Go Back

Last Updated :

Last Updated :

Jan 15, 2026

Jan 15, 2026

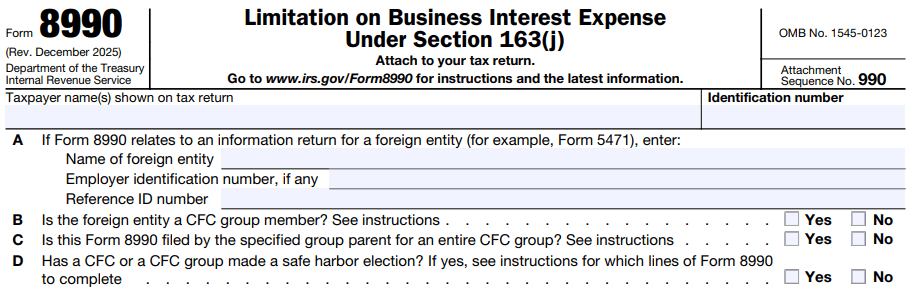

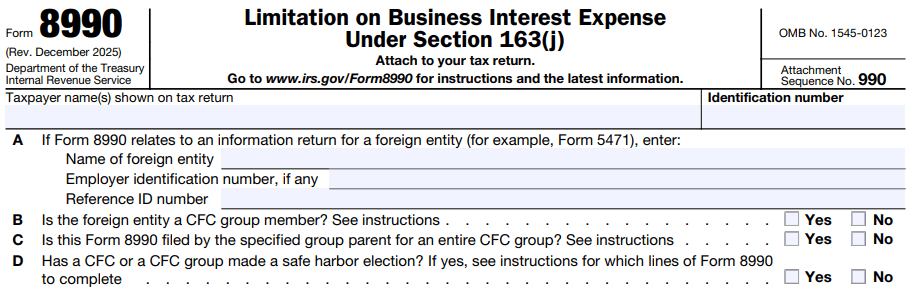

How to File Form 8990: Business Interest Expense Limitation (Section 163(j))

As a founder steering your startup or e-commerce company toward growth, managing your business’s finances efficiently can unlock both strategic advantage and meaningful tax savings. One critical yet often overlooked area is Form 8990, which directly affects how much interest expense you can deduct on your business tax return under Section 163(j) of the Internal Revenue Code.

This guide walks founders through the essentials of Form 8990 and how the business interest expense limitation works — with practical steps to ensure you leverage it correctly while keeping your financial operations streamlined.

Understanding Form 8990 and the Business Interest Expense Limitation

Form 8990 is a tax form filed by businesses to calculate the allowable deduction for business interest expense under Section 163(j). The Tax Cuts and Jobs Act (TCJA) introduced limits on the amount of interest businesses could deduct to prevent companies from over-leveraging and sheltering too much income. The core objective for founders is to understand how this limitation can affect your startup’s tax filing and cash flow.

What Is Business Interest Expense?

Business interest expense generally refers to the interest paid or accrued on money borrowed for business activities. Examples include:

Loans taken to finance equipment

Lines of credit used for operational cash flow

Interest on business credit cards (used strictly for business purposes)

While interest payments are an operating expense, the IRS limits how much of those interest payments can be deducted according to your business’s adjusted taxable income.

How Section 163(j) Limits Interest Deductions

Under Section 163(j), your business’s deductible interest expense is generally limited to 30% of your adjusted taxable income (ATI) plus your business interest income and floor plan financing interest (for certain industries). Any disallowed interest can be carried forward to future years, but this limitation can substantially affect businesses with significant debt financing.

Adjusted Taxable Income for this purpose is essentially your taxable income from business operations before these deductions:

Interest expense

Depreciation, amortization, and depletion

This means your ATI tends to reflect your core operating profitability, which is the baseline for calculating the interest deduction.

Why Founders Need to Pay Close Attention to Form 8990

For a founder, overlooking the business interest expense limitation can result in unexpected tax bills and inaccurate financial projections. Here are key reasons Form 8990 matters to your startup or agency:

Tax Compliance: Accurate filing helps avoid IRS audits and penalties related to interest deduction claims.

Cash Flow Management: Knowing your deductible interest helps forecast after-tax cash flows and informs your financing strategy.

Financing Decisions: Understanding Section 163(j) limits can shape borrowing decisions, preventing over-leveraging or inefficient capital structures.

Maximizing Tax Savings: Properly applying the carryforward rules ensures you don’t miss out on future deductions.

For a founder focused on growth, staying ahead of these rules is an essential part of financial stewardship.

To deepen your understanding of your overall tax compliance posture, consider this comprehensive guide to business tax compliance from Haven.

Step-by-Step Guide to Completing Form 8990

Filing Form 8990 can feel intimidating, but breaking it down into manageable parts helps simplify the process.

Here’s a pragmatic step-by-step approach tailored for founders:

1. Gather Your Financial Information

Be ready with key financial statements, including:

Income statement (Profit & Loss)

Balance sheet showing debt and interest liabilities

Details of business interest income and interest expense

Depreciation and amortization schedules

Having accurate and up-to-date bookkeeping records is crucial. Modern bookkeeping systems with categorization tailored toward tax reporting make it easier.

2. Calculate Business Interest Expense and Income

Identify all qualifying business interest expenses paid or accrued during the tax year. Also report any business interest income earned (e.g., interest received from a related party or on business investments). These figures are the starting point for the form.

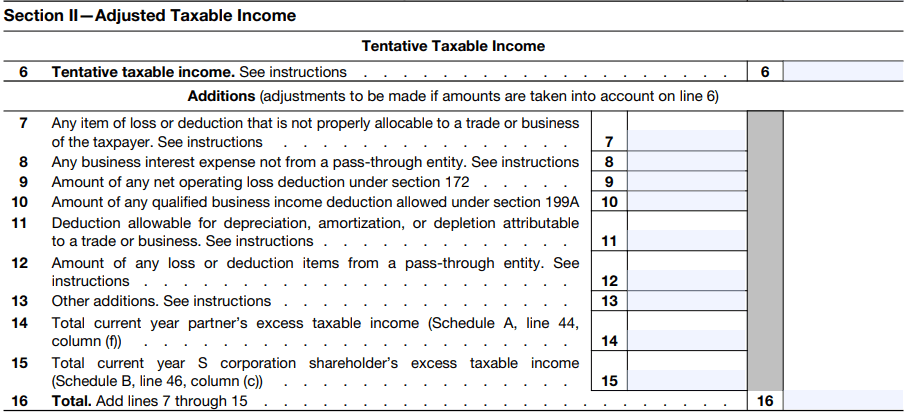

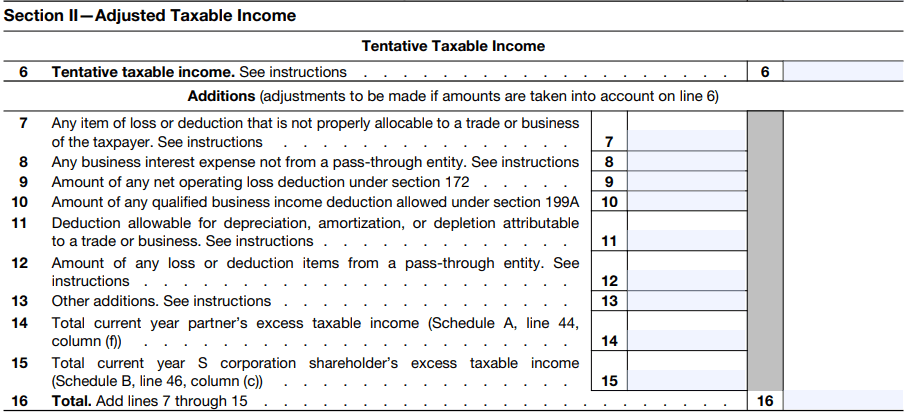

3. Determine Adjusted Taxable Income (ATI)

Calculate ATI, which requires adding back to taxable income the deductions for:

Business interest expense

Depreciation, amortization, and depletion

Note that for tax years beginning after December 31, 2021, the ATI calculation reverts to EBITDA (earnings before interest, taxes, depreciation, and amortization) instead of EBIT, further favoring startups investing heavily in capital.

4. Apply the 30% Limitation

Multiply your ATI plus interest income by 30% (or the applicable percentage based on the tax year). This equals your maximum allowed business interest deduction.

5. Report the Limit and Carryforwards

If your business interest expense is less than this limit, deduct the full amount.

If it exceeds the limit, only deduct up to the limit on this year’s return.

The excess becomes a carryforward to future tax years, which you track on the Form 8990 carryforward schedule.

Practical Tips for Founders Navigating Section 163(j)

Use Modern Bookkeeping Tools to Track Interest Expense

Modern cloud bookkeeping tools automatically categorize and track interest-related expenses separately — a must-have for startups aiming to file Form 8990 accurately without weeks of manual work. Consider integrating bookkeeping with your tax filing process to flag issues early.

Plan Debt Structure Strategically

Aim to balance equity and debt financing while anticipating the impact on your interest deductions. Avoid excessive reliance on high-interest loans that may limit your deductible interest and weigh the benefit of non-interest financing options when scaling.

Monitor Your Depreciation Methods

Depreciation expenses reduce your ATI, increasing the allowable interest deduction. Evaluate if accelerated depreciation methods make sense for your business timeline to optimize interest expense deductions.

Work With Tax Advisors Familiar with Section 163(j)

The mechanics around this limitation can get complex, especially when combined with related tax credits such as the R&D tax credit or different business entity structures (C-corporations, partnerships, S-corporations). Expert advisors can help ensure you’re correctly applying all rules.

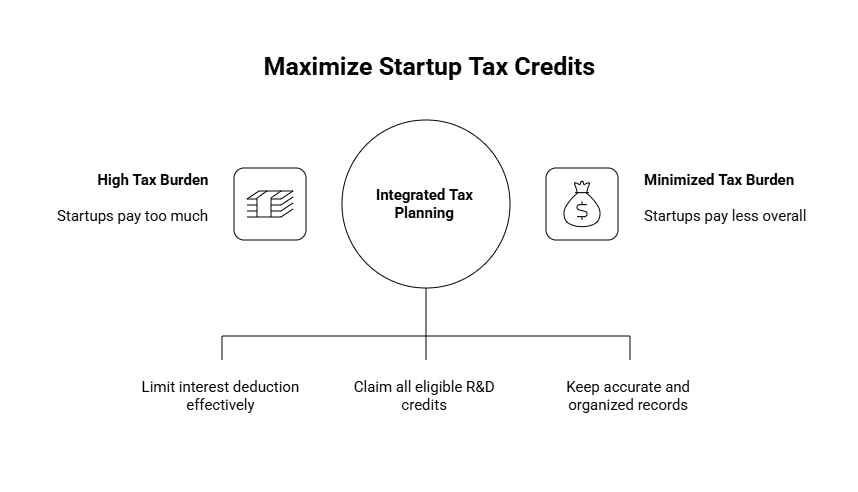

Understanding the Linkage Between Form 8990 and Startup Tax Credits

Startups focused on innovation often leverage tax credits, especially the Research & Development (R&D) tax credit. While Form 8990 limits interest deductions, credits like R&D don't directly affect business interest but can influence your overall tax planning.

Founders should navigate both with an integrated approach: managing interest deduction limits while maximizing credits to minimize tax burden holistically. Haven’s support covers modern tax strategies including R&D credits along with streamlined bookkeeping. Learn more in our 10 step guide to saving money on taxes for small businesses.

Optimizing Compliance and Cash Flow with Haven’s Founders-Focused Services

At Haven, we specialize in helping founders handle the nuances of tax and financial operations — so you can focus on scaling your business. Our startup-native bookkeeping combined with expert tax filing support includes:

Managing accurate categorization of interest expenses for precise Form 8990 reporting

Guidance on leveraging interest deduction limitations and carryforwards

Strategic planning to optimize financing structure and tax credits including R&D

Responsive, founder-friendly service tailored to fast-growing startups and agencies

Leveraging modern accounting and proactive advisement can reduce stress around complicated issues like Section 163(j).

Key Takeaways for Founders on Form 8990 and Interest Expense Limitations

Aspect | What Founders Should Know |

Form 8990 | Required IRS form that calculates your business interest deduction limit. |

Section 163(j) Limitation | Restricts deductible interest to 30% of your adjusted taxable income. |

Adjusted Taxable Income (ATI) | Taxable income before interest, depreciation, and amortization deductions. |

Impact on Startups | Limits benefit from high-interest debt; encourages balanced financing. |

Carryforward Option | Disallowed interest can be carried forward indefinitely. |

Tax Planning | Strategic use of depreciation and financing structure maximizes savings. |

For startups seeking to comply with these rules seamlessly, revisiting your bookkeeping and tax filing approach annually is key to avoiding surprises.

Check out our complete guide for founders filing U.S. corporate taxes to understand how other IRS forms interact with Form 8990.

Keep Form 8990 Compliance Simple and Strategic

For founders aiming to scale without getting bogged down by tax pitfalls, mastering Form 8990 is essential. The business interest expense limitation under Section 163(j) can directly influence your cash flow and tax position, but with the right knowledge and systems, it becomes manageable.

By adopting a modern, startup-native approach to bookkeeping and engaging expert advisors, your business can take full advantage of allowable deductions, maintain compliance, and plan financing strategies effectively.

Stay proactive — accurate reporting on Form 8990 and timely tax planning positions your company for financial resilience and competitive advantage. Haven is here to support founders on that journey.

As a founder steering your startup or e-commerce company toward growth, managing your business’s finances efficiently can unlock both strategic advantage and meaningful tax savings. One critical yet often overlooked area is Form 8990, which directly affects how much interest expense you can deduct on your business tax return under Section 163(j) of the Internal Revenue Code.

This guide walks founders through the essentials of Form 8990 and how the business interest expense limitation works — with practical steps to ensure you leverage it correctly while keeping your financial operations streamlined.

Understanding Form 8990 and the Business Interest Expense Limitation

Form 8990 is a tax form filed by businesses to calculate the allowable deduction for business interest expense under Section 163(j). The Tax Cuts and Jobs Act (TCJA) introduced limits on the amount of interest businesses could deduct to prevent companies from over-leveraging and sheltering too much income. The core objective for founders is to understand how this limitation can affect your startup’s tax filing and cash flow.

What Is Business Interest Expense?

Business interest expense generally refers to the interest paid or accrued on money borrowed for business activities. Examples include:

Loans taken to finance equipment

Lines of credit used for operational cash flow

Interest on business credit cards (used strictly for business purposes)

While interest payments are an operating expense, the IRS limits how much of those interest payments can be deducted according to your business’s adjusted taxable income.

How Section 163(j) Limits Interest Deductions

Under Section 163(j), your business’s deductible interest expense is generally limited to 30% of your adjusted taxable income (ATI) plus your business interest income and floor plan financing interest (for certain industries). Any disallowed interest can be carried forward to future years, but this limitation can substantially affect businesses with significant debt financing.

Adjusted Taxable Income for this purpose is essentially your taxable income from business operations before these deductions:

Interest expense

Depreciation, amortization, and depletion

This means your ATI tends to reflect your core operating profitability, which is the baseline for calculating the interest deduction.

Why Founders Need to Pay Close Attention to Form 8990

For a founder, overlooking the business interest expense limitation can result in unexpected tax bills and inaccurate financial projections. Here are key reasons Form 8990 matters to your startup or agency:

Tax Compliance: Accurate filing helps avoid IRS audits and penalties related to interest deduction claims.

Cash Flow Management: Knowing your deductible interest helps forecast after-tax cash flows and informs your financing strategy.

Financing Decisions: Understanding Section 163(j) limits can shape borrowing decisions, preventing over-leveraging or inefficient capital structures.

Maximizing Tax Savings: Properly applying the carryforward rules ensures you don’t miss out on future deductions.

For a founder focused on growth, staying ahead of these rules is an essential part of financial stewardship.

To deepen your understanding of your overall tax compliance posture, consider this comprehensive guide to business tax compliance from Haven.

Step-by-Step Guide to Completing Form 8990

Filing Form 8990 can feel intimidating, but breaking it down into manageable parts helps simplify the process.

Here’s a pragmatic step-by-step approach tailored for founders:

1. Gather Your Financial Information

Be ready with key financial statements, including:

Income statement (Profit & Loss)

Balance sheet showing debt and interest liabilities

Details of business interest income and interest expense

Depreciation and amortization schedules

Having accurate and up-to-date bookkeeping records is crucial. Modern bookkeeping systems with categorization tailored toward tax reporting make it easier.

2. Calculate Business Interest Expense and Income

Identify all qualifying business interest expenses paid or accrued during the tax year. Also report any business interest income earned (e.g., interest received from a related party or on business investments). These figures are the starting point for the form.

3. Determine Adjusted Taxable Income (ATI)

Calculate ATI, which requires adding back to taxable income the deductions for:

Business interest expense

Depreciation, amortization, and depletion

Note that for tax years beginning after December 31, 2021, the ATI calculation reverts to EBITDA (earnings before interest, taxes, depreciation, and amortization) instead of EBIT, further favoring startups investing heavily in capital.

4. Apply the 30% Limitation

Multiply your ATI plus interest income by 30% (or the applicable percentage based on the tax year). This equals your maximum allowed business interest deduction.

5. Report the Limit and Carryforwards

If your business interest expense is less than this limit, deduct the full amount.

If it exceeds the limit, only deduct up to the limit on this year’s return.

The excess becomes a carryforward to future tax years, which you track on the Form 8990 carryforward schedule.

Practical Tips for Founders Navigating Section 163(j)

Use Modern Bookkeeping Tools to Track Interest Expense

Modern cloud bookkeeping tools automatically categorize and track interest-related expenses separately — a must-have for startups aiming to file Form 8990 accurately without weeks of manual work. Consider integrating bookkeeping with your tax filing process to flag issues early.

Plan Debt Structure Strategically

Aim to balance equity and debt financing while anticipating the impact on your interest deductions. Avoid excessive reliance on high-interest loans that may limit your deductible interest and weigh the benefit of non-interest financing options when scaling.

Monitor Your Depreciation Methods

Depreciation expenses reduce your ATI, increasing the allowable interest deduction. Evaluate if accelerated depreciation methods make sense for your business timeline to optimize interest expense deductions.

Work With Tax Advisors Familiar with Section 163(j)

The mechanics around this limitation can get complex, especially when combined with related tax credits such as the R&D tax credit or different business entity structures (C-corporations, partnerships, S-corporations). Expert advisors can help ensure you’re correctly applying all rules.

Understanding the Linkage Between Form 8990 and Startup Tax Credits

Startups focused on innovation often leverage tax credits, especially the Research & Development (R&D) tax credit. While Form 8990 limits interest deductions, credits like R&D don't directly affect business interest but can influence your overall tax planning.

Founders should navigate both with an integrated approach: managing interest deduction limits while maximizing credits to minimize tax burden holistically. Haven’s support covers modern tax strategies including R&D credits along with streamlined bookkeeping. Learn more in our 10 step guide to saving money on taxes for small businesses.

Optimizing Compliance and Cash Flow with Haven’s Founders-Focused Services

At Haven, we specialize in helping founders handle the nuances of tax and financial operations — so you can focus on scaling your business. Our startup-native bookkeeping combined with expert tax filing support includes:

Managing accurate categorization of interest expenses for precise Form 8990 reporting

Guidance on leveraging interest deduction limitations and carryforwards

Strategic planning to optimize financing structure and tax credits including R&D

Responsive, founder-friendly service tailored to fast-growing startups and agencies

Leveraging modern accounting and proactive advisement can reduce stress around complicated issues like Section 163(j).

Key Takeaways for Founders on Form 8990 and Interest Expense Limitations

Aspect | What Founders Should Know |

Form 8990 | Required IRS form that calculates your business interest deduction limit. |

Section 163(j) Limitation | Restricts deductible interest to 30% of your adjusted taxable income. |

Adjusted Taxable Income (ATI) | Taxable income before interest, depreciation, and amortization deductions. |

Impact on Startups | Limits benefit from high-interest debt; encourages balanced financing. |

Carryforward Option | Disallowed interest can be carried forward indefinitely. |

Tax Planning | Strategic use of depreciation and financing structure maximizes savings. |

For startups seeking to comply with these rules seamlessly, revisiting your bookkeeping and tax filing approach annually is key to avoiding surprises.

Check out our complete guide for founders filing U.S. corporate taxes to understand how other IRS forms interact with Form 8990.

Keep Form 8990 Compliance Simple and Strategic

For founders aiming to scale without getting bogged down by tax pitfalls, mastering Form 8990 is essential. The business interest expense limitation under Section 163(j) can directly influence your cash flow and tax position, but with the right knowledge and systems, it becomes manageable.

By adopting a modern, startup-native approach to bookkeeping and engaging expert advisors, your business can take full advantage of allowable deductions, maintain compliance, and plan financing strategies effectively.

Stay proactive — accurate reporting on Form 8990 and timely tax planning positions your company for financial resilience and competitive advantage. Haven is here to support founders on that journey.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026