Go Back

Last Updated :

Last Updated :

Jan 15, 2026

Jan 15, 2026

Properly Filing Form 8814: Parent’s Election to Report a Child’s Investment Income

For founders and startup executives navigating complex financial waters, understanding the nuances of tax filings can directly impact cash flow, compliance, and even growth strategy.

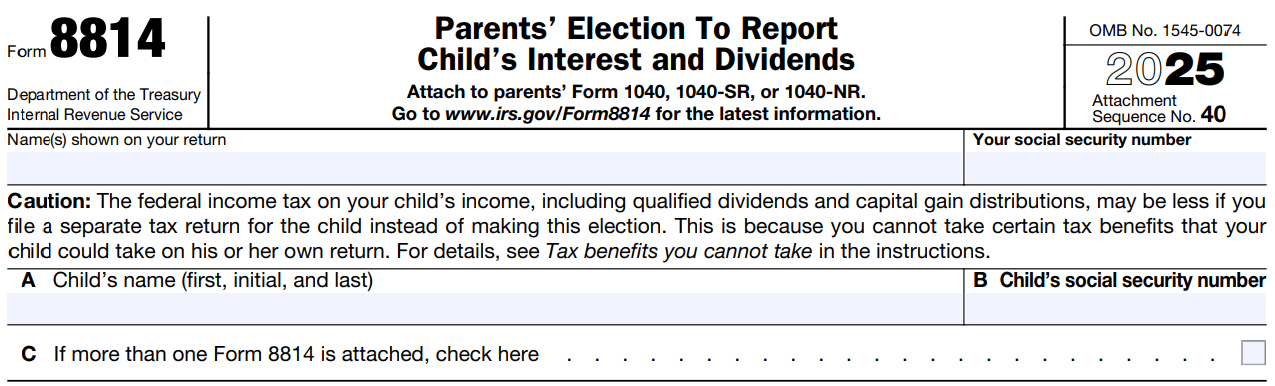

One often overlooked yet highly strategic option is Form 8814, a useful IRS provision allowing parents to report their child's interest and dividends on their tax return. This article will walk you through the essentials of Form 8814, helping founders make smarter tax decisions without getting lost in the technical maze.

What Is Form 8814 and Why Should Founders Care?

Form 8814, officially known as the “Parents’ Election to Report Child’s Interest and Dividends,” offers a way for parents to include their children's investment income under their own tax return. This can simplify filing and, in some cases, reduce overall tax exposure by avoiding the 'kiddie tax', which can apply higher rates to a child’s unearned income.

The Founder's Perspective on Form 8814

Founders often have children who might receive dividends or interest from savings accounts, trusts, or inherited equity stakes — common occurrences in entrepreneurial families. For startups with stock options or equity held for minors, understanding how these earnings are taxed is crucial.

Using Form 8814 means:

Streamlined filing: File your child’s investment income on your tax return instead of preparing a separate return.

Potential tax savings: Depending on tax brackets, it may be advantageous to include the income on the parent’s return.

Avoiding complexity: Reduces the need to calculate kiddie tax separately, which has its own rules and thresholds.

Understanding this form doesn’t replace a tax advisor, but familiarizing yourself with it arms you for smarter planning conversations.

Eligibility and Filing Requirements for Form 8814: A Startup Founder’s Checklist

Before electing to file using Form 8814, check to ensure your situation qualifies. Here’s a helpful resource for founders evaluating eligibility:

Eligibility Criteria for Form 8814 | Explanation | Founder-Specific Notes |

Child must have only interest and dividends | Only unearned income—interest and dividends—qualify. | Equity dividends from seed-stage trusts or UTMAs generally count. |

Child must be under 19 (or under 24 if a full-time student) | Age determines eligibility. | Double-check status of dependents with startup-tied portfolios. |

Child cannot have filed a separate tax return for this income | Election disqualifies separate filing for the same income. | A time-saver for busy founders handling family finances. |

Total interest and dividend income must not exceed $11,000 (2023) | IRS income cap to qualify for Form 8814 in the 2023 tax year. | Monitor multiple accounts to stay under the threshold. |

If you qualify, you complete and attach Form 8814 to your Form 1040 (or 1040-SR) return. If your child earns qualifying income from more than one account, aggregate that carefully. Exceeding the $11,000 limit disqualifies its use.

How to Fill Out Form 8814: Step-by-Step for Founders

Filing Form 8814 is more straightforward than many founders expect. Here’s a clear breakdown tailored to your startup-life schedule:

Step 1: Gather Your Child’s Investment Income Forms

Collect all 1099-INT and 1099-DIV forms received for your child. Confirm all income shown is passive investment income—no wages or capital gains are allowed for Form 8814.

Step 2: Report Interest and Dividends on the Form

Report all qualifying income in Part I of the form.

Be certain the combined total doesn't surpass the $11,000 limit.

Step 3: Calculate the Tax Owed

Use Part II and III of Form 8814 to calculate any additional tax owed.

The income is generally taxed at the parent's applicable rate, as if it were their own.

Step 4: Attach Form 8814 to Your Return

Include the completed form when filing your Form 1040 or 1040-SR. Do not file a separate return for your child’s income if you’ve included it via Form 8814.

This process can reduce both filing time and mental clutter—founders juggling startup books will appreciate that.

Strategic Considerations for Founders Using Form 8814

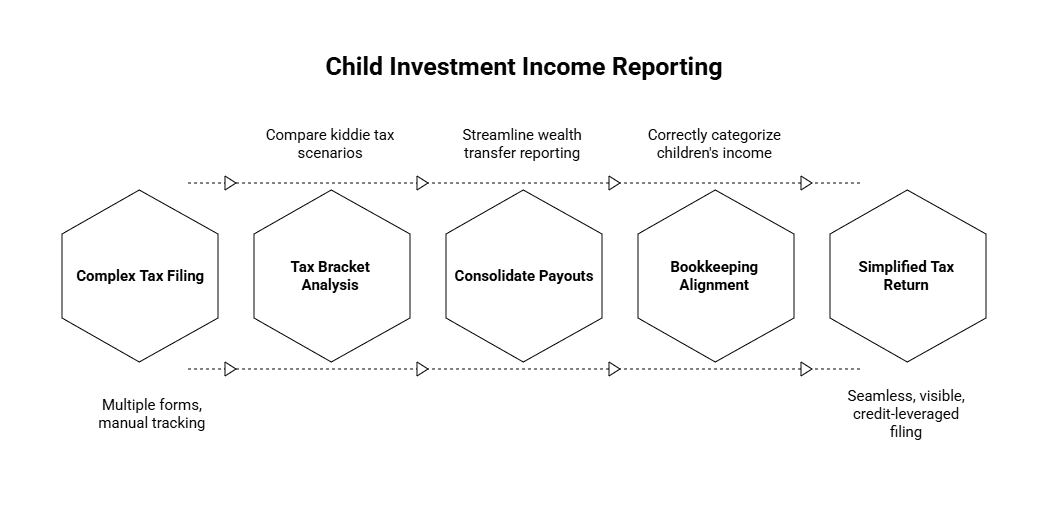

Tax Bracket Analysis: Will It Help or Hurt?

Since the child’s income is taxed at the parent’s rate, a high-income family could actually pay more using Form 8814. Founders in the upper tax brackets (say, 35% or higher) should compare the kiddie tax scenario to the direct inclusion to determine which is favorable.

Startup Equity Held by Minors

Startup founders often give equity to trusts, 529 plans, or custodial accounts. These can generate dividend income that qualifies for Form 8814. The form helps track and consolidate these payouts into one filing—a streamlined approach to wealth transfer and reporting.

Aligning with Bookkeeping and Credits

Make sure your bookkeeping systems correctly categorize children’s investment income. At Haven, our modern books automatically classify interest and dividends from UTMAs or minor-held equity, helping you:

Seamlessly complete your return

Leverage relevant credits like the R&D tax credit

Maintain visibility across personal and corporate tax positions

Explore our full overview of the R&D tax credit and founder strategy to learn more.

Keep Up with IRS Threshold Updates

Thresholds shift. Always use the most current guidance from the official IRS site to confirm annual eligibility, reporting limits, and technical requirements.

Founder Family Tax Scenario: A Practical Example

Let’s say a founder’s 17-year-old son receives $8,000 in dividends from a custodial account funded by early startup stock proceeds. Here’s how using Form 8814 plays out:

The $8,000 is under the $11,000 threshold for the tax year.

The founder chooses to report this investment income under their own 1040 using Form 8814.

The income is taxed at the parent’s 24% marginal rate, avoiding the complexity of kiddie tax rules or filing a separate child return.

Outcome: Fewer headaches, centralized filing, and visibility over tax impacts on family wealth.

Make Form 8814 Work for Your Startup Family Finances

Navigating Form 8814 can be a game-changer for founders who want to consolidate child investment income into one return, simplify reporting, and reduce administrative burden. When properly applied, the form gives you control over tax timing and clarity on how family-held investments impact your broader financial picture.

At Haven, we specialize in helping founders optimize taxes, track income from equity and trusts, and unlock relevant credits like the R&D tax credit—all under one unified approach.

Understanding how to use Form 8814 strategically is a small but significant win in building a tax-savvy legacy for your startup family.

For founders and startup executives navigating complex financial waters, understanding the nuances of tax filings can directly impact cash flow, compliance, and even growth strategy.

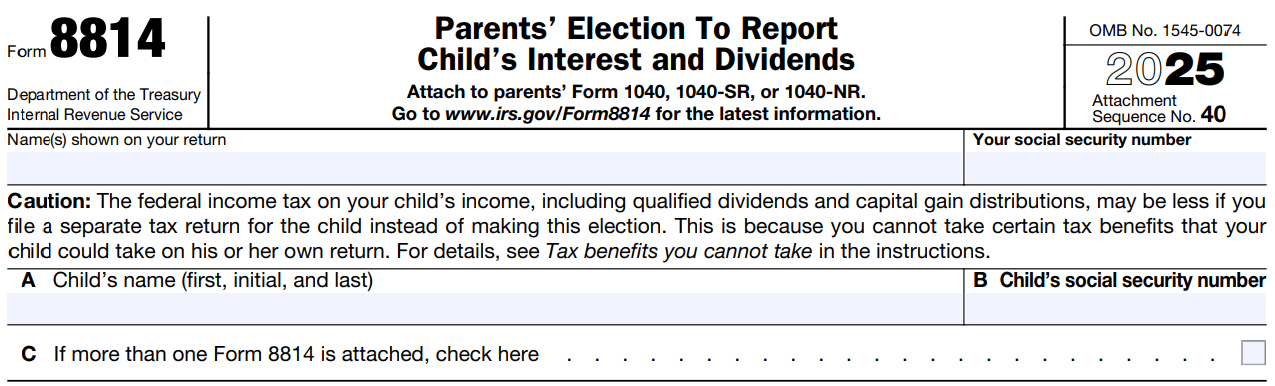

One often overlooked yet highly strategic option is Form 8814, a useful IRS provision allowing parents to report their child's interest and dividends on their tax return. This article will walk you through the essentials of Form 8814, helping founders make smarter tax decisions without getting lost in the technical maze.

What Is Form 8814 and Why Should Founders Care?

Form 8814, officially known as the “Parents’ Election to Report Child’s Interest and Dividends,” offers a way for parents to include their children's investment income under their own tax return. This can simplify filing and, in some cases, reduce overall tax exposure by avoiding the 'kiddie tax', which can apply higher rates to a child’s unearned income.

The Founder's Perspective on Form 8814

Founders often have children who might receive dividends or interest from savings accounts, trusts, or inherited equity stakes — common occurrences in entrepreneurial families. For startups with stock options or equity held for minors, understanding how these earnings are taxed is crucial.

Using Form 8814 means:

Streamlined filing: File your child’s investment income on your tax return instead of preparing a separate return.

Potential tax savings: Depending on tax brackets, it may be advantageous to include the income on the parent’s return.

Avoiding complexity: Reduces the need to calculate kiddie tax separately, which has its own rules and thresholds.

Understanding this form doesn’t replace a tax advisor, but familiarizing yourself with it arms you for smarter planning conversations.

Eligibility and Filing Requirements for Form 8814: A Startup Founder’s Checklist

Before electing to file using Form 8814, check to ensure your situation qualifies. Here’s a helpful resource for founders evaluating eligibility:

Eligibility Criteria for Form 8814 | Explanation | Founder-Specific Notes |

Child must have only interest and dividends | Only unearned income—interest and dividends—qualify. | Equity dividends from seed-stage trusts or UTMAs generally count. |

Child must be under 19 (or under 24 if a full-time student) | Age determines eligibility. | Double-check status of dependents with startup-tied portfolios. |

Child cannot have filed a separate tax return for this income | Election disqualifies separate filing for the same income. | A time-saver for busy founders handling family finances. |

Total interest and dividend income must not exceed $11,000 (2023) | IRS income cap to qualify for Form 8814 in the 2023 tax year. | Monitor multiple accounts to stay under the threshold. |

If you qualify, you complete and attach Form 8814 to your Form 1040 (or 1040-SR) return. If your child earns qualifying income from more than one account, aggregate that carefully. Exceeding the $11,000 limit disqualifies its use.

How to Fill Out Form 8814: Step-by-Step for Founders

Filing Form 8814 is more straightforward than many founders expect. Here’s a clear breakdown tailored to your startup-life schedule:

Step 1: Gather Your Child’s Investment Income Forms

Collect all 1099-INT and 1099-DIV forms received for your child. Confirm all income shown is passive investment income—no wages or capital gains are allowed for Form 8814.

Step 2: Report Interest and Dividends on the Form

Report all qualifying income in Part I of the form.

Be certain the combined total doesn't surpass the $11,000 limit.

Step 3: Calculate the Tax Owed

Use Part II and III of Form 8814 to calculate any additional tax owed.

The income is generally taxed at the parent's applicable rate, as if it were their own.

Step 4: Attach Form 8814 to Your Return

Include the completed form when filing your Form 1040 or 1040-SR. Do not file a separate return for your child’s income if you’ve included it via Form 8814.

This process can reduce both filing time and mental clutter—founders juggling startup books will appreciate that.

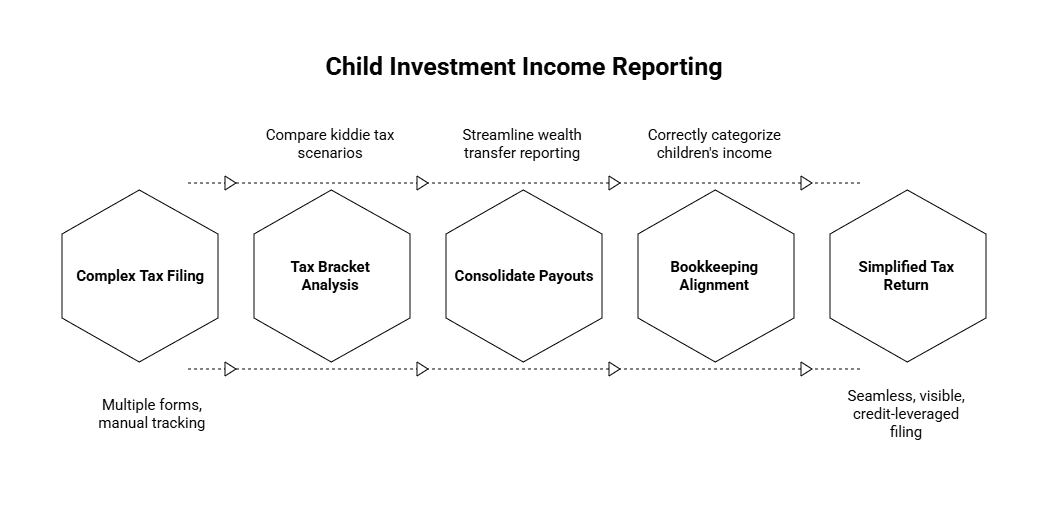

Strategic Considerations for Founders Using Form 8814

Tax Bracket Analysis: Will It Help or Hurt?

Since the child’s income is taxed at the parent’s rate, a high-income family could actually pay more using Form 8814. Founders in the upper tax brackets (say, 35% or higher) should compare the kiddie tax scenario to the direct inclusion to determine which is favorable.

Startup Equity Held by Minors

Startup founders often give equity to trusts, 529 plans, or custodial accounts. These can generate dividend income that qualifies for Form 8814. The form helps track and consolidate these payouts into one filing—a streamlined approach to wealth transfer and reporting.

Aligning with Bookkeeping and Credits

Make sure your bookkeeping systems correctly categorize children’s investment income. At Haven, our modern books automatically classify interest and dividends from UTMAs or minor-held equity, helping you:

Seamlessly complete your return

Leverage relevant credits like the R&D tax credit

Maintain visibility across personal and corporate tax positions

Explore our full overview of the R&D tax credit and founder strategy to learn more.

Keep Up with IRS Threshold Updates

Thresholds shift. Always use the most current guidance from the official IRS site to confirm annual eligibility, reporting limits, and technical requirements.

Founder Family Tax Scenario: A Practical Example

Let’s say a founder’s 17-year-old son receives $8,000 in dividends from a custodial account funded by early startup stock proceeds. Here’s how using Form 8814 plays out:

The $8,000 is under the $11,000 threshold for the tax year.

The founder chooses to report this investment income under their own 1040 using Form 8814.

The income is taxed at the parent’s 24% marginal rate, avoiding the complexity of kiddie tax rules or filing a separate child return.

Outcome: Fewer headaches, centralized filing, and visibility over tax impacts on family wealth.

Make Form 8814 Work for Your Startup Family Finances

Navigating Form 8814 can be a game-changer for founders who want to consolidate child investment income into one return, simplify reporting, and reduce administrative burden. When properly applied, the form gives you control over tax timing and clarity on how family-held investments impact your broader financial picture.

At Haven, we specialize in helping founders optimize taxes, track income from equity and trusts, and unlock relevant credits like the R&D tax credit—all under one unified approach.

Understanding how to use Form 8814 strategically is a small but significant win in building a tax-savvy legacy for your startup family.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026