Go Back

Last Updated :

Last Updated :

Dec 29, 2025

Dec 29, 2025

Form 5471: Filing Requirements and Compliance for Foreign Corporations

For founders and finance leaders running startups, agencies, and e-commerce companies, navigating international tax reporting can be daunting. Form 5471 is a critical IRS filing for U.S. persons with specific interests in foreign corporations. Getting it right is essential to avoid costly penalties and maintain compliance.

This guide provides practical, guidance-oriented steps to demystify Form 5471, breaking down who must file, what to report, and how to approach this complex obligation effectively.

What Is Form 5471 and Why Does It Matter?

Form 5471, officially titled "Information Return of U.S. Persons With Respect To Certain Foreign Corporations," is an informational reporting document. It is used by U.S. shareholders to disclose their ownership and transactions involving certain foreign corporations to the IRS.

The IRS uses this data to:

Track the ownership structure of foreign entities.

Ensure U.S. shareholders are correctly reporting their income (like Subpart F income and GILTI).

Monitor financial transactions between the foreign corporation and related U.S. parties.

The Penalty Risk (and Why Founders Must Be Careful)

The stakes are exceptionally high. Failing to file Form 5471 accurately and timely can lead to severe financial penalties:

Initial Penalty: $10,000 for each annual accounting period the information is not provided.

Continuation Penalty: If the failure continues 90 days after IRS notification, an additional $10,000 penalty is assessed for every 30-day period (or fraction thereof), up to a maximum of $50,000 per violation.

Statute of Limitations: Failure to file Form 5471 keeps the statute of limitations open indefinitely for the entire tax return.

Who Must File Form 5471? A Founder’s Checklist

A U.S. Person (which includes U.S. citizens, residents, domestic corporations, partnerships, and certain trusts/estates) is required to file Form 5471 if they meet the criteria for one of five Filer Categories.

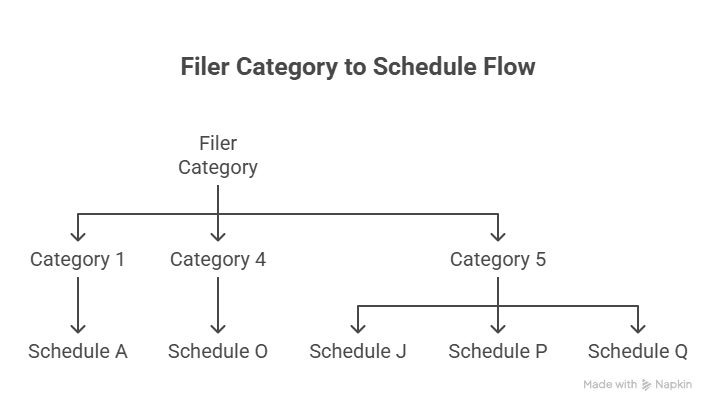

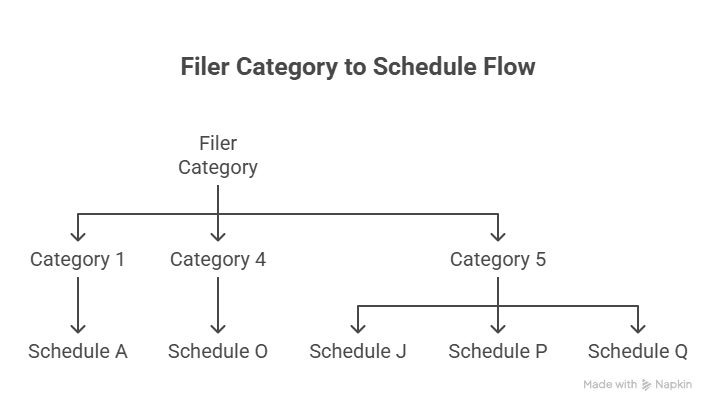

Determining your Filer Category is the most critical first step, as it dictates exactly which parts and schedules of the form you must complete.

Category | Filer Description | Key Trigger |

Category 1 | U.S. shareholder of a Specified Foreign Corporation (SFC) | Generally related to the Section 965 transition tax. |

Category 2 | U.S. person who is an officer or director of a foreign corporation where a U.S. person (or persons) acquires stock that meets the 10% ownership threshold. | Officer/Director involvement during a 10% ownership acquisition. |

Category 3 | U.S. person who acquires 10% stock ownership, disposes of stock to drop below 10%, or becomes a U.S. person while meeting the 10% ownership threshold. | Change in 10% or more ownership (acquisition or disposition). |

Category 4 | U.S. person who has Control (more than 50% voting power or value) of a foreign corporation for an uninterrupted period of 30 days or more during the annual accounting period. | Control Test (over 50% ownership). |

Category 5 | U.S. shareholder of a Controlled Foreign Corporation (CFC) for an uninterrupted period of 30 days or more, who owned stock on the last day of the foreign corporation's tax year. | CFC Status (U.S. shareholders own more than 50% of the vote or value). |

GUIDANCE: Many startups and agencies with foreign subsidiaries fall under Category 4 (Control) or Category 5 (CFC Shareholder). You may qualify as a filer under multiple categories, but often only need to file once, completing the schedules required by all applicable categories.

When Is Form 5471 Due?

Form 5471 is an information return filed as an attachment to your federal income tax return.

Due Date: Form 5471 is due the same date as the U.S. person’s income tax return (e.g., Form 1040, 1120, or 1065), including any extensions.

Extension: Filing an extension for your tax return (e.g., Form 7004 for corporations) automatically extends the due date for Form 5471.

How to Fill Out Form 5471: Step-by-Step Guidance

Form 5471 is divided into three main pages that require identification data, followed by numerous informational schedules.

Step 1: Determine Your Filing Category and Required Schedules

Use the table above to identify your category (1-5). This guides which schedules you must complete.

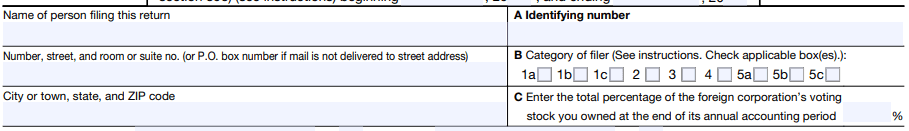

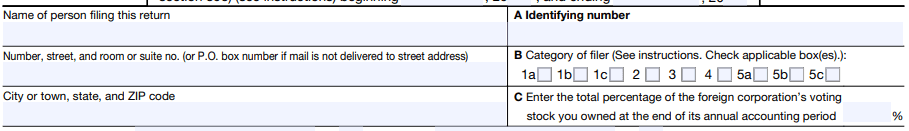

Step 2: Complete Page 1 - Identification

Fill out the top section of the form with details for both the U.S. person filing and the foreign corporation.

Line B: Crucially, check the box(es) corresponding to your Filer Category (e.g., if you are a Category 5 filer, check box 5a, 5b, or 5c).

Line C: Enter the total percentage of the foreign corporation’s voting stock you owned at the end of its annual accounting period.

Foreign Corporation Info: Enter the full name, address, and foreign identification number of the foreign corporation.

Step 3: Complete Schedule A (Stock Ownership)

This schedule details the U.S. person’s direct, indirect, and constructive ownership of the foreign corporation's stock.

You must list the name and address of each U.S. person who is a shareholder of the foreign corporation, even if they are not the filer.

You must calculate and report the number of shares and percentage of voting power owned.

Step 4: Complete Schedule C (Income Statement)

Schedule C provides a snapshot of the foreign corporation’s financial performance.

This requires reporting the foreign corporation's income and deductions based on its foreign books and records, often requiring conversion to U.S. GAAP or U.S. tax accounting principles.

Guidance: Ensure all revenue and expense categories are accurately translated and mapped to the appropriate lines, as this data feeds into Subpart F and GILTI calculations.

Step 5: Complete Schedule J (Accumulated Earnings & Profits)

This schedule tracks the foreign corporation's accumulated earnings and profits (E&P), critical for calculating distributions and deemed inclusions.

Guidance: E&P calculation follows specific U.S. tax rules, not necessarily foreign GAAP. Use the beginning and end of the tax year balances and track the components (e.g., previously taxed E&P, non-previously taxed E&P).

Step 6: Complete Required Transactional Schedules (M, N, O, P, Q)

Depending on your category, you may need other complex schedules:

Schedule M (Transactions): Details financial transactions (sales, purchases, loans, etc.) between the foreign corporation and its U.S. shareholders or related entities.

Schedule O (Organization/Reorganization): Required when a U.S. person acquires 10% or more stock, or an existing U.S. person increases their holding to meet or exceed 10%.

Schedule P and Q: Track previously taxed E&P and specific income details, typically required for CFC shareholders (Category 5).

Common Mistakes and How Founders Can Avoid Them

International tax complexity often leads to avoidable errors.

Pitfall | Explanation | Founder-Friendly Fix |

Missing the Filing Requirement | Assuming the foreign entity is small and doesn't require reporting, or relying on incorrect definitions of "U.S. Shareholder." | Proactive Review: Annually review your entire ownership structure (direct, indirect, and constructive) with an international tax expert. |

Incorrect Filer Category | Checking the wrong box on Line B means filing an incomplete return, which is treated as a non-filing. | Categorization Tool: Use the official IRS Form 5471 Instructions and seek professional help to confirm the correct category before starting. |

Incomplete Financials | Failing to convert the foreign corporation's financials to U.S. tax accounting standards (E&P, tax basis). | Mandate U.S. Standards: Ensure foreign entity bookkeeping is translated to U.S. GAAP/tax principles early in the process, not at the last minute. |

Ignoring Intercompany Transactions | Failing to document or report related-party transactions (loans, services, fees) on Schedule M. | Clear Documentation: Maintain clear, written agreements and detailed records for all intercompany transactions throughout the year. |

Frequently Asked Questions (FAQs)

What is the difference between direct, indirect, and constructive ownership?

Direct: Stock owned directly in the shareholder's name.

Indirect: Stock owned through another entity (like a foreign partnership or trust).

Constructive: Stock deemed owned by the U.S. person due to relationship rules (e.g., family members, controlled entities). All three types are used to determine the 10% or 50% threshold.

Do I need to file Form 5471 if my foreign corporation didn't have any income?

Yes. Form 5471 is an informational return based on ownership status, not profitability. If you meet the criteria for any Filer Category, the form must be filed regardless of the foreign corporation’s financial results.

Can a U.S. partnership or corporation be a "U.S. Person" that must file Form 5471?

Yes. The term "U.S. Person" includes domestic corporations and partnerships. If your startup (a U.S. corporation) owns a foreign subsidiary, the startup is the U.S. person responsible for filing Form 5471.

Is Form 5471 related to the R&D Tax Credit?

Yes, indirectly. If your foreign subsidiary is involved in R&D activities, the expenses of that subsidiary must be properly recorded and reported on Form 5471 (Schedule C). This reporting must be coordinated with your overall U.S. tax strategy to ensure eligible R&D expenses are properly classified and reported for any potential R&D tax credit claims made on your U.S. income tax return.

For founders and finance leaders running startups, agencies, and e-commerce companies, navigating international tax reporting can be daunting. Form 5471 is a critical IRS filing for U.S. persons with specific interests in foreign corporations. Getting it right is essential to avoid costly penalties and maintain compliance.

This guide provides practical, guidance-oriented steps to demystify Form 5471, breaking down who must file, what to report, and how to approach this complex obligation effectively.

What Is Form 5471 and Why Does It Matter?

Form 5471, officially titled "Information Return of U.S. Persons With Respect To Certain Foreign Corporations," is an informational reporting document. It is used by U.S. shareholders to disclose their ownership and transactions involving certain foreign corporations to the IRS.

The IRS uses this data to:

Track the ownership structure of foreign entities.

Ensure U.S. shareholders are correctly reporting their income (like Subpart F income and GILTI).

Monitor financial transactions between the foreign corporation and related U.S. parties.

The Penalty Risk (and Why Founders Must Be Careful)

The stakes are exceptionally high. Failing to file Form 5471 accurately and timely can lead to severe financial penalties:

Initial Penalty: $10,000 for each annual accounting period the information is not provided.

Continuation Penalty: If the failure continues 90 days after IRS notification, an additional $10,000 penalty is assessed for every 30-day period (or fraction thereof), up to a maximum of $50,000 per violation.

Statute of Limitations: Failure to file Form 5471 keeps the statute of limitations open indefinitely for the entire tax return.

Who Must File Form 5471? A Founder’s Checklist

A U.S. Person (which includes U.S. citizens, residents, domestic corporations, partnerships, and certain trusts/estates) is required to file Form 5471 if they meet the criteria for one of five Filer Categories.

Determining your Filer Category is the most critical first step, as it dictates exactly which parts and schedules of the form you must complete.

Category | Filer Description | Key Trigger |

Category 1 | U.S. shareholder of a Specified Foreign Corporation (SFC) | Generally related to the Section 965 transition tax. |

Category 2 | U.S. person who is an officer or director of a foreign corporation where a U.S. person (or persons) acquires stock that meets the 10% ownership threshold. | Officer/Director involvement during a 10% ownership acquisition. |

Category 3 | U.S. person who acquires 10% stock ownership, disposes of stock to drop below 10%, or becomes a U.S. person while meeting the 10% ownership threshold. | Change in 10% or more ownership (acquisition or disposition). |

Category 4 | U.S. person who has Control (more than 50% voting power or value) of a foreign corporation for an uninterrupted period of 30 days or more during the annual accounting period. | Control Test (over 50% ownership). |

Category 5 | U.S. shareholder of a Controlled Foreign Corporation (CFC) for an uninterrupted period of 30 days or more, who owned stock on the last day of the foreign corporation's tax year. | CFC Status (U.S. shareholders own more than 50% of the vote or value). |

GUIDANCE: Many startups and agencies with foreign subsidiaries fall under Category 4 (Control) or Category 5 (CFC Shareholder). You may qualify as a filer under multiple categories, but often only need to file once, completing the schedules required by all applicable categories.

When Is Form 5471 Due?

Form 5471 is an information return filed as an attachment to your federal income tax return.

Due Date: Form 5471 is due the same date as the U.S. person’s income tax return (e.g., Form 1040, 1120, or 1065), including any extensions.

Extension: Filing an extension for your tax return (e.g., Form 7004 for corporations) automatically extends the due date for Form 5471.

How to Fill Out Form 5471: Step-by-Step Guidance

Form 5471 is divided into three main pages that require identification data, followed by numerous informational schedules.

Step 1: Determine Your Filing Category and Required Schedules

Use the table above to identify your category (1-5). This guides which schedules you must complete.

Step 2: Complete Page 1 - Identification

Fill out the top section of the form with details for both the U.S. person filing and the foreign corporation.

Line B: Crucially, check the box(es) corresponding to your Filer Category (e.g., if you are a Category 5 filer, check box 5a, 5b, or 5c).

Line C: Enter the total percentage of the foreign corporation’s voting stock you owned at the end of its annual accounting period.

Foreign Corporation Info: Enter the full name, address, and foreign identification number of the foreign corporation.

Step 3: Complete Schedule A (Stock Ownership)

This schedule details the U.S. person’s direct, indirect, and constructive ownership of the foreign corporation's stock.

You must list the name and address of each U.S. person who is a shareholder of the foreign corporation, even if they are not the filer.

You must calculate and report the number of shares and percentage of voting power owned.

Step 4: Complete Schedule C (Income Statement)

Schedule C provides a snapshot of the foreign corporation’s financial performance.

This requires reporting the foreign corporation's income and deductions based on its foreign books and records, often requiring conversion to U.S. GAAP or U.S. tax accounting principles.

Guidance: Ensure all revenue and expense categories are accurately translated and mapped to the appropriate lines, as this data feeds into Subpart F and GILTI calculations.

Step 5: Complete Schedule J (Accumulated Earnings & Profits)

This schedule tracks the foreign corporation's accumulated earnings and profits (E&P), critical for calculating distributions and deemed inclusions.

Guidance: E&P calculation follows specific U.S. tax rules, not necessarily foreign GAAP. Use the beginning and end of the tax year balances and track the components (e.g., previously taxed E&P, non-previously taxed E&P).

Step 6: Complete Required Transactional Schedules (M, N, O, P, Q)

Depending on your category, you may need other complex schedules:

Schedule M (Transactions): Details financial transactions (sales, purchases, loans, etc.) between the foreign corporation and its U.S. shareholders or related entities.

Schedule O (Organization/Reorganization): Required when a U.S. person acquires 10% or more stock, or an existing U.S. person increases their holding to meet or exceed 10%.

Schedule P and Q: Track previously taxed E&P and specific income details, typically required for CFC shareholders (Category 5).

Common Mistakes and How Founders Can Avoid Them

International tax complexity often leads to avoidable errors.

Pitfall | Explanation | Founder-Friendly Fix |

Missing the Filing Requirement | Assuming the foreign entity is small and doesn't require reporting, or relying on incorrect definitions of "U.S. Shareholder." | Proactive Review: Annually review your entire ownership structure (direct, indirect, and constructive) with an international tax expert. |

Incorrect Filer Category | Checking the wrong box on Line B means filing an incomplete return, which is treated as a non-filing. | Categorization Tool: Use the official IRS Form 5471 Instructions and seek professional help to confirm the correct category before starting. |

Incomplete Financials | Failing to convert the foreign corporation's financials to U.S. tax accounting standards (E&P, tax basis). | Mandate U.S. Standards: Ensure foreign entity bookkeeping is translated to U.S. GAAP/tax principles early in the process, not at the last minute. |

Ignoring Intercompany Transactions | Failing to document or report related-party transactions (loans, services, fees) on Schedule M. | Clear Documentation: Maintain clear, written agreements and detailed records for all intercompany transactions throughout the year. |

Frequently Asked Questions (FAQs)

What is the difference between direct, indirect, and constructive ownership?

Direct: Stock owned directly in the shareholder's name.

Indirect: Stock owned through another entity (like a foreign partnership or trust).

Constructive: Stock deemed owned by the U.S. person due to relationship rules (e.g., family members, controlled entities). All three types are used to determine the 10% or 50% threshold.

Do I need to file Form 5471 if my foreign corporation didn't have any income?

Yes. Form 5471 is an informational return based on ownership status, not profitability. If you meet the criteria for any Filer Category, the form must be filed regardless of the foreign corporation’s financial results.

Can a U.S. partnership or corporation be a "U.S. Person" that must file Form 5471?

Yes. The term "U.S. Person" includes domestic corporations and partnerships. If your startup (a U.S. corporation) owns a foreign subsidiary, the startup is the U.S. person responsible for filing Form 5471.

Is Form 5471 related to the R&D Tax Credit?

Yes, indirectly. If your foreign subsidiary is involved in R&D activities, the expenses of that subsidiary must be properly recorded and reported on Form 5471 (Schedule C). This reporting must be coordinated with your overall U.S. tax strategy to ensure eligible R&D expenses are properly classified and reported for any potential R&D tax credit claims made on your U.S. income tax return.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026