Go Back

Last Updated :

Last Updated :

Jan 9, 2026

Jan 9, 2026

Section 1202 Explained: How Founders Can Exclude Capital Gains with QSBS

For founders and startup leaders navigating the complex landscape of funding, growth, and exit strategies, qsbs tax treatment under Section 1202 of the Internal Revenue Code presents a powerful but often underutilized opportunity. This tax provision can dramatically reduce, or even eliminate, capital gains taxes on the sale of Qualified Small Business Stock (QSBS), offering founders million-dollar savings — if structured correctly from day one.

This guide offers a founder-focused roadmap to understanding Section 1202, how to qualify your startup, and best practices for preserving your QSBS tax benefits through your company’s lifecycle. Whether you’re a CEO, COO, head of finance, or CTO weighing engineering spend against R&D tax credits, this article is tailored to help you make informed and strategic decisions that can materially improve your company’s and your personal financial outcomes.

What is QSBS and Why Does Section 1202 Matter for Founders?

Qualified Small Business Stock (QSBS) refers to shares issued by certain small businesses that qualify for substantial federal tax advantages under IRS Section 1202. This section enables founders and early investors to exclude up to 100% of capital gains realized upon the sale of QSBS shares held for at least five years — subject to specific caps and conditions.

Key benefits of QSBS tax treatment for founders:

Capital gains exclusion: Depending on when you acquired the stock, you may exclude from $10 million or 10 times the adjusted basis of your investment in capital gains on a per-issuer basis.

Ordinary income tax avoidance: Gains excluded from tax under Section 1202 are not subject to ordinary income tax or the Net Investment Income Tax.

Encourages long-term investment: The five-year holding period incentivizes founders and investors to maintain stake during critical growth phases.

For startups scaling in industries like technology, SaaS, e-commerce, and agencies — where liquidity events or acquisitions can be life-changing — QSBS tax treatment can dramatically boost after-tax returns. As a founder it’s important to understand how QSBS works in detail.

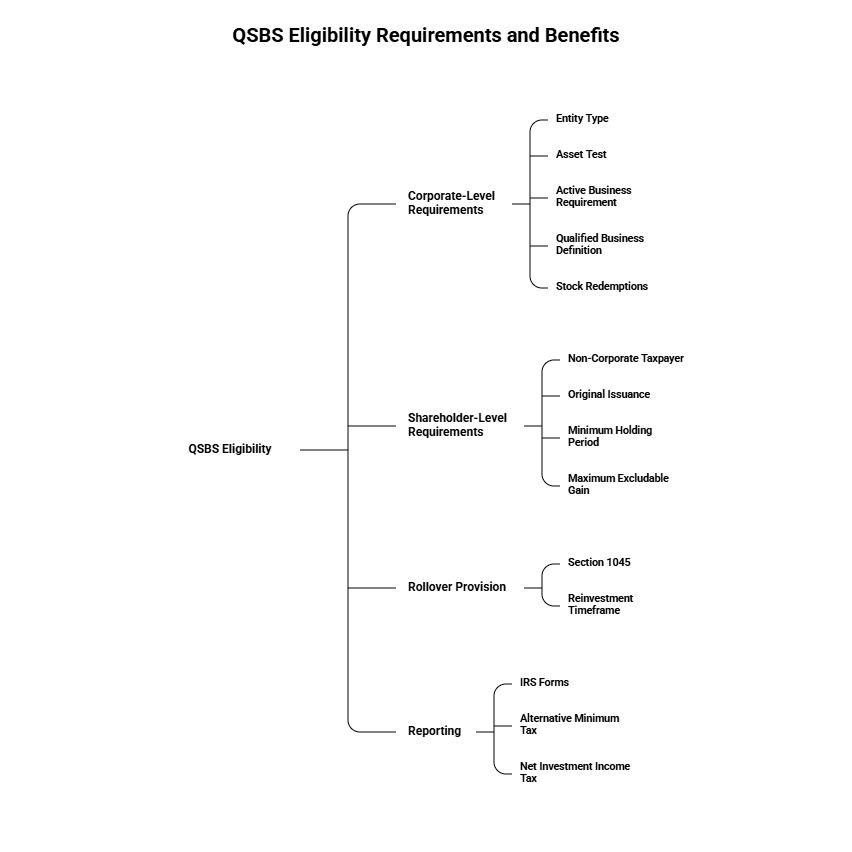

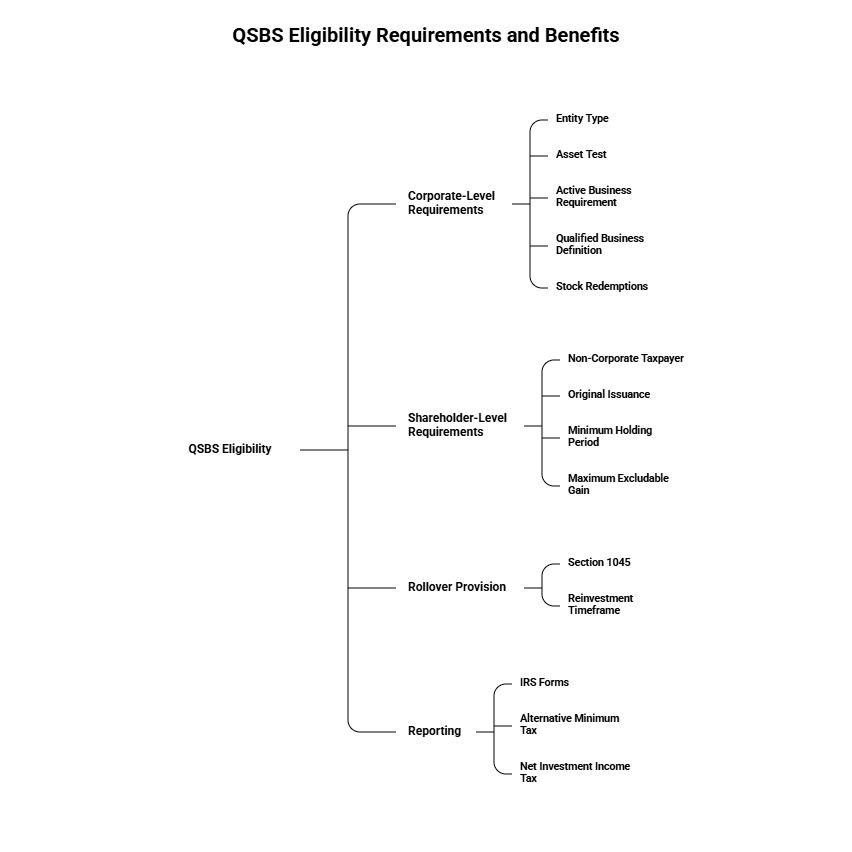

Understanding QSBS Eligibility: The Founder’s Checklist

Not every startup qualifies, and the details matter deeply. To benefit from Section 1202, your stock must meet several rigorous requirements often missed without intentional planning.

Eligibility Factor | Requirement | Notes for Founders |

Entity Type | Must be a domestic C corporation | LLCs and S corps do not qualify directly; see LLC vs. C corp for startups |

Gross Assets | Aggregate gross assets ≤ $50 million before stock issuance (adjusted post-2025 to $75M) | Includes cash and tangible/intangible assets; timing matters |

Active Business Requirement | ≥80% of assets used in qualified active business (not passive investments) | Align activities with IRS-approved industries |

Type of Stock | Must be original issuance stock directly from the company | Avoid purchasing shares from existing shareholders |

Holding Period | Must hold stock for at least five years | Early sales disqualify benefits |

Business Activity | Excludes certain service, finance, and hospitality industries | Review NAICS classification carefully |

Planning for qualification means aligning corporate form, capitalization events, and operational focus with these criteria from inception and maintaining this status through growth.

The Financial Impact: How QSBS Tax Treatment Can Yield Multi-Million Dollar Savings

To illustrate, suppose a founder exits after five years:

Scenario | Non-QSBS Capital Gains Tax | QSBS Exclusion Applies | Federal Tax Savings |

Founder sells $20M in shares | 20% Capital Gains + 3.8% NIIT ≈ 23.8% | Yes, 100% excluded | ≈ $4.76M in federal tax savings |

Holding period: 5+ years | Applies | Meets holding threshold |

Given capital gains and Net Investment Income Tax (NIIT) rates totaling up to 23.8%, the QSBS exemption could save founders millions at exit.

The exclusion is the greater of $10 million or 10x your basis — meaning founders who received shares at nominal value during incorporation could recognize substantial tax-free gains at exit.

Understanding these savings allows better equity structuring, investor presentations, and acquisition preparation.

Navigating Common QSBS Pitfalls Founders Must Avoid Early

Despite the promise of QSBS, it’s surprisingly easy to disqualify through overlooked structural or operational missteps. Awareness is everything.

1. Corporate Form Mistakes

Starting with an LLC or S corp and converting later: Doesn't retroactively qualify earlier shares.

Poor documentation of incorporation and share issuance records may fail to prove QSBS eligibility.

2. Gross Asset Thresholds Misunderstood

Raising large rounds too early or accumulating too much non-operational cash can tip you over the $50M limit (or $75M post-2025).

Conduct periodic cap table and asset audits pre-financing.

3. Wrong Type of Stock

Must be original issuance stock. Acquiring from secondary markets or employee buybacks is generally not eligible.

4. Liquidity Too Early

Selling before five years disqualifies gains from QSBS exclusion — potentially leading to millions in surprise tax bills.

5. Business Type Issues

Industries like legal consulting, financial services, health, or hospitality aren’t QSBS-qualified.

Verify your NAICS code — it affects IRS interpretation of “qualified business.”

These slips are often unintentional but avoidable with early tax planning.

Legislative Developments: What Founders Should Know

Founders must stay ahead of evolving QSBS rules to preserve benefits through fundraising and exit.

Gross Asset Limit Expansion: From $50M to $75M post-July 2025 — growing companies may still qualify longer.

Increased Exclusion: Legislative proposals include retention of the 100% exemption, even for large gains, helping high-growth startups stay optimized.

Potential Reduced Holding Periods: Some proposals explore reducing 5-year requirements for specific sectors or under certain liquidity scenarios.

For authoritative guidance, refer to IRS Section 1202 Guidelines.

Strategic Steps for Founders to Preserve QSBS Eligibility

1. Form a C Corporation Early

Only C corporations qualify. Founders should consult counsel before forming an LLC or S corp if planning a venture-scale startup. It’s important for founders to understand the difference between LLC vs. C Corp.

2. Maintain the 80% Active Business Use Rule

Ensure 80% of assets are used in operational business activities — avoid passive income strategies or parking funds unrelated to your product/service.

3. Track Stock Grant Dates and Ownership

Only original issuance shares qualify. Maintain robust, timestamped cap tables and secure equity documents to validate shareholding timelines.

4. Educate Your Cap Table

Ensure employees and angel investors understand the five-year holding requirement. Early liquidity events may reduce overall shareholder benefit. Understanding start-up equity is pivotal to run a successful business. If you need this guidance, see Startup Equity 101.

5. Integrate Tax Planning with Fundraising

Involve tax counsel in capital raise strategies. Consider the impact of valuation, timing, and purpose of funds on QSBS compliance and optimization.

Conclusion: Unlocking QSBS Tax Treatment as a Million-Dollar Founder’s Advantage

Section 1202’s qsbs tax treatment is a dynamic tool for startup founders looking to maximize wealth at exit while optimizing federal tax exposure. But the path to benefit is paved with nuanced requirements — from entity type to business activity classification and disciplined stock tracking.

Founders who prioritize structure early, monitor trajectory, and engage specialized startup tax partners stand to unlock seven-figure advantages. Don’t leave it to chance — make QSBS part of your broader financial and equity strategy.

For founders and startup leaders navigating the complex landscape of funding, growth, and exit strategies, qsbs tax treatment under Section 1202 of the Internal Revenue Code presents a powerful but often underutilized opportunity. This tax provision can dramatically reduce, or even eliminate, capital gains taxes on the sale of Qualified Small Business Stock (QSBS), offering founders million-dollar savings — if structured correctly from day one.

This guide offers a founder-focused roadmap to understanding Section 1202, how to qualify your startup, and best practices for preserving your QSBS tax benefits through your company’s lifecycle. Whether you’re a CEO, COO, head of finance, or CTO weighing engineering spend against R&D tax credits, this article is tailored to help you make informed and strategic decisions that can materially improve your company’s and your personal financial outcomes.

What is QSBS and Why Does Section 1202 Matter for Founders?

Qualified Small Business Stock (QSBS) refers to shares issued by certain small businesses that qualify for substantial federal tax advantages under IRS Section 1202. This section enables founders and early investors to exclude up to 100% of capital gains realized upon the sale of QSBS shares held for at least five years — subject to specific caps and conditions.

Key benefits of QSBS tax treatment for founders:

Capital gains exclusion: Depending on when you acquired the stock, you may exclude from $10 million or 10 times the adjusted basis of your investment in capital gains on a per-issuer basis.

Ordinary income tax avoidance: Gains excluded from tax under Section 1202 are not subject to ordinary income tax or the Net Investment Income Tax.

Encourages long-term investment: The five-year holding period incentivizes founders and investors to maintain stake during critical growth phases.

For startups scaling in industries like technology, SaaS, e-commerce, and agencies — where liquidity events or acquisitions can be life-changing — QSBS tax treatment can dramatically boost after-tax returns. As a founder it’s important to understand how QSBS works in detail.

Understanding QSBS Eligibility: The Founder’s Checklist

Not every startup qualifies, and the details matter deeply. To benefit from Section 1202, your stock must meet several rigorous requirements often missed without intentional planning.

Eligibility Factor | Requirement | Notes for Founders |

Entity Type | Must be a domestic C corporation | LLCs and S corps do not qualify directly; see LLC vs. C corp for startups |

Gross Assets | Aggregate gross assets ≤ $50 million before stock issuance (adjusted post-2025 to $75M) | Includes cash and tangible/intangible assets; timing matters |

Active Business Requirement | ≥80% of assets used in qualified active business (not passive investments) | Align activities with IRS-approved industries |

Type of Stock | Must be original issuance stock directly from the company | Avoid purchasing shares from existing shareholders |

Holding Period | Must hold stock for at least five years | Early sales disqualify benefits |

Business Activity | Excludes certain service, finance, and hospitality industries | Review NAICS classification carefully |

Planning for qualification means aligning corporate form, capitalization events, and operational focus with these criteria from inception and maintaining this status through growth.

The Financial Impact: How QSBS Tax Treatment Can Yield Multi-Million Dollar Savings

To illustrate, suppose a founder exits after five years:

Scenario | Non-QSBS Capital Gains Tax | QSBS Exclusion Applies | Federal Tax Savings |

Founder sells $20M in shares | 20% Capital Gains + 3.8% NIIT ≈ 23.8% | Yes, 100% excluded | ≈ $4.76M in federal tax savings |

Holding period: 5+ years | Applies | Meets holding threshold |

Given capital gains and Net Investment Income Tax (NIIT) rates totaling up to 23.8%, the QSBS exemption could save founders millions at exit.

The exclusion is the greater of $10 million or 10x your basis — meaning founders who received shares at nominal value during incorporation could recognize substantial tax-free gains at exit.

Understanding these savings allows better equity structuring, investor presentations, and acquisition preparation.

Navigating Common QSBS Pitfalls Founders Must Avoid Early

Despite the promise of QSBS, it’s surprisingly easy to disqualify through overlooked structural or operational missteps. Awareness is everything.

1. Corporate Form Mistakes

Starting with an LLC or S corp and converting later: Doesn't retroactively qualify earlier shares.

Poor documentation of incorporation and share issuance records may fail to prove QSBS eligibility.

2. Gross Asset Thresholds Misunderstood

Raising large rounds too early or accumulating too much non-operational cash can tip you over the $50M limit (or $75M post-2025).

Conduct periodic cap table and asset audits pre-financing.

3. Wrong Type of Stock

Must be original issuance stock. Acquiring from secondary markets or employee buybacks is generally not eligible.

4. Liquidity Too Early

Selling before five years disqualifies gains from QSBS exclusion — potentially leading to millions in surprise tax bills.

5. Business Type Issues

Industries like legal consulting, financial services, health, or hospitality aren’t QSBS-qualified.

Verify your NAICS code — it affects IRS interpretation of “qualified business.”

These slips are often unintentional but avoidable with early tax planning.

Legislative Developments: What Founders Should Know

Founders must stay ahead of evolving QSBS rules to preserve benefits through fundraising and exit.

Gross Asset Limit Expansion: From $50M to $75M post-July 2025 — growing companies may still qualify longer.

Increased Exclusion: Legislative proposals include retention of the 100% exemption, even for large gains, helping high-growth startups stay optimized.

Potential Reduced Holding Periods: Some proposals explore reducing 5-year requirements for specific sectors or under certain liquidity scenarios.

For authoritative guidance, refer to IRS Section 1202 Guidelines.

Strategic Steps for Founders to Preserve QSBS Eligibility

1. Form a C Corporation Early

Only C corporations qualify. Founders should consult counsel before forming an LLC or S corp if planning a venture-scale startup. It’s important for founders to understand the difference between LLC vs. C Corp.

2. Maintain the 80% Active Business Use Rule

Ensure 80% of assets are used in operational business activities — avoid passive income strategies or parking funds unrelated to your product/service.

3. Track Stock Grant Dates and Ownership

Only original issuance shares qualify. Maintain robust, timestamped cap tables and secure equity documents to validate shareholding timelines.

4. Educate Your Cap Table

Ensure employees and angel investors understand the five-year holding requirement. Early liquidity events may reduce overall shareholder benefit. Understanding start-up equity is pivotal to run a successful business. If you need this guidance, see Startup Equity 101.

5. Integrate Tax Planning with Fundraising

Involve tax counsel in capital raise strategies. Consider the impact of valuation, timing, and purpose of funds on QSBS compliance and optimization.

Conclusion: Unlocking QSBS Tax Treatment as a Million-Dollar Founder’s Advantage

Section 1202’s qsbs tax treatment is a dynamic tool for startup founders looking to maximize wealth at exit while optimizing federal tax exposure. But the path to benefit is paved with nuanced requirements — from entity type to business activity classification and disciplined stock tracking.

Founders who prioritize structure early, monitor trajectory, and engage specialized startup tax partners stand to unlock seven-figure advantages. Don’t leave it to chance — make QSBS part of your broader financial and equity strategy.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026