Go Back

Last Updated :

Last Updated :

Dec 17, 2025

Dec 17, 2025

Choosing the Best Bookkeeping Firm for Your Financial Advisory Practice

As a founder or operations lead running a financial advisory firm, choosing the best bookkeeping firms for financial advisors isn’t just about ticking a box on your business checklist.

Your firm’s success hinges on insightful financial data, timely reporting, and smooth tax filings, all driven by top-notch bookkeeping. This guide breaks down what founders and finance heads should look for when selecting bookkeeping services tailored explicitly for the unique demands of financial advisory businesses.

Why Specialized Bookkeeping Matters for Financial Advisors

Financial advisory firms face distinct regulatory requirements, compliance standards, and financial reporting complexities. Unlike general bookkeeping, specialized bookkeeping for financial advisors aligns accounting processes with key industry nuances such as:

Regulatory compliance (SEC, FINRA)

Client fund management with strict fiduciary standards

Complex revenue recognition related to advisory fees and commissions

Accurate tracking of research and development costs for credits or capitalized expenses

Integrated tax planning and timely filing to optimize returns and avoid penalties

Choosing bookkeeping firms that understand these intricacies saves founders time and operational headaches while strengthening financial transparency for investors and clients alike.

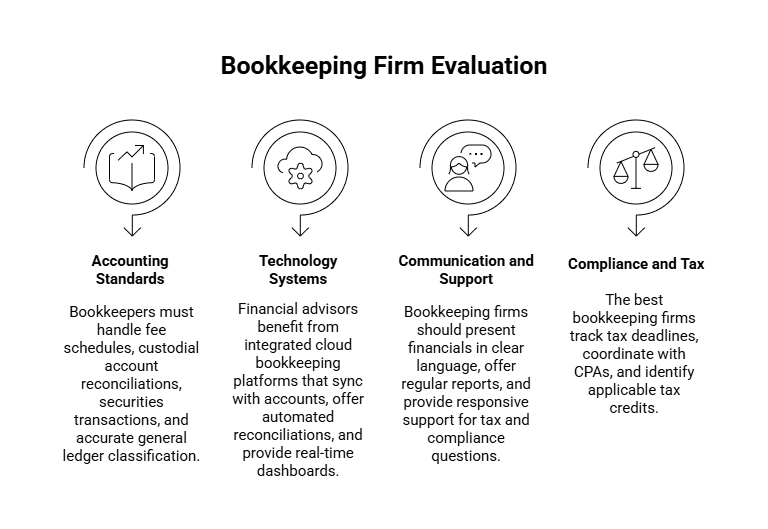

What Makes the Best Bookkeeping Firms for Financial Advisors?

When evaluating bookkeeping providers, financial advisors should prioritize partners that understand the specific operational, regulatory, and reporting demands of advisory businesses. The right bookkeeping firm should go beyond basic accounting and support the financial realities of managing client assets, fees, and compliance.

1. Deep Understanding of Financial Advisory Accounting Standards

Bookkeepers must handle:

Fee schedules with tiered, recurring, and performance-based components

Custodial account reconciliations aligned with client fund trust requirements

Securities transactions, including cost basis tracking and wash sales

Accurate general ledger classification for advisory revenues, commissions, and expenses

2. Technology-Forward Systems for Real-Time Visibility

Financial advisors benefit from integrated cloud bookkeeping platforms that:

Sync directly with custodial accounts and bank feeds

Offer automated reconciliations minimizing manual errors

Provide dashboards for real-time P&L, balance sheets, and client profitability

Facilitate quick preparation for audits and financial reviews

3. Founder-Friendly Communication and Support

Bookkeeping firms should present complex financials in clear, jargon-free language with:

Regular financial health reports timed to your business rhythms

Responsive support to answer tax and compliance questions

Advisory insights on optimizing deductions, credits, and cash flow

4. Comprehensive Compliance & Tax Filing Expertise

Given the tight regulatory environment, the best bookkeeping firms:

Track tax deadlines and state-specific filing requirements

Coordinate closely with your CPA or tax advisor for year-end filings

Identify and claim credits such as the R&D tax credit when applicable

Speaking of tax credits, many financial advisory firms invest extensively in R&D to develop proprietary analytics and trading algorithms. Proper bookkeeping can help unlock these R&D tax credits, an often-overlooked treasure for founders. Haven integrates bookkeeping and R&D credit support to maximize returns and minimize audit risk.

Explore Haven’s integrated approach to both bookkeeping services and tax filing to see how you can leverage bookkeeping as a strategic tool—not just an operational necessity.

Choosing Between In-House, Outsourced, and Hybrid Bookkeeping

Financial advisory firms typically evaluate three bookkeeping models: in-house, outsourced, and hybrid. Each option offers a different balance between control, cost, expertise, and scalability — and the right choice depends on firm size, operational complexity, and growth stage.

Below is a brief overview of how each model works in practice, followed by a comparison of pros and cons.

In-House Bookkeeping

In this model, bookkeeping is handled internally by dedicated staff within the advisory firm. It offers maximum control over processes, data access, and day-to-day workflows, but comes with higher fixed costs and ongoing management overhead.

Outsourced Bookkeeping

Outsourced bookkeeping relies on an external firm that specializes in financial advisory accounting. This model prioritizes efficiency, scalability, and access to experienced professionals, making it a strong option for firms that want expert support without building an internal team.

Hybrid Bookkeeping

A hybrid approach combines internal oversight with outsourced expertise. Core financial operations stay in-house, while specialized or high-complexity tasks are handled by external partners. This model works well for firms in transition or scaling their operations.

Model | Pros | Cons | Best for |

In-House | Complete control over data security and process | High overhead; requires expert hires and ongoing training | Large firms with complex workflows |

Outsourced | Cost-effective; access to experts; scalability | Potential communication lags; less direct oversight | Startups, agencies, and firms focused on growth |

Hybrid | Internal control + expert support for advanced tasks | Coordination challenges; workflow inefficiencies | Mid-sized firms expanding operations |

Founders running startups and e-commerce agencies often find outsourcing to a reputable firm like Haven strikes the best balance between cost, expertise, and agility.

How to Evaluate Bookkeeping Pricing for Financial Advisors

Bookkeeping pricing for financial advisors can vary significantly, but the real question isn’t how providers charge — it’s whether the pricing reflects the level of support, accuracy, and advisory-specific expertise your firm needs.

When evaluating bookkeeping costs, financial advisors should focus on value drivers, scope clarity, and long-term fit rather than price alone.

What to Look for When Evaluating Bookkeeping Pricing

1. Scope clarity and inclusions

Before comparing prices, confirm exactly what’s included in each plan. Strong bookkeeping partners clearly define:

Monthly reconciliation coverage (accounts, custodians, entities)

Reporting cadence and level of detail

Support for advisory-specific workflows (AUM-based fees, custodial reconciliations, compliance reporting)

Vague pricing often leads to unexpected add-ons later.

2. Alignment with advisory complexity

Pricing should scale based on transaction volume, number of custodial accounts, reporting complexity, and regulatory needs — not just firm size. A low-cost plan that doesn’t account for advisory-specific requirements can quickly become inefficient or risky.

3. Predictability vs. flexibility

Fixed monthly pricing works well for firms with stable operations and predictable workflows. Hourly or hybrid models may suit firms with fluctuating workloads, but they require tighter oversight to avoid cost creep.

4. Transparency around add-ons and exceptions

Evaluate how providers handle services outside the core scope, such as:

Cleanup or historical corrections

Tax coordination or year-end support

One-off advisory or compliance requests

Clear pricing boundaries signal operational maturity.

Common Pricing Structures (and How to Interpret Them)

Fixed monthly fees offer budgeting predictability, but should be evaluated against service depth and advisory expertise.

Hourly rates provide flexibility, but can introduce variability and require stronger internal tracking.

Tiered packages work best when tiers are tied to meaningful drivers like transaction volume or reporting complexity — not arbitrary thresholds.

A Value-First Perspective on Pricing

For financial advisors, the right bookkeeping pricing model reduces operational risk, improves reporting accuracy, and frees internal time, even if it isn’t the lowest-cost option. Evaluating pricing through this lens helps firms avoid under-scoped solutions that limit growth later.

Maximizing the Benefits of Bookkeeping to Grow Your Advisory Firm

Selecting the best bookkeeping firms for financial advisors is just the beginning. Founders can unlock business value by proactively leveraging bookkeeping outputs:

Cash flow forecasting: anticipate client payment cycles and vendor obligations

Performance analysis: compare profitability across service lines or client segments

Tax planning strategies: identify deductions and credits early in the fiscal year

Compliance readiness: maintain audit trails for SEC or FINRA inquiries

Also, don’t overlook the importance of regularly reviewing your bookkeeping partner’s reports with your CFO or finance team. This habit transforms bookkeeping from a transactional task into a strategic asset.

For those starting the selection process or wanting to understand compliance better, the Small Business Administration (SBA) guide on bookkeeping offers practical insights into record keeping and financial management—a trusted resource to complement your decision.

What Defines the Best Bookkeeping Firms for Growth and Compliance

The best bookkeeping firms for financial advisors aren’t defined by size or brand — they’re defined by how well they support regulatory accuracy, reporting clarity, and scalable operations.

When evaluating bookkeeping firms, financial advisors should look for partners that offer:

Advisory-specific accounting expertise, including fee-based revenue and custodial workflows

Strong tax and compliance coordination, reducing risk and last-minute surprises

Transparent reporting and communication, built for financial decision-making

Flexible, scalable service models that adapt as the firm grows

Firms that meet these criteria are better positioned to support both growth and compliance over time.

As a founder or operations lead running a financial advisory firm, choosing the best bookkeeping firms for financial advisors isn’t just about ticking a box on your business checklist.

Your firm’s success hinges on insightful financial data, timely reporting, and smooth tax filings, all driven by top-notch bookkeeping. This guide breaks down what founders and finance heads should look for when selecting bookkeeping services tailored explicitly for the unique demands of financial advisory businesses.

Why Specialized Bookkeeping Matters for Financial Advisors

Financial advisory firms face distinct regulatory requirements, compliance standards, and financial reporting complexities. Unlike general bookkeeping, specialized bookkeeping for financial advisors aligns accounting processes with key industry nuances such as:

Regulatory compliance (SEC, FINRA)

Client fund management with strict fiduciary standards

Complex revenue recognition related to advisory fees and commissions

Accurate tracking of research and development costs for credits or capitalized expenses

Integrated tax planning and timely filing to optimize returns and avoid penalties

Choosing bookkeeping firms that understand these intricacies saves founders time and operational headaches while strengthening financial transparency for investors and clients alike.

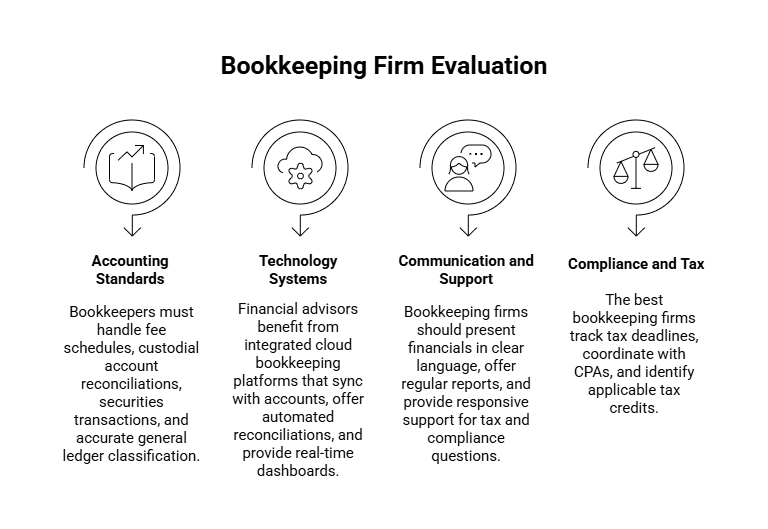

What Makes the Best Bookkeeping Firms for Financial Advisors?

When evaluating bookkeeping providers, financial advisors should prioritize partners that understand the specific operational, regulatory, and reporting demands of advisory businesses. The right bookkeeping firm should go beyond basic accounting and support the financial realities of managing client assets, fees, and compliance.

1. Deep Understanding of Financial Advisory Accounting Standards

Bookkeepers must handle:

Fee schedules with tiered, recurring, and performance-based components

Custodial account reconciliations aligned with client fund trust requirements

Securities transactions, including cost basis tracking and wash sales

Accurate general ledger classification for advisory revenues, commissions, and expenses

2. Technology-Forward Systems for Real-Time Visibility

Financial advisors benefit from integrated cloud bookkeeping platforms that:

Sync directly with custodial accounts and bank feeds

Offer automated reconciliations minimizing manual errors

Provide dashboards for real-time P&L, balance sheets, and client profitability

Facilitate quick preparation for audits and financial reviews

3. Founder-Friendly Communication and Support

Bookkeeping firms should present complex financials in clear, jargon-free language with:

Regular financial health reports timed to your business rhythms

Responsive support to answer tax and compliance questions

Advisory insights on optimizing deductions, credits, and cash flow

4. Comprehensive Compliance & Tax Filing Expertise

Given the tight regulatory environment, the best bookkeeping firms:

Track tax deadlines and state-specific filing requirements

Coordinate closely with your CPA or tax advisor for year-end filings

Identify and claim credits such as the R&D tax credit when applicable

Speaking of tax credits, many financial advisory firms invest extensively in R&D to develop proprietary analytics and trading algorithms. Proper bookkeeping can help unlock these R&D tax credits, an often-overlooked treasure for founders. Haven integrates bookkeeping and R&D credit support to maximize returns and minimize audit risk.

Explore Haven’s integrated approach to both bookkeeping services and tax filing to see how you can leverage bookkeeping as a strategic tool—not just an operational necessity.

Choosing Between In-House, Outsourced, and Hybrid Bookkeeping

Financial advisory firms typically evaluate three bookkeeping models: in-house, outsourced, and hybrid. Each option offers a different balance between control, cost, expertise, and scalability — and the right choice depends on firm size, operational complexity, and growth stage.

Below is a brief overview of how each model works in practice, followed by a comparison of pros and cons.

In-House Bookkeeping

In this model, bookkeeping is handled internally by dedicated staff within the advisory firm. It offers maximum control over processes, data access, and day-to-day workflows, but comes with higher fixed costs and ongoing management overhead.

Outsourced Bookkeeping

Outsourced bookkeeping relies on an external firm that specializes in financial advisory accounting. This model prioritizes efficiency, scalability, and access to experienced professionals, making it a strong option for firms that want expert support without building an internal team.

Hybrid Bookkeeping

A hybrid approach combines internal oversight with outsourced expertise. Core financial operations stay in-house, while specialized or high-complexity tasks are handled by external partners. This model works well for firms in transition or scaling their operations.

Model | Pros | Cons | Best for |

In-House | Complete control over data security and process | High overhead; requires expert hires and ongoing training | Large firms with complex workflows |

Outsourced | Cost-effective; access to experts; scalability | Potential communication lags; less direct oversight | Startups, agencies, and firms focused on growth |

Hybrid | Internal control + expert support for advanced tasks | Coordination challenges; workflow inefficiencies | Mid-sized firms expanding operations |

Founders running startups and e-commerce agencies often find outsourcing to a reputable firm like Haven strikes the best balance between cost, expertise, and agility.

How to Evaluate Bookkeeping Pricing for Financial Advisors

Bookkeeping pricing for financial advisors can vary significantly, but the real question isn’t how providers charge — it’s whether the pricing reflects the level of support, accuracy, and advisory-specific expertise your firm needs.

When evaluating bookkeeping costs, financial advisors should focus on value drivers, scope clarity, and long-term fit rather than price alone.

What to Look for When Evaluating Bookkeeping Pricing

1. Scope clarity and inclusions

Before comparing prices, confirm exactly what’s included in each plan. Strong bookkeeping partners clearly define:

Monthly reconciliation coverage (accounts, custodians, entities)

Reporting cadence and level of detail

Support for advisory-specific workflows (AUM-based fees, custodial reconciliations, compliance reporting)

Vague pricing often leads to unexpected add-ons later.

2. Alignment with advisory complexity

Pricing should scale based on transaction volume, number of custodial accounts, reporting complexity, and regulatory needs — not just firm size. A low-cost plan that doesn’t account for advisory-specific requirements can quickly become inefficient or risky.

3. Predictability vs. flexibility

Fixed monthly pricing works well for firms with stable operations and predictable workflows. Hourly or hybrid models may suit firms with fluctuating workloads, but they require tighter oversight to avoid cost creep.

4. Transparency around add-ons and exceptions

Evaluate how providers handle services outside the core scope, such as:

Cleanup or historical corrections

Tax coordination or year-end support

One-off advisory or compliance requests

Clear pricing boundaries signal operational maturity.

Common Pricing Structures (and How to Interpret Them)

Fixed monthly fees offer budgeting predictability, but should be evaluated against service depth and advisory expertise.

Hourly rates provide flexibility, but can introduce variability and require stronger internal tracking.

Tiered packages work best when tiers are tied to meaningful drivers like transaction volume or reporting complexity — not arbitrary thresholds.

A Value-First Perspective on Pricing

For financial advisors, the right bookkeeping pricing model reduces operational risk, improves reporting accuracy, and frees internal time, even if it isn’t the lowest-cost option. Evaluating pricing through this lens helps firms avoid under-scoped solutions that limit growth later.

Maximizing the Benefits of Bookkeeping to Grow Your Advisory Firm

Selecting the best bookkeeping firms for financial advisors is just the beginning. Founders can unlock business value by proactively leveraging bookkeeping outputs:

Cash flow forecasting: anticipate client payment cycles and vendor obligations

Performance analysis: compare profitability across service lines or client segments

Tax planning strategies: identify deductions and credits early in the fiscal year

Compliance readiness: maintain audit trails for SEC or FINRA inquiries

Also, don’t overlook the importance of regularly reviewing your bookkeeping partner’s reports with your CFO or finance team. This habit transforms bookkeeping from a transactional task into a strategic asset.

For those starting the selection process or wanting to understand compliance better, the Small Business Administration (SBA) guide on bookkeeping offers practical insights into record keeping and financial management—a trusted resource to complement your decision.

What Defines the Best Bookkeeping Firms for Growth and Compliance

The best bookkeeping firms for financial advisors aren’t defined by size or brand — they’re defined by how well they support regulatory accuracy, reporting clarity, and scalable operations.

When evaluating bookkeeping firms, financial advisors should look for partners that offer:

Advisory-specific accounting expertise, including fee-based revenue and custodial workflows

Strong tax and compliance coordination, reducing risk and last-minute surprises

Transparent reporting and communication, built for financial decision-making

Flexible, scalable service models that adapt as the firm grows

Firms that meet these criteria are better positioned to support both growth and compliance over time.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026