Go Back

Last Updated :

Last Updated :

Jan 20, 2026

Jan 20, 2026

Form 9465: Managing Business Cash Flow Applying for an IRS Installment Agreement

When running a startup or fast-growing e-commerce business, managing business cash flow is one of the most critical — yet challenging — aspects of financial leadership. Taxes, often a significant and unavoidable expense for any business, can create cash flow crunches, especially if you face an unexpected tax bill or seasonal revenue fluctuations.

If you owe taxes but don’t have the liquidity to pay them entirely at once, Form 9465 offers a way to manage your obligations through an IRS installment agreement.

In this article, we’ll unpack how founders and finance leaders can leverage Form 9465 to ease immediate tax payment pressures while preserving cash flow for vital operations and growth.

Understanding Form 9465 and Why It Matters for Business Cash Flow

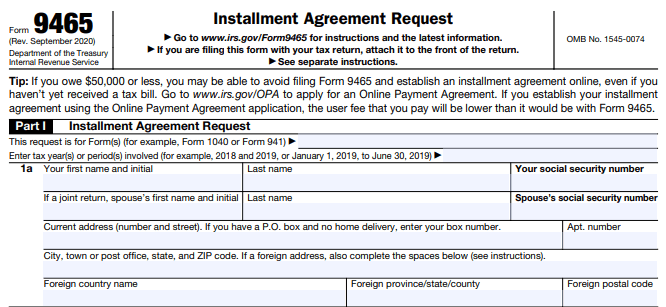

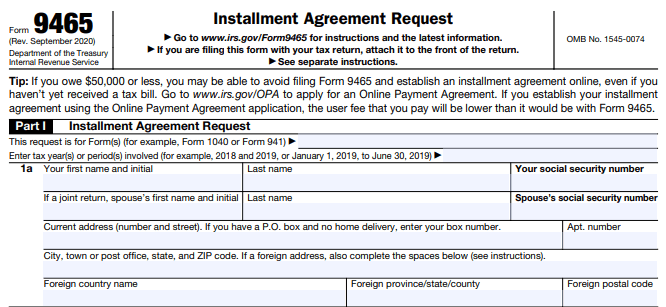

Form 9465, officially titled “Installment Agreement Request,” is the IRS form used by individuals and businesses to apply for a monthly payment plan when they cannot pay their federal tax bill in full immediately. For many founders, especially in startups or agencies with uneven revenue cycles, installments can be a smart way to honor tax obligations while avoiding more disruptive collection actions.

Why Use Form 9465?

Preserves Critical Cash Flow: Instead of depleting working capital to pay taxes all at once, founders can spread payments in more manageable chunks.

Avoids Collection Enforcement: Establishing an installment agreement generally stops IRS levies, liens, and wage garnishments.

Maintains Business-Oriented Focus: You remain concentrated on business operations instead of tax collection disputes.

Accommodates Financial Hardship or Seasonality: If your income is unpredictable or you’re in a growth investment phase, this brings flexibility.

Form 9465 is particularly helpful when a tax assessment happens outside your normal planning cycles. Taxes might come due via quarterly estimated payments owed for 1099 contractors, R&D credits adjustments, or sales taxes, creating short-term cash flow constraints.

Who Should Consider an IRS Installment Agreement via Form 9465?

While Form 9465 is accessible to many taxpayers, it’s important to understand the specific situations where filing for an IRS installment agreement makes the most sense.

Eligibility Criteria

You owe a tax liability to the IRS, whether individual or business (including sole proprietorships).

You cannot pay the tax debt in full at the time of notice or filing.

You want to establish a structured payment arrangement to avoid enforced collections.

Qualifying Scenarios Include:

A startup experiences a cash crunch after a profitable quarter but lacks liquid assets to pay quarterly taxes fully.

An agency’s tax withholding liability spikes unexpectedly due to bonuses or contract renegotiations.

E-commerce businesses face tax adjustments due to evolving nexus laws and need time to stabilize cash flow.

You’re a founder adjusting R&D tax credits, impacting your quarterly filings and payments.

If you’re unsure whether an installment agreement fits your cash flow situation or your business tax profile, consider consulting tax professionals who specialize in startup and small business tax services like those we offer at Haven (business tax services).

Types of IRS Installment Agreements Using Form 9465

Knowing which type of agreement to apply for allows proper forecasting and helps ensure compliance.

Type of Installment Agreement | Description | Common Use Cases |

Guaranteed Installment Agreement | Available if you owe $10,000 or less, and meet simple eligibility criteria. No financial info required. | Smaller individual or business debts |

Streamlined Installment Agreement | For tax debts up to $50,000; allows monthly payments over 72 months without deep financial review. | Medium-scale startup balances |

Partial Payment Installment Agreement (PPIA) | For businesses unable to cover even minimum monthly payments; based on ability to pay via detailed financials. | Cash-strapped or distressed businesses |

Most startups and e-commerce businesses fall under the streamlined option, providing a manageable path without a lengthy verification process.

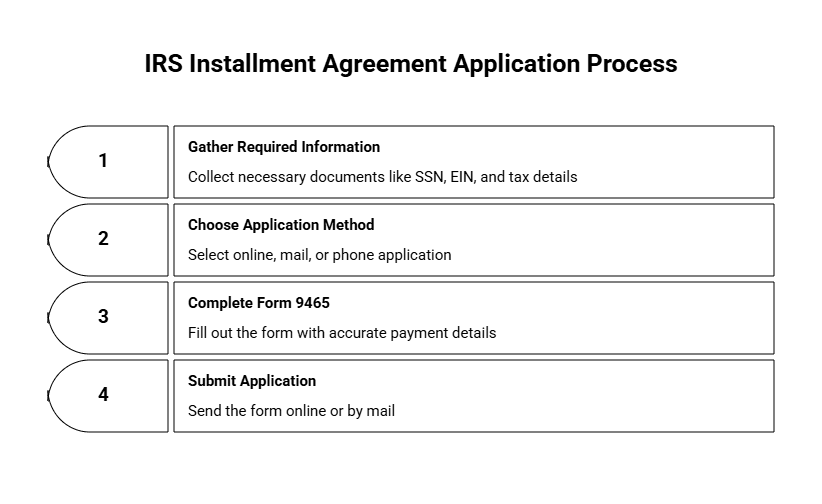

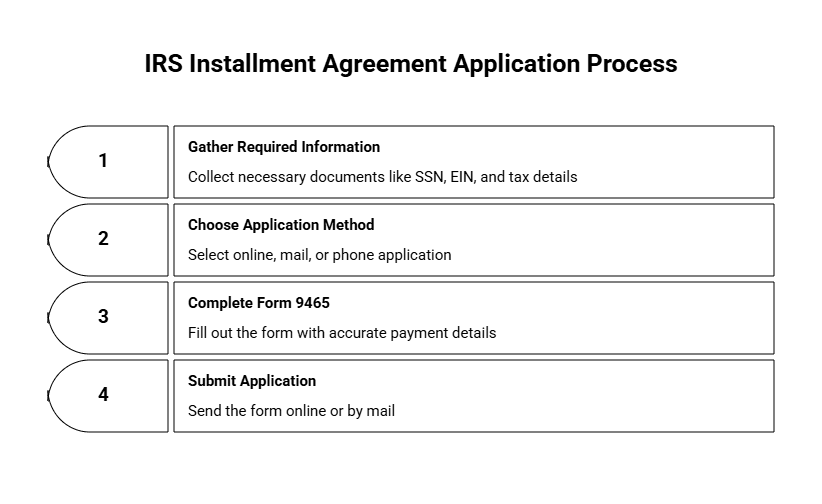

How to Apply for an IRS Installment Agreement Using Form 9465

The IRS has made the application process for an installment agreement relatively straightforward—but accuracy and planning still matter.

Step 1: Gather Required Information

Social Security Number or Employer Identification Number (EIN)

Total tax owed (from IRS notice or tax return)

Monthly payment amount you can afford

Contact and banking information if setting up automatic payments

Step 2: Choose Your Application Method

Online: Using the IRS Payment Agreement Portal is the fastest and most efficient for most business taxpayers.

Mail: Fill out and send Form 9465 to the address provided in your IRS notice.

Phone: In limited cases, agreements may be initiated by calling the IRS automated line.

Step 3: Complete Form 9465 Details Accurately

Indicate how much you propose to pay monthly and on which date.

Automated withdrawals are recommended to reduce risks of missed or delayed payments.

Review all entries for consistency with IRS records.

Step 4: Submit Your Application

Submit online for most efficient processing.

If mailing, retain a copy and use tracked delivery if possible.

Costs and Fees Related to IRS Installment Agreements

Installment agreements do come with costs, but they remain significantly more affordable than enforcement actions or credit disruption.

Fee Type | Amount | Possible Waivers |

Setup Fee | $31–$225 depending on method | May be waived for low-income taxpayers (Form 13844) |

Interest on Unpaid Tax | Applies throughout repayment | Cannot be waived |

Late Payment Penalties | Adds to total liability | May be reduced if you show reasonable cause |

Those in tight situations may qualify for the IRS’s reduced user fee by submitting Form 13844. Also, the SBA.gov IRS Installment Plans overview is a reliable resource for comparing payment methods and costs.

Managing Installment Payments Alongside Cash Flow

An IRS installment agreement is not “set it and forget it.” It must live harmoniously with your broader cash management strategy.

Best Practices for Finance Teams and Founders:

Stay Current: Make each scheduled payment—missing even once can nullify the agreement.

Forecast Cash Flow: Integrate installment obligations into weekly, monthly, and quarterly projections.

File All Taxes On Time: IRS expects full tax compliance during the agreement term.

Update IRS Upon Major Changes: If revenue drops dramatically, you may negotiate new terms.

Consider aligning agreement planning with broader services like our business tax support to reduce admin load and avoid compliance issues.

When Not to Use Form 9465: Alternative Options

Sometimes, Form 9465 might not meet the scale or urgency of your tax issues. Evaluate alternatives when necessary.

Situation | Recommended Action |

Large tax liability (>$50,000) | Explore an Offer in Compromise (OIC) |

Facing garnishment or imminent levy | Contact a CPA or tax resolution specialist urgently |

Need to reduce taxable income sooner | Claim full business deductions or leverage R&D credits |

For businesses developing intellectual property or software, explore R&D tax credit services to offset future tax obligations (view our services).

Form 9465 as a Practical Tool for Startup Tax Strategy

Modern founders and finance leaders must balance aggressive growth with responsible tax management. For many U.S. startups and e-commerce businesses, Form 9465 offers a practical, founder-friendly solution to handling IRS tax liabilities without compromising critical working capital.

When applied strategically, this form becomes more than paperwork—it’s a tool to preserve momentum, manage compliance, and protect business cash flow when it matters most.

When running a startup or fast-growing e-commerce business, managing business cash flow is one of the most critical — yet challenging — aspects of financial leadership. Taxes, often a significant and unavoidable expense for any business, can create cash flow crunches, especially if you face an unexpected tax bill or seasonal revenue fluctuations.

If you owe taxes but don’t have the liquidity to pay them entirely at once, Form 9465 offers a way to manage your obligations through an IRS installment agreement.

In this article, we’ll unpack how founders and finance leaders can leverage Form 9465 to ease immediate tax payment pressures while preserving cash flow for vital operations and growth.

Understanding Form 9465 and Why It Matters for Business Cash Flow

Form 9465, officially titled “Installment Agreement Request,” is the IRS form used by individuals and businesses to apply for a monthly payment plan when they cannot pay their federal tax bill in full immediately. For many founders, especially in startups or agencies with uneven revenue cycles, installments can be a smart way to honor tax obligations while avoiding more disruptive collection actions.

Why Use Form 9465?

Preserves Critical Cash Flow: Instead of depleting working capital to pay taxes all at once, founders can spread payments in more manageable chunks.

Avoids Collection Enforcement: Establishing an installment agreement generally stops IRS levies, liens, and wage garnishments.

Maintains Business-Oriented Focus: You remain concentrated on business operations instead of tax collection disputes.

Accommodates Financial Hardship or Seasonality: If your income is unpredictable or you’re in a growth investment phase, this brings flexibility.

Form 9465 is particularly helpful when a tax assessment happens outside your normal planning cycles. Taxes might come due via quarterly estimated payments owed for 1099 contractors, R&D credits adjustments, or sales taxes, creating short-term cash flow constraints.

Who Should Consider an IRS Installment Agreement via Form 9465?

While Form 9465 is accessible to many taxpayers, it’s important to understand the specific situations where filing for an IRS installment agreement makes the most sense.

Eligibility Criteria

You owe a tax liability to the IRS, whether individual or business (including sole proprietorships).

You cannot pay the tax debt in full at the time of notice or filing.

You want to establish a structured payment arrangement to avoid enforced collections.

Qualifying Scenarios Include:

A startup experiences a cash crunch after a profitable quarter but lacks liquid assets to pay quarterly taxes fully.

An agency’s tax withholding liability spikes unexpectedly due to bonuses or contract renegotiations.

E-commerce businesses face tax adjustments due to evolving nexus laws and need time to stabilize cash flow.

You’re a founder adjusting R&D tax credits, impacting your quarterly filings and payments.

If you’re unsure whether an installment agreement fits your cash flow situation or your business tax profile, consider consulting tax professionals who specialize in startup and small business tax services like those we offer at Haven (business tax services).

Types of IRS Installment Agreements Using Form 9465

Knowing which type of agreement to apply for allows proper forecasting and helps ensure compliance.

Type of Installment Agreement | Description | Common Use Cases |

Guaranteed Installment Agreement | Available if you owe $10,000 or less, and meet simple eligibility criteria. No financial info required. | Smaller individual or business debts |

Streamlined Installment Agreement | For tax debts up to $50,000; allows monthly payments over 72 months without deep financial review. | Medium-scale startup balances |

Partial Payment Installment Agreement (PPIA) | For businesses unable to cover even minimum monthly payments; based on ability to pay via detailed financials. | Cash-strapped or distressed businesses |

Most startups and e-commerce businesses fall under the streamlined option, providing a manageable path without a lengthy verification process.

How to Apply for an IRS Installment Agreement Using Form 9465

The IRS has made the application process for an installment agreement relatively straightforward—but accuracy and planning still matter.

Step 1: Gather Required Information

Social Security Number or Employer Identification Number (EIN)

Total tax owed (from IRS notice or tax return)

Monthly payment amount you can afford

Contact and banking information if setting up automatic payments

Step 2: Choose Your Application Method

Online: Using the IRS Payment Agreement Portal is the fastest and most efficient for most business taxpayers.

Mail: Fill out and send Form 9465 to the address provided in your IRS notice.

Phone: In limited cases, agreements may be initiated by calling the IRS automated line.

Step 3: Complete Form 9465 Details Accurately

Indicate how much you propose to pay monthly and on which date.

Automated withdrawals are recommended to reduce risks of missed or delayed payments.

Review all entries for consistency with IRS records.

Step 4: Submit Your Application

Submit online for most efficient processing.

If mailing, retain a copy and use tracked delivery if possible.

Costs and Fees Related to IRS Installment Agreements

Installment agreements do come with costs, but they remain significantly more affordable than enforcement actions or credit disruption.

Fee Type | Amount | Possible Waivers |

Setup Fee | $31–$225 depending on method | May be waived for low-income taxpayers (Form 13844) |

Interest on Unpaid Tax | Applies throughout repayment | Cannot be waived |

Late Payment Penalties | Adds to total liability | May be reduced if you show reasonable cause |

Those in tight situations may qualify for the IRS’s reduced user fee by submitting Form 13844. Also, the SBA.gov IRS Installment Plans overview is a reliable resource for comparing payment methods and costs.

Managing Installment Payments Alongside Cash Flow

An IRS installment agreement is not “set it and forget it.” It must live harmoniously with your broader cash management strategy.

Best Practices for Finance Teams and Founders:

Stay Current: Make each scheduled payment—missing even once can nullify the agreement.

Forecast Cash Flow: Integrate installment obligations into weekly, monthly, and quarterly projections.

File All Taxes On Time: IRS expects full tax compliance during the agreement term.

Update IRS Upon Major Changes: If revenue drops dramatically, you may negotiate new terms.

Consider aligning agreement planning with broader services like our business tax support to reduce admin load and avoid compliance issues.

When Not to Use Form 9465: Alternative Options

Sometimes, Form 9465 might not meet the scale or urgency of your tax issues. Evaluate alternatives when necessary.

Situation | Recommended Action |

Large tax liability (>$50,000) | Explore an Offer in Compromise (OIC) |

Facing garnishment or imminent levy | Contact a CPA or tax resolution specialist urgently |

Need to reduce taxable income sooner | Claim full business deductions or leverage R&D credits |

For businesses developing intellectual property or software, explore R&D tax credit services to offset future tax obligations (view our services).

Form 9465 as a Practical Tool for Startup Tax Strategy

Modern founders and finance leaders must balance aggressive growth with responsible tax management. For many U.S. startups and e-commerce businesses, Form 9465 offers a practical, founder-friendly solution to handling IRS tax liabilities without compromising critical working capital.

When applied strategically, this form becomes more than paperwork—it’s a tool to preserve momentum, manage compliance, and protect business cash flow when it matters most.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026