Go Back

Last Updated :

Last Updated :

Feb 9, 2026

Feb 9, 2026

What Does a Bookkeeper Do? Guide to Small Business + Daily tasks

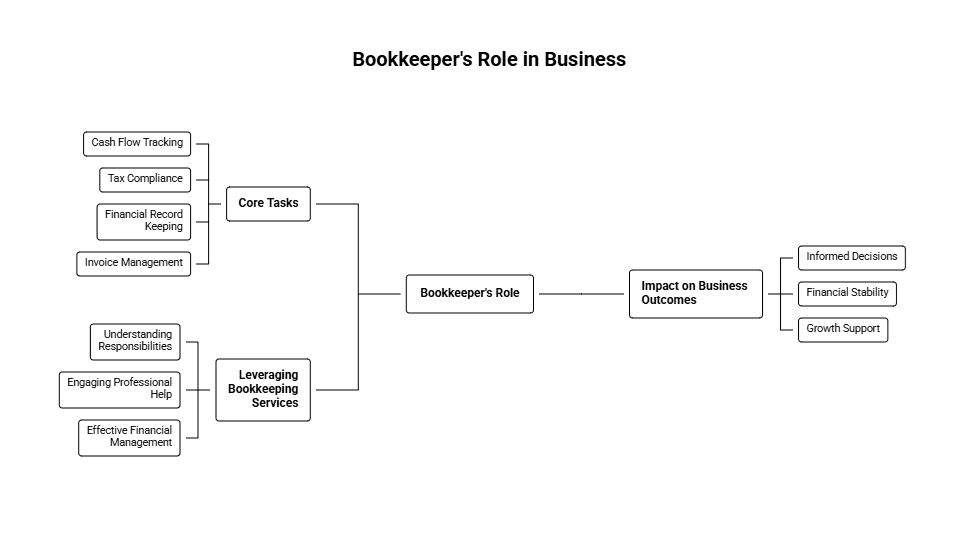

For founders navigating the early stages of their startup or managing a growing agency or e-commerce business, understanding what does a bookkeeper do is crucial.

Bookkeeping serves as the financial backbone for your business, enabling you to track cash flow, comply with tax requirements, and make informed operational decisions. Yet, many founders remain unclear about the specific responsibilities a bookkeeper handles, how those tasks add value, or when to engage professional help.

In this article, we'll provide a founder-friendly breakdown of a bookkeeper's core tasks, explain their impact on business outcomes, and share practical insights on leveraging bookkeeping services effectively.

What Does a Bookkeeper Do for Small Businesses?

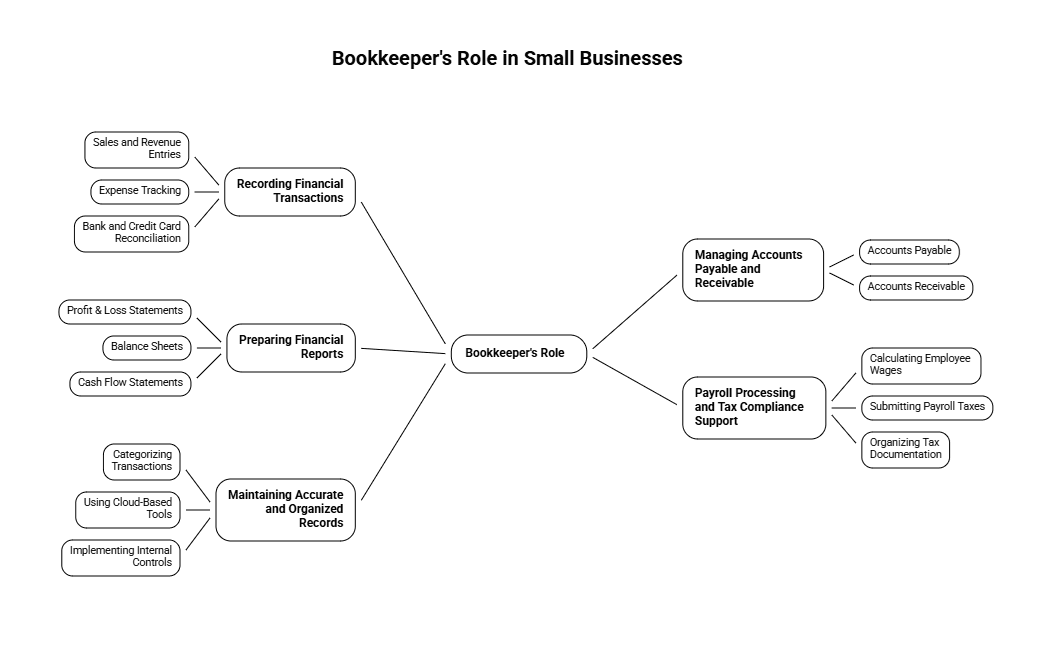

A bookkeeper’s role centers on accurate record-keeping of your business's financial transactions. But the scope goes well beyond merely entering numbers. Here's a breakdown of the key tasks:

1. Recording Financial Transactions

The foundation of bookkeeping is systematically recording all business transactions — sales, purchases, payments, and receipts — into your accounting system or software.

Sales and Revenue Entries: Documenting all income sources, whether from product sales, client services, or other revenue streams.

Expense Tracking: Logging invoices, bills, and receipts for business expenses including supplies, rent, utilities, and payroll.

Bank and Credit Card Reconciliation: Comparing your internal records against bank and credit card statements to identify discrepancies or unauthorized transactions.

Accurate transaction recording gives founders real-time visibility into cash flow and financial health, enabling confident decision-making. Poor transaction data can cause costly compliance issues or misinformed strategies.

2. Managing Accounts Payable and Receivable

Two critical processes that bookkeepers oversee are:

Accounts Payable (AP): Tracking what your business owes vendors and suppliers, ensuring bills are paid on time to maintain good relationships and avoid late penalties.

Accounts Receivable (AR): Monitoring customer invoices and payments to speed up cash inflows, improve liquidity, and reduce overdue receivables.

When a bookkeeper keeps these workflows organized, it drives operational efficiency and strengthens your startup’s cash position.

3. Preparing Financial Reports

While bookkeepers aren’t responsible for complex tax planning or audit preparation, they generate foundational reports that inform business decisions:

Profit & Loss Statements: Summarize revenues, costs, and expenses over a defined period to reflect profitability.

Balance Sheets: Present your company’s assets, liabilities, and equity at any given point.

Cash Flow Statements: Track money going in and out of your business—vital for short-term planning.

Well-prepared financial reports guide smarter growth strategies and provide transparency for stakeholders and potential investors.

4. Payroll Processing and Tax Compliance Support

Bookkeepers often assist with payroll activities, which may include:

Calculating employee wages, tracking time, and managing benefits

Submitting payroll taxes and reports to government agencies

Ensuring compliance with employment and tax regulations

They also help organize necessary documentation for tax filings, reducing last-minute stress and potential fines. For authoritative guidelines, see the IRS Payroll Tax Basics.

5. Maintaining Accurate and Organized Records

Robust bookkeeping involves more than data entry. It’s about maintaining a system of financial recordkeeping that withstands scrutiny and scales with your business:

Categorizing transactions accurately

Using cloud-based bookkeeping tools for automation

Implementing internal controls to detect fraud or errors

Clean and accessible records give founders the ability to act fast, secure funding, and prepare for audits without hassle.

Why It Matters: Bookkeeping’s Business Impact

Understanding what does a bookkeeper do is about more than ticking off tasks. It’s about appreciating how effective bookkeeping supports your business at every stage:

Benefit | How Bookkeeping Drives It |

Cash Flow Visibility | Real-time data helps forecast runway and avoid cash shortages |

Smarter Decision-Making | Financial reports direct operational and growth priorities |

Compliance and Tax Confidence | Easily accessible records streamline year-end filing and audits |

Operational Efficiency | Automated entries and reconciliations save manual work |

Investor and Lender Confidence | Reliable books validated during due diligence, increasing trust |

As a founder, your time is valuable. Delegating these core financial processes ensures you stay focused on product development, team leadership, and business expansion.

What’s Included in Modern Bookkeeping Services?

Today’s bookkeeping services are more than just data entry. With automation and software integrations, providers offer scalable, tech-forward support tailored to founders and operators.

Comprehensive bookkeeping services might include:

QuickBooks or Xero setup and customization

Ongoing transaction categorization and reconciliation

Invoice and accounts payable/receivable workflows

Payroll processing tools or integrations

Month-end report generation and insights

Tax support prep and 1099/contractor tracking

Secure, cloud-based record storage

Many startups benefit from finance partners who also provide strategic support, like helping founders coordinate R&D tax credits or plan for hiring budgets.

Bookkeeping vs. Accounting: Know the Difference

While bookkeeping and accounting are closely related, they play different roles in your finance stack:

Role | Bookkeeping | Accounting |

Focus | Daily transaction records | Analysis, reporting, tax strategy |

Tools | QuickBooks, Xero, Expensify | Financial models, tax software |

Output | Clean financial statements, reconciliations | Tax returns, budgets, forecasts |

Strategic Level | Tactical: inputs into decision-making | Strategic: interprets financial trends |

Founders benefit most when both roles are integrated —clean books inform better financial planning and forecasting that drive smarter growth.

Tips for Founders: Getting the Most from Your Bookkeeper

Here’s how to strengthen your partnership with a bookkeeper:

Clarify Scope Upfront: Set clear expectations about responsibilities and reporting cadence.

Choose Compatible Tools: Use platforms that sync with your payroll, e-commerce, or invoicing workflows.

Set a Review Rhythm: Hold monthly meetings to review reports, spend trends, and anomalies.

Keep Communication Open: Share upcoming changes like product launches or new funding that affect finances.

Plan for Scale: As your business grows, consider adding a part-time CFO or upgrading to fractional finance leadership.

A strong bookkeeper relationship saves time, avoids surprises, and gives founders confidence in their numbers.

Empowering Your Growth Through Financial Clarity

Understanding what a bookkeeper does is the first step toward moving from "founder-led chaos" to "system-driven growth." By delegating the meticulous tasks of transaction recording, payroll, and reconciliation, you reclaim the most valuable asset in your startup: your time.

Effective bookkeeping isn't just about staying compliant with the IRS; it’s about building a scalable cap table and a reliable financial foundation that invites investor trust. Whether you are just starting out or preparing for a Series A, clean books ensure that when an opportunity for funding or a strategic partnership arises, you are ready to act with data-backed confidence.

For founders navigating the early stages of their startup or managing a growing agency or e-commerce business, understanding what does a bookkeeper do is crucial.

Bookkeeping serves as the financial backbone for your business, enabling you to track cash flow, comply with tax requirements, and make informed operational decisions. Yet, many founders remain unclear about the specific responsibilities a bookkeeper handles, how those tasks add value, or when to engage professional help.

In this article, we'll provide a founder-friendly breakdown of a bookkeeper's core tasks, explain their impact on business outcomes, and share practical insights on leveraging bookkeeping services effectively.

What Does a Bookkeeper Do for Small Businesses?

A bookkeeper’s role centers on accurate record-keeping of your business's financial transactions. But the scope goes well beyond merely entering numbers. Here's a breakdown of the key tasks:

1. Recording Financial Transactions

The foundation of bookkeeping is systematically recording all business transactions — sales, purchases, payments, and receipts — into your accounting system or software.

Sales and Revenue Entries: Documenting all income sources, whether from product sales, client services, or other revenue streams.

Expense Tracking: Logging invoices, bills, and receipts for business expenses including supplies, rent, utilities, and payroll.

Bank and Credit Card Reconciliation: Comparing your internal records against bank and credit card statements to identify discrepancies or unauthorized transactions.

Accurate transaction recording gives founders real-time visibility into cash flow and financial health, enabling confident decision-making. Poor transaction data can cause costly compliance issues or misinformed strategies.

2. Managing Accounts Payable and Receivable

Two critical processes that bookkeepers oversee are:

Accounts Payable (AP): Tracking what your business owes vendors and suppliers, ensuring bills are paid on time to maintain good relationships and avoid late penalties.

Accounts Receivable (AR): Monitoring customer invoices and payments to speed up cash inflows, improve liquidity, and reduce overdue receivables.

When a bookkeeper keeps these workflows organized, it drives operational efficiency and strengthens your startup’s cash position.

3. Preparing Financial Reports

While bookkeepers aren’t responsible for complex tax planning or audit preparation, they generate foundational reports that inform business decisions:

Profit & Loss Statements: Summarize revenues, costs, and expenses over a defined period to reflect profitability.

Balance Sheets: Present your company’s assets, liabilities, and equity at any given point.

Cash Flow Statements: Track money going in and out of your business—vital for short-term planning.

Well-prepared financial reports guide smarter growth strategies and provide transparency for stakeholders and potential investors.

4. Payroll Processing and Tax Compliance Support

Bookkeepers often assist with payroll activities, which may include:

Calculating employee wages, tracking time, and managing benefits

Submitting payroll taxes and reports to government agencies

Ensuring compliance with employment and tax regulations

They also help organize necessary documentation for tax filings, reducing last-minute stress and potential fines. For authoritative guidelines, see the IRS Payroll Tax Basics.

5. Maintaining Accurate and Organized Records

Robust bookkeeping involves more than data entry. It’s about maintaining a system of financial recordkeeping that withstands scrutiny and scales with your business:

Categorizing transactions accurately

Using cloud-based bookkeeping tools for automation

Implementing internal controls to detect fraud or errors

Clean and accessible records give founders the ability to act fast, secure funding, and prepare for audits without hassle.

Why It Matters: Bookkeeping’s Business Impact

Understanding what does a bookkeeper do is about more than ticking off tasks. It’s about appreciating how effective bookkeeping supports your business at every stage:

Benefit | How Bookkeeping Drives It |

Cash Flow Visibility | Real-time data helps forecast runway and avoid cash shortages |

Smarter Decision-Making | Financial reports direct operational and growth priorities |

Compliance and Tax Confidence | Easily accessible records streamline year-end filing and audits |

Operational Efficiency | Automated entries and reconciliations save manual work |

Investor and Lender Confidence | Reliable books validated during due diligence, increasing trust |

As a founder, your time is valuable. Delegating these core financial processes ensures you stay focused on product development, team leadership, and business expansion.

What’s Included in Modern Bookkeeping Services?

Today’s bookkeeping services are more than just data entry. With automation and software integrations, providers offer scalable, tech-forward support tailored to founders and operators.

Comprehensive bookkeeping services might include:

QuickBooks or Xero setup and customization

Ongoing transaction categorization and reconciliation

Invoice and accounts payable/receivable workflows

Payroll processing tools or integrations

Month-end report generation and insights

Tax support prep and 1099/contractor tracking

Secure, cloud-based record storage

Many startups benefit from finance partners who also provide strategic support, like helping founders coordinate R&D tax credits or plan for hiring budgets.

Bookkeeping vs. Accounting: Know the Difference

While bookkeeping and accounting are closely related, they play different roles in your finance stack:

Role | Bookkeeping | Accounting |

Focus | Daily transaction records | Analysis, reporting, tax strategy |

Tools | QuickBooks, Xero, Expensify | Financial models, tax software |

Output | Clean financial statements, reconciliations | Tax returns, budgets, forecasts |

Strategic Level | Tactical: inputs into decision-making | Strategic: interprets financial trends |

Founders benefit most when both roles are integrated —clean books inform better financial planning and forecasting that drive smarter growth.

Tips for Founders: Getting the Most from Your Bookkeeper

Here’s how to strengthen your partnership with a bookkeeper:

Clarify Scope Upfront: Set clear expectations about responsibilities and reporting cadence.

Choose Compatible Tools: Use platforms that sync with your payroll, e-commerce, or invoicing workflows.

Set a Review Rhythm: Hold monthly meetings to review reports, spend trends, and anomalies.

Keep Communication Open: Share upcoming changes like product launches or new funding that affect finances.

Plan for Scale: As your business grows, consider adding a part-time CFO or upgrading to fractional finance leadership.

A strong bookkeeper relationship saves time, avoids surprises, and gives founders confidence in their numbers.

Empowering Your Growth Through Financial Clarity

Understanding what a bookkeeper does is the first step toward moving from "founder-led chaos" to "system-driven growth." By delegating the meticulous tasks of transaction recording, payroll, and reconciliation, you reclaim the most valuable asset in your startup: your time.

Effective bookkeeping isn't just about staying compliant with the IRS; it’s about building a scalable cap table and a reliable financial foundation that invites investor trust. Whether you are just starting out or preparing for a Series A, clean books ensure that when an opportunity for funding or a strategic partnership arises, you are ready to act with data-backed confidence.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026