Go Back

Last Updated :

Last Updated :

Jan 15, 2026

Jan 15, 2026

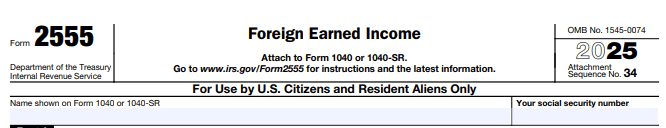

Foreign Earned Income Exclusion Guide for Startup Founders (Form 2555 Explained)

For founders and startup leaders managing the complexities of global income, understanding Form 2555 is essential. This IRS form allows eligible taxpayers to exclude a portion of their foreign earned income from U.S. taxation, which can significantly reduce tax liability for founders working abroad or from multiple international hubs.

In this detailed guide, we’ll walk through everything you need to know about Form 2555, including eligibility criteria, how to claim the Foreign Earned Income Exclusion (FEIE), and strategic considerations tailored specifically for founders running startups, agencies, and e-commerce companies.

Why Founders Should Care About Form 2555

Form 2555, officially titled “Foreign Earned Income,” is the key to claiming the Foreign Earned Income Exclusion, which allows qualifying U.S. citizens or resident aliens living and working abroad to exclude up to $120,000 (for tax year 2023) of foreign earned income from U.S. taxation. This cap adjusts annually for inflation, so staying current is important.

Why does this matter for founders?

Global operating models: Many founders alternate between the U.S. and international locations or run remotely distributed teams.

Multiple revenue channels: Founders may draw income from foreign subsidiaries, consulting arrangements, or agency clients overseas.

Smarter tax planning: Using FEIE via Form 2555 effectively improves cash flow, enabling greater reinvestment into your business.

For founders, mastering this form ensures better alignment between tax strategies and global scaling ambitions—minimizing friction and unlocking resources to grow faster.

For how the tax filing process fits into your business structure, explore Haven’s business tax services, which offer personalized support built for startups and founders like you.

Who Can Use Form 2555: Eligibility Requirements

Before you claim the foreign earned income exclusion, you must meet specific IRS criteria. Here's a founder-focused breakdown:

Eligibility Requirement | Founder-Friendly Interpretation |

U.S. Citizen or Resident Alien | Must be a U.S. citizen or lawful permanent resident. |

Earn Foreign Income | Income must be earned abroad through employment or self-employment (e.g., contracts, salaries, service revenue). |

Tax Home Outside U.S. | Your primary work base is overseas—not just temporary travel. |

Pass One of Two Residency Tests | Either the Physical Presence Test or Bona Fide Residence Test. See below. |

Physical Presence Test

You must spend at least 330 full days in a foreign country within a 12-month period.

Perfect for digital nomad founders or those working across global client hubs.

Bona Fide Residence Test

You’ve lived in a foreign country for at least one uninterrupted tax year.

You typically must maintain residency, lease/rent housing, and establish ties (e.g., bank accounts, local taxation).

Founders operating from multiple countries should pay attention to travel logs and visa details to ensure they qualify under one of these methods.

How to Complete Form 2555 (Step-by-Step)

Knowing what's required for filing doesn’t just bring peace of mind—it helps you prepare earlier and catch errors that could cost real money.

Step 1: Gather Essential Documentation

You’ll need:

Passport and travel logs to support presence/residency

Foreign tax documents and pay statements

Evidence of a foreign home (rental contracts, utility bills)

Proof of salary or self-employment income abroad

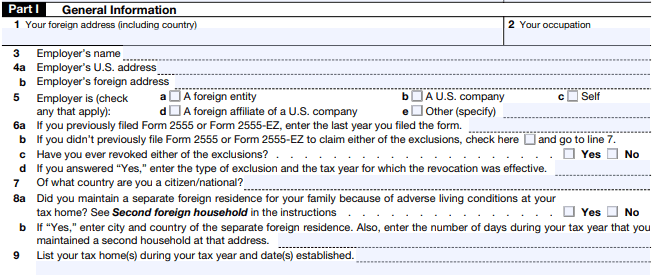

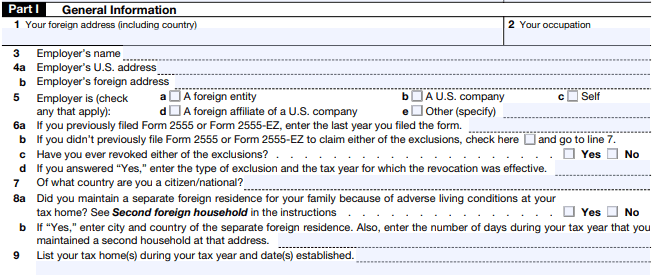

Step 2: Fill Out Part I – General Information

Enter basic personal details, the tax year, and whether you qualify under the physical presence test or bona fide residence.

Step 3: Identify Your Foreign Tax Home (Part II)

Indicate where your principal place of employment is located. Founders running startups or agencies abroad must document ownership structure and business registration country.

Step 4: Complete Residency Qualification (Part III)

Choose which test you're applying under.

Use precise date tracking for the 330-day rule.

For bona fide residents, ensure you’ve lived in one country throughout the entire tax year.

Step 5: Calculate Foreign Earned Income Exclusion (Part IV)

List all qualifying foreign income up to the allowable exclusion.

For 2023, this exclusion is $120,000 per person.

Salary and consulting income count—equity gains and dividends typically do not.

Step 6: (Optional) Claim the Foreign Housing Exclusion (Part V)

If your housing costs exceed a specified amount and you're living abroad, you may qualify for additional exclusions.

This can include rent, utilities (but not phone/internet), insurance, and household repairs.

Actual eligibility limits vary per city and country—founders living in high-cost cities should double-check IRS guidelines.

See the IRS’ official housing exclusion instructions for details.

Step 7: Attach Form 2555 to Your Tax Return

Submit it alongside your Form 1040. The standard due date is April 15 (June 15 if you’re living abroad, but interest may still accrue). Keep digital and paper records for all supporting evidence

If you're choosing between S-Corp and international pass-through options, check out Haven’s Form 2553 Guide.

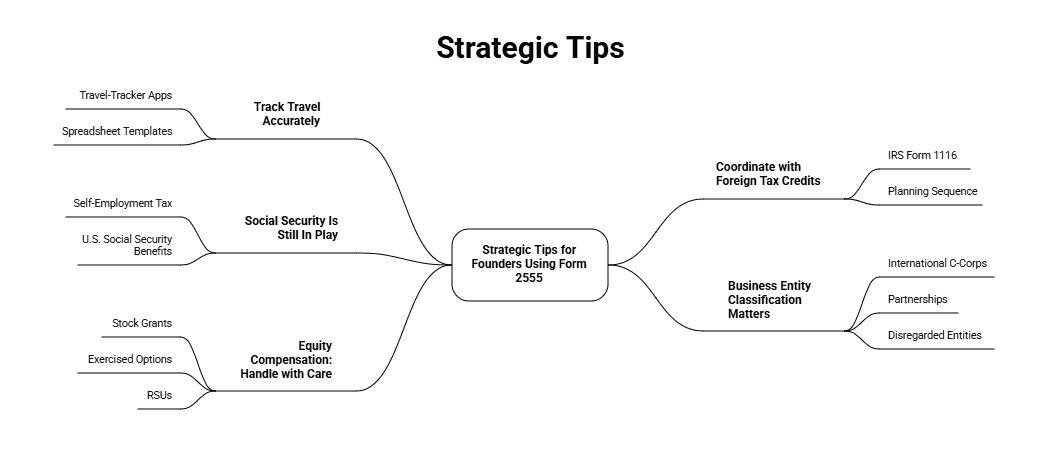

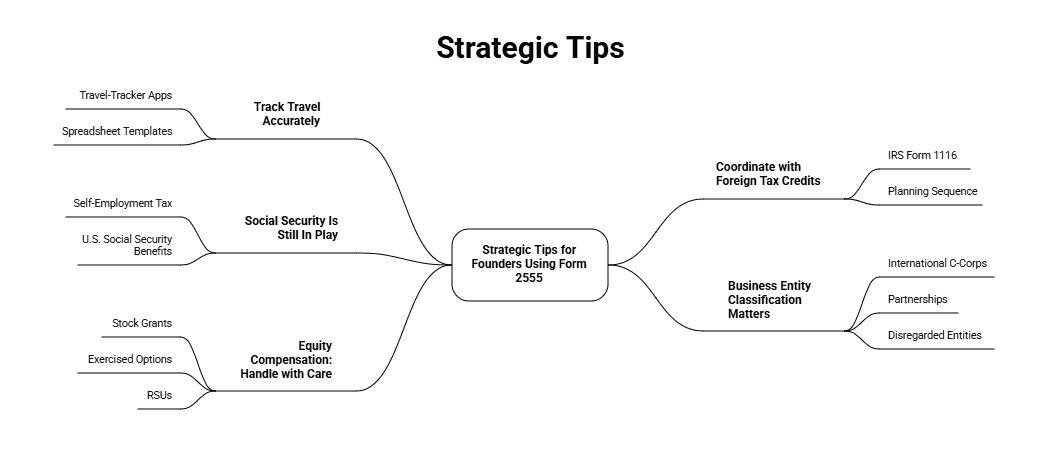

Strategic Tips for Founders Using Form 2555

Claiming the FEIE is more than a checkbox—it’s part of your larger global finance playbook. Here’s what growth-oriented founders should consider:

1. Track Travel Accurately

Consider travel-tracker apps or spreadsheet templates to log international days—especially if working across Europe, Asia, or Latin America.

2. Coordinate with Foreign Tax Credits

You may also qualify for credits under IRS Form 1116. But know that FEIE and the Foreign Tax Credit can't be applied to the same income. Planning the sequence matters.

3. Social Security Is Still In Play

Exclusion via Form 2555 doesn’t eliminate self-employment tax. Founders paying themselves abroad should still consider SE tax planning, especially if contributing toward U.S. Social Security benefits.

4. Business Entity Classification Matters

Founders with international C-Corps, partnerships, or disregarded entities need to coordinate foreign income reporting structures with exclusion limits. Poor entity planning can undermine FEIE eligibility.

5. Equity Compensation: Handle with Care

Stock grants, exercised options, and RSUs from foreign-based startups often don’t count as “earned” income. Work with your CPA or tax advisor to structure contracts that optimize for FEIE potential.

For official IRS guidance on this exclusion, visit the IRS page on Foreign Earned Income Exclusion.

Use Form 2555 to Supercharge Your Startup’s Global Strategy

For founders navigating global markets and managing international income, Form 2555 offers a vital strategy to optimize your tax posture and retain more earnings for growth. From confirming eligibility to tracking global presence and coordinating with other tax strategies, this form deserves real attention in your financial playbook.

At Haven, we specialize in bringing sanity to complex filing processes for founders scaling across borders. Our expert-backed approach helps startup teams stay compliant while freeing up capital to focus on what matters most—building.

For founders and startup leaders managing the complexities of global income, understanding Form 2555 is essential. This IRS form allows eligible taxpayers to exclude a portion of their foreign earned income from U.S. taxation, which can significantly reduce tax liability for founders working abroad or from multiple international hubs.

In this detailed guide, we’ll walk through everything you need to know about Form 2555, including eligibility criteria, how to claim the Foreign Earned Income Exclusion (FEIE), and strategic considerations tailored specifically for founders running startups, agencies, and e-commerce companies.

Why Founders Should Care About Form 2555

Form 2555, officially titled “Foreign Earned Income,” is the key to claiming the Foreign Earned Income Exclusion, which allows qualifying U.S. citizens or resident aliens living and working abroad to exclude up to $120,000 (for tax year 2023) of foreign earned income from U.S. taxation. This cap adjusts annually for inflation, so staying current is important.

Why does this matter for founders?

Global operating models: Many founders alternate between the U.S. and international locations or run remotely distributed teams.

Multiple revenue channels: Founders may draw income from foreign subsidiaries, consulting arrangements, or agency clients overseas.

Smarter tax planning: Using FEIE via Form 2555 effectively improves cash flow, enabling greater reinvestment into your business.

For founders, mastering this form ensures better alignment between tax strategies and global scaling ambitions—minimizing friction and unlocking resources to grow faster.

For how the tax filing process fits into your business structure, explore Haven’s business tax services, which offer personalized support built for startups and founders like you.

Who Can Use Form 2555: Eligibility Requirements

Before you claim the foreign earned income exclusion, you must meet specific IRS criteria. Here's a founder-focused breakdown:

Eligibility Requirement | Founder-Friendly Interpretation |

U.S. Citizen or Resident Alien | Must be a U.S. citizen or lawful permanent resident. |

Earn Foreign Income | Income must be earned abroad through employment or self-employment (e.g., contracts, salaries, service revenue). |

Tax Home Outside U.S. | Your primary work base is overseas—not just temporary travel. |

Pass One of Two Residency Tests | Either the Physical Presence Test or Bona Fide Residence Test. See below. |

Physical Presence Test

You must spend at least 330 full days in a foreign country within a 12-month period.

Perfect for digital nomad founders or those working across global client hubs.

Bona Fide Residence Test

You’ve lived in a foreign country for at least one uninterrupted tax year.

You typically must maintain residency, lease/rent housing, and establish ties (e.g., bank accounts, local taxation).

Founders operating from multiple countries should pay attention to travel logs and visa details to ensure they qualify under one of these methods.

How to Complete Form 2555 (Step-by-Step)

Knowing what's required for filing doesn’t just bring peace of mind—it helps you prepare earlier and catch errors that could cost real money.

Step 1: Gather Essential Documentation

You’ll need:

Passport and travel logs to support presence/residency

Foreign tax documents and pay statements

Evidence of a foreign home (rental contracts, utility bills)

Proof of salary or self-employment income abroad

Step 2: Fill Out Part I – General Information

Enter basic personal details, the tax year, and whether you qualify under the physical presence test or bona fide residence.

Step 3: Identify Your Foreign Tax Home (Part II)

Indicate where your principal place of employment is located. Founders running startups or agencies abroad must document ownership structure and business registration country.

Step 4: Complete Residency Qualification (Part III)

Choose which test you're applying under.

Use precise date tracking for the 330-day rule.

For bona fide residents, ensure you’ve lived in one country throughout the entire tax year.

Step 5: Calculate Foreign Earned Income Exclusion (Part IV)

List all qualifying foreign income up to the allowable exclusion.

For 2023, this exclusion is $120,000 per person.

Salary and consulting income count—equity gains and dividends typically do not.

Step 6: (Optional) Claim the Foreign Housing Exclusion (Part V)

If your housing costs exceed a specified amount and you're living abroad, you may qualify for additional exclusions.

This can include rent, utilities (but not phone/internet), insurance, and household repairs.

Actual eligibility limits vary per city and country—founders living in high-cost cities should double-check IRS guidelines.

See the IRS’ official housing exclusion instructions for details.

Step 7: Attach Form 2555 to Your Tax Return

Submit it alongside your Form 1040. The standard due date is April 15 (June 15 if you’re living abroad, but interest may still accrue). Keep digital and paper records for all supporting evidence

If you're choosing between S-Corp and international pass-through options, check out Haven’s Form 2553 Guide.

Strategic Tips for Founders Using Form 2555

Claiming the FEIE is more than a checkbox—it’s part of your larger global finance playbook. Here’s what growth-oriented founders should consider:

1. Track Travel Accurately

Consider travel-tracker apps or spreadsheet templates to log international days—especially if working across Europe, Asia, or Latin America.

2. Coordinate with Foreign Tax Credits

You may also qualify for credits under IRS Form 1116. But know that FEIE and the Foreign Tax Credit can't be applied to the same income. Planning the sequence matters.

3. Social Security Is Still In Play

Exclusion via Form 2555 doesn’t eliminate self-employment tax. Founders paying themselves abroad should still consider SE tax planning, especially if contributing toward U.S. Social Security benefits.

4. Business Entity Classification Matters

Founders with international C-Corps, partnerships, or disregarded entities need to coordinate foreign income reporting structures with exclusion limits. Poor entity planning can undermine FEIE eligibility.

5. Equity Compensation: Handle with Care

Stock grants, exercised options, and RSUs from foreign-based startups often don’t count as “earned” income. Work with your CPA or tax advisor to structure contracts that optimize for FEIE potential.

For official IRS guidance on this exclusion, visit the IRS page on Foreign Earned Income Exclusion.

Use Form 2555 to Supercharge Your Startup’s Global Strategy

For founders navigating global markets and managing international income, Form 2555 offers a vital strategy to optimize your tax posture and retain more earnings for growth. From confirming eligibility to tracking global presence and coordinating with other tax strategies, this form deserves real attention in your financial playbook.

At Haven, we specialize in bringing sanity to complex filing processes for founders scaling across borders. Our expert-backed approach helps startup teams stay compliant while freeing up capital to focus on what matters most—building.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026