Go Back

Last Updated :

Last Updated :

Jan 15, 2026

Jan 15, 2026

Form 8615: Filing Rules for Unearned Income of Dependents

As a founder navigating the complex financial landscape of your startup, understanding key tax forms can help you make smarter decisions—not just for your company but also for your family’s financial well-being. Form 8615, commonly known as the “kiddie tax” form, plays a crucial role when it comes to managing unearned income for dependents such as children.

This guide will walk you through the essentials of Form 8615, highlighting important filing rules and how this impacts startup founders with dependents who earn investment or other unearned income.

What is Form 8615 and Why Should Founders Care?

At its core, Form 8615 determines the tax rate applied to certain types of unearned income for children and other dependents under age 19 (or under 24 if a full-time student). This form prevents shifts of investment income to lower tax brackets by applying the parents’ tax rate on such income above a specific threshold, often leading to higher taxes for the child’s unearned income.

As a founder, your family’s financial planning often intersects with your business decisions. If your children or dependents receive dividends, interest, or capital gains—perhaps from your startup’s equity or family investments—a solid grasp of Form 8615 rules ensures you avoid unexpected tax liabilities and optimize overall tax positions.

Quick Overview of Key Filing Rules for Form 8615

Here are the most important points founders should know:

Aspect | Key Detail |

Who Must File | Children under 19 (or 24 if a full-time student) with unearned income > $2,200 in the tax year |

Types of Income Covered | Interest, dividends, capital gains, rents, royalties, and other unearned income |

Tax Rate Applied | Parents’ highest marginal tax rate on income above the $2,200 threshold |

Filing Requirement | Attach Form 8615 to the child’s Form 1040 |

Exception for Own Income | Does not apply if child files jointly, child’s earned income exceeds half of support, or parent unavailable |

For founders, this means when your children earn investment income—perhaps through holdings related to your startup or family investments—their tax burden could jump unexpectedly. Knowing when and how to file Form 8615 is essential.

Unearned Income Impact on Startup Founders’ Financial Planning

Startup founders often maintain family investment accounts or pass on shares or options to dependents as part of wealth planning. Consider these scenarios:

Your child inherits early stock options or shares in the company that produce dividends or capital gains.

Your family holds investments in a trust generating rental income or royalties.

You transfer common stock or other equity with deferred tax benefits.

In all these cases, unearned income may trigger Form 8615 filing and affect your family’s tax landscape. When unearned income crosses the $2,200 threshold, the child’s tax rate on this income aligns with the parents’, possibly increasing the overall tax bill.

How to File Form 8615: Step-by-Step for Founders

Navigating Form 8615 doesn’t have to be intimidating. Here’s a practical walkthrough tailored for busy founders:

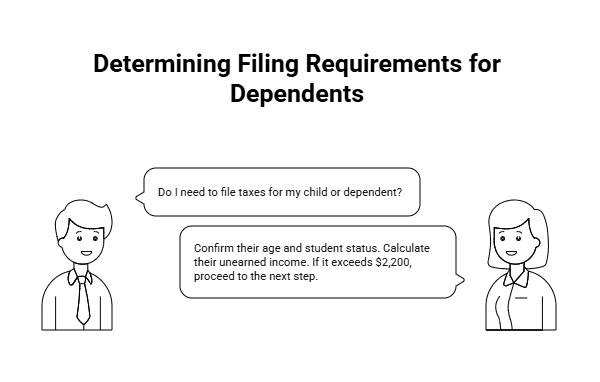

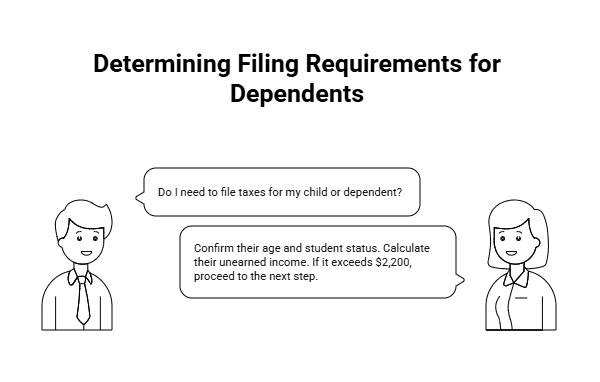

1. Determine if Your Child or Dependent Must File

Confirm age and student status.

Calculate unearned income.

If unearned income exceeds $2,200, proceed to next step.

2. Gather Necessary Information

Parents’ tax return details.

Child’s unearned income statements (1099-DIV, 1099-INT, brokerage statements).

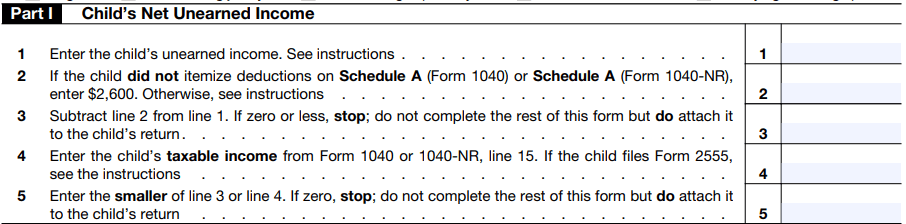

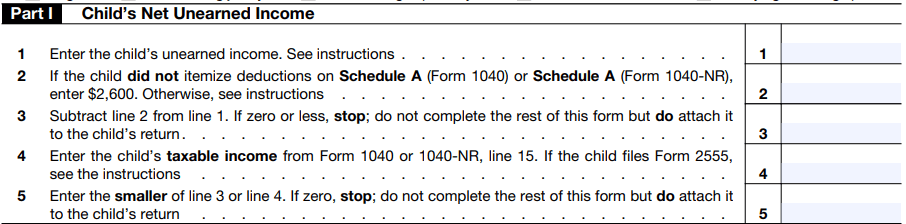

3. Complete the Form 8615 Calculations

Follow the form instructions to compute the tax on unearned income using the parents’ tax rate.

Use IRS worksheets or tax software designed to handle kiddie tax calculations.

4. Attach Form 8615 to the Dependent’s Form 1040

File the child’s tax return including Form 8615.

Parents report relevant income on their returns as usual.

5. Keep Records for Future Tax Years

Maintain investment and income documentation.

Review annually as income thresholds or family situations change.

For foundational knowledge on managing taxes and investment-related forms, see our guide on Form 5329 and Additional Taxes.

Planning Tips to Minimize Kiddie Tax Burden

Consider Gifting Strategies

Leverage Tax-Advantaged Accounts

Monitor Timing of Earnings

Use Professional Guidance for R&D Tax Credits

Learn more in our resource on R&D tax credits for startups.

Interaction With Other Tax Forms and Compliance Considerations

Form 8615 doesn’t operate in isolation. Its interaction with other IRS forms matters:

Form 1040

Form 1099 Series

Form 5329

Alternative Minimum Tax (AMT)

To avoid surprises, founders should adopt an integrated bookkeeping approach. For example, our guide on Bookkeeping for Amazon Sellers shares practical advice on keeping finances clearly separated.

Where to Find Authoritative Guidance

Visit the official IRS page on Tax on Child’s Unearned Income for instructions, worksheets, and FAQs.

Why Founders Should Prioritize Understanding Form 8615

In your role as a founder managing both startup finances and family wealth, understanding Form 8615 is essential. This form directly affects taxation on dependents’ investment income, carrying meaningful implications for your overall tax strategy and cash flow.

At Haven, we specialize in modern bookkeeping and tax filing tailored to startup founders and their evolving financial landscapes. Our founder-friendly team can simplify the complexities of unearned income reporting and form compliance.

As a founder navigating the complex financial landscape of your startup, understanding key tax forms can help you make smarter decisions—not just for your company but also for your family’s financial well-being. Form 8615, commonly known as the “kiddie tax” form, plays a crucial role when it comes to managing unearned income for dependents such as children.

This guide will walk you through the essentials of Form 8615, highlighting important filing rules and how this impacts startup founders with dependents who earn investment or other unearned income.

What is Form 8615 and Why Should Founders Care?

At its core, Form 8615 determines the tax rate applied to certain types of unearned income for children and other dependents under age 19 (or under 24 if a full-time student). This form prevents shifts of investment income to lower tax brackets by applying the parents’ tax rate on such income above a specific threshold, often leading to higher taxes for the child’s unearned income.

As a founder, your family’s financial planning often intersects with your business decisions. If your children or dependents receive dividends, interest, or capital gains—perhaps from your startup’s equity or family investments—a solid grasp of Form 8615 rules ensures you avoid unexpected tax liabilities and optimize overall tax positions.

Quick Overview of Key Filing Rules for Form 8615

Here are the most important points founders should know:

Aspect | Key Detail |

Who Must File | Children under 19 (or 24 if a full-time student) with unearned income > $2,200 in the tax year |

Types of Income Covered | Interest, dividends, capital gains, rents, royalties, and other unearned income |

Tax Rate Applied | Parents’ highest marginal tax rate on income above the $2,200 threshold |

Filing Requirement | Attach Form 8615 to the child’s Form 1040 |

Exception for Own Income | Does not apply if child files jointly, child’s earned income exceeds half of support, or parent unavailable |

For founders, this means when your children earn investment income—perhaps through holdings related to your startup or family investments—their tax burden could jump unexpectedly. Knowing when and how to file Form 8615 is essential.

Unearned Income Impact on Startup Founders’ Financial Planning

Startup founders often maintain family investment accounts or pass on shares or options to dependents as part of wealth planning. Consider these scenarios:

Your child inherits early stock options or shares in the company that produce dividends or capital gains.

Your family holds investments in a trust generating rental income or royalties.

You transfer common stock or other equity with deferred tax benefits.

In all these cases, unearned income may trigger Form 8615 filing and affect your family’s tax landscape. When unearned income crosses the $2,200 threshold, the child’s tax rate on this income aligns with the parents’, possibly increasing the overall tax bill.

How to File Form 8615: Step-by-Step for Founders

Navigating Form 8615 doesn’t have to be intimidating. Here’s a practical walkthrough tailored for busy founders:

1. Determine if Your Child or Dependent Must File

Confirm age and student status.

Calculate unearned income.

If unearned income exceeds $2,200, proceed to next step.

2. Gather Necessary Information

Parents’ tax return details.

Child’s unearned income statements (1099-DIV, 1099-INT, brokerage statements).

3. Complete the Form 8615 Calculations

Follow the form instructions to compute the tax on unearned income using the parents’ tax rate.

Use IRS worksheets or tax software designed to handle kiddie tax calculations.

4. Attach Form 8615 to the Dependent’s Form 1040

File the child’s tax return including Form 8615.

Parents report relevant income on their returns as usual.

5. Keep Records for Future Tax Years

Maintain investment and income documentation.

Review annually as income thresholds or family situations change.

For foundational knowledge on managing taxes and investment-related forms, see our guide on Form 5329 and Additional Taxes.

Planning Tips to Minimize Kiddie Tax Burden

Consider Gifting Strategies

Leverage Tax-Advantaged Accounts

Monitor Timing of Earnings

Use Professional Guidance for R&D Tax Credits

Learn more in our resource on R&D tax credits for startups.

Interaction With Other Tax Forms and Compliance Considerations

Form 8615 doesn’t operate in isolation. Its interaction with other IRS forms matters:

Form 1040

Form 1099 Series

Form 5329

Alternative Minimum Tax (AMT)

To avoid surprises, founders should adopt an integrated bookkeeping approach. For example, our guide on Bookkeeping for Amazon Sellers shares practical advice on keeping finances clearly separated.

Where to Find Authoritative Guidance

Visit the official IRS page on Tax on Child’s Unearned Income for instructions, worksheets, and FAQs.

Why Founders Should Prioritize Understanding Form 8615

In your role as a founder managing both startup finances and family wealth, understanding Form 8615 is essential. This form directly affects taxation on dependents’ investment income, carrying meaningful implications for your overall tax strategy and cash flow.

At Haven, we specialize in modern bookkeeping and tax filing tailored to startup founders and their evolving financial landscapes. Our founder-friendly team can simplify the complexities of unearned income reporting and form compliance.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026