Go Back

Last Updated :

Last Updated :

Jan 5, 2026

Jan 5, 2026

Form 3520 Guide: Reporting Foreign Gifts & Trust Transactions

When managing a startup or scaling your e-commerce business, tax compliance is a strategic piece of your financial health. For founders dealing with international financial activities, understanding IRS Form 3520 is crucial. This form is used to disclose foreign gifts, inheritances, and certain trust transactions. Mishandling it can expose your company to costly penalties—often up to 35% of the unreported amount—and significant audit risks.

What Is Form 3520?

Form 3520, the Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts, is an information return. It does not necessarily mean you owe tax, but it is the IRS’s way of tracking large movements of wealth into the U.S. from foreign sources.

Key Categories for Founders

You may need to file this form if you fall into one of these common startup scenarios :

Foreign Gifts: Receiving over $100,000 from a nonresident alien or a foreign estate.

Foreign Trust Transactions: Transferring money to a foreign trust, being a U.S. owner of a foreign trust, or receiving distributions/loans from one.

Business Gifts: Receiving over $19,571 (for 2024, adjusted annually) from foreign corporations or partnerships.

Who Needs to File?

A "U.S. person" must file Form 3520. In the context of a startup, this includes:

Individual Founders who are U.S. citizens or residents.

Domestic Corporations or Partnerships that receive foreign gifts or interact with foreign trusts.

Trust Executors of a U.S. decedent's estate involved with foreign trusts.

When Is It Due?

Form 3520 is generally due on the same date as your individual income tax return (typically April 15th), including extensions. However, unlike your tax return, it is often filed separately from your Form 1040.

Step-by-Step: How to Fill Out Form 3520

The form is modular. You only fill out the parts that apply to your specific transaction.

Step 1: Identifying Information (Page 1)

Check Boxes A & B: Indicate if this is an initial, final, or amended return, and whether you are filing as an individual, corporation, or partnership.

Check Box Checklist: This is critical. Check the box that describes your status (e.g., recipient of a foreign gift) to determine which Parts you must complete.

Step 2: Part I – Transfers to Foreign Trusts

Complete this if you moved cash or property to a foreign trust during the year. You must provide the trust's EIN and details about the transfer.

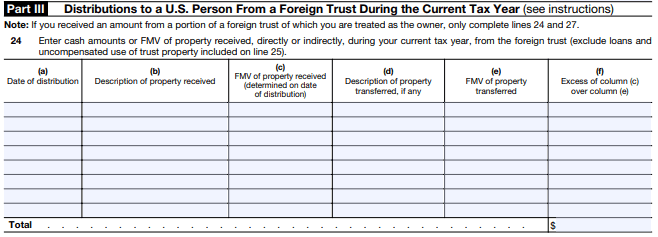

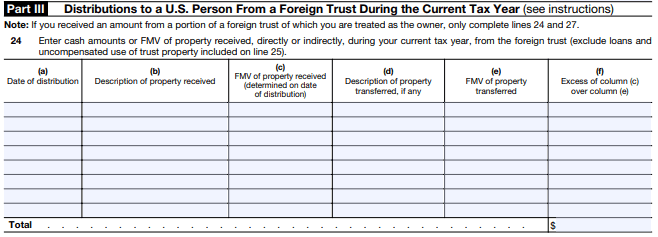

Step 3: Part III – Distributions from Foreign Trusts

If you received a loan or a distribution (cash or property) from a foreign trust, you must report it here.

Lines 24–27: Report the total distributions and determine if they are taxable as ordinary income or capital gains.

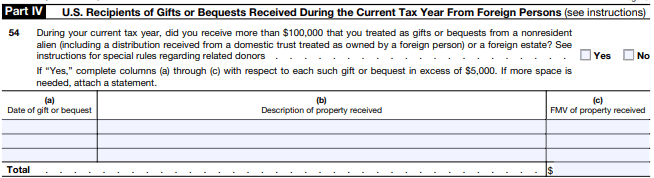

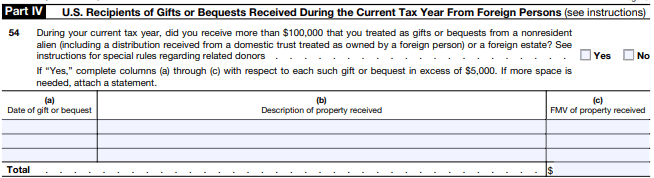

Step 4: Part IV – Foreign Gifts and Bequests

This is the most common section for individual founders.

Line 54: If you received more than $100,000 from a foreign individual, you must list the date and description of each gift.

Note: You do not need to identify the donor for individual gifts, but you must identify foreign corporations or partnerships if the gift exceeds the threshold.

Common Mistakes to Avoid

Ignoring Small Gifts from Related Parties: If you receive multiple small gifts from "related" foreign persons (like family members), the IRS aggregates them. If the total exceeds $100,000, you must report them.

Missing the Threshold: Forgetting that the threshold for gifts from foreign businesses is much lower (~$19k) than from individuals ($100k).

Late Filing: Penalties for Form 3520 are among the most severe. The IRS can charge 35% of the gross value of the transaction for failure to report.

FAQs

Q: Is the foreign gift taxable?

A: Generally, no. Form 3520 is an informational return. However, failing to report it can lead to the IRS treating the gift as taxable income until you prove otherwise.

Q: Do I need to file if I just moved money between my own accounts?

A: No, Form 3520 is for transactions involving foreign trusts or foreign persons. Moving personal funds between your own U.S. and foreign bank accounts is usually reported on the FBAR or Form 89.

Streamline Your Global Compliance with Haven

Managing international financial reporting while scaling a business is a high-stakes distraction. Haven provides founder-centric tax and bookkeeping services that catch these requirements before they become penalties.

Global Activity Tracking: We monitor your international transfers to flag Form 3520 requirements early.

Integrated Reporting: We ensure your foreign gift disclosures align with your broader tax strategy and R&D credits.

Audit-Ready Books: We maintain the documentation required to prove a gift is actually a gift, protecting you from IRS scrutiny.

When managing a startup or scaling your e-commerce business, tax compliance is a strategic piece of your financial health. For founders dealing with international financial activities, understanding IRS Form 3520 is crucial. This form is used to disclose foreign gifts, inheritances, and certain trust transactions. Mishandling it can expose your company to costly penalties—often up to 35% of the unreported amount—and significant audit risks.

What Is Form 3520?

Form 3520, the Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts, is an information return. It does not necessarily mean you owe tax, but it is the IRS’s way of tracking large movements of wealth into the U.S. from foreign sources.

Key Categories for Founders

You may need to file this form if you fall into one of these common startup scenarios :

Foreign Gifts: Receiving over $100,000 from a nonresident alien or a foreign estate.

Foreign Trust Transactions: Transferring money to a foreign trust, being a U.S. owner of a foreign trust, or receiving distributions/loans from one.

Business Gifts: Receiving over $19,571 (for 2024, adjusted annually) from foreign corporations or partnerships.

Who Needs to File?

A "U.S. person" must file Form 3520. In the context of a startup, this includes:

Individual Founders who are U.S. citizens or residents.

Domestic Corporations or Partnerships that receive foreign gifts or interact with foreign trusts.

Trust Executors of a U.S. decedent's estate involved with foreign trusts.

When Is It Due?

Form 3520 is generally due on the same date as your individual income tax return (typically April 15th), including extensions. However, unlike your tax return, it is often filed separately from your Form 1040.

Step-by-Step: How to Fill Out Form 3520

The form is modular. You only fill out the parts that apply to your specific transaction.

Step 1: Identifying Information (Page 1)

Check Boxes A & B: Indicate if this is an initial, final, or amended return, and whether you are filing as an individual, corporation, or partnership.

Check Box Checklist: This is critical. Check the box that describes your status (e.g., recipient of a foreign gift) to determine which Parts you must complete.

Step 2: Part I – Transfers to Foreign Trusts

Complete this if you moved cash or property to a foreign trust during the year. You must provide the trust's EIN and details about the transfer.

Step 3: Part III – Distributions from Foreign Trusts

If you received a loan or a distribution (cash or property) from a foreign trust, you must report it here.

Lines 24–27: Report the total distributions and determine if they are taxable as ordinary income or capital gains.

Step 4: Part IV – Foreign Gifts and Bequests

This is the most common section for individual founders.

Line 54: If you received more than $100,000 from a foreign individual, you must list the date and description of each gift.

Note: You do not need to identify the donor for individual gifts, but you must identify foreign corporations or partnerships if the gift exceeds the threshold.

Common Mistakes to Avoid

Ignoring Small Gifts from Related Parties: If you receive multiple small gifts from "related" foreign persons (like family members), the IRS aggregates them. If the total exceeds $100,000, you must report them.

Missing the Threshold: Forgetting that the threshold for gifts from foreign businesses is much lower (~$19k) than from individuals ($100k).

Late Filing: Penalties for Form 3520 are among the most severe. The IRS can charge 35% of the gross value of the transaction for failure to report.

FAQs

Q: Is the foreign gift taxable?

A: Generally, no. Form 3520 is an informational return. However, failing to report it can lead to the IRS treating the gift as taxable income until you prove otherwise.

Q: Do I need to file if I just moved money between my own accounts?

A: No, Form 3520 is for transactions involving foreign trusts or foreign persons. Moving personal funds between your own U.S. and foreign bank accounts is usually reported on the FBAR or Form 89.

Streamline Your Global Compliance with Haven

Managing international financial reporting while scaling a business is a high-stakes distraction. Haven provides founder-centric tax and bookkeeping services that catch these requirements before they become penalties.

Global Activity Tracking: We monitor your international transfers to flag Form 3520 requirements early.

Integrated Reporting: We ensure your foreign gift disclosures align with your broader tax strategy and R&D credits.

Audit-Ready Books: We maintain the documentation required to prove a gift is actually a gift, protecting you from IRS scrutiny.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026