Go Back

Last Updated :

Last Updated :

Jan 9, 2026

Jan 9, 2026

How to File a Business Tax Extension: A Step-by-Step for C-Corps

Tax season can be a hectic time for any founder or finance lead managing a C-Corporation. Deadlines loom, numbers need to be precise, and cash flow management is critical — especially for startups navigating rapid growth. Understanding how to file business tax extension offers you a strategic way to ease that crunch without risking penalties for late filing. But remember, an extension to file is not an extension to pay what you owe.

This guide unpacks the entire process specifically for C-Corps, clarifying forms, deadlines, payment considerations, and practical tips that align with your startup’s business rhythm. By the end, you'll be able to confidently strip away the confusion and use extensions as an effective tool within your broader tax and finance strategy.

What Is a Business Tax Extension and Why Should C-Corps Consider Filing One?

A business tax extension grants your corporation additional time to file its corporate tax return, typically an extra six months beyond the normal deadline. For C-Corps, this usually means shifting your filing date from April 15 to October 15 (or the 15th day of the 10th month after the end of your fiscal year). Filing this extension is done through IRS Form 7004.

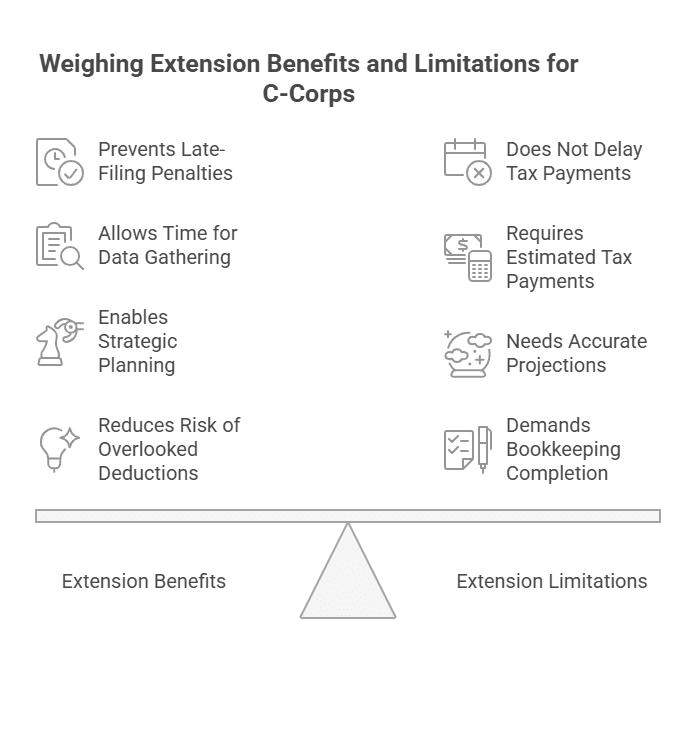

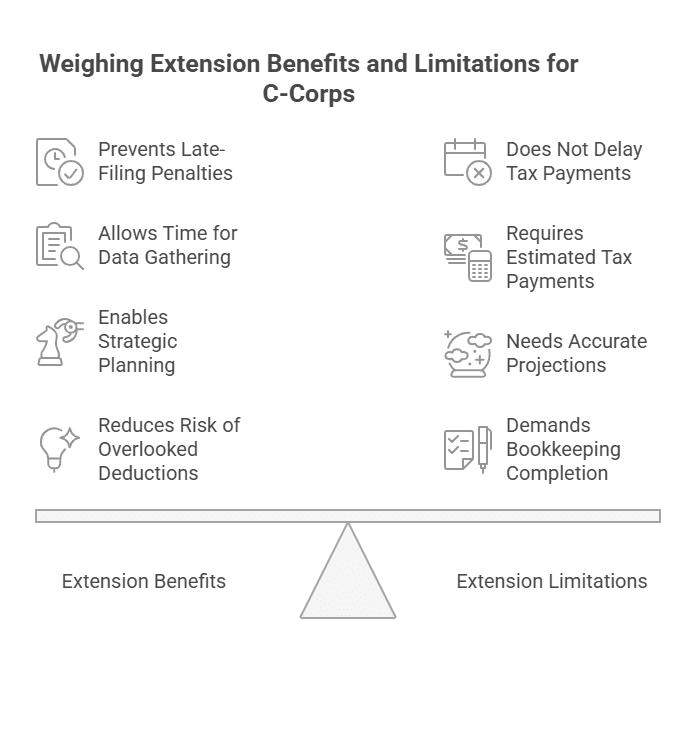

Key Points for C-Corps:

Extension does NOT delay tax payments — you still owe estimated taxes by the original filing deadline.

It prevents late-filing penalties if you can't get your Form 1120 in on time.

Gives your team time to gather complete financial data and plan strategically.

Reduces risk of mistakes or overlooked deductions, such as R&D tax credits.

If your team is considering filing an extension, evaluate your tax readiness:

Is bookkeeping for the fiscal year complete and reviewed?

Do you expect to owe taxes but need time for more accurate projections or cash flow?

Would the delay help optimize your R&D tax credit or other incentives?

This strategic pause often leads to better financial outcomes, especially for startups taking advantage of eligible credits and compliance best practices. For broader tax guidance, explore our Complete Guide for Founders Filing U.S. Corporate Taxes.

How to File a Business Tax Extension for C-Corps

Filing a business tax extension may seem intimidating, but it’s a compact process when broken down. Here’s how to navigate it in five key steps:

Step 1: Gather Necessary Information

Before starting, collect the following:

Your company’s Employer Identification Number (EIN)

The fiscal year-end date

Estimated total tax liability

Payment method information (if you plan to pay immediately)

Being accurate upfront helps you avoid IRS notices or rework later.

Step 2: Complete IRS Form 7004

Use IRS Form 7004 to request an extension for filing Form 1120. Be sure to:

Identify your C-Corp with business name, EIN, and address

Select the box corresponding to Form 1120

Estimate your annual tax liability

Note whether you’re submitting a payment with the form

Important: You should pay any expected tax due at this point — penalties and interest apply if taxes are late, even if you're on time filing the extension.

Step 3: Choose How to File Form 7004

You’ve got two submission options:

E-file (Recommended): Use authorized software or an IRS-approved e-file provider. This method offers quicker confirmation and lower error rates.

Paper File: You can mail a physical Form 7004, but consider slower IRS processing and delayed confirmations.

Most startups benefit from e-filing due to the faster feedback loop and digital confirmation.

Step 4: Submit Payment for Estimated Taxes (If Applicable)

Don’t forget: this is an extension to file — not to pay.

If you owe taxes, you should submit an estimate via one of these options:

Electronic Federal Tax Payment System (EFTPS)

Credit/Debit Card (via IRS-approved payment gateways)

Check or money order

Need help calculating your estimated payment? Your controller or tax advisor should guide you. The IRS page on business taxes provides helpful resources to estimate properly.

Step 5: Store Proof of Your Filing and Payment

Keep digital or paper records of the following:

Submission confirmation of Form 7004 (especially from e-file platforms)

Screenshots or documents proving tax payments

This will be essential in any IRS dispute or audit.

Deadlines: Calendar vs. Fiscal Year C-Corps

Filing Deadlines At-a-Glance

Tax Year-End | Filing Deadline | Extended Deadline |

December 31 (Calendar) | April 15 | October 15 |

Non-Dec (Fiscal Year) | 15th day of 4th month after year-end | 15th day of 10th month after year-end |

To secure the extension:

File Form 7004 by the original filing deadline

Submit estimated tax payments by that same date

Failing to meet this deadline disqualifies you from automatic penalty relief.

Penalties and What an Extension Doesn’t Cover

Filing a business tax extension helps avoid late-filing penalties but does not stop the IRS from charging interest or late payment penalties.

Watch Out For:

Late Filing Penalty: 5% of unpaid tax per month (max 25%)

Late Payment Penalty: 0.5% per month on unpaid tax

Interest Charges: Accrue on unpaid balances from the original deadline

Penalty Minimization Tips:

File Form 7004 on time — even without full payment

Pay as much as possible by the deadline

Document everything (form and payment confirmations)

For high-growth startups juggling runway and R&D investments, this is especially critical.

Extensions & R&D Tax Credit Optimization

Businesses invested in innovation can benefit meaningfully from the C-Corp filing extension. Why?

It buys time to conduct thorough R&D expense analysis

Improves accuracy in quantifying and supporting credit claims

Helps align with qualified small business rules for payroll tax offsets

Integrating extension filing with strong bookkeeping practices ensures you're not leaving credit dollars behind. Want to improve your internal compliance setup? Our Business Tax Compliance Guide lays out how founders can connect the dots between finance ops and IRS requirements.

Take Control by Knowing How to File Business Tax Extensions

Filing a business tax extension for your C-Corp via IRS Form 7004 gives your startup valuable breathing room, reduces compliance risks, and opens the door to a more optimized tax position.

Let’s recap:

Step | What to Do |

Understand Extension | Filing is delayed, payment is not |

Gather Data | EIN, fiscal year, estimated tax owed |

Submit Form 7004 | Online preferred; include Form 1120 info |

Pay Estimated Tax | Choose EFTPS, card, or mailed check |

Keep Proof | Save confirmations of payment and filing |

When combined with proactive R&D credit strategy and sound bookkeeping, this process becomes not just a lifeline but a lever.

Additional Resource

For the full and authoritative policy language and instructions, review the IRS's Instructions for Form 7004 — the definitive source for deadlines, payment options, and technical guidelines.

Tax season can be a hectic time for any founder or finance lead managing a C-Corporation. Deadlines loom, numbers need to be precise, and cash flow management is critical — especially for startups navigating rapid growth. Understanding how to file business tax extension offers you a strategic way to ease that crunch without risking penalties for late filing. But remember, an extension to file is not an extension to pay what you owe.

This guide unpacks the entire process specifically for C-Corps, clarifying forms, deadlines, payment considerations, and practical tips that align with your startup’s business rhythm. By the end, you'll be able to confidently strip away the confusion and use extensions as an effective tool within your broader tax and finance strategy.

What Is a Business Tax Extension and Why Should C-Corps Consider Filing One?

A business tax extension grants your corporation additional time to file its corporate tax return, typically an extra six months beyond the normal deadline. For C-Corps, this usually means shifting your filing date from April 15 to October 15 (or the 15th day of the 10th month after the end of your fiscal year). Filing this extension is done through IRS Form 7004.

Key Points for C-Corps:

Extension does NOT delay tax payments — you still owe estimated taxes by the original filing deadline.

It prevents late-filing penalties if you can't get your Form 1120 in on time.

Gives your team time to gather complete financial data and plan strategically.

Reduces risk of mistakes or overlooked deductions, such as R&D tax credits.

If your team is considering filing an extension, evaluate your tax readiness:

Is bookkeeping for the fiscal year complete and reviewed?

Do you expect to owe taxes but need time for more accurate projections or cash flow?

Would the delay help optimize your R&D tax credit or other incentives?

This strategic pause often leads to better financial outcomes, especially for startups taking advantage of eligible credits and compliance best practices. For broader tax guidance, explore our Complete Guide for Founders Filing U.S. Corporate Taxes.

How to File a Business Tax Extension for C-Corps

Filing a business tax extension may seem intimidating, but it’s a compact process when broken down. Here’s how to navigate it in five key steps:

Step 1: Gather Necessary Information

Before starting, collect the following:

Your company’s Employer Identification Number (EIN)

The fiscal year-end date

Estimated total tax liability

Payment method information (if you plan to pay immediately)

Being accurate upfront helps you avoid IRS notices or rework later.

Step 2: Complete IRS Form 7004

Use IRS Form 7004 to request an extension for filing Form 1120. Be sure to:

Identify your C-Corp with business name, EIN, and address

Select the box corresponding to Form 1120

Estimate your annual tax liability

Note whether you’re submitting a payment with the form

Important: You should pay any expected tax due at this point — penalties and interest apply if taxes are late, even if you're on time filing the extension.

Step 3: Choose How to File Form 7004

You’ve got two submission options:

E-file (Recommended): Use authorized software or an IRS-approved e-file provider. This method offers quicker confirmation and lower error rates.

Paper File: You can mail a physical Form 7004, but consider slower IRS processing and delayed confirmations.

Most startups benefit from e-filing due to the faster feedback loop and digital confirmation.

Step 4: Submit Payment for Estimated Taxes (If Applicable)

Don’t forget: this is an extension to file — not to pay.

If you owe taxes, you should submit an estimate via one of these options:

Electronic Federal Tax Payment System (EFTPS)

Credit/Debit Card (via IRS-approved payment gateways)

Check or money order

Need help calculating your estimated payment? Your controller or tax advisor should guide you. The IRS page on business taxes provides helpful resources to estimate properly.

Step 5: Store Proof of Your Filing and Payment

Keep digital or paper records of the following:

Submission confirmation of Form 7004 (especially from e-file platforms)

Screenshots or documents proving tax payments

This will be essential in any IRS dispute or audit.

Deadlines: Calendar vs. Fiscal Year C-Corps

Filing Deadlines At-a-Glance

Tax Year-End | Filing Deadline | Extended Deadline |

December 31 (Calendar) | April 15 | October 15 |

Non-Dec (Fiscal Year) | 15th day of 4th month after year-end | 15th day of 10th month after year-end |

To secure the extension:

File Form 7004 by the original filing deadline

Submit estimated tax payments by that same date

Failing to meet this deadline disqualifies you from automatic penalty relief.

Penalties and What an Extension Doesn’t Cover

Filing a business tax extension helps avoid late-filing penalties but does not stop the IRS from charging interest or late payment penalties.

Watch Out For:

Late Filing Penalty: 5% of unpaid tax per month (max 25%)

Late Payment Penalty: 0.5% per month on unpaid tax

Interest Charges: Accrue on unpaid balances from the original deadline

Penalty Minimization Tips:

File Form 7004 on time — even without full payment

Pay as much as possible by the deadline

Document everything (form and payment confirmations)

For high-growth startups juggling runway and R&D investments, this is especially critical.

Extensions & R&D Tax Credit Optimization

Businesses invested in innovation can benefit meaningfully from the C-Corp filing extension. Why?

It buys time to conduct thorough R&D expense analysis

Improves accuracy in quantifying and supporting credit claims

Helps align with qualified small business rules for payroll tax offsets

Integrating extension filing with strong bookkeeping practices ensures you're not leaving credit dollars behind. Want to improve your internal compliance setup? Our Business Tax Compliance Guide lays out how founders can connect the dots between finance ops and IRS requirements.

Take Control by Knowing How to File Business Tax Extensions

Filing a business tax extension for your C-Corp via IRS Form 7004 gives your startup valuable breathing room, reduces compliance risks, and opens the door to a more optimized tax position.

Let’s recap:

Step | What to Do |

Understand Extension | Filing is delayed, payment is not |

Gather Data | EIN, fiscal year, estimated tax owed |

Submit Form 7004 | Online preferred; include Form 1120 info |

Pay Estimated Tax | Choose EFTPS, card, or mailed check |

Keep Proof | Save confirmations of payment and filing |

When combined with proactive R&D credit strategy and sound bookkeeping, this process becomes not just a lifeline but a lever.

Additional Resource

For the full and authoritative policy language and instructions, review the IRS's Instructions for Form 7004 — the definitive source for deadlines, payment options, and technical guidelines.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026