Go Back

Last Updated :

Last Updated :

Dec 17, 2025

Dec 17, 2025

What Is Series A Funding and Why Financial Readiness Matters

Navigating the complex world of startup financing can be daunting, especially for first-time founders preparing for their first major capital raise. At the heart of this journey lies a pivotal milestone: what is Series A funding and how it can catapult your startup’s growth.

Understanding this stage is crucial for founders intent on securing resources that fuel innovation, scale operations, and build sustainable business models.

This guide breaks down the essentials of Series A funding from a founder’s perspective. It highlights how this investment round fits within the overall funding lifecycle, what investors look for, and strategic considerations for managing your accounting and financial operations. We’ll also explore how modern bookkeeping and tax strategies, including R&D tax credits, play a vital role in positioning your startup for a successful raise.

What Is Series A Funding and Its Role in Your Startup Growth

Series A funding is typically the first significant round of venture capital investment your startup will seek after initial seed capital. Unlike seed rounds that focus on validating your product or market fit, Series A is about scaling and optimizing a tested business model.

Key characteristics of Series A funding:

Investment size: Usually between $2 million and $15 million — though this can vary widely depending on sector and geography.

Investors: Venture-capital firms specializing in early-stage technology or high-growth companies.

Purpose: Expand your team, accelerate customer acquisition, and refine your product or service.

Valuation: Sets a critical precedent for your company’s valuation and future fundraising potential.

Series A investors look for startups with clear, scalable business models, proven traction, and strong market potential. They’re betting that, with their infusion of capital, your company can leap to the next level of maturity and revenue generation.

Key Metrics Series A Investors Examine and How to Prepare Financially

Before investors write their checks, they perform rigorous due diligence — one of the core pillars is evaluating your startup's financial health and growth metrics. Understanding these key metrics empowers founders to present their business in the best light and anticipate investor questions.

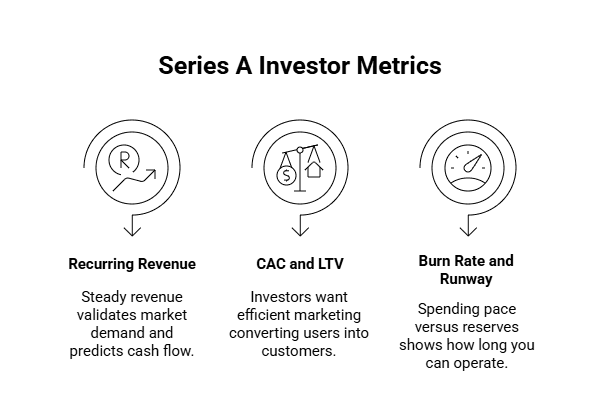

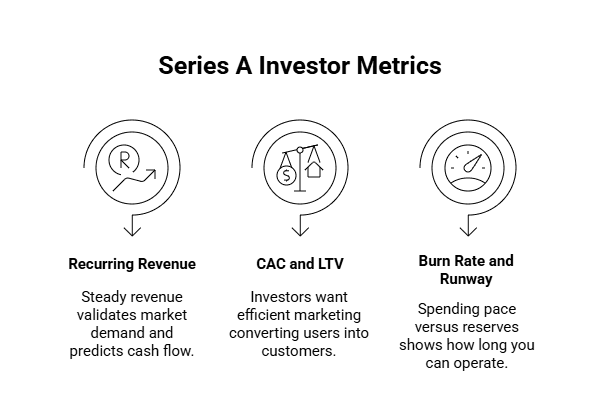

Three critical metrics every Series A investor typically reviews

Monthly Recurring Revenue (MRR) or Annual Recurring Revenue (ARR): For SaaS and subscription models, a steady and growing recurring revenue stream validates market demand and predicts future cash flow.

Customer Acquisition Cost (CAC) and Lifetime Value (LTV): Investors want to ensure your marketing spend efficiently converts users into long-term paying customers.

Burn Rate and Runway: Your current spending pace versus cash reserves shows how long you can operate before requiring additional capital.

Practical steps to prepare your startup’s finances

Maintain clean, up-to-date bookkeeping: Accurate and timely bookkeeping not only keeps your financials transparent but also helps detect cash flow trends and cost drivers that could impact investor confidence.

Engage with startup-friendly accounting: Modern bookkeeping solutions tailored for startups make it easier to track expenses, generate reports, and project financial scenarios — essential during fundraising.

Understand your tax position and opportunities: Leveraging tax credits, particularly the R&D tax credit, can improve your cash flow and reduce pre-Series A burn rate.

Use financial models to illustrate growth: Create clear, data-backed projections that explain where the Series A capital will be deployed and the expected impact on your business.

Why Modern Accounting and R&D Tax Credits Matter

As you plan for Series A funding, finances aren’t just about collecting numbers — it’s about optimizing your startup’s financial health to attract and retain investor interest.

Role of modern bookkeeping in scaling startups

Founders often juggle multiple roles, making it hard to maintain precise financial records. However, investors scrutinize your books, requiring founders to:

Provide quick access to profit and loss statements, balance sheets, and cash flow reports.

Demonstrate a clear picture of spending on product development, marketing, and operations.

Highlight consistency in financial practices that supports confidence in your company’s management.

Modern bookkeeping platforms — like those integrated by Haven — automate many manual tasks relevant to startups, ensuring compliance and readiness for investor audits without overwhelming the founder team.

Leveraging R&D tax credits to maximize runway and valuation

Many startups innovate through product development or engineering and often qualify for valuable R&D tax credits. These credits provide financial relief by lowering your tax liability or even generating refunds on qualifying research expenditures.

Benefits for a Series A founder include:

Extended runway: By reducing tax expenses, you can preserve cash reserves critical for meeting milestones before raising additional capital.

Increased valuation: Demonstrating a strategic approach to financial management uplifts investor confidence and can justify higher valuation multiples.

Enhanced operational efficiency: The tax credit process requires proper accounting of R&D expenses, pushing startups toward robust internal controls — a key factor investors evaluate.

Founders should work with professionals who understand the nuances of these credits, especially as certain startup activities — such as software development or prototyping — can be documented to maximize returns.

Strategic Considerations for Founders Facing Their First Series A

From a founder’s perspective, preparing and executing a successful Series A round isn’t just about funding — it’s about building a foundation for sustainable growth.

Align your financial operations with fundraising goals

Invest early in scalable accounting systems: Don't wait until just before your raise to get your financials in order. Early adoption reduces last-minute scrambles and accelerates due-diligence.

Maintain open communication with potential investors: Transparency paired with clean data helps establish trust and shortens negotiation cycles.

Plan for post-Series A growth financially: Understand how your capital raise will impact budgeting, hiring, and product development. Proactive planning minimizes surprises.

Partner with a finance and accounting provider that understands founders

At Haven, we know the pressure founders face juggling day-to-day startup life and preparing for fundraising. Our services span modern bookkeeping, tax filings, and specialized support for R&D credits, helping you focus on scaling your business with fewer financial headaches.

Bringing Your Series A Strategy Together

When asking what is series A funding is, remember it is more than capital; it’s your gateway to scaling, an endorsement of your business model, and a litmus test of your company’s operational maturity. By preparing your financial systems early, understanding key investor metrics, and leveraging strategic tax benefits like R&D credits, you position your startup for a smoother funding journey.

Founders taking a proactive approach to accounting and fundraising strategy unlock faster decision-making and better outcomes, empowering their startups to thrive beyond the Series A milestone.

Navigating the complex world of startup financing can be daunting, especially for first-time founders preparing for their first major capital raise. At the heart of this journey lies a pivotal milestone: what is Series A funding and how it can catapult your startup’s growth.

Understanding this stage is crucial for founders intent on securing resources that fuel innovation, scale operations, and build sustainable business models.

This guide breaks down the essentials of Series A funding from a founder’s perspective. It highlights how this investment round fits within the overall funding lifecycle, what investors look for, and strategic considerations for managing your accounting and financial operations. We’ll also explore how modern bookkeeping and tax strategies, including R&D tax credits, play a vital role in positioning your startup for a successful raise.

What Is Series A Funding and Its Role in Your Startup Growth

Series A funding is typically the first significant round of venture capital investment your startup will seek after initial seed capital. Unlike seed rounds that focus on validating your product or market fit, Series A is about scaling and optimizing a tested business model.

Key characteristics of Series A funding:

Investment size: Usually between $2 million and $15 million — though this can vary widely depending on sector and geography.

Investors: Venture-capital firms specializing in early-stage technology or high-growth companies.

Purpose: Expand your team, accelerate customer acquisition, and refine your product or service.

Valuation: Sets a critical precedent for your company’s valuation and future fundraising potential.

Series A investors look for startups with clear, scalable business models, proven traction, and strong market potential. They’re betting that, with their infusion of capital, your company can leap to the next level of maturity and revenue generation.

Key Metrics Series A Investors Examine and How to Prepare Financially

Before investors write their checks, they perform rigorous due diligence — one of the core pillars is evaluating your startup's financial health and growth metrics. Understanding these key metrics empowers founders to present their business in the best light and anticipate investor questions.

Three critical metrics every Series A investor typically reviews

Monthly Recurring Revenue (MRR) or Annual Recurring Revenue (ARR): For SaaS and subscription models, a steady and growing recurring revenue stream validates market demand and predicts future cash flow.

Customer Acquisition Cost (CAC) and Lifetime Value (LTV): Investors want to ensure your marketing spend efficiently converts users into long-term paying customers.

Burn Rate and Runway: Your current spending pace versus cash reserves shows how long you can operate before requiring additional capital.

Practical steps to prepare your startup’s finances

Maintain clean, up-to-date bookkeeping: Accurate and timely bookkeeping not only keeps your financials transparent but also helps detect cash flow trends and cost drivers that could impact investor confidence.

Engage with startup-friendly accounting: Modern bookkeeping solutions tailored for startups make it easier to track expenses, generate reports, and project financial scenarios — essential during fundraising.

Understand your tax position and opportunities: Leveraging tax credits, particularly the R&D tax credit, can improve your cash flow and reduce pre-Series A burn rate.

Use financial models to illustrate growth: Create clear, data-backed projections that explain where the Series A capital will be deployed and the expected impact on your business.

Why Modern Accounting and R&D Tax Credits Matter

As you plan for Series A funding, finances aren’t just about collecting numbers — it’s about optimizing your startup’s financial health to attract and retain investor interest.

Role of modern bookkeeping in scaling startups

Founders often juggle multiple roles, making it hard to maintain precise financial records. However, investors scrutinize your books, requiring founders to:

Provide quick access to profit and loss statements, balance sheets, and cash flow reports.

Demonstrate a clear picture of spending on product development, marketing, and operations.

Highlight consistency in financial practices that supports confidence in your company’s management.

Modern bookkeeping platforms — like those integrated by Haven — automate many manual tasks relevant to startups, ensuring compliance and readiness for investor audits without overwhelming the founder team.

Leveraging R&D tax credits to maximize runway and valuation

Many startups innovate through product development or engineering and often qualify for valuable R&D tax credits. These credits provide financial relief by lowering your tax liability or even generating refunds on qualifying research expenditures.

Benefits for a Series A founder include:

Extended runway: By reducing tax expenses, you can preserve cash reserves critical for meeting milestones before raising additional capital.

Increased valuation: Demonstrating a strategic approach to financial management uplifts investor confidence and can justify higher valuation multiples.

Enhanced operational efficiency: The tax credit process requires proper accounting of R&D expenses, pushing startups toward robust internal controls — a key factor investors evaluate.

Founders should work with professionals who understand the nuances of these credits, especially as certain startup activities — such as software development or prototyping — can be documented to maximize returns.

Strategic Considerations for Founders Facing Their First Series A

From a founder’s perspective, preparing and executing a successful Series A round isn’t just about funding — it’s about building a foundation for sustainable growth.

Align your financial operations with fundraising goals

Invest early in scalable accounting systems: Don't wait until just before your raise to get your financials in order. Early adoption reduces last-minute scrambles and accelerates due-diligence.

Maintain open communication with potential investors: Transparency paired with clean data helps establish trust and shortens negotiation cycles.

Plan for post-Series A growth financially: Understand how your capital raise will impact budgeting, hiring, and product development. Proactive planning minimizes surprises.

Partner with a finance and accounting provider that understands founders

At Haven, we know the pressure founders face juggling day-to-day startup life and preparing for fundraising. Our services span modern bookkeeping, tax filings, and specialized support for R&D credits, helping you focus on scaling your business with fewer financial headaches.

Bringing Your Series A Strategy Together

When asking what is series A funding is, remember it is more than capital; it’s your gateway to scaling, an endorsement of your business model, and a litmus test of your company’s operational maturity. By preparing your financial systems early, understanding key investor metrics, and leveraging strategic tax benefits like R&D credits, you position your startup for a smoother funding journey.

Founders taking a proactive approach to accounting and fundraising strategy unlock faster decision-making and better outcomes, empowering their startups to thrive beyond the Series A milestone.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026