Go Back

Last Updated :

Last Updated :

Jan 19, 2026

Jan 19, 2026

Form 8582 Guide: Managing Passive Activity Loss Limitations for Business Investors

Form 8582 is the IRS form that governs how you calculate, report, and ultimately deduct such losses on your tax returns.

As a founder or business leader, financial and tax decisions have a considerable impact on your company’s cash flow, investment strategy, and long-term sustainability. One crucial, yet often confusing, area for many investors and business owners involved in multiple ventures is how to handle passive activity losses (PALs) and their limitations.

This article unpacks the complexities involved in managing passive activity loss limitations. We’ll cover what constitutes passive activity, how Form 8582 works, its role in loss limitation, key IRS rules you need to know, and strategies to optimize your deductions.

What is Form 8582 and Why Does It Matter to Business Investors?

Form 8582, officially titled Passive Activity Loss Limitations, is used to report income and losses from passive activities and determine how much of those losses can be deducted in the current tax year. It also tracks losses that cannot be used immediately and must be carried forward to future years.

For founders and startup investors, Form 8582 often becomes relevant when income extends beyond operating businesses into real estate, fund investments, or minority ownership stakes.

Understanding Passive Activities and Passive Activity Losses (PALs)

The Internal Revenue Service defines a passive activity as a trade or business in which the taxpayer does not materially participate. In practice, this commonly includes:

Rental real estate where you are not involved in day-to-day management

Investments in LLCs, partnerships, or S corporations where your role is primarily that of an investor

Businesses where your involvement is limited, non-operational, or advisory

Losses generated from these activities are classified as passive activity losses (PALs).

The key rule is straightforward but often misunderstood:

PALs can generally be deducted only against passive income, not against active income such as wages, founder compensation, or profits from businesses where you materially participate.

Why Is This Important?

Consider a founder who invests in a rental property that generates a $50,000 loss for the year. If that activity is classified as passive, the loss typically cannot be used to offset salary or operating business income.

Instead, the loss may be suspended and carried forward until one of the following occurs:

The investor generates sufficient passive income

The property or investment is disposed of in a taxable transaction

A specific exception applies

Form 8582 is what ensures these limitations are calculated correctly and that suspended losses are tracked year over year, rather than lost or incorrectly deducted.

Who Needs to File Form 8582?

As a founder or investor, you’ll need to file Form 8582 if:

You have passive activity losses or credits for the tax year

You have rental real estate activities or investments in partnerships, S-corporations, or LLCs considered passive under IRS rules

You need to figure out how many PALs you can deduct this year versus what must be suspended

You have income from passive activities to offset

Exceptions apply if your modified adjusted gross income (MAGI) is below certain thresholds or if you qualify as a real estate professional under IRS standards (more on that shortly).

If you are new to how Form 8582 impacts your tax planning, it's wise to consult detailed Business Tax Compliance resources or professional advice to manage multi-entity income, deductions, and ongoing IRS compliance obligations.

Key Components of Form 8582

Form 8582 consists of multiple sections. As an entrepreneur, here are the parts to know:

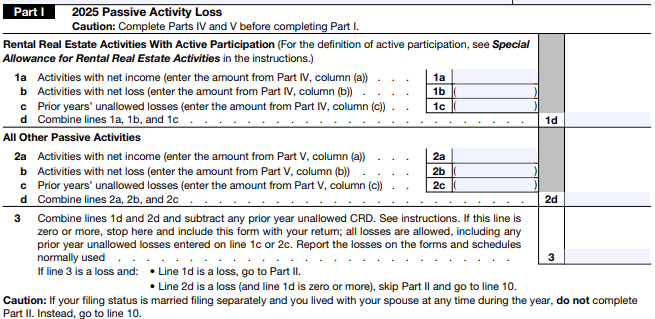

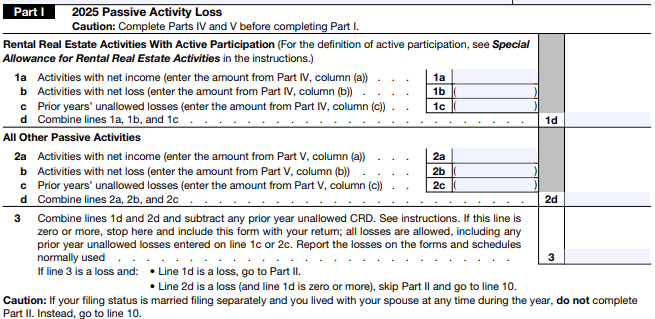

Part I: Income or Loss From Passive Activities

List your total passive income and total passive losses

Establishes net passive income available to offset losses

Part II: Special Allowance for Rental Real Estate Activities With Active Participation

Allows certain taxpayers to deduct up to $25,000 of passive losses from rental real estate with active involvement if MAGI is under $100,000

The deduction phases out between $100,000–$150,000 of MAGI

Part III: At-Risk Amounts and Suspended Losses

Ensures you don’t deduct losses greater than the amount you’ve financially invested (your amount "at-risk"")

Tracks losses suspended due to these limitations or previously unallowed PALs

Carryforwards of Passive Losses

Disallowed losses don’t disappear—they get carried forward to future tax years until one of the following happens:

You generate enough passive income in the future to absorb them

You completely dispose of the passive activity, triggering full deductibility

Material Participation vs. Passive Involvement: Founders Must Know the Difference

The distinction between material participation and passive involvement is foundational to correctly filing Form 8582.

Material participation means you’re involved in operations on a regular, continuous, substantial basis (as defined by IRS tests). Think: running your agency daily, managing your startup hands-on.

If you materially participate, your losses are non-passive, and don’t go on Form 8582.

If you don’t meet that standard (common in investment scenarios), your activities are passive, and deductibility is limited.

One notable exception: if real estate is central to your work, the real estate professional designation may qualify you to treat rental losses as non-passive. This requires over 750 hours of material participation annually and that over half your working year be spent in real estate activities.

Common Scenarios Where Form 8582 Applies to Founders

Scenario | Form 8582 Treatment | Founder Insight |

Passive investment in multiple LLCs or partnerships | Losses are limited to net income from all passive activities | Aggregate passive streams carefully |

Rental real estate with some management involvement | May qualify for the $25,000 special allowance | Track hours/involvement to claim the exemption |

Active business with some passive side ventures | Only passive activity losses go on Form 8582 | Segment business and passive roles for clarity |

Exit from passive investment | Suspended losses become deductible in full | Plan exits to unlock carried forward losses |

Calculating and Reporting Passive Losses on Form 8582

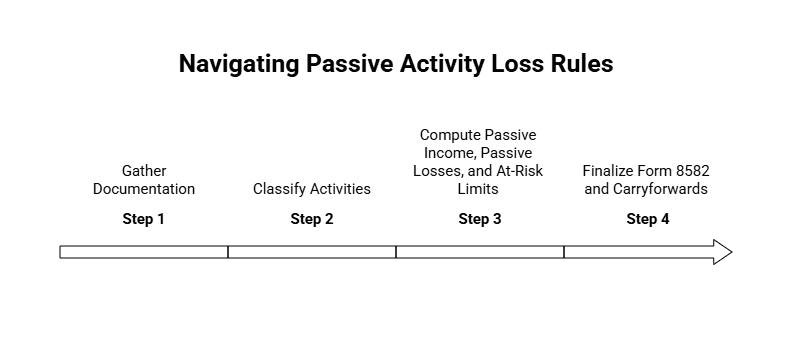

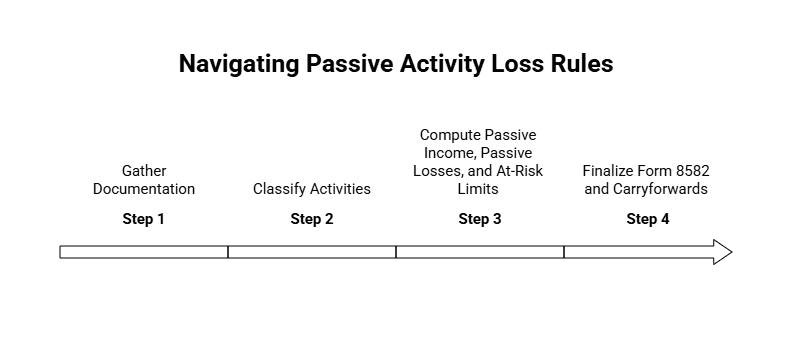

Form 8582 is mechanical. The goal is to correctly classify activities, calculate allowable losses, and track what must be carried forward. The steps below reflect how the process works in practice.

Step 1: Gather Documentation

Before touching the form, assemble all source data used in the calculations:

Schedule K-1s from partnerships and S corporations

Rental property statements showing income, expenses, and depreciation

Records of involvement (hours worked, management duties, decision-making authority)

Prior-year suspended loss schedules from earlier Form 8582 filings

Missing prior-year carryforwards is one of the most common causes of incorrect filings.

Step 2: Classify Activities

Each activity must be evaluated separately using the IRS material participation tests. The classification determines whether losses are currently deductible or restricted.

Activities where you materially participate are treated as active

Activities where participation is limited or investment-only are treated as passive

Incorrect classification here cascades through the rest of the form and often triggers IRS adjustments.

Step 3: Compute Passive Income, Passive Losses, and At-Risk Limits

Next, compute totals using IRS worksheets:

Aggregate passive income and passive losses across all passive activities

Apply at-risk rules to determine whether losses are limited further (often requiring Form 6198)

Evaluate rental real estate exceptions, such as the $25,000 special allowance or real estate professional status

Only losses that clear both passive activity and at-risk rules are potentially deductible.

Step 4: Complete Form 8582 and Track Carryforwards

Form 8582 determines:

The allowable passive loss deduction for the current year

The disallowed portion, which becomes a suspended loss carry-forward

Suspended losses must be tracked year over year and can only be released when passive income is generated or the activity is fully disposed of in a taxable transaction. Accurate recordkeeping is critical for future IRS filings.

For more tax strategies designed for lean, fast-moving businesses, see our Small Business Tax Planning Guide.

IRS Rules That Affect Form 8582 Use and Reporting

MAGI Thresholds

Modified Adjusted Gross Income directly impacts deduction eligibility. You lose access to the $25,000 rental deduction around $150,000 of MAGI.

At-Risk Rules

Don't deduct more than you’ve invested (aka, what’s ""at-risk""). You may need to fill out Form 6198 in addition to Form 8582.

Grouping Passive Activities

You can group all similar passive activities into one for IRS reporting. This may help offset losses against income and simplify compliance—but make sure grouping is appropriate by IRS standards.

Carryforwards of Disallowed Losses

Track and report unauthorized losses year over year until:

Sufficient passive income appears

Complete disposition of the passive asset

Strategies for Startup Founders Looking to Maximize PAL Deductions

Document your hours and role—solid evidence of material participation saves time and protects deductions.

Bundle passive income across investments to gain better offset opportunities.

Time your investments and exits—dispose of loss-carrying assets when they yield a favorable deduction opportunity.

Monitor MAGI actively and configure revenue disbursements accordingly.

Use startup-savvy tax professionals who understand tech-forward, founder-friendly approaches to PAL tracking, at-risk calculations, and reporting.

Ready to take control of your passive activity losses and maximize your tax benefits? Our expert team specializes in modern bookkeeping and tax strategies tailored to US startups and growth-stage businesses.

Form 8582 is the IRS form that governs how you calculate, report, and ultimately deduct such losses on your tax returns.

As a founder or business leader, financial and tax decisions have a considerable impact on your company’s cash flow, investment strategy, and long-term sustainability. One crucial, yet often confusing, area for many investors and business owners involved in multiple ventures is how to handle passive activity losses (PALs) and their limitations.

This article unpacks the complexities involved in managing passive activity loss limitations. We’ll cover what constitutes passive activity, how Form 8582 works, its role in loss limitation, key IRS rules you need to know, and strategies to optimize your deductions.

What is Form 8582 and Why Does It Matter to Business Investors?

Form 8582, officially titled Passive Activity Loss Limitations, is used to report income and losses from passive activities and determine how much of those losses can be deducted in the current tax year. It also tracks losses that cannot be used immediately and must be carried forward to future years.

For founders and startup investors, Form 8582 often becomes relevant when income extends beyond operating businesses into real estate, fund investments, or minority ownership stakes.

Understanding Passive Activities and Passive Activity Losses (PALs)

The Internal Revenue Service defines a passive activity as a trade or business in which the taxpayer does not materially participate. In practice, this commonly includes:

Rental real estate where you are not involved in day-to-day management

Investments in LLCs, partnerships, or S corporations where your role is primarily that of an investor

Businesses where your involvement is limited, non-operational, or advisory

Losses generated from these activities are classified as passive activity losses (PALs).

The key rule is straightforward but often misunderstood:

PALs can generally be deducted only against passive income, not against active income such as wages, founder compensation, or profits from businesses where you materially participate.

Why Is This Important?

Consider a founder who invests in a rental property that generates a $50,000 loss for the year. If that activity is classified as passive, the loss typically cannot be used to offset salary or operating business income.

Instead, the loss may be suspended and carried forward until one of the following occurs:

The investor generates sufficient passive income

The property or investment is disposed of in a taxable transaction

A specific exception applies

Form 8582 is what ensures these limitations are calculated correctly and that suspended losses are tracked year over year, rather than lost or incorrectly deducted.

Who Needs to File Form 8582?

As a founder or investor, you’ll need to file Form 8582 if:

You have passive activity losses or credits for the tax year

You have rental real estate activities or investments in partnerships, S-corporations, or LLCs considered passive under IRS rules

You need to figure out how many PALs you can deduct this year versus what must be suspended

You have income from passive activities to offset

Exceptions apply if your modified adjusted gross income (MAGI) is below certain thresholds or if you qualify as a real estate professional under IRS standards (more on that shortly).

If you are new to how Form 8582 impacts your tax planning, it's wise to consult detailed Business Tax Compliance resources or professional advice to manage multi-entity income, deductions, and ongoing IRS compliance obligations.

Key Components of Form 8582

Form 8582 consists of multiple sections. As an entrepreneur, here are the parts to know:

Part I: Income or Loss From Passive Activities

List your total passive income and total passive losses

Establishes net passive income available to offset losses

Part II: Special Allowance for Rental Real Estate Activities With Active Participation

Allows certain taxpayers to deduct up to $25,000 of passive losses from rental real estate with active involvement if MAGI is under $100,000

The deduction phases out between $100,000–$150,000 of MAGI

Part III: At-Risk Amounts and Suspended Losses

Ensures you don’t deduct losses greater than the amount you’ve financially invested (your amount "at-risk"")

Tracks losses suspended due to these limitations or previously unallowed PALs

Carryforwards of Passive Losses

Disallowed losses don’t disappear—they get carried forward to future tax years until one of the following happens:

You generate enough passive income in the future to absorb them

You completely dispose of the passive activity, triggering full deductibility

Material Participation vs. Passive Involvement: Founders Must Know the Difference

The distinction between material participation and passive involvement is foundational to correctly filing Form 8582.

Material participation means you’re involved in operations on a regular, continuous, substantial basis (as defined by IRS tests). Think: running your agency daily, managing your startup hands-on.

If you materially participate, your losses are non-passive, and don’t go on Form 8582.

If you don’t meet that standard (common in investment scenarios), your activities are passive, and deductibility is limited.

One notable exception: if real estate is central to your work, the real estate professional designation may qualify you to treat rental losses as non-passive. This requires over 750 hours of material participation annually and that over half your working year be spent in real estate activities.

Common Scenarios Where Form 8582 Applies to Founders

Scenario | Form 8582 Treatment | Founder Insight |

Passive investment in multiple LLCs or partnerships | Losses are limited to net income from all passive activities | Aggregate passive streams carefully |

Rental real estate with some management involvement | May qualify for the $25,000 special allowance | Track hours/involvement to claim the exemption |

Active business with some passive side ventures | Only passive activity losses go on Form 8582 | Segment business and passive roles for clarity |

Exit from passive investment | Suspended losses become deductible in full | Plan exits to unlock carried forward losses |

Calculating and Reporting Passive Losses on Form 8582

Form 8582 is mechanical. The goal is to correctly classify activities, calculate allowable losses, and track what must be carried forward. The steps below reflect how the process works in practice.

Step 1: Gather Documentation

Before touching the form, assemble all source data used in the calculations:

Schedule K-1s from partnerships and S corporations

Rental property statements showing income, expenses, and depreciation

Records of involvement (hours worked, management duties, decision-making authority)

Prior-year suspended loss schedules from earlier Form 8582 filings

Missing prior-year carryforwards is one of the most common causes of incorrect filings.

Step 2: Classify Activities

Each activity must be evaluated separately using the IRS material participation tests. The classification determines whether losses are currently deductible or restricted.

Activities where you materially participate are treated as active

Activities where participation is limited or investment-only are treated as passive

Incorrect classification here cascades through the rest of the form and often triggers IRS adjustments.

Step 3: Compute Passive Income, Passive Losses, and At-Risk Limits

Next, compute totals using IRS worksheets:

Aggregate passive income and passive losses across all passive activities

Apply at-risk rules to determine whether losses are limited further (often requiring Form 6198)

Evaluate rental real estate exceptions, such as the $25,000 special allowance or real estate professional status

Only losses that clear both passive activity and at-risk rules are potentially deductible.

Step 4: Complete Form 8582 and Track Carryforwards

Form 8582 determines:

The allowable passive loss deduction for the current year

The disallowed portion, which becomes a suspended loss carry-forward

Suspended losses must be tracked year over year and can only be released when passive income is generated or the activity is fully disposed of in a taxable transaction. Accurate recordkeeping is critical for future IRS filings.

For more tax strategies designed for lean, fast-moving businesses, see our Small Business Tax Planning Guide.

IRS Rules That Affect Form 8582 Use and Reporting

MAGI Thresholds

Modified Adjusted Gross Income directly impacts deduction eligibility. You lose access to the $25,000 rental deduction around $150,000 of MAGI.

At-Risk Rules

Don't deduct more than you’ve invested (aka, what’s ""at-risk""). You may need to fill out Form 6198 in addition to Form 8582.

Grouping Passive Activities

You can group all similar passive activities into one for IRS reporting. This may help offset losses against income and simplify compliance—but make sure grouping is appropriate by IRS standards.

Carryforwards of Disallowed Losses

Track and report unauthorized losses year over year until:

Sufficient passive income appears

Complete disposition of the passive asset

Strategies for Startup Founders Looking to Maximize PAL Deductions

Document your hours and role—solid evidence of material participation saves time and protects deductions.

Bundle passive income across investments to gain better offset opportunities.

Time your investments and exits—dispose of loss-carrying assets when they yield a favorable deduction opportunity.

Monitor MAGI actively and configure revenue disbursements accordingly.

Use startup-savvy tax professionals who understand tech-forward, founder-friendly approaches to PAL tracking, at-risk calculations, and reporting.

Ready to take control of your passive activity losses and maximize your tax benefits? Our expert team specializes in modern bookkeeping and tax strategies tailored to US startups and growth-stage businesses.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026