Go Back

Last Updated :

Last Updated :

Jan 20, 2026

Jan 20, 2026

Form 1042-s: How to Report U.S. Source Income Paid to Foreign Persons and Entities

When running a U.S.-based startup, agency, or e-commerce business that works with foreign individuals or companies, understanding the form 1042-s is essential for accurate tax reporting and compliance. This IRS form serves a very specific function: reporting U.S. source income paid to foreign persons and entities, and the associated withholding tax.

In this comprehensive guide, we'll break down what form 1042-s is, who needs to file it, key deadlines, and best practices to streamline the process so you can focus on growing your business.

What Is Form 1042-s and Why Is It Important?

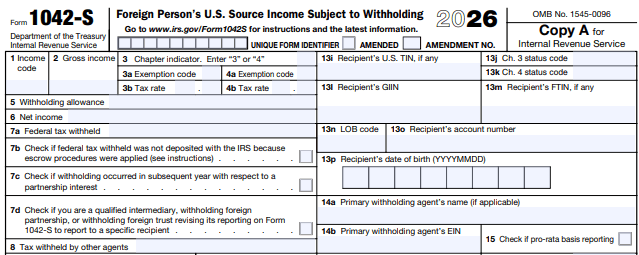

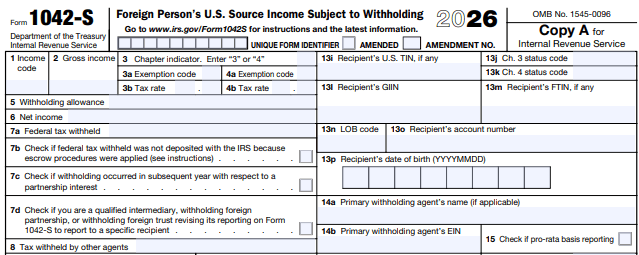

Form 1042-s, officially titled “Foreign Person’s U.S. Source Income Subject to Withholding,” is an IRS information return used by U.S. withholding agents. Essentially, if your company pays U.S. source income to foreign persons or entities—such as contractors, service providers, or investors—you’re likely required to report these payments on this form.

Key Functions of Form 1042-s:

Reports the amount of income paid to foreign persons or entities.

Details any U.S. federal income tax withheld on these payments.

Communicates critical information to foreign recipients who need it to comply with their own tax obligations.

Helps the IRS monitor and enforce tax withholding compliance under IRC Chapters 3 and 4, as well as FATCA (Foreign Account Tax Compliance Act).

Why should founders care?

Misreporting or neglecting form 1042-s impacts your company’s standing with the IRS and can result in fines, interest on unpaid taxes, or audits. Moreover, ensuring this process runs smoothly fosters strong international business relationships, especially when foreign partners rely on these forms to claim foreign tax credits or to fulfill their tax reporting requirements in their own countries.

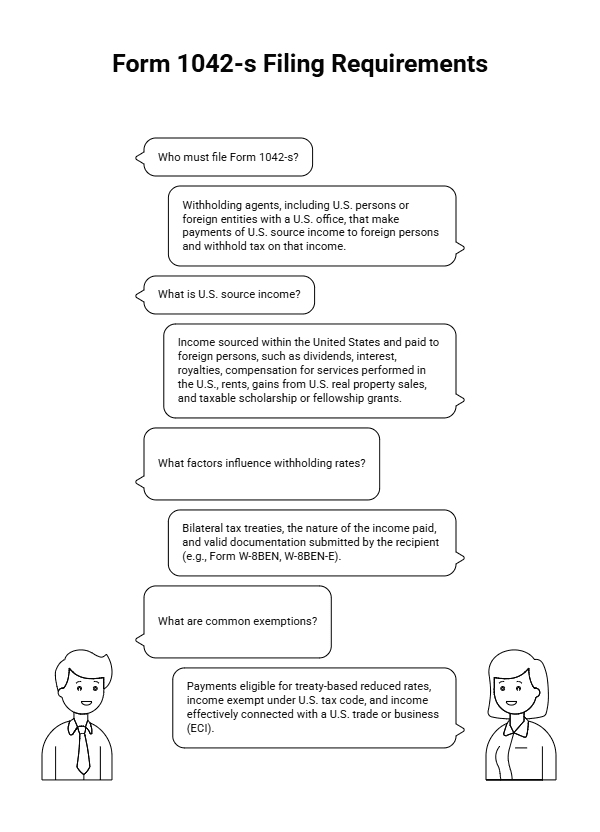

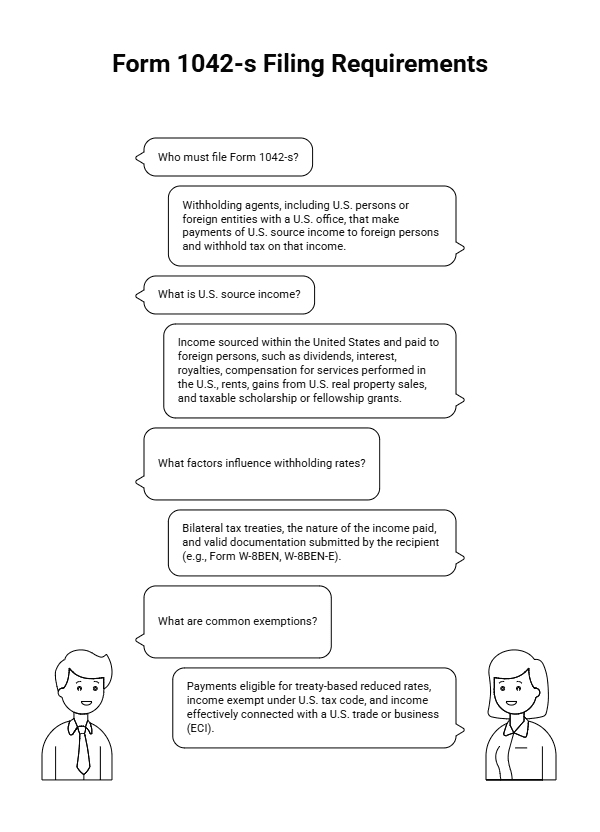

Who Must File Form 1042-s?

Form 1042-s filing responsibility falls primarily on withholding agents. This includes any U.S. person (individual, corporation, partnership, trust, or estate) or foreign entity with a U.S. office that:

Makes payments of U.S. source income to foreign persons or entities.

Withholds or is responsible for withholding tax on that income.

The IRS defines “foreign persons” to include:

Nonresident aliens

Foreign corporations

Foreign partnerships

Foreign trusts

Foreign estates

Examples of Withholding Agents:

Business Type | Example Payments |

Startups hiring foreign consultants | Payment for software development services |

E-commerce platforms paying suppliers | Royalties or commission fees |

Agencies hiring foreign creatives | Advertising or content creation service fees |

Universities or research institutions | Scholarships, fellowships, or grant distributions |

Important note: foreign persons typically do not file Form 1042-s themselves. Instead, the withholding agent completes it and provides a copy to the foreign recipient and the IRS for reporting purposes.

Understanding U.S. Source Income and Withholding

A cornerstone of form 1042-s reporting is the concept of ""U.S. source income."" Only income sourced within the United States and paid to foreign persons falls under this reporting requirement. Common examples include:

Dividends, interest, and royalties

Compensation for services performed within the United States

Rents

Gains from U.S. real property sales

Taxable scholarship or fellowship grants

Each category of income is assigned a specific income code on Form 1042-s, which drives applicable withholding rates and exemption eligibility.

Common Income Code Examples

Income Code | Description | Notes |

01 | Interest | May qualify for reduced treaty rates |

06 | Dividends | Check for treaty exemptions |

12 | Royalties | Includes software and ebook royalties |

16 | Compensation for services | Common for contractors, freelancers, consultants |

Selecting the correct income code ensures accurate withholding, fulfils reporting requirements, and avoids IRS scrutiny.

Determining Exemptions and Withholding Rates

Not all U.S. source income owed to foreign persons is subject to standard withholding rates. Tax treaties and documentation can affect withholding outcomes.

Factors That Influence Withholding Rates:

Bilateral tax treaties between the U.S. and the recipient’s country of residence

Nature of the income paid

Valid documentation submitted by the recipient (e.g., Form W-8BEN, W-8BEN-E)

Common Exemptions

Payments eligible for treaty-based reduced rates

Income exempt under U.S. tax code

Income effectively connected with a U.S. trade or business (ECI), which may require filing Form 1040NR by the foreign person instead

Each exemption reason must be documented with an exemption code on the Form 1042-s return. Using incorrect or unsupported exemption codes can lead to compliance issues or IRS audits.

For a full list of exemption codes and treaty benefits, refer to the official IRS instructions for Form 1042-s.

Deadlines and Electronic Filing

Key Dates Founders Should Know:

March 15: Deadline to provide foreign recipients their copy of Form 1042-s

March 15: Deadline to electronically file or mail the form to the IRS

Timely distribution and submission help you avoid penalties that increase based on the number of late forms.

Electronic Filing with FIRE

If you’re filing 250 or more forms in a given year, the IRS mandates electronic filing through its FIRE (Filing Information Returns Electronically) system. However, smaller companies are encouraged to file electronically to reduce errors and processing lags.

Steps to prepare:

Obtain a Transmitter Control Code (TCC) from the IRS

Use compatible software to format files to FIRE specifications

Test your data file using the FIRE Test system before live submission

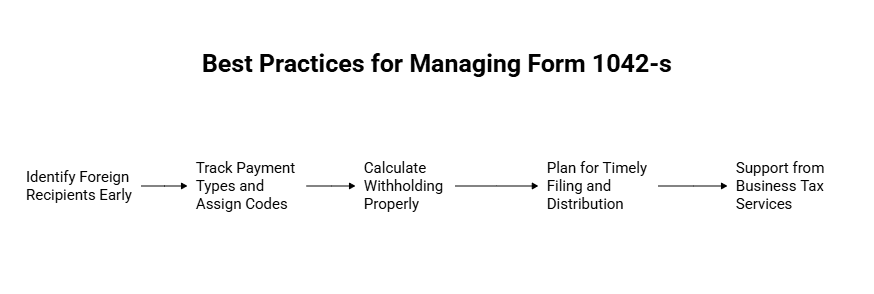

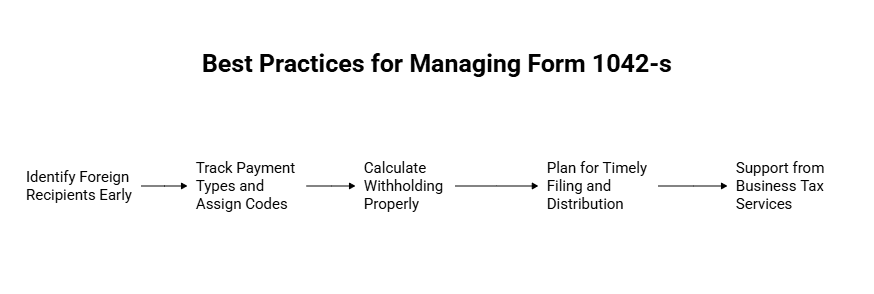

Best Practices for Startups Managing Form 1042-s

Startups with international contractors or partners need strong workflows to handle the Form 1042-s accurately. Here’s how to stay ahead:

1. Identify Foreign Recipients Early

As you onboard international vendors or service providers, request completed Forms W-8BEN or W-8BEN-E upfront to verify their foreign status and treaty claims.

2. Track Payment Types and Assign Codes

Create a categorized ledger that records:

Payment amounts

Type of income (aligned with IRS income codes)

Withholding and exemption codes

Dates and notes per payee

3. Calculate Withholding Properly

Validate whether any payments qualify for reduced treaty rates or other exemptions. Document backing must be on file before payment is made.

Tip: Consider running calculations through a tax platform familiar with non-U.S. recipient payments to reduce error risk.

4. Plan for Timely Filing and Distribution

Build action items into your year-end close process to prepare Form 1042-s promptly. Notify stakeholders in January and aim to file well before the March 15 deadline.

Our business tax services can support your team with documentation, form generation, and electronic filing.

Integrating Form 1042-s into Your Startup’s Financial Workflow

For startups and fast-growing businesses, compliance with international withholding and reporting requirements is critical but manageable with a clear understanding of form 1042-s and its implications.

By identifying foreign payees early, confirming relevant exemptions, calculating withholding correctly, and submitting forms on time, founders can safeguard their business and unlock long-term international success.

Founders looking to simplify compliance and save time should consider technology-forward tax service providers.

When running a U.S.-based startup, agency, or e-commerce business that works with foreign individuals or companies, understanding the form 1042-s is essential for accurate tax reporting and compliance. This IRS form serves a very specific function: reporting U.S. source income paid to foreign persons and entities, and the associated withholding tax.

In this comprehensive guide, we'll break down what form 1042-s is, who needs to file it, key deadlines, and best practices to streamline the process so you can focus on growing your business.

What Is Form 1042-s and Why Is It Important?

Form 1042-s, officially titled “Foreign Person’s U.S. Source Income Subject to Withholding,” is an IRS information return used by U.S. withholding agents. Essentially, if your company pays U.S. source income to foreign persons or entities—such as contractors, service providers, or investors—you’re likely required to report these payments on this form.

Key Functions of Form 1042-s:

Reports the amount of income paid to foreign persons or entities.

Details any U.S. federal income tax withheld on these payments.

Communicates critical information to foreign recipients who need it to comply with their own tax obligations.

Helps the IRS monitor and enforce tax withholding compliance under IRC Chapters 3 and 4, as well as FATCA (Foreign Account Tax Compliance Act).

Why should founders care?

Misreporting or neglecting form 1042-s impacts your company’s standing with the IRS and can result in fines, interest on unpaid taxes, or audits. Moreover, ensuring this process runs smoothly fosters strong international business relationships, especially when foreign partners rely on these forms to claim foreign tax credits or to fulfill their tax reporting requirements in their own countries.

Who Must File Form 1042-s?

Form 1042-s filing responsibility falls primarily on withholding agents. This includes any U.S. person (individual, corporation, partnership, trust, or estate) or foreign entity with a U.S. office that:

Makes payments of U.S. source income to foreign persons or entities.

Withholds or is responsible for withholding tax on that income.

The IRS defines “foreign persons” to include:

Nonresident aliens

Foreign corporations

Foreign partnerships

Foreign trusts

Foreign estates

Examples of Withholding Agents:

Business Type | Example Payments |

Startups hiring foreign consultants | Payment for software development services |

E-commerce platforms paying suppliers | Royalties or commission fees |

Agencies hiring foreign creatives | Advertising or content creation service fees |

Universities or research institutions | Scholarships, fellowships, or grant distributions |

Important note: foreign persons typically do not file Form 1042-s themselves. Instead, the withholding agent completes it and provides a copy to the foreign recipient and the IRS for reporting purposes.

Understanding U.S. Source Income and Withholding

A cornerstone of form 1042-s reporting is the concept of ""U.S. source income."" Only income sourced within the United States and paid to foreign persons falls under this reporting requirement. Common examples include:

Dividends, interest, and royalties

Compensation for services performed within the United States

Rents

Gains from U.S. real property sales

Taxable scholarship or fellowship grants

Each category of income is assigned a specific income code on Form 1042-s, which drives applicable withholding rates and exemption eligibility.

Common Income Code Examples

Income Code | Description | Notes |

01 | Interest | May qualify for reduced treaty rates |

06 | Dividends | Check for treaty exemptions |

12 | Royalties | Includes software and ebook royalties |

16 | Compensation for services | Common for contractors, freelancers, consultants |

Selecting the correct income code ensures accurate withholding, fulfils reporting requirements, and avoids IRS scrutiny.

Determining Exemptions and Withholding Rates

Not all U.S. source income owed to foreign persons is subject to standard withholding rates. Tax treaties and documentation can affect withholding outcomes.

Factors That Influence Withholding Rates:

Bilateral tax treaties between the U.S. and the recipient’s country of residence

Nature of the income paid

Valid documentation submitted by the recipient (e.g., Form W-8BEN, W-8BEN-E)

Common Exemptions

Payments eligible for treaty-based reduced rates

Income exempt under U.S. tax code

Income effectively connected with a U.S. trade or business (ECI), which may require filing Form 1040NR by the foreign person instead

Each exemption reason must be documented with an exemption code on the Form 1042-s return. Using incorrect or unsupported exemption codes can lead to compliance issues or IRS audits.

For a full list of exemption codes and treaty benefits, refer to the official IRS instructions for Form 1042-s.

Deadlines and Electronic Filing

Key Dates Founders Should Know:

March 15: Deadline to provide foreign recipients their copy of Form 1042-s

March 15: Deadline to electronically file or mail the form to the IRS

Timely distribution and submission help you avoid penalties that increase based on the number of late forms.

Electronic Filing with FIRE

If you’re filing 250 or more forms in a given year, the IRS mandates electronic filing through its FIRE (Filing Information Returns Electronically) system. However, smaller companies are encouraged to file electronically to reduce errors and processing lags.

Steps to prepare:

Obtain a Transmitter Control Code (TCC) from the IRS

Use compatible software to format files to FIRE specifications

Test your data file using the FIRE Test system before live submission

Best Practices for Startups Managing Form 1042-s

Startups with international contractors or partners need strong workflows to handle the Form 1042-s accurately. Here’s how to stay ahead:

1. Identify Foreign Recipients Early

As you onboard international vendors or service providers, request completed Forms W-8BEN or W-8BEN-E upfront to verify their foreign status and treaty claims.

2. Track Payment Types and Assign Codes

Create a categorized ledger that records:

Payment amounts

Type of income (aligned with IRS income codes)

Withholding and exemption codes

Dates and notes per payee

3. Calculate Withholding Properly

Validate whether any payments qualify for reduced treaty rates or other exemptions. Document backing must be on file before payment is made.

Tip: Consider running calculations through a tax platform familiar with non-U.S. recipient payments to reduce error risk.

4. Plan for Timely Filing and Distribution

Build action items into your year-end close process to prepare Form 1042-s promptly. Notify stakeholders in January and aim to file well before the March 15 deadline.

Our business tax services can support your team with documentation, form generation, and electronic filing.

Integrating Form 1042-s into Your Startup’s Financial Workflow

For startups and fast-growing businesses, compliance with international withholding and reporting requirements is critical but manageable with a clear understanding of form 1042-s and its implications.

By identifying foreign payees early, confirming relevant exemptions, calculating withholding correctly, and submitting forms on time, founders can safeguard their business and unlock long-term international success.

Founders looking to simplify compliance and save time should consider technology-forward tax service providers.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026