Go Back

Last Updated :

Last Updated :

Jan 26, 2026

Jan 26, 2026

Form W-8BEN-E: Managing International Tax for Entities

For founders running startups, e-commerce, or agency businesses with international reach, understanding Form W-8BEN-E is essential to navigating U.S. tax withholding on foreign entity income efficiently. Whether you’re working with global suppliers, foreign investors, or receiving cross-border revenue, the form enables your company — or your partners’ companies — to certify foreign status, claim beneficial tax treaty rates, and avoid default withholding penalties.

This comprehensive guide breaks down what Form W-8BEN-E is, who needs to file it, key parts of the form, and practical steps founders can take to manage compliance confidently and minimize tax friction in international transactions.

What is Form W-8BEN-E and Why Does it Matter?

In simplest terms, Form W-8BEN-E is an IRS document foreign business entities submit to U.S. withholding agents (your company, your payment processors, or banks, for example) to:

Certify that they are not U.S. entities,

Declare their Chapter 3 and Chapter 4 (FATCA) status,

Claim benefits under an applicable tax treaty to claim applicable tax treaty benefits on U.S. source income.

Without a valid Form W-8BEN-E on file, U.S. payers are required to withhold a default 30% tax from certain payments such as interest, dividends, royalties, and rent made to foreign entities.

Why Founders Need to Care

Avoid over-withholding: If your business pays foreign vendors or investors, withholding 30% IRS tax unnecessarily increases costs or delays cash flow.

Claim treaty benefits: Many countries have tax treaties with the U.S. that lower or eliminate withholding tax—but claiming those treaty rates requires a correctly completed W-8BEN-E.

Stay compliant: Incorrect or missing forms cause withholding agents to withhold more, trigger penalties, or require expensive retroactive filings.

Streamline outsourcing and partnerships: Ensuring your foreign partners complete this form reduces friction and confusion during payments.

Who Must Fill Out Form W-8BEN-E?

Not all foreign people use this form. The W-8BEN-E is specifically for foreign entities, including corporations, partnerships, trusts, and estates that receive income from U.S. sources.

Understanding Form Differences

Form | Intended for | Use Case |

W-8BEN | Foreign individuals | Sole proprietors, freelancers, non-U.S. individuals receiving income |

W-8BEN-E | Foreign entities (businesses) | Corporations, partnerships, trusts involved in U.S. income transactions |

W-8ECI | Foreign persons with U.S. trade or business income | Claim exemption from withholding on effectively connected income |

W-9 | U.S. persons/entities | Provides TIN for reporting payments within the U.S. |

Examples of entities that file Form W-8BEN-E:

A German digital marketing agency invoicing a U.S. startup

An Irish holding company receiving dividend income from U.S. investments

A Singapore-based R&D firm earning royalty income for intellectual property licensed in the U.S.

If you work with or pay foreign business entities, verify that they submit Form W-8BEN-E to apply the correct withholding treatment.

How to Complete Form W-8BEN-E

The form can be dense, but foreign entities typically only need to complete specific sections based on their classification. Here's an overview:

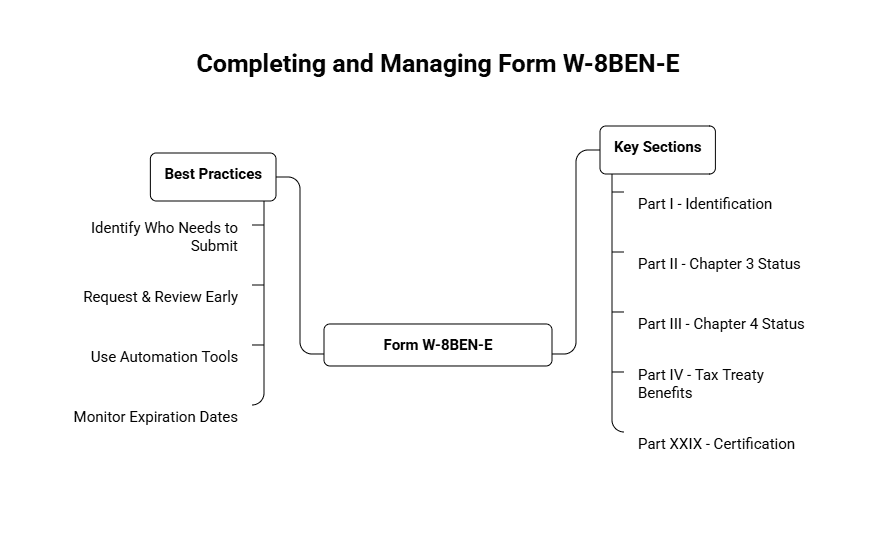

Key Sections and What They Mean

Section | Purpose & Guidance |

Part I - Identification | Entity name, country of incorporation, address, U.S. TIN (if applicable). Must match legal registration. |

Part II - Chapter 3 Status | Choose classification such as corporation, partnership, or foreign trust. This determines withholding rates. |

Part III - Chapter 4 Status (FATCA) | Disclose FATCA status. Options include participating FFI, certified deemed-compliant, or exempt. |

Part IV - Claim of Tax Treaty Benefits | Complete if eligible. Name the tax treaty country and relevant article. Add TIN if required. |

Part XXIX - Certification | Must be signed under penalties of perjury. Authorized official only. Valid for 3 years. |

Accurate completion ensures the foreign party receives the correct withholding treatment and avoids unnecessary IRS withholding.

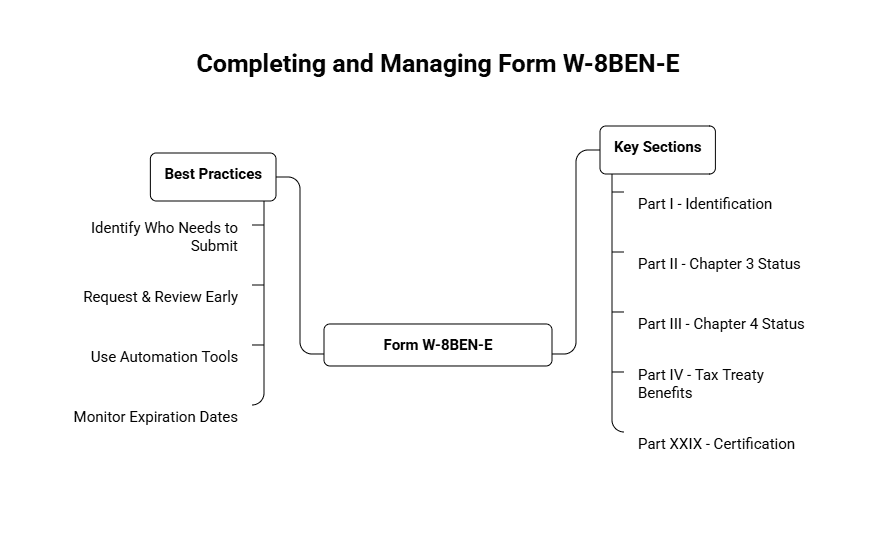

Best Practices for Managing Compliance

Founders often juggle multiple priorities — but neglecting international tax compliance invites avoidable penalties. Here’s how to proactively manage the process:

1. Identify Who Needs to Submit the Form

Start by mapping out all foreign business partners receiving U.S. payments, such as:

International vendors or consultants

Foreign investment recipients

Overseas firms earning licensing or royalty income

2. Request & Review W-8BEN-E Forms Early

Don’t wait until payments are due. Collect forms during onboarding to:

Prevent delays

Ensure alignment with IRS documentation requirements

Allow time for verification and correction if needed

Ensure forms:

Are fully completed and signed

Match supporting documentation (e.g., invoices, contracts)

Claim valid tax treaty benefits, if applicable

3. Use Automation Tools

Tracking expiration dates, FATCA status, and filing cycles manually is error-prone. Consider software or compliance platforms that can:

Send reminder notifications

Store validated copies securely

Flag inconsistencies in data

This reduces the operational burden and improves audit readiness.

4. Monitor Expiration Dates

Form W-8BEN-E is valid for up to three years unless circumstances change. Use compliance calendars or internal tools to request forms before expiration.

Without this, your business may be forced to apply 30% default withholding — even on long-time partners — resulting in strained vendor relationships.

What Happens If a Form W-8BEN-E Is Missing or Wrong?

If a required Form W-8BEN-E is missing, expired, or completed incorrectly, U.S. payers are generally required to apply the default 30% withholding rate to applicable U.S.-source income paid to the foreign entity.

In practice, missing or invalid documentation can also:

Delay payments by banks or payment processors

Require corrective filings and reconciliation later

Increase compliance and audit scrutiny

Collecting and validating Form W-8BEN-E upfront helps avoid unnecessary withholding and operational disruption.

Additional IRS Reporting Requirements Founders Should Watch

Form W-8BEN-E is only one aspect of managing tax obligations for foreign entity payments. Founders should also be aware of:

Form 1042-S: Documenting Withholding

Used to report U.S. income paid to foreign persons along with amounts withheld. Founders must file this if U.S. source payments are made to foreign parties with IRS Form 1042-S.

Form 8804: If You’re a Partnership With Foreign Partners

Applies if your startup is a partnership allocating U.S. source income to international partners. Founders must track withholding amounts and file on behalf of the entity.

Form 5472: Reporting Foreign-Controlled U.S. Entities

Foreign-owned corporations with reportable transactions (e.g., loans from parent companies) must file this form with their U.S. tax return.

Understanding these reporting obligations ensures your startup’s global tax footprint stays compliant.

How to Maximize Tax Treaty Benefits

The United States maintains income tax treaties with many foreign governments that reduce or eliminate U.S. withholding tax on:

Dividends

Royalties

Interest

Rents

Claiming These Benefits Properly

Foreign entities must explicitly claim relief on Form W-8BEN-E

Must cite the treaty article and provide a U.S. TIN if the article requires it

Must meet Limitation on Benefits (LOB) provisions to qualify (e.g., active business test, ownership thresholds)

Failure to complete the form correctly means the IRS will expect the full 30% withholding.

Founders working with international vendors or investors should familiarize themselves with applicable treaty rules.

The IRS maintains a searchable list of tax treaties and withholding rates. Bookmark this page for reference: IRS Tax Treaty Table

Take Control of Cross-Border Tax Withholding

For startup founders and operational leaders working with foreign entities, managing Form W-8BEN-E correctly is key to avoiding unnecessary IRS withholding, maintaining compliance, and improving the smoothness of global revenue flows.

By taking a proactive stance with:

Early identification of affected parties,

Automated collection systems,

Regular review & expiration tracking,

Tactical treaty benefits claims, and

Awareness of related documentation

you turn international tax compliance from a risk into an advantage.

At Haven, we help founders streamline their international compliance — from W-8BEN-E and Form 5472, to R&D claims and investor reporting — all delivered with real-time visibility and founder-first insights.

For founders running startups, e-commerce, or agency businesses with international reach, understanding Form W-8BEN-E is essential to navigating U.S. tax withholding on foreign entity income efficiently. Whether you’re working with global suppliers, foreign investors, or receiving cross-border revenue, the form enables your company — or your partners’ companies — to certify foreign status, claim beneficial tax treaty rates, and avoid default withholding penalties.

This comprehensive guide breaks down what Form W-8BEN-E is, who needs to file it, key parts of the form, and practical steps founders can take to manage compliance confidently and minimize tax friction in international transactions.

What is Form W-8BEN-E and Why Does it Matter?

In simplest terms, Form W-8BEN-E is an IRS document foreign business entities submit to U.S. withholding agents (your company, your payment processors, or banks, for example) to:

Certify that they are not U.S. entities,

Declare their Chapter 3 and Chapter 4 (FATCA) status,

Claim benefits under an applicable tax treaty to claim applicable tax treaty benefits on U.S. source income.

Without a valid Form W-8BEN-E on file, U.S. payers are required to withhold a default 30% tax from certain payments such as interest, dividends, royalties, and rent made to foreign entities.

Why Founders Need to Care

Avoid over-withholding: If your business pays foreign vendors or investors, withholding 30% IRS tax unnecessarily increases costs or delays cash flow.

Claim treaty benefits: Many countries have tax treaties with the U.S. that lower or eliminate withholding tax—but claiming those treaty rates requires a correctly completed W-8BEN-E.

Stay compliant: Incorrect or missing forms cause withholding agents to withhold more, trigger penalties, or require expensive retroactive filings.

Streamline outsourcing and partnerships: Ensuring your foreign partners complete this form reduces friction and confusion during payments.

Who Must Fill Out Form W-8BEN-E?

Not all foreign people use this form. The W-8BEN-E is specifically for foreign entities, including corporations, partnerships, trusts, and estates that receive income from U.S. sources.

Understanding Form Differences

Form | Intended for | Use Case |

W-8BEN | Foreign individuals | Sole proprietors, freelancers, non-U.S. individuals receiving income |

W-8BEN-E | Foreign entities (businesses) | Corporations, partnerships, trusts involved in U.S. income transactions |

W-8ECI | Foreign persons with U.S. trade or business income | Claim exemption from withholding on effectively connected income |

W-9 | U.S. persons/entities | Provides TIN for reporting payments within the U.S. |

Examples of entities that file Form W-8BEN-E:

A German digital marketing agency invoicing a U.S. startup

An Irish holding company receiving dividend income from U.S. investments

A Singapore-based R&D firm earning royalty income for intellectual property licensed in the U.S.

If you work with or pay foreign business entities, verify that they submit Form W-8BEN-E to apply the correct withholding treatment.

How to Complete Form W-8BEN-E

The form can be dense, but foreign entities typically only need to complete specific sections based on their classification. Here's an overview:

Key Sections and What They Mean

Section | Purpose & Guidance |

Part I - Identification | Entity name, country of incorporation, address, U.S. TIN (if applicable). Must match legal registration. |

Part II - Chapter 3 Status | Choose classification such as corporation, partnership, or foreign trust. This determines withholding rates. |

Part III - Chapter 4 Status (FATCA) | Disclose FATCA status. Options include participating FFI, certified deemed-compliant, or exempt. |

Part IV - Claim of Tax Treaty Benefits | Complete if eligible. Name the tax treaty country and relevant article. Add TIN if required. |

Part XXIX - Certification | Must be signed under penalties of perjury. Authorized official only. Valid for 3 years. |

Accurate completion ensures the foreign party receives the correct withholding treatment and avoids unnecessary IRS withholding.

Best Practices for Managing Compliance

Founders often juggle multiple priorities — but neglecting international tax compliance invites avoidable penalties. Here’s how to proactively manage the process:

1. Identify Who Needs to Submit the Form

Start by mapping out all foreign business partners receiving U.S. payments, such as:

International vendors or consultants

Foreign investment recipients

Overseas firms earning licensing or royalty income

2. Request & Review W-8BEN-E Forms Early

Don’t wait until payments are due. Collect forms during onboarding to:

Prevent delays

Ensure alignment with IRS documentation requirements

Allow time for verification and correction if needed

Ensure forms:

Are fully completed and signed

Match supporting documentation (e.g., invoices, contracts)

Claim valid tax treaty benefits, if applicable

3. Use Automation Tools

Tracking expiration dates, FATCA status, and filing cycles manually is error-prone. Consider software or compliance platforms that can:

Send reminder notifications

Store validated copies securely

Flag inconsistencies in data

This reduces the operational burden and improves audit readiness.

4. Monitor Expiration Dates

Form W-8BEN-E is valid for up to three years unless circumstances change. Use compliance calendars or internal tools to request forms before expiration.

Without this, your business may be forced to apply 30% default withholding — even on long-time partners — resulting in strained vendor relationships.

What Happens If a Form W-8BEN-E Is Missing or Wrong?

If a required Form W-8BEN-E is missing, expired, or completed incorrectly, U.S. payers are generally required to apply the default 30% withholding rate to applicable U.S.-source income paid to the foreign entity.

In practice, missing or invalid documentation can also:

Delay payments by banks or payment processors

Require corrective filings and reconciliation later

Increase compliance and audit scrutiny

Collecting and validating Form W-8BEN-E upfront helps avoid unnecessary withholding and operational disruption.

Additional IRS Reporting Requirements Founders Should Watch

Form W-8BEN-E is only one aspect of managing tax obligations for foreign entity payments. Founders should also be aware of:

Form 1042-S: Documenting Withholding

Used to report U.S. income paid to foreign persons along with amounts withheld. Founders must file this if U.S. source payments are made to foreign parties with IRS Form 1042-S.

Form 8804: If You’re a Partnership With Foreign Partners

Applies if your startup is a partnership allocating U.S. source income to international partners. Founders must track withholding amounts and file on behalf of the entity.

Form 5472: Reporting Foreign-Controlled U.S. Entities

Foreign-owned corporations with reportable transactions (e.g., loans from parent companies) must file this form with their U.S. tax return.

Understanding these reporting obligations ensures your startup’s global tax footprint stays compliant.

How to Maximize Tax Treaty Benefits

The United States maintains income tax treaties with many foreign governments that reduce or eliminate U.S. withholding tax on:

Dividends

Royalties

Interest

Rents

Claiming These Benefits Properly

Foreign entities must explicitly claim relief on Form W-8BEN-E

Must cite the treaty article and provide a U.S. TIN if the article requires it

Must meet Limitation on Benefits (LOB) provisions to qualify (e.g., active business test, ownership thresholds)

Failure to complete the form correctly means the IRS will expect the full 30% withholding.

Founders working with international vendors or investors should familiarize themselves with applicable treaty rules.

The IRS maintains a searchable list of tax treaties and withholding rates. Bookmark this page for reference: IRS Tax Treaty Table

Take Control of Cross-Border Tax Withholding

For startup founders and operational leaders working with foreign entities, managing Form W-8BEN-E correctly is key to avoiding unnecessary IRS withholding, maintaining compliance, and improving the smoothness of global revenue flows.

By taking a proactive stance with:

Early identification of affected parties,

Automated collection systems,

Regular review & expiration tracking,

Tactical treaty benefits claims, and

Awareness of related documentation

you turn international tax compliance from a risk into an advantage.

At Haven, we help founders streamline their international compliance — from W-8BEN-E and Form 5472, to R&D claims and investor reporting — all delivered with real-time visibility and founder-first insights.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026