Go Back

Last Updated :

Last Updated :

Jan 9, 2026

Jan 9, 2026

What Is a Fractional CFO? A Guide for Series A Founders

As a founder gearing up for or recently completing your Series A funding round, you are stepping into a rapid growth phase filled with new opportunities—and challenges. One key decision that can greatly influence your trajectory is financial leadership. You may have started with a bookkeeper, an accountant, or a Controller, but now is often the time to ask:

What is a fractional CFO, and when should I hire one?

This guide breaks down the concept of a fractional CFO, their services and benefits, and how to decide if your startup is ready for this nuanced financial leadership approach.

What Is a Fractional CFO?

A fractional CFO is a part-time Chief Financial Officer who provides strategic financial leadership to startups without the expense or commitment of a full-time executive. Unlike a full-time CFO, a fractional CFO works on a contract or retainer basis—often a few days a week or month—tailored to your startup’s specific growth stage and needs.

Key Characteristics of a Fractional CFO

Characteristic | Description |

Part-time, flexible | Scheduled engagement, from project basis to ongoing |

Strategic focus | Financial planning, fundraising, forecasting, growth |

Cost-efficient | Fraction of the salary and benefits of a full-time CFO |

Startup-savvy | Experienced in early-stage growth opportunities and risks |

Fractional Chief Financial Officers blend the high-level expertise of incumbents from mature companies with the agility demanded by startups. They deliver seasoned financial insight exactly when and where you need it most.

If you want to explore how a fractional CFO fits into your startup’s evolving financial leadership team, this article on the essential role of fractional CFOs for growing startups offers valuable perspectives.

What Services Does a Fractional CFO Offer Startups?

The tasks a fractional CFO undertakes will depend on your company’s stage and immediate challenges, but common services include:

1. Financial Strategy and Forecasting

Fractional CFOs build and maintain financial models that incorporate operational insights, funding needs, burn rates, and revenue projections. They help you create realistic growth scenarios so you can plan for multiple futures.

2. Fundraising Support

Having a CFO who understands investor expectations improves your capital-raising chances. From crafting financial narratives for pitch decks to managing due diligence and negotiations, fractional CFOs serve as key interlocutors between founders and investors.

3. Cash Flow Management and Budgeting

Smart cash flow monitoring helps prevent startups from running out of runway. Fractional CFOs work with your accounting team or bookkeeper to implement budgeting processes that keep your finances transparent and under control.

4. Financial Controls and Compliance

As your startup grows, internal controls and compliance become critical. A fractional CFO helps set up accounting frameworks, expense policies, and reporting lines to minimize risk.

5. Metrics and KPIs Reporting

Your fractional CFO will ensure you track the financial metrics that matter—in order to measure progress, spot problems, and inform decision-making.

6. Operational Efficiency and Cost Management

Analyzing expense trends and advising on operational adjustments are common CFO deliverables. Efficiency gains can significantly impact your bottom line during growth stages.

7. Tax and R&D Credit Optimization (in collaboration)

While not always directly handling tax filings, fractional CFOs often work closely with accounting professionals to maximize R&D tax credit opportunities and optimize tax strategies.

When Should a Series A Startup Hire a Fractional CFO?

Deciding when to bring a fractional CFO onboard depends on your startup’s complexity and immediate financial needs. Consider these signs as triggers:

Sign You Need a Fractional CFO | Why It Matters |

Preparing for or closing a Series A or later funding round | A CFO specializing in investor relations can elevate your pitch and manage financial due diligence |

Revenue growth causing financial planning complexity | You need strategic forecasting beyond spreadsheet basics |

Increased operational complexity and burn rate | Effective cash flow management is critical to avoid running out of runway |

Lack of senior financial leadership for budget and metrics | Founders need actionable financial insights to steer decisions |

Planning to optimize tax credits or financial reporting | Strategic tax planning and compliance reduce risk and improve margins |

Rapid team expansion requiring scalable financial processes | A fractional CFO can design scalable systems without full-time overhead |

If you recognize any of these indicators, it is time to explore adding fractional CFO support.

For startups not quite ready for a fractional CFO, foundational bookkeeping and accounting services remain essential. Haven offers modern bookkeeping and financial services tailored to startups, ensuring your financial basics are solid while preparing you for CFO-level guidance.

How to Assess the Value of Hiring a Fractional CFO

The biggest appeal of a fractional CFO is access to expert financial leadership without full-time CFO salary commitments. But how do you weigh this investment?

Benefits Include:

Cost-effective leadership: A fraction of full-time CFO costs, freeing capital for growth activities.

Flexible engagement: Tweak frequency and scope as your business evolves.

Focused expertise: Get precisely the financial services your business requires, from forecasting to fundraising.

Investor confidence: A CFO on your team signals maturity and readiness to outside investors.

Risk mitigation: Avoid common financial pitfalls during hyper-growth phases.

Understanding these benefits helps justify the financial commitment. Typical costs vary based on scope and frequency. For more details on pricing models and to compare fractional CFO options, check out our transparent pricing overview.

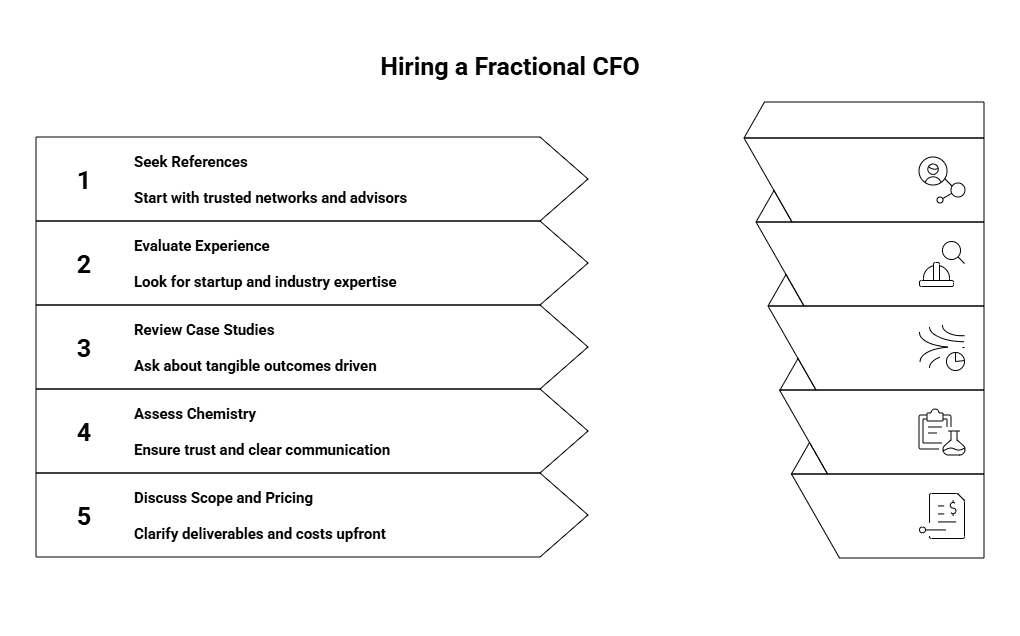

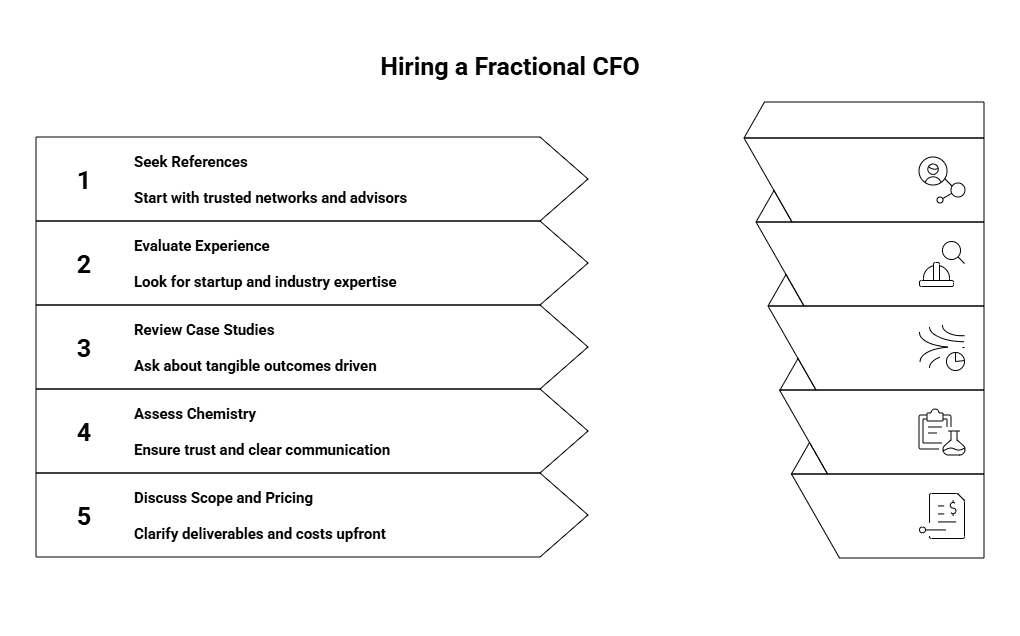

How to Find and Vet the Right Fractional CFO

Hiring a fractional CFO is not just about filling a role—it’s about finding a trusted partner for your startup’s financial journey.

Steps to Consider

Step | Details |

Define your needs | What are your immediate financial challenges and goals? |

Seek references | Start with trusted networks, advisors, or platforms |

Evaluate experience | Look for fractional CFOs with startup and industry expertise |

Review case studies | Ask candidates about tangible outcomes they’ve driven |

Assess chemistry and communication | Financial leadership requires trust and clear dialogue |

Discuss scope and pricing upfront | Avoid surprises by clarifying deliverables and cost |

Hiring a fractional CFO is a strategic decision—do not rush. Use a clear vetting framework aligned with your business objectives.

Fractional CFO vs. Full-Time CFO vs. Interim CFO

With multiple finance leadership options, understanding distinctions clarifies which best fits your context.

CFO Type | Definition | Best For |

Fractional CFO | Part-time, contract-based CFO for ongoing support | Startups needing cost-efficient, strategic advice without full-time salary |

Full-Time CFO | Executive-level financial leader on staff full-time | Established startups or scale-ups requiring daily leadership |

Interim CFO | Temporary CFO filling gaps during transition | Companies in between CFOs or managing sudden leadership changes |

Most Series A startups find that fractional CFOs provide a strong balance of expertise, cost, and flexibility during their growth phase.

Is a Fractional CFO Right for Your Series A Startup?

Navigating your Series A startup’s financial future is complex, fast-moving, and high-stakes. Understanding what is a fractional CFO and the strategic role they play can be a game changer in this phase.

Fractional CFOs deliver experienced financial leadership tailored to startup realities—accelerating fundraising, improving forecasting, controlling cash flow, and optimizing operational efficiency without the budget stress of a full-time executive.

If your startup faces the complexities of growth, investor expectations, and operational scaling—but is not yet ready to commit to a full-time CFO—a fractional CFO may be the ideal solution.

Explore how a fractional CFO can specifically help your business by reviewing the essential role of fractional CFOs for growing startups and assessing your current financial needs with our expert team.

Further Reading

For a comprehensive overview of startup bookkeeping, tax filing, and financing services that complement financial leadership, visit Haven’s startup-tailored services.

To learn more about fractional CFO costs and fee structures, see our detailed pricing page.

For official guidance on startup financial planning and compliance, the Small Business Administration offers authoritative resources.

Actionable Next Steps for Founders

Review your current financial leadership and identify gaps impacting growth.

Evaluate whether fundraising, cash flow management, or financial planning require elevated expertise.

Engage with fractional CFO candidates with proven startup experience.

Incorporate scalable financial controls and reporting processes now to ease future transitions.

Partner with specialized providers offering integrated bookkeeping, tax, and advisory services designed for startups.

Founders who embrace fractional CFO services position their startups for scalable success—balancing agility, expertise, and cost efficiency in a critical growth window.

By strategically investing in a fractional CFO, your Series A startup gains the financial leadership necessary to turn vision into reality—without the overhead or risks of premature full-time hires.

As a founder gearing up for or recently completing your Series A funding round, you are stepping into a rapid growth phase filled with new opportunities—and challenges. One key decision that can greatly influence your trajectory is financial leadership. You may have started with a bookkeeper, an accountant, or a Controller, but now is often the time to ask:

What is a fractional CFO, and when should I hire one?

This guide breaks down the concept of a fractional CFO, their services and benefits, and how to decide if your startup is ready for this nuanced financial leadership approach.

What Is a Fractional CFO?

A fractional CFO is a part-time Chief Financial Officer who provides strategic financial leadership to startups without the expense or commitment of a full-time executive. Unlike a full-time CFO, a fractional CFO works on a contract or retainer basis—often a few days a week or month—tailored to your startup’s specific growth stage and needs.

Key Characteristics of a Fractional CFO

Characteristic | Description |

Part-time, flexible | Scheduled engagement, from project basis to ongoing |

Strategic focus | Financial planning, fundraising, forecasting, growth |

Cost-efficient | Fraction of the salary and benefits of a full-time CFO |

Startup-savvy | Experienced in early-stage growth opportunities and risks |

Fractional Chief Financial Officers blend the high-level expertise of incumbents from mature companies with the agility demanded by startups. They deliver seasoned financial insight exactly when and where you need it most.

If you want to explore how a fractional CFO fits into your startup’s evolving financial leadership team, this article on the essential role of fractional CFOs for growing startups offers valuable perspectives.

What Services Does a Fractional CFO Offer Startups?

The tasks a fractional CFO undertakes will depend on your company’s stage and immediate challenges, but common services include:

1. Financial Strategy and Forecasting

Fractional CFOs build and maintain financial models that incorporate operational insights, funding needs, burn rates, and revenue projections. They help you create realistic growth scenarios so you can plan for multiple futures.

2. Fundraising Support

Having a CFO who understands investor expectations improves your capital-raising chances. From crafting financial narratives for pitch decks to managing due diligence and negotiations, fractional CFOs serve as key interlocutors between founders and investors.

3. Cash Flow Management and Budgeting

Smart cash flow monitoring helps prevent startups from running out of runway. Fractional CFOs work with your accounting team or bookkeeper to implement budgeting processes that keep your finances transparent and under control.

4. Financial Controls and Compliance

As your startup grows, internal controls and compliance become critical. A fractional CFO helps set up accounting frameworks, expense policies, and reporting lines to minimize risk.

5. Metrics and KPIs Reporting

Your fractional CFO will ensure you track the financial metrics that matter—in order to measure progress, spot problems, and inform decision-making.

6. Operational Efficiency and Cost Management

Analyzing expense trends and advising on operational adjustments are common CFO deliverables. Efficiency gains can significantly impact your bottom line during growth stages.

7. Tax and R&D Credit Optimization (in collaboration)

While not always directly handling tax filings, fractional CFOs often work closely with accounting professionals to maximize R&D tax credit opportunities and optimize tax strategies.

When Should a Series A Startup Hire a Fractional CFO?

Deciding when to bring a fractional CFO onboard depends on your startup’s complexity and immediate financial needs. Consider these signs as triggers:

Sign You Need a Fractional CFO | Why It Matters |

Preparing for or closing a Series A or later funding round | A CFO specializing in investor relations can elevate your pitch and manage financial due diligence |

Revenue growth causing financial planning complexity | You need strategic forecasting beyond spreadsheet basics |

Increased operational complexity and burn rate | Effective cash flow management is critical to avoid running out of runway |

Lack of senior financial leadership for budget and metrics | Founders need actionable financial insights to steer decisions |

Planning to optimize tax credits or financial reporting | Strategic tax planning and compliance reduce risk and improve margins |

Rapid team expansion requiring scalable financial processes | A fractional CFO can design scalable systems without full-time overhead |

If you recognize any of these indicators, it is time to explore adding fractional CFO support.

For startups not quite ready for a fractional CFO, foundational bookkeeping and accounting services remain essential. Haven offers modern bookkeeping and financial services tailored to startups, ensuring your financial basics are solid while preparing you for CFO-level guidance.

How to Assess the Value of Hiring a Fractional CFO

The biggest appeal of a fractional CFO is access to expert financial leadership without full-time CFO salary commitments. But how do you weigh this investment?

Benefits Include:

Cost-effective leadership: A fraction of full-time CFO costs, freeing capital for growth activities.

Flexible engagement: Tweak frequency and scope as your business evolves.

Focused expertise: Get precisely the financial services your business requires, from forecasting to fundraising.

Investor confidence: A CFO on your team signals maturity and readiness to outside investors.

Risk mitigation: Avoid common financial pitfalls during hyper-growth phases.

Understanding these benefits helps justify the financial commitment. Typical costs vary based on scope and frequency. For more details on pricing models and to compare fractional CFO options, check out our transparent pricing overview.

How to Find and Vet the Right Fractional CFO

Hiring a fractional CFO is not just about filling a role—it’s about finding a trusted partner for your startup’s financial journey.

Steps to Consider

Step | Details |

Define your needs | What are your immediate financial challenges and goals? |

Seek references | Start with trusted networks, advisors, or platforms |

Evaluate experience | Look for fractional CFOs with startup and industry expertise |

Review case studies | Ask candidates about tangible outcomes they’ve driven |

Assess chemistry and communication | Financial leadership requires trust and clear dialogue |

Discuss scope and pricing upfront | Avoid surprises by clarifying deliverables and cost |

Hiring a fractional CFO is a strategic decision—do not rush. Use a clear vetting framework aligned with your business objectives.

Fractional CFO vs. Full-Time CFO vs. Interim CFO

With multiple finance leadership options, understanding distinctions clarifies which best fits your context.

CFO Type | Definition | Best For |

Fractional CFO | Part-time, contract-based CFO for ongoing support | Startups needing cost-efficient, strategic advice without full-time salary |

Full-Time CFO | Executive-level financial leader on staff full-time | Established startups or scale-ups requiring daily leadership |

Interim CFO | Temporary CFO filling gaps during transition | Companies in between CFOs or managing sudden leadership changes |

Most Series A startups find that fractional CFOs provide a strong balance of expertise, cost, and flexibility during their growth phase.

Is a Fractional CFO Right for Your Series A Startup?

Navigating your Series A startup’s financial future is complex, fast-moving, and high-stakes. Understanding what is a fractional CFO and the strategic role they play can be a game changer in this phase.

Fractional CFOs deliver experienced financial leadership tailored to startup realities—accelerating fundraising, improving forecasting, controlling cash flow, and optimizing operational efficiency without the budget stress of a full-time executive.

If your startup faces the complexities of growth, investor expectations, and operational scaling—but is not yet ready to commit to a full-time CFO—a fractional CFO may be the ideal solution.

Explore how a fractional CFO can specifically help your business by reviewing the essential role of fractional CFOs for growing startups and assessing your current financial needs with our expert team.

Further Reading

For a comprehensive overview of startup bookkeeping, tax filing, and financing services that complement financial leadership, visit Haven’s startup-tailored services.

To learn more about fractional CFO costs and fee structures, see our detailed pricing page.

For official guidance on startup financial planning and compliance, the Small Business Administration offers authoritative resources.

Actionable Next Steps for Founders

Review your current financial leadership and identify gaps impacting growth.

Evaluate whether fundraising, cash flow management, or financial planning require elevated expertise.

Engage with fractional CFO candidates with proven startup experience.

Incorporate scalable financial controls and reporting processes now to ease future transitions.

Partner with specialized providers offering integrated bookkeeping, tax, and advisory services designed for startups.

Founders who embrace fractional CFO services position their startups for scalable success—balancing agility, expertise, and cost efficiency in a critical growth window.

By strategically investing in a fractional CFO, your Series A startup gains the financial leadership necessary to turn vision into reality—without the overhead or risks of premature full-time hires.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026