Go Back

Last Updated :

Last Updated :

Jan 15, 2026

Jan 15, 2026

Startup Tax Credit Compliance: How to File Form 8867

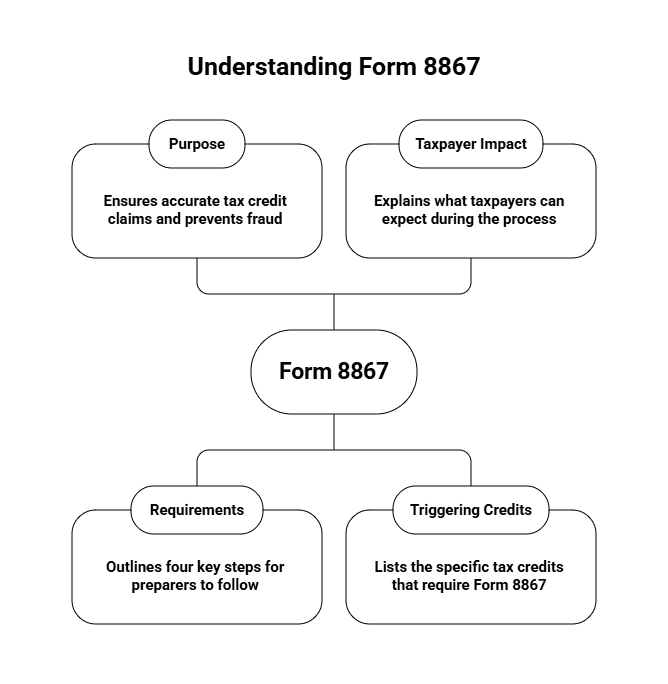

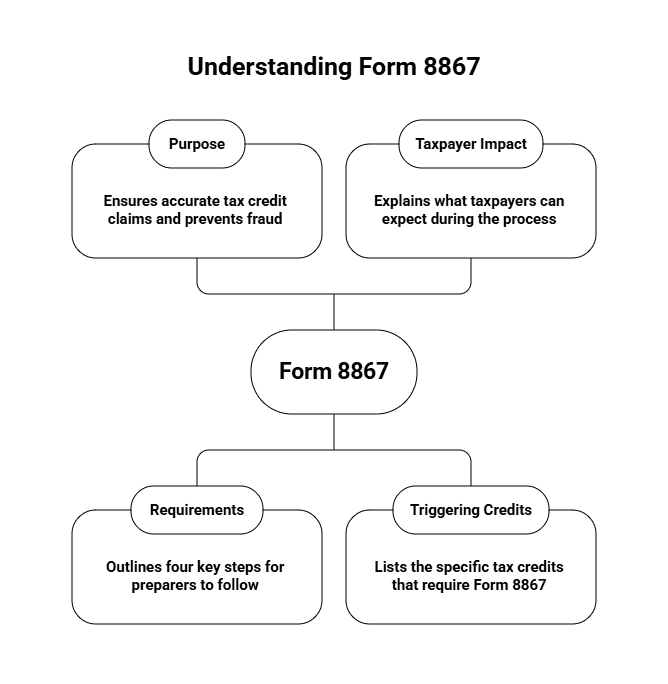

For founders steering startups, agencies, and e-commerce ventures, understanding the Form 8867 requirements is crucial for effective tax planning and compliance. This form, officially labeled the “Paid Preparer's Due Diligence Checklist,” is a key piece to claiming valuable tax credits like the Earned Income Tax Credit (EITC), Child Tax Credit (CTC), American Opportunity Tax Credit (AOTC), and others.

This guide breaks down the essentials of Form 8867, highlights its due-diligence requirements, and offers founder-friendly guidance to help you make informed decisions about tax preparation and filing. Whether you’re evaluating your startup’s current tax service or selecting a new provider, this practical overview will keep tax compliance manageable and aligned with your business goals.

What Is Form 8867 and Why Founders Should Care

Form 8867 is an IRS-mandated checklist used exclusively by tax preparers to document they have fulfilled due diligence requirements when preparing tax returns claiming certain tax credits. Since tax credits like the Earned Income Tax Credit (EITC) can significantly reduce a startup or small business’s tax liability, the IRS requires tax preparers to verify key facts to prevent misuse.

Key Tax Credits Requiring Form 8867 Due Diligence

Earned Income Tax Credit (EITC)

Child Tax Credit (CTC)

Additional Child Tax Credit (ACTC)

American Opportunity Tax Credit (AOTC)

Head of Household (HOH) filing status

A founder’s understanding of this form is important because:

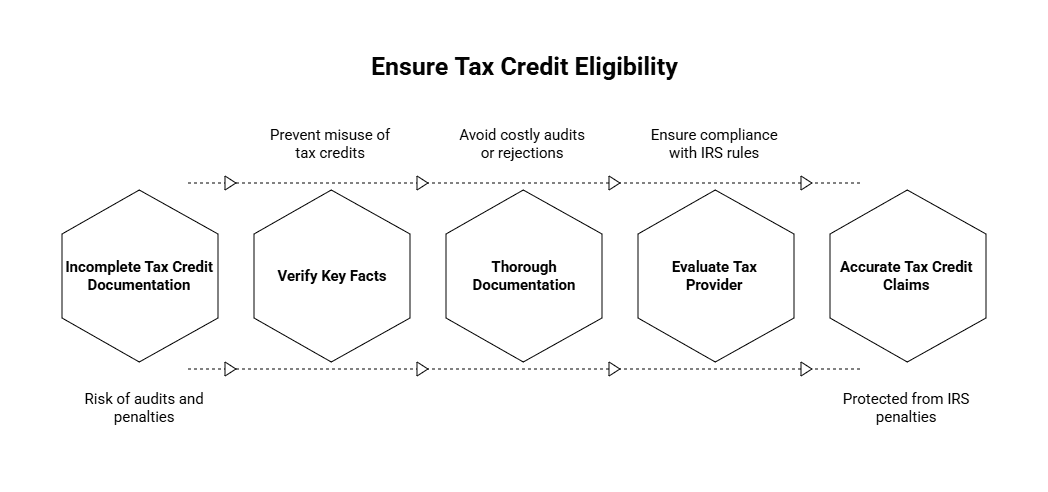

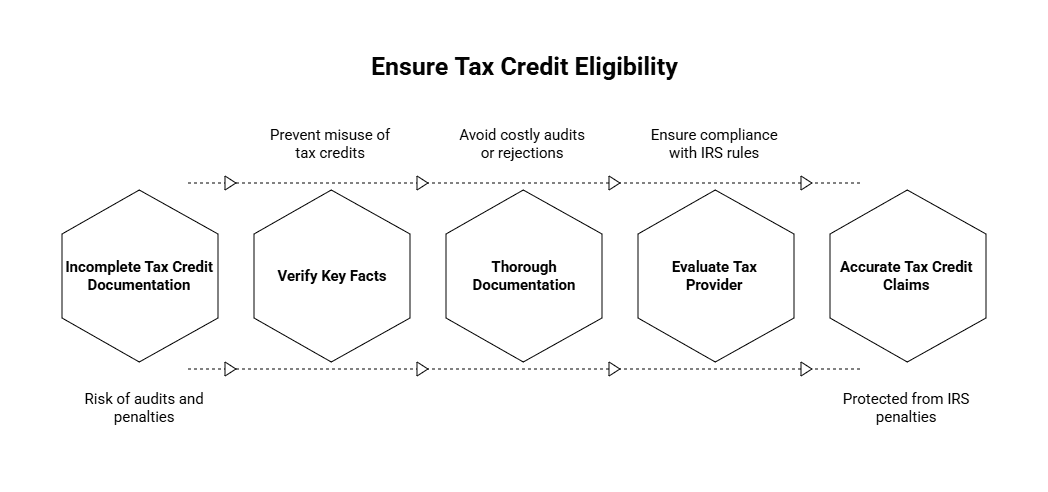

You want to ensure your tax preparer thoroughly documents eligibility to avoid costly audits or rejected returns.

Proper due diligence protects your startup from IRS penalties related to inaccurate or fraudulent claims.

It gives you a benchmark to evaluate whether your current accounting or tax provider follows IRS rules—especially if you leverage tax credits frequently.

Understanding Due Diligence Requirements: What Tax Preparers Must Verify

When your tax preparer uses Form 8867, they attest to the IRS that they have obtained and documented the information needed to substantiate eligible credits. Founders should be aware of these critical due diligence steps:

Due Diligence Step | What Your Tax Preparer Must Do | Why It Matters for Founders |

Obtain Eligibility Info | Collect detailed facts such as income, filing status, number of qualifying children, etc. | Validates your claim to tax credits and prevents costly errors. |

Reasonable Inquiry | Probe further when information is incomplete or inconsistent. | Ensures accurate filings that can withstand IRS scrutiny. |

Complete Form 8867 | Submit the form with your tax return and retain adequate records. | Demonstrates due diligence to the IRS and reduces audit risk. |

Retain Documentation | Keep documentation for three years post-filing or two years after tax payment. | Safeguards your business in case of IRS review or audit. |

How Founders Can Leverage This Knowledge in Tax Preparation

Select Tax Preparers Familiar with Form 8867 Compliance

Startups and small businesses benefit most when they work with providers who understand the nuances and legal obligations tied to tax credits. Always confirm your preparer understands Form 8867 and conducts full due diligence—this protects your business from IRS penalties, which can be as high as $545 per failure.

Provide Clear and Accurate Information Upfront

To simplify Form 8867 due diligence for your preparer, keep thorough records of income, dependent details, and documents supporting eligibility for credits.

Use a Streamlined Checklist to Track Key Documentation

A streamlined tax preparation checklist keeps all required documentation organized in one place, so every tax credit claim is clearly supported and easy to validate.

By tracking what’s complete and what’s missing in real time, you reduce back-and-forth, cut preparation time, and move faster with confidence when it’s time to file.

Practical Example: Navigating Child Tax Credit with Form 8867

Imagine your e-commerce startup is claiming the Child Tax Credit. Your tax preparer must:

Verify each child has a valid Social Security Number.

Confirm the child lived with you for over six months during the tax year.

Check income thresholds and recent tax law changes affecting the credit amount.

Using Form 8867, your preparer certifies that inquiries were made and supporting details documented. Skipping these steps could result in the IRS disallowing the credit—putting your startup at financial risk.

Founders’ Perspective: Common Misconceptions About Form 8867

Misconception | Reality |

“Form 8867 is just tax preparer paperwork.” | Founders must understand it to ensure their tax preparer is compliant. |

“If I have a CPA, due diligence is automatic.” | Due diligence must be explicitly documented, even by CPAs. |

“Form 8867 only applies to personal tax returns.” | If your business income flows through personal returns (e.g., Schedule C), it still matters. |

How Haven Helps Founders With Form 8867 and More

At Haven, we deliver a modern, startup-native approach to bookkeeping and tax filing that includes all required due diligence, including Form 8867. Our founder-friendly service ensures:

Responsive guidance on credit eligibility and documentation

Transparent processes so you always understand what’s being verified

Streamlined systems to reduce manual work

Explore how our services protect startups from tax complications while unlocking value from credits and deductions. For more insight, see our guide on deducting tax preparation fees.

Empower Your Tax Filing With Form 8867 Knowledge

Understanding the Form 8867 due diligence checklist empowers founders to work confidently with tax preparers who prioritize accuracy and compliance—essential for startups leveraging tax credits as part of their financial strategy.

As your company grows, ensuring your preparer thoroughly documents eligibility and understands IRS expectations helps reduce audit risk and increase tax savings opportunities.

For founders steering startups, agencies, and e-commerce ventures, understanding the Form 8867 requirements is crucial for effective tax planning and compliance. This form, officially labeled the “Paid Preparer's Due Diligence Checklist,” is a key piece to claiming valuable tax credits like the Earned Income Tax Credit (EITC), Child Tax Credit (CTC), American Opportunity Tax Credit (AOTC), and others.

This guide breaks down the essentials of Form 8867, highlights its due-diligence requirements, and offers founder-friendly guidance to help you make informed decisions about tax preparation and filing. Whether you’re evaluating your startup’s current tax service or selecting a new provider, this practical overview will keep tax compliance manageable and aligned with your business goals.

What Is Form 8867 and Why Founders Should Care

Form 8867 is an IRS-mandated checklist used exclusively by tax preparers to document they have fulfilled due diligence requirements when preparing tax returns claiming certain tax credits. Since tax credits like the Earned Income Tax Credit (EITC) can significantly reduce a startup or small business’s tax liability, the IRS requires tax preparers to verify key facts to prevent misuse.

Key Tax Credits Requiring Form 8867 Due Diligence

Earned Income Tax Credit (EITC)

Child Tax Credit (CTC)

Additional Child Tax Credit (ACTC)

American Opportunity Tax Credit (AOTC)

Head of Household (HOH) filing status

A founder’s understanding of this form is important because:

You want to ensure your tax preparer thoroughly documents eligibility to avoid costly audits or rejected returns.

Proper due diligence protects your startup from IRS penalties related to inaccurate or fraudulent claims.

It gives you a benchmark to evaluate whether your current accounting or tax provider follows IRS rules—especially if you leverage tax credits frequently.

Understanding Due Diligence Requirements: What Tax Preparers Must Verify

When your tax preparer uses Form 8867, they attest to the IRS that they have obtained and documented the information needed to substantiate eligible credits. Founders should be aware of these critical due diligence steps:

Due Diligence Step | What Your Tax Preparer Must Do | Why It Matters for Founders |

Obtain Eligibility Info | Collect detailed facts such as income, filing status, number of qualifying children, etc. | Validates your claim to tax credits and prevents costly errors. |

Reasonable Inquiry | Probe further when information is incomplete or inconsistent. | Ensures accurate filings that can withstand IRS scrutiny. |

Complete Form 8867 | Submit the form with your tax return and retain adequate records. | Demonstrates due diligence to the IRS and reduces audit risk. |

Retain Documentation | Keep documentation for three years post-filing or two years after tax payment. | Safeguards your business in case of IRS review or audit. |

How Founders Can Leverage This Knowledge in Tax Preparation

Select Tax Preparers Familiar with Form 8867 Compliance

Startups and small businesses benefit most when they work with providers who understand the nuances and legal obligations tied to tax credits. Always confirm your preparer understands Form 8867 and conducts full due diligence—this protects your business from IRS penalties, which can be as high as $545 per failure.

Provide Clear and Accurate Information Upfront

To simplify Form 8867 due diligence for your preparer, keep thorough records of income, dependent details, and documents supporting eligibility for credits.

Use a Streamlined Checklist to Track Key Documentation

A streamlined tax preparation checklist keeps all required documentation organized in one place, so every tax credit claim is clearly supported and easy to validate.

By tracking what’s complete and what’s missing in real time, you reduce back-and-forth, cut preparation time, and move faster with confidence when it’s time to file.

Practical Example: Navigating Child Tax Credit with Form 8867

Imagine your e-commerce startup is claiming the Child Tax Credit. Your tax preparer must:

Verify each child has a valid Social Security Number.

Confirm the child lived with you for over six months during the tax year.

Check income thresholds and recent tax law changes affecting the credit amount.

Using Form 8867, your preparer certifies that inquiries were made and supporting details documented. Skipping these steps could result in the IRS disallowing the credit—putting your startup at financial risk.

Founders’ Perspective: Common Misconceptions About Form 8867

Misconception | Reality |

“Form 8867 is just tax preparer paperwork.” | Founders must understand it to ensure their tax preparer is compliant. |

“If I have a CPA, due diligence is automatic.” | Due diligence must be explicitly documented, even by CPAs. |

“Form 8867 only applies to personal tax returns.” | If your business income flows through personal returns (e.g., Schedule C), it still matters. |

How Haven Helps Founders With Form 8867 and More

At Haven, we deliver a modern, startup-native approach to bookkeeping and tax filing that includes all required due diligence, including Form 8867. Our founder-friendly service ensures:

Responsive guidance on credit eligibility and documentation

Transparent processes so you always understand what’s being verified

Streamlined systems to reduce manual work

Explore how our services protect startups from tax complications while unlocking value from credits and deductions. For more insight, see our guide on deducting tax preparation fees.

Empower Your Tax Filing With Form 8867 Knowledge

Understanding the Form 8867 due diligence checklist empowers founders to work confidently with tax preparers who prioritize accuracy and compliance—essential for startups leveraging tax credits as part of their financial strategy.

As your company grows, ensuring your preparer thoroughly documents eligibility and understands IRS expectations helps reduce audit risk and increase tax savings opportunities.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026