Go Back

Last Updated :

Last Updated :

Dec 11, 2025

Dec 11, 2025

Form 720: Quarterly Federal Informative Tax Return

For founders navigating the complex landscape of business taxes, understanding Form 720 is essential. Whether you run a startup, an e-commerce company, or a digital agency, filing this quarterly federal excise tax return correctly can save your business from costly penalties and maintain compliance with the IRS. As your operational or finance lead, knowing the ins and outs of this form—and how it fits into your broader tax strategy—is a strategic advantage.

At Haven, our goal is to simplify tax processes for founders like you, providing modern, responsive bookkeeping and tax filing services tailored to startups and growing businesses. This guide will walk you through the essentials of Form 720, helping you manage this quarterly requirement smoothly.

What Is Form 720 and Why Does It Matter for Founders?

Form 720 is the IRS form used to report and pay federal excise taxes. These taxes apply to specific goods, services, and activities—ranging from transportation and communication services to fuel, environmental taxes, and certain luxury items. Not every business will need to file this form, but if yours is involved in activities subject to excise taxes, understanding how to comply is non-negotiable.

Why founders should care:

Stay compliant to avoid penalties: Excise tax violations can result in substantial fines and accrued interest, impacting your cash flow and business reputation.

Cash flow forecasting: Because these taxes are reported quarterly, planning for them can help smooth out your cash flow management and avoid surprises at tax time.

Optimize your tax strategy: Some excise taxes offer credits or exemptions; understanding these nuances can reduce your overall tax burden.

For a broader perspective on your business’s tax needs, browse Haven’s business tax services to access tools and expert advice designed for startups and agencies.

Step-by-Step Guide to Filing Form 720

Let’s break down the filing process into manageable steps, so you can incorporate it efficiently into your financial workflow.

1. Determine If Your Business Owes an Excise Tax

Not all founders must file Form 720. The IRS identifies multiple categories under which excise taxes apply:

Environmental taxes (e.g., ozone-depleting chemicals)

Fuel taxes

Air transportation taxes

Heavy highway vehicle use taxes

Communications and air passengers taxes

Health-related taxes, including Affordable Care Act fees

Review the IRS’s list to see if your business activities fall under these categories. See details on IRS excise taxes.

2. Gather Your Business Records

Accurate bookkeeping is vital here. Collect:

Records of taxable activities or sales covered under excise categories

Invoices, fuel logs, or transaction documentation

Prior Form 720 filings

This preparation helps ensure correct calculations and reduces audit risk.

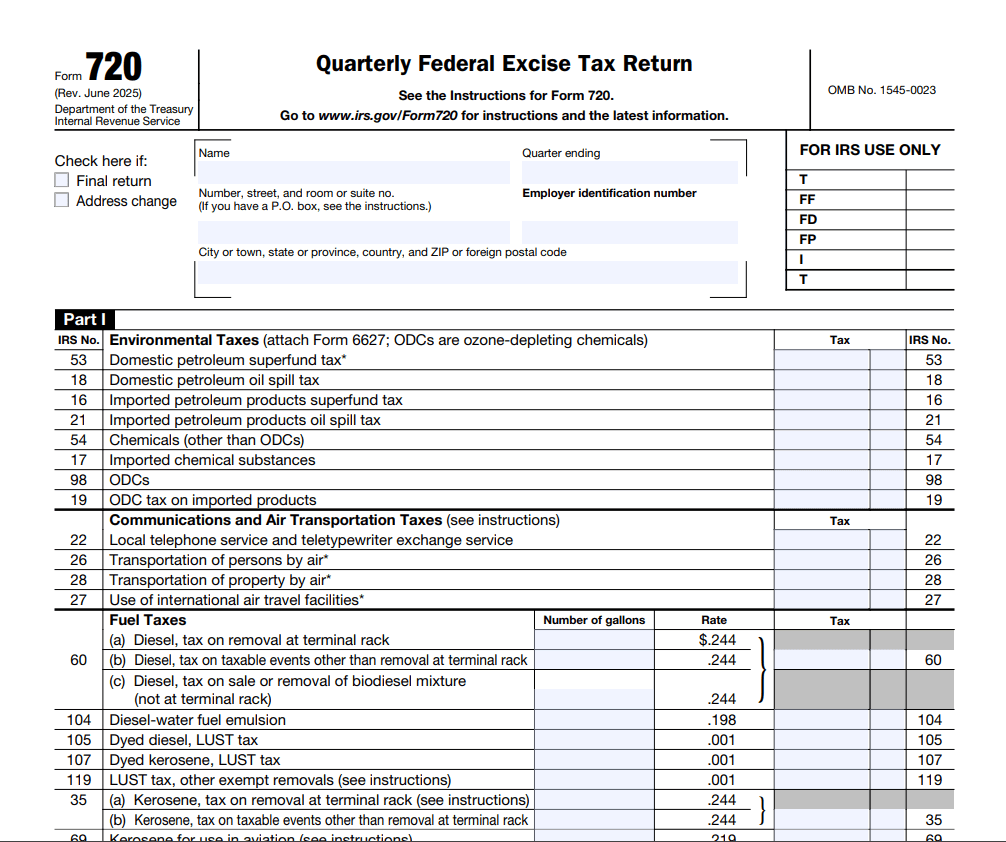

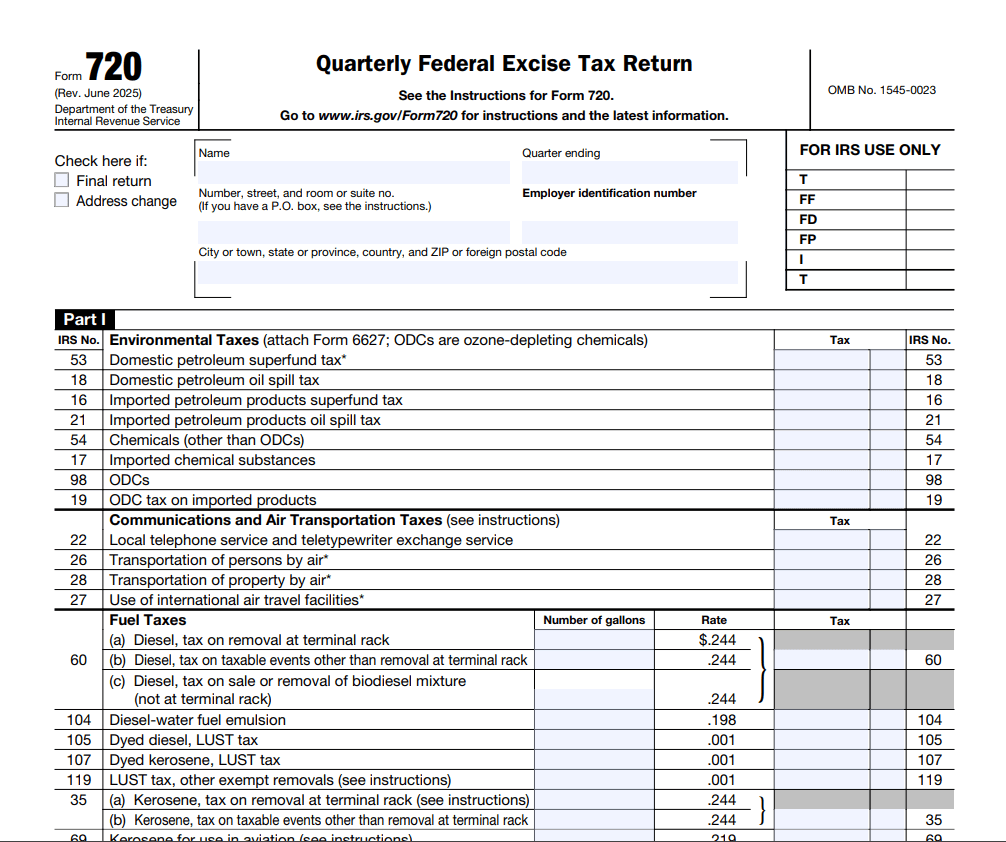

3. Complete Each Applicable Part of Form 720

To complete Form 720 accurately, you’ll need to determine which specific excise tax categories apply to your business activities. The form is divided into multiple sections, each covering a different group of excise taxes—from environmental and fuel-related taxes to manufacturer and retailer obligations.

Before filling out the form, review each category carefully and identify the parts that correspond to the products you sell, services you provide, or activities you conduct. This ensures you only complete the sections that are relevant, keeping your filing compliant and avoiding unnecessary reporting.

Form 720 Sections | Tax Categories Covered |

Part I | Environmental Taxes |

Part II | Fuel Taxes |

Part III | Communication & Air Transportation Taxes |

Part IV | Manufacturer Taxes |

Part V | Retailer Taxes |

Part VI | Heavy Highway Vehicles |

Part VII | Luxury Taxes |

Complete only the parts relevant to your operations.

4. Calculate Your Total Excise Tax Liability

After completing the relevant sections:

Add up all taxes owed

Confirm reporting periods

Retain all supporting documentation

5. File Form 720 and Pay Your Tax

Once you’ve calculated the total excise taxes owed for the quarter, you’re ready to file. Form 720 follows a fixed quarterly schedule, so make sure you submit both the return and your payment by the IRS deadline that corresponds to your reporting period.

Quarter Ending | Filing Deadline |

March 31 | April 30 |

June 30 | July 31 |

September 30 | October 31 |

December 31 | January 31 |

File electronically using the IRS e-file system or mail a paper return where applicable. Pay electronically via EFTPS.

Common Excise Tax Types Affecting Startups and E-commerce

Fuel Taxes: For businesses operating delivery or logistics fleets

Communication Services Taxes: For telecom-associated products or SaaS add-ons

Air Transportation Taxes: For companies using charter services

Heavy Highway Vehicle Use Tax: For vehicles > 55,000 lbs

Environmental Taxes: For chemicals or manufacturing environments

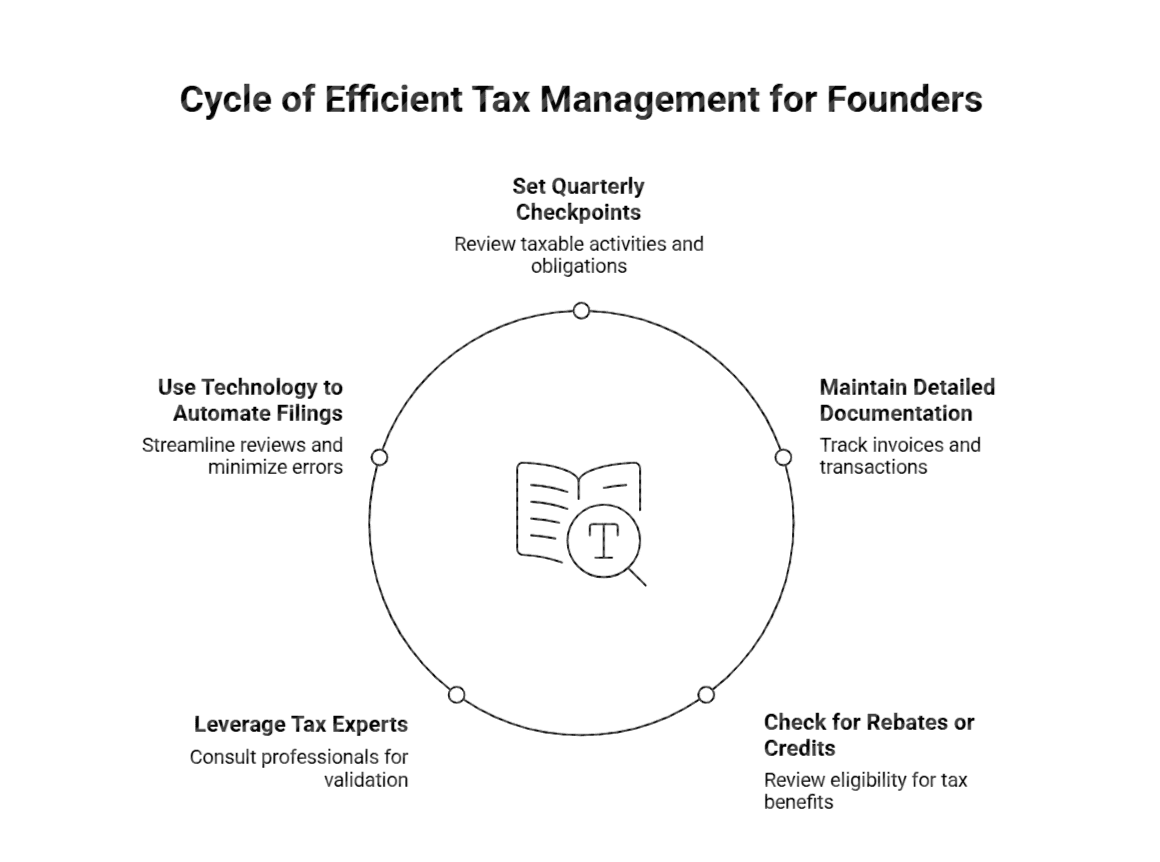

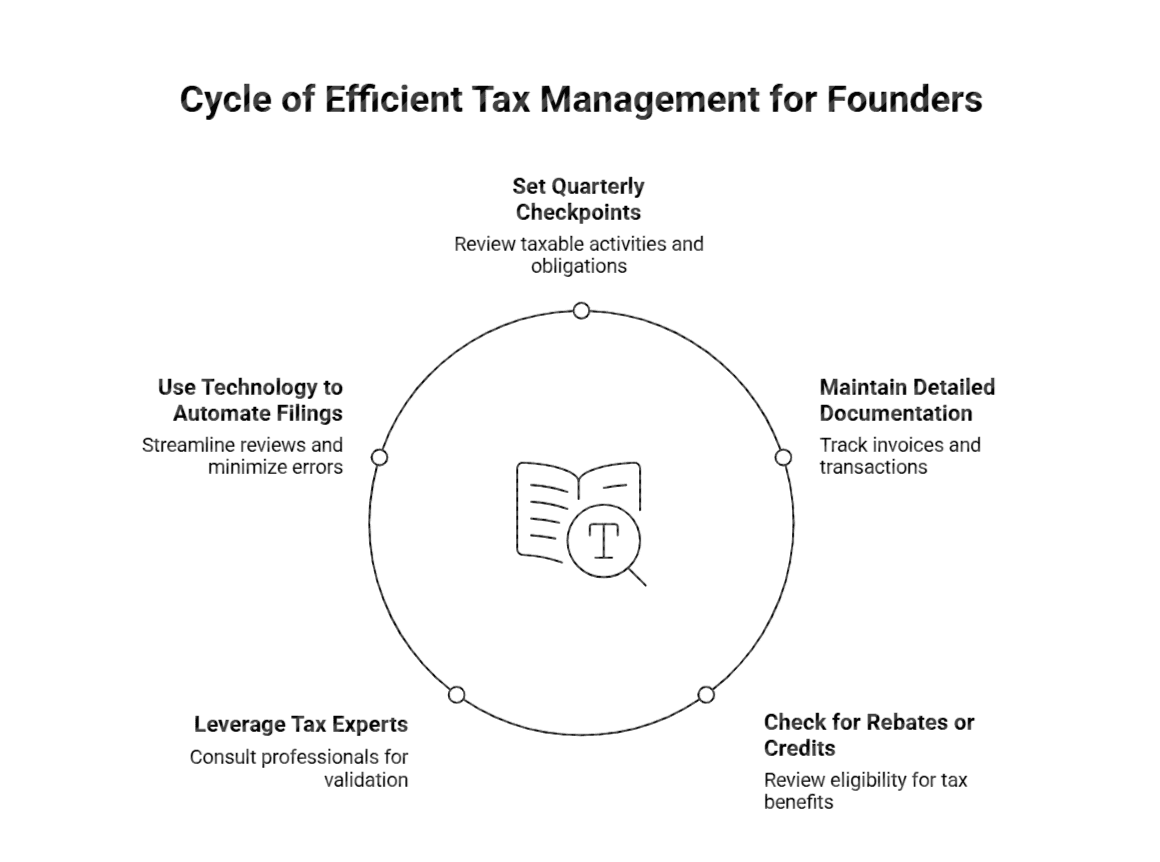

Key Tips for Founders to Manage Form 720 Efficiently

Set quarterly checkpoints

Review taxable activities and confirm whether new products or services trigger additional excise obligations. Staying proactive prevents surprises at filing time.

Maintain detailed documentation

Track invoices, inventory movements, and taxable transactions in a consistent system. This ensures accurate reporting and fast reconciliation during each quarter.

Check for rebates or credits

Certain excise taxes allow refunds or credits depending on how goods are used or sold. Reviewing eligibility regularly can reduce your net tax liability.

Leverage tax experts

Consulting a professional helps validate your calculations and clarify edge cases, especially if your business spans multiple taxable categories. Expert oversight reduces audit risk.

Use technology to automate filings

Adopting accounting or compliance tools streamlines quarterly reviews and minimizes manual errors. Automating reminders also ensures you never miss a deadline.

How Modern Bookkeeping and Tax Compliance Tools Simplify Form 720 Filing

Modern bookkeeping solutions like Haven help founders by:

Automating data capture

Flagging excise liabilities in real time

Providing deadline reminders

Integrating directly with tax filing platforms

Learn more in our business tax compliance guide.

Mastering Form 720 Is a Foundation to Fiscal Health

Filing Form 720 correctly and on time is essential federal tax compliance for businesses impacted by excise taxes. For founders, a proactive, tech-enabled approach means less risk and more predictable financial operations.

At Haven, our modern bookkeeping and tax filing framework ensures you stay ahead of regulatory requirements—without the usual headaches. Whether you touch one or multiple excise categories, we help you file Form 720 efficiently.

For authoritative details, see the IRS official page on Federal Excise Tax Returns and Payment.

For founders navigating the complex landscape of business taxes, understanding Form 720 is essential. Whether you run a startup, an e-commerce company, or a digital agency, filing this quarterly federal excise tax return correctly can save your business from costly penalties and maintain compliance with the IRS. As your operational or finance lead, knowing the ins and outs of this form—and how it fits into your broader tax strategy—is a strategic advantage.

At Haven, our goal is to simplify tax processes for founders like you, providing modern, responsive bookkeeping and tax filing services tailored to startups and growing businesses. This guide will walk you through the essentials of Form 720, helping you manage this quarterly requirement smoothly.

What Is Form 720 and Why Does It Matter for Founders?

Form 720 is the IRS form used to report and pay federal excise taxes. These taxes apply to specific goods, services, and activities—ranging from transportation and communication services to fuel, environmental taxes, and certain luxury items. Not every business will need to file this form, but if yours is involved in activities subject to excise taxes, understanding how to comply is non-negotiable.

Why founders should care:

Stay compliant to avoid penalties: Excise tax violations can result in substantial fines and accrued interest, impacting your cash flow and business reputation.

Cash flow forecasting: Because these taxes are reported quarterly, planning for them can help smooth out your cash flow management and avoid surprises at tax time.

Optimize your tax strategy: Some excise taxes offer credits or exemptions; understanding these nuances can reduce your overall tax burden.

For a broader perspective on your business’s tax needs, browse Haven’s business tax services to access tools and expert advice designed for startups and agencies.

Step-by-Step Guide to Filing Form 720

Let’s break down the filing process into manageable steps, so you can incorporate it efficiently into your financial workflow.

1. Determine If Your Business Owes an Excise Tax

Not all founders must file Form 720. The IRS identifies multiple categories under which excise taxes apply:

Environmental taxes (e.g., ozone-depleting chemicals)

Fuel taxes

Air transportation taxes

Heavy highway vehicle use taxes

Communications and air passengers taxes

Health-related taxes, including Affordable Care Act fees

Review the IRS’s list to see if your business activities fall under these categories. See details on IRS excise taxes.

2. Gather Your Business Records

Accurate bookkeeping is vital here. Collect:

Records of taxable activities or sales covered under excise categories

Invoices, fuel logs, or transaction documentation

Prior Form 720 filings

This preparation helps ensure correct calculations and reduces audit risk.

3. Complete Each Applicable Part of Form 720

To complete Form 720 accurately, you’ll need to determine which specific excise tax categories apply to your business activities. The form is divided into multiple sections, each covering a different group of excise taxes—from environmental and fuel-related taxes to manufacturer and retailer obligations.

Before filling out the form, review each category carefully and identify the parts that correspond to the products you sell, services you provide, or activities you conduct. This ensures you only complete the sections that are relevant, keeping your filing compliant and avoiding unnecessary reporting.

Form 720 Sections | Tax Categories Covered |

Part I | Environmental Taxes |

Part II | Fuel Taxes |

Part III | Communication & Air Transportation Taxes |

Part IV | Manufacturer Taxes |

Part V | Retailer Taxes |

Part VI | Heavy Highway Vehicles |

Part VII | Luxury Taxes |

Complete only the parts relevant to your operations.

4. Calculate Your Total Excise Tax Liability

After completing the relevant sections:

Add up all taxes owed

Confirm reporting periods

Retain all supporting documentation

5. File Form 720 and Pay Your Tax

Once you’ve calculated the total excise taxes owed for the quarter, you’re ready to file. Form 720 follows a fixed quarterly schedule, so make sure you submit both the return and your payment by the IRS deadline that corresponds to your reporting period.

Quarter Ending | Filing Deadline |

March 31 | April 30 |

June 30 | July 31 |

September 30 | October 31 |

December 31 | January 31 |

File electronically using the IRS e-file system or mail a paper return where applicable. Pay electronically via EFTPS.

Common Excise Tax Types Affecting Startups and E-commerce

Fuel Taxes: For businesses operating delivery or logistics fleets

Communication Services Taxes: For telecom-associated products or SaaS add-ons

Air Transportation Taxes: For companies using charter services

Heavy Highway Vehicle Use Tax: For vehicles > 55,000 lbs

Environmental Taxes: For chemicals or manufacturing environments

Key Tips for Founders to Manage Form 720 Efficiently

Set quarterly checkpoints

Review taxable activities and confirm whether new products or services trigger additional excise obligations. Staying proactive prevents surprises at filing time.

Maintain detailed documentation

Track invoices, inventory movements, and taxable transactions in a consistent system. This ensures accurate reporting and fast reconciliation during each quarter.

Check for rebates or credits

Certain excise taxes allow refunds or credits depending on how goods are used or sold. Reviewing eligibility regularly can reduce your net tax liability.

Leverage tax experts

Consulting a professional helps validate your calculations and clarify edge cases, especially if your business spans multiple taxable categories. Expert oversight reduces audit risk.

Use technology to automate filings

Adopting accounting or compliance tools streamlines quarterly reviews and minimizes manual errors. Automating reminders also ensures you never miss a deadline.

How Modern Bookkeeping and Tax Compliance Tools Simplify Form 720 Filing

Modern bookkeeping solutions like Haven help founders by:

Automating data capture

Flagging excise liabilities in real time

Providing deadline reminders

Integrating directly with tax filing platforms

Learn more in our business tax compliance guide.

Mastering Form 720 Is a Foundation to Fiscal Health

Filing Form 720 correctly and on time is essential federal tax compliance for businesses impacted by excise taxes. For founders, a proactive, tech-enabled approach means less risk and more predictable financial operations.

At Haven, our modern bookkeeping and tax filing framework ensures you stay ahead of regulatory requirements—without the usual headaches. Whether you touch one or multiple excise categories, we help you file Form 720 efficiently.

For authoritative details, see the IRS official page on Federal Excise Tax Returns and Payment.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026