Go Back

Last Updated :

Last Updated :

Feb 6, 2026

Feb 6, 2026

The Startup’s Guide to Corporate Income Tax Nexus by State

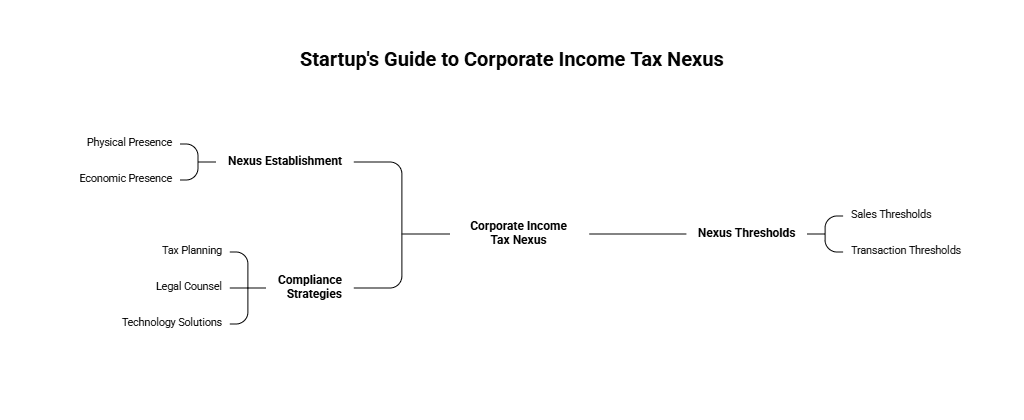

For startup founders navigating the complexities of state taxing jurisdictions, understanding corporate income tax nexus by state is a crucial operational and financial milestone. Nexus determines when your startup owes income tax in a particular state—a decision with real consequences for compliance, risk, and cash flow management.

This guide unpacks the essentials of corporate income tax nexus, highlights how nexus is established across states, and offers practical strategies to help founders stay compliant while minimizing the administrative burden. If you’re leading a startup scaling across state lines, this article will empower you with a clear framework for making intelligent tax decisions, safeguarding your capital, and focusing on growth.

What is the Corporate Income Tax Nexus?

At its core, a corporate income tax nexus is a legal connection between your business and a state that mandates your company owes income tax there. Nexus arises when your startup has a sufficient “presence” in that state—typically established by physical operations, economic thresholds, or other factors defined by state law.

Why should founders care?

Compliance impact: Once nexus is established, your startup must register with the state, file returns, and remit corporate income taxes.

Financial impact: States have different tax rates and filing rules. Missing nexus could mean unexpected tax liabilities, penalties, and interest.

Operational impact: Maintaining compliance across states affects accounting systems, internal controls, and cash forecasting.

Startups often face hurdles given evolving nexus rules, especially amid growing e-commerce and remote sales. Awareness and early planning around nexus help contain surprises that disrupt operational cash flow or inflate compliance costs.

Startups with complex revenue streams or multistate footprints should regularly review nexus status, ideally starting before crossing thresholds.

How Corporate Income Tax Nexus by State is Established

Unlike sales tax economic nexus thresholds, corporate income tax nexus rules are less uniform and often more complex.

Common Nexus Triggers for Corporate Income Tax

Nexus Factor | Explanation | Examples |

Physical Presence | Having offices, employees, property, or inventory in a state | Having a warehouse or remote employees in State A |

Economic Nexus | Meeting revenue or transaction thresholds from sales in state | $500K annual sales into State B (varies by state) |

Affiliate Nexus | Using related entities or agents with a presence in the state | Franchisees, subsidiaries operating locally |

Factor Presence Nexus / MTC Formula | Nexus was established using physical and economic factors like payroll, property, and sales | Combined presence triggers nexus based on formula |

Sales of Tangible Personal Property (TPP) | Significant sales or distribution of goods in state | Sending goods through fulfillment centers |

States with Simplified Economic Nexus Thresholds

Several states now have clear economic thresholds similar to sales tax nexus:

California: $500K in sales or 25% of property or payroll

New York: $500K in sales and 10 or more transactions

Texas: $1,130,000 in gross receipts

Washington: $250,000 in sales

Thresholds vary widely, and some states have no explicit economic nexus rules but rely heavily on physical or factor presence nexus.

Navigating Multistate Tax Compliance: Strategic Considerations

To help founders make practical decisions, here are actionable insights and tips:

1. Map Your Physical and Economic Footprint

List all states where you have:

Employees working onsite or remotely

Property including equipment, inventory, or leased spaces

Significant sales, contracts, or fulfillment relationships

Identify states where thresholds are close or exceeded.

2. Understand State-Specific Nexus Rules

Nexus rules differ—some emphasize physical presence, others economic, and some both.

States with population/business hubs (CA, NY, TX) have stringent nexus regulations.

Use resources like corporate income tax filing requirements by state for detailed filings and thresholds.

3. Register and File Where Required

Once nexus exists, timely registration with the state Department of Revenue is critical.

Failure to file income tax returns where nexus exists invites penalties and interest.

Automate reminders and workflows or outsource to modern service providers who understand startup nuances.

4. Leverage the MTC Factor Presence Nexus Framework

The Multistate Tax Commission (MTC) formula considers property, payroll, and sales.

Founders can anticipate nexus by evaluating if combined factors exceed specific thresholds in a state.

This holistic approach is especially useful for startups with mixed physical and economic footprints.

5. Anticipate R&D Tax Credits and Nexus Intersections

For startups with significant engineering teams, R&D spending in various states can impact nexus assessments.

Nexus may trigger tax obligations beyond income tax, affecting R&D credit eligibility.

Align your tax planning between income tax and credit strategies for maximum benefit.

State-by-State Examples: Corporate Income Tax Nexus in Action

State | Nexus Trigger Highlights | Threshold Examples | Notes for Startups |

California | Physical and Economic Nexus | $500K sales OR 25% property/payroll | Requires close monitoring for out-of-state startups with sales |

New York | Physical presence + economic nexus | $500K sales AND 10+ transactions | Specific rules on transaction counts |

Texas | Economic nexus by gross receipts | $1,130,000 gross receipts rule | High threshold but monitor rapidly growing revenue |

Washington | Physical presence & sales thresholds | $250K in gross receipts | Lower threshold, particularly relevant for e-commerce startups |

Florida | Primarily physical presence | No clear economic nexus threshold | Physical presence remains the determining factor |

How Founders Can Stay Ahead

Startup founders juggling compliance and growth need practical, scalable workflows:

Centralize tax tracking: Integrate sales, payroll, and asset data to flag nexus triggers automatically.

Use startup-focused tax service providers: Modern firms combine bookkeeping, tax compliance, and R&D credit support under one roof.

Plan for changes: Hiring remote teams or entering new markets triggers new nexus considerations.

Voluntary disclosure programs: If your startup missed filings, many states offer amnesty.

Stay informed with trustworthy guidance: For up-to-date policy resources, refer to the Small Business Administration’s multistate tax advice.

Why Corporate Income Tax Nexus by State Matters More Than Ever

For startups navigating multistate sales and operations, corporate income tax nexus by state is a fundamental part of the financial and operational puzzle. A proactive, systematized approach to tracking nexus—understanding physical and economic presence, recognizing varied state thresholds, and engaging the right compliance partners—will safeguard your startup from unexpected tax liabilities and penalties.

By sharpening your nexus management, you free up resources to focus on innovation, growth, and market expansion with confidence. Starting early with founder-friendly, fast, and modern compliance strategies transforms what can be a blocker into a competitive advantage.

Don’t leave nexus compliance to chance—build systems, partner with experienced advisors, and stay informed with resources like business tax compliance insights crafted specifically for startups like yours. Managing corporate income tax nexus by state is much more than a tax necessity; it’s a critical step toward sustainable startup success.

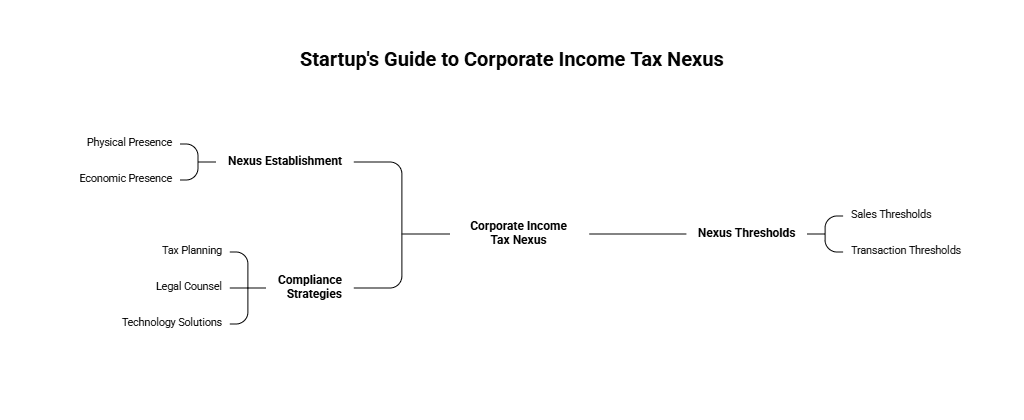

For startup founders navigating the complexities of state taxing jurisdictions, understanding corporate income tax nexus by state is a crucial operational and financial milestone. Nexus determines when your startup owes income tax in a particular state—a decision with real consequences for compliance, risk, and cash flow management.

This guide unpacks the essentials of corporate income tax nexus, highlights how nexus is established across states, and offers practical strategies to help founders stay compliant while minimizing the administrative burden. If you’re leading a startup scaling across state lines, this article will empower you with a clear framework for making intelligent tax decisions, safeguarding your capital, and focusing on growth.

What is the Corporate Income Tax Nexus?

At its core, a corporate income tax nexus is a legal connection between your business and a state that mandates your company owes income tax there. Nexus arises when your startup has a sufficient “presence” in that state—typically established by physical operations, economic thresholds, or other factors defined by state law.

Why should founders care?

Compliance impact: Once nexus is established, your startup must register with the state, file returns, and remit corporate income taxes.

Financial impact: States have different tax rates and filing rules. Missing nexus could mean unexpected tax liabilities, penalties, and interest.

Operational impact: Maintaining compliance across states affects accounting systems, internal controls, and cash forecasting.

Startups often face hurdles given evolving nexus rules, especially amid growing e-commerce and remote sales. Awareness and early planning around nexus help contain surprises that disrupt operational cash flow or inflate compliance costs.

Startups with complex revenue streams or multistate footprints should regularly review nexus status, ideally starting before crossing thresholds.

How Corporate Income Tax Nexus by State is Established

Unlike sales tax economic nexus thresholds, corporate income tax nexus rules are less uniform and often more complex.

Common Nexus Triggers for Corporate Income Tax

Nexus Factor | Explanation | Examples |

Physical Presence | Having offices, employees, property, or inventory in a state | Having a warehouse or remote employees in State A |

Economic Nexus | Meeting revenue or transaction thresholds from sales in state | $500K annual sales into State B (varies by state) |

Affiliate Nexus | Using related entities or agents with a presence in the state | Franchisees, subsidiaries operating locally |

Factor Presence Nexus / MTC Formula | Nexus was established using physical and economic factors like payroll, property, and sales | Combined presence triggers nexus based on formula |

Sales of Tangible Personal Property (TPP) | Significant sales or distribution of goods in state | Sending goods through fulfillment centers |

States with Simplified Economic Nexus Thresholds

Several states now have clear economic thresholds similar to sales tax nexus:

California: $500K in sales or 25% of property or payroll

New York: $500K in sales and 10 or more transactions

Texas: $1,130,000 in gross receipts

Washington: $250,000 in sales

Thresholds vary widely, and some states have no explicit economic nexus rules but rely heavily on physical or factor presence nexus.

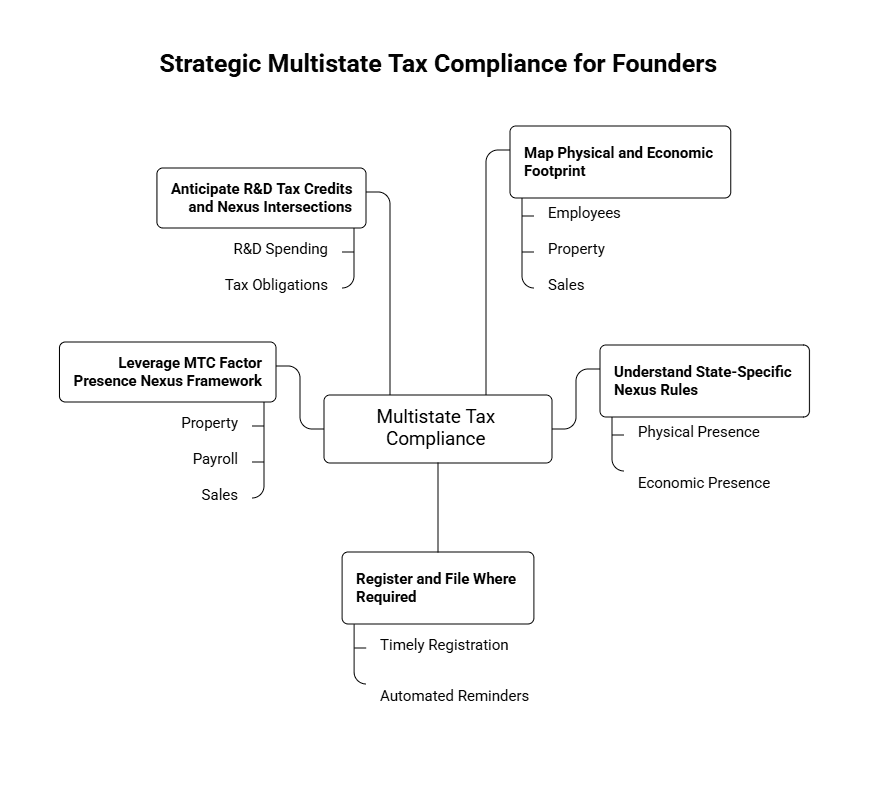

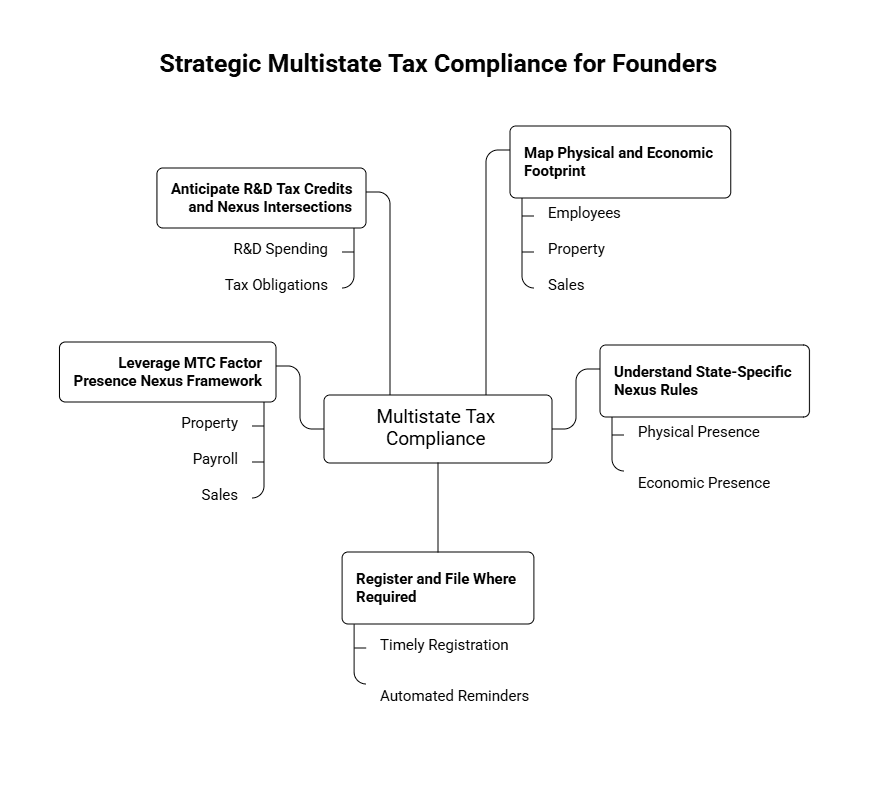

Navigating Multistate Tax Compliance: Strategic Considerations

To help founders make practical decisions, here are actionable insights and tips:

1. Map Your Physical and Economic Footprint

List all states where you have:

Employees working onsite or remotely

Property including equipment, inventory, or leased spaces

Significant sales, contracts, or fulfillment relationships

Identify states where thresholds are close or exceeded.

2. Understand State-Specific Nexus Rules

Nexus rules differ—some emphasize physical presence, others economic, and some both.

States with population/business hubs (CA, NY, TX) have stringent nexus regulations.

Use resources like corporate income tax filing requirements by state for detailed filings and thresholds.

3. Register and File Where Required

Once nexus exists, timely registration with the state Department of Revenue is critical.

Failure to file income tax returns where nexus exists invites penalties and interest.

Automate reminders and workflows or outsource to modern service providers who understand startup nuances.

4. Leverage the MTC Factor Presence Nexus Framework

The Multistate Tax Commission (MTC) formula considers property, payroll, and sales.

Founders can anticipate nexus by evaluating if combined factors exceed specific thresholds in a state.

This holistic approach is especially useful for startups with mixed physical and economic footprints.

5. Anticipate R&D Tax Credits and Nexus Intersections

For startups with significant engineering teams, R&D spending in various states can impact nexus assessments.

Nexus may trigger tax obligations beyond income tax, affecting R&D credit eligibility.

Align your tax planning between income tax and credit strategies for maximum benefit.

State-by-State Examples: Corporate Income Tax Nexus in Action

State | Nexus Trigger Highlights | Threshold Examples | Notes for Startups |

California | Physical and Economic Nexus | $500K sales OR 25% property/payroll | Requires close monitoring for out-of-state startups with sales |

New York | Physical presence + economic nexus | $500K sales AND 10+ transactions | Specific rules on transaction counts |

Texas | Economic nexus by gross receipts | $1,130,000 gross receipts rule | High threshold but monitor rapidly growing revenue |

Washington | Physical presence & sales thresholds | $250K in gross receipts | Lower threshold, particularly relevant for e-commerce startups |

Florida | Primarily physical presence | No clear economic nexus threshold | Physical presence remains the determining factor |

How Founders Can Stay Ahead

Startup founders juggling compliance and growth need practical, scalable workflows:

Centralize tax tracking: Integrate sales, payroll, and asset data to flag nexus triggers automatically.

Use startup-focused tax service providers: Modern firms combine bookkeeping, tax compliance, and R&D credit support under one roof.

Plan for changes: Hiring remote teams or entering new markets triggers new nexus considerations.

Voluntary disclosure programs: If your startup missed filings, many states offer amnesty.

Stay informed with trustworthy guidance: For up-to-date policy resources, refer to the Small Business Administration’s multistate tax advice.

Why Corporate Income Tax Nexus by State Matters More Than Ever

For startups navigating multistate sales and operations, corporate income tax nexus by state is a fundamental part of the financial and operational puzzle. A proactive, systematized approach to tracking nexus—understanding physical and economic presence, recognizing varied state thresholds, and engaging the right compliance partners—will safeguard your startup from unexpected tax liabilities and penalties.

By sharpening your nexus management, you free up resources to focus on innovation, growth, and market expansion with confidence. Starting early with founder-friendly, fast, and modern compliance strategies transforms what can be a blocker into a competitive advantage.

Don’t leave nexus compliance to chance—build systems, partner with experienced advisors, and stay informed with resources like business tax compliance insights crafted specifically for startups like yours. Managing corporate income tax nexus by state is much more than a tax necessity; it’s a critical step toward sustainable startup success.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026