Go Back

Last Updated :

Last Updated :

Jan 9, 2026

Jan 9, 2026

GAAP for Startups: Why Cash-Basis Accounting Breaks at Scale

When building a startup, especially in dynamic sectors like tech, e-commerce, or agencies, founders wear many hats—from product development and sales to marketing and customer success. However, one foundational area that often needs sharper focus early on is financial accounting.

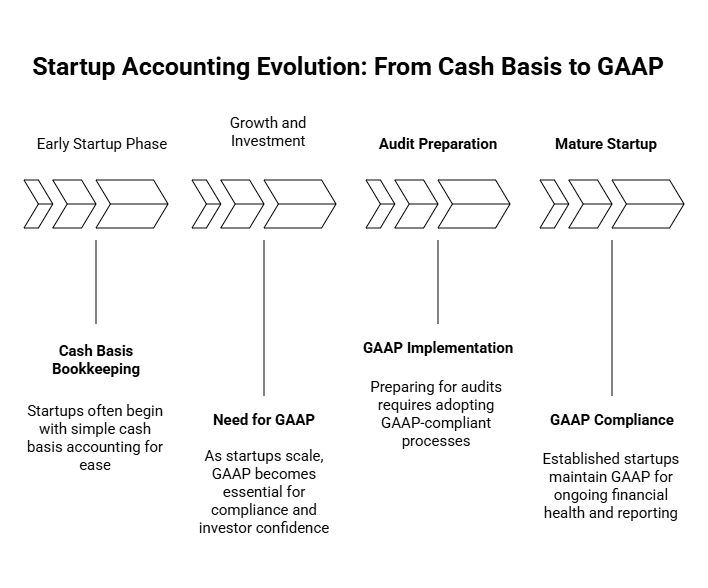

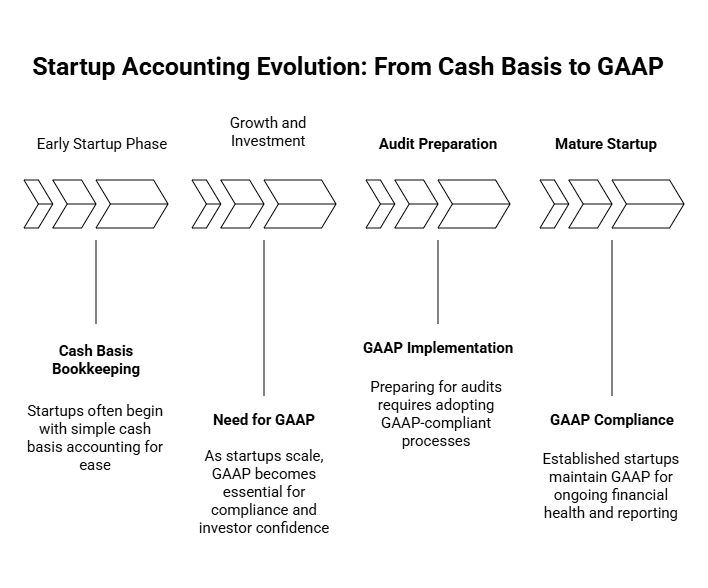

Many startups begin with simple cash basis bookkeeping because it’s straightforward and keeps administrative overhead low. But as a founder aiming to scale, secure investment, or prepare for an audit, understanding why your accountant needs to move beyond cash basis and embrace GAAP for startups is critical.

This guide breaks down what GAAP is, why it matters for startups, how it differs from cash basis accounting, and practical advice for founders to implement GAAP-compliant accounting processes. We also highlight the risks of ignoring GAAP and how it supports not only compliance but smarter financial decision-making and investor confidence.

What Is GAAP and Why Must Startups Adopt It?

GAAP, or Generally Accepted Accounting Principles, is the standardized accounting framework in the United States. Think of it as the rulebook that ensures financial statements are prepared consistently and transparently across companies. GAAP governs how companies recognize revenue, match expenses, handle stock-based compensation, and disclose financial information—elements essential for trustworthy reporting.

Why Is GAAP Important for Startups?

Investor and Stakeholder Confidence: Early-stage companies often seek capital from angel investors, venture capitalists, or strategic partners. These investors expect financial statements prepared under GAAP because it provides a standardized, credible basis to assess the startup’s financial health.

Audit Readiness: Raising funds often comes with eventual audits—either formal external audits or due diligence exercises. GAAP compliance ensures your startup withstands scrutiny without surprises or costly restatements.

Better Business Decisions: GAAP enforces accrual accounting principles that align revenue and expenses with the period they occur, helping founders see a clearer, more accurate picture of business performance.

Scalability: As startups scale, complexity in transactions, revenue streams (like subscriptions or milestone-based contracts), and expenses grows. GAAP provides a rigorous framework that scales with your business and industry nuances.

Importantly, while startups may start on a cash basis (recording income and expenses only when cash exchanges hands) — this approach falls short as your startup iterates, grows revenue complexity, or seeks outside funding. Modern startups may benefit from specialized bookkeeping services to streamline this process.

Key Differences Between GAAP and Cash Basis Accounting

At its heart, the main distinction between GAAP and cash basis accounting rests on timing and recognition of transactions:

Aspect | Cash Basis Accounting | GAAP Accounting (Accrual Basis) |

Revenue Recognition | Recognized only when cash is received | Recognized when earned, regardless of cash receipt |

Expense Recognition | Recorded only when cash is paid | Recorded in the period expenses contribute to revenue |

Financial Accuracy | May distort performance in periods with delayed payments or expenses | Matches revenues and expenses for accurate performance measurement |

Compliance | Not GAAP-compliant, less credible to investors | Required for GAAP compliance, preferred by investors |

Suitability for Growth | Simple but limited for complex transactions | Supports complex contracts, deferred revenue, R&D capitalization |

Why Does the Accrual Method Matter?

GAAP requires the accrual accounting method, where you recognize economic activity as it happens, not just when cash flows. This method:

Reflects ongoing obligations and earned revenues

Enables thorough financial forecasting

Provides visibility on accounts receivable and payable

GAAP Principles Every Startup Founder Should Know

GAAP is comprehensive. But understanding these foundational principles will help you partner more effectively with your accountant and avoid compliance pitfalls:

Principle | What It Means for Startups | Founder Tip |

Consistency | Use the same accounting methods period-to-period | Avoid shifting methods to inflate or hide performance metrics |

Accrual Principle | Record revenues and expenses when they occur, not just on cash flow | Know key revenue recognition rules for your contracts |

Prudence (Conservatism) | Avoid overstating assets or income; recognize potential losses early | Always report allowances for doubtful accounts etc. |

Matching Principle | Match expenses directly to the revenues they helped generate | Ensure you capture costs (e.g., R&D) in the right periods |

Full Disclosure | Transparently disclose all relevant financial information | Provide notes on stock options, SAFE instruments, and deferred revenue |

Revenue Recognition (ASC 606) | Recognize revenue based on when control transfers to customer | Understand how milestones, subscriptions, and contracts affect revenue recognition |

How GAAP Handles Startup-Specific Transactions

Startups aren’t just scaled-down versions of mature companies—they have uniquely complex financial elements that cash basis accounting fails to capture properly.

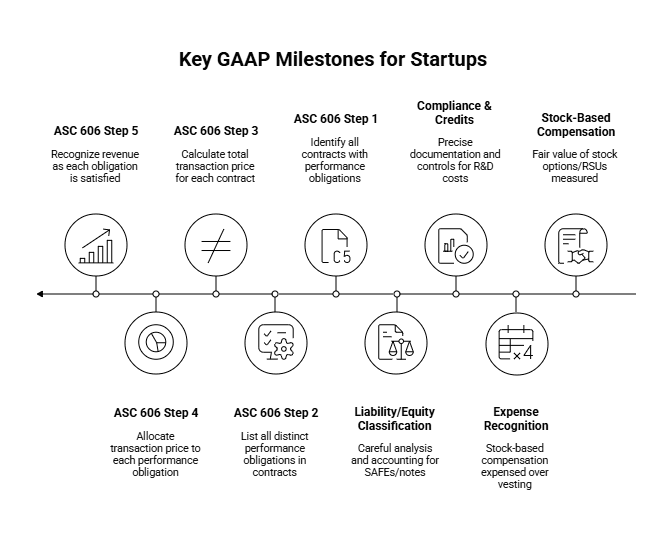

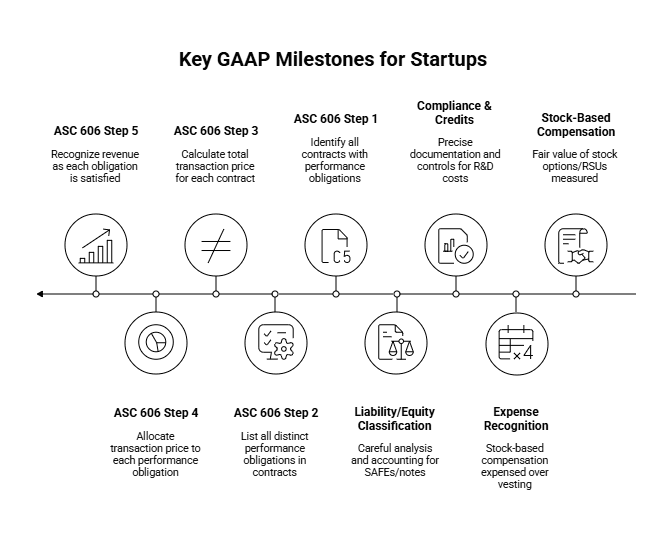

Stock-Based Compensation

Many startups grant employees stock options or RSUs. GAAP requires:

Fair value measurement of stock-based compensation at grant date.

Expense recognition over vesting periods.

Cash basis accounting ignores this, potentially causing material misstatements of expenses and net income. Proper GAAP treatment ensures founders and investors can gauge true employee compensation costs and how they impact profitability.

Research & Development (R&D) Costs

GAAP generally requires startups to expense R&D immediately unless certain criteria for capitalization are met. Accompanying documentation, controls, and precise expense tracking are vital for compliance and potentially unlocking R&D tax credits from sources like the IRS.

SAFE Notes and Convertible Instruments

Many startups raise via Simple Agreements for Future Equity (SAFEs) or convertible notes. GAAP requires companies to analyze and account for these instruments carefully—often as liabilities or equity with detailed disclosures. Cash basis ignores these nuances, underreporting liabilities and misleading stakeholders.

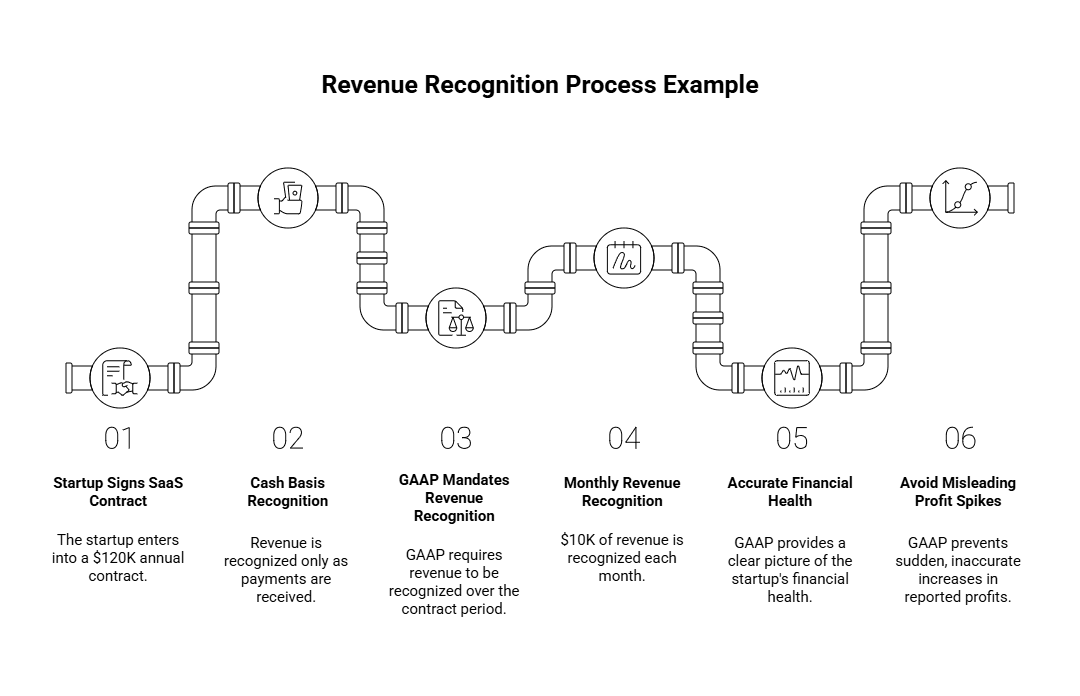

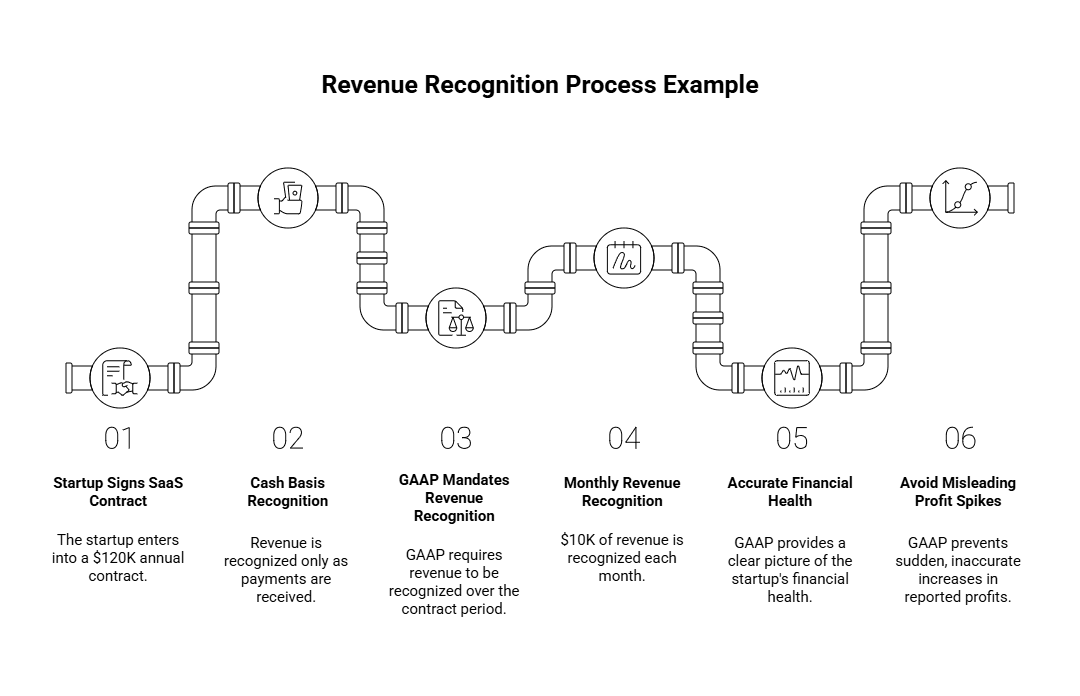

Revenue Recognition under ASC 606

For startups selling subscriptions, milestone-based deliverables, or multi-element contracts, ASC 606 provides a revenue recognition framework:

Identify contract(s)

Identify performance obligations

Determine transaction price

Allocate price to obligations

Recognize revenue as obligations are satisfied

This can drastically differ from cash basis timelines and better aligns revenue with actual performance.

Implementing GAAP in Your Startup

Transitioning from cash basis to GAAP for startups accounting can seem daunting, but breaking it into manageable steps makes it achievable:

1. Evaluate Readiness and Compliance Needs Early

Are you approaching a funding round? Investor or auditor demands often trigger GAAP adoption.

Are your revenue streams becoming complex? Subscriptions, deferred revenue, SAFEs require accrual methods.

Engage your accountant or financial advisor early to assess current processes.

2. Upgrade Your Accounting System

Cash basis bookkeeping tools often lack accrual functionality. Consider startup-native platforms supporting:

Sophisticated revenue recognition models

Stock compensation tracking

Automated accounts receivable/payable management

Learn about bookkeeping services designed specifically for startups navigating complexity.

3. Set Up Internal Controls

Revenue and expense recognition policies

Controls on journal entries and reconciliations

Formal documentation of key transactions and judgments

These are essential for GAAP compliance and audit preparedness.

4. Leverage In-House or Outsourced Experts

Your accounting or finance lead must understand GAAP principles relevant to your model. Outsourcing to specialized startup accounting firms lets founders stay focused on growth.

5. Regularly Review and Adapt

GAAP compliance isn’t one-and-done. Your processes should evolve with contracts, funding, and changing standards.

For official GAAP guidelines, visit the Financial Accounting Standards Board (FASB) website.

Risks of Sticking with Cash Basis Accounting

While tempting for simplicity, cash basis accounting carries serious drawbacks as your startup matures:

Risk | Explanation | Potential Founder Impact |

Misleading Financials | Inaccurate profit/loss recognition distorts business health | Poor decision-making, surprise financial gaps |

Investor Skepticism | Investors view cash basis as less reliable or opaque | Reduced valuation, lost funding opportunities |

Audit Complications | Switching to GAAP late generates expensive restatements and delays | Increased legal, accounting costs, and headaches |

Missed Tax or R&D Opportunities | Non-GAAP accounting may overlook eligible credits from R&D spending | Forgone cash savings that impact runway |

To mitigate these risks, collaborate with experts comfortable navigating startup GAAP challenges. Explore R&D tax credit and business tax services tailored for startups.

Making GAAP Work for Your Startup’s Growth

For startup founders striving to build credible, scalable businesses, GAAP for startups isn’t just accounting pedantry—it’s an essential toolkit for attracting investment, enabling strategic decisions, and ensuring operational readiness for audits and growth.

Moving beyond cash basis accounting to GAAP-compliant accrual methods equips founders with:

Transparent, comparable financials trusted by investors

Accurate revenue and expense matching reflecting economic reality

Clear insights into stock compensation, R&D capitalization, and complex contracts

While initially requiring organized effort, the long-term payoff is smoother fundraising, smarter business decisions, and peace of mind. If you’re still relying on cash basis bookkeeping or unclear on GAAP requirements for your startup, now is the time to act.

For startups seeking responsive, founder-friendly GAAP and bookkeeping guidance grounded in modern startup realities, our startup-native accounting services deliver hands-on support designed to accelerate your journey from seed to scale.

When building a startup, especially in dynamic sectors like tech, e-commerce, or agencies, founders wear many hats—from product development and sales to marketing and customer success. However, one foundational area that often needs sharper focus early on is financial accounting.

Many startups begin with simple cash basis bookkeeping because it’s straightforward and keeps administrative overhead low. But as a founder aiming to scale, secure investment, or prepare for an audit, understanding why your accountant needs to move beyond cash basis and embrace GAAP for startups is critical.

This guide breaks down what GAAP is, why it matters for startups, how it differs from cash basis accounting, and practical advice for founders to implement GAAP-compliant accounting processes. We also highlight the risks of ignoring GAAP and how it supports not only compliance but smarter financial decision-making and investor confidence.

What Is GAAP and Why Must Startups Adopt It?

GAAP, or Generally Accepted Accounting Principles, is the standardized accounting framework in the United States. Think of it as the rulebook that ensures financial statements are prepared consistently and transparently across companies. GAAP governs how companies recognize revenue, match expenses, handle stock-based compensation, and disclose financial information—elements essential for trustworthy reporting.

Why Is GAAP Important for Startups?

Investor and Stakeholder Confidence: Early-stage companies often seek capital from angel investors, venture capitalists, or strategic partners. These investors expect financial statements prepared under GAAP because it provides a standardized, credible basis to assess the startup’s financial health.

Audit Readiness: Raising funds often comes with eventual audits—either formal external audits or due diligence exercises. GAAP compliance ensures your startup withstands scrutiny without surprises or costly restatements.

Better Business Decisions: GAAP enforces accrual accounting principles that align revenue and expenses with the period they occur, helping founders see a clearer, more accurate picture of business performance.

Scalability: As startups scale, complexity in transactions, revenue streams (like subscriptions or milestone-based contracts), and expenses grows. GAAP provides a rigorous framework that scales with your business and industry nuances.

Importantly, while startups may start on a cash basis (recording income and expenses only when cash exchanges hands) — this approach falls short as your startup iterates, grows revenue complexity, or seeks outside funding. Modern startups may benefit from specialized bookkeeping services to streamline this process.

Key Differences Between GAAP and Cash Basis Accounting

At its heart, the main distinction between GAAP and cash basis accounting rests on timing and recognition of transactions:

Aspect | Cash Basis Accounting | GAAP Accounting (Accrual Basis) |

Revenue Recognition | Recognized only when cash is received | Recognized when earned, regardless of cash receipt |

Expense Recognition | Recorded only when cash is paid | Recorded in the period expenses contribute to revenue |

Financial Accuracy | May distort performance in periods with delayed payments or expenses | Matches revenues and expenses for accurate performance measurement |

Compliance | Not GAAP-compliant, less credible to investors | Required for GAAP compliance, preferred by investors |

Suitability for Growth | Simple but limited for complex transactions | Supports complex contracts, deferred revenue, R&D capitalization |

Why Does the Accrual Method Matter?

GAAP requires the accrual accounting method, where you recognize economic activity as it happens, not just when cash flows. This method:

Reflects ongoing obligations and earned revenues

Enables thorough financial forecasting

Provides visibility on accounts receivable and payable

GAAP Principles Every Startup Founder Should Know

GAAP is comprehensive. But understanding these foundational principles will help you partner more effectively with your accountant and avoid compliance pitfalls:

Principle | What It Means for Startups | Founder Tip |

Consistency | Use the same accounting methods period-to-period | Avoid shifting methods to inflate or hide performance metrics |

Accrual Principle | Record revenues and expenses when they occur, not just on cash flow | Know key revenue recognition rules for your contracts |

Prudence (Conservatism) | Avoid overstating assets or income; recognize potential losses early | Always report allowances for doubtful accounts etc. |

Matching Principle | Match expenses directly to the revenues they helped generate | Ensure you capture costs (e.g., R&D) in the right periods |

Full Disclosure | Transparently disclose all relevant financial information | Provide notes on stock options, SAFE instruments, and deferred revenue |

Revenue Recognition (ASC 606) | Recognize revenue based on when control transfers to customer | Understand how milestones, subscriptions, and contracts affect revenue recognition |

How GAAP Handles Startup-Specific Transactions

Startups aren’t just scaled-down versions of mature companies—they have uniquely complex financial elements that cash basis accounting fails to capture properly.

Stock-Based Compensation

Many startups grant employees stock options or RSUs. GAAP requires:

Fair value measurement of stock-based compensation at grant date.

Expense recognition over vesting periods.

Cash basis accounting ignores this, potentially causing material misstatements of expenses and net income. Proper GAAP treatment ensures founders and investors can gauge true employee compensation costs and how they impact profitability.

Research & Development (R&D) Costs

GAAP generally requires startups to expense R&D immediately unless certain criteria for capitalization are met. Accompanying documentation, controls, and precise expense tracking are vital for compliance and potentially unlocking R&D tax credits from sources like the IRS.

SAFE Notes and Convertible Instruments

Many startups raise via Simple Agreements for Future Equity (SAFEs) or convertible notes. GAAP requires companies to analyze and account for these instruments carefully—often as liabilities or equity with detailed disclosures. Cash basis ignores these nuances, underreporting liabilities and misleading stakeholders.

Revenue Recognition under ASC 606

For startups selling subscriptions, milestone-based deliverables, or multi-element contracts, ASC 606 provides a revenue recognition framework:

Identify contract(s)

Identify performance obligations

Determine transaction price

Allocate price to obligations

Recognize revenue as obligations are satisfied

This can drastically differ from cash basis timelines and better aligns revenue with actual performance.

Implementing GAAP in Your Startup

Transitioning from cash basis to GAAP for startups accounting can seem daunting, but breaking it into manageable steps makes it achievable:

1. Evaluate Readiness and Compliance Needs Early

Are you approaching a funding round? Investor or auditor demands often trigger GAAP adoption.

Are your revenue streams becoming complex? Subscriptions, deferred revenue, SAFEs require accrual methods.

Engage your accountant or financial advisor early to assess current processes.

2. Upgrade Your Accounting System

Cash basis bookkeeping tools often lack accrual functionality. Consider startup-native platforms supporting:

Sophisticated revenue recognition models

Stock compensation tracking

Automated accounts receivable/payable management

Learn about bookkeeping services designed specifically for startups navigating complexity.

3. Set Up Internal Controls

Revenue and expense recognition policies

Controls on journal entries and reconciliations

Formal documentation of key transactions and judgments

These are essential for GAAP compliance and audit preparedness.

4. Leverage In-House or Outsourced Experts

Your accounting or finance lead must understand GAAP principles relevant to your model. Outsourcing to specialized startup accounting firms lets founders stay focused on growth.

5. Regularly Review and Adapt

GAAP compliance isn’t one-and-done. Your processes should evolve with contracts, funding, and changing standards.

For official GAAP guidelines, visit the Financial Accounting Standards Board (FASB) website.

Risks of Sticking with Cash Basis Accounting

While tempting for simplicity, cash basis accounting carries serious drawbacks as your startup matures:

Risk | Explanation | Potential Founder Impact |

Misleading Financials | Inaccurate profit/loss recognition distorts business health | Poor decision-making, surprise financial gaps |

Investor Skepticism | Investors view cash basis as less reliable or opaque | Reduced valuation, lost funding opportunities |

Audit Complications | Switching to GAAP late generates expensive restatements and delays | Increased legal, accounting costs, and headaches |

Missed Tax or R&D Opportunities | Non-GAAP accounting may overlook eligible credits from R&D spending | Forgone cash savings that impact runway |

To mitigate these risks, collaborate with experts comfortable navigating startup GAAP challenges. Explore R&D tax credit and business tax services tailored for startups.

Making GAAP Work for Your Startup’s Growth

For startup founders striving to build credible, scalable businesses, GAAP for startups isn’t just accounting pedantry—it’s an essential toolkit for attracting investment, enabling strategic decisions, and ensuring operational readiness for audits and growth.

Moving beyond cash basis accounting to GAAP-compliant accrual methods equips founders with:

Transparent, comparable financials trusted by investors

Accurate revenue and expense matching reflecting economic reality

Clear insights into stock compensation, R&D capitalization, and complex contracts

While initially requiring organized effort, the long-term payoff is smoother fundraising, smarter business decisions, and peace of mind. If you’re still relying on cash basis bookkeeping or unclear on GAAP requirements for your startup, now is the time to act.

For startups seeking responsive, founder-friendly GAAP and bookkeeping guidance grounded in modern startup realities, our startup-native accounting services deliver hands-on support designed to accelerate your journey from seed to scale.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026