Go Back

Last Updated :

Last Updated :

Dec 22, 2025

Dec 22, 2025

Form 843 Filing Guide: How to Request Tax Refunds & Abatement

When you run a startup or growing business, unexpected tax assessments—whether penalties or interest—can quickly disrupt your financial planning. Knowing how to navigate the IRS process for obtaining refunds or abatement of such charges is essential for preserving cash flow and avoiding prolonged headaches.

Form 843 is the key IRS form that lets you officially request these adjustments. This guide unpacks the essentials of Form 843 specifically for founders, COOs, and heads of finance, enabling you to confidently initiate tax refund or abatement requests without costly missteps.

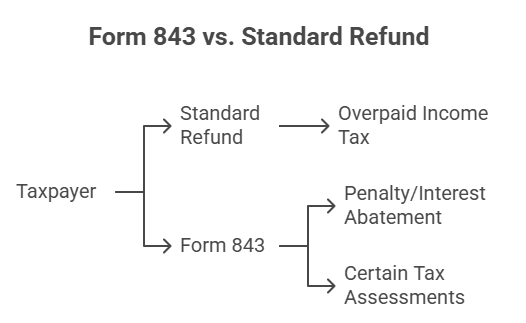

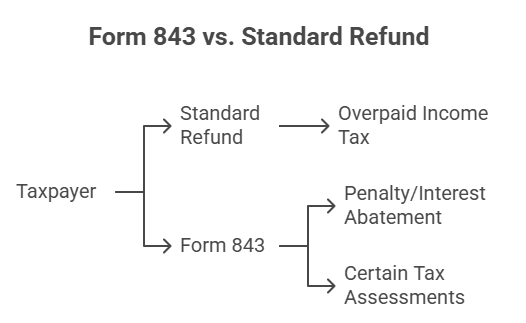

What Is Form 843 and When Should Founders Use It?

Form 843, officially titled "Claim for Refund and Request for Abatement," is an IRS administrative tool designed for taxpayers to request a reduction or cancellation of:

Penalties

Interest

Certain tax assessments that the IRS has imposed.

Unlike standard refund claims tied to overpaid taxes, Form 843 specifically addresses cases where you believe a charge is incorrect due to IRS error, reasonable cause, or other eligible grounds.

Common Scenarios for Filing Form 843

Founders and financial leads typically use Form 843 in the following situations:

Penalty Abatement Requests: If your startup faced a late filing or late payment penalty but you have a reasonable cause (e.g., serious illness, natural disaster, or other hardships), Form 843 allows you to formally request the IRS forgive or reduce these penalties.

Interest Abatement: If you are being charged IRS interest due to adjustments made by the IRS, but you believe the interest is unwarranted, Form 843 can ask for this interest to be abated. This is often tied to delays or errors caused by the IRS itself (see Section 6404(e)(1)).

Removing Certain Prior Assessments: For example, erroneous Trust Fund Recovery Penalties (section 6672) or certain excise taxes.

Tax Refunds Related to Certain Credits or Adjustments: In limited situations, such as specific credits not handled through regular refund forms.

Important Compliance Note: Form 843 is not a substitute for filing amended tax returns. Do not use it to claim a refund of income taxes paid (use Form 1040X or corporate amended returns instead). It is complementary and typically used alongside or after other IRS forms when addressing penalties or interest.

How to Properly Complete and Submit Form 843

Filing Form 843 correctly is crucial to avoid delays or outright denials. Use this step-by-step process to ensure accuracy and maximize your chance for approval.

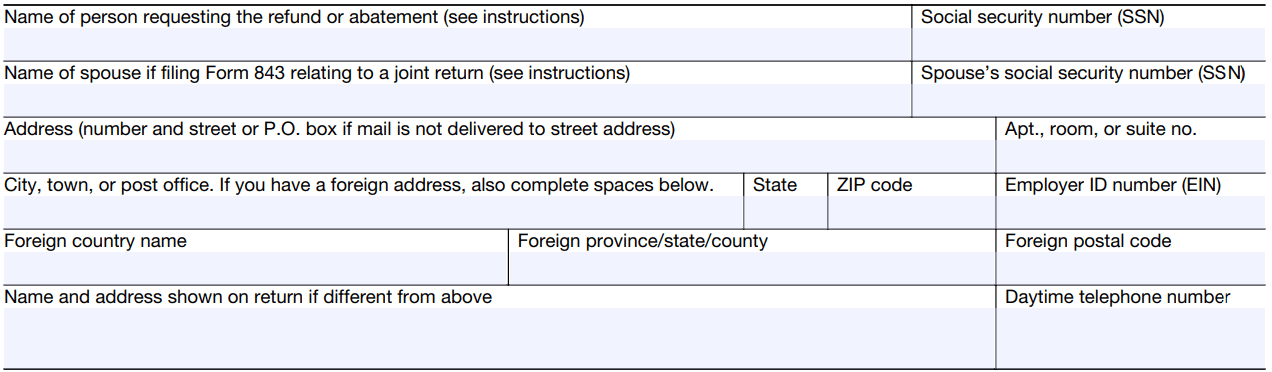

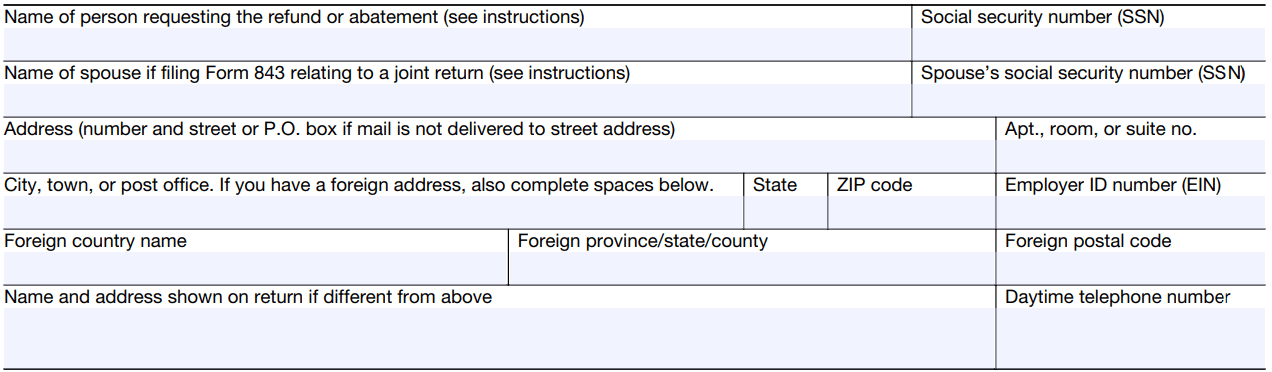

Step 1: Complete Personal/Business Information

Fill in the taxpayer's name, EIN, address, and daytime telephone number.

Guidance: Ensure the name and address match the information the IRS has on file or the information shown on the original return. For corporate filings, use the Employer ID Number (EIN).

Step 2: Enter the Tax Period and Amount

Tax Period (Line 1): Enter the beginning and ending dates for the specific tax period or fee year to which the penalty or interest relates. Prepare a separate Form 843 for each tax period.

Amount to be Refunded or Abated (Line 2): Specify the exact penalty and/or interest amounts you want abated.

Date(s) of Payment (Line 3): If you are requesting a refund for a payment already made, list the date(s) of payment.

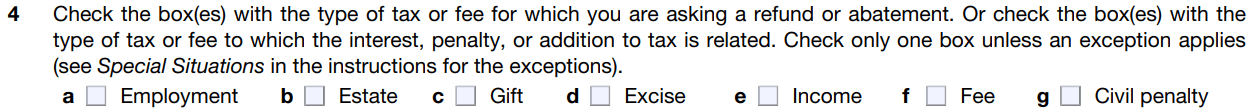

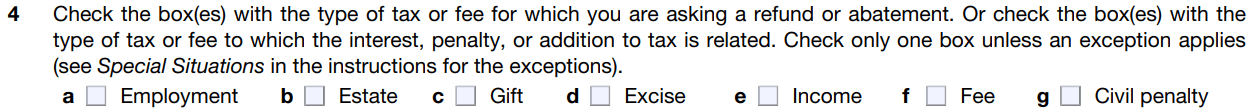

Step 3: Check the Box for Type of Tax/Fee (Line 4)

Check the box that indicates the type of tax or fee to which the penalty, interest, or refund is related.

Guidance: For startups, this often relates to Employment Tax (Box a), which covers penalties related to Forms 941 or 940. Check only one box unless an exception applies.

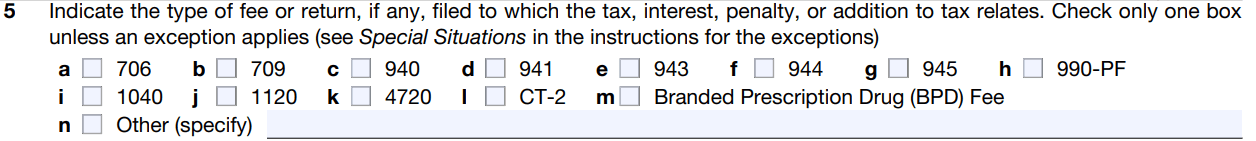

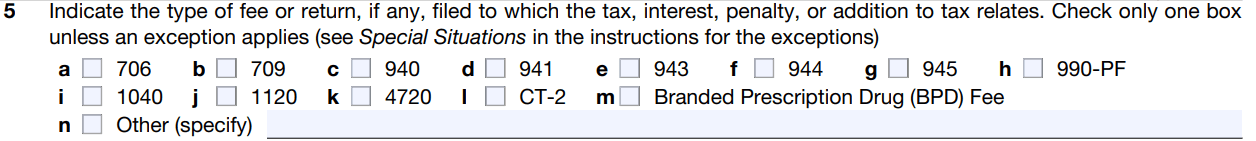

Step 4: Indicate Related Form/Fee (Line 5)

Indicate the type of fee or return filed to which the tax, interest, or penalty relates.

Guidance: If the penalty is for late payment of quarterly payroll taxes, you would likely check Box d (941). Check the instructions for the form that corresponds to the tax type you selected in Line 4.

Step 5: Explain Your Request (Line 7 and 8)

This is the most critical section for abatement requests.

Reason for Request (Line 7): Check the box that best indicates why the request should be allowed.

Box c: Reasonable cause or other reason allowed under the law is the most common selection for startups contesting penalties.

Box a: Check this if you are requesting interest abatement due to IRS errors or delays.

Detailed Explanation (Line 8): Clearly and concisely explain why the claim should be allowed and show how you calculated the amount in Line 2.

Key Tip: Provide a concise explanation, e.g., "Requesting penalty abatement due to natural disaster affecting timely payroll tax payment.".

Step 6: Attach Supporting Documentation

You must submit copies of all relevant documents.

Submit copies of: IRS notices, proof of payment, hardship evidence (e.g., medical notes, legal records, or server logs), or legal rulings.

The more relevant evidence, the higher your chance of success.

Step 7: Sign and File

Signature: A corporate officer authorized to sign must sign and include their title.

Filing: The IRS provides different addresses depending on your business type and tax issue; review the Form 843 Instructions for your precise filing location.

Track Submission: Retain copies of all submitted materials and use certified mail or other trackable methods to confirm receipt.

Strategies to Maximize Success with Form 843

Simply submitting Form 843 doesn't guarantee results. Increase your chances of a successful outcome by following these strategies:

Demonstrate "Reasonable Cause" with Documentation

IRS guidelines prioritize penalty abatement for "reasonable cause," meaning you must prove circumstances beyond your control prevented compliance. Examples include:

Serious illness or injury to key personnel

Natural disasters impacting operations

IRS errors or misinformation leading to penalties

Real-World Example: Your e-commerce startup received a $5,000 penalty for a late payroll tax deposit because a failed API deployment froze payment processing. To contest it, you must assemble internal server logs and vendor emails proving the outage. This shows the error was outside your control.

Reference IRS Regulations

In your written explanation (Line 8), refer to specific IRS revenue procedures or policy language. This signals that you have researched your position and adds legitimacy to your claim.

Combine Requests Strategically

Use a single Form 843 to request both penalty abatement and interest relief if applicable. This saves time and reduces the need for duplicate documentation.

File Promptly, Track Closely

IRS deadlines for refund and abatement requests can be strict. Submitting early gives you more time to correct errors or provide follow-up information if requested.

Common Mistakes to Avoid

Using Form 843 for Income Tax Refunds: The form clearly states this is for claims that can't be claimed on other forms. Do not use Form 843 to claim a refund of income taxes; use Form 1040X (for individuals) or corporate amended returns.

Incomplete or Vague Requests: Failure to specify exact penalty and/or interest amounts, or providing a vague explanation on Line 8, will significantly slow processing.

Missing Required Information: Errors in the tax period (Line 1) or type of tax (Line 4) cause processing delays.

Lack of Supporting Evidence: The claim must be supported by documentation proving "reasonable cause." A claim without evidence is likely to be denied.

What Happens After You File Form 843? (FAQs)

How long does it take for the IRS to process Form 843?

The IRS generally takes 60 to 90 days to process Form 843, but inquiries can take longer during peak periods.

What is the process after submission?

Acknowledgment: The IRS may send a letter confirming your request is in process.

Review: IRS staff will evaluate your form and attachments.

Decision: You will receive a ruling in writing—either an approval, partial approval, or denial.

What if my request is denied?

If denied, you can submit a formal request for reconsideration or request a conference with an IRS appeals officer.

Can a founder file Form 843 themselves?

Yes, you can file Form 843 yourself or authorize a tax professional. However, founders with in-house finance leads may file directly after due diligence.

When you run a startup or growing business, unexpected tax assessments—whether penalties or interest—can quickly disrupt your financial planning. Knowing how to navigate the IRS process for obtaining refunds or abatement of such charges is essential for preserving cash flow and avoiding prolonged headaches.

Form 843 is the key IRS form that lets you officially request these adjustments. This guide unpacks the essentials of Form 843 specifically for founders, COOs, and heads of finance, enabling you to confidently initiate tax refund or abatement requests without costly missteps.

What Is Form 843 and When Should Founders Use It?

Form 843, officially titled "Claim for Refund and Request for Abatement," is an IRS administrative tool designed for taxpayers to request a reduction or cancellation of:

Penalties

Interest

Certain tax assessments that the IRS has imposed.

Unlike standard refund claims tied to overpaid taxes, Form 843 specifically addresses cases where you believe a charge is incorrect due to IRS error, reasonable cause, or other eligible grounds.

Common Scenarios for Filing Form 843

Founders and financial leads typically use Form 843 in the following situations:

Penalty Abatement Requests: If your startup faced a late filing or late payment penalty but you have a reasonable cause (e.g., serious illness, natural disaster, or other hardships), Form 843 allows you to formally request the IRS forgive or reduce these penalties.

Interest Abatement: If you are being charged IRS interest due to adjustments made by the IRS, but you believe the interest is unwarranted, Form 843 can ask for this interest to be abated. This is often tied to delays or errors caused by the IRS itself (see Section 6404(e)(1)).

Removing Certain Prior Assessments: For example, erroneous Trust Fund Recovery Penalties (section 6672) or certain excise taxes.

Tax Refunds Related to Certain Credits or Adjustments: In limited situations, such as specific credits not handled through regular refund forms.

Important Compliance Note: Form 843 is not a substitute for filing amended tax returns. Do not use it to claim a refund of income taxes paid (use Form 1040X or corporate amended returns instead). It is complementary and typically used alongside or after other IRS forms when addressing penalties or interest.

How to Properly Complete and Submit Form 843

Filing Form 843 correctly is crucial to avoid delays or outright denials. Use this step-by-step process to ensure accuracy and maximize your chance for approval.

Step 1: Complete Personal/Business Information

Fill in the taxpayer's name, EIN, address, and daytime telephone number.

Guidance: Ensure the name and address match the information the IRS has on file or the information shown on the original return. For corporate filings, use the Employer ID Number (EIN).

Step 2: Enter the Tax Period and Amount

Tax Period (Line 1): Enter the beginning and ending dates for the specific tax period or fee year to which the penalty or interest relates. Prepare a separate Form 843 for each tax period.

Amount to be Refunded or Abated (Line 2): Specify the exact penalty and/or interest amounts you want abated.

Date(s) of Payment (Line 3): If you are requesting a refund for a payment already made, list the date(s) of payment.

Step 3: Check the Box for Type of Tax/Fee (Line 4)

Check the box that indicates the type of tax or fee to which the penalty, interest, or refund is related.

Guidance: For startups, this often relates to Employment Tax (Box a), which covers penalties related to Forms 941 or 940. Check only one box unless an exception applies.

Step 4: Indicate Related Form/Fee (Line 5)

Indicate the type of fee or return filed to which the tax, interest, or penalty relates.

Guidance: If the penalty is for late payment of quarterly payroll taxes, you would likely check Box d (941). Check the instructions for the form that corresponds to the tax type you selected in Line 4.

Step 5: Explain Your Request (Line 7 and 8)

This is the most critical section for abatement requests.

Reason for Request (Line 7): Check the box that best indicates why the request should be allowed.

Box c: Reasonable cause or other reason allowed under the law is the most common selection for startups contesting penalties.

Box a: Check this if you are requesting interest abatement due to IRS errors or delays.

Detailed Explanation (Line 8): Clearly and concisely explain why the claim should be allowed and show how you calculated the amount in Line 2.

Key Tip: Provide a concise explanation, e.g., "Requesting penalty abatement due to natural disaster affecting timely payroll tax payment.".

Step 6: Attach Supporting Documentation

You must submit copies of all relevant documents.

Submit copies of: IRS notices, proof of payment, hardship evidence (e.g., medical notes, legal records, or server logs), or legal rulings.

The more relevant evidence, the higher your chance of success.

Step 7: Sign and File

Signature: A corporate officer authorized to sign must sign and include their title.

Filing: The IRS provides different addresses depending on your business type and tax issue; review the Form 843 Instructions for your precise filing location.

Track Submission: Retain copies of all submitted materials and use certified mail or other trackable methods to confirm receipt.

Strategies to Maximize Success with Form 843

Simply submitting Form 843 doesn't guarantee results. Increase your chances of a successful outcome by following these strategies:

Demonstrate "Reasonable Cause" with Documentation

IRS guidelines prioritize penalty abatement for "reasonable cause," meaning you must prove circumstances beyond your control prevented compliance. Examples include:

Serious illness or injury to key personnel

Natural disasters impacting operations

IRS errors or misinformation leading to penalties

Real-World Example: Your e-commerce startup received a $5,000 penalty for a late payroll tax deposit because a failed API deployment froze payment processing. To contest it, you must assemble internal server logs and vendor emails proving the outage. This shows the error was outside your control.

Reference IRS Regulations

In your written explanation (Line 8), refer to specific IRS revenue procedures or policy language. This signals that you have researched your position and adds legitimacy to your claim.

Combine Requests Strategically

Use a single Form 843 to request both penalty abatement and interest relief if applicable. This saves time and reduces the need for duplicate documentation.

File Promptly, Track Closely

IRS deadlines for refund and abatement requests can be strict. Submitting early gives you more time to correct errors or provide follow-up information if requested.

Common Mistakes to Avoid

Using Form 843 for Income Tax Refunds: The form clearly states this is for claims that can't be claimed on other forms. Do not use Form 843 to claim a refund of income taxes; use Form 1040X (for individuals) or corporate amended returns.

Incomplete or Vague Requests: Failure to specify exact penalty and/or interest amounts, or providing a vague explanation on Line 8, will significantly slow processing.

Missing Required Information: Errors in the tax period (Line 1) or type of tax (Line 4) cause processing delays.

Lack of Supporting Evidence: The claim must be supported by documentation proving "reasonable cause." A claim without evidence is likely to be denied.

What Happens After You File Form 843? (FAQs)

How long does it take for the IRS to process Form 843?

The IRS generally takes 60 to 90 days to process Form 843, but inquiries can take longer during peak periods.

What is the process after submission?

Acknowledgment: The IRS may send a letter confirming your request is in process.

Review: IRS staff will evaluate your form and attachments.

Decision: You will receive a ruling in writing—either an approval, partial approval, or denial.

What if my request is denied?

If denied, you can submit a formal request for reconsideration or request a conference with an IRS appeals officer.

Can a founder file Form 843 themselves?

Yes, you can file Form 843 yourself or authorize a tax professional. However, founders with in-house finance leads may file directly after due diligence.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026