Go Back

Last Updated :

Last Updated :

Dec 22, 2025

Dec 22, 2025

Form SS-4 Guide for Founders: How to Apply for an EIN

When you're launching a startup or scaling your business, handling paperwork efficiently helps you focus on what matters most: growth. For founders in the US, one fundamental step early on is obtaining your Employer Identification Number (EIN) by submitting Form SS-4. This guide breaks down everything you need to know to complete Form SS-4 correctly, get your EIN swiftly, and leverage it for smoother business operations.

What Is Form SS-4 and Why Founders Need It

Form SS-4 is the application the IRS uses to assign an EIN to your business. Think of the EIN as a Social Security number for your company—it plays a critical role in your finance and tax setup from day one.

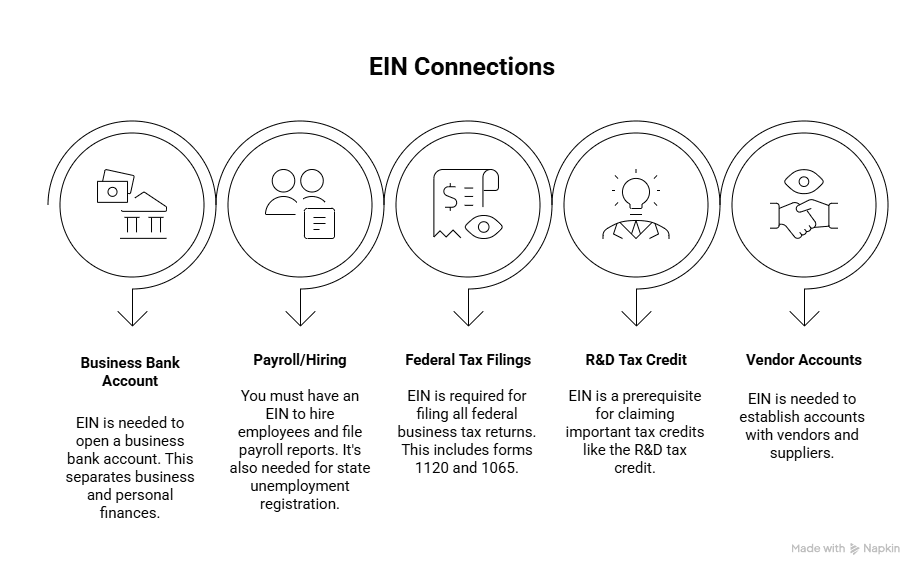

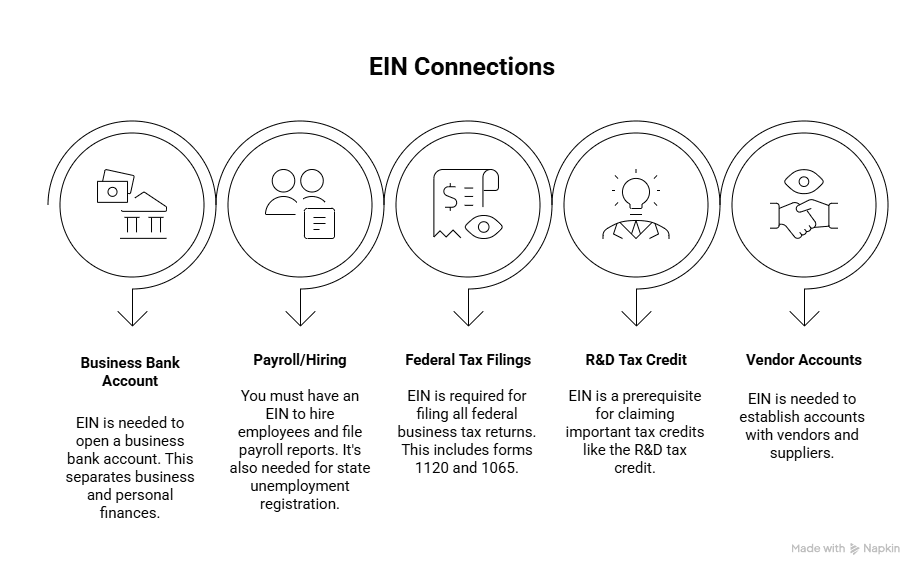

Why the EIN is Critical for Startups:

Financial Separation: The EIN is required to open a business bank account, effectively separating business and personal finances, which simplifies tax filing and bookkeeping.

Hiring & Payroll: You must have an EIN to hire employees, file payroll reports (Forms 940/941), and register with state unemployment agencies.

Compliance & Credits: It is a prerequisite for claiming important tax credits, such as the R&D tax credit, and for filing all federal business tax returns (e.g., 1120, 1065).

Vendor Relations: Major platforms and service providers (like Stripe or Amazon) require an EIN before establishing vendor accounts.

Who Must File and When to Apply

The IRS requires every business entity to have an EIN if it meets certain criteria. Founders should apply as soon as they incorporate or form their entity to avoid operational delays.

Who Must File

You must apply for an EIN if your business:

Has employees (even one part-time W-2 employee).

Operates as a corporation or partnership.

Files excise tax, alcohol, tobacco, and firearms tax returns.

Withholds taxes on income paid to a non-resident alien.

Involves specific types of trusts, estates, real estate mortgage investment conduits (REMICs), or non-profit organizations.

When to Apply

The best time to apply is immediately after your entity is legally formed with the state (e.g., after receiving your Articles of Incorporation/Organization).

GUIDANCE: Even if you don't plan to hire right away, securing your EIN early is essential for opening bank accounts and registering with key vendors (like payment processors), which are necessary for launch. The online application method is instant, making early filing the easiest approach.

How to Fill Out Form SS-4 (Step-by-Step)

Filling out your EIN application is straightforward, provided you understand the specific requirements for each section.

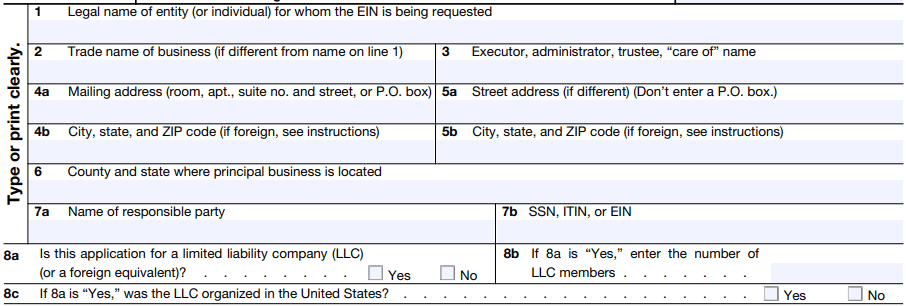

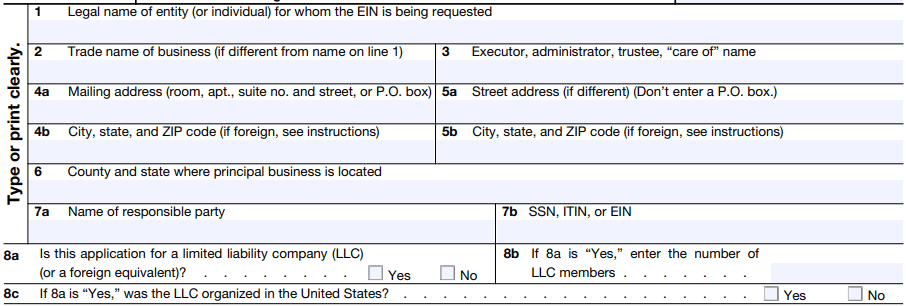

Part 1: Identifying Information (Lines 1-7)

Line 1 (Legal Name): Enter your official business name exactly as it appears in your state formation documents.

Line 2 (Trade Name/DBA): Provide your “Doing Business As” name only if it’s different from your legal name.

Lines 4a/4b (Mailing Address): Enter the address where you want to receive official IRS correspondence. This could be your office or your accountant’s address.

Lines 5a/5b (Physical Address): Provide your business’s physical address only if it's different from the mailing address.

Line 7a & 7b (Responsible Party): Enter the name and SSN/ITIN of the founder, CEO, or person responsible for the business's financial operations.

GUIDANCE: The Responsible Party must be an individual, not another business entity. Their SSN or ITIN is required for identification.

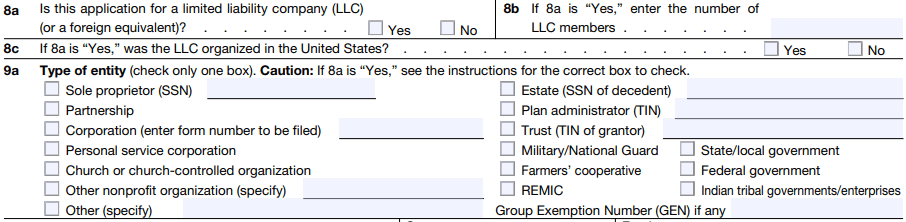

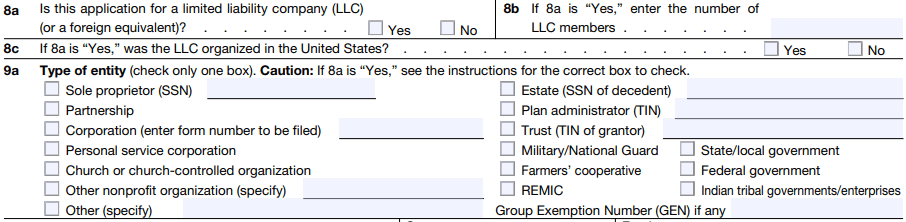

Part 2: Entity Classification (Lines 8-9)

This is one of the most common areas for error.

Line 8a-8c (LLC Status): Check "Yes" if you are an LLC (or foreign equivalent). Then, you must check the correct box on Line 9a.

Line 9a (Type of Entity): Check only one box.

Sole Proprietor: Choose this if you are a single-member LLC electing to be taxed as a disregarded entity (using your personal SSN for federal tax purposes) OR a true sole proprietor.

Corporation (S or C): Choose this if your entity is legally a Corporation.

Partnership: Choose this if your entity is legally a Partnership or a multi-member LLC electing to be taxed as a partnership.

Line 9b (Reason for Applying): Check the box that best describes your situation.

GUIDANCE: "Started new business" is the most common reason for a newly formed startup.

Part 3: Business Details (Lines 10-18)

Line 10 (Date Business Started): Enter the date of formation or when operations officially began. This should match your state formation documents.

Line 11 (Accounting Year Close): Enter the month your fiscal year ends. For most US-based C-Corps and LLCs, this is December.

Line 12 (Number of Employees): Provide your estimated number of employees for the current year. If zero, enter “0.”

Line 17 & 18 (Principal Activity/Products): Briefly describe your core business activity (e.g., "SaaS development" or "E-commerce retail").

Part 4: Prior Information (Line 19)

Line 19 (Prior EINs): Complete this only if your business was previously assigned an EIN (e.g., if you changed entity type from a sole proprietorship to a corporation).

How to Submit Form SS-4

You have a few ways to file, depending on your timeline and location.

Submission Method | Founder Type | Expected Processing Time | Recommended |

Online (IRS EIN Online Assistant) | US-Based Entity | Instant | YES |

Fax (Form SS-4) | All Applicants | ~4 business days | YES (Second best) |

Mail (Form SS-4) | All Applicants | ~4 weeks | NO (Avoid) |

Phone | International Applicants only | Instant | YES (If international) |

Key Requirement: The fastest method, the IRS EIN Online Assistant, is only available Monday through Friday, 7 a.m. to 10 p.m. Eastern Time. You must complete the session in one sitting.

Common Mistakes Founders Should Avoid

IRS delays often stem from avoidable missteps.

Confusing Names: Using a DBA name instead of the legal name on Line 1.

Incorrect Entity Type: Checking an entity type on Line 9a that does not align with your legal formation documents or your tax election (e.g., selecting Sole Proprietor when you filed for C-Corp status).

Missing Responsible Party Info: Submitting without the required name and SSN/ITIN for the Responsible Party on Line 7a/7b.

Filing for the Wrong Event: Applying for a new EIN when your business only changed its name or address—you should continue using the existing EIN in those cases.

Frequently Asked Questions (FAQs)

Does it cost money to apply for an EIN?

No. Applying for an EIN is free through the IRS.

How fast can I get my EIN?

If you use the IRS EIN Online Assistant and the responsible party has a valid SSN/ITIN, your EIN is issued instantly (during the hours of operation).

Do I need an EIN if I am a single-member LLC?

It depends on how you elect to be taxed.

Disregarded Entity: If you choose to be taxed as a disregarded entity, you can use your SSN for most federal tax purposes. However, you will still need an EIN if you hire employees or set up a retirement plan.

Corporation (S-Corp/C-Corp): If you elect to be taxed as a corporation, you must have an EIN.

When you're launching a startup or scaling your business, handling paperwork efficiently helps you focus on what matters most: growth. For founders in the US, one fundamental step early on is obtaining your Employer Identification Number (EIN) by submitting Form SS-4. This guide breaks down everything you need to know to complete Form SS-4 correctly, get your EIN swiftly, and leverage it for smoother business operations.

What Is Form SS-4 and Why Founders Need It

Form SS-4 is the application the IRS uses to assign an EIN to your business. Think of the EIN as a Social Security number for your company—it plays a critical role in your finance and tax setup from day one.

Why the EIN is Critical for Startups:

Financial Separation: The EIN is required to open a business bank account, effectively separating business and personal finances, which simplifies tax filing and bookkeeping.

Hiring & Payroll: You must have an EIN to hire employees, file payroll reports (Forms 940/941), and register with state unemployment agencies.

Compliance & Credits: It is a prerequisite for claiming important tax credits, such as the R&D tax credit, and for filing all federal business tax returns (e.g., 1120, 1065).

Vendor Relations: Major platforms and service providers (like Stripe or Amazon) require an EIN before establishing vendor accounts.

Who Must File and When to Apply

The IRS requires every business entity to have an EIN if it meets certain criteria. Founders should apply as soon as they incorporate or form their entity to avoid operational delays.

Who Must File

You must apply for an EIN if your business:

Has employees (even one part-time W-2 employee).

Operates as a corporation or partnership.

Files excise tax, alcohol, tobacco, and firearms tax returns.

Withholds taxes on income paid to a non-resident alien.

Involves specific types of trusts, estates, real estate mortgage investment conduits (REMICs), or non-profit organizations.

When to Apply

The best time to apply is immediately after your entity is legally formed with the state (e.g., after receiving your Articles of Incorporation/Organization).

GUIDANCE: Even if you don't plan to hire right away, securing your EIN early is essential for opening bank accounts and registering with key vendors (like payment processors), which are necessary for launch. The online application method is instant, making early filing the easiest approach.

How to Fill Out Form SS-4 (Step-by-Step)

Filling out your EIN application is straightforward, provided you understand the specific requirements for each section.

Part 1: Identifying Information (Lines 1-7)

Line 1 (Legal Name): Enter your official business name exactly as it appears in your state formation documents.

Line 2 (Trade Name/DBA): Provide your “Doing Business As” name only if it’s different from your legal name.

Lines 4a/4b (Mailing Address): Enter the address where you want to receive official IRS correspondence. This could be your office or your accountant’s address.

Lines 5a/5b (Physical Address): Provide your business’s physical address only if it's different from the mailing address.

Line 7a & 7b (Responsible Party): Enter the name and SSN/ITIN of the founder, CEO, or person responsible for the business's financial operations.

GUIDANCE: The Responsible Party must be an individual, not another business entity. Their SSN or ITIN is required for identification.

Part 2: Entity Classification (Lines 8-9)

This is one of the most common areas for error.

Line 8a-8c (LLC Status): Check "Yes" if you are an LLC (or foreign equivalent). Then, you must check the correct box on Line 9a.

Line 9a (Type of Entity): Check only one box.

Sole Proprietor: Choose this if you are a single-member LLC electing to be taxed as a disregarded entity (using your personal SSN for federal tax purposes) OR a true sole proprietor.

Corporation (S or C): Choose this if your entity is legally a Corporation.

Partnership: Choose this if your entity is legally a Partnership or a multi-member LLC electing to be taxed as a partnership.

Line 9b (Reason for Applying): Check the box that best describes your situation.

GUIDANCE: "Started new business" is the most common reason for a newly formed startup.

Part 3: Business Details (Lines 10-18)

Line 10 (Date Business Started): Enter the date of formation or when operations officially began. This should match your state formation documents.

Line 11 (Accounting Year Close): Enter the month your fiscal year ends. For most US-based C-Corps and LLCs, this is December.

Line 12 (Number of Employees): Provide your estimated number of employees for the current year. If zero, enter “0.”

Line 17 & 18 (Principal Activity/Products): Briefly describe your core business activity (e.g., "SaaS development" or "E-commerce retail").

Part 4: Prior Information (Line 19)

Line 19 (Prior EINs): Complete this only if your business was previously assigned an EIN (e.g., if you changed entity type from a sole proprietorship to a corporation).

How to Submit Form SS-4

You have a few ways to file, depending on your timeline and location.

Submission Method | Founder Type | Expected Processing Time | Recommended |

Online (IRS EIN Online Assistant) | US-Based Entity | Instant | YES |

Fax (Form SS-4) | All Applicants | ~4 business days | YES (Second best) |

Mail (Form SS-4) | All Applicants | ~4 weeks | NO (Avoid) |

Phone | International Applicants only | Instant | YES (If international) |

Key Requirement: The fastest method, the IRS EIN Online Assistant, is only available Monday through Friday, 7 a.m. to 10 p.m. Eastern Time. You must complete the session in one sitting.

Common Mistakes Founders Should Avoid

IRS delays often stem from avoidable missteps.

Confusing Names: Using a DBA name instead of the legal name on Line 1.

Incorrect Entity Type: Checking an entity type on Line 9a that does not align with your legal formation documents or your tax election (e.g., selecting Sole Proprietor when you filed for C-Corp status).

Missing Responsible Party Info: Submitting without the required name and SSN/ITIN for the Responsible Party on Line 7a/7b.

Filing for the Wrong Event: Applying for a new EIN when your business only changed its name or address—you should continue using the existing EIN in those cases.

Frequently Asked Questions (FAQs)

Does it cost money to apply for an EIN?

No. Applying for an EIN is free through the IRS.

How fast can I get my EIN?

If you use the IRS EIN Online Assistant and the responsible party has a valid SSN/ITIN, your EIN is issued instantly (during the hours of operation).

Do I need an EIN if I am a single-member LLC?

It depends on how you elect to be taxed.

Disregarded Entity: If you choose to be taxed as a disregarded entity, you can use your SSN for most federal tax purposes. However, you will still need an EIN if you hire employees or set up a retirement plan.

Corporation (S-Corp/C-Corp): If you elect to be taxed as a corporation, you must have an EIN.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026