Go Back

Last Updated :

Last Updated :

Feb 6, 2026

Feb 6, 2026

Tax Benefits of S Corp vs. LLC: Which Election Minimizes Your Tax Liability?

When founders build a startup, choosing a tax structure is a high-stakes decision that directly impacts taxation, personal liability, and corporate flexibility. Specifically, understanding the tax benefits of S Corp vs. LLC is essential to strategically minimize your founder tax liability while keeping your business agile.

This guide provides clear, actionable insights into how these entities differ under the hood, focusing on where one gives you a tactical edge over the other in terms of total tax savings.

Understanding the Basics: S Corp vs. LLC Tax Models

Before comparing savings, it is important to distinguish between the legal entity and the tax election. An LLC is a legal structure recognized by state law, while an S Corp is a tax designation that either an LLC or a C Corp can elect by filing IRS Form 2553.

LLC (The Default "Pass-Through")

Self-Employment Tax: By default, the IRS treats a single-member LLC as a sole proprietorship, meaning 100% of your business profits are subject to the 15.3% self-employment tax for Social Security and Medicare.

Flexibility: LLCs offer "check-the-box" simplicity, allowing you to stay as a default pass-through or elect S Corp status once your profits reach a threshold where savings outweigh administrative costs.

S Corp (The Strategic Split)

The Salary/Distribution Hack: The primary tax benefit of an S Corp vs. an LLC is the ability to split income into two categories: a "reasonable salary" and shareholder distributions.

Tax Shield: Only the salary portion is subject to payroll taxes; the remaining profit taken as a distribution is generally exempt from the 15.3% self-employment tax.

For a deeper dive into the structural nuances, you can explore our article on LLC vs. S-Corp differences.

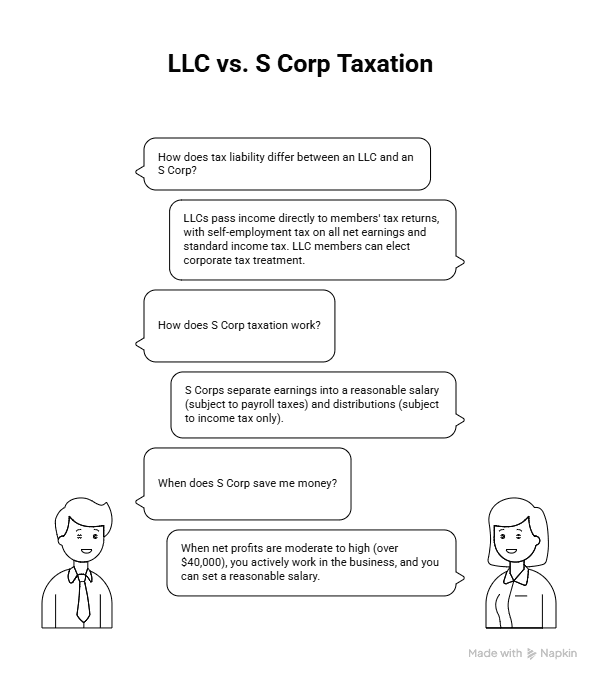

How Do Taxes Differ? The Core of Founder Liability

For founders, the critical issue is how tax liability differs between an LLC and an S Corp—not just in terms of rates, but the types of taxes and reporting complexity.

LLC Taxation: Simplicity Meets Higher Self-Employment Tax

By default, an LLC’s income passes through directly to members’ tax returns. If you are a single-member LLC, the IRS treats you as a sole proprietor—filing Schedule C with your personal taxes. Multi-member LLCs file Form 1065 and issue K-1s to members.

Self-employment tax: LLC members pay self-employment tax (Social Security + Medicare) on all net business earnings, typically ~15.3% up to a wage base limit.

Income tax: Standard individual rates apply on all profits after expenses minus deductions.

Flexibility: LLC members can elect corporate tax treatment, including S Corp, to change tax dynamics.

S Corp Taxation: Balancing Salary and Distributions for Tax Savings

The standout tax feature of an S Corp election is the ability to separate earnings into two buckets:

Reasonable salary: Subject to payroll (FICA) taxes like Social Security and Medicare (about 15.3% split between employer and employee).

Distributions/dividends: These profits are not subject to self-employment or payroll taxes, only income tax.

Example: Suppose your business nets $120,000 yearly. As an LLC owner, you pay self-employment tax on the entire amount. If you elect S Corp, you might pay yourself a $70,000 reasonable salary and receive the remaining $50,000 as distributions. The $70,000 salary pays payroll taxes, but the $50,000 distribution only incurs regular income tax—generating potential tax savings of several thousand dollars.

When Does S Corp Save You Money?

Net profits are moderate to high: Typically over $40,000 profit where paying payroll taxes on 100% of income becomes expensive.

You actively work in the business: The salary requirement only applies if you perform substantial services.

You can set a “reasonable” salary: The IRS carefully scrutinizes salaries that are unreasonably low, so compliance is essential.

For full-service startup tax filing support—including navigating these nuances—you may benefit from hiring business tax services.

Compliance and Reporting: The Founder's Operational Impact

Choosing between an LLC and S Corp isn’t only a tax checkbox—it changes your ongoing administrative tasks and compliance posture.

Aspect | LLC | S Corp |

Formation & State Fees | Relatively straightforward, state-dependent fees | Starts as C Corp (incorporation fees), then IRS filing |

Annual Filings | Annual report with state, possibly simple tax filings | Annual corporate minutes, filings with Secretary of State |

Tax Filing | Form 1040 Schedule C or Form 1065 + Schedule K-1 | Form 1120S (S Corp return), individual Schedule K-1 |

Payroll Requirements | None required if sole/only members | Mandatory payroll and payroll tax filings for salaries |

Ownership Restrictions | Unlimited members, foreign owners allowed | Limited to 100 shareholders, US persons only |

Profit Distribution Rules | Flexible, any distribution amounts | Proportional to shares owned |

From a founder’s operational standpoint, S Corps require more bookkeeping, payroll setup, and IRS oversight. However, this added effort can pay off via tax savings if structured well.

Special Considerations for Founders: R&D Credits and Growth Impact

Your choice also affects eligibility and deployment of credits such as the Research and Development (R&D) tax credit, which many startups and tech founders leverage to reduce tax liability on innovation spend.

Both LLCs and S Corps can claim R&D credits, but S Corps may offer smoother integration with salaries, allowing founders to optimize payroll tax savings alongside credits.

CTOs and heads of finance need to account for this when forecasting wages and allocating engineering spend, as it affects cash flow and tax planning.

Making the Decision: LLC or S Corp for Your Startup?

Here’s a practical checklist founders can use to evaluate which is the better tax election based on your situation:

Factor | LLC More Suitable If... | S Corp More Suitable If... |

You want minimal formalities | ✓ | Requires more governance and payroll setup |

Your net profits are low (< $40k) | Less benefit from S Corp payroll tax splitting | Payroll tax savings may not justify compliance effort |

You actively perform services | Payroll taxes may be high on full income | Splitting salary and distributions reduces tax burden |

You want ownership flexibility | Unlimited and foreign members allowed | US citizens/residents only; 100 shareholder cap |

You want to utilize R&D credits | More complex integration possible | Easier structuring with salaries and distributions |

What Founders Often Miss: IRS Scrutiny and Reasonable Salary

The IRS pays close attention to S Corp salaries. An unreasonably low salary can trigger audits and penalties that wipe out tax savings, so it’s crucial to:

Set salaries based on industry standards and your roles.

Document salary decisions with comparable job data.

Work with founder-friendly tax professionals who understand startup realities.

These nuances are a strong reason to use professional tax advisory services rather than DIY filings.

Minimizing Founder Tax Liability with the Right Election

Making the right choice between an LLC and S Corp election can materially reduce your tax burden as a founder. The difference between an LLC and S Corp primarily boils down to how earnings are taxed—whether all profits face self-employment taxes (LLC default) or whether you can separate compensation into salary plus distributions to optimize payroll taxes (S Corp).

Key takeaways:

LLCs offer simplicity, flexibility, and fewer formalities but come with higher self-employment tax exposure.

S Corps demand more paperwork, governance, and payroll administration, but grant significant tax savings when properly structured.

Founder salary is a critical compliance and tax lever.

Your profit level, ownership needs, and R&D credit interactions shape the best choice.

If you’re looking for fast, modern, startup-native support that takes the guesswork out of your business structure and tax planning while maximizing founder tax savings, our expert team is ready to help. Explore how our full spectrum of business tax services can give you clear, founder-focused guidance tailored for your scale and growth trajectory.

When founders build a startup, choosing a tax structure is a high-stakes decision that directly impacts taxation, personal liability, and corporate flexibility. Specifically, understanding the tax benefits of S Corp vs. LLC is essential to strategically minimize your founder tax liability while keeping your business agile.

This guide provides clear, actionable insights into how these entities differ under the hood, focusing on where one gives you a tactical edge over the other in terms of total tax savings.

Understanding the Basics: S Corp vs. LLC Tax Models

Before comparing savings, it is important to distinguish between the legal entity and the tax election. An LLC is a legal structure recognized by state law, while an S Corp is a tax designation that either an LLC or a C Corp can elect by filing IRS Form 2553.

LLC (The Default "Pass-Through")

Self-Employment Tax: By default, the IRS treats a single-member LLC as a sole proprietorship, meaning 100% of your business profits are subject to the 15.3% self-employment tax for Social Security and Medicare.

Flexibility: LLCs offer "check-the-box" simplicity, allowing you to stay as a default pass-through or elect S Corp status once your profits reach a threshold where savings outweigh administrative costs.

S Corp (The Strategic Split)

The Salary/Distribution Hack: The primary tax benefit of an S Corp vs. an LLC is the ability to split income into two categories: a "reasonable salary" and shareholder distributions.

Tax Shield: Only the salary portion is subject to payroll taxes; the remaining profit taken as a distribution is generally exempt from the 15.3% self-employment tax.

For a deeper dive into the structural nuances, you can explore our article on LLC vs. S-Corp differences.

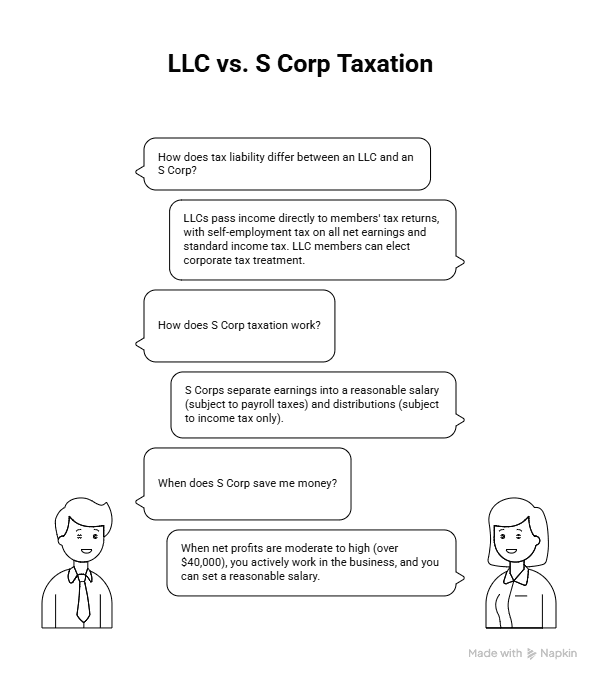

How Do Taxes Differ? The Core of Founder Liability

For founders, the critical issue is how tax liability differs between an LLC and an S Corp—not just in terms of rates, but the types of taxes and reporting complexity.

LLC Taxation: Simplicity Meets Higher Self-Employment Tax

By default, an LLC’s income passes through directly to members’ tax returns. If you are a single-member LLC, the IRS treats you as a sole proprietor—filing Schedule C with your personal taxes. Multi-member LLCs file Form 1065 and issue K-1s to members.

Self-employment tax: LLC members pay self-employment tax (Social Security + Medicare) on all net business earnings, typically ~15.3% up to a wage base limit.

Income tax: Standard individual rates apply on all profits after expenses minus deductions.

Flexibility: LLC members can elect corporate tax treatment, including S Corp, to change tax dynamics.

S Corp Taxation: Balancing Salary and Distributions for Tax Savings

The standout tax feature of an S Corp election is the ability to separate earnings into two buckets:

Reasonable salary: Subject to payroll (FICA) taxes like Social Security and Medicare (about 15.3% split between employer and employee).

Distributions/dividends: These profits are not subject to self-employment or payroll taxes, only income tax.

Example: Suppose your business nets $120,000 yearly. As an LLC owner, you pay self-employment tax on the entire amount. If you elect S Corp, you might pay yourself a $70,000 reasonable salary and receive the remaining $50,000 as distributions. The $70,000 salary pays payroll taxes, but the $50,000 distribution only incurs regular income tax—generating potential tax savings of several thousand dollars.

When Does S Corp Save You Money?

Net profits are moderate to high: Typically over $40,000 profit where paying payroll taxes on 100% of income becomes expensive.

You actively work in the business: The salary requirement only applies if you perform substantial services.

You can set a “reasonable” salary: The IRS carefully scrutinizes salaries that are unreasonably low, so compliance is essential.

For full-service startup tax filing support—including navigating these nuances—you may benefit from hiring business tax services.

Compliance and Reporting: The Founder's Operational Impact

Choosing between an LLC and S Corp isn’t only a tax checkbox—it changes your ongoing administrative tasks and compliance posture.

Aspect | LLC | S Corp |

Formation & State Fees | Relatively straightforward, state-dependent fees | Starts as C Corp (incorporation fees), then IRS filing |

Annual Filings | Annual report with state, possibly simple tax filings | Annual corporate minutes, filings with Secretary of State |

Tax Filing | Form 1040 Schedule C or Form 1065 + Schedule K-1 | Form 1120S (S Corp return), individual Schedule K-1 |

Payroll Requirements | None required if sole/only members | Mandatory payroll and payroll tax filings for salaries |

Ownership Restrictions | Unlimited members, foreign owners allowed | Limited to 100 shareholders, US persons only |

Profit Distribution Rules | Flexible, any distribution amounts | Proportional to shares owned |

From a founder’s operational standpoint, S Corps require more bookkeeping, payroll setup, and IRS oversight. However, this added effort can pay off via tax savings if structured well.

Special Considerations for Founders: R&D Credits and Growth Impact

Your choice also affects eligibility and deployment of credits such as the Research and Development (R&D) tax credit, which many startups and tech founders leverage to reduce tax liability on innovation spend.

Both LLCs and S Corps can claim R&D credits, but S Corps may offer smoother integration with salaries, allowing founders to optimize payroll tax savings alongside credits.

CTOs and heads of finance need to account for this when forecasting wages and allocating engineering spend, as it affects cash flow and tax planning.

Making the Decision: LLC or S Corp for Your Startup?

Here’s a practical checklist founders can use to evaluate which is the better tax election based on your situation:

Factor | LLC More Suitable If... | S Corp More Suitable If... |

You want minimal formalities | ✓ | Requires more governance and payroll setup |

Your net profits are low (< $40k) | Less benefit from S Corp payroll tax splitting | Payroll tax savings may not justify compliance effort |

You actively perform services | Payroll taxes may be high on full income | Splitting salary and distributions reduces tax burden |

You want ownership flexibility | Unlimited and foreign members allowed | US citizens/residents only; 100 shareholder cap |

You want to utilize R&D credits | More complex integration possible | Easier structuring with salaries and distributions |

What Founders Often Miss: IRS Scrutiny and Reasonable Salary

The IRS pays close attention to S Corp salaries. An unreasonably low salary can trigger audits and penalties that wipe out tax savings, so it’s crucial to:

Set salaries based on industry standards and your roles.

Document salary decisions with comparable job data.

Work with founder-friendly tax professionals who understand startup realities.

These nuances are a strong reason to use professional tax advisory services rather than DIY filings.

Minimizing Founder Tax Liability with the Right Election

Making the right choice between an LLC and S Corp election can materially reduce your tax burden as a founder. The difference between an LLC and S Corp primarily boils down to how earnings are taxed—whether all profits face self-employment taxes (LLC default) or whether you can separate compensation into salary plus distributions to optimize payroll taxes (S Corp).

Key takeaways:

LLCs offer simplicity, flexibility, and fewer formalities but come with higher self-employment tax exposure.

S Corps demand more paperwork, governance, and payroll administration, but grant significant tax savings when properly structured.

Founder salary is a critical compliance and tax lever.

Your profit level, ownership needs, and R&D credit interactions shape the best choice.

If you’re looking for fast, modern, startup-native support that takes the guesswork out of your business structure and tax planning while maximizing founder tax savings, our expert team is ready to help. Explore how our full spectrum of business tax services can give you clear, founder-focused guidance tailored for your scale and growth trajectory.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026