Go Back

Last Updated :

Last Updated :

Jan 15, 2026

Jan 15, 2026

Form 8865 Filing Guide: Reporting Foreign Partnerships & Compliance Essentials

Navigating international partnerships can be a strategic growth lever. However, with foreign investments or operations, tax compliance complexity grows—particularly for founders responsible for full financial oversight. One critical IRS filing in this landscape is Form 8865: Return of U.S. Persons With Respect to Certain Foreign Partnerships.

This comprehensive guide is tailored for founders and executive leaders who need a practical, founder-friendly breakdown of when, how, and why to file Form 8865 correctly. We'll also explore the interplay with other tax filings, common pitfalls, and where to find expert help—so you can keep your cross-border operations compliant and focused on growth.

What Is Form 8865 and Why Founders Need to Care

Form 8865 is an IRS informational return required from U.S. persons who have significant ownership or control in certain foreign partnerships. Unlike domestic partnerships, the IRS demands detailed partnership activity, ownership percentages, and income reporting to ensure appropriate taxation and combat offshore tax evasion.

When Does Form 8865 Apply to Your Startup?

You need to file Form 8865 if your startup, or its U.S. owners, fall under categories that include:

Control or Ownership Thresholds: U.S. persons owning at least 10% direct or indirect interest in a foreign partnership.

Control Test: U.S. persons owning more than 50% interest by vote or capital.

Transfer of Property: U.S. persons contributing property to the foreign partnership that triggers filing.

Increased Interest or Certain Distributions: U.S. persons whose interests in the foreign partnership increase by 10% or receive significant distributions.

For startups with cross-border founders or investments, understanding these triggers is the first step to compliance.

Importance to Founders and Financial Leaders

Avoid Penalties: Failure to file can lead to penalties starting at $10,000 per missed form, with escalating amounts for ongoing failure.

Transparency & Audits: The IRS uses Form 8865 to verify income and foreign tax credits, reducing audit risk.

Supporting R&D Tax Credit Planning: For startups investing in foreign R&D, properly reporting foreign partnerships can impact your overall tax credit strategy.

For more in-depth insights on startup tax obligations, you can visit Haven’s Business Tax Services page.

For the most authoritative guidance, view the official IRS Form 8865 Instructions.

Breaking Down Form 8865: Key Sections and Reporting Requirements

Form 8865 is complex, but this section filters it down into essential components founders and finance leads must know:

Section | Description | Action Steps for Founders |

Part I | Information about the filer | Gather identification info to start the form |

Part II | Information about the foreign partnership | Collect partnership documents and foreign EIN |

Part III | Partner's share of income, deductions, etc. | Coordinate with foreign partners to get financial info |

Part IV | Transfer of property to partnership | Track any property or asset transfers |

Part V | Transactions between the partner and partnership | Maintain detailed records of any monetary exchanges |

Part VI | Balance sheets and income statements | Work with your foreign partnership accountant |

Tips for Gathering Required Documentation

Establish communication with foreign partners to obtain partnership financials timely.

Centralize records related to ownership percentages and transactions.

Confirm the foreign partnership’s fiscal year aligns or reconcile differences.

Early preparation simplifies year-end reporting and reduces stress during tax season.

Common Founder Missteps & How to Avoid Them: Form 8865 Best Practices

Founders often stumble on Form 8865 due to its technical nuances and the foreign element. Here’s a pragmatic checklist to help:

Ignoring Indirect Ownership

Delaying Coordination with Partners

Confusing Form 8865 with Form 5471

Underestimating Penalties

Mismatching Fiscal Years

Founder-Friendly Workflow for Filing Form 8865

Delegate initial data requests to your finance or accounting team.

Use tax software or coordinate with professional advisors familiar with international tax compliance.

Regularly review partnership ownership changes during the year.

Consult Haven’s Tax Guide for startup-specific insights on foreign partnership compliance.

Integrating Form 8865 Compliance with Your Broader Startup Tax Strategy

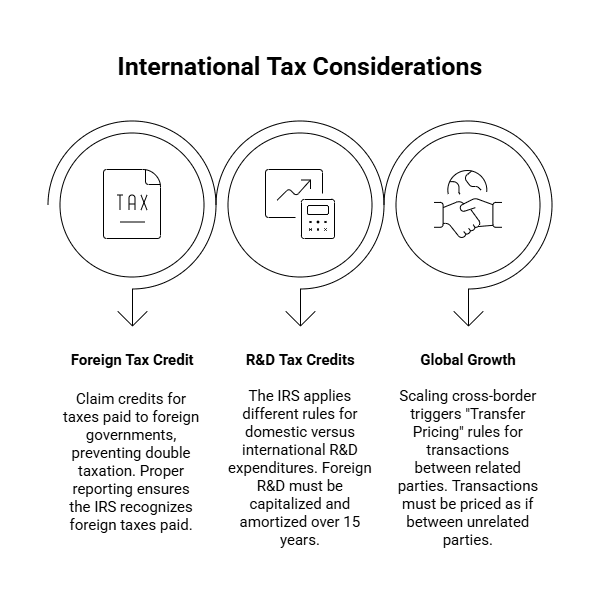

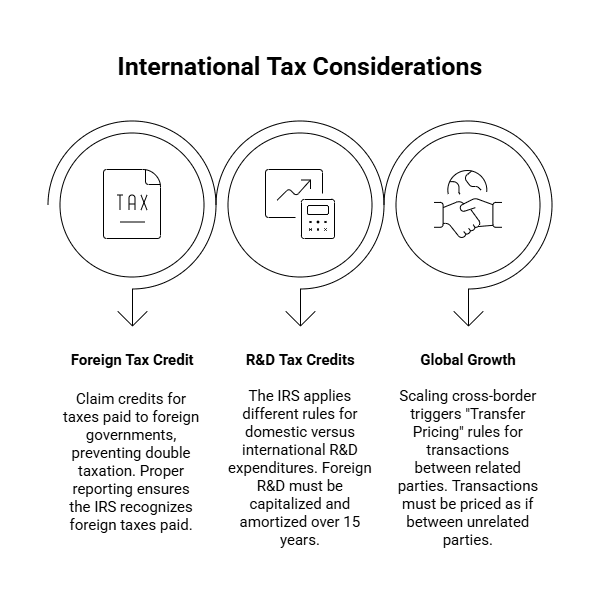

Form 8865 does not exist in isolation. Its reporting touches on other tax aspects such as:

Foreign Tax Credit Utilization

R&D Tax Credits for International Research

Global Growth and Transfer Pricing

Founders who integrate Form 8865 compliance into their overall tax planning have a holistic view, enabling smarter decisions and better cash flow forecasting.

Additional Resources and Next Steps for Founders

To maintain a founder-focused, actionable approach:

Review IRS instructions for Form 8865 directly on IRS.gov for the most up-to-date official guidance.

Implement a quarterly foreign partnership review process overseen by finance leads.

Schedule an annual tax consultation with internationally experienced professionals.

At Haven, we specialize in modern bookkeeping, tax filing, and R&D tax credit support tailored to startups navigating complex foreign partnership landscapes. Our responsive, founder-friendly service helps demystify filings like Form 8865 so your team can focus on building business value instead of wrestling with tax forms.

Learn how Haven can help streamline your startup’s foreign partnership compliance by exploring our Reporting Services.

Mastering Form 8865 for Startup Success

Filing Form 8865 accurately is a non-negotiable part of managing foreign partnerships for founders and financial leaders committed to compliance and optimized tax strategy. This IRS requirement, though detailed, is navigable with the right preparation, documentation, and expert guidance.

By understanding the filing triggers, filing process, and integration with broader tax credit and growth plans, founders safeguard their startups from penalties, audits, and missed opportunities.

Partner with Haven for founder-friendly international tax solutions designed to support your vision and growth.

Navigating international partnerships can be a strategic growth lever. However, with foreign investments or operations, tax compliance complexity grows—particularly for founders responsible for full financial oversight. One critical IRS filing in this landscape is Form 8865: Return of U.S. Persons With Respect to Certain Foreign Partnerships.

This comprehensive guide is tailored for founders and executive leaders who need a practical, founder-friendly breakdown of when, how, and why to file Form 8865 correctly. We'll also explore the interplay with other tax filings, common pitfalls, and where to find expert help—so you can keep your cross-border operations compliant and focused on growth.

What Is Form 8865 and Why Founders Need to Care

Form 8865 is an IRS informational return required from U.S. persons who have significant ownership or control in certain foreign partnerships. Unlike domestic partnerships, the IRS demands detailed partnership activity, ownership percentages, and income reporting to ensure appropriate taxation and combat offshore tax evasion.

When Does Form 8865 Apply to Your Startup?

You need to file Form 8865 if your startup, or its U.S. owners, fall under categories that include:

Control or Ownership Thresholds: U.S. persons owning at least 10% direct or indirect interest in a foreign partnership.

Control Test: U.S. persons owning more than 50% interest by vote or capital.

Transfer of Property: U.S. persons contributing property to the foreign partnership that triggers filing.

Increased Interest or Certain Distributions: U.S. persons whose interests in the foreign partnership increase by 10% or receive significant distributions.

For startups with cross-border founders or investments, understanding these triggers is the first step to compliance.

Importance to Founders and Financial Leaders

Avoid Penalties: Failure to file can lead to penalties starting at $10,000 per missed form, with escalating amounts for ongoing failure.

Transparency & Audits: The IRS uses Form 8865 to verify income and foreign tax credits, reducing audit risk.

Supporting R&D Tax Credit Planning: For startups investing in foreign R&D, properly reporting foreign partnerships can impact your overall tax credit strategy.

For more in-depth insights on startup tax obligations, you can visit Haven’s Business Tax Services page.

For the most authoritative guidance, view the official IRS Form 8865 Instructions.

Breaking Down Form 8865: Key Sections and Reporting Requirements

Form 8865 is complex, but this section filters it down into essential components founders and finance leads must know:

Section | Description | Action Steps for Founders |

Part I | Information about the filer | Gather identification info to start the form |

Part II | Information about the foreign partnership | Collect partnership documents and foreign EIN |

Part III | Partner's share of income, deductions, etc. | Coordinate with foreign partners to get financial info |

Part IV | Transfer of property to partnership | Track any property or asset transfers |

Part V | Transactions between the partner and partnership | Maintain detailed records of any monetary exchanges |

Part VI | Balance sheets and income statements | Work with your foreign partnership accountant |

Tips for Gathering Required Documentation

Establish communication with foreign partners to obtain partnership financials timely.

Centralize records related to ownership percentages and transactions.

Confirm the foreign partnership’s fiscal year aligns or reconcile differences.

Early preparation simplifies year-end reporting and reduces stress during tax season.

Common Founder Missteps & How to Avoid Them: Form 8865 Best Practices

Founders often stumble on Form 8865 due to its technical nuances and the foreign element. Here’s a pragmatic checklist to help:

Ignoring Indirect Ownership

Delaying Coordination with Partners

Confusing Form 8865 with Form 5471

Underestimating Penalties

Mismatching Fiscal Years

Founder-Friendly Workflow for Filing Form 8865

Delegate initial data requests to your finance or accounting team.

Use tax software or coordinate with professional advisors familiar with international tax compliance.

Regularly review partnership ownership changes during the year.

Consult Haven’s Tax Guide for startup-specific insights on foreign partnership compliance.

Integrating Form 8865 Compliance with Your Broader Startup Tax Strategy

Form 8865 does not exist in isolation. Its reporting touches on other tax aspects such as:

Foreign Tax Credit Utilization

R&D Tax Credits for International Research

Global Growth and Transfer Pricing

Founders who integrate Form 8865 compliance into their overall tax planning have a holistic view, enabling smarter decisions and better cash flow forecasting.

Additional Resources and Next Steps for Founders

To maintain a founder-focused, actionable approach:

Review IRS instructions for Form 8865 directly on IRS.gov for the most up-to-date official guidance.

Implement a quarterly foreign partnership review process overseen by finance leads.

Schedule an annual tax consultation with internationally experienced professionals.

At Haven, we specialize in modern bookkeeping, tax filing, and R&D tax credit support tailored to startups navigating complex foreign partnership landscapes. Our responsive, founder-friendly service helps demystify filings like Form 8865 so your team can focus on building business value instead of wrestling with tax forms.

Learn how Haven can help streamline your startup’s foreign partnership compliance by exploring our Reporting Services.

Mastering Form 8865 for Startup Success

Filing Form 8865 accurately is a non-negotiable part of managing foreign partnerships for founders and financial leaders committed to compliance and optimized tax strategy. This IRS requirement, though detailed, is navigable with the right preparation, documentation, and expert guidance.

By understanding the filing triggers, filing process, and integration with broader tax credit and growth plans, founders safeguard their startups from penalties, audits, and missed opportunities.

Partner with Haven for founder-friendly international tax solutions designed to support your vision and growth.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026