Go Back

Last Updated :

Last Updated :

Feb 6, 2026

Feb 6, 2026

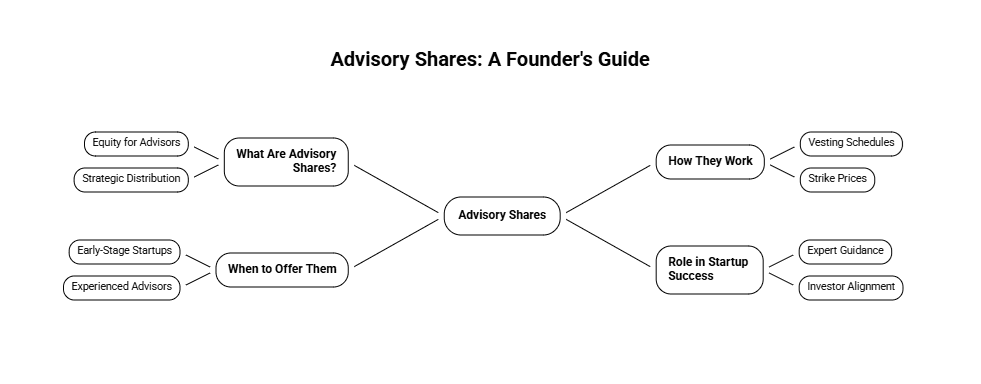

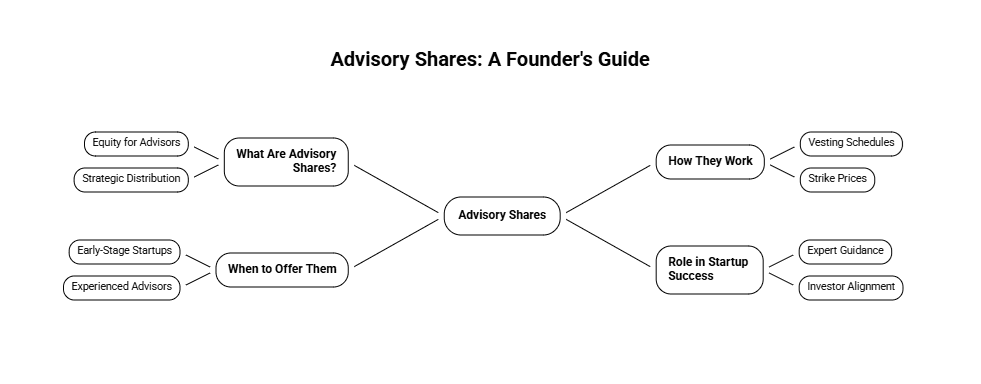

What Are Advisory Shares? Founder’s Guide to How They Work and When to Use Them

In the early stages of a startup, you often need high-level expertise—think a former VP of Sales from a unicorn or a seasoned technical architect—that you simply cannot afford to hire full-time. Advisory shares are the currency you use to "buy" their time and reputation without draining your cash reserves.

Technically, these are non-qualified stock options (NSOs) granted to external mentors or advisors. Unlike an employee who gets a salary and a large equity stake for 40+ hours a week, an advisor receives a small slice of equity (typically 0.1% to 1%) in exchange for strategic guidance, networking, or credibility. In this guide, we’ll explore the concept of advisory shares from a practical, founder-focused perspective — covering how they work, their role in amplifying startup success, and when to offer them effectively.

What Are Advisory Shares?

Advisory shares are a form of equity compensation given to external experts who provide strategic guidance, networking, or specialized skills to a startup. Because early-stage companies are often cash-strapped, these shares serve as a way to attract high-caliber talent and "buy" their time without a traditional salary. This arrangement creates a long-term incentive for advisors to help the company succeed.

How Advisory Shares Work in Practice

Purpose: They allow startups to recruit industry veterans, R&D specialists, or marketing experts who support growth without becoming full-time employees.

Types of Equity: Grants are typically issued as Restricted Stock Awards (RSAs) for very early stages or Non-Qualified Stock Options (NSOs), which provide the right to buy shares later at a set price.

Equity Amount: The amount granted depends on the company's stage and the advisor's potential contribution. While ranges vary, they often reflect the specific value the advisor brings to the table.

Vesting Schedule: Advisory shares typically feature faster vesting than employee options, often occurring over a period of one to two years. This ensures the advisor remains aligned with the company's progress.

Legal Framework: Founders should use a formal advisor agreement to ensure everyone is on the same page regarding expectations and compensation. These documents often cover specific milestones and confidentiality.

Tax and Reporting: Issuing equity has tax consequences that vary based on the type of shares granted. It is essential to manage these grants within a scalable cap table to track dilution and maintain compliance.

Advisory Shares vs. Other Equity Types

Equity Type | Recipient | Purpose | Vesting | Typical Stake |

Founder Shares | Founders | Ownership from inception | Often immediate | Large majority |

Employee Stock Options | Employees | Incentivize performance and retention | 3–4 years | Varies broadly |

Advisory Shares | External Advisors | Reward strategic advice and connections | ~1–2 years | 0.1%–1% (typically) |

Investor Shares | Investors | Exchange investment for equity | None | Varies by round |

For a deeper dive into startup terms you need to master, check out our comprehensive startup terms guide.

Why Do Startups Use Advisory Shares? Benefits Beyond the Equity

For startups operating on tight budgets but facing high uncertainty, advisory shares are a powerful tool to access top-tier expertise without immediate cash outlay.

1. Access to Expertise That Scales Your Business

Startups often lack in-house experience in specialized areas like financial compliance, product marketing, or patent filing. Offering advisory shares attracts seasoned professionals who bring knowledge and networks that accelerate your go-to-market or fundraising efforts.

2. Flexibility in Rewarding Contributions

Because advisory shares vest over a shorter period than employee options, they allow you to test the relationship’s value. If an advisor’s input proves invaluable, you retain them; if not, their equity doesn’t fully vest, protecting you from over-issuing equity.

3. Signaling Credibility to Investors

Having recognizable advisors with equity stakes can boost investor confidence. It shows your startup is supported by industry insiders who believe in the vision enough to take ownership.

4. Cost-Effective Growth

Cash is king, but cash burn must be tightly managed. Advisory shares let you conserve cash while gaining insight that might otherwise cost tens or hundreds of thousands in consulting fees.

When Is the Best Time to Issue Advisory Shares?

Timing matters. Issuing advisory shares too early could dilute founders excessively; too late means missing growth opportunities shaped by good advice.

Early-Stage: Pre-Seed to Seed

At this critical phase, advisory shares can help you build a solid foundation. Advisors might include founders’ mentors, technical experts, or early investors who also act as advisors. Their battle-tested guidance can de-risk your product development, incorporation, or fundraising strategy.

During Fundraising Stages

When preparing for seed or Series A rounds, consider granting advisory shares to professionals who can help refine your pitch, connect to VC networks, or strategize growth. Their vested stake also aligns interests as you scale investor relationships.

For more on typical startup funding timelines and where advisory inputs fit, review our article on startup funding stages.

For Specific Milestones or Projects

If you foresee certain challenges — like R&D tax credits optimization, regulatory compliance, or international expansion — bringing in specialized advisors with equity incentives ensures focus and alignment.

How to Structure Advisory Shares for Maximum Impact

As you design your advisory equity program, consider these practical steps:

Step | Why It Matters | Actionable Tip |

Define Advisor Role Clearly | Sets expectations and boundaries | Draft a brief role description and goals in the advisory agreement |

Determine Equity Percentage | Balances dilution and motivation | Start with modest stakes (0.1%–0.5%); adjust by contribution |

Set Vesting Terms | Protects founders from upfront dilution | Use 1–2 year vesting with a cliff (e.g., 3–6 months) |

Incorporate Performance Milestones | Ensures value delivery | Link vesting triggers to agreed advisor activities |

Align with Overall Cap Table | Prevents unexpected dilution | Update cap table proactively and communicate transparently |

Using a modern, cloud-based cap table management tool can simplify this complexity and keep all stakeholders aligned.

Common Pitfalls Founders Should Avoid When Granting Advisory Shares

Equity distribution can be a sticking point if not thoughtfully managed:

Over-granting equity to advisors: Dilution limits future fundraising and can demotivate founders.

Neglecting vesting schedules: Immediate equity grants may result in equity holders who fail to deliver value over time.

Not formalizing agreements: Informal promises create legal risks and confusion down the line.

Ignoring tax implications: Advisors receiving shares may have tax events triggered; early consultation with tax professionals avoids surprises.

You can find authoritative IRS guidance on related equity issues at IRS.gov Equity Compensation.

Advisory Share Management: Integrating with Your Overall Startup Strategy

Balancing advisory shares alongside employee options and investor equity takes intentional planning. Leveraging advisory shares as part of your broader financial and operational roadmap ensures alignment with business outcomes.

For founders managing bookkeeping and compliance, using an all-in-one platform that supports equity management, tax filings, and financial reporting streamlines your workflows significantly. Discover how our tailored services empower startups to optimize these processes with minimal administrative overhead.

In the early stages of a startup, you often need high-level expertise—think a former VP of Sales from a unicorn or a seasoned technical architect—that you simply cannot afford to hire full-time. Advisory shares are the currency you use to "buy" their time and reputation without draining your cash reserves.

Technically, these are non-qualified stock options (NSOs) granted to external mentors or advisors. Unlike an employee who gets a salary and a large equity stake for 40+ hours a week, an advisor receives a small slice of equity (typically 0.1% to 1%) in exchange for strategic guidance, networking, or credibility. In this guide, we’ll explore the concept of advisory shares from a practical, founder-focused perspective — covering how they work, their role in amplifying startup success, and when to offer them effectively.

What Are Advisory Shares?

Advisory shares are a form of equity compensation given to external experts who provide strategic guidance, networking, or specialized skills to a startup. Because early-stage companies are often cash-strapped, these shares serve as a way to attract high-caliber talent and "buy" their time without a traditional salary. This arrangement creates a long-term incentive for advisors to help the company succeed.

How Advisory Shares Work in Practice

Purpose: They allow startups to recruit industry veterans, R&D specialists, or marketing experts who support growth without becoming full-time employees.

Types of Equity: Grants are typically issued as Restricted Stock Awards (RSAs) for very early stages or Non-Qualified Stock Options (NSOs), which provide the right to buy shares later at a set price.

Equity Amount: The amount granted depends on the company's stage and the advisor's potential contribution. While ranges vary, they often reflect the specific value the advisor brings to the table.

Vesting Schedule: Advisory shares typically feature faster vesting than employee options, often occurring over a period of one to two years. This ensures the advisor remains aligned with the company's progress.

Legal Framework: Founders should use a formal advisor agreement to ensure everyone is on the same page regarding expectations and compensation. These documents often cover specific milestones and confidentiality.

Tax and Reporting: Issuing equity has tax consequences that vary based on the type of shares granted. It is essential to manage these grants within a scalable cap table to track dilution and maintain compliance.

Advisory Shares vs. Other Equity Types

Equity Type | Recipient | Purpose | Vesting | Typical Stake |

Founder Shares | Founders | Ownership from inception | Often immediate | Large majority |

Employee Stock Options | Employees | Incentivize performance and retention | 3–4 years | Varies broadly |

Advisory Shares | External Advisors | Reward strategic advice and connections | ~1–2 years | 0.1%–1% (typically) |

Investor Shares | Investors | Exchange investment for equity | None | Varies by round |

For a deeper dive into startup terms you need to master, check out our comprehensive startup terms guide.

Why Do Startups Use Advisory Shares? Benefits Beyond the Equity

For startups operating on tight budgets but facing high uncertainty, advisory shares are a powerful tool to access top-tier expertise without immediate cash outlay.

1. Access to Expertise That Scales Your Business

Startups often lack in-house experience in specialized areas like financial compliance, product marketing, or patent filing. Offering advisory shares attracts seasoned professionals who bring knowledge and networks that accelerate your go-to-market or fundraising efforts.

2. Flexibility in Rewarding Contributions

Because advisory shares vest over a shorter period than employee options, they allow you to test the relationship’s value. If an advisor’s input proves invaluable, you retain them; if not, their equity doesn’t fully vest, protecting you from over-issuing equity.

3. Signaling Credibility to Investors

Having recognizable advisors with equity stakes can boost investor confidence. It shows your startup is supported by industry insiders who believe in the vision enough to take ownership.

4. Cost-Effective Growth

Cash is king, but cash burn must be tightly managed. Advisory shares let you conserve cash while gaining insight that might otherwise cost tens or hundreds of thousands in consulting fees.

When Is the Best Time to Issue Advisory Shares?

Timing matters. Issuing advisory shares too early could dilute founders excessively; too late means missing growth opportunities shaped by good advice.

Early-Stage: Pre-Seed to Seed

At this critical phase, advisory shares can help you build a solid foundation. Advisors might include founders’ mentors, technical experts, or early investors who also act as advisors. Their battle-tested guidance can de-risk your product development, incorporation, or fundraising strategy.

During Fundraising Stages

When preparing for seed or Series A rounds, consider granting advisory shares to professionals who can help refine your pitch, connect to VC networks, or strategize growth. Their vested stake also aligns interests as you scale investor relationships.

For more on typical startup funding timelines and where advisory inputs fit, review our article on startup funding stages.

For Specific Milestones or Projects

If you foresee certain challenges — like R&D tax credits optimization, regulatory compliance, or international expansion — bringing in specialized advisors with equity incentives ensures focus and alignment.

How to Structure Advisory Shares for Maximum Impact

As you design your advisory equity program, consider these practical steps:

Step | Why It Matters | Actionable Tip |

Define Advisor Role Clearly | Sets expectations and boundaries | Draft a brief role description and goals in the advisory agreement |

Determine Equity Percentage | Balances dilution and motivation | Start with modest stakes (0.1%–0.5%); adjust by contribution |

Set Vesting Terms | Protects founders from upfront dilution | Use 1–2 year vesting with a cliff (e.g., 3–6 months) |

Incorporate Performance Milestones | Ensures value delivery | Link vesting triggers to agreed advisor activities |

Align with Overall Cap Table | Prevents unexpected dilution | Update cap table proactively and communicate transparently |

Using a modern, cloud-based cap table management tool can simplify this complexity and keep all stakeholders aligned.

Common Pitfalls Founders Should Avoid When Granting Advisory Shares

Equity distribution can be a sticking point if not thoughtfully managed:

Over-granting equity to advisors: Dilution limits future fundraising and can demotivate founders.

Neglecting vesting schedules: Immediate equity grants may result in equity holders who fail to deliver value over time.

Not formalizing agreements: Informal promises create legal risks and confusion down the line.

Ignoring tax implications: Advisors receiving shares may have tax events triggered; early consultation with tax professionals avoids surprises.

You can find authoritative IRS guidance on related equity issues at IRS.gov Equity Compensation.

Advisory Share Management: Integrating with Your Overall Startup Strategy

Balancing advisory shares alongside employee options and investor equity takes intentional planning. Leveraging advisory shares as part of your broader financial and operational roadmap ensures alignment with business outcomes.

For founders managing bookkeeping and compliance, using an all-in-one platform that supports equity management, tax filings, and financial reporting streamlines your workflows significantly. Discover how our tailored services empower startups to optimize these processes with minimal administrative overhead.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026