Go Back

Last Updated :

Last Updated :

Jan 15, 2026

Jan 15, 2026

Form 5472: How to Report Foreign Ownership Requirements

For founders of U.S.-based startups, agencies, and e-commerce companies with foreign ownership, navigating reporting requirements can be complex and time-consuming. One vital tax form that often catches founders by surprise is Form 5472. This form is crucial for certain U.S. corporations with foreign owners or related party transactions, and failing to file it correctly can lead to significant penalties and compliance headaches.

This guide breaks down the essentials of Form 5472, explaining what it is, who needs to file it, and how to approach the filing process to minimize business disruption and keep your corporate taxes on the right track. We’ll also discuss practical tips for founders to maintain compliant financial records, streamline reporting with strategic bookkeeping, and leverage expert support to reduce audit risk.

What is Form 5472 and Why Does It Matter for Founders?

Form 5472, “Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business,” is an IRS disclosure form used to report transactions between a U.S. corporation and related foreign parties.

Who Must File Form 5472?

U.S. corporations that are at least 25% foreign-owned directly or indirectly.

Foreign corporations engaged in a U.S. trade or business.

For founders of startups and small to medium-sized businesses, this usually means if a non-U.S. person or entity holds 25% or more of your company’s ownership, your corporation is obligated to file Form 5472 if any reportable transactions occurred during the tax year.

What Are Reportable Transactions?

Reportable transactions include:

Sales and purchases of inventory or equipment

Rent or lease payments

Interest or loans

Royalties or licensing fees

Capital contributions or distributions

If your startup engaged in any of these transactions with a foreign 25%-or-more owner or related party, you must report them on Form 5472.

Why Form 5472 Matters for Founders

Many founders underestimate the complexity and risk related to Form 5472. Beyond IRS compliance, this form sheds light on cross-border financial activity that can impact funding structures, cash flow, and even credits like the R&D tax credit.

Penalties for failing to file Form 5472 are steep—starting at $25,000 per tax year, with additional penalties accruing if the failure continues after IRS notice.

For additional guidance on corporate tax filing basics that complement your Form 5472 compliance, see our Form 1120 Guide for Founders.

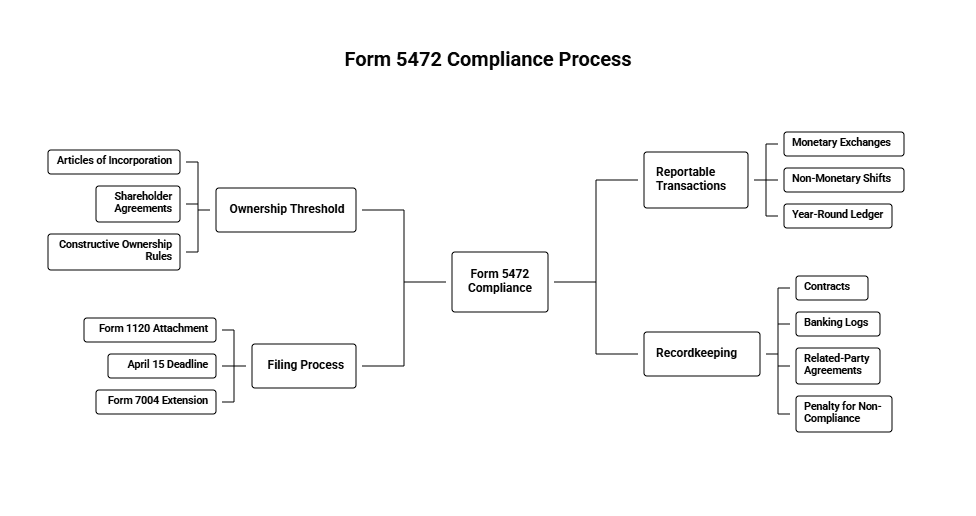

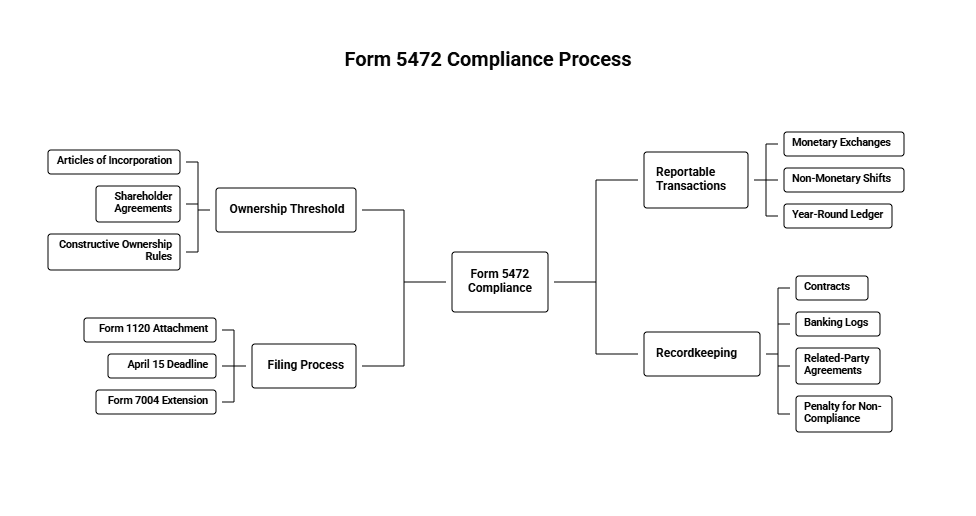

How Founders Should Approach Form 5472 Filing

Identify Ownership and Related Parties

Begin by determining whether your company meets the foreign ownership threshold:

Review Articles of Incorporation, shareholder agreements, and investment documents

Identify direct or indirect foreign ownership of 25% or more

Clarify complex cap tables with advisors

Understand Reportable Transactions

Gather documentation on cross-border financial activity, including:

Loan agreements

Purchases or sales of services

Royalties and IP licenses

Capital contributions and dividends

Lease agreements

Accurate and detailed records make filing significantly easier.

Prepare Your Reporting Materials

Form 5472 is attached to your corporate income tax return (Form 1120), and it requires:

Dollar amounts of each transaction

Related party details

Alignment with your financial statements

Many founders pair this process with structured bookkeeping systems that tag related party activities — a best practice reinforced in our Business Tax Compliance overview.

File on Time

Key deadlines:

Due annually with Form 1120

Calendar-year entities: April 15 (extensions push to October 15)

Maintain Long-Term Records

Maintain for a minimum of 3 years:

Contracts

Banking and transaction logs

Related-party agreements

Tips for Managing Form 5472 Compliance

Before preparing Form 5472, it’s helpful to put a few foundational practices in place. The tips below outline simple steps that strengthen your recordkeeping, reduce errors, and make annual compliance much easier to manage.

Tip | Explanation |

Build a Robust Bookkeeping System | Track and tag related party transactions automatically. |

Assign Ownership Monitoring Roles | Keep investor updates reflected in your financial system. |

Involve Tax Advisors Early | Spot risks before filing season. |

Centralize Foreign Entity Data | Make cross-border reporting more efficient. |

Monitor IRS Updates | Stay current via IRS.gov. |

Broader Tax Implications of Foreign Ownership

Foreign ownership frequently intersects with other tax areas:

Transfer pricing requirements

R&D tax credit eligibility

Multi-form alignment across filings

Explore more startup tax obligations in our Business Tax Services or in-depth IRS resources like the R&D Credit Information Page.

Positioning Your Company for Long-Term Compliance Success

For U.S.-based founders with foreign investors or related entities, Form 5472 is a critical compliance requirement. Proper reporting protects your company from penalties, ensures tax transparency, and supports long-term financial stability.

By tracking ownership, maintaining organized records, and partnering with tax professionals, founders can reduce compliance burdens and stay focused on growth.

At Haven, we specialize in assisting US startups with modern bookkeeping, tax filing, and foreign ownership reporting.

For founders of U.S.-based startups, agencies, and e-commerce companies with foreign ownership, navigating reporting requirements can be complex and time-consuming. One vital tax form that often catches founders by surprise is Form 5472. This form is crucial for certain U.S. corporations with foreign owners or related party transactions, and failing to file it correctly can lead to significant penalties and compliance headaches.

This guide breaks down the essentials of Form 5472, explaining what it is, who needs to file it, and how to approach the filing process to minimize business disruption and keep your corporate taxes on the right track. We’ll also discuss practical tips for founders to maintain compliant financial records, streamline reporting with strategic bookkeeping, and leverage expert support to reduce audit risk.

What is Form 5472 and Why Does It Matter for Founders?

Form 5472, “Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business,” is an IRS disclosure form used to report transactions between a U.S. corporation and related foreign parties.

Who Must File Form 5472?

U.S. corporations that are at least 25% foreign-owned directly or indirectly.

Foreign corporations engaged in a U.S. trade or business.

For founders of startups and small to medium-sized businesses, this usually means if a non-U.S. person or entity holds 25% or more of your company’s ownership, your corporation is obligated to file Form 5472 if any reportable transactions occurred during the tax year.

What Are Reportable Transactions?

Reportable transactions include:

Sales and purchases of inventory or equipment

Rent or lease payments

Interest or loans

Royalties or licensing fees

Capital contributions or distributions

If your startup engaged in any of these transactions with a foreign 25%-or-more owner or related party, you must report them on Form 5472.

Why Form 5472 Matters for Founders

Many founders underestimate the complexity and risk related to Form 5472. Beyond IRS compliance, this form sheds light on cross-border financial activity that can impact funding structures, cash flow, and even credits like the R&D tax credit.

Penalties for failing to file Form 5472 are steep—starting at $25,000 per tax year, with additional penalties accruing if the failure continues after IRS notice.

For additional guidance on corporate tax filing basics that complement your Form 5472 compliance, see our Form 1120 Guide for Founders.

How Founders Should Approach Form 5472 Filing

Identify Ownership and Related Parties

Begin by determining whether your company meets the foreign ownership threshold:

Review Articles of Incorporation, shareholder agreements, and investment documents

Identify direct or indirect foreign ownership of 25% or more

Clarify complex cap tables with advisors

Understand Reportable Transactions

Gather documentation on cross-border financial activity, including:

Loan agreements

Purchases or sales of services

Royalties and IP licenses

Capital contributions and dividends

Lease agreements

Accurate and detailed records make filing significantly easier.

Prepare Your Reporting Materials

Form 5472 is attached to your corporate income tax return (Form 1120), and it requires:

Dollar amounts of each transaction

Related party details

Alignment with your financial statements

Many founders pair this process with structured bookkeeping systems that tag related party activities — a best practice reinforced in our Business Tax Compliance overview.

File on Time

Key deadlines:

Due annually with Form 1120

Calendar-year entities: April 15 (extensions push to October 15)

Maintain Long-Term Records

Maintain for a minimum of 3 years:

Contracts

Banking and transaction logs

Related-party agreements

Tips for Managing Form 5472 Compliance

Before preparing Form 5472, it’s helpful to put a few foundational practices in place. The tips below outline simple steps that strengthen your recordkeeping, reduce errors, and make annual compliance much easier to manage.

Tip | Explanation |

Build a Robust Bookkeeping System | Track and tag related party transactions automatically. |

Assign Ownership Monitoring Roles | Keep investor updates reflected in your financial system. |

Involve Tax Advisors Early | Spot risks before filing season. |

Centralize Foreign Entity Data | Make cross-border reporting more efficient. |

Monitor IRS Updates | Stay current via IRS.gov. |

Broader Tax Implications of Foreign Ownership

Foreign ownership frequently intersects with other tax areas:

Transfer pricing requirements

R&D tax credit eligibility

Multi-form alignment across filings

Explore more startup tax obligations in our Business Tax Services or in-depth IRS resources like the R&D Credit Information Page.

Positioning Your Company for Long-Term Compliance Success

For U.S.-based founders with foreign investors or related entities, Form 5472 is a critical compliance requirement. Proper reporting protects your company from penalties, ensures tax transparency, and supports long-term financial stability.

By tracking ownership, maintaining organized records, and partnering with tax professionals, founders can reduce compliance burdens and stay focused on growth.

At Haven, we specialize in assisting US startups with modern bookkeeping, tax filing, and foreign ownership reporting.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026