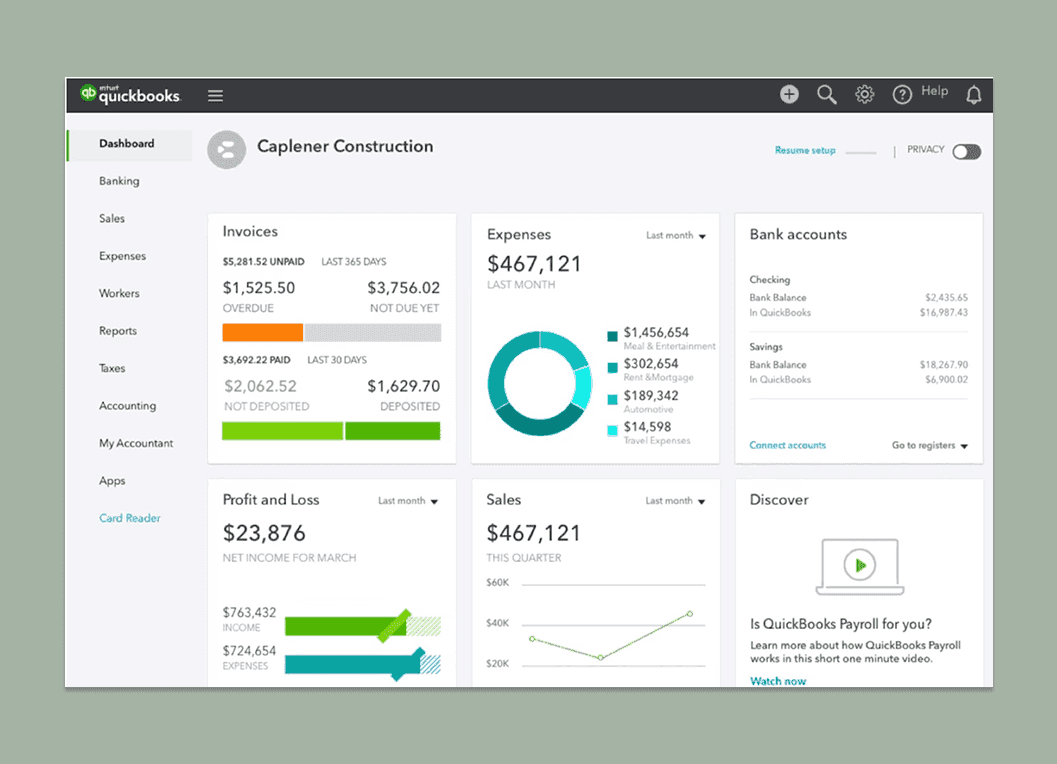

3. QuickBooks

QuickBooks remains one of the most widely used small business accounting software options in the world. With its powerful automation and hundreds of integrations, it handles everything from payroll to forecasting.

What You Get with QuickBooks

Income and expense tracking with automatic bank feeds

Custom invoicing and online payments (PayPal, Venmo, credit cards)

Payroll and HR management tools

Real-time dashboards for cash flow and profitability

Inventory and project tracking for product-based businesses

Mobile app for on-the-go invoicing and mileage tracking

Integrations with Shopify, Square, Salesforce, and more

QuickBooks’ AI automation tools — like Intuit Assist and Accounting Agent — help categorize transactions, detect inconsistencies, and surface insights before issues arise.

Pricing

QuickBooks offers four main plans (Simple Start, Essentials, Plus, and Advanced). Each comes with a 30-day free trial and frequent promotional discounts (typically 50% off the first three months).

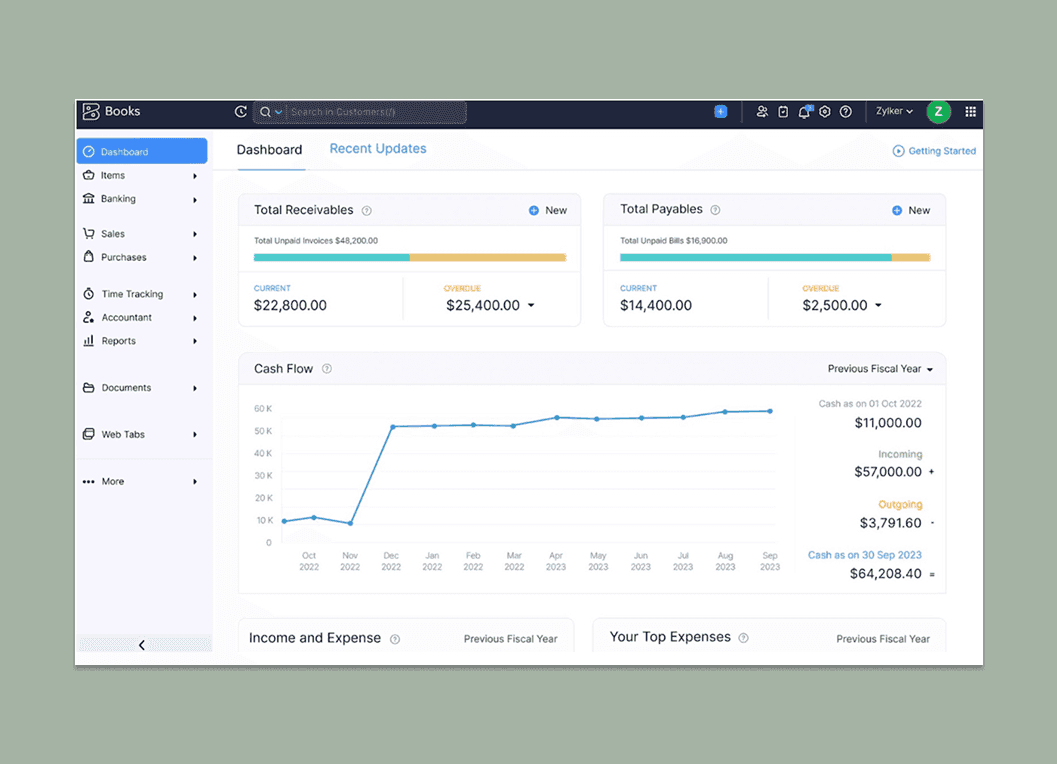

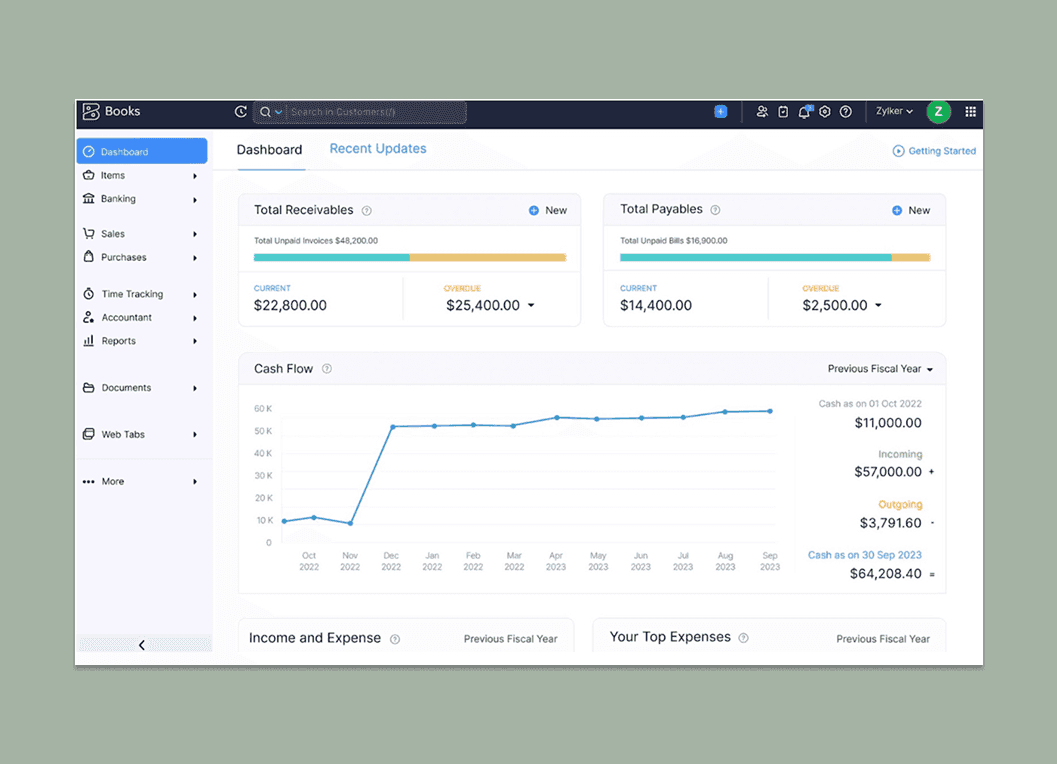

4. Zoho Books

Zoho Books is a standout among accounting automation tools for its balance of affordability and depth. Even its lower-tier plans include invoicing, automation, and integrations typically reserved for premium platforms.

What You Get with Zoho Books

Invoicing & Payments: Custom recurring invoices and online payment integrations (Stripe, PayPal, etc.)

Expense Tracking: AI receipt scanning and multi-currency management

Inventory & Project Tools: Track stock, time logs, and project profitability

Automation: Custom workflows and reminders that reduce manual input

Reports & Compliance: 50+ built-in financial reports and support for local tax laws (VAT, GST, 1099)

If you already use Zoho CRM, Payroll, or Projects, Zoho Books integrates seamlessly across the ecosystem.

Pricing

A generous free plan covers basic needs, while paid plans start at $15/month. All paid tiers include a 14-day free trial and discounts for annual subscriptions.

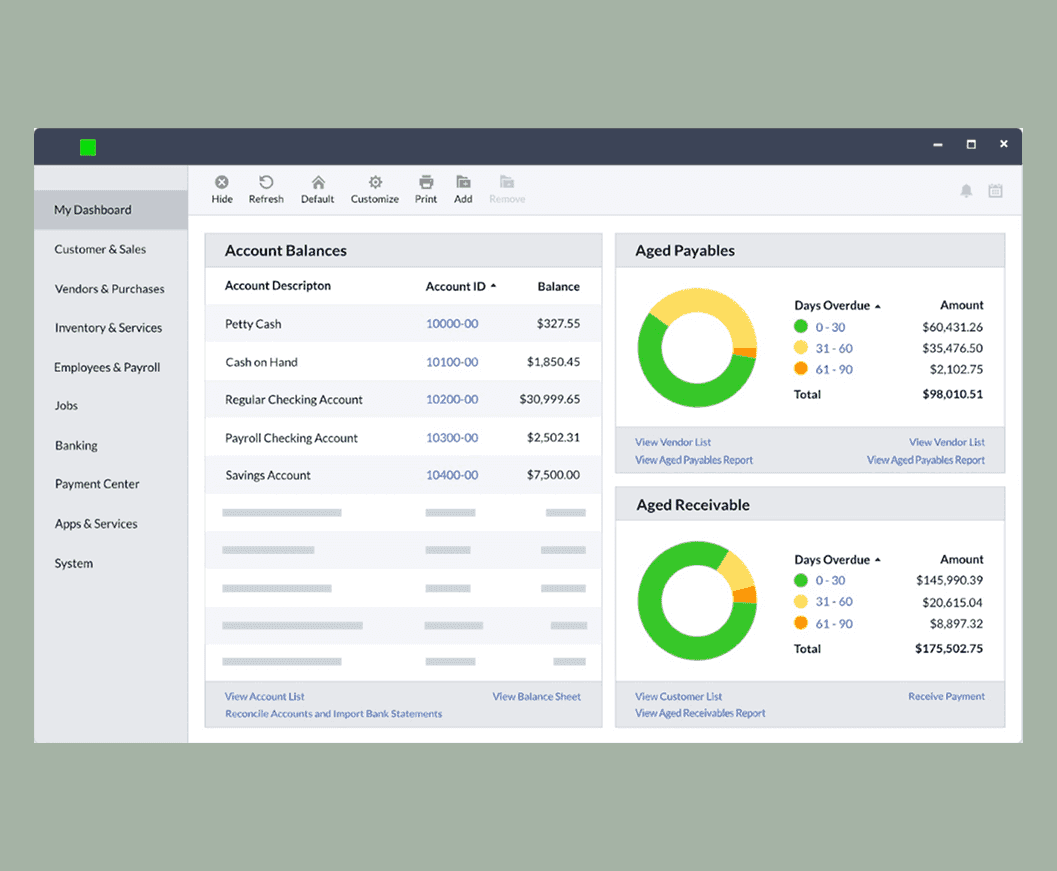

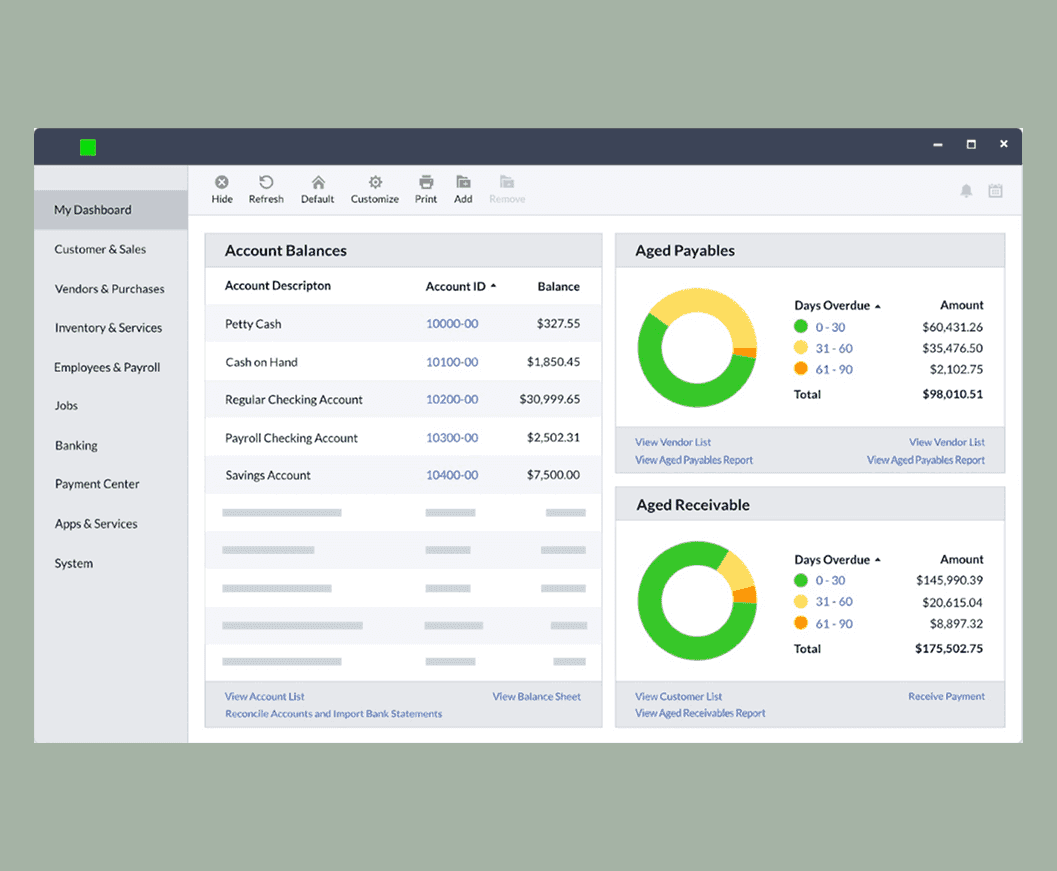

5. Sage 50

Sage 50 offers the depth of traditional accounting software with added cloud accessibility. It’s ideal for small to medium-sized businesses that require detailed job costing, inventory tracking, and multi-company management.

What You Get with Sage 50

Automated reconciliations and receipt scanning (via AutoEntry)

Custom invoices, quotes, and online payments

In-depth financial reports — P&L, balance sheet, cash flow, and job costing

Real-time inventory and multi-tier pricing

Payroll and HR add-ons with integrated tax filing

Support for multiple entities and consolidated reporting

Pricing

Annual subscriptions start at $668/year (about $62/month), scaling by user. Add-ons like Sage HR and payroll cost extra.

How to Choose the Right Accounting Software

The best accounting software for small businesses isn’t the one with the most features — it’s the one that fits how you actually operate. Before deciding, ask yourself:

Do you need automation only, or expert oversight too?

How many people on your team will use the platform?

Does it integrate with your banking, CRM, and payment systems?

What’s your budget, and how important is human support?

Cheaper online accounting software can automate well, but hybrid options like Haven ensure accuracy and strategic insight — giving founders more confidence when making financial decisions.

Software Alone Won’t Grow Your Business

Even the best bookkeeping software for startups can’t replace human insight. Tools organize numbers; experts turn them into a strategy.

At Haven, you get both. Our accountants handle your books, taxes, and reports while AI takes care of repetitive tasks behind the scenes. You see everything in one intuitive dashboard — from cash flow to profit and runway — without chasing spreadsheets or late reconciliations.

Talk to our team. A quick strategy call is the easiest way to see how Haven can save you time, reduce stress, and give you clear, confident numbers year-round.

The right accounting software for small businesses should make decisions faster, not add noise. Yet comparing features, pricing pages, and trial limits across dozens of tools can drag on longer than it should.

We’ve done the work for you. In this guide, you’ll find the top 5 accounting software for small businesses in 2025, along with what each platform does best and how much it costs. By the end, you’ll know which one fits your goals — and which may not be worth your time.

Quick Comparison: Best Accounting Software 2025

Here’s a quick overview before we dive deeper into each option:

Software | Starting Price | Key Features | Best For |

Haven | From $300/month (service + software) | Dedicated accountant + real-time dashboard for P&L, cash flow, runway, and tax handling. Startup-specific accounting and Slack-first support. | Startups and SMBs that want expert accounting, not another DIY tool. |

Xero | From $25/month | Cloud-based with unlimited users, automated bank feeds, invoicing, and 1,000+ integrations. | Small teams or international businesses that want collaboration and automation. |

QuickBooks | From $38/month | All-in-one accounting with invoicing, payroll, inventory, and AI automation via Intuit Assist. | Small to medium businesses that need reliable automation. |

Zoho Books | Free plan available; paid from $15/month | Affordable and automation-driven with invoicing, projects, and full Zoho ecosystem integration. | Founders who want smart features on a budget. |

Sage 50 | From ~$62/month (billed annually) | Desktop reliability + cloud backups, detailed reporting, and job costing. | Product-based or multi-entity businesses needing robust accounting. |

1. Haven

Haven is more than bookkeeping software for startups — it’s a modern accounting partner built for founders. Combining AI-driven systems with real accountants, Haven automates repetitive tasks like expense categorization and reconciliations while keeping human oversight at every step.

What You Get with Haven

End-to-end bookkeeping: Monthly reconciliations, tax prep, and financial reports handled for you.

AI-assisted accuracy: Proprietary systems use automation to speed up document processing and data extraction.

Dedicated accountant: You always have a professional reviewing your books for accuracy.

Slack-first support: Get answers instantly, no waiting or support tickets.

Startup-specific accounting: Handle deferred revenue, accruals, and SaaS metrics easily.

Haven gives you the clarity of top-tier software with the reliability of expert oversight.

Pricing

Plans start around $300/month for businesses spending roughly $20K monthly. Pricing scales based on complexity (multi-entity, crypto, or inventory management). Every plan includes a dedicated accountant and complete financial reporting.

Book a free strategy call to see how Haven can simplify your finances and free up your time.

2. Xero

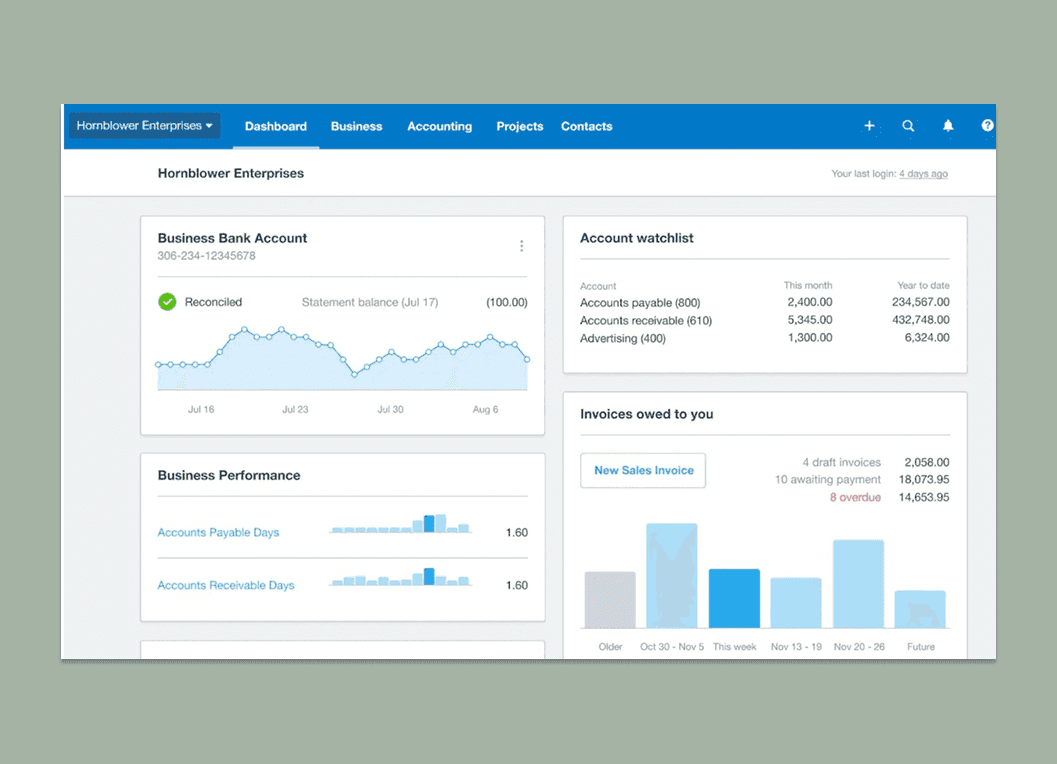

Xero is a favorite among small teams thanks to its intuitive interface and strong automation. It connects with over 1,000 apps — including Stripe, Shopify, and HubSpot — allowing businesses to manage everything from invoicing to payments in one place.

Key Features

Unlimited users across all plans (rare for accounting tools)

Multi-currency support for global operations

Project tracking and basic inventory management

Real-time collaboration with accountants or bookkeepers

Full mobile access for invoicing and expense tracking on the go

Pricing

Plans start at $25/month with a 30-day free trial. Xero often offers 90% off for the first three months, making it a great low-commitment way to test.

3. QuickBooks

QuickBooks remains one of the most widely used small business accounting software options in the world. With its powerful automation and hundreds of integrations, it handles everything from payroll to forecasting.

What You Get with QuickBooks

Income and expense tracking with automatic bank feeds

Custom invoicing and online payments (PayPal, Venmo, credit cards)

Payroll and HR management tools

Real-time dashboards for cash flow and profitability

Inventory and project tracking for product-based businesses

Mobile app for on-the-go invoicing and mileage tracking

Integrations with Shopify, Square, Salesforce, and more

QuickBooks’ AI automation tools — like Intuit Assist and Accounting Agent — help categorize transactions, detect inconsistencies, and surface insights before issues arise.

Pricing

QuickBooks offers four main plans (Simple Start, Essentials, Plus, and Advanced). Each comes with a 30-day free trial and frequent promotional discounts (typically 50% off the first three months).

4. Zoho Books

Zoho Books is a standout among accounting automation tools for its balance of affordability and depth. Even its lower-tier plans include invoicing, automation, and integrations typically reserved for premium platforms.

What You Get with Zoho Books

Invoicing & Payments: Custom recurring invoices and online payment integrations (Stripe, PayPal, etc.)

Expense Tracking: AI receipt scanning and multi-currency management

Inventory & Project Tools: Track stock, time logs, and project profitability

Automation: Custom workflows and reminders that reduce manual input

Reports & Compliance: 50+ built-in financial reports and support for local tax laws (VAT, GST, 1099)

If you already use Zoho CRM, Payroll, or Projects, Zoho Books integrates seamlessly across the ecosystem.

Pricing

A generous free plan covers basic needs, while paid plans start at $15/month. All paid tiers include a 14-day free trial and discounts for annual subscriptions.

5. Sage 50

Sage 50 offers the depth of traditional accounting software with added cloud accessibility. It’s ideal for small to medium-sized businesses that require detailed job costing, inventory tracking, and multi-company management.

What You Get with Sage 50

Automated reconciliations and receipt scanning (via AutoEntry)

Custom invoices, quotes, and online payments

In-depth financial reports — P&L, balance sheet, cash flow, and job costing

Real-time inventory and multi-tier pricing

Payroll and HR add-ons with integrated tax filing

Support for multiple entities and consolidated reporting

Pricing

Annual subscriptions start at $668/year (about $62/month), scaling by user. Add-ons like Sage HR and payroll cost extra.

How to Choose the Right Accounting Software

The best accounting software for small businesses isn’t the one with the most features — it’s the one that fits how you actually operate. Before deciding, ask yourself:

Do you need automation only, or expert oversight too?

How many people on your team will use the platform?

Does it integrate with your banking, CRM, and payment systems?

What’s your budget, and how important is human support?

Cheaper online accounting software can automate well, but hybrid options like Haven ensure accuracy and strategic insight — giving founders more confidence when making financial decisions.

Software Alone Won’t Grow Your Business

Even the best bookkeeping software for startups can’t replace human insight. Tools organize numbers; experts turn them into a strategy.

At Haven, you get both. Our accountants handle your books, taxes, and reports while AI takes care of repetitive tasks behind the scenes. You see everything in one intuitive dashboard — from cash flow to profit and runway — without chasing spreadsheets or late reconciliations.

Talk to our team. A quick strategy call is the easiest way to see how Haven can save you time, reduce stress, and give you clear, confident numbers year-round.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026