Go Back

Last Updated :

Last Updated :

Feb 6, 2026

Feb 6, 2026

Startup Finance 101: Understand the Basics

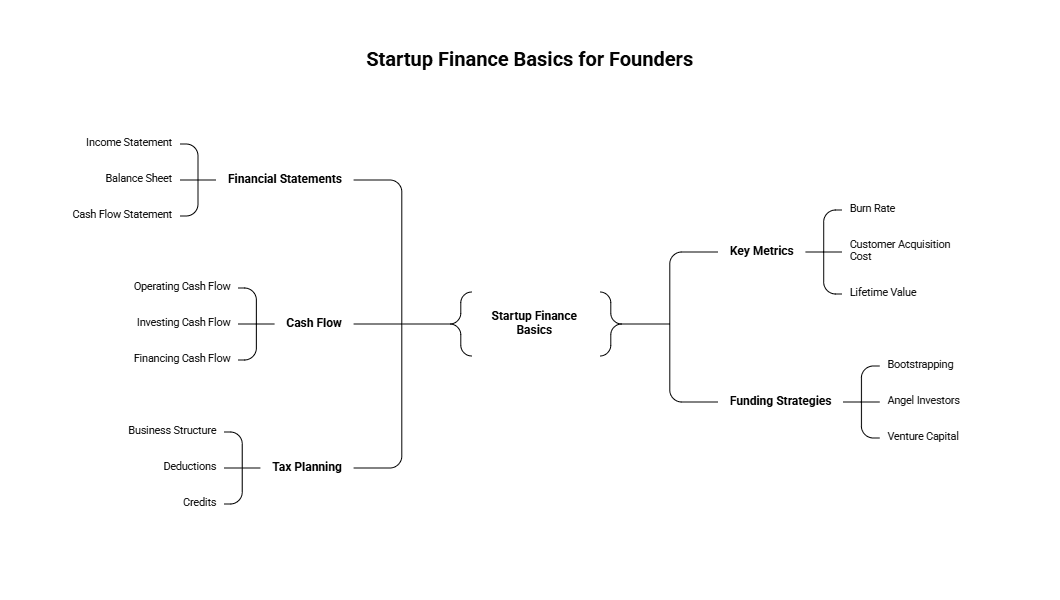

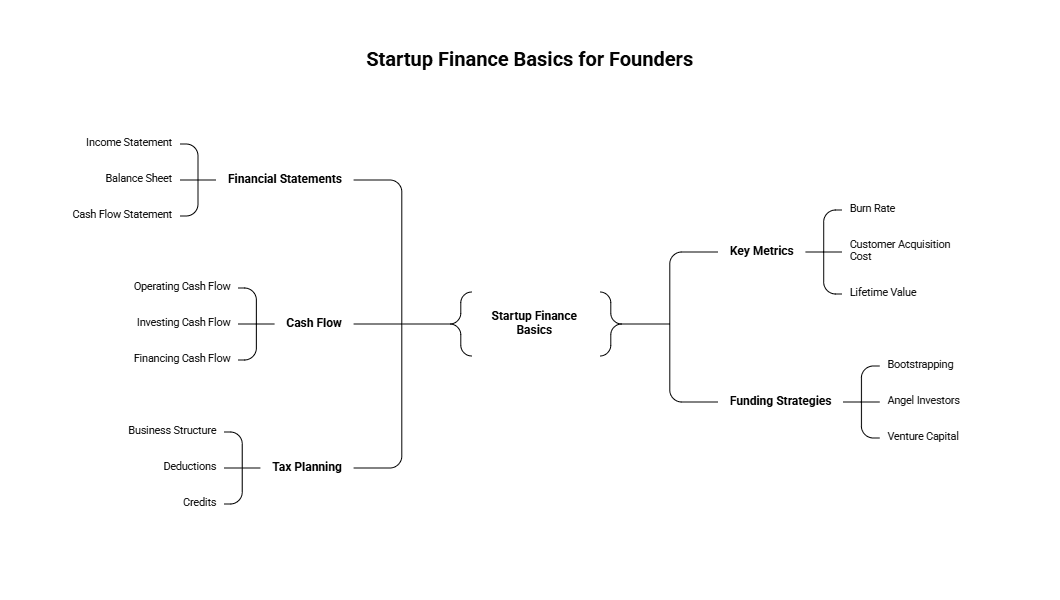

For every founder launching a startup, mastering startup finance basics is critical—not just to survive, but to thrive. As you navigate early growth stages, your ability to interpret financial signals, manage cash flow, and make data-driven decisions can spell the difference between scaling or stalling.

A strong financial foundation empowers you to steer your business smartly, attract the right investors, optimize operations, and align your entire team toward sustainable growth.

This guide distills the essential startup finance knowledge you actually need as a founder, cutting through noise and jargon.

Why Startup Finance Basics Matter

Founders wear many hats, but financial literacy must top your skill set. Here’s why:

Informed Decision Making: Financial awareness helps you evaluate investments, hiring, pricing, and growth initiatives with data-backed insight.

Cash Flow Survival: Knowing how to monitor and control cash flow prevents bankruptcy surprises and missteps in managing operational costs.

Investor Relations: Investors want to see founders who understand their numbers; strong financial fluency builds confidence in your leadership.

Risk Mitigation: Recognizing red flags early (e.g., burn rate spikes, declining sales) helps you pivot before crisis hits.

Fundraising Strategy: Understanding funding stages and instruments enables smarter timing and structuring of capital raises.

In essence, mastering these basics gives you a strategic edge in running a lean, efficient startup that maximizes every dollar and opportunity.

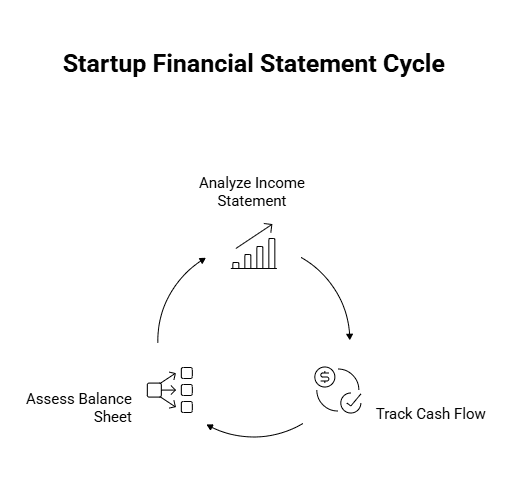

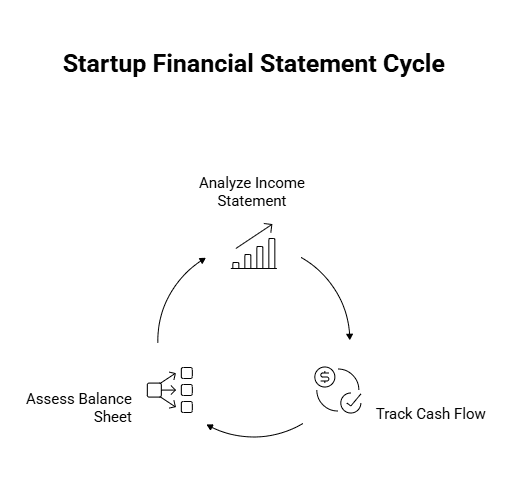

Key Financial Statements Every Founder Should Know

Understanding your startup's financial story starts with three essential reports. These documents give you clear views into your business performance, liquidity, and financial position.

1. Income Statement (Profit & Loss)

The income statement summarizes your revenues, expenses, and profitability over a specific period (monthly, quarterly, or annually).

Why It Matters: Shows if you're profitable or burning cash; helps analyze cost structures and revenue streams.

Key Components:

Revenue (Sales): Money earned from products or services.

Cost of Goods Sold (COGS): Direct costs to produce or deliver.

Gross Profit: Revenue minus COGS.

Operating Expenses: Marketing, R&D, salaries, rent, etc.

Net Income: Profit or loss after all expenses.

2. Cash Flow Statement

Cash flow reports track actual cash moving into and out of your business, crucial for managing day-to-day liquidity.

Why It Matters: Cash is king—without enough cash on hand, even profitable startups can fail.

Key Sections:

Operating Activities: Cash from core business operations.

Investing Activities: Cash used for assets or investments.

Financing Activities: Cash raised from or paid to investors/lenders.

3. Balance Sheet

A snapshot of your startup’s financial position at a given point, showing assets, liabilities, and equity.

Why It Matters: Helps assess your startup's net worth and financial stability.

Key Concepts:

Assets: What the startup owns (cash, inventory, equipment).

Liabilities: What the startup owes (loans, accounts payable).

Equity: Owner’s stake (capital invested plus retained earnings).

Essential Metrics Founders Must Track

Beyond the basic statements, understanding specific financial metrics informs better decisions and growth planning.

Startup Burn Rate and Runway

Burn Rate: Your monthly net cash outflow. The higher it is, the faster you’re spending cash.

Runway: The time (months) your current cash reserves will last at the current burn rate.

Example: If you burn $50,000/month and have $300,000 cash, your runway is 6 months (300,000 ÷ 50,000).

Why monitor? Because knowing burn and runway helps optimize spending and plan fundraising before you run out of cash.

Customer Acquisition Cost (CAC)

CAC is the average amount spent to acquire a new customer, including sales salaries, marketing campaigns, and overheads.

How to Calculate:

Total sales and marketing expenses ÷ Number of new customers acquired.

Lowering CAC means increased efficiency in marketing spend.

Customer Lifetime Value (LTV)

LTV estimates the total revenue or profit generated from a customer over their entire relationship.

Why It’s Important: Comparing LTV to CAC informs if your customer relationships are profitable.

Rule of thumb: LTV should be at least 3x CAC for a sustainable business.

Other Useful Metrics

Metric | What It Reveals | Founder Application |

Gross Margin | Profitability of your products | Guide pricing and cost reduction |

Churn Rate | Customer retention rate | Signal product satisfaction and loyalty |

Run Rate Revenue | Projected annual revenue | Forecast future growth |

Operating Leverage | Relationship between fixed & variable costs | Plan scaling and expense management |

Strategic Budgeting and Cash Flow Management

Financial planning is not budgeting in a silo — it’s a strategic tool to align spending with goals while preserving cash.

How Founders Can Build a Startup Budget That Works

Start with a Revenue Forecast: Base on realistic sales pipeline, historical data, or market benchmarks.

Outline Fixed and Variable Costs: Rent, salaries vs. marketing campaigns, raw materials.

Plan for Seasonality and Growth Sprints: Incorporate expected fluctuations or product launches.

Include Contingency Buffers: Cushion for unexpected expenses or slower sales.

Why Daily Cash Flow Monitoring Is Critical

Unlike large corporations, startups must be vigilant with cash daily or weekly. Tools that integrate with bookkeeping can alert you to cash crunch risks.

Navigating Startup Funding Options

Understanding funding instruments tailored to startup growth stages lets you raise capital strategically.

Common Startup Funding Stages:

Bootstrapping: Founder’s own capital and revenues.

Friends & Family: Early small rounds from close contacts.

Angel Investors: Wealthy individuals investing in early risk.

Seed Funding: Professional investors backing product-market fit.

Series A and Beyond: Venture capital for growth scaling.

Learn more about startup funding stages in detail here.

Popular Funding Instruments:

Instrument | Description | Founder Pros/Cons |

Convertible Notes | Debt that converts into equity later | Avoids early valuation but adds complexity |

SAFE (Simple Agreement for Future Equity) | Agreement for future shares without valuation now | Faster, founder-friendly; can dilute founders later |

Preferred Stock | Equity with special rights for investors | Attractive to investors; dilutes existing owners |

Startup Accounting — Beyond Bookkeeping

Bookkeeping and accounting aren’t merely transactional — they’re strategic pillars for founders. Proper financial records build the foundation for projections, tax planning, audits, and decisions.

Why Founders Need Startup-Native Bookkeeping

Traditional bookkeeping often falls short for dynamic startups where burn rate and runway are sensitive indicators of health.

Automate reporting and reconciliations.

Customize chart of accounts for financial modeling.

Stay funding- and tax-ready year-round.

Explore how specialized bookkeeping can accelerate your startup’s financial health with targeted support bookkeeping services for startups.

Integrating Accounting with Tax Planning

Don’t overlook tax credits like R&D tax credit which can materially reduce tax liabilities and support cash flow.

Why Founders Should Understand Tax Implications Early

Taxes can be complex and costly when ignored. Understanding key aspects upfront reduces surprises.

R&D Tax Credit: Many startups qualify and miss out on valuable credits for innovation-related expenses.

Startup Expenses Deductibility: Capitalizing vs. immediately expensing items impacts cash flow and profitability.

Nexus and State Taxes: Operating in multiple states can trigger additional tax filings.

Payroll Taxes: Proper setup avoids penalties and keeps employees satisfied.

For applied guidance, refer to authoritative IRS resources like IRS.gov.

Take Action: Build Your Financial Foundation Now

Mastering startup finance basics isn’t a one-time task — it’s an ongoing habit that underpins every founder’s success. Today’s startup environment demands fast, modern, founder-friendly financial operations that enable confident decisions and fuel growth.

If your team needs modern bookkeeping solutions, financial forecasting advice, or help navigating startup funding and tax credits, exploring comprehensive services tailored for startups can accelerate your path forward.

For every founder launching a startup, mastering startup finance basics is critical—not just to survive, but to thrive. As you navigate early growth stages, your ability to interpret financial signals, manage cash flow, and make data-driven decisions can spell the difference between scaling or stalling.

A strong financial foundation empowers you to steer your business smartly, attract the right investors, optimize operations, and align your entire team toward sustainable growth.

This guide distills the essential startup finance knowledge you actually need as a founder, cutting through noise and jargon.

Why Startup Finance Basics Matter

Founders wear many hats, but financial literacy must top your skill set. Here’s why:

Informed Decision Making: Financial awareness helps you evaluate investments, hiring, pricing, and growth initiatives with data-backed insight.

Cash Flow Survival: Knowing how to monitor and control cash flow prevents bankruptcy surprises and missteps in managing operational costs.

Investor Relations: Investors want to see founders who understand their numbers; strong financial fluency builds confidence in your leadership.

Risk Mitigation: Recognizing red flags early (e.g., burn rate spikes, declining sales) helps you pivot before crisis hits.

Fundraising Strategy: Understanding funding stages and instruments enables smarter timing and structuring of capital raises.

In essence, mastering these basics gives you a strategic edge in running a lean, efficient startup that maximizes every dollar and opportunity.

Key Financial Statements Every Founder Should Know

Understanding your startup's financial story starts with three essential reports. These documents give you clear views into your business performance, liquidity, and financial position.

1. Income Statement (Profit & Loss)

The income statement summarizes your revenues, expenses, and profitability over a specific period (monthly, quarterly, or annually).

Why It Matters: Shows if you're profitable or burning cash; helps analyze cost structures and revenue streams.

Key Components:

Revenue (Sales): Money earned from products or services.

Cost of Goods Sold (COGS): Direct costs to produce or deliver.

Gross Profit: Revenue minus COGS.

Operating Expenses: Marketing, R&D, salaries, rent, etc.

Net Income: Profit or loss after all expenses.

2. Cash Flow Statement

Cash flow reports track actual cash moving into and out of your business, crucial for managing day-to-day liquidity.

Why It Matters: Cash is king—without enough cash on hand, even profitable startups can fail.

Key Sections:

Operating Activities: Cash from core business operations.

Investing Activities: Cash used for assets or investments.

Financing Activities: Cash raised from or paid to investors/lenders.

3. Balance Sheet

A snapshot of your startup’s financial position at a given point, showing assets, liabilities, and equity.

Why It Matters: Helps assess your startup's net worth and financial stability.

Key Concepts:

Assets: What the startup owns (cash, inventory, equipment).

Liabilities: What the startup owes (loans, accounts payable).

Equity: Owner’s stake (capital invested plus retained earnings).

Essential Metrics Founders Must Track

Beyond the basic statements, understanding specific financial metrics informs better decisions and growth planning.

Startup Burn Rate and Runway

Burn Rate: Your monthly net cash outflow. The higher it is, the faster you’re spending cash.

Runway: The time (months) your current cash reserves will last at the current burn rate.

Example: If you burn $50,000/month and have $300,000 cash, your runway is 6 months (300,000 ÷ 50,000).

Why monitor? Because knowing burn and runway helps optimize spending and plan fundraising before you run out of cash.

Customer Acquisition Cost (CAC)

CAC is the average amount spent to acquire a new customer, including sales salaries, marketing campaigns, and overheads.

How to Calculate:

Total sales and marketing expenses ÷ Number of new customers acquired.

Lowering CAC means increased efficiency in marketing spend.

Customer Lifetime Value (LTV)

LTV estimates the total revenue or profit generated from a customer over their entire relationship.

Why It’s Important: Comparing LTV to CAC informs if your customer relationships are profitable.

Rule of thumb: LTV should be at least 3x CAC for a sustainable business.

Other Useful Metrics

Metric | What It Reveals | Founder Application |

Gross Margin | Profitability of your products | Guide pricing and cost reduction |

Churn Rate | Customer retention rate | Signal product satisfaction and loyalty |

Run Rate Revenue | Projected annual revenue | Forecast future growth |

Operating Leverage | Relationship between fixed & variable costs | Plan scaling and expense management |

Strategic Budgeting and Cash Flow Management

Financial planning is not budgeting in a silo — it’s a strategic tool to align spending with goals while preserving cash.

How Founders Can Build a Startup Budget That Works

Start with a Revenue Forecast: Base on realistic sales pipeline, historical data, or market benchmarks.

Outline Fixed and Variable Costs: Rent, salaries vs. marketing campaigns, raw materials.

Plan for Seasonality and Growth Sprints: Incorporate expected fluctuations or product launches.

Include Contingency Buffers: Cushion for unexpected expenses or slower sales.

Why Daily Cash Flow Monitoring Is Critical

Unlike large corporations, startups must be vigilant with cash daily or weekly. Tools that integrate with bookkeeping can alert you to cash crunch risks.

Navigating Startup Funding Options

Understanding funding instruments tailored to startup growth stages lets you raise capital strategically.

Common Startup Funding Stages:

Bootstrapping: Founder’s own capital and revenues.

Friends & Family: Early small rounds from close contacts.

Angel Investors: Wealthy individuals investing in early risk.

Seed Funding: Professional investors backing product-market fit.

Series A and Beyond: Venture capital for growth scaling.

Learn more about startup funding stages in detail here.

Popular Funding Instruments:

Instrument | Description | Founder Pros/Cons |

Convertible Notes | Debt that converts into equity later | Avoids early valuation but adds complexity |

SAFE (Simple Agreement for Future Equity) | Agreement for future shares without valuation now | Faster, founder-friendly; can dilute founders later |

Preferred Stock | Equity with special rights for investors | Attractive to investors; dilutes existing owners |

Startup Accounting — Beyond Bookkeeping

Bookkeeping and accounting aren’t merely transactional — they’re strategic pillars for founders. Proper financial records build the foundation for projections, tax planning, audits, and decisions.

Why Founders Need Startup-Native Bookkeeping

Traditional bookkeeping often falls short for dynamic startups where burn rate and runway are sensitive indicators of health.

Automate reporting and reconciliations.

Customize chart of accounts for financial modeling.

Stay funding- and tax-ready year-round.

Explore how specialized bookkeeping can accelerate your startup’s financial health with targeted support bookkeeping services for startups.

Integrating Accounting with Tax Planning

Don’t overlook tax credits like R&D tax credit which can materially reduce tax liabilities and support cash flow.

Why Founders Should Understand Tax Implications Early

Taxes can be complex and costly when ignored. Understanding key aspects upfront reduces surprises.

R&D Tax Credit: Many startups qualify and miss out on valuable credits for innovation-related expenses.

Startup Expenses Deductibility: Capitalizing vs. immediately expensing items impacts cash flow and profitability.

Nexus and State Taxes: Operating in multiple states can trigger additional tax filings.

Payroll Taxes: Proper setup avoids penalties and keeps employees satisfied.

For applied guidance, refer to authoritative IRS resources like IRS.gov.

Take Action: Build Your Financial Foundation Now

Mastering startup finance basics isn’t a one-time task — it’s an ongoing habit that underpins every founder’s success. Today’s startup environment demands fast, modern, founder-friendly financial operations that enable confident decisions and fuel growth.

If your team needs modern bookkeeping solutions, financial forecasting advice, or help navigating startup funding and tax credits, exploring comprehensive services tailored for startups can accelerate your path forward.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026