Go Back

Last Updated :

Last Updated :

Jan 5, 2026

Jan 5, 2026

Form 1099-K Guide: Payment Transaction Reporting for Businesses

Navigating tax season can be daunting for any founder, especially when it comes to understanding the nuances of IRS reporting requirements like Form 1099-K. For startups, e-commerce businesses, and agencies, staying compliant while optimizing cash flow is critical. This guide provides a practical overview of Form 1099-K—what it is, who needs it, and how to leverage it in your overall tax strategy.

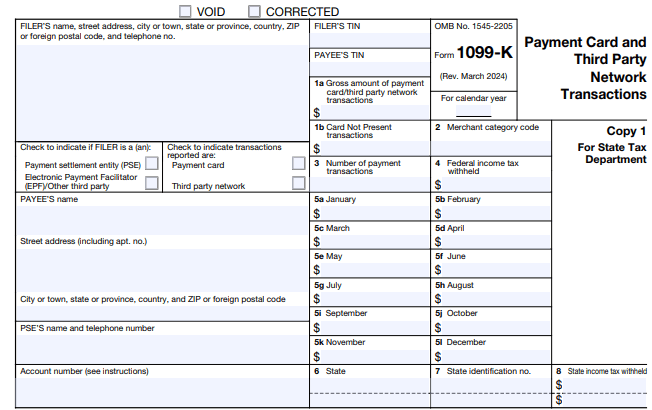

What is Form 1099-K?

Form 1099-K, Payment Card and Third Party Network Transactions, is an information return used by the IRS to monitor payment transactions processed through third-party networks.

Why founders should care:

Gross Reporting: This form reports the gross amount of payment transactions received, which includes refunds, chargebacks, and fees that might not be taxable income.

IRS Matching: The IRS receives a copy of this form and will look for a matching amount on your tax return.

Who Receives Form 1099-K?

You don't file Form 1099-K yourself; you receive it from your payment settlement entities (PSEs), such as:

Payment Card Networks: (e.g., Visa, Mastercard).

Third-Party Settlement Organizations (TPSOs): (e.g., Stripe, PayPal, Square, Etsy, eBay).

Reporting Thresholds

The IRS has been transitioning toward a lower threshold for TPSOs. For the 2024 tax year:

Threshold: Generally, if you receive more than $5,000 in gross payments from a TPSO, you should expect a Form 1099-K.

Future Change: The IRS plans to eventually lower this threshold to $600.

When is Form 1099-K Due?

Recipient Deadline: You should receive your copy of Form 1099-K by January 31.

IRS Deadline: Your payment processor must file the form with the IRS by February 28 (if filing on paper) or March 31 (if filing electronically).

How to Manage Form 1099-K Data: Step-by-Step

Since you are the recipient, your "step-by-step" involves reconciling the form against your own books.

1. Verify Your Information

Check that your Legal Name and Employer Identification Number (EIN) match exactly what is on file with your payment processor and the IRS.

2. Reconcile Gross Amounts (Box 1a)

Compare the amount in Box 1a (Gross amount of payment card/third party network transactions) with your internal accounting software records.

Remember: Box 1a is the gross amount. It does not account for refunds, credits, or processor fees.

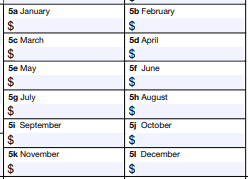

3. Account for Monthly Totals (Boxes 5a-5l)

Review the monthly breakdown provided on the form to identify any specific months where discrepancies might exist between your deposits and the reported transactions.

4. Deduct Business Expenses

When filing your tax return (e.g., Schedule C or Form 1120), use your records to deduct the fees and refunds that the 1099-K includes in its gross total. This ensures you only pay tax on your net income.

Common Mistakes Founders Make

Reporting the 1099-K Amount as "Net" Income: Doing this will cause you to overpay taxes by failing to deduct processor fees and refunds.

Ignoring Discrepancies: If the 1099-K is wrong, contact the processor immediately to get a corrected version. An uncorrected discrepancy is an audit trigger.

Mixing Personal and Business Funds: If you use a personal PayPal or Venmo for business, you may receive a 1099-K that mixes personal gifts with business revenue, making reconciliation difficult.

FAQs

Q: I received a 1099-K for a personal sale. Is this taxable?

A: Selling personal items at a loss is generally not taxable. However, you must still account for the 1099-K on your tax return to explain why the amount isn't being taxed.

Q: Why is the amount on my 1099-K higher than what was deposited in my bank account?

A: Form 1099-K reports the total transaction amount before the payment processor takes their fees. Your bank deposits are usually net of those fees.

Take Control of Your Tax Strategy with Haven

The landscape of payment reporting is evolving, and Form 1099-K now applies to a broader range of businesses. Haven translates these complex requirements into practical, founder-ready strategies.

Automated Reconciliation: We integrate directly with Stripe, PayPal, and Square to sync and reconcile your payment data in real-time.

Strategic Planning: Our advisory services forecast your tax impact, ensuring you're never surprised by a tax bill.

Audit-Ready Books: We clearly distinguish between gross income, refunds, and chargebacks to prevent IRS mismatches.

Navigating tax season can be daunting for any founder, especially when it comes to understanding the nuances of IRS reporting requirements like Form 1099-K. For startups, e-commerce businesses, and agencies, staying compliant while optimizing cash flow is critical. This guide provides a practical overview of Form 1099-K—what it is, who needs it, and how to leverage it in your overall tax strategy.

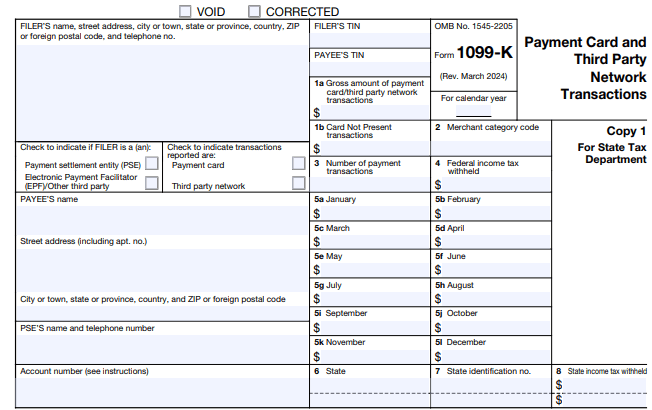

What is Form 1099-K?

Form 1099-K, Payment Card and Third Party Network Transactions, is an information return used by the IRS to monitor payment transactions processed through third-party networks.

Why founders should care:

Gross Reporting: This form reports the gross amount of payment transactions received, which includes refunds, chargebacks, and fees that might not be taxable income.

IRS Matching: The IRS receives a copy of this form and will look for a matching amount on your tax return.

Who Receives Form 1099-K?

You don't file Form 1099-K yourself; you receive it from your payment settlement entities (PSEs), such as:

Payment Card Networks: (e.g., Visa, Mastercard).

Third-Party Settlement Organizations (TPSOs): (e.g., Stripe, PayPal, Square, Etsy, eBay).

Reporting Thresholds

The IRS has been transitioning toward a lower threshold for TPSOs. For the 2024 tax year:

Threshold: Generally, if you receive more than $5,000 in gross payments from a TPSO, you should expect a Form 1099-K.

Future Change: The IRS plans to eventually lower this threshold to $600.

When is Form 1099-K Due?

Recipient Deadline: You should receive your copy of Form 1099-K by January 31.

IRS Deadline: Your payment processor must file the form with the IRS by February 28 (if filing on paper) or March 31 (if filing electronically).

How to Manage Form 1099-K Data: Step-by-Step

Since you are the recipient, your "step-by-step" involves reconciling the form against your own books.

1. Verify Your Information

Check that your Legal Name and Employer Identification Number (EIN) match exactly what is on file with your payment processor and the IRS.

2. Reconcile Gross Amounts (Box 1a)

Compare the amount in Box 1a (Gross amount of payment card/third party network transactions) with your internal accounting software records.

Remember: Box 1a is the gross amount. It does not account for refunds, credits, or processor fees.

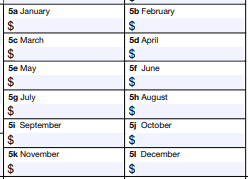

3. Account for Monthly Totals (Boxes 5a-5l)

Review the monthly breakdown provided on the form to identify any specific months where discrepancies might exist between your deposits and the reported transactions.

4. Deduct Business Expenses

When filing your tax return (e.g., Schedule C or Form 1120), use your records to deduct the fees and refunds that the 1099-K includes in its gross total. This ensures you only pay tax on your net income.

Common Mistakes Founders Make

Reporting the 1099-K Amount as "Net" Income: Doing this will cause you to overpay taxes by failing to deduct processor fees and refunds.

Ignoring Discrepancies: If the 1099-K is wrong, contact the processor immediately to get a corrected version. An uncorrected discrepancy is an audit trigger.

Mixing Personal and Business Funds: If you use a personal PayPal or Venmo for business, you may receive a 1099-K that mixes personal gifts with business revenue, making reconciliation difficult.

FAQs

Q: I received a 1099-K for a personal sale. Is this taxable?

A: Selling personal items at a loss is generally not taxable. However, you must still account for the 1099-K on your tax return to explain why the amount isn't being taxed.

Q: Why is the amount on my 1099-K higher than what was deposited in my bank account?

A: Form 1099-K reports the total transaction amount before the payment processor takes their fees. Your bank deposits are usually net of those fees.

Take Control of Your Tax Strategy with Haven

The landscape of payment reporting is evolving, and Form 1099-K now applies to a broader range of businesses. Haven translates these complex requirements into practical, founder-ready strategies.

Automated Reconciliation: We integrate directly with Stripe, PayPal, and Square to sync and reconcile your payment data in real-time.

Strategic Planning: Our advisory services forecast your tax impact, ensuring you're never surprised by a tax bill.

Audit-Ready Books: We clearly distinguish between gross income, refunds, and chargebacks to prevent IRS mismatches.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026