Go Back

Last Updated :

Last Updated :

Jan 6, 2026

Jan 6, 2026

Form 1116 Filing Guide: Claiming the Foreign Tax Credit

For founders steering startups, agencies, or e-commerce companies through the complexities of tax filing, Form 1116 represents a vital tool for reducing the tax burden on foreign income. Navigating this form effectively can save your business significant money and avoid double taxation—something every founder should understand to optimize cash flow and reinvest in growth.

What is Form 1116?

Form 1116 is the IRS form designed to claim the Foreign Tax Credit (FTC). Its primary purpose is to offset U.S. tax liabilities on income that has already been taxed by a foreign country or U.S. territory.

Why Founders Should Care

Protect Profit Margins: Avoid losing revenue to double taxation.

Improve Cash Flow: Use the credit as a strategic lever to keep more capital in your business.

Financial Forecasting: More accurately anticipate net tax expenses to plan for growth.

Who Needs to File?

You should file Form 1116 if:

Your company paid or accrued foreign income taxes.

You want to claim a credit (rather than a deduction) against U.S. tax on that same income.

You are an individual, estate, or trust with foreign source income.

Note: If you use Form 1116 to claim a credit, you cannot also deduct those same taxes on your return.

Step-by-Step: How to Fill Out Form 1116

Filing can be complex, but breaking it down by part ensures you maximize your credit while remaining compliant.

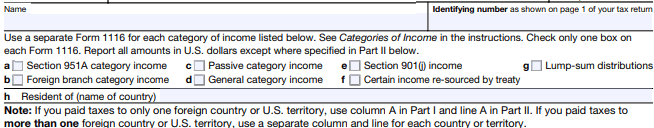

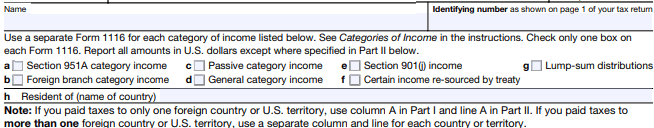

Step 1: Identify the Income Category

You must file a separate Form 1116 for each category of income. Check the appropriate box at the top of the form:

Passive category income: Often includes dividends, interest, and royalties.

General category income: Most common for active business operations.

Section 951A category income: Specifically for Global Intangible Low-Taxed Income (GILTI).

Step 2: Part I – Taxable Income or Loss from Foreign Sources

In this section, you calculate your net foreign source income.

Line 1a: Enter your gross income from the specific foreign country.

Lines 2–5: Deduct expenses definitely related to that income, as well as a pro-rata share of other deductions (like the standard deduction or interest expense).

Line 7: Subtract total deductions from gross income to find your taxable foreign income.

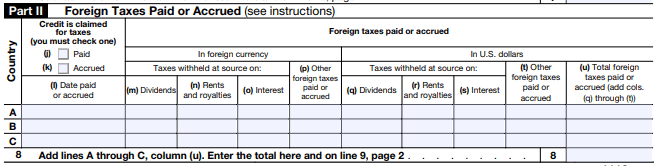

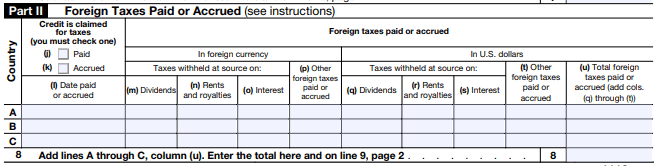

Step 3: Part II – Foreign Taxes Paid or Accrued

List the taxes you paid to foreign governments.

Check whether the taxes were Paid or Accrued.

Report amounts in U.S. dollars unless specified otherwise.

Use separate columns (A, B, and C) if you paid taxes to more than one country.

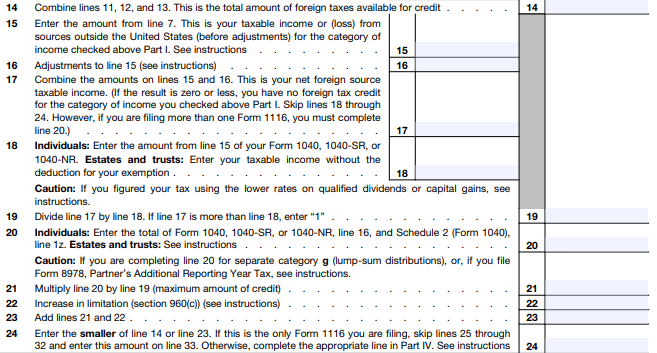

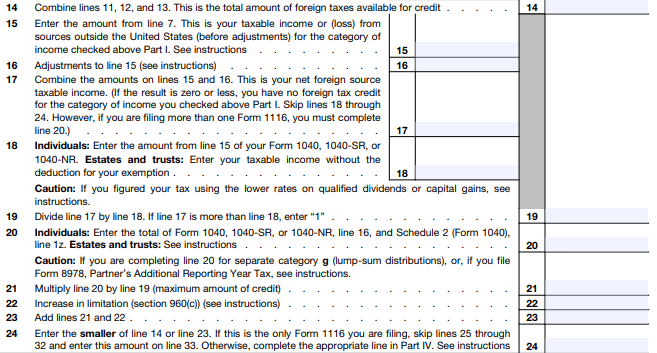

Step 4: Part III – Figuring the Credit

This is where you determine how much of the foreign tax you can actually claim.

Line 14: Total foreign taxes available for credit.

Line 19: Divide your net foreign income (Line 17) by your total taxable income (Line 18) to find your foreign tax percentage.

Line 21: Multiply your U.S. tax liability (Line 20) by that percentage.

Line 24: Enter the smaller of Line 14 or Line 21. This is your allowable credit for this category.

Step 5: Part IV – Summary of Credits

If you are filing multiple Forms 1116 for different income categories, summarize them here to find your total foreign tax credit.

Common Mistakes to Avoid

Incorrect Categorization: Mixing passive and general income can lead to limit errors; involve your controller early.

Currency Errors: Foreign taxes must be converted to USD using accurate, regularly updated exchange rates.

Missing Carryovers: If you can't use the full credit this year, you can carry it back 1 year or forward 10 years—don't let it expire.

Lack of Documentation: Always retain receipts and government records of foreign taxes paid to protect against audits.

When is Form 1116 Due?

Form 1116 must be attached to your individual or corporate tax return (e.g., Form 1040, 1120-S). It is due by the deadline of your tax return, including extensions.

For founders steering startups, agencies, or e-commerce companies through the complexities of tax filing, Form 1116 represents a vital tool for reducing the tax burden on foreign income. Navigating this form effectively can save your business significant money and avoid double taxation—something every founder should understand to optimize cash flow and reinvest in growth.

What is Form 1116?

Form 1116 is the IRS form designed to claim the Foreign Tax Credit (FTC). Its primary purpose is to offset U.S. tax liabilities on income that has already been taxed by a foreign country or U.S. territory.

Why Founders Should Care

Protect Profit Margins: Avoid losing revenue to double taxation.

Improve Cash Flow: Use the credit as a strategic lever to keep more capital in your business.

Financial Forecasting: More accurately anticipate net tax expenses to plan for growth.

Who Needs to File?

You should file Form 1116 if:

Your company paid or accrued foreign income taxes.

You want to claim a credit (rather than a deduction) against U.S. tax on that same income.

You are an individual, estate, or trust with foreign source income.

Note: If you use Form 1116 to claim a credit, you cannot also deduct those same taxes on your return.

Step-by-Step: How to Fill Out Form 1116

Filing can be complex, but breaking it down by part ensures you maximize your credit while remaining compliant.

Step 1: Identify the Income Category

You must file a separate Form 1116 for each category of income. Check the appropriate box at the top of the form:

Passive category income: Often includes dividends, interest, and royalties.

General category income: Most common for active business operations.

Section 951A category income: Specifically for Global Intangible Low-Taxed Income (GILTI).

Step 2: Part I – Taxable Income or Loss from Foreign Sources

In this section, you calculate your net foreign source income.

Line 1a: Enter your gross income from the specific foreign country.

Lines 2–5: Deduct expenses definitely related to that income, as well as a pro-rata share of other deductions (like the standard deduction or interest expense).

Line 7: Subtract total deductions from gross income to find your taxable foreign income.

Step 3: Part II – Foreign Taxes Paid or Accrued

List the taxes you paid to foreign governments.

Check whether the taxes were Paid or Accrued.

Report amounts in U.S. dollars unless specified otherwise.

Use separate columns (A, B, and C) if you paid taxes to more than one country.

Step 4: Part III – Figuring the Credit

This is where you determine how much of the foreign tax you can actually claim.

Line 14: Total foreign taxes available for credit.

Line 19: Divide your net foreign income (Line 17) by your total taxable income (Line 18) to find your foreign tax percentage.

Line 21: Multiply your U.S. tax liability (Line 20) by that percentage.

Line 24: Enter the smaller of Line 14 or Line 21. This is your allowable credit for this category.

Step 5: Part IV – Summary of Credits

If you are filing multiple Forms 1116 for different income categories, summarize them here to find your total foreign tax credit.

Common Mistakes to Avoid

Incorrect Categorization: Mixing passive and general income can lead to limit errors; involve your controller early.

Currency Errors: Foreign taxes must be converted to USD using accurate, regularly updated exchange rates.

Missing Carryovers: If you can't use the full credit this year, you can carry it back 1 year or forward 10 years—don't let it expire.

Lack of Documentation: Always retain receipts and government records of foreign taxes paid to protect against audits.

When is Form 1116 Due?

Form 1116 must be attached to your individual or corporate tax return (e.g., Form 1040, 1120-S). It is due by the deadline of your tax return, including extensions.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026