Go Back

Last Updated :

Last Updated :

Jan 20, 2026

Jan 20, 2026

Form 1099-BR: Reporting Equity Sales and Asset Liquidation

When your startup, agency, or e-commerce business sells equity or liquidates assets through a brokerage, understanding how to properly report those transactions is critical. For founders and finance leaders, Form 1099-B is a cornerstone tax document that communicates the proceeds from broker transactions to the IRS and guides your capital gains or losses reporting.

Navigating its details with clarity can save you headaches come tax season and ensure compliance without overpaying.

This guide helps you decode Form 1099-B, interpret broker proceeds, and optimize how you report equity sales and asset liquidation.

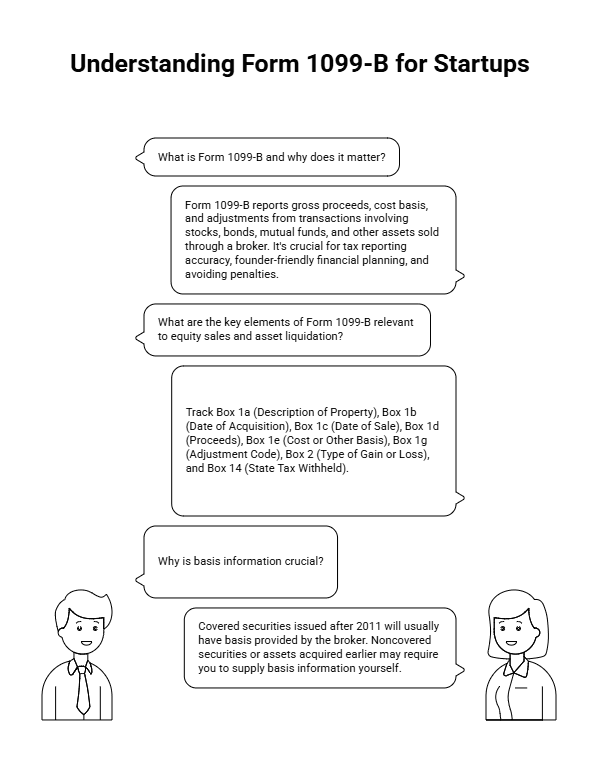

What is Form 1099-B and Why Does It Matter for Founders?

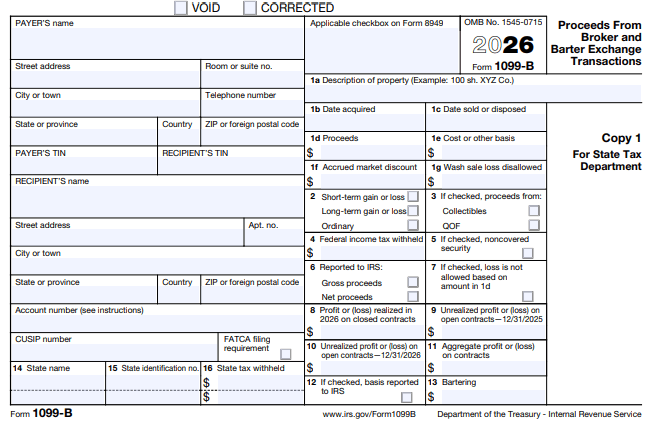

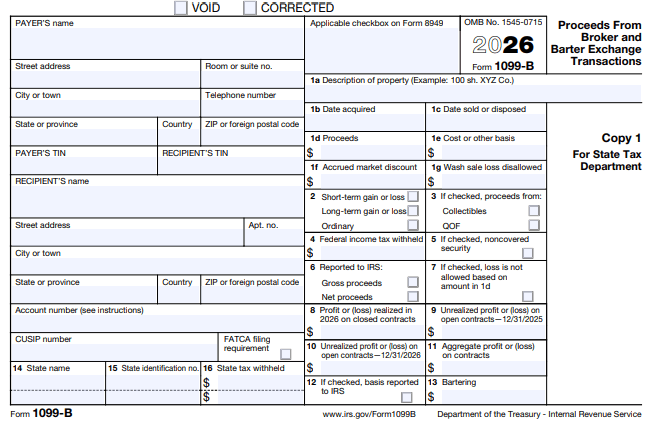

Form 1099-B, officially the ""Proceeds From Broker and Barter Exchange Transactions"" form, is issued by your brokerage firm for transactions involving stocks, bonds, mutual funds, and other assets sold through a broker. It reports gross proceeds from sales, cost basis (if available), and any applicable adjustments—essential data that your business uses to calculate capital gains or losses.

Understanding Form 1099-B is fundamental because:

Tax Reporting Accuracy: It supplies the IRS and the taxpayer with precise sale information necessary for capital gains tax computations.

Founder-Friendly Financial Planning: Knowing gains vs. losses impacts your strategic capital allocation decisions.

Avoiding Penalties: Mistakes or omissions can trigger audits or penalties, interrupting your operational focus.

Startups increasingly transact with brokerages for equity financing rounds, stock option exercises, or asset liquidation tied to pivot or shutdown scenarios. Ensuring correct recording and reporting of these transactions on Form 1099-B aligns your tax filing with IRS requirements, minimizes risk, and improves your confidence in financial data management.

Internal Reference: For a broader view on reporting tax compliance for startup founders, check Form 1099-K: A Guide for Founders.

Key Elements of Form 1099-B Relevant to Equity Sales and Asset Liquidation

Reading Form 1099-B with an eye toward your business decisions involves understanding its core boxes and fields. Here’s what to track:

Box on Form 1099-B | What It Shows | Why It Matters for Your Reporting |

Box 1a | Description of Property | Identifies the asset sold (e.g., stock ticker, bond) |

Box 1b | Date of Acquisition | Helps differentiate long-term vs. short-term gains |

Box 1c | Date of Sale or Exchange | Establishes transaction timeline for tax purposes |

Box 1d | Proceeds | Gross amount received from sale (before fees) |

Box 1e | Cost or Other Basis | Your original investment or adjusted basis |

Box 1g | Adjustment Code | Codes explaining adjustments affecting gain/loss calculation |

Box 2 | Type of Gain or Loss | Short-term or long-term classification affects tax rates |

Box 14 | State Tax Withheld | Relevant for multistate tax filings |

Why is basis information crucial? Covered securities issued after 2011 will usually have basis provided by the broker, simplifying your tax reporting process. Noncovered securities or assets acquired earlier may require you to supply basis information yourself.

Form 1099-B data isn’t filed in isolation—for tax reporting, you’ll transfer this information to Form 8949 and Schedule D to calculate and report your capital gains or losses clearly.

Reporting Capital Gains and Losses from Form 1099-B

Startups often realize capital gains from equity sales (such as stock from employee stock option exercises or secondary market sales) or asset liquidation (selling fixed assets or inventory via a broker).

Here’s a founder-friendly workflow to report broker proceeds accurately:

Gather Form 1099-Bs early: Brokerage firms usually issue these forms by February 15. Confirm you’ve received all your brokerage statements.

Categorize transactions by asset type and term: Separate short-term (<1 year) and long-term (>1 year) holdings, as tax rates differ.

Match broker-reported proceeds to your cost basis: Check the form’s cost basis field and adjust if you have additional acquisition details or stock splits.

Use Form 8949: Report individual transactions detailing sales and adjusted basis. Enter any adjustments from codes on Form 1099-B.

Summarize totals on Schedule D: Transfer total gains or losses here, combining with other capital transactions.

Account for Wash Sales: Transactions where stocks sold at a loss are repurchased within 30 days, which defers losses, need careful tracking.

For early-stage startups, the importance of separating short-term versus long-term and capturing accurate basis can directly impact tax liability and cash flow projections.

Pro tip: Implement a system for recording your equity transaction cost basis using cap table management software or integrated bookkeeping tools to reduce manual errors.

Special Considerations for Asset Liquidation via Broker Proceeds

Liquidating assets beyond traditional securities—such as business equipment, inventory, or intellectual property rights—often interacts differently with Form 1099-B and tax rules but can still involve broker reporting if sold through intermediaries.

Business Asset Sales: Gains here are reported on Form 4797 rather than Schedule D but may still be reflected in the proceeds reported by brokers.

Barter Exchanges: Non-cash transactions traded through brokers require reporting of fair market value on Form 1099-B, impacting income recognition.

Broker Fees: Ensure fees and commissions deducted by brokers are correctly reflected in adjusted basis or sale proceeds to avoid overstating gains.

R&D Credit Impact: If you liquidate assets tied to R&D efforts, consult with your finance or tax advisor to understand how amortizations or credits influence gain/loss recognition.

Understanding nuances in the liquidation process ensures you avoid missing taxable events or misrepresenting proceeds—founders should coordinate closely with their controllers or tax advisors early in the asset sale lifecycle.

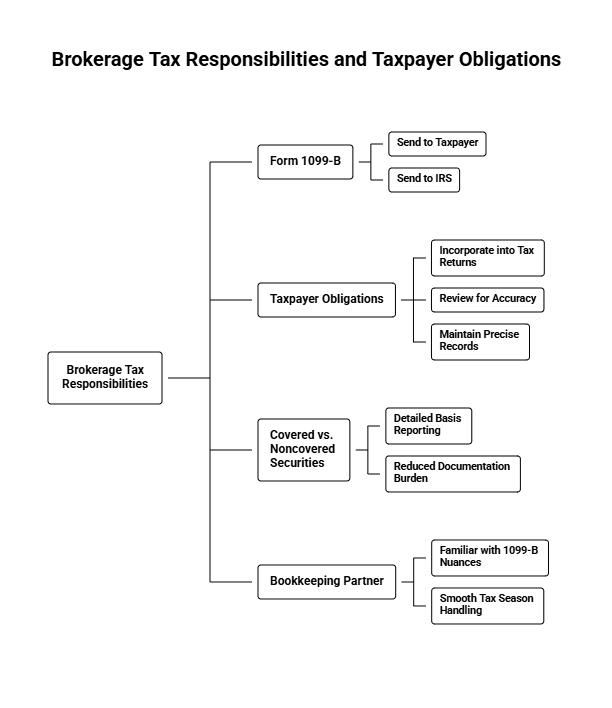

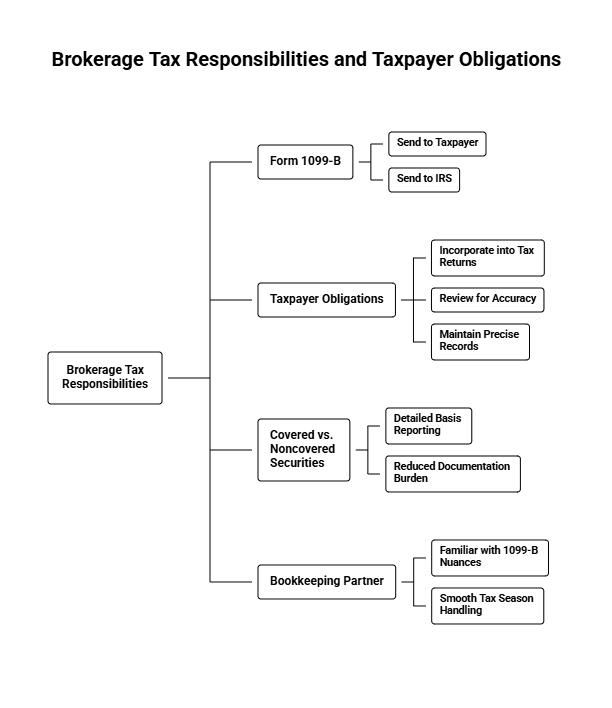

Filing Deadlines, Corrections, and Broker Responsibilities

Brokerages are required to send Form 1099-B to you and the IRS by mid-February annually. You, as the taxpayer or responsible party in your startup, need to:

Incorporate 1099-B info into your tax returns by April 15 (or extension deadline).

Review forms for accuracy: If you notice errors like wrong basis or omitted transactions, request corrections promptly from your broker.

Maintain precise records: Keep documentation supporting acquisition dates and values to substantiate your reporting positions.

Additionally, it’s vital to stay aware of distinctions between covered and non-covered securities in your brokerage activity. Covered securities, introduced as part of IRS updates, provide detailed basis reporting to reduce your documentation burden and returns risk.

For startups managing multiple equity plan participants or complex transactions, opting for a bookkeeping partner familiar with Form 1099-B nuances ensures smooth tax season handling and focused operational leadership.

How to Leverage Internal Resources for Streamlined Reporting

Modern startups benefit from integrated reporting and bookkeeping platforms tailored for founders’ needs to streamline Form 1099-B handling and overall compliance:

Centralized Reporting Portal: Consolidates 1099 forms, easing review and error detection.

Automated Data Transfers: Populates Form 8949 and Schedule D tax forms directly from brokerage data.

Cross-form Compliance Checks: Ensures consistent reporting across Form 1099-K (for payment processing) and 1099-B.

Also, learn about general Form 1099 requirements to stay ahead of compliance obligations that naturally intersect with equity sales and asset sales reporting.

Mastering Form 1099-B for Startup Success

Equity sales and asset liquidation mark pivotal financial events for startups. Mastering Form 1099-B reporting empowers founders and finance leaders to manage capital gains and losses with confidence, avoid penalties, and optimize tax liability. By understanding form details, applying practical reporting workflows, and leveraging modern bookkeeping resources, your startup can maintain tax compliance while focusing on growth.

Accurate broker proceeds reporting is not just a tax obligation—it’s a foundational element of transparent financial leadership that supports your company’s long-term health and investor confidence.

When your startup, agency, or e-commerce business sells equity or liquidates assets through a brokerage, understanding how to properly report those transactions is critical. For founders and finance leaders, Form 1099-B is a cornerstone tax document that communicates the proceeds from broker transactions to the IRS and guides your capital gains or losses reporting.

Navigating its details with clarity can save you headaches come tax season and ensure compliance without overpaying.

This guide helps you decode Form 1099-B, interpret broker proceeds, and optimize how you report equity sales and asset liquidation.

What is Form 1099-B and Why Does It Matter for Founders?

Form 1099-B, officially the ""Proceeds From Broker and Barter Exchange Transactions"" form, is issued by your brokerage firm for transactions involving stocks, bonds, mutual funds, and other assets sold through a broker. It reports gross proceeds from sales, cost basis (if available), and any applicable adjustments—essential data that your business uses to calculate capital gains or losses.

Understanding Form 1099-B is fundamental because:

Tax Reporting Accuracy: It supplies the IRS and the taxpayer with precise sale information necessary for capital gains tax computations.

Founder-Friendly Financial Planning: Knowing gains vs. losses impacts your strategic capital allocation decisions.

Avoiding Penalties: Mistakes or omissions can trigger audits or penalties, interrupting your operational focus.

Startups increasingly transact with brokerages for equity financing rounds, stock option exercises, or asset liquidation tied to pivot or shutdown scenarios. Ensuring correct recording and reporting of these transactions on Form 1099-B aligns your tax filing with IRS requirements, minimizes risk, and improves your confidence in financial data management.

Internal Reference: For a broader view on reporting tax compliance for startup founders, check Form 1099-K: A Guide for Founders.

Key Elements of Form 1099-B Relevant to Equity Sales and Asset Liquidation

Reading Form 1099-B with an eye toward your business decisions involves understanding its core boxes and fields. Here’s what to track:

Box on Form 1099-B | What It Shows | Why It Matters for Your Reporting |

Box 1a | Description of Property | Identifies the asset sold (e.g., stock ticker, bond) |

Box 1b | Date of Acquisition | Helps differentiate long-term vs. short-term gains |

Box 1c | Date of Sale or Exchange | Establishes transaction timeline for tax purposes |

Box 1d | Proceeds | Gross amount received from sale (before fees) |

Box 1e | Cost or Other Basis | Your original investment or adjusted basis |

Box 1g | Adjustment Code | Codes explaining adjustments affecting gain/loss calculation |

Box 2 | Type of Gain or Loss | Short-term or long-term classification affects tax rates |

Box 14 | State Tax Withheld | Relevant for multistate tax filings |

Why is basis information crucial? Covered securities issued after 2011 will usually have basis provided by the broker, simplifying your tax reporting process. Noncovered securities or assets acquired earlier may require you to supply basis information yourself.

Form 1099-B data isn’t filed in isolation—for tax reporting, you’ll transfer this information to Form 8949 and Schedule D to calculate and report your capital gains or losses clearly.

Reporting Capital Gains and Losses from Form 1099-B

Startups often realize capital gains from equity sales (such as stock from employee stock option exercises or secondary market sales) or asset liquidation (selling fixed assets or inventory via a broker).

Here’s a founder-friendly workflow to report broker proceeds accurately:

Gather Form 1099-Bs early: Brokerage firms usually issue these forms by February 15. Confirm you’ve received all your brokerage statements.

Categorize transactions by asset type and term: Separate short-term (<1 year) and long-term (>1 year) holdings, as tax rates differ.

Match broker-reported proceeds to your cost basis: Check the form’s cost basis field and adjust if you have additional acquisition details or stock splits.

Use Form 8949: Report individual transactions detailing sales and adjusted basis. Enter any adjustments from codes on Form 1099-B.

Summarize totals on Schedule D: Transfer total gains or losses here, combining with other capital transactions.

Account for Wash Sales: Transactions where stocks sold at a loss are repurchased within 30 days, which defers losses, need careful tracking.

For early-stage startups, the importance of separating short-term versus long-term and capturing accurate basis can directly impact tax liability and cash flow projections.

Pro tip: Implement a system for recording your equity transaction cost basis using cap table management software or integrated bookkeeping tools to reduce manual errors.

Special Considerations for Asset Liquidation via Broker Proceeds

Liquidating assets beyond traditional securities—such as business equipment, inventory, or intellectual property rights—often interacts differently with Form 1099-B and tax rules but can still involve broker reporting if sold through intermediaries.

Business Asset Sales: Gains here are reported on Form 4797 rather than Schedule D but may still be reflected in the proceeds reported by brokers.

Barter Exchanges: Non-cash transactions traded through brokers require reporting of fair market value on Form 1099-B, impacting income recognition.

Broker Fees: Ensure fees and commissions deducted by brokers are correctly reflected in adjusted basis or sale proceeds to avoid overstating gains.

R&D Credit Impact: If you liquidate assets tied to R&D efforts, consult with your finance or tax advisor to understand how amortizations or credits influence gain/loss recognition.

Understanding nuances in the liquidation process ensures you avoid missing taxable events or misrepresenting proceeds—founders should coordinate closely with their controllers or tax advisors early in the asset sale lifecycle.

Filing Deadlines, Corrections, and Broker Responsibilities

Brokerages are required to send Form 1099-B to you and the IRS by mid-February annually. You, as the taxpayer or responsible party in your startup, need to:

Incorporate 1099-B info into your tax returns by April 15 (or extension deadline).

Review forms for accuracy: If you notice errors like wrong basis or omitted transactions, request corrections promptly from your broker.

Maintain precise records: Keep documentation supporting acquisition dates and values to substantiate your reporting positions.

Additionally, it’s vital to stay aware of distinctions between covered and non-covered securities in your brokerage activity. Covered securities, introduced as part of IRS updates, provide detailed basis reporting to reduce your documentation burden and returns risk.

For startups managing multiple equity plan participants or complex transactions, opting for a bookkeeping partner familiar with Form 1099-B nuances ensures smooth tax season handling and focused operational leadership.

How to Leverage Internal Resources for Streamlined Reporting

Modern startups benefit from integrated reporting and bookkeeping platforms tailored for founders’ needs to streamline Form 1099-B handling and overall compliance:

Centralized Reporting Portal: Consolidates 1099 forms, easing review and error detection.

Automated Data Transfers: Populates Form 8949 and Schedule D tax forms directly from brokerage data.

Cross-form Compliance Checks: Ensures consistent reporting across Form 1099-K (for payment processing) and 1099-B.

Also, learn about general Form 1099 requirements to stay ahead of compliance obligations that naturally intersect with equity sales and asset sales reporting.

Mastering Form 1099-B for Startup Success

Equity sales and asset liquidation mark pivotal financial events for startups. Mastering Form 1099-B reporting empowers founders and finance leaders to manage capital gains and losses with confidence, avoid penalties, and optimize tax liability. By understanding form details, applying practical reporting workflows, and leveraging modern bookkeeping resources, your startup can maintain tax compliance while focusing on growth.

Accurate broker proceeds reporting is not just a tax obligation—it’s a foundational element of transparent financial leadership that supports your company’s long-term health and investor confidence.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026