Go Back

Last Updated :

Last Updated :

Feb 6, 2026

Feb 6, 2026

Startup Burn Rate: Key Metrics and Benchmarks for Growth

For founders navigating the fast-paced and competitive startup landscape, understanding your startup burn rate is crucial. It’s more than just a number—burn rate is a vital financial signpost that affects your runway, fundraising strategy, and ultimately your company’s survival.

This guide cuts through the noise to give you concrete insights on what burn rate means, how to calculate it correctly, benchmarks to watch, and smart ways to manage it—all designed specifically for startup leaders who want to make confident, strategic decisions.

What Is Startup Burn Rate? Gross vs. Net Explained

Startup burn rate measures how quickly your startup is spending cash. It’s essentially the rate at which you are ""burning through"" your cash reserves. This metric helps founders grasp how long their company can operate before needing additional funding.

Key Definitions:

Gross Burn Rate: Total cash spent each month on all operating expenses (paying salaries, rent, marketing, product development).

Net Burn Rate: The net cash flow lost monthly after accounting for revenue. It’s gross burn minus monthly revenues (if any).

For very early-stage startups without revenue, gross and net burn rates can be the same. As your business grows and starts generating sales, net burn rate becomes a more accurate reflection of cash depletion.

Formula Recap:

Gross Burn Rate = Sum of monthly cash outflows

Net Burn Rate = Gross Burn Rate – Monthly Revenue

Why This Matters for Founders

Understanding runway: Your runway is how many months your cash balance can support current spending patterns before funds run out. Runway = Cash on Hand / Net Burn Rate.

Investor signaling: Investors scrutinize burn rate to assess your discipline and sustainability. A high burn rate with a short runway raises red flags.

Strategic decisions: Burn rate insights guide when to cut costs, ramp growth, or start fundraising.

Typical Burn Rates and Benchmarks by Startup Stage

Burn rates vary widely depending on your startup’s stage and industry. Here’s a practical breakdown against benchmarks founders can use to evaluate their financial health.

Startup Stage | Typical Burn Rate ($/month) | Key Focus | Cash Runway Ideal (months) |

Pre-Seed | $20K - $50K | Product development, team building | 12–18 |

Seed | $50K - $150K | User acquisition, market validation | 9–12 |

Series A | $150K - $500K | Scaling operations, sales & marketing | 6–9 |

Growth | $500K+ | Rapid scaling and expansion | 3–6 |

Industry Considerations

SaaS Startups: Tend to have moderate burn rates with a focus on R&D and sales team growth. Burn multiples (burn relative to revenue growth) around 1–1.5 are considered healthy.

E-commerce: E-commerce cash flow can swing sharply due to inventory costs; emphasis is often on optimizing unit economics to control burn.

Agencies & Services: Usually lower burn rates but sensitive to headcount costs and billable hours realization.

Understanding these benchmarks helps founders benchmark themselves appropriately rather than chasing irrelevant peers.

Calculating and Managing Your Startup Burn Rate for Longevity

Step-by-Step Burn Rate Calculation

Gather monthly expenses: Total all cash outflows—fixed costs like rent, salaries, plus variable costs such as marketing spend or subcontractor fees.

Consider revenues: Subtract monthly revenue to get net burn.

Calculate runway: Divide current cash by net burn rate to estimate months of runway remaining.

Note: If revenue fluctuates, use a rolling average to avoid misleading spikes.

Practical Tips to Manage Burn Rate Without Stalling Growth

Founders want to keep a balance—cutting spending too fast can stifle momentum; overspending risks running out of cash. Here’s how to be strategic with burn:

Focus on unit economics: Evaluate the cost of acquiring and serving customers versus value they generate. Improving unit economics can reduce net burn over time.

Prioritize revenue growth: Even a modest monthly revenue helps reduce net burn rapidly. Align product development and sales efforts to deliver this.

Monitor burn multiple: Burn multiple = Net Burn / Net New ARR (annual recurring revenue). Aim for burn multiples below 1. This means you’re generating more revenue growth than cash burned.

Adjust headcount carefully: As salaries often make up the largest expense, scale your team in alignment with clear milestones and revenue.

Negotiate and optimize fixed costs: Review software subscriptions, office rent, and vendor contracts regularly. Small reductions add up.

Plan fundraising early: Initiate conversations well before runway drops below six months to avoid rushed or disadvantageous deals.

For founders seeking modern solutions to help manage finances, including bookkeeping and tax filings, Haven’s tailored startup services offer responsive, startup-native support.

When Burn Rate Goes Dangerously High: Early Warning Signs and Remedies

A high burn rate isn’t inherently bad if it’s deliberate and backed by growth plans. However, these signs point to dangerous territory:

Runway drops below 3–6 months: You must urgently raise capital or trim expenses.

Burn multiple trends above 2: You’re losing twice as much cash as you gain in revenue—unsustainable long term.

Customer acquisition cost (CAC) outpaces lifetime value (LTV): Wasteful spending without sustainable unit economics.

Revenue plateau with increasing expenses: Indicates product-market fit issues or operational inefficiency.

Action Steps When Facing High Burn

Issue | Strategy |

Runway < 6 months | Expedite fundraising process, reduce discretionary costs |

High Burn Multiple (>2) | Reevaluate growth levers, focus on profitable segments |

CAC > LTV | Shift marketing focus, refine sales funnel |

Revenue Plateaus | Reinvest in product-market fit, cut non-essential spend |

Respecting these warning signs early preserves valuation and avoids crisis scenarios.

Burn Rate and Fundraising: Timing Your Next Raise

Knowing your startup’s burn rate is central to planning funding rounds in a measured way.

Ideal runway when fundraising: Most investors expect 9–12 months of runway post-funding to give you time to execute.

Assess burn rate trajectories before raising: Can your burn support the scale you propose? Will new funding cover increased spend?

Communicate metrics clearly: Investors ask about burn rate, burn multiple, and runway. Having these numbers refined demonstrates financial discipline and builds confidence.

Bringing It Together: Runway, Burn Rate, and Sustainable Growth

In summary, mastering your startup burn rate enables informed strategic decisions. Keep these foundational elements always top of mind:

Burn rate is not just a monthly spend figure; net burn rate and burn multiple give a deeper reality check.

Benchmarks vary; match comparisons to your stage and sector to avoid misconceptions.

Cash runway is your lifeline—monitor it religiously to avoid surprises.

Sustainable growth requires balancing operational costs with revenue growth and capital availability.

By tracking these metrics carefully and adjusting as needed, founders gain the confidence to grow efficiently and fundraise strategically—maximizing chances of startup success.

For additional insights on how startups can modernize financial operations—from bookkeeping to tax filing and R&D tax credits—visit the Haven startup resource page.

Take Control of Your Burn Rate with Expert Financial Support

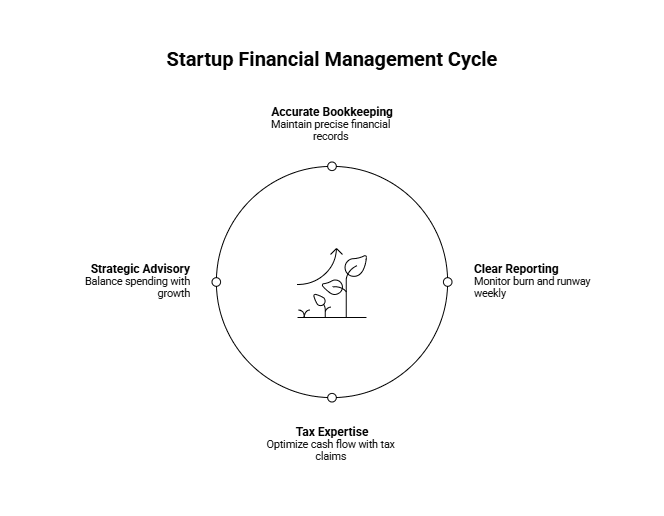

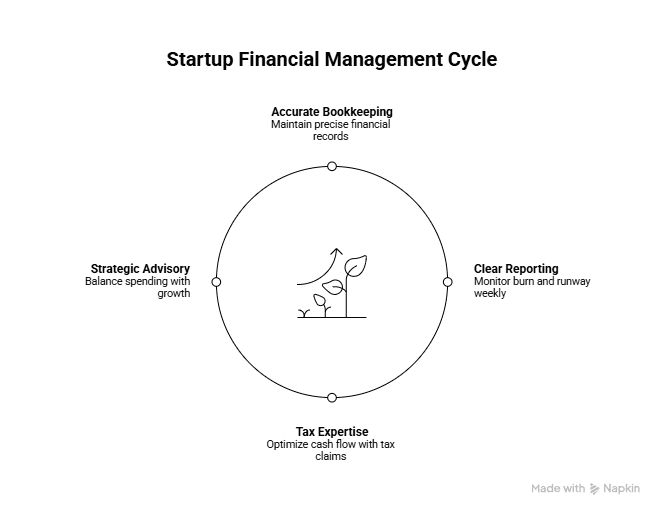

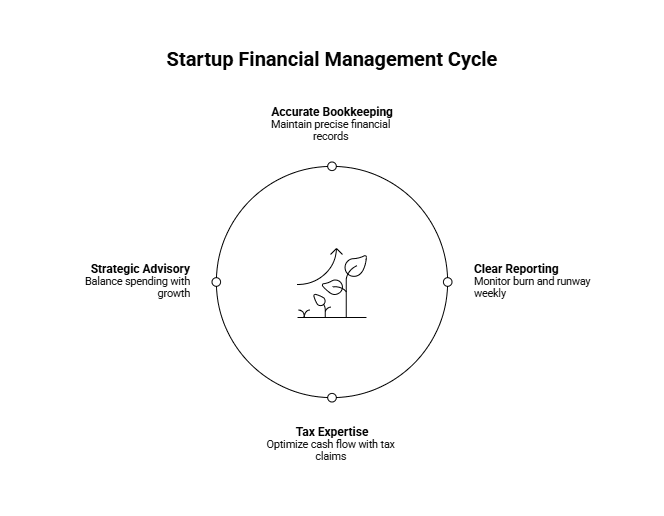

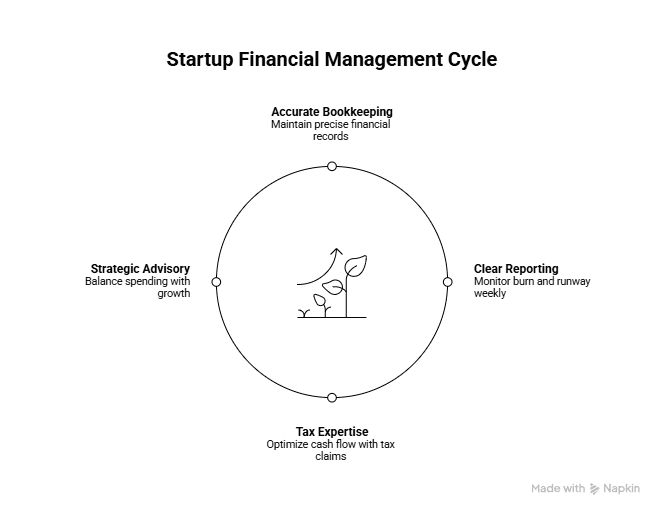

Managing your startup burn rate effectively need not be a solo endeavor. Founders today benefit tremendously from a specialized, startup-native service that combines:

Accurate bookkeeping tailored for rapid iteration and team scaling

Clear, accessible financial reporting to help you monitor burn and runway weekly

Tax filing expertise including R&D credit claims to optimize cash flow

Strategic financial advisory helping you balance spending with growth and fundraising

For founders navigating the fast-paced and competitive startup landscape, understanding your startup burn rate is crucial. It’s more than just a number—burn rate is a vital financial signpost that affects your runway, fundraising strategy, and ultimately your company’s survival.

This guide cuts through the noise to give you concrete insights on what burn rate means, how to calculate it correctly, benchmarks to watch, and smart ways to manage it—all designed specifically for startup leaders who want to make confident, strategic decisions.

What Is Startup Burn Rate? Gross vs. Net Explained

Startup burn rate measures how quickly your startup is spending cash. It’s essentially the rate at which you are ""burning through"" your cash reserves. This metric helps founders grasp how long their company can operate before needing additional funding.

Key Definitions:

Gross Burn Rate: Total cash spent each month on all operating expenses (paying salaries, rent, marketing, product development).

Net Burn Rate: The net cash flow lost monthly after accounting for revenue. It’s gross burn minus monthly revenues (if any).

For very early-stage startups without revenue, gross and net burn rates can be the same. As your business grows and starts generating sales, net burn rate becomes a more accurate reflection of cash depletion.

Formula Recap:

Gross Burn Rate = Sum of monthly cash outflows

Net Burn Rate = Gross Burn Rate – Monthly Revenue

Why This Matters for Founders

Understanding runway: Your runway is how many months your cash balance can support current spending patterns before funds run out. Runway = Cash on Hand / Net Burn Rate.

Investor signaling: Investors scrutinize burn rate to assess your discipline and sustainability. A high burn rate with a short runway raises red flags.

Strategic decisions: Burn rate insights guide when to cut costs, ramp growth, or start fundraising.

Typical Burn Rates and Benchmarks by Startup Stage

Burn rates vary widely depending on your startup’s stage and industry. Here’s a practical breakdown against benchmarks founders can use to evaluate their financial health.

Startup Stage | Typical Burn Rate ($/month) | Key Focus | Cash Runway Ideal (months) |

Pre-Seed | $20K - $50K | Product development, team building | 12–18 |

Seed | $50K - $150K | User acquisition, market validation | 9–12 |

Series A | $150K - $500K | Scaling operations, sales & marketing | 6–9 |

Growth | $500K+ | Rapid scaling and expansion | 3–6 |

Industry Considerations

SaaS Startups: Tend to have moderate burn rates with a focus on R&D and sales team growth. Burn multiples (burn relative to revenue growth) around 1–1.5 are considered healthy.

E-commerce: E-commerce cash flow can swing sharply due to inventory costs; emphasis is often on optimizing unit economics to control burn.

Agencies & Services: Usually lower burn rates but sensitive to headcount costs and billable hours realization.

Understanding these benchmarks helps founders benchmark themselves appropriately rather than chasing irrelevant peers.

Calculating and Managing Your Startup Burn Rate for Longevity

Step-by-Step Burn Rate Calculation

Gather monthly expenses: Total all cash outflows—fixed costs like rent, salaries, plus variable costs such as marketing spend or subcontractor fees.

Consider revenues: Subtract monthly revenue to get net burn.

Calculate runway: Divide current cash by net burn rate to estimate months of runway remaining.

Note: If revenue fluctuates, use a rolling average to avoid misleading spikes.

Practical Tips to Manage Burn Rate Without Stalling Growth

Founders want to keep a balance—cutting spending too fast can stifle momentum; overspending risks running out of cash. Here’s how to be strategic with burn:

Focus on unit economics: Evaluate the cost of acquiring and serving customers versus value they generate. Improving unit economics can reduce net burn over time.

Prioritize revenue growth: Even a modest monthly revenue helps reduce net burn rapidly. Align product development and sales efforts to deliver this.

Monitor burn multiple: Burn multiple = Net Burn / Net New ARR (annual recurring revenue). Aim for burn multiples below 1. This means you’re generating more revenue growth than cash burned.

Adjust headcount carefully: As salaries often make up the largest expense, scale your team in alignment with clear milestones and revenue.

Negotiate and optimize fixed costs: Review software subscriptions, office rent, and vendor contracts regularly. Small reductions add up.

Plan fundraising early: Initiate conversations well before runway drops below six months to avoid rushed or disadvantageous deals.

For founders seeking modern solutions to help manage finances, including bookkeeping and tax filings, Haven’s tailored startup services offer responsive, startup-native support.

When Burn Rate Goes Dangerously High: Early Warning Signs and Remedies

A high burn rate isn’t inherently bad if it’s deliberate and backed by growth plans. However, these signs point to dangerous territory:

Runway drops below 3–6 months: You must urgently raise capital or trim expenses.

Burn multiple trends above 2: You’re losing twice as much cash as you gain in revenue—unsustainable long term.

Customer acquisition cost (CAC) outpaces lifetime value (LTV): Wasteful spending without sustainable unit economics.

Revenue plateau with increasing expenses: Indicates product-market fit issues or operational inefficiency.

Action Steps When Facing High Burn

Issue | Strategy |

Runway < 6 months | Expedite fundraising process, reduce discretionary costs |

High Burn Multiple (>2) | Reevaluate growth levers, focus on profitable segments |

CAC > LTV | Shift marketing focus, refine sales funnel |

Revenue Plateaus | Reinvest in product-market fit, cut non-essential spend |

Respecting these warning signs early preserves valuation and avoids crisis scenarios.

Burn Rate and Fundraising: Timing Your Next Raise

Knowing your startup’s burn rate is central to planning funding rounds in a measured way.

Ideal runway when fundraising: Most investors expect 9–12 months of runway post-funding to give you time to execute.

Assess burn rate trajectories before raising: Can your burn support the scale you propose? Will new funding cover increased spend?

Communicate metrics clearly: Investors ask about burn rate, burn multiple, and runway. Having these numbers refined demonstrates financial discipline and builds confidence.

Bringing It Together: Runway, Burn Rate, and Sustainable Growth

In summary, mastering your startup burn rate enables informed strategic decisions. Keep these foundational elements always top of mind:

Burn rate is not just a monthly spend figure; net burn rate and burn multiple give a deeper reality check.

Benchmarks vary; match comparisons to your stage and sector to avoid misconceptions.

Cash runway is your lifeline—monitor it religiously to avoid surprises.

Sustainable growth requires balancing operational costs with revenue growth and capital availability.

By tracking these metrics carefully and adjusting as needed, founders gain the confidence to grow efficiently and fundraise strategically—maximizing chances of startup success.

For additional insights on how startups can modernize financial operations—from bookkeeping to tax filing and R&D tax credits—visit the Haven startup resource page.

Take Control of Your Burn Rate with Expert Financial Support

Managing your startup burn rate effectively need not be a solo endeavor. Founders today benefit tremendously from a specialized, startup-native service that combines:

Accurate bookkeeping tailored for rapid iteration and team scaling

Clear, accessible financial reporting to help you monitor burn and runway weekly

Tax filing expertise including R&D credit claims to optimize cash flow

Strategic financial advisory helping you balance spending with growth and fundraising

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026