Go Back

Last Updated :

Last Updated :

Dec 17, 2025

Dec 17, 2025

What Is Private Equity? Key Points For Founder’s Compliance

As a founder or CEO navigating the complex landscape of startup funding and growth strategies, understanding what private equity is and how it operates can be pivotal for making informed decisions about your company’s future.

Private equity (PE) is often misunderstood as just another avenue for raising funds, but for startups, agencies, and e-commerce businesses aiming for fast, scalable growth, it's more nuanced—and knowing this can help you strategically align with investors who add value beyond capital.

In this guide, we’ll walk you through the fundamentals of private equity, highlight its distinctions from venture capital, and explain why and when engaging with private equity might be right for your business. Along the way, we’ll arm you with practical insights to assess PE offers and leverage your financial data more effectively.

What Is Private Equity, and How Does It Differ from Venture Capital?

At its core, private equity refers to investment funds, typically structured as limited partnerships, that buy equity ownership in companies. Unlike venture capital (VC), which primarily targets early-stage startups with high growth potential, private equity often focuses on more mature companies, sometimes ones that are underperforming but have latent value or strong cash flow prospects.

PE firms raise capital from institutional investors and high-net-worth individuals, then deploy that capital to acquire controlling or significant minority stakes in companies. Their objective is to improve operational efficiency, grow revenues, and ultimately sell the business at a profit after several years.

Key Differences: Private Equity vs Venture Capital

Feature | Private Equity | Venture Capital |

Stage of Investment | Mature, stable, or struggling firms | Early-stage startups |

Control Over the Company | Often acquires controlling shares | Usually minority stakes |

Investment Size | Large deals ($10M to billions) | Smaller checks ($100K to several million) |

Time Horizon | 3–7 years | 5–10 years |

Focus | Operational improvements, cash flow | Rapid growth and scalability |

For founders, understanding these differences matters because PE’s operational involvement can dramatically change your business approach, profit expectations, and governance.

If you're interested in opportunities that overlap between venture capital and private equity, like growth equity rounds, from investors who understand both startup hustle and financial discipline, consider exploring partners like Hustle Fund, who offer founder-first approaches with capital and strategic support.

Why Should Founders Care About Private Equity?

It’s easy for founders to think of private equity as irrelevant to their startup phase. However, recognizing what is private equity and its role can prepare you for critical junctures such as late-stage funding, exit planning, or restructuring.

Reasons Founders Should Pay Attention to PE:

Capital for Growth and Expansion

PE firms can provide larger funding rounds than venture capital, enabling acquisitions, new market entry, or scaled operations.Operational Expertise

Many PE teams bring hands-on support in areas like finance, operations, and sales to help companies improve profitability.Exit Strategy

PE involvement often opens structured paths to liquidity—through buyouts, mergers, or planned recapitalizations.Tax and Financial Structuring

PE transactions can reshape your tax position, requiring thoughtful planning to optimize cash flow and compliance.

For startups with significant R&D pipelines, understanding the relationship between PE ownership and tax credits is increasingly important.

PE portfolios often include firms specializing in innovation tax credits; your engineering spend on product development could qualify for subsidies that improve cash flow. To navigate this complexity, Haven offers dedicated R&D tax credit support tailored to the needs of startups.

How Private Equity Firms Evaluate Companies

From a founder’s perspective, knowing what PE firms scrutinize before investing helps you prepare your financials and growth story accordingly. Most private equity firms focus on:

Cash Flow Stability and Projections

Market Position

Operational Efficiency

Management Team

Growth Opportunities

Founders can use these criteria as a checklist to ready their startup for private equity engagement. Strengthening your bookkeeping systems ensures accurate, transparent financial data that builds investor trust. Here at Haven, modern bookkeeping tailored for fast-growing companies means your metrics are always investor-ready, avoiding surprises in due diligence.

What Happens After a Private Equity Investment?

For founders, a PE investment isn’t just a cash infusion—it’s an operational relationship. Depending on the deal terms, the PE firm may:

Take Board and Operational Control: This could mean adding new executives or redefining roles.

Drive Strategic Initiatives: Introducing cost controls, new sales channels, or mergers and acquisitions.

Implement Rigorous Reporting and KPIs: Expect frequent, detailed financial and operational reports to track progress.

Plan for an Exit Timeline: PE firms typically hold investments for 3–7 years, with defined exit strategies like IPOs, sales, or recapitalizations.

Maintaining close collaboration with your financial team is vital during this period. An experienced accounting partner can accommodate increased reporting requirements and help navigate complex tax filings and audit preparations—critical to ensuring smooth progress with PE stakeholders.

Actionable Steps for Founders Considering Private Equity

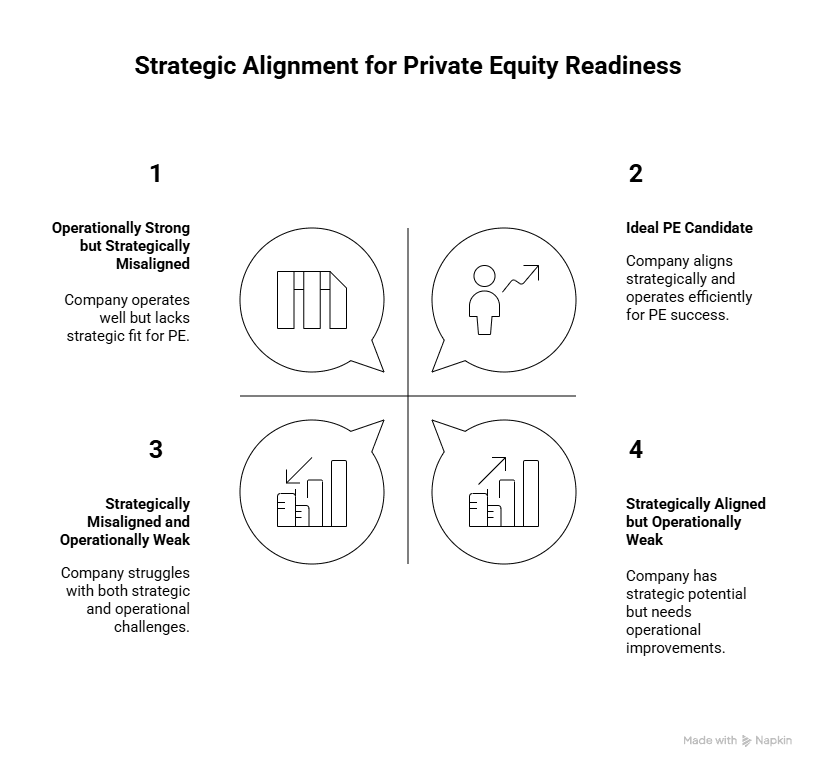

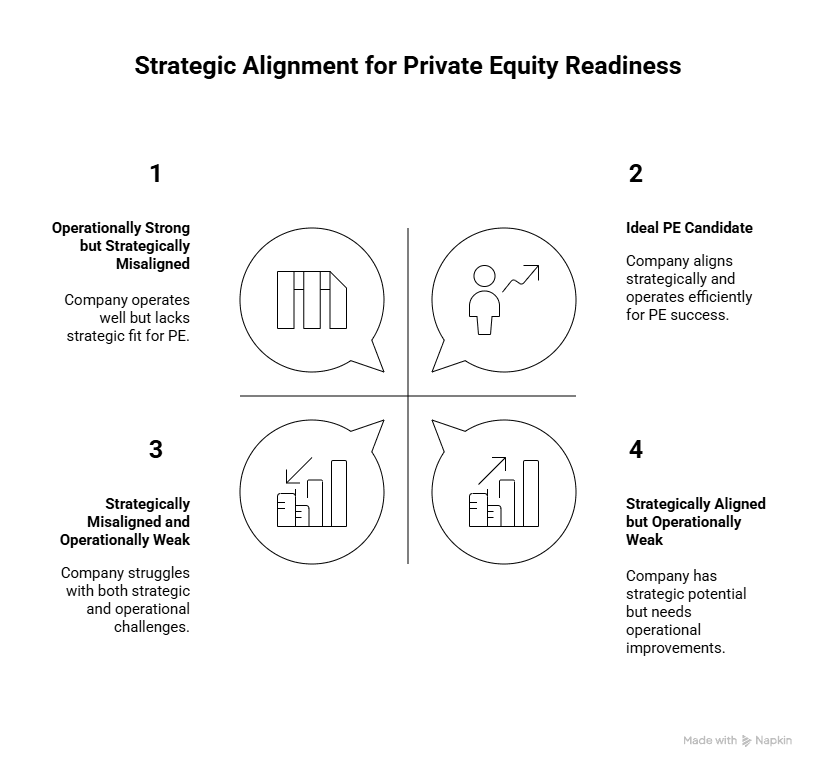

1. Assess Fit Carefully

Understand if your company aligns with typical PE investment profiles—stable cash flows, scalable operations, and clear growth levers. PE is less suited for early-stage or unprofitable startups.

2. Strengthen Financial Transparency

Investors value clean, timely financials. Use modern bookkeeping tools that integrate smoothly with your operations and provide precise cash flow, profitability, and cost analysis.

3. Evaluate Operational Readiness

Consider if your management team is prepared for a more hands-on ownership style. PE partnerships demand accountability and collaboration to execute strategic changes.

4. Leverage Tax Credits and Incentives

Multifaceted strategies including R&D tax credits can enhance valuation and cash flow. Don’t overlook these opportunities or the impact of PE ownership on tax planning.

5. Plan for Growth and Exit

Understand and align on PE’s exit horizons, so your vision syncs with theirs—this minimizes surprises later and ensures mutual success.

At Haven, we partner with founders and finance leaders to modernize bookkeeping, optimize tax filing, and maximize credits like R&D tax incentives—arming you with clarity and confidence in every growth phase.

Why Understanding Private Equity Is Important for Your Financial Health

For founders who aim to steer their startups toward scale and sustainability, knowing what private equity is comes not as an academic exercise but rather a strategic necessity.

This understanding helps you:

Evaluate whether PE or other funding routes best suit your growth stage and vision.

Prepare financials that meet PE’s rigorous standards.

Anticipate operational changes and governance shifts following the investment.

Optimize tax positions and cash flow through smart accounting and credit management.

Navigating PE investment successfully requires more than just raising capital—it demands pragmatic financial leadership, honed with reliable bookkeeping and tax strategies designed for startups.

As a founder or CEO navigating the complex landscape of startup funding and growth strategies, understanding what private equity is and how it operates can be pivotal for making informed decisions about your company’s future.

Private equity (PE) is often misunderstood as just another avenue for raising funds, but for startups, agencies, and e-commerce businesses aiming for fast, scalable growth, it's more nuanced—and knowing this can help you strategically align with investors who add value beyond capital.

In this guide, we’ll walk you through the fundamentals of private equity, highlight its distinctions from venture capital, and explain why and when engaging with private equity might be right for your business. Along the way, we’ll arm you with practical insights to assess PE offers and leverage your financial data more effectively.

What Is Private Equity, and How Does It Differ from Venture Capital?

At its core, private equity refers to investment funds, typically structured as limited partnerships, that buy equity ownership in companies. Unlike venture capital (VC), which primarily targets early-stage startups with high growth potential, private equity often focuses on more mature companies, sometimes ones that are underperforming but have latent value or strong cash flow prospects.

PE firms raise capital from institutional investors and high-net-worth individuals, then deploy that capital to acquire controlling or significant minority stakes in companies. Their objective is to improve operational efficiency, grow revenues, and ultimately sell the business at a profit after several years.

Key Differences: Private Equity vs Venture Capital

Feature | Private Equity | Venture Capital |

Stage of Investment | Mature, stable, or struggling firms | Early-stage startups |

Control Over the Company | Often acquires controlling shares | Usually minority stakes |

Investment Size | Large deals ($10M to billions) | Smaller checks ($100K to several million) |

Time Horizon | 3–7 years | 5–10 years |

Focus | Operational improvements, cash flow | Rapid growth and scalability |

For founders, understanding these differences matters because PE’s operational involvement can dramatically change your business approach, profit expectations, and governance.

If you're interested in opportunities that overlap between venture capital and private equity, like growth equity rounds, from investors who understand both startup hustle and financial discipline, consider exploring partners like Hustle Fund, who offer founder-first approaches with capital and strategic support.

Why Should Founders Care About Private Equity?

It’s easy for founders to think of private equity as irrelevant to their startup phase. However, recognizing what is private equity and its role can prepare you for critical junctures such as late-stage funding, exit planning, or restructuring.

Reasons Founders Should Pay Attention to PE:

Capital for Growth and Expansion

PE firms can provide larger funding rounds than venture capital, enabling acquisitions, new market entry, or scaled operations.Operational Expertise

Many PE teams bring hands-on support in areas like finance, operations, and sales to help companies improve profitability.Exit Strategy

PE involvement often opens structured paths to liquidity—through buyouts, mergers, or planned recapitalizations.Tax and Financial Structuring

PE transactions can reshape your tax position, requiring thoughtful planning to optimize cash flow and compliance.

For startups with significant R&D pipelines, understanding the relationship between PE ownership and tax credits is increasingly important.

PE portfolios often include firms specializing in innovation tax credits; your engineering spend on product development could qualify for subsidies that improve cash flow. To navigate this complexity, Haven offers dedicated R&D tax credit support tailored to the needs of startups.

How Private Equity Firms Evaluate Companies

From a founder’s perspective, knowing what PE firms scrutinize before investing helps you prepare your financials and growth story accordingly. Most private equity firms focus on:

Cash Flow Stability and Projections

Market Position

Operational Efficiency

Management Team

Growth Opportunities

Founders can use these criteria as a checklist to ready their startup for private equity engagement. Strengthening your bookkeeping systems ensures accurate, transparent financial data that builds investor trust. Here at Haven, modern bookkeeping tailored for fast-growing companies means your metrics are always investor-ready, avoiding surprises in due diligence.

What Happens After a Private Equity Investment?

For founders, a PE investment isn’t just a cash infusion—it’s an operational relationship. Depending on the deal terms, the PE firm may:

Take Board and Operational Control: This could mean adding new executives or redefining roles.

Drive Strategic Initiatives: Introducing cost controls, new sales channels, or mergers and acquisitions.

Implement Rigorous Reporting and KPIs: Expect frequent, detailed financial and operational reports to track progress.

Plan for an Exit Timeline: PE firms typically hold investments for 3–7 years, with defined exit strategies like IPOs, sales, or recapitalizations.

Maintaining close collaboration with your financial team is vital during this period. An experienced accounting partner can accommodate increased reporting requirements and help navigate complex tax filings and audit preparations—critical to ensuring smooth progress with PE stakeholders.

Actionable Steps for Founders Considering Private Equity

1. Assess Fit Carefully

Understand if your company aligns with typical PE investment profiles—stable cash flows, scalable operations, and clear growth levers. PE is less suited for early-stage or unprofitable startups.

2. Strengthen Financial Transparency

Investors value clean, timely financials. Use modern bookkeeping tools that integrate smoothly with your operations and provide precise cash flow, profitability, and cost analysis.

3. Evaluate Operational Readiness

Consider if your management team is prepared for a more hands-on ownership style. PE partnerships demand accountability and collaboration to execute strategic changes.

4. Leverage Tax Credits and Incentives

Multifaceted strategies including R&D tax credits can enhance valuation and cash flow. Don’t overlook these opportunities or the impact of PE ownership on tax planning.

5. Plan for Growth and Exit

Understand and align on PE’s exit horizons, so your vision syncs with theirs—this minimizes surprises later and ensures mutual success.

At Haven, we partner with founders and finance leaders to modernize bookkeeping, optimize tax filing, and maximize credits like R&D tax incentives—arming you with clarity and confidence in every growth phase.

Why Understanding Private Equity Is Important for Your Financial Health

For founders who aim to steer their startups toward scale and sustainability, knowing what private equity is comes not as an academic exercise but rather a strategic necessity.

This understanding helps you:

Evaluate whether PE or other funding routes best suit your growth stage and vision.

Prepare financials that meet PE’s rigorous standards.

Anticipate operational changes and governance shifts following the investment.

Optimize tax positions and cash flow through smart accounting and credit management.

Navigating PE investment successfully requires more than just raising capital—it demands pragmatic financial leadership, honed with reliable bookkeeping and tax strategies designed for startups.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026