Go Back

Last Updated :

Last Updated :

Jan 20, 2026

Jan 20, 2026

Form 8804 Guide: Withholding Tax Essentials for Partnerships with Foreign Partners

Navigating U.S. tax requirements as a partnership with foreign partners can be complex—especially when it comes to withholding and reporting. For founders, COOs, and finance leads operating startups, agencies, or e-commerce businesses with foreign investors or co-owners, understanding Form 8804 is essential to stay compliant and avoid costly penalties.

This article breaks down the essentials around Form 8804, the annual return for partnership withholding tax under Section 1446 of the Internal Revenue Code (IRC). Plus, we’ll point you toward helpful resources and best practices tailored for startups and fast-moving businesses.

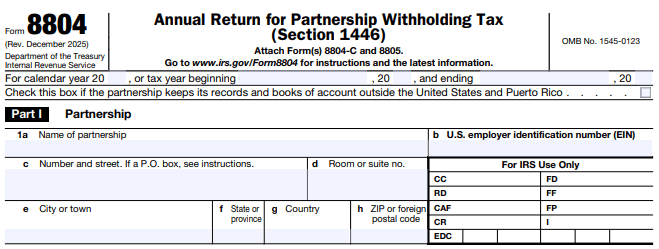

What is Form 8804 and Why Does It Matter?

Form 8804, officially titled “Annual Return for Partnership Withholding Tax (Section 1446),” is the IRS form used by partnerships that have effectively connected taxable income (ECTI) allocated to foreign partners. The form reports the total amount of withholding tax the partnership has deducted based on the foreign partners’ allocable shares of ECTI.

Why Is Form 8804 Important for Your Partnership?

Ensures IRS Compliance: Filing the form and correctly withholding protects the partnership and the foreign partners from IRS penalties and audits.

Payment and Reporting Mechanism: Form 8804 calculates the total withholding tax due, which supports timely payments during the tax year.

Supports Foreign Partner Tax Reporting: Provides transparency and documentation for foreign partners’ own U.S. tax filings and credits.

Avoids Withholding Tax Disputes: Accurate filing reduces the risk of disputes or interest charges when income is allocated across borders.

In short, if your partnership has foreign members and generates ECTI, Form 8804 is a critical piece of your tax compliance puzzle.

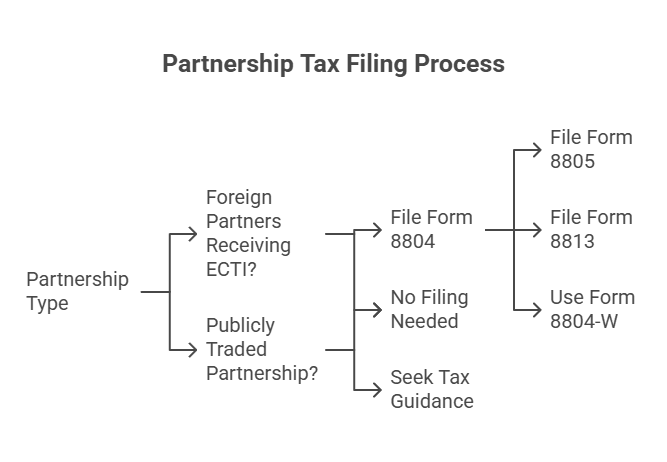

Who Must File Form 8804?

Not every partnership is required to file Form 8804. Below are the general rules:

Partnership Type | Must File? | Notes |

Partnerships with foreign partners receiving ECTI | Yes | Required to report and withhold tax on foreign partners’ share. |

U.S. Partnerships with only domestic partners | No | No foreign partner, no Form 8804 filing needed. |

Publicly Traded Partnerships (PTPs) | Generally No* | May have differing obligations and should seek specific tax guidance. |

*PTPs may require customized tax handling. Always consult a tax advisor to determine your specific obligations.

What Qualifies as Effectively Connected Taxable Income (ECTI)?

Effectively Connected Taxable Income, or ECTI, means income generated from a U.S. trade or business. For tax purposes, this U.S.-source income is considered “effectively connected” and therefore liable to U.S. taxation even if allocated to a non-resident partner.

Key takeaway: If your partnership has foreign partners and generates U.S.-sourced trade income, you likely fall under the Section 1446 rules and need to file Form 8804.

Understanding IRS Forms Related to Form 8804

Form 8804 works in tandem with several other IRS forms that together ensure accurate annual reporting and payment of withholding tax:

Form Number | Purpose | Notes |

Form 8804 | Annual return reporting total withholding tax | Filed by the partnership, summarizing overall obligations. |

Form 8805 | Individual partner withholding statement | Issued per foreign partner to show their share of ECTI and withholding. |

Form 8813 | Withholding tax payment voucher | Used quarterly to remit tax amounts. |

Form 8804-W | Worksheet for estimated tax calculations | Helps forecast required withholding based on current-year projections. |

Workflow Summary

Use Form 8813 for installment payments throughout the tax year.

Prepare Form 8804-W to calculate total estimated withholding.

File Form 8804 annually, summarizing obligations.

Furnish Form 8805 to each foreign partner as documentation.

These forms work together to ensure proper allocation and documentation while meeting IRS requirements.

Key Deadlines and Extension Options

Missing a deadline can be costly. Understanding your timeline for Form 8804 and its related filings is essential.

Deadline/Event | Date | Notes |

Annual Form 8804 Filing | March 15 (or next business day) | Due on fourth month’s 15th day after tax year-end (e.g., March 15). |

Foreign Partner Form 8805 | March 15 | Furnished to each foreign partner by this date. |

Form 8813 Payments | Quarterly | Typically due April 15, June 15, Sept 15, and Jan 15. |

Extension to file Form 8804 | Automatic if Form 1065 extended | File Form 7004 for Form 1065 to extend Form 8804. |

Pro Tip: Using software that aligns 8804 obligations with your K-1 and 1065 deadlines helps ensure consistency.

Understanding Section 1446 Withholding Rates

Withholding Basics

Under Section 1446, partnerships must withhold tax on each foreign partner’s allocable share of ECTI. The general rates are:

37% for individuals

21% for corporate foreign partners

Treaty Exception

Some countries have tax treaties with the U.S. that allow for reduced withholding rates. In these cases, the partnership must verify eligibility through IRS Form W-8BEN (for individuals) or W-8BEN-E (for entities).

Example:

If $300,000 in ECTI is allocable to a foreign individual partner:

$300,000 × 37% = $111,000 withholding to remit and report on Form 8804.

Use Form 8805 to show their tax withheld and give them credit for U.S. taxes already paid.

For treaty specifics or to determine withholding rates, refer to the IRS's Tax Treaty Table.

Avoiding Common Form 8804 Errors

Common mistakes can result in monetary penalties, partner confusion, and IRS scrutiny.

Error Type | Impact | Prevention Tip |

Missing or late Form 8804 filing | Penalties up to 25% of tax due | Set automated calendar reminders for compliance dates. |

Incorrect partner details | IRS notices and audit risk | Cross-check ITINs/EINs and treaty paperwork before filing. |

Underpayment via Form 8813 | Interest on unpaid balances | Monitor ECTI and run quarterly forecasts using Form 8804-W. |

Incomplete Form 8805 disclosures | Foreign partners cannot claim credit | Proactively issue Forms 8805 by March 15 or extended deadline. |

Penalty snapshot: Late or incorrect forms can attract penalties of $210–$270 per form, plus interest on unpaid withholdings.

Practical Tips for Managing Form 8804 Compliance

Here are actionable strategies for startup founders and small partnership finance teams:

Align With Fundraising Outlook: Foreign investors add both capital and tax complexity—plan for withholding cases in your cap table.

Stay Software-Ready: Use accounting platforms that support multiple-member LLC and 8804 tracking.

Build Strong Advisor Relationships: Choose a tax preparer familiar with international startup tax dynamics.

Document Proactively: Maintain up-to-date W-8 forms and partner details to reduce last-minute scrambling.

For an in-depth playbook, check out our Startup Tax Guide.

Making Form 8804 Work for Your Startup or Partnership

Filing Form 8804 is more than just a tax obligation—it’s a governance practice that establishes transparency and builds credibility with your foreign partners. Structured correctly, your approach to Section 1446 withholding can avoid penalties, optimize partner experiences, and build trust as you scale internationally.

Whether you’re managing a bootstrap agency or fast-growing SaaS platform with cross-border investors, staying ahead on IRS filing requirements protects both your business and your partners.

Need expert help tackling Form 8804 and your partnership’s tax compliance?Talk to an expert

Navigating U.S. tax requirements as a partnership with foreign partners can be complex—especially when it comes to withholding and reporting. For founders, COOs, and finance leads operating startups, agencies, or e-commerce businesses with foreign investors or co-owners, understanding Form 8804 is essential to stay compliant and avoid costly penalties.

This article breaks down the essentials around Form 8804, the annual return for partnership withholding tax under Section 1446 of the Internal Revenue Code (IRC). Plus, we’ll point you toward helpful resources and best practices tailored for startups and fast-moving businesses.

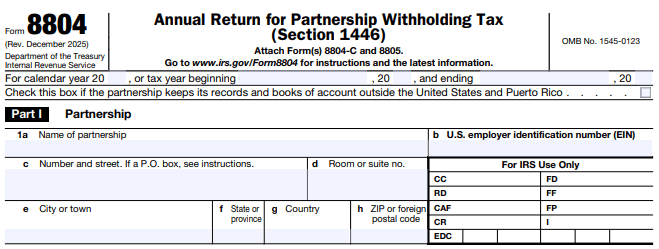

What is Form 8804 and Why Does It Matter?

Form 8804, officially titled “Annual Return for Partnership Withholding Tax (Section 1446),” is the IRS form used by partnerships that have effectively connected taxable income (ECTI) allocated to foreign partners. The form reports the total amount of withholding tax the partnership has deducted based on the foreign partners’ allocable shares of ECTI.

Why Is Form 8804 Important for Your Partnership?

Ensures IRS Compliance: Filing the form and correctly withholding protects the partnership and the foreign partners from IRS penalties and audits.

Payment and Reporting Mechanism: Form 8804 calculates the total withholding tax due, which supports timely payments during the tax year.

Supports Foreign Partner Tax Reporting: Provides transparency and documentation for foreign partners’ own U.S. tax filings and credits.

Avoids Withholding Tax Disputes: Accurate filing reduces the risk of disputes or interest charges when income is allocated across borders.

In short, if your partnership has foreign members and generates ECTI, Form 8804 is a critical piece of your tax compliance puzzle.

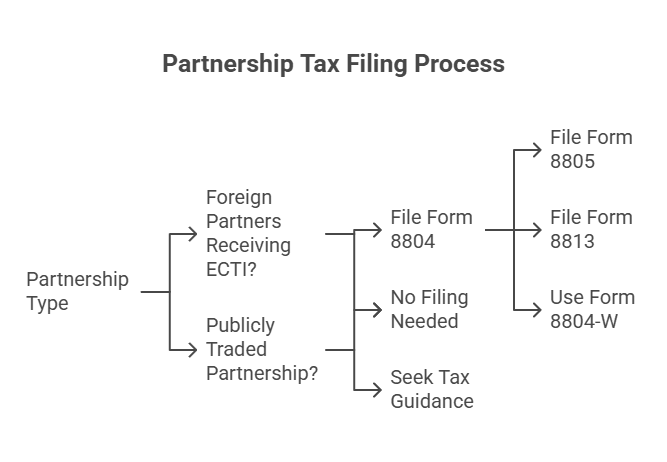

Who Must File Form 8804?

Not every partnership is required to file Form 8804. Below are the general rules:

Partnership Type | Must File? | Notes |

Partnerships with foreign partners receiving ECTI | Yes | Required to report and withhold tax on foreign partners’ share. |

U.S. Partnerships with only domestic partners | No | No foreign partner, no Form 8804 filing needed. |

Publicly Traded Partnerships (PTPs) | Generally No* | May have differing obligations and should seek specific tax guidance. |

*PTPs may require customized tax handling. Always consult a tax advisor to determine your specific obligations.

What Qualifies as Effectively Connected Taxable Income (ECTI)?

Effectively Connected Taxable Income, or ECTI, means income generated from a U.S. trade or business. For tax purposes, this U.S.-source income is considered “effectively connected” and therefore liable to U.S. taxation even if allocated to a non-resident partner.

Key takeaway: If your partnership has foreign partners and generates U.S.-sourced trade income, you likely fall under the Section 1446 rules and need to file Form 8804.

Understanding IRS Forms Related to Form 8804

Form 8804 works in tandem with several other IRS forms that together ensure accurate annual reporting and payment of withholding tax:

Form Number | Purpose | Notes |

Form 8804 | Annual return reporting total withholding tax | Filed by the partnership, summarizing overall obligations. |

Form 8805 | Individual partner withholding statement | Issued per foreign partner to show their share of ECTI and withholding. |

Form 8813 | Withholding tax payment voucher | Used quarterly to remit tax amounts. |

Form 8804-W | Worksheet for estimated tax calculations | Helps forecast required withholding based on current-year projections. |

Workflow Summary

Use Form 8813 for installment payments throughout the tax year.

Prepare Form 8804-W to calculate total estimated withholding.

File Form 8804 annually, summarizing obligations.

Furnish Form 8805 to each foreign partner as documentation.

These forms work together to ensure proper allocation and documentation while meeting IRS requirements.

Key Deadlines and Extension Options

Missing a deadline can be costly. Understanding your timeline for Form 8804 and its related filings is essential.

Deadline/Event | Date | Notes |

Annual Form 8804 Filing | March 15 (or next business day) | Due on fourth month’s 15th day after tax year-end (e.g., March 15). |

Foreign Partner Form 8805 | March 15 | Furnished to each foreign partner by this date. |

Form 8813 Payments | Quarterly | Typically due April 15, June 15, Sept 15, and Jan 15. |

Extension to file Form 8804 | Automatic if Form 1065 extended | File Form 7004 for Form 1065 to extend Form 8804. |

Pro Tip: Using software that aligns 8804 obligations with your K-1 and 1065 deadlines helps ensure consistency.

Understanding Section 1446 Withholding Rates

Withholding Basics

Under Section 1446, partnerships must withhold tax on each foreign partner’s allocable share of ECTI. The general rates are:

37% for individuals

21% for corporate foreign partners

Treaty Exception

Some countries have tax treaties with the U.S. that allow for reduced withholding rates. In these cases, the partnership must verify eligibility through IRS Form W-8BEN (for individuals) or W-8BEN-E (for entities).

Example:

If $300,000 in ECTI is allocable to a foreign individual partner:

$300,000 × 37% = $111,000 withholding to remit and report on Form 8804.

Use Form 8805 to show their tax withheld and give them credit for U.S. taxes already paid.

For treaty specifics or to determine withholding rates, refer to the IRS's Tax Treaty Table.

Avoiding Common Form 8804 Errors

Common mistakes can result in monetary penalties, partner confusion, and IRS scrutiny.

Error Type | Impact | Prevention Tip |

Missing or late Form 8804 filing | Penalties up to 25% of tax due | Set automated calendar reminders for compliance dates. |

Incorrect partner details | IRS notices and audit risk | Cross-check ITINs/EINs and treaty paperwork before filing. |

Underpayment via Form 8813 | Interest on unpaid balances | Monitor ECTI and run quarterly forecasts using Form 8804-W. |

Incomplete Form 8805 disclosures | Foreign partners cannot claim credit | Proactively issue Forms 8805 by March 15 or extended deadline. |

Penalty snapshot: Late or incorrect forms can attract penalties of $210–$270 per form, plus interest on unpaid withholdings.

Practical Tips for Managing Form 8804 Compliance

Here are actionable strategies for startup founders and small partnership finance teams:

Align With Fundraising Outlook: Foreign investors add both capital and tax complexity—plan for withholding cases in your cap table.

Stay Software-Ready: Use accounting platforms that support multiple-member LLC and 8804 tracking.

Build Strong Advisor Relationships: Choose a tax preparer familiar with international startup tax dynamics.

Document Proactively: Maintain up-to-date W-8 forms and partner details to reduce last-minute scrambling.

For an in-depth playbook, check out our Startup Tax Guide.

Making Form 8804 Work for Your Startup or Partnership

Filing Form 8804 is more than just a tax obligation—it’s a governance practice that establishes transparency and builds credibility with your foreign partners. Structured correctly, your approach to Section 1446 withholding can avoid penalties, optimize partner experiences, and build trust as you scale internationally.

Whether you’re managing a bootstrap agency or fast-growing SaaS platform with cross-border investors, staying ahead on IRS filing requirements protects both your business and your partners.

Need expert help tackling Form 8804 and your partnership’s tax compliance?Talk to an expert

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026