Go Back

Last Updated :

Last Updated :

Jan 20, 2026

Jan 20, 2026

How to File IRS Form 8621: Navigating PFIC Rules

Investing in foreign companies can offer startups, agencies, and e-commerce businesses valuable portfolio diversification and growth opportunities. However, U.S. founders and financial leaders should be aware of the specific tax rules affecting Passive Foreign Investment Companies (PFICs). One critical compliance requirement is Form 8621, which the IRS mandates for shareholders of these foreign investment vehicles.

This guide will unpack the essentials around Form 8621, clarify who must file, and provide practical steps for navigating PFIC regulations without getting lost in tax jargon. Understanding this form enables better-informed investment decisions and helps prevent costly surprises on your tax return.

What is Form 8621 and Why Founders Should Care

Form 8621, Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund, is a specialized IRS form designed to track U.S. taxpayers’ income and distributions from PFIC investments.

A PFIC generally is any foreign corporation where:

At least 75% of its gross income is passive income, such as dividends, interest, rents, royalties, or capital gains, or

At least 50% of its assets produce or are held for producing passive income.

These companies often include foreign mutual funds, holding companies, or investment vehicles holding stocks and bonds.

Why it Matters for U.S. Investors and Founders

Tax rules around PFICs aim to prevent U.S. taxpayers from deferring or avoiding U.S. tax on foreign investment income. This is particularly relevant if your startup or e-commerce company invests directly or indirectly in foreign funds or entities that meet PFIC criteria.

Failing to properly file Form 8621 can lead to:

Double taxation or punitive tax rates on distributions and gains,

Complicated tax calculations with "excess distributions" and interest charges,

IRS penalties for non-disclosure, and

Unnecessary complexity during tax audits.

For founders balancing rapid growth and regulatory compliance, understanding Form 8621 early improves financial oversight and strategic tax planning.

Who Must File Form 8621?

You must file Form 8621 if you are a U.S. person who is a direct or indirect shareholder of a Passive Foreign Investment Company (PFIC) at any point during the tax year. Filing obligations are driven by ownership status and elections—not just income received.

The main triggers include:

Shareholder status:

Applies to U.S. individuals, corporations, partnerships, trusts, and estates that own PFIC stock, either directly or through another entity.Indirect or constructive ownership:

If you hold PFIC exposure through partnerships, funds, holding companies, or foreign subsidiaries, attribution rules may still require filing—even if you do not hold shares personally.Ownership without distributions:

Form 8621 may be required even if you received no distributions and recognized no gains during the year. In many cases, mere ownership triggers the filing.Dispositions or gains:

Sales, redemptions, or other taxable dispositions of PFIC stock always require Form 8621 reporting.PFIC elections:

Making or maintaining elections—such as a Qualified Electing Fund (QEF) or Mark-to-Market election—generally requires annual Form 8621 filings to report income, basis adjustments, and compliance with election rules.

Exceptions and Limited Relief

Certain exceptions apply, most commonly for de minimis holdings or where specific elections eliminate ongoing reporting requirements. These exceptions are narrow and depend on ownership value, income thresholds, and prior filings.

Because PFIC rules are technical and penalties for non-filing can be severe, Form 8621 determinations are typically reviewed alongside broader international and investment reporting obligations with the IRS.

Common Terms Founders Should Know

Term | Definition |

PFIC | Passive Foreign Investment Company as defined by IRS rules. |

Qualified Electing Fund (QEF) | A PFIC structure where the investor includes earnings annually to avoid harsh PFIC tax treatment. |

Excess Distribution | Distribution that exceeds 125% of the average from the past three years. |

Mark-to-Market Election | Method to report annual gains/losses based on fair market value of PFIC shares. |

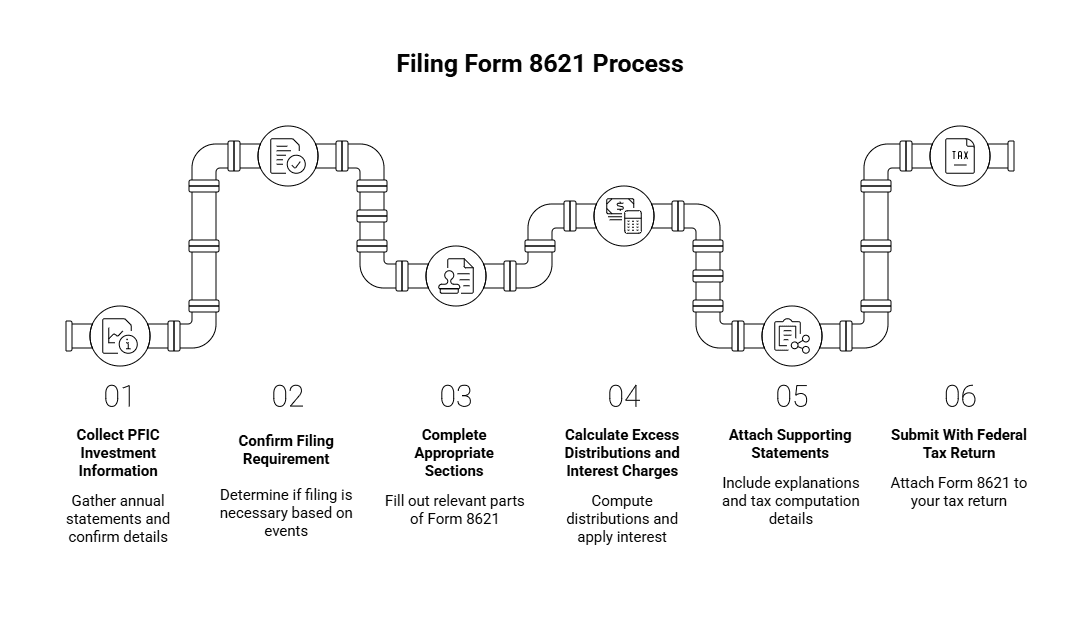

Step-by-Step Guide: Filing Form 8621

Filing Form 8621 may appear complex, but breaking it into clear steps improves compliance and efficiency.

Step 1: Collect PFIC Investment Information

Start by assembling complete records for each PFIC held during the tax year:

Annual statements from brokers, fund administrators, or foreign investment platforms

Acquisition and disposition dates for PFIC shares

Cost basis and adjusted basis information

Distributions received, if any

Prior-year elections in effect (QEF, Mark-to-Market, or default excess distribution regime)

An incomplete basis or election history is a common source of errors and amended filings.

Step 2: Confirm if Filing is Required

You must evaluate each PFIC holding against the following triggers:

Acquisitions or dispositions of PFIC stock during the year

Distributions, including excess distributions

Ongoing elections that require annual reporting, even in no-income years

Indirect ownership through partnerships, funds, or other pass-through entities

If Form 8621 was required in a prior year but not filed, late filing may require additional disclosure statements to mitigate penalties and preserve favorable tax elections.

Step 3: Complete Appropriate Sections

Part I: General shareholder and PFIC info.

Part II: The type of PFIC event (acquisition, disposition).

Part III: Tax calculations, including excess distributions.

Parts IV–V: QEF and Mark-to-Market elections.

Step 4: Calculate Excess Distributions and Interest Charges

If no Qualified Electing Fund (QEF) or Mark-to-Market election is in place, PFIC income is generally taxed under the excess distribution regime.

At this stage, you must:

Identify excess distributions (normally, unusually large gains or payments).

Allocate distributed gains across prior years.

Apply interest charges as prescribed by IRS PFIC rules.

Calculate interest charges on the resulting deferred tax

Step 5: Attach Supporting Statements

Depending on the filing scenario, you may need to attach:

Election statements, including QEF or Mark-to-Market elections (or election continuation disclosures)

Late-filing explanations, if Form 8621 was required in prior years but not submitted

Detailed tax computations, showing how income, excess distributions, and interest charges were calculated

You should also retain all PFIC-provided annual information statements and broker reports in your permanent records.

Step 6: Submit With Your Federal Tax Return

Attach Form 8621 to your Form 1040, 1120, or appropriate return.

Timely payment of any resulting taxes is critical to avoid penalties.

How PFIC Rules Impact Startup and E-Commerce Founders

Entrepreneurs and startups with foreign holdings should consider the following:

Cash Flow Strain: Unexpected tax liabilities from PFICs may restrict working capital during critical growth phases.

R&D Credit Planning: Misaligned reporting can affect eligibility or reduce benefits of R&D incentives.

Double Taxation Risks: Without elections like QEF or Mark-to-Market, founders may face tax on phantom income.

Governance Complexity: PFIC compliance adds administrative complexity disproportionate to the size of investment in some cases.

Coordinated Tax Compliance

PFIC reporting is part of a broader international tax framework. Because the IRS cross-references these forms, maintaining consistency across all filings is essential to avoid audit triggers.

Key International Forms to Monitor:

Form 5471 (Foreign Corporations): Required if you own 10% or more of a foreign corporation controlled by U.S. persons. It tracks the entity's overall financial health, not just passive income.

Form 3520 (Foreign Gifts & Trusts): Required if you receive gifts or inheritances exceeding $100,000 from a non-U.S. person, or if you engage with foreign trusts.

These obligations all benefit from clear record-keeping and integrated reporting strategies.

Common Pitfalls to Avoid

Avoid these frequent mistakes when dealing with PFIC filing:

Not filing when required: Risking significant penalties.

Incorrect excess distribution calculations: Often leads to tax underpayments.

Delayed or invalid elections: Reduce strategic flexibility and can’t always be corrected retroactively.

Neglecting indirect ownership: Especially easy to miss when tiered entities are involved.

Ignoring IRS updates: Stay informed about regulatory changes to PFIC definitions or filing thresholds.

Tips for Founders Navigating PFIC Compliance

Tip | Impact |

Identify PFICs Early | Improves timing for optimal elections and reduces year-end stress. |

Work With Legal and Tax Counsel | Ensures structure aligns with both business and regulatory objectives. |

Use Specialized Software or Experts | Helps with complex calculations and minimizes human error. |

Keep Annual PFIC Reports | Required for elections and critical for audit readiness. |

Conduct Investment Reviews | Ensure foreign holdings still support business goals post-tax impact. |

Form 8621 for Founder-Led Growth

Navigating IRS regulations around Form 8621 is essential for startups and U.S.-based companies investing in foreign entities classified as PFICs. Early awareness and disciplined compliance can protect your business from steep tax penalties and support smoother financial operations.

Founders who master PFIC rules and reporting turn compliance from a complex obstacle into part of a strategic advantage. Whether managing bookkeeping workflows, coordinating with tax professionals, or integrating R&D tax credit considerations, understanding Form 8621 facilitates optimized investment decisions and business growth.

Investing in foreign companies can offer startups, agencies, and e-commerce businesses valuable portfolio diversification and growth opportunities. However, U.S. founders and financial leaders should be aware of the specific tax rules affecting Passive Foreign Investment Companies (PFICs). One critical compliance requirement is Form 8621, which the IRS mandates for shareholders of these foreign investment vehicles.

This guide will unpack the essentials around Form 8621, clarify who must file, and provide practical steps for navigating PFIC regulations without getting lost in tax jargon. Understanding this form enables better-informed investment decisions and helps prevent costly surprises on your tax return.

What is Form 8621 and Why Founders Should Care

Form 8621, Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund, is a specialized IRS form designed to track U.S. taxpayers’ income and distributions from PFIC investments.

A PFIC generally is any foreign corporation where:

At least 75% of its gross income is passive income, such as dividends, interest, rents, royalties, or capital gains, or

At least 50% of its assets produce or are held for producing passive income.

These companies often include foreign mutual funds, holding companies, or investment vehicles holding stocks and bonds.

Why it Matters for U.S. Investors and Founders

Tax rules around PFICs aim to prevent U.S. taxpayers from deferring or avoiding U.S. tax on foreign investment income. This is particularly relevant if your startup or e-commerce company invests directly or indirectly in foreign funds or entities that meet PFIC criteria.

Failing to properly file Form 8621 can lead to:

Double taxation or punitive tax rates on distributions and gains,

Complicated tax calculations with "excess distributions" and interest charges,

IRS penalties for non-disclosure, and

Unnecessary complexity during tax audits.

For founders balancing rapid growth and regulatory compliance, understanding Form 8621 early improves financial oversight and strategic tax planning.

Who Must File Form 8621?

You must file Form 8621 if you are a U.S. person who is a direct or indirect shareholder of a Passive Foreign Investment Company (PFIC) at any point during the tax year. Filing obligations are driven by ownership status and elections—not just income received.

The main triggers include:

Shareholder status:

Applies to U.S. individuals, corporations, partnerships, trusts, and estates that own PFIC stock, either directly or through another entity.Indirect or constructive ownership:

If you hold PFIC exposure through partnerships, funds, holding companies, or foreign subsidiaries, attribution rules may still require filing—even if you do not hold shares personally.Ownership without distributions:

Form 8621 may be required even if you received no distributions and recognized no gains during the year. In many cases, mere ownership triggers the filing.Dispositions or gains:

Sales, redemptions, or other taxable dispositions of PFIC stock always require Form 8621 reporting.PFIC elections:

Making or maintaining elections—such as a Qualified Electing Fund (QEF) or Mark-to-Market election—generally requires annual Form 8621 filings to report income, basis adjustments, and compliance with election rules.

Exceptions and Limited Relief

Certain exceptions apply, most commonly for de minimis holdings or where specific elections eliminate ongoing reporting requirements. These exceptions are narrow and depend on ownership value, income thresholds, and prior filings.

Because PFIC rules are technical and penalties for non-filing can be severe, Form 8621 determinations are typically reviewed alongside broader international and investment reporting obligations with the IRS.

Common Terms Founders Should Know

Term | Definition |

PFIC | Passive Foreign Investment Company as defined by IRS rules. |

Qualified Electing Fund (QEF) | A PFIC structure where the investor includes earnings annually to avoid harsh PFIC tax treatment. |

Excess Distribution | Distribution that exceeds 125% of the average from the past three years. |

Mark-to-Market Election | Method to report annual gains/losses based on fair market value of PFIC shares. |

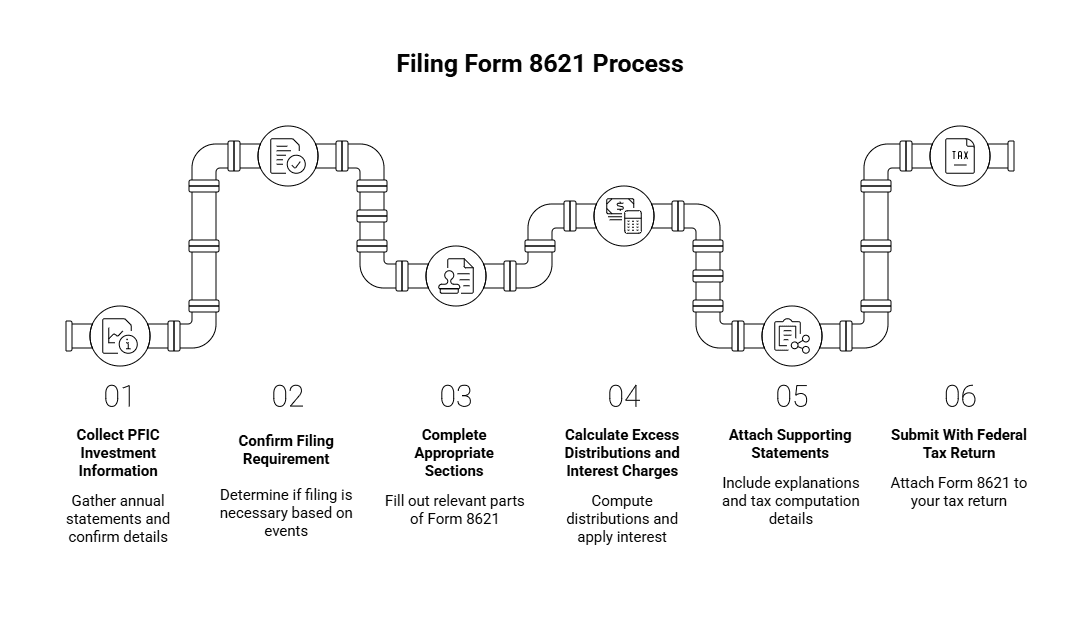

Step-by-Step Guide: Filing Form 8621

Filing Form 8621 may appear complex, but breaking it into clear steps improves compliance and efficiency.

Step 1: Collect PFIC Investment Information

Start by assembling complete records for each PFIC held during the tax year:

Annual statements from brokers, fund administrators, or foreign investment platforms

Acquisition and disposition dates for PFIC shares

Cost basis and adjusted basis information

Distributions received, if any

Prior-year elections in effect (QEF, Mark-to-Market, or default excess distribution regime)

An incomplete basis or election history is a common source of errors and amended filings.

Step 2: Confirm if Filing is Required

You must evaluate each PFIC holding against the following triggers:

Acquisitions or dispositions of PFIC stock during the year

Distributions, including excess distributions

Ongoing elections that require annual reporting, even in no-income years

Indirect ownership through partnerships, funds, or other pass-through entities

If Form 8621 was required in a prior year but not filed, late filing may require additional disclosure statements to mitigate penalties and preserve favorable tax elections.

Step 3: Complete Appropriate Sections

Part I: General shareholder and PFIC info.

Part II: The type of PFIC event (acquisition, disposition).

Part III: Tax calculations, including excess distributions.

Parts IV–V: QEF and Mark-to-Market elections.

Step 4: Calculate Excess Distributions and Interest Charges

If no Qualified Electing Fund (QEF) or Mark-to-Market election is in place, PFIC income is generally taxed under the excess distribution regime.

At this stage, you must:

Identify excess distributions (normally, unusually large gains or payments).

Allocate distributed gains across prior years.

Apply interest charges as prescribed by IRS PFIC rules.

Calculate interest charges on the resulting deferred tax

Step 5: Attach Supporting Statements

Depending on the filing scenario, you may need to attach:

Election statements, including QEF or Mark-to-Market elections (or election continuation disclosures)

Late-filing explanations, if Form 8621 was required in prior years but not submitted

Detailed tax computations, showing how income, excess distributions, and interest charges were calculated

You should also retain all PFIC-provided annual information statements and broker reports in your permanent records.

Step 6: Submit With Your Federal Tax Return

Attach Form 8621 to your Form 1040, 1120, or appropriate return.

Timely payment of any resulting taxes is critical to avoid penalties.

How PFIC Rules Impact Startup and E-Commerce Founders

Entrepreneurs and startups with foreign holdings should consider the following:

Cash Flow Strain: Unexpected tax liabilities from PFICs may restrict working capital during critical growth phases.

R&D Credit Planning: Misaligned reporting can affect eligibility or reduce benefits of R&D incentives.

Double Taxation Risks: Without elections like QEF or Mark-to-Market, founders may face tax on phantom income.

Governance Complexity: PFIC compliance adds administrative complexity disproportionate to the size of investment in some cases.

Coordinated Tax Compliance

PFIC reporting is part of a broader international tax framework. Because the IRS cross-references these forms, maintaining consistency across all filings is essential to avoid audit triggers.

Key International Forms to Monitor:

Form 5471 (Foreign Corporations): Required if you own 10% or more of a foreign corporation controlled by U.S. persons. It tracks the entity's overall financial health, not just passive income.

Form 3520 (Foreign Gifts & Trusts): Required if you receive gifts or inheritances exceeding $100,000 from a non-U.S. person, or if you engage with foreign trusts.

These obligations all benefit from clear record-keeping and integrated reporting strategies.

Common Pitfalls to Avoid

Avoid these frequent mistakes when dealing with PFIC filing:

Not filing when required: Risking significant penalties.

Incorrect excess distribution calculations: Often leads to tax underpayments.

Delayed or invalid elections: Reduce strategic flexibility and can’t always be corrected retroactively.

Neglecting indirect ownership: Especially easy to miss when tiered entities are involved.

Ignoring IRS updates: Stay informed about regulatory changes to PFIC definitions or filing thresholds.

Tips for Founders Navigating PFIC Compliance

Tip | Impact |

Identify PFICs Early | Improves timing for optimal elections and reduces year-end stress. |

Work With Legal and Tax Counsel | Ensures structure aligns with both business and regulatory objectives. |

Use Specialized Software or Experts | Helps with complex calculations and minimizes human error. |

Keep Annual PFIC Reports | Required for elections and critical for audit readiness. |

Conduct Investment Reviews | Ensure foreign holdings still support business goals post-tax impact. |

Form 8621 for Founder-Led Growth

Navigating IRS regulations around Form 8621 is essential for startups and U.S.-based companies investing in foreign entities classified as PFICs. Early awareness and disciplined compliance can protect your business from steep tax penalties and support smoother financial operations.

Founders who master PFIC rules and reporting turn compliance from a complex obstacle into part of a strategic advantage. Whether managing bookkeeping workflows, coordinating with tax professionals, or integrating R&D tax credit considerations, understanding Form 8621 facilitates optimized investment decisions and business growth.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026