Go Back

Last Updated :

Last Updated :

Jan 5, 2026

Jan 5, 2026

Form 944 Filing Guide: Annual Federal Payroll Tax Return for Founders

For founders of startups, agencies, and e-commerce companies, managing payroll tax is a critical administrative hurdle. IRS Form 944 offers a streamlined alternative to the standard quarterly filings, allowing eligible small businesses to report and pay their federal payroll taxes just once a year.

This guide breaks down how to determine eligibility, navigate the filing process, and leverage Form 944 to keep your focus on scaling your business.

What is Form 944?

Form 944, the Employer’s ANNUAL Federal Tax Return, is designed for the smallest employers. Instead of filing Form 941 every quarter, eligible businesses file this single form to report:

Federal income tax withheld from employee wages.

Social Security tax (both employer and employee shares).

Medicare tax (both employer and employee shares).

Who Needs to File?

Not every small business can use Form 944; it is strictly for employers with very small tax liabilities.

The $1,000 Threshold: You are generally eligible if your estimated annual liability for Social Security, Medicare, and withheld federal income taxes is $1,000 or less.

IRS Notification is Mandatory: You must receive written notification from the IRS stating that you are required to file Form 944. You cannot simply choose to file it on your own.

Requesting a Switch: If you believe you qualify but haven't been notified, you can contact the IRS to request a change from quarterly to annual filing.

When is Form 944 Due?

Because this is an annual return, the deadline falls shortly after the close of the calendar year.

Filing Deadline: January 31st of the following year.

Payment Deadline: If you are paying your taxes with the return, the payment is also due January 31st.

Step-by-Step: How to Fill Out Form 944

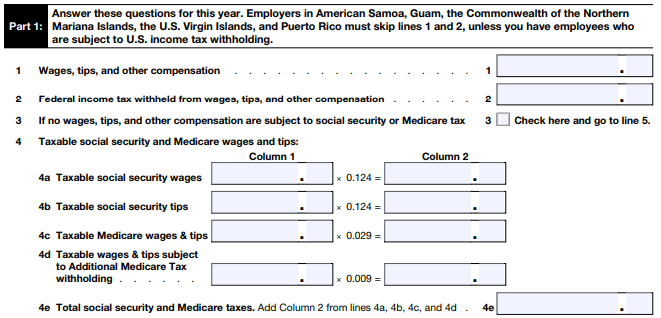

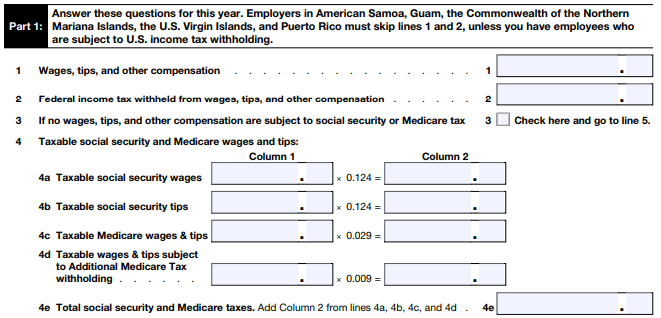

Step 1: Wages and Withholding (Lines 1-2)

Line 1: Enter the total wages, tips, and other compensation paid to your employees during the year.

Line 2: Enter the total federal income tax you withheld from those wages.

Step 2: Social Security and Medicare (Line 4)

This section calculates the statutory tax amounts.

Line 4a (Social Security): Multiply your total taxable Social Security wages by 12.4% (0.124).

Line 4c (Medicare): Multiply your total taxable Medicare wages and tips by 2.9% (0.029).

Line 4e: Add these amounts together to get your total social security and medicare taxes.

Step 3: Total Liability and Adjustments (Lines 5-9)

Line 7: Enter the total taxes (Line 2 + Line 4e + any other adjustments).

Line 9: If you have qualified small business nonrefundable credits for increasing research activities (R&D credits), enter them here.

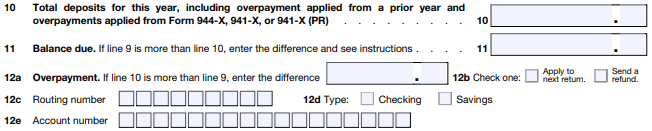

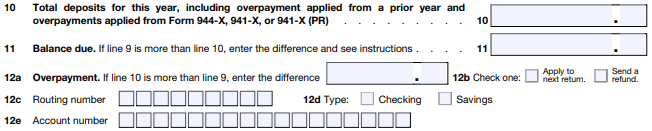

Step 4: Final Balance (Lines 10-15)

Line 10: This is your total tax after adjustments.

Line 11: Enter the total deposits you made during the year, if any.

Line 13: If your total tax is more than your deposits, enter the balance due.

Common Mistakes to Avoid

Filing Without Permission: Filing Form 944 when the IRS expects Form 941 can lead to "failure to file" penalties for the missing quarters.

Missing the $1,000 Cap: If your team grows and your tax liability exceeds $1,000, you must notify the IRS to switch back to quarterly Form 941 filing.

Incorrect EIN: Always use your legal Employer Identification Number to ensure payments are credited to the right account.

FAQs

Q: What if I have no employees for part of the year? A: Once you are designated a Form 944 filer, you must file a return every year even if you have no taxes to report, unless you file a final return to close your account.

Q: Does Form 944 cover state payroll taxes? A: No. Form 944 only applies to federal payroll taxes. You must still comply with your state’s specific payroll reporting and payment schedules.

Simplify Your Operations with Haven

Payroll compliance shouldn't slow down your startup’s growth. Haven provides founder-friendly tax and bookkeeping support designed for modern businesses.

Eligibility Monitoring: We help you track your payroll growth and notify you when it's time to transition between annual and quarterly filings.

Automated Filing: Our platform handles the math and the submissions, ensuring your Form 944 is accurate and on time.

Strategic Growth Support: We integrate your payroll data with broader tax strategies, like the R&D Tax Credit, to maximize your cash flow.

For founders of startups, agencies, and e-commerce companies, managing payroll tax is a critical administrative hurdle. IRS Form 944 offers a streamlined alternative to the standard quarterly filings, allowing eligible small businesses to report and pay their federal payroll taxes just once a year.

This guide breaks down how to determine eligibility, navigate the filing process, and leverage Form 944 to keep your focus on scaling your business.

What is Form 944?

Form 944, the Employer’s ANNUAL Federal Tax Return, is designed for the smallest employers. Instead of filing Form 941 every quarter, eligible businesses file this single form to report:

Federal income tax withheld from employee wages.

Social Security tax (both employer and employee shares).

Medicare tax (both employer and employee shares).

Who Needs to File?

Not every small business can use Form 944; it is strictly for employers with very small tax liabilities.

The $1,000 Threshold: You are generally eligible if your estimated annual liability for Social Security, Medicare, and withheld federal income taxes is $1,000 or less.

IRS Notification is Mandatory: You must receive written notification from the IRS stating that you are required to file Form 944. You cannot simply choose to file it on your own.

Requesting a Switch: If you believe you qualify but haven't been notified, you can contact the IRS to request a change from quarterly to annual filing.

When is Form 944 Due?

Because this is an annual return, the deadline falls shortly after the close of the calendar year.

Filing Deadline: January 31st of the following year.

Payment Deadline: If you are paying your taxes with the return, the payment is also due January 31st.

Step-by-Step: How to Fill Out Form 944

Step 1: Wages and Withholding (Lines 1-2)

Line 1: Enter the total wages, tips, and other compensation paid to your employees during the year.

Line 2: Enter the total federal income tax you withheld from those wages.

Step 2: Social Security and Medicare (Line 4)

This section calculates the statutory tax amounts.

Line 4a (Social Security): Multiply your total taxable Social Security wages by 12.4% (0.124).

Line 4c (Medicare): Multiply your total taxable Medicare wages and tips by 2.9% (0.029).

Line 4e: Add these amounts together to get your total social security and medicare taxes.

Step 3: Total Liability and Adjustments (Lines 5-9)

Line 7: Enter the total taxes (Line 2 + Line 4e + any other adjustments).

Line 9: If you have qualified small business nonrefundable credits for increasing research activities (R&D credits), enter them here.

Step 4: Final Balance (Lines 10-15)

Line 10: This is your total tax after adjustments.

Line 11: Enter the total deposits you made during the year, if any.

Line 13: If your total tax is more than your deposits, enter the balance due.

Common Mistakes to Avoid

Filing Without Permission: Filing Form 944 when the IRS expects Form 941 can lead to "failure to file" penalties for the missing quarters.

Missing the $1,000 Cap: If your team grows and your tax liability exceeds $1,000, you must notify the IRS to switch back to quarterly Form 941 filing.

Incorrect EIN: Always use your legal Employer Identification Number to ensure payments are credited to the right account.

FAQs

Q: What if I have no employees for part of the year? A: Once you are designated a Form 944 filer, you must file a return every year even if you have no taxes to report, unless you file a final return to close your account.

Q: Does Form 944 cover state payroll taxes? A: No. Form 944 only applies to federal payroll taxes. You must still comply with your state’s specific payroll reporting and payment schedules.

Simplify Your Operations with Haven

Payroll compliance shouldn't slow down your startup’s growth. Haven provides founder-friendly tax and bookkeeping support designed for modern businesses.

Eligibility Monitoring: We help you track your payroll growth and notify you when it's time to transition between annual and quarterly filings.

Automated Filing: Our platform handles the math and the submissions, ensuring your Form 944 is accurate and on time.

Strategic Growth Support: We integrate your payroll data with broader tax strategies, like the R&D Tax Credit, to maximize your cash flow.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026