Go Back

Last Updated :

Last Updated :

Dec 22, 2025

Dec 22, 2025

Form 4562 Guide for Founders: Depreciation & Amortization Rules (Revised)

Form 4562 Guide for Founders: Depreciation & Amortization Rules (Revised)

Navigating tax compliance is a critical aspect of managing a startup’s finances, especially when it comes to maximizing deductions and credits that can significantly improve your cash flow. For founders, understanding Form 4562—the IRS form used to claim deductions for depreciation and amortization—is essential to capturing tax benefits on your business assets.

This guide breaks down Form 4562 in practical terms designed specifically for startup founders, COOs, and finance leads.

What Is Form 4562 and Why Does It Matter?

Form 4562 is used by businesses to claim deductions related to the depreciation and amortization of tangible and intangible business assets. In essence, it allows you to spread out the cost of big purchases—like equipment, vehicles, software, or patents—over their useful life instead of expensing them all at once.

Why Founders and Startups Should Care:

Preserve Cash: Taking these deductions reduces your taxable income, lowering the cash taxes you owe and freeing up capital to reinvest in your growth.

Avoid Missed Opportunities: Many startups neglect filing Form 4562 or fail to track asset costs correctly, leaving significant deductions on the table.

Clarity on Asset Value: Proper use of Form 4562 helps your finance team and investors understand your asset base and expense timing accurately.

Who Needs to File Form 4562?

Form 4562 is required if your business does any of the following during the tax year:

Elects the Section 179 deduction for any property.

Claims depreciation on any new asset placed in service during the year.

Claims the Special Depreciation Allowance (Bonus Depreciation).

Claims depreciation on listed property (such as vehicles, computers, or cell phones used 50% or less for business).

Claims amortization of certain costs (e.g., startup or organizational costs).

When Is Form 4562 Due?

Form 4562 is not filed separately. It is an attachment to your business income tax return and is due on the same date as that return (including extensions).

Entity Type | Required Tax Form | Due Date (Typically) |

C Corporations | Form 1120 | 15th day of the 4th month after year-end. |

Partnerships/S Corps | Form 1065 / Form 1120-S | 15th day of the 3rd month after year-end. |

Sole Proprietors | Schedule C (Attached to Form 1040) | April 15th (or tax deadline). |

Understanding Depreciation & Amortization Key Strategies

Depreciation: Tangible Assets (Equipment, Vehicles, Furniture)

Deduction Strategy | Description | Key 2024 Thresholds |

Section 179 | Elect to deduct the full cost of qualifying property immediately. The deduction cannot exceed your business income. | Max Deduction: $1,220,000 |

Bonus Depreciation | Allows a percentage of the asset’s cost to be deducted immediately. This can create or increase a loss. | Rate: 60% for assets placed in service in 2024. |

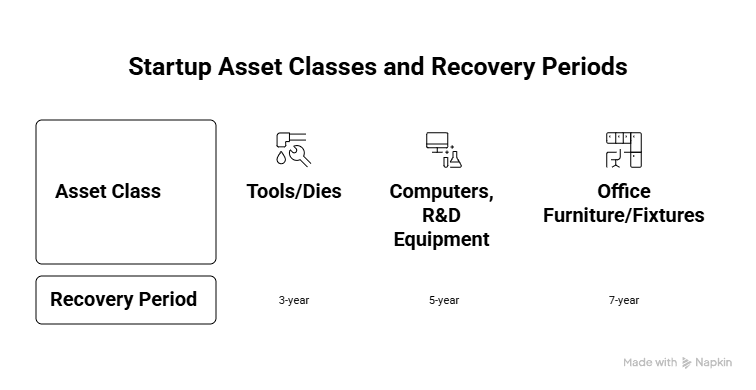

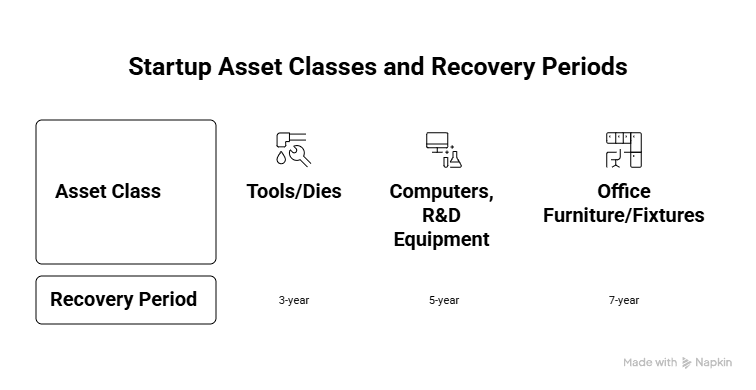

MACRS (Traditional) | Spreads the remaining cost over the asset’s prescribed useful life (e.g., 5-year for computers). | Varies by asset class (3-20 years). |

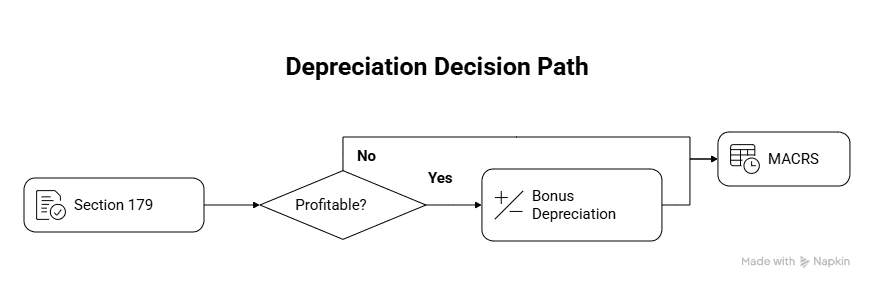

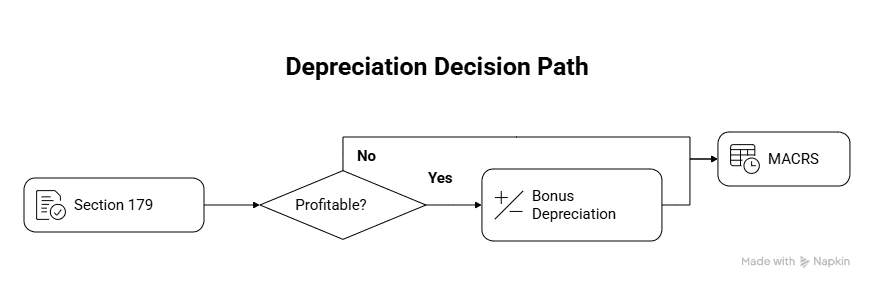

Guidance Tip: Section 179 is limited by taxable income; Bonus Depreciation is not. Founders should prioritize using Bonus Depreciation to maximize current losses, or use Section 179 if the business is profitable and needs a large, immediate offset.

Amortization: Intangible Assets (Startup Costs, Patents)

Amortization applies to assets without physical substance, such as patents, copyrights, and certain organizational/startup costs. These are usually amortized (deducted) on a straight-line basis over a set period.

Startup Costs: Typically amortized over 180 months (15 years), starting the month the business begins actively operating.

Internally Developed Software: Current tax law generally requires these costs to be capitalized and amortized over 5 years (60 months).

How to Fill Out Form 4562: Step-by-Step Guidance

Filing properly requires careful attention to which Part applies to your purchases.

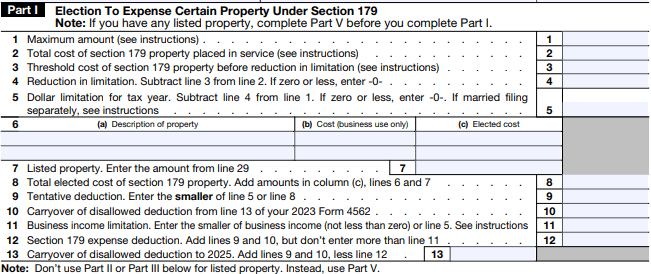

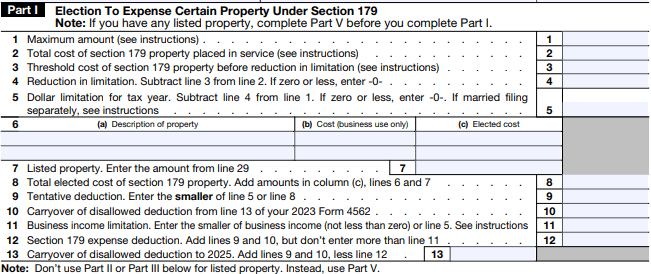

Part I: The Section 179 Election

This section is where you take the immediate expensing deduction.

Check Limits (Lines 1–5):

Enter the total cost of all Section 179 property placed in service on Line 2.

The form will calculate the final dollar limitation for your tax year on Line 5.

List Property (Line 6):

Use the table on Line 6 to list the description and cost of each asset you are expensing using Section 179.

Bolding Key Action: Enter the elected deduction amount in column (c).

Final Deduction (Lines 9–12):

Line 9 is your Tentative Deduction.

Line 11 requires your business income limitation—the deduction cannot exceed this amount.

Line 12 is your final Section 179 deduction for the year.

Part II: Special Depreciation Allowance (Bonus)

Used to claim the immediate percentage deduction for qualified property.

Enter Deduction (Line 14):

Enter the amount of 60% Bonus Depreciation you are claiming for the year.

Guidance Tip: If you apply Section 179 first, the 60% is applied to the remaining adjusted basis of the asset.

Part III: MACRS Depreciation (Traditional Schedule)

Use this for any asset cost remaining after Part I and Part II, or for assets that don't qualify for immediate expensing.

List MACRS Property (Line 17):

The table on Line 17 is the primary area for reporting MACRS depreciation. You will need to know the asset's Recovery Period (e.g., 5-year, 7-year) and the Convention (e.g., Half-Year).

Bolding Key Action: Group similar assets (e.g., all 5-year property placed in service on the same date) to simplify the entry.

Total Depreciation (Line 22):

Line 22 is the total deduction from all depreciation methods (Part I, Part II, and Part III). This amount is then carried over to your main tax return (e.g., Form 1120, Line 20).

Part VI: Amortization of Intangibles

Critical for claiming startup and organizational cost deductions.

List Intangible Costs (Line 42):

Use the table on Line 42 to describe the intangible cost (e.g., "Organizational Costs," "Startup Costs," "Purchased Software").

Bolding Key Action: Clearly enter the Amortization Period (e.g., 180 months) and the relevant Code Section (e.g., Sec. 195 for startup costs, Sec. 167(a) for purchased software).

Total Amortization (Line 44):

Line 44 is the total amortization deduction for the year.

Common Form 4562 Mistakes Founders Make

Avoiding these errors ensures faster processing and lowers audit risk:

Failing to File Form 4562: If you claim any depreciation deduction on your main tax form (e.g., Form 1120), you must attach Form 4562.

Incorrect "Date Placed in Service": Using the purchase date instead of the date the asset was actually ready and available for its intended business use.

Overlooking the Business Income Limit (Part I): The Section 179 deduction (Part I, Line 12) cannot create or increase a net loss. Any excess is carried forward.

Mismanaging Listed Property (Part V): Assets like vehicles and certain computers require detailed mileage/use logs. If business use is 50% or less, special rules apply, and the entire Part V must be completed.

Missing Amortization: Forgetting to formally elect to amortize startup costs (Line 42) over 180 months can mean the entire deduction is lost until the business liquidates.

FAQs for Startup Founders

Q: Can I take both Section 179 and Bonus Depreciation?

A: Yes. You first apply the Section 179 deduction (up to the $1,220,000 limit) to reduce the cost basis. You then apply Bonus Depreciation (60% in 2024) to any remaining cost of the eligible asset.

Q: What if I forget to claim a deduction in time?

A: You can file an amended return (e.g., Form 1120-X) to claim missed depreciation within the statute of limitations. For a permanent change in accounting method, you may need to file Form 3115, which is highly complex and requires professional guidance.

Q: Are software development costs amortized or depreciated?

A: Internally developed software costs must generally be capitalized and amortized over a 5-year period (or 15 years for foreign development) starting in 2022. Purchased software used for more than one year is also amortized (Part VI).

Q: What is the benefit of the Section 179 phase-out threshold?

A: The Section 179 deduction begins to phase out dollar-for-dollar once your total cost of qualifying property exceeds $3,050,000 (2024 limit). Founders should track this threshold to see if a significant portion of the deduction is lost due to high asset purchases.

Form 4562 Guide for Founders: Depreciation & Amortization Rules (Revised)

Navigating tax compliance is a critical aspect of managing a startup’s finances, especially when it comes to maximizing deductions and credits that can significantly improve your cash flow. For founders, understanding Form 4562—the IRS form used to claim deductions for depreciation and amortization—is essential to capturing tax benefits on your business assets.

This guide breaks down Form 4562 in practical terms designed specifically for startup founders, COOs, and finance leads.

What Is Form 4562 and Why Does It Matter?

Form 4562 is used by businesses to claim deductions related to the depreciation and amortization of tangible and intangible business assets. In essence, it allows you to spread out the cost of big purchases—like equipment, vehicles, software, or patents—over their useful life instead of expensing them all at once.

Why Founders and Startups Should Care:

Preserve Cash: Taking these deductions reduces your taxable income, lowering the cash taxes you owe and freeing up capital to reinvest in your growth.

Avoid Missed Opportunities: Many startups neglect filing Form 4562 or fail to track asset costs correctly, leaving significant deductions on the table.

Clarity on Asset Value: Proper use of Form 4562 helps your finance team and investors understand your asset base and expense timing accurately.

Who Needs to File Form 4562?

Form 4562 is required if your business does any of the following during the tax year:

Elects the Section 179 deduction for any property.

Claims depreciation on any new asset placed in service during the year.

Claims the Special Depreciation Allowance (Bonus Depreciation).

Claims depreciation on listed property (such as vehicles, computers, or cell phones used 50% or less for business).

Claims amortization of certain costs (e.g., startup or organizational costs).

When Is Form 4562 Due?

Form 4562 is not filed separately. It is an attachment to your business income tax return and is due on the same date as that return (including extensions).

Entity Type | Required Tax Form | Due Date (Typically) |

C Corporations | Form 1120 | 15th day of the 4th month after year-end. |

Partnerships/S Corps | Form 1065 / Form 1120-S | 15th day of the 3rd month after year-end. |

Sole Proprietors | Schedule C (Attached to Form 1040) | April 15th (or tax deadline). |

Understanding Depreciation & Amortization Key Strategies

Depreciation: Tangible Assets (Equipment, Vehicles, Furniture)

Deduction Strategy | Description | Key 2024 Thresholds |

Section 179 | Elect to deduct the full cost of qualifying property immediately. The deduction cannot exceed your business income. | Max Deduction: $1,220,000 |

Bonus Depreciation | Allows a percentage of the asset’s cost to be deducted immediately. This can create or increase a loss. | Rate: 60% for assets placed in service in 2024. |

MACRS (Traditional) | Spreads the remaining cost over the asset’s prescribed useful life (e.g., 5-year for computers). | Varies by asset class (3-20 years). |

Guidance Tip: Section 179 is limited by taxable income; Bonus Depreciation is not. Founders should prioritize using Bonus Depreciation to maximize current losses, or use Section 179 if the business is profitable and needs a large, immediate offset.

Amortization: Intangible Assets (Startup Costs, Patents)

Amortization applies to assets without physical substance, such as patents, copyrights, and certain organizational/startup costs. These are usually amortized (deducted) on a straight-line basis over a set period.

Startup Costs: Typically amortized over 180 months (15 years), starting the month the business begins actively operating.

Internally Developed Software: Current tax law generally requires these costs to be capitalized and amortized over 5 years (60 months).

How to Fill Out Form 4562: Step-by-Step Guidance

Filing properly requires careful attention to which Part applies to your purchases.

Part I: The Section 179 Election

This section is where you take the immediate expensing deduction.

Check Limits (Lines 1–5):

Enter the total cost of all Section 179 property placed in service on Line 2.

The form will calculate the final dollar limitation for your tax year on Line 5.

List Property (Line 6):

Use the table on Line 6 to list the description and cost of each asset you are expensing using Section 179.

Bolding Key Action: Enter the elected deduction amount in column (c).

Final Deduction (Lines 9–12):

Line 9 is your Tentative Deduction.

Line 11 requires your business income limitation—the deduction cannot exceed this amount.

Line 12 is your final Section 179 deduction for the year.

Part II: Special Depreciation Allowance (Bonus)

Used to claim the immediate percentage deduction for qualified property.

Enter Deduction (Line 14):

Enter the amount of 60% Bonus Depreciation you are claiming for the year.

Guidance Tip: If you apply Section 179 first, the 60% is applied to the remaining adjusted basis of the asset.

Part III: MACRS Depreciation (Traditional Schedule)

Use this for any asset cost remaining after Part I and Part II, or for assets that don't qualify for immediate expensing.

List MACRS Property (Line 17):

The table on Line 17 is the primary area for reporting MACRS depreciation. You will need to know the asset's Recovery Period (e.g., 5-year, 7-year) and the Convention (e.g., Half-Year).

Bolding Key Action: Group similar assets (e.g., all 5-year property placed in service on the same date) to simplify the entry.

Total Depreciation (Line 22):

Line 22 is the total deduction from all depreciation methods (Part I, Part II, and Part III). This amount is then carried over to your main tax return (e.g., Form 1120, Line 20).

Part VI: Amortization of Intangibles

Critical for claiming startup and organizational cost deductions.

List Intangible Costs (Line 42):

Use the table on Line 42 to describe the intangible cost (e.g., "Organizational Costs," "Startup Costs," "Purchased Software").

Bolding Key Action: Clearly enter the Amortization Period (e.g., 180 months) and the relevant Code Section (e.g., Sec. 195 for startup costs, Sec. 167(a) for purchased software).

Total Amortization (Line 44):

Line 44 is the total amortization deduction for the year.

Common Form 4562 Mistakes Founders Make

Avoiding these errors ensures faster processing and lowers audit risk:

Failing to File Form 4562: If you claim any depreciation deduction on your main tax form (e.g., Form 1120), you must attach Form 4562.

Incorrect "Date Placed in Service": Using the purchase date instead of the date the asset was actually ready and available for its intended business use.

Overlooking the Business Income Limit (Part I): The Section 179 deduction (Part I, Line 12) cannot create or increase a net loss. Any excess is carried forward.

Mismanaging Listed Property (Part V): Assets like vehicles and certain computers require detailed mileage/use logs. If business use is 50% or less, special rules apply, and the entire Part V must be completed.

Missing Amortization: Forgetting to formally elect to amortize startup costs (Line 42) over 180 months can mean the entire deduction is lost until the business liquidates.

FAQs for Startup Founders

Q: Can I take both Section 179 and Bonus Depreciation?

A: Yes. You first apply the Section 179 deduction (up to the $1,220,000 limit) to reduce the cost basis. You then apply Bonus Depreciation (60% in 2024) to any remaining cost of the eligible asset.

Q: What if I forget to claim a deduction in time?

A: You can file an amended return (e.g., Form 1120-X) to claim missed depreciation within the statute of limitations. For a permanent change in accounting method, you may need to file Form 3115, which is highly complex and requires professional guidance.

Q: Are software development costs amortized or depreciated?

A: Internally developed software costs must generally be capitalized and amortized over a 5-year period (or 15 years for foreign development) starting in 2022. Purchased software used for more than one year is also amortized (Part VI).

Q: What is the benefit of the Section 179 phase-out threshold?

A: The Section 179 deduction begins to phase out dollar-for-dollar once your total cost of qualifying property exceeds $3,050,000 (2024 limit). Founders should track this threshold to see if a significant portion of the deduction is lost due to high asset purchases.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026