Go Back

Last Updated :

Last Updated :

Jan 15, 2026

Jan 15, 2026

Form 3921 Filing Guide: ISO Stock Exercise Reporting Requirements

For startup founders navigating the complexities of equity compensation, Form 3921 is a critical yet often misunderstood tax document. If your company grants Incentive Stock Options (ISOs), understanding how and when to use Form 3921 is essential not only for compliance but also to support your employees’ tax filing processes smoothly.

This practical guide breaks down the key aspects of Form 3921, its role in ISO stock exercise reporting requirements, and how founders can manage this process effectively to avoid pitfalls and optimize tax outcomes for their teams.

What Is Form 3921 and Why Does It Matter for Founders?

Form 3921, officially titled “Exercise of an Incentive Stock Option Under Section 422(b),” is an IRS information return that corporations must file when an employee exercises their ISOs. It reports specific transaction details that are foundational for accurate tax reporting by both the employee and the company.

Why Founders Should Care About Form 3921

ISOs are a popular equity compensation vehicle in startups because of their favorable tax treatment — if handled correctly. However, when an employee exercises their stock options, timely and accurate reporting is legally mandated by the IRS via Form 3921. Missing or incorrect filings can:

Trigger IRS penalties and audits,

Complicated employees' filing of Alternative Minimum Tax (AMT) forms,

Create confusion on when employees may terminate holding requirements for preferential tax treatment,

Obscure proper documentation for your company’s equity compensation accounting.

From a founder’s perspective, ensuring that Form 3921 reporting is done right is part of sound financial governance and employee relations. It signals a commitment to transparency and streamlines tax processes that otherwise could slow down your team's tax compliance every year.

What Information Is Reported on Form 3921?

Form 3921 captures key details of the ISO exercise event, including:

Section on Form 3921 | Description |

Issuer’s information | Your company’s name, address, EIN |

Employee details | Name, address, and SSN |

ISO specifics | Grant date, exercise date, exercise price |

Stock information | Number of shares, FMV on exercise date |

When and How to File Form 3921: Founders’ Checklist

Form 3921 must be filed with the IRS annually, and copies must be furnished to employees. Timing and accuracy are crucial:

Key Deadlines

Deadline | Action |

January 31 (following year of exercise) | Provide copies of Form 3921 to employees |

February 28 (paper) or March 31 (electronic) | File Form 3921 with the IRS |

Missing the deadline or submitting incomplete forms can result in fines from the IRS, which can accumulate quickly for startups issuing options to multiple employees.

Electronic vs. Paper Filing

Startups filing 250 or more Forms 3921 must file electronically.

Smaller companies may file on paper, but electronic filing is encouraged for accuracy and efficiency.

Best Practices for Filing Form 3921

Keep a centralized log of all ISO grants and exercises.

Use equity management software that supports IRS form generation.

Sync often with your tax team or advisors before the end-of-year rush.

Educate your HR/payroll team to track exercises in real-time.

If you want a broader overview of related corporate tax filings your startup may face, check out our Form 1120-A Guide.

Supporting Employees With Their Tax Reporting

Form 3921 doesn’t just impact your backend compliance—it’s a vital data source for employees who exercised ISOs in the tax year.

How Form 3921 Affects Employee Tax Returns

Helps employees determine AMT liability for the year of ISO exercise.

Sets the clock on holding periods required for long-term capital gains.

Prevents errors or omissions on employee-reported income linked to equity.

Making sure employees understand how to use Form 3921 minimizes tax confusion and reduces the risk of frustrating surprises come April.

Founders’ Role in Employee Education

Part of your job as a startup leader is ensuring your team can navigate the tax ramifications of equity compensation. Most employees don’t realize that ISO exercise can affect their taxes long before they sell shares.

Ways to provide support:

Run a yearly tax-prep webinar for employees receiving equity.

Share plain-English tip sheets outlining what Form 3921 is and how to use it.

Offer access to financial advisors during equity-heavy tax years.

These steps help employees feel confident and supported—and reflect well on your company’s culture.

Navigating Pitfalls and Leveraging Opportunities

Common Mistakes to Avoid

Pitfall | Impact | How to Avoid |

Late filing or missing employee copies | IRS penalties; employee confusion | Use automated tracking & alert systems |

Incorrect or incomplete data | IRS rejections; employee AMT errors | Double-check grant and SSN data |

Inaccurate FMV reporting | Tax misstatements; audit risk | Use certified 409A valuations |

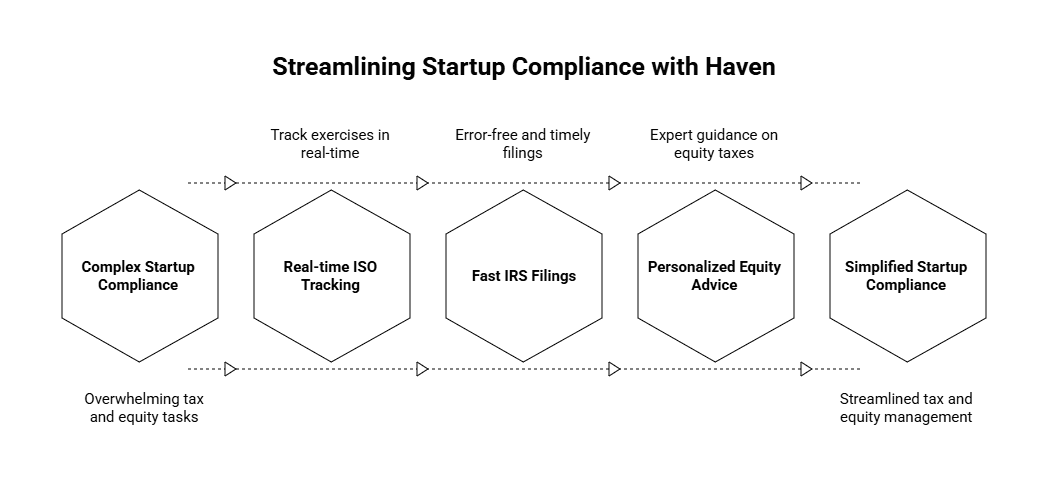

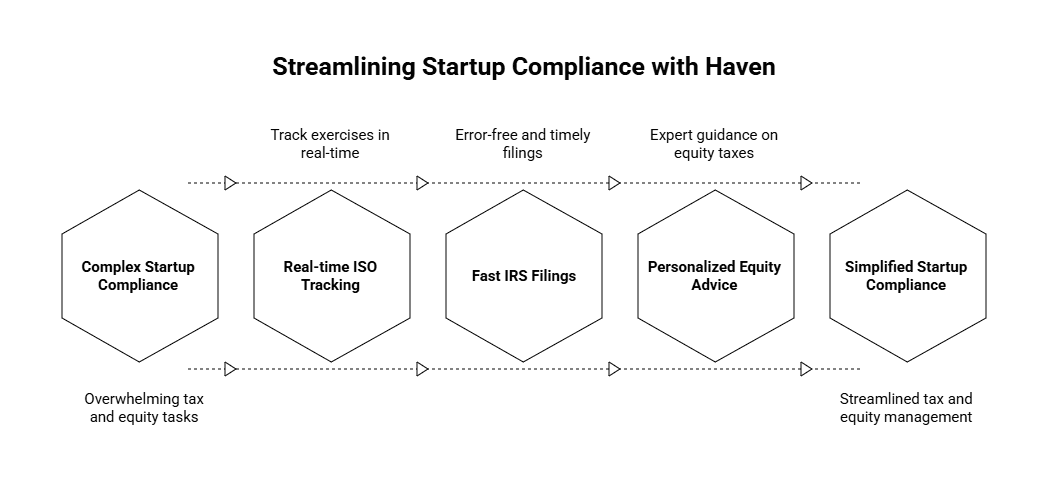

How Haven Helps Founders Get It Right

At Haven, we understand that accurate tax reporting—including Form 3921—is only one piece of your greater compliance puzzle. Our modern bookkeeping and tax filing services are built for startups looking for:

Real-time ISO exercise tracking,

Fast, error-free IRS filings,

Personalized advice on handling equity taxation.

We’re not just forms and filings—Haven acts as a partner for startup leaders building toward scale.

Learn more about how our services support founders managing equity, taxes, and more.

Making Form 3921 Work for Your Startup

For founders, mastering Form 3921 isn’t just about staying compliant — it’s about delivering a seamless experience for your team while preserving your startup’s standing with the IRS. By meeting filing deadlines, keeping accurate equity records, and helping employees understand how ISO exercises impact taxes, you prevent costly setbacks and cultivate a financially literate team.

And you don’t have to do it alone. Haven’s tailored services help you streamline Form 3921 reporting with expert-backed tools designed for early-stage companies.

For startup founders navigating the complexities of equity compensation, Form 3921 is a critical yet often misunderstood tax document. If your company grants Incentive Stock Options (ISOs), understanding how and when to use Form 3921 is essential not only for compliance but also to support your employees’ tax filing processes smoothly.

This practical guide breaks down the key aspects of Form 3921, its role in ISO stock exercise reporting requirements, and how founders can manage this process effectively to avoid pitfalls and optimize tax outcomes for their teams.

What Is Form 3921 and Why Does It Matter for Founders?

Form 3921, officially titled “Exercise of an Incentive Stock Option Under Section 422(b),” is an IRS information return that corporations must file when an employee exercises their ISOs. It reports specific transaction details that are foundational for accurate tax reporting by both the employee and the company.

Why Founders Should Care About Form 3921

ISOs are a popular equity compensation vehicle in startups because of their favorable tax treatment — if handled correctly. However, when an employee exercises their stock options, timely and accurate reporting is legally mandated by the IRS via Form 3921. Missing or incorrect filings can:

Trigger IRS penalties and audits,

Complicated employees' filing of Alternative Minimum Tax (AMT) forms,

Create confusion on when employees may terminate holding requirements for preferential tax treatment,

Obscure proper documentation for your company’s equity compensation accounting.

From a founder’s perspective, ensuring that Form 3921 reporting is done right is part of sound financial governance and employee relations. It signals a commitment to transparency and streamlines tax processes that otherwise could slow down your team's tax compliance every year.

What Information Is Reported on Form 3921?

Form 3921 captures key details of the ISO exercise event, including:

Section on Form 3921 | Description |

Issuer’s information | Your company’s name, address, EIN |

Employee details | Name, address, and SSN |

ISO specifics | Grant date, exercise date, exercise price |

Stock information | Number of shares, FMV on exercise date |

When and How to File Form 3921: Founders’ Checklist

Form 3921 must be filed with the IRS annually, and copies must be furnished to employees. Timing and accuracy are crucial:

Key Deadlines

Deadline | Action |

January 31 (following year of exercise) | Provide copies of Form 3921 to employees |

February 28 (paper) or March 31 (electronic) | File Form 3921 with the IRS |

Missing the deadline or submitting incomplete forms can result in fines from the IRS, which can accumulate quickly for startups issuing options to multiple employees.

Electronic vs. Paper Filing

Startups filing 250 or more Forms 3921 must file electronically.

Smaller companies may file on paper, but electronic filing is encouraged for accuracy and efficiency.

Best Practices for Filing Form 3921

Keep a centralized log of all ISO grants and exercises.

Use equity management software that supports IRS form generation.

Sync often with your tax team or advisors before the end-of-year rush.

Educate your HR/payroll team to track exercises in real-time.

If you want a broader overview of related corporate tax filings your startup may face, check out our Form 1120-A Guide.

Supporting Employees With Their Tax Reporting

Form 3921 doesn’t just impact your backend compliance—it’s a vital data source for employees who exercised ISOs in the tax year.

How Form 3921 Affects Employee Tax Returns

Helps employees determine AMT liability for the year of ISO exercise.

Sets the clock on holding periods required for long-term capital gains.

Prevents errors or omissions on employee-reported income linked to equity.

Making sure employees understand how to use Form 3921 minimizes tax confusion and reduces the risk of frustrating surprises come April.

Founders’ Role in Employee Education

Part of your job as a startup leader is ensuring your team can navigate the tax ramifications of equity compensation. Most employees don’t realize that ISO exercise can affect their taxes long before they sell shares.

Ways to provide support:

Run a yearly tax-prep webinar for employees receiving equity.

Share plain-English tip sheets outlining what Form 3921 is and how to use it.

Offer access to financial advisors during equity-heavy tax years.

These steps help employees feel confident and supported—and reflect well on your company’s culture.

Navigating Pitfalls and Leveraging Opportunities

Common Mistakes to Avoid

Pitfall | Impact | How to Avoid |

Late filing or missing employee copies | IRS penalties; employee confusion | Use automated tracking & alert systems |

Incorrect or incomplete data | IRS rejections; employee AMT errors | Double-check grant and SSN data |

Inaccurate FMV reporting | Tax misstatements; audit risk | Use certified 409A valuations |

How Haven Helps Founders Get It Right

At Haven, we understand that accurate tax reporting—including Form 3921—is only one piece of your greater compliance puzzle. Our modern bookkeeping and tax filing services are built for startups looking for:

Real-time ISO exercise tracking,

Fast, error-free IRS filings,

Personalized advice on handling equity taxation.

We’re not just forms and filings—Haven acts as a partner for startup leaders building toward scale.

Learn more about how our services support founders managing equity, taxes, and more.

Making Form 3921 Work for Your Startup

For founders, mastering Form 3921 isn’t just about staying compliant — it’s about delivering a seamless experience for your team while preserving your startup’s standing with the IRS. By meeting filing deadlines, keeping accurate equity records, and helping employees understand how ISO exercises impact taxes, you prevent costly setbacks and cultivate a financially literate team.

And you don’t have to do it alone. Haven’s tailored services help you streamline Form 3921 reporting with expert-backed tools designed for early-stage companies.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026