Go Back

Last Updated :

Last Updated :

Jan 9, 2026

Jan 9, 2026

What is Cash Flow in Business? A Founder’s Guide to Managing Money Movement

Understanding what is cash flow in business is foundational for founders who want to steer their startups, agencies, or e-commerce brands toward sustainable success. Cash flow is not just about having money in the bank; it’s the real-time pulse of your company’s financial health. Without positive cash flow, even the most innovative ideas and robust revenue streams can struggle to cover expenses, invest in growth, or weather unforeseen challenges.

In this founder-friendly guide, we’ll demystify cash flow: what it is, why it matters, how it differs from profit, and practical ways to track and improve it. This insight arms you with the financial visibility necessary to make informed decisions, avoid cash crises, and build a resilient business.

What is Cash Flow in Business? Understanding the Basics

At its core, cash flow measures the net amount of cash moving into and out of your business over a specific period. Think of your business like a personal bank account. Cash inflows are deposits — money coming in from customers, investors, or loans. Cash outflows are withdrawals — payments for salaries, rent, inventory, software tools, and other operational costs.

Why is this distinction so crucial? Because revenue or profit doesn’t always equate to cash available on hand. For example, you can close a big sale (recording revenue), but if the customer hasn’t paid yet, your cash balance remains unchanged. This timing mismatch means a company can technically be profitable yet face cash shortages that threaten daily operations.

Key Components of Cash Flow

Your cash flow breaks down into three segments:

Cash Flow Category | Purpose | Common Examples |

Operating Cash Flow | Cash generated or used by core business activities | Customer payments, supplier invoices, payroll |

Investing Cash Flow | Cash related to buying or selling long-term assets | Purchase of equipment, sales of property |

Financing Cash Flow | Cash received from or paid to external financiers | Bank loans, equity funding, dividend payments |

Understanding how cash flows through each segment enables you to diagnose which parts of your business are driving or draining cash.

For a deeper dive into your cash flow statement — where these categories come together — and how to read it confidently, check out How to Read a Cash Flow Statement.

Cash Flow Is Critical for Business Survival — Beyond Profit

Many founders conflate profitability with financial health, but the reality is more nuanced. Positive cash flow is what keeps the lights on and the company growing. Here’s why it’s non-negotiable for survival:

Meet immediate obligations: Payroll, rent, vendor payments, and taxes all require cash on hand. Running out of cash can lead to late fees, strained relationships, layoffs, or worse — insolvency.

Fuel growth: Investing in inventory, marketing, product development, or entering new markets depends on having readily available cash.

Create resilience: Healthy cash reserves provide a buffer to navigate unexpected downturns, customer payment delays, or sudden expenses.

Attract investments and credit: Banks and investors scrutinize cash flow to assess whether your business can repay loans or deliver returns, often more so than profits alone.

Cash Flow vs. Profit: What Founders Must Know

Profit answers the question, ""Is the business making money on paper?"" Cash flow answers, ""Do we have the money in hand to operate today?"" It’s possible to be profitable but cash-poor if receivables pile up without payment or if capital investments consume cash reserves.

A company might realize $50,000 in profit but have $10,000 in actual cash after all inflows and outflows. This low liquidity can stall operations even amid apparent 'success.' Conversely, a company managing cash flow well can navigate lean periods and capitalize on opportunities despite temporarily lower profits.

How Cash Moves Through a Business?

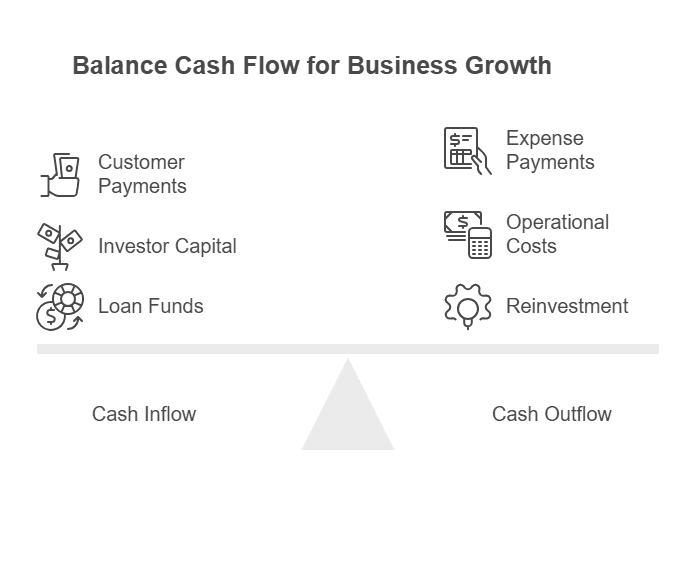

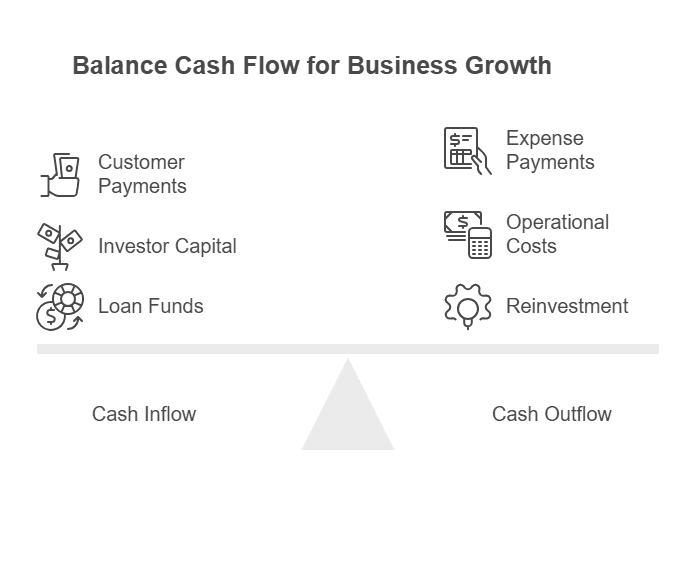

Visualize cash flow as a continuous cycle:

Cash inflow: Customers pay invoices, investors inject capital, or funds come through loans.

Cash management: You allocate cash efficiently — paying bills, managing payroll, and covering fixed and variable costs.

Cash outflow: Expenses like rent, services, subscriptions, marketing campaigns, and inventory purchases are paid.

Cash reinvestment: Surplus cash is reinvested into equipment, software, or research and development to fuel growth.

Mapping this cycle regularly enables you to forecast cash shortages before they happen and avoid making reactionary decisions under pressure.

Effective Cash Flow Management Strategies for Founders

Good cash flow management involves more than tracking — it’s about proactively controlling how money moves through your business. Here are some pragmatic tactics tailored for fast-moving startups and ecommerce companies:

Regular cash flow forecasting: Update a projection weekly or monthly to plan for predictable income and expenses and anticipate shortfalls. Factor in payment terms, seasonality, and known upcoming obligations.

Accelerate receivables: Encourage faster customer payments through incentives, clear invoicing, and timely reminders. Offering early payment discounts can strengthen your cash position.

Control payables without harming relationships: Negotiate longer payment terms, stagger large invoice payments, and prioritize essential expenses to smooth out cash demands.

Maintain a cash reserve: Aim to keep 1–3 months’ worth of operating expenses in accessible accounts to avoid emergency scrambles.

Leverage financing smartly: Short-term credit lines or working capital loans can help bridge gaps, but manage debt exposure carefully.

Automate cash tracking and payments: Implement tools to manage accounts receivable, schedule bill payments, and centralize cash flow insights in real-time.

Our article on Effective Cash Management Strategies for Founders offers more detailed approaches and tools to optimize your process.

Practical Example: Cash Flow in an Ecommerce Startup

Imagine a new ecommerce brand launching seasonal products. They generate $100K in gross sales over a month, but 30% is on 30-day credit terms, so only $70K is collected during the same period.

Meanwhile, the business pays $50K in inventory costs upfront to prepare for next season and $20K in operational expenses like rent, marketing, and salaries.

Description | Amount |

Cash inflow (collected revenue) | $70,000 |

Cash outflow (suppliers, expenses) | $70,000 |

Net cash flow | $0 |

Although profitable on paper, the available cash for the month nets out. Without close monitoring, this timing mismatch could cause the founder to misjudge financial health and miss payroll or other obligations.

Tools and Resources to Improve Cash Flow Visibility

Cloud bookkeeping platforms: Tools like QuickBooks, Xero, or Zoho keep you updated on cash positions and automate transaction inputs.

Payment automation solutions: Platforms such as Bill.com or Stripe help collect faster and streamline vendor payments.

Professional advisory services: Bookkeeping and tax experts can maximize accuracy and ensure you don’t miss important benefits (like R&D tax credits) that could improve cash availability.

Looking for actionable help? Learn more about our founder-first services designed for startups and ecommerce brands.

Cash Flow Is the Lifeblood of Your Business — Master It for Survival and Growth

In summary, mastering what is cash flow in business is and how to manage it isn’t just an accounting exercise — it’s foundational to your company’s survival and scaling. Focus on maintaining positive cash flow through proactive forecasting, efficient receivables and payables management, and thoughtful reinvestment decisions.

With modern bookkeeping strategies and founder-focused support, you can continue growing confidently, knowing that your business’s money movement is optimized to support your vision. Lack of cash flow explains why promising startups stall, so prioritize this financial vital sign continuously.

For official guidelines and deeper insights into cash flow reporting, the Small Business Administration (SBA) website is a reliable resource offering business financing and cash flow management advice for US startups.

Understanding what is cash flow in business is foundational for founders who want to steer their startups, agencies, or e-commerce brands toward sustainable success. Cash flow is not just about having money in the bank; it’s the real-time pulse of your company’s financial health. Without positive cash flow, even the most innovative ideas and robust revenue streams can struggle to cover expenses, invest in growth, or weather unforeseen challenges.

In this founder-friendly guide, we’ll demystify cash flow: what it is, why it matters, how it differs from profit, and practical ways to track and improve it. This insight arms you with the financial visibility necessary to make informed decisions, avoid cash crises, and build a resilient business.

What is Cash Flow in Business? Understanding the Basics

At its core, cash flow measures the net amount of cash moving into and out of your business over a specific period. Think of your business like a personal bank account. Cash inflows are deposits — money coming in from customers, investors, or loans. Cash outflows are withdrawals — payments for salaries, rent, inventory, software tools, and other operational costs.

Why is this distinction so crucial? Because revenue or profit doesn’t always equate to cash available on hand. For example, you can close a big sale (recording revenue), but if the customer hasn’t paid yet, your cash balance remains unchanged. This timing mismatch means a company can technically be profitable yet face cash shortages that threaten daily operations.

Key Components of Cash Flow

Your cash flow breaks down into three segments:

Cash Flow Category | Purpose | Common Examples |

Operating Cash Flow | Cash generated or used by core business activities | Customer payments, supplier invoices, payroll |

Investing Cash Flow | Cash related to buying or selling long-term assets | Purchase of equipment, sales of property |

Financing Cash Flow | Cash received from or paid to external financiers | Bank loans, equity funding, dividend payments |

Understanding how cash flows through each segment enables you to diagnose which parts of your business are driving or draining cash.

For a deeper dive into your cash flow statement — where these categories come together — and how to read it confidently, check out How to Read a Cash Flow Statement.

Cash Flow Is Critical for Business Survival — Beyond Profit

Many founders conflate profitability with financial health, but the reality is more nuanced. Positive cash flow is what keeps the lights on and the company growing. Here’s why it’s non-negotiable for survival:

Meet immediate obligations: Payroll, rent, vendor payments, and taxes all require cash on hand. Running out of cash can lead to late fees, strained relationships, layoffs, or worse — insolvency.

Fuel growth: Investing in inventory, marketing, product development, or entering new markets depends on having readily available cash.

Create resilience: Healthy cash reserves provide a buffer to navigate unexpected downturns, customer payment delays, or sudden expenses.

Attract investments and credit: Banks and investors scrutinize cash flow to assess whether your business can repay loans or deliver returns, often more so than profits alone.

Cash Flow vs. Profit: What Founders Must Know

Profit answers the question, ""Is the business making money on paper?"" Cash flow answers, ""Do we have the money in hand to operate today?"" It’s possible to be profitable but cash-poor if receivables pile up without payment or if capital investments consume cash reserves.

A company might realize $50,000 in profit but have $10,000 in actual cash after all inflows and outflows. This low liquidity can stall operations even amid apparent 'success.' Conversely, a company managing cash flow well can navigate lean periods and capitalize on opportunities despite temporarily lower profits.

How Cash Moves Through a Business?

Visualize cash flow as a continuous cycle:

Cash inflow: Customers pay invoices, investors inject capital, or funds come through loans.

Cash management: You allocate cash efficiently — paying bills, managing payroll, and covering fixed and variable costs.

Cash outflow: Expenses like rent, services, subscriptions, marketing campaigns, and inventory purchases are paid.

Cash reinvestment: Surplus cash is reinvested into equipment, software, or research and development to fuel growth.

Mapping this cycle regularly enables you to forecast cash shortages before they happen and avoid making reactionary decisions under pressure.

Effective Cash Flow Management Strategies for Founders

Good cash flow management involves more than tracking — it’s about proactively controlling how money moves through your business. Here are some pragmatic tactics tailored for fast-moving startups and ecommerce companies:

Regular cash flow forecasting: Update a projection weekly or monthly to plan for predictable income and expenses and anticipate shortfalls. Factor in payment terms, seasonality, and known upcoming obligations.

Accelerate receivables: Encourage faster customer payments through incentives, clear invoicing, and timely reminders. Offering early payment discounts can strengthen your cash position.

Control payables without harming relationships: Negotiate longer payment terms, stagger large invoice payments, and prioritize essential expenses to smooth out cash demands.

Maintain a cash reserve: Aim to keep 1–3 months’ worth of operating expenses in accessible accounts to avoid emergency scrambles.

Leverage financing smartly: Short-term credit lines or working capital loans can help bridge gaps, but manage debt exposure carefully.

Automate cash tracking and payments: Implement tools to manage accounts receivable, schedule bill payments, and centralize cash flow insights in real-time.

Our article on Effective Cash Management Strategies for Founders offers more detailed approaches and tools to optimize your process.

Practical Example: Cash Flow in an Ecommerce Startup

Imagine a new ecommerce brand launching seasonal products. They generate $100K in gross sales over a month, but 30% is on 30-day credit terms, so only $70K is collected during the same period.

Meanwhile, the business pays $50K in inventory costs upfront to prepare for next season and $20K in operational expenses like rent, marketing, and salaries.

Description | Amount |

Cash inflow (collected revenue) | $70,000 |

Cash outflow (suppliers, expenses) | $70,000 |

Net cash flow | $0 |

Although profitable on paper, the available cash for the month nets out. Without close monitoring, this timing mismatch could cause the founder to misjudge financial health and miss payroll or other obligations.

Tools and Resources to Improve Cash Flow Visibility

Cloud bookkeeping platforms: Tools like QuickBooks, Xero, or Zoho keep you updated on cash positions and automate transaction inputs.

Payment automation solutions: Platforms such as Bill.com or Stripe help collect faster and streamline vendor payments.

Professional advisory services: Bookkeeping and tax experts can maximize accuracy and ensure you don’t miss important benefits (like R&D tax credits) that could improve cash availability.

Looking for actionable help? Learn more about our founder-first services designed for startups and ecommerce brands.

Cash Flow Is the Lifeblood of Your Business — Master It for Survival and Growth

In summary, mastering what is cash flow in business is and how to manage it isn’t just an accounting exercise — it’s foundational to your company’s survival and scaling. Focus on maintaining positive cash flow through proactive forecasting, efficient receivables and payables management, and thoughtful reinvestment decisions.

With modern bookkeeping strategies and founder-focused support, you can continue growing confidently, knowing that your business’s money movement is optimized to support your vision. Lack of cash flow explains why promising startups stall, so prioritize this financial vital sign continuously.

For official guidelines and deeper insights into cash flow reporting, the Small Business Administration (SBA) website is a reliable resource offering business financing and cash flow management advice for US startups.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026