Go Back

Last Updated :

Last Updated :

Dec 17, 2025

Dec 17, 2025

Bookkeeping for Interior Designers: A Simplified Guide to Clear, Confident Financials

For interior designers navigating both creative and operational demands, bookkeeping for interior designers is often a challenging but essential task. Accurate and streamlined bookkeeping not only ensures compliance but also unlocks the insights needed to make smarter financial decisions, optimize cash flow, and identify opportunities for growth.

This guide offers practical, founder-friendly approaches to bookkeeping that fit the interior design business model—freeing you up to focus on design work and client relationships.

Why Simplified Bookkeeping Matters for Interior Designers

Interior design projects involve numerous vendors, materials, subcontractors, and client payments. Managing this flow of invoices, receipts, and expenses manually, or through scattered spreadsheets, leads to errors, missed deductions, and delayed financial visibility. This challenge is even more pronounced for startup design firms without dedicated finance teams.

Simplifying your bookkeeping process allows you to:

Save time and reduce manual errors

Gain real-time visibility into project profitability

Capture tax deductions and credits effectively—including the R&D tax credit when applicable

Prepare for investor, lender, or client scrutiny with clean financials

Simplifying your bookkeeping process not only helps reduce errors and improve financial visibility, but also frees up valuable time for designers to focus on what truly matters — delivering creative, profitable projects. With streamlined systems in place, you can ensure that your financials are always ready for investor, lender, or client review, giving you peace of mind as your business grows.

Now that you understand the importance of simplifying bookkeeping for your business, let's dive into the practical steps you can take to set up an efficient system that supports your growth.

Building a Practical Bookkeeping System: Key Steps

Once your bookkeeping is simplified at a high level, the next step is turning that clarity into a repeatable, day-to-day system. A practical bookkeeping setup isn’t about adding more tools or complexity; it’s about creating consistent processes that make financial data easier to track, review, and act on.

The following steps focus on the core building blocks of a bookkeeping system that supports project-based businesses, improves visibility into profitability, and scales as your design firm grows.

To simplify your bookkeeping, create systems that streamline these foundational areas:

1. Organize Income by Project and Client

Revenue varies widely by project size, timeline, and payment structure (fixed fee, retainer, milestone). Accurately segment income by:

Setting up project- and client-specific accounts in your accounting software

Aligning invoice descriptions with your contract terms

Tracking deposits and progress payments separately to reflect cash flow accurately

Tools like QuickBooks Online or Wave allow you to link invoices, expenses, and payments to specific projects automatically offering clear insight into project-level profitability.

2. Classify Expenses with Detail

Interior design expenses can include materials, contractor payments, travel, and software. Proper classification improves cost control, financial tracking, and tax reporting.

Expense Category | Examples | Tax Considerations |

Materials & Supplies | Fabrics, furniture, paint | Often fully deductible |

Subcontractors | Installation specialists | Collect 1099 information for vendors |

Travel & Meals | Client visits, supplier meetings | Partial deduction limitations |

Software & Licenses | Design tools, project management apps | Standard business deductions |

Always attach digital receipts to expense entries—this reduces audit risk and speeds up tax preparation. Tools like Expensify make the process seamless.

3. Automate Recurring Transactions

Create automation wherever possible:

Use bank feeds to pull in transactions daily

Apply rules to automatically categorize recurring expenses

Set up recurring invoices and automated late-payment reminders

Schedule vendor payments to avoid late fees

Automation reduces manual work and stabilizes cash flow—a major advantage for design firms with seasonal project cycles.

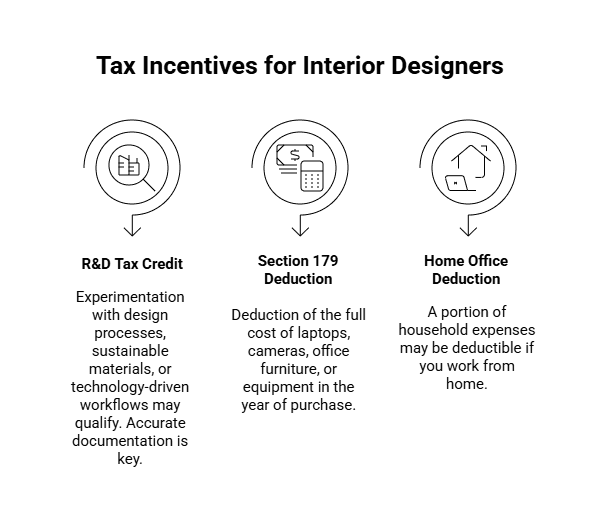

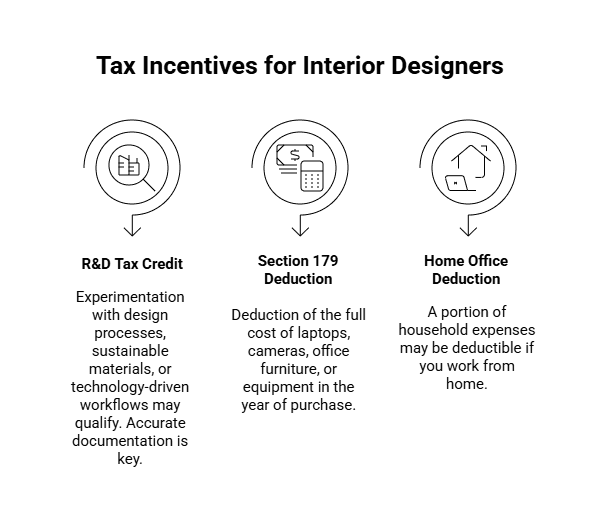

Maximizing Tax Incentives for Interior Designers

Tax incentives are government-approved benefits that allow businesses to reduce their taxable income or overall tax liability when certain activities, investments, or expenses meet specific criteria. For interior designers, these incentives are often tied to how projects are structured, how expenses are documented, and how accurately financial records are maintained throughout the year.

With proper bookkeeping in place, interior design firms may qualify for valuable tax incentives that reward innovation, business investment, and operational efficiency. Below are some of the most common incentives that may apply, depending on your firm’s activities and setup:

R&D Tax Credit

If your firm experiments with design processes, sustainable materials, or technology-driven workflows, you may qualify for the R&D tax credit.

Accurate documentation and expense tagging make submissions seamless.

Section 179 Deduction

Design firms investing in laptops, cameras, office furniture, or equipment can often deduct the full cost in the year of purchase.

Home Office Deduction

If you work from home, a portion of household expenses—utilities, internet, rent—may be deductible.

Haven’s tax credit specialists help founders identify and maximize these incentives. Learn more about R&D tax opportunities for design and tech firms on our R&D tax credit page.

Choosing the Right Bookkeeping Tools for Design Businesses

The best bookkeeping tools for interior designers provide clarity while staying easy to use. Look for platforms with:

Project-based financial tracking

Mobile receipt capture

Bank and payment integration

Customizable reporting dashboards

Popular options include QuickBooks Online, Xero, and FreshBooks. Many integrate directly with design workflows or project management tools like Trello, Asana, or ClickUp.

At Haven, we help clients optimize their financial stack—selecting tools, syncing data sources, and building fluid workflows that fit creative work.

Founder-Friendly Bookkeeping Habits That Stick

Tools matter—but habits matter more:

Schedule weekly or biweekly finance check-ins

Train team members on proper expense coding and reimbursement rules

Centralize document storage in Google Drive, Dropbox, or Notion

Work with a bookkeeping partner familiar with creative industries

These habits build operational rhythm and prevent financial surprises later on.

Modern Bookkeeping Helps Interior Designers Focus on What Matters Most

Efficient bookkeeping for interior designers isn’t just about compliance—it’s about gaining the financial clarity needed to run a sustainable, profitable design firm. By organizing income and expenses, automating workflows, and taking advantage of tax incentives, founders can simplify operations and reduce administrative stress.

At Haven, we help interior designers implement streamlined, modern systems built for scale—so you can reclaim your time, stay tax-ready, and operate with confidence.

For additional guidance, the U.S. Small Business Administration offers helpful insights on small business financial management.

For interior designers navigating both creative and operational demands, bookkeeping for interior designers is often a challenging but essential task. Accurate and streamlined bookkeeping not only ensures compliance but also unlocks the insights needed to make smarter financial decisions, optimize cash flow, and identify opportunities for growth.

This guide offers practical, founder-friendly approaches to bookkeeping that fit the interior design business model—freeing you up to focus on design work and client relationships.

Why Simplified Bookkeeping Matters for Interior Designers

Interior design projects involve numerous vendors, materials, subcontractors, and client payments. Managing this flow of invoices, receipts, and expenses manually, or through scattered spreadsheets, leads to errors, missed deductions, and delayed financial visibility. This challenge is even more pronounced for startup design firms without dedicated finance teams.

Simplifying your bookkeeping process allows you to:

Save time and reduce manual errors

Gain real-time visibility into project profitability

Capture tax deductions and credits effectively—including the R&D tax credit when applicable

Prepare for investor, lender, or client scrutiny with clean financials

Simplifying your bookkeeping process not only helps reduce errors and improve financial visibility, but also frees up valuable time for designers to focus on what truly matters — delivering creative, profitable projects. With streamlined systems in place, you can ensure that your financials are always ready for investor, lender, or client review, giving you peace of mind as your business grows.

Now that you understand the importance of simplifying bookkeeping for your business, let's dive into the practical steps you can take to set up an efficient system that supports your growth.

Building a Practical Bookkeeping System: Key Steps

Once your bookkeeping is simplified at a high level, the next step is turning that clarity into a repeatable, day-to-day system. A practical bookkeeping setup isn’t about adding more tools or complexity; it’s about creating consistent processes that make financial data easier to track, review, and act on.

The following steps focus on the core building blocks of a bookkeeping system that supports project-based businesses, improves visibility into profitability, and scales as your design firm grows.

To simplify your bookkeeping, create systems that streamline these foundational areas:

1. Organize Income by Project and Client

Revenue varies widely by project size, timeline, and payment structure (fixed fee, retainer, milestone). Accurately segment income by:

Setting up project- and client-specific accounts in your accounting software

Aligning invoice descriptions with your contract terms

Tracking deposits and progress payments separately to reflect cash flow accurately

Tools like QuickBooks Online or Wave allow you to link invoices, expenses, and payments to specific projects automatically offering clear insight into project-level profitability.

2. Classify Expenses with Detail

Interior design expenses can include materials, contractor payments, travel, and software. Proper classification improves cost control, financial tracking, and tax reporting.

Expense Category | Examples | Tax Considerations |

Materials & Supplies | Fabrics, furniture, paint | Often fully deductible |

Subcontractors | Installation specialists | Collect 1099 information for vendors |

Travel & Meals | Client visits, supplier meetings | Partial deduction limitations |

Software & Licenses | Design tools, project management apps | Standard business deductions |

Always attach digital receipts to expense entries—this reduces audit risk and speeds up tax preparation. Tools like Expensify make the process seamless.

3. Automate Recurring Transactions

Create automation wherever possible:

Use bank feeds to pull in transactions daily

Apply rules to automatically categorize recurring expenses

Set up recurring invoices and automated late-payment reminders

Schedule vendor payments to avoid late fees

Automation reduces manual work and stabilizes cash flow—a major advantage for design firms with seasonal project cycles.

Maximizing Tax Incentives for Interior Designers

Tax incentives are government-approved benefits that allow businesses to reduce their taxable income or overall tax liability when certain activities, investments, or expenses meet specific criteria. For interior designers, these incentives are often tied to how projects are structured, how expenses are documented, and how accurately financial records are maintained throughout the year.

With proper bookkeeping in place, interior design firms may qualify for valuable tax incentives that reward innovation, business investment, and operational efficiency. Below are some of the most common incentives that may apply, depending on your firm’s activities and setup:

R&D Tax Credit

If your firm experiments with design processes, sustainable materials, or technology-driven workflows, you may qualify for the R&D tax credit.

Accurate documentation and expense tagging make submissions seamless.

Section 179 Deduction

Design firms investing in laptops, cameras, office furniture, or equipment can often deduct the full cost in the year of purchase.

Home Office Deduction

If you work from home, a portion of household expenses—utilities, internet, rent—may be deductible.

Haven’s tax credit specialists help founders identify and maximize these incentives. Learn more about R&D tax opportunities for design and tech firms on our R&D tax credit page.

Choosing the Right Bookkeeping Tools for Design Businesses

The best bookkeeping tools for interior designers provide clarity while staying easy to use. Look for platforms with:

Project-based financial tracking

Mobile receipt capture

Bank and payment integration

Customizable reporting dashboards

Popular options include QuickBooks Online, Xero, and FreshBooks. Many integrate directly with design workflows or project management tools like Trello, Asana, or ClickUp.

At Haven, we help clients optimize their financial stack—selecting tools, syncing data sources, and building fluid workflows that fit creative work.

Founder-Friendly Bookkeeping Habits That Stick

Tools matter—but habits matter more:

Schedule weekly or biweekly finance check-ins

Train team members on proper expense coding and reimbursement rules

Centralize document storage in Google Drive, Dropbox, or Notion

Work with a bookkeeping partner familiar with creative industries

These habits build operational rhythm and prevent financial surprises later on.

Modern Bookkeeping Helps Interior Designers Focus on What Matters Most

Efficient bookkeeping for interior designers isn’t just about compliance—it’s about gaining the financial clarity needed to run a sustainable, profitable design firm. By organizing income and expenses, automating workflows, and taking advantage of tax incentives, founders can simplify operations and reduce administrative stress.

At Haven, we help interior designers implement streamlined, modern systems built for scale—so you can reclaim your time, stay tax-ready, and operate with confidence.

For additional guidance, the U.S. Small Business Administration offers helpful insights on small business financial management.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026