Go Back

Last Updated :

Last Updated :

Jan 19, 2026

Jan 19, 2026

Applying for 501(c)(3) Tax-Exempt Status: A Founder’s Guide to Form 1023

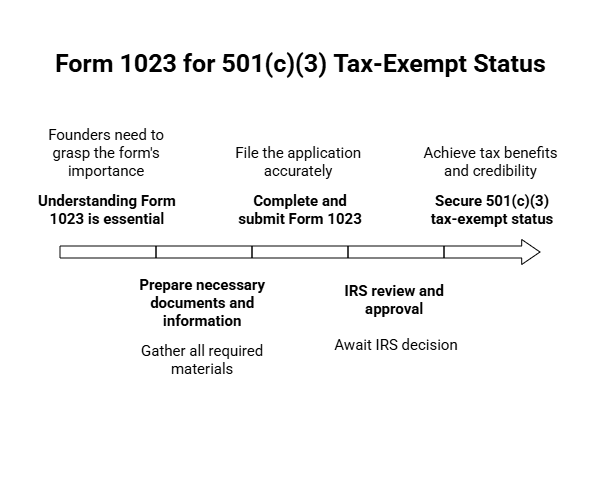

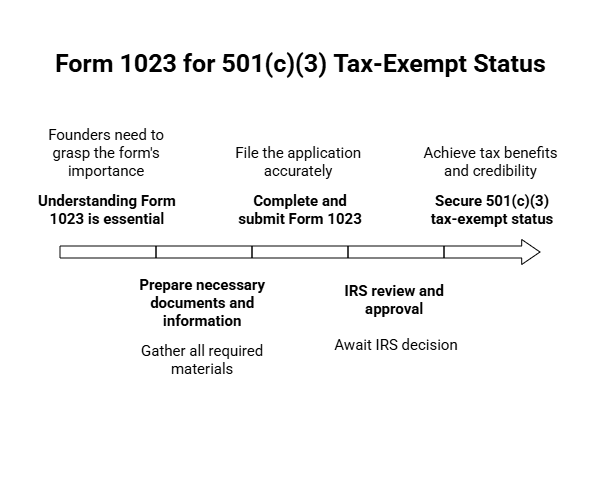

For founders navigating the complexities of nonprofit formation, understanding Form 1023 is essential to secure 501(c)(3) tax-exempt status. This designation not only offers significant tax benefits but also enables organizations to access grants, attract donations, and build credibility. However, the process can be complex and demands both precision and strategy—a challenge for busy startup founders balancing impact goals with operational execution.

This practical guide demystifies Form 1023 filing, detailing what founders need to know and highlighting actionable steps to streamline the application.

What is Form 1023 used for?

Form 1023 is the official IRS application for recognition as a 501(c)(3) tax-exempt organization. Museums, educational institutions, charitable organizations, and many social enterprises rely on this status for substantial tax relief.

For founders, the stakes are high: the difference between gaining approval vs. rejection can impact fundraising capabilities, operational flexibility, and long-term growth.

Key Benefits of 501(c)(3) Status

Tax Exemption: Exempt from federal income tax on activities related to the nonprofit’s exempt purpose.

Tax-Deductible Donations: Donors can deduct contributions, which improves fundraising effectiveness.

Grant Eligibility: Qualify for private, state, and federal grants requiring 501(c)(3) status.

Sales and Property Tax Exemptions: Possible exemptions depending on state laws.

Credibility: Strengthens legitimacy with partners, volunteers, and the public.

A strategic approach to preparing and submitting Form 1023 can maximize these benefits, ensuring your organization operates on a solid financial and legal foundation.

What Founders Need to Prepare Before Filing Form 1023

Filing Form 1023 is a detailed process that requires comprehensive documentation of your organization's structure, operations, and finances. Here’s what founders need to keep in mind:

Step | Description | Founder Tips |

Determine Eligibility | Confirm your organization fits IRS criteria for tax-exempt status under 501(c)(3). | Use IRS guidelines from IRS.gov. |

Gather Organizing Documents | Articles of Incorporation, bylaws, conflict of interest policy, etc. | Ensure documents explicitly state nonprofit purpose and dissolution clauses. |

Describe Activities | Provide narrative on past, current, and planned activities. | Be concrete; align mission to IRS exempt categories. |

Financial Information | Submit budgets, revenue projections, and expenses. | Prepare realistic financials that demonstrate sustainability. |

Compensation & Governance | Disclose director compensation and governance structure. | Avoid conflicts of interest; document roles clearly. |

To understand additional tax considerations founders face after securing status, explore our comprehensive tax guide for startups.

Common Pitfalls Founders Face When Filing Form 1023

Applying for tax-exempt status is a documentation-heavy process, and many delays stem from avoidable mistakes. Understanding where applications commonly fall short can reduce back-and-forth with the IRS and move through the review process more efficiently.

Incomplete or Vague Activity Descriptions

Form 1023 requires organizations to clearly demonstrate that their activities further an exempt purpose. High-level or generic descriptions often trigger follow-up requests.

Successful applications typically include specific programs, concrete examples of services provided, and measurable goals that show how activities align with the stated mission.

Inadequate Financial Detail

Budgets and projections that lack detail—or appear disconnected from actual operations—can weaken an application. Missing line items, rounded estimates, or overly optimistic revenue assumptions raise questions during review.

Governance Issues

Weak or missing conflict-of-interest policies, unclear board roles, or inconsistent bylaws can signal compliance risk.

Founders often benefit from formalizing governance structures and documenting oversight responsibilities before submitting Form 1023.

Selecting the Incorrect Form

Not every organization qualifies for the streamlined Form 1023-EZ. Filing the wrong version can result in rejection or significant processing delays.

Eligibility should be evaluated carefully before submission, especially for organizations with higher projected revenue, more complex activities, or international operations.

We also recommend reviewing our business tax services to support founders managing complex operational workloads.

How Founders Can Streamline the Form 1023 Process

While the application itself is fixed, preparation and coordination can significantly reduce friction.

Use Structured Templates and Checklists

Standardized templates help ensure that narrative responses and financial disclosures address all required IRS criteria. Checklists reduce the risk of omissions across sections.

Coordinate Across Finance and Legal Functions

Budgets, bylaws, and supporting documentation should be reviewed collaboratively. Early alignment between finance and legal stakeholders minimizes inconsistencies that can slow approval.

Plan for Ongoing Compliance Requirements

Obtaining tax-exempt status is only the first step. Maintaining it requires ongoing compliance, including annual filing of Form 990. Missed or late filings can jeopardize exemption status.

Implement Appropriate Accounting Systems

Nonprofits often require accounting systems that support donor tracking, grant reporting, and restricted fund management. Implementing these tools early simplifies both reporting and future audits.

Seek Experienced Guidance When Needed

Founders navigating Form 1023 for the first time often benefit from advisors with direct experience in nonprofit formation and compliance. Clear coordination between tax, accounting, and governance considerations can reduce administrative burden and help founders stay focused on mission execution rather than process management.

Make Form 1023 Work for Your Mission and Growth

For founders seeking to maximize impact through nonprofit status, the Form 1023 application is a pivotal step that requires thoughtful planning and cross-functional collaboration. The benefits of achieving 501(c)(3) status—tax advantages, funding access, and public trust—are substantial, but only with proper preparation.

Approach the process with strategic clarity and a strong support system. At Haven, we help mission-driven founders navigate every stage of nonprofit formation with confidence.

For founders navigating the complexities of nonprofit formation, understanding Form 1023 is essential to secure 501(c)(3) tax-exempt status. This designation not only offers significant tax benefits but also enables organizations to access grants, attract donations, and build credibility. However, the process can be complex and demands both precision and strategy—a challenge for busy startup founders balancing impact goals with operational execution.

This practical guide demystifies Form 1023 filing, detailing what founders need to know and highlighting actionable steps to streamline the application.

What is Form 1023 used for?

Form 1023 is the official IRS application for recognition as a 501(c)(3) tax-exempt organization. Museums, educational institutions, charitable organizations, and many social enterprises rely on this status for substantial tax relief.

For founders, the stakes are high: the difference between gaining approval vs. rejection can impact fundraising capabilities, operational flexibility, and long-term growth.

Key Benefits of 501(c)(3) Status

Tax Exemption: Exempt from federal income tax on activities related to the nonprofit’s exempt purpose.

Tax-Deductible Donations: Donors can deduct contributions, which improves fundraising effectiveness.

Grant Eligibility: Qualify for private, state, and federal grants requiring 501(c)(3) status.

Sales and Property Tax Exemptions: Possible exemptions depending on state laws.

Credibility: Strengthens legitimacy with partners, volunteers, and the public.

A strategic approach to preparing and submitting Form 1023 can maximize these benefits, ensuring your organization operates on a solid financial and legal foundation.

What Founders Need to Prepare Before Filing Form 1023

Filing Form 1023 is a detailed process that requires comprehensive documentation of your organization's structure, operations, and finances. Here’s what founders need to keep in mind:

Step | Description | Founder Tips |

Determine Eligibility | Confirm your organization fits IRS criteria for tax-exempt status under 501(c)(3). | Use IRS guidelines from IRS.gov. |

Gather Organizing Documents | Articles of Incorporation, bylaws, conflict of interest policy, etc. | Ensure documents explicitly state nonprofit purpose and dissolution clauses. |

Describe Activities | Provide narrative on past, current, and planned activities. | Be concrete; align mission to IRS exempt categories. |

Financial Information | Submit budgets, revenue projections, and expenses. | Prepare realistic financials that demonstrate sustainability. |

Compensation & Governance | Disclose director compensation and governance structure. | Avoid conflicts of interest; document roles clearly. |

To understand additional tax considerations founders face after securing status, explore our comprehensive tax guide for startups.

Common Pitfalls Founders Face When Filing Form 1023

Applying for tax-exempt status is a documentation-heavy process, and many delays stem from avoidable mistakes. Understanding where applications commonly fall short can reduce back-and-forth with the IRS and move through the review process more efficiently.

Incomplete or Vague Activity Descriptions

Form 1023 requires organizations to clearly demonstrate that their activities further an exempt purpose. High-level or generic descriptions often trigger follow-up requests.

Successful applications typically include specific programs, concrete examples of services provided, and measurable goals that show how activities align with the stated mission.

Inadequate Financial Detail

Budgets and projections that lack detail—or appear disconnected from actual operations—can weaken an application. Missing line items, rounded estimates, or overly optimistic revenue assumptions raise questions during review.

Governance Issues

Weak or missing conflict-of-interest policies, unclear board roles, or inconsistent bylaws can signal compliance risk.

Founders often benefit from formalizing governance structures and documenting oversight responsibilities before submitting Form 1023.

Selecting the Incorrect Form

Not every organization qualifies for the streamlined Form 1023-EZ. Filing the wrong version can result in rejection or significant processing delays.

Eligibility should be evaluated carefully before submission, especially for organizations with higher projected revenue, more complex activities, or international operations.

We also recommend reviewing our business tax services to support founders managing complex operational workloads.

How Founders Can Streamline the Form 1023 Process

While the application itself is fixed, preparation and coordination can significantly reduce friction.

Use Structured Templates and Checklists

Standardized templates help ensure that narrative responses and financial disclosures address all required IRS criteria. Checklists reduce the risk of omissions across sections.

Coordinate Across Finance and Legal Functions

Budgets, bylaws, and supporting documentation should be reviewed collaboratively. Early alignment between finance and legal stakeholders minimizes inconsistencies that can slow approval.

Plan for Ongoing Compliance Requirements

Obtaining tax-exempt status is only the first step. Maintaining it requires ongoing compliance, including annual filing of Form 990. Missed or late filings can jeopardize exemption status.

Implement Appropriate Accounting Systems

Nonprofits often require accounting systems that support donor tracking, grant reporting, and restricted fund management. Implementing these tools early simplifies both reporting and future audits.

Seek Experienced Guidance When Needed

Founders navigating Form 1023 for the first time often benefit from advisors with direct experience in nonprofit formation and compliance. Clear coordination between tax, accounting, and governance considerations can reduce administrative burden and help founders stay focused on mission execution rather than process management.

Make Form 1023 Work for Your Mission and Growth

For founders seeking to maximize impact through nonprofit status, the Form 1023 application is a pivotal step that requires thoughtful planning and cross-functional collaboration. The benefits of achieving 501(c)(3) status—tax advantages, funding access, and public trust—are substantial, but only with proper preparation.

Approach the process with strategic clarity and a strong support system. At Haven, we help mission-driven founders navigate every stage of nonprofit formation with confidence.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026