Go Back

Last Updated :

Last Updated :

Jan 26, 2026

Jan 26, 2026

Form 8978: Partner's Audit Liability and Reporting Adjustments

For founders and financial leaders steering startups, agencies, or e-commerce companies navigating complex partnership tax landscapes, understanding Form 8978 is critical. This IRS form plays a pivotal role for partners who face audit adjustments under the Bipartisan Budget Act's streamlined partnership audit rules. Mastery of Form 8978 ensures you handle additional tax liabilities appropriately and avoid costly errors or delays.

This article provides a practical, founder-friendly guide to Form 8978. You'll learn who must file, how to complete it accurately, and how to integrate its requirements with your overall tax compliance strategy.

Understanding the Bipartisan Budget Act and Form 8978’s Role

Before diving into the specifics of Form 8978, it’s important to grasp the legislative backdrop that created it. The Bipartisan Budget Act of 2015 (BBA) revolutionized how the IRS audits partnerships.

The Centralization of Partnership Audits

Historically, audits were conducted at the partner level or involved multiple layers of reporting complexity. The BBA introduced a centralized audit regime for partnerships with two core goals:

Streamline and expedite IRS audits

Simplify adjustments and tax collections post-audit

Instead of recalculating each partner’s tax, the IRS adjusts the partnership return, then ""pushes out"" the resulting tax adjustments to partners via specific reporting requirements, which is where Form 8978 enters the workflow.

Key IRC Sections Involved

Two primary Internal Revenue Code sections govern these rules:

IRC Section 6226: Covers the partnership’s election to ""push out"" adjustments to its partners, enabling partners to report and pay their share independently on amended returns.

IRC Section 6227: Focuses on the partner’s responsibility to report and pay tax liabilities allocated from these adjustments.

Form 8978 facilitates partners’ reporting and payment responsibilities under these provisions.

Who Must File Form 8978?

Form 8978 is intended for non-pass-through partners who receive audit adjustments pushed out by a partnership under the BBA audit regime. Specifically, you must file Form 8978 if:

You received a Form 8986, Notice of Final Partnership Adjustment (NFPA), indicating tax adjustments allocated to you.

The partnership elected to push out audit adjustments under IRC Section 6226.

You are required to report and pay additional tax, including penalties and interest, related to these adjustments.

Note that passthrough partners (e.g., individuals reporting on personal returns) typically do not file Form 8978. This form is primarily relevant for entities or partners that must address audit adjustments at their own tax level.

For a comprehensive overview of tax reporting obligations for partnerships and partners, see Haven’s business tax services.

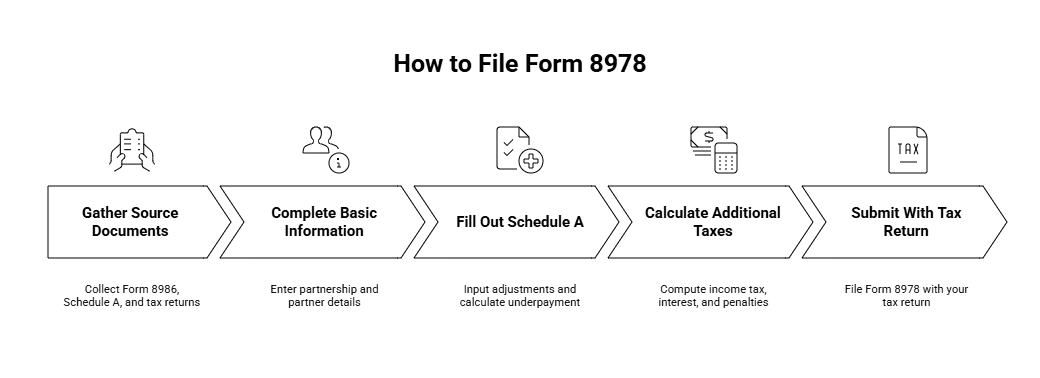

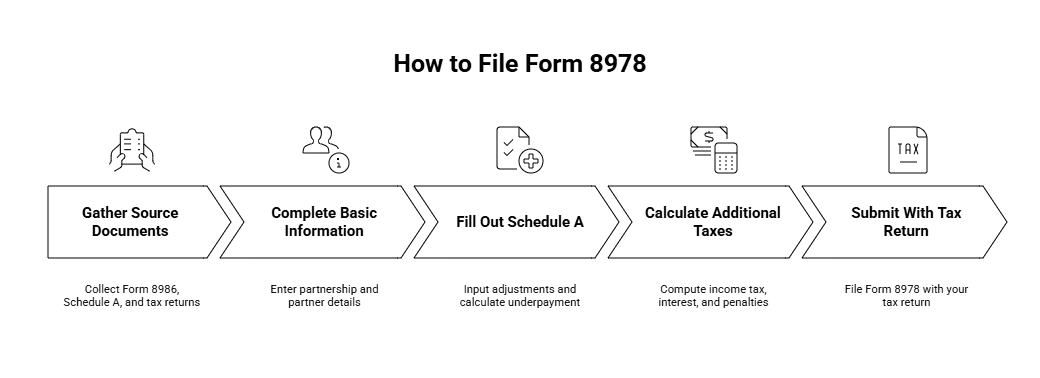

How to File Form 8978 in 5 Steps

Form 8978 can appear technical, but breaking it down into manageable pieces empowers founders and controllers to file accurately without unnecessary delays or penalties.

Step 1: Gather Your Source Documents

Form 8986 (Notice of Final Partnership Adjustment): This form from the partnership contains the finalized adjustments, tax year in question, and the imputed underpayment amount due from you as a partner.

Schedule A to Form 8978: This schedules details of the adjustments across the relevant years (up to four years).

Your own tax returns and prior payments—ensure these figures align to prevent discrepancies.

Step 2: Complete the Basic Information Section

Enter your partnership and partner identifying information (EIN, name, address).

Specify the tax year of the audit adjustment.

Indicate the relationship type (e.g., corporation, estate, or trust).

Step 3: Fill Out Schedule A Accurately

Input the adjustments for each year as outlined in the Form 8986 and partner statements.

Calculate the imputed underpayment using IRS rules based on allocation percentages and tax rates.

Include self-employment tax adjustments if applicable—a common factor for founder-owners involved in operations.

Step 4: Calculate Additional Taxes, Interest, and Penalties

Compute additional income tax due on the adjustments.

Calculate IRS interest from the year the audit adjustments pertain to. Reference current IRS interest rates.

Record late penalties, if any, under IRC guidance.

Step 5: Submit With Your Tax Return

File Form 8978 with your federal income tax return for the year the final partnership adjustment was issued.

Include payment for any additional tax owed.

Retain documentation, including Form 8986 and related calculations.

Common Challenges and How to Overcome Them

Reconciling Adjustments to Prior Returns

Discrepancies often arise when reconciling pushed-out audit adjustments with previously filed returns. To manage this:

Obtain all supporting schedules from the partnership.

Align your accounting system or ledger with adjustments.

Use tools like Haven’s reporting solutions to simplify reconciliation.

Consult advisors for complex basis or capital account movements.

Adjustments Across More Than Four Years

Schedule A supports four tax years. If adjustments span more:

Attach supplemental statements to include additional years.

Document all adjustments clearly to ensure IRS compliance.

Self-Employment Tax Considerations

If partners materially participate, self-employment tax may apply to increased income due to audit adjustments. A collaborative review between finance and payroll is key to addressing:

Revised SE tax obligations

Additional Medicare or Social Security contributions

Integrating Form 8978 Reporting with Finance Operations

Proactive finance leadership plays a vital role in managing Form 8978 obligations without derailing startup operations.

Best Practices for Founders and Controllers:

Create Seamless Data Flows: Confirm timely delivery of Form 8986 from partnerships. Build tracking processes to ensure prompt reporting.

Leverage Expert Assistance: Involve tax advisors experienced in the BBA regime to avoid misinterpreting audit data.

Upgrade Accounting Infrastructure: Adopt systems that monitor partner basis, capital accounts, and K-1 distributions over time.

Forecast Cash Needs Early: Plan for possible additional liabilities related to audit adjustments before filing deadlines hit.

Stay Informed: Refer to the IRS partnership audit program page for real-time updates.

Relationship Between Form 8978 and Form 8986

These two forms are closely tied, and understanding their functions is essential for compliance.

Key Differences

Aspect | Form 8986 | Form 8978 |

Issued By | Partnership | Partner |

Purpose | Notify partners of audit adjustments | Report tax liabilities from adjustments |

Submission Timing | Sent post-audit finalization | Filed with current partner’s tax return |

Key IRC Sections | Section 6226 | Section 6227 |

Partners receiving Form 8986 must use it to populate and file Form 8978.

Example: Form 8978 in Action for a Startup Partner

Imagine a startup with three partners is audited for underreported revenue in 2019 and 2020. The partnership opts for a push-out election and issues each partner a Form 8986.

Partner A, a corporate partner, proceeds as follows:

Retrieves Form 8986 and supporting schedules.

Finance lead compiles Schedule A data and calculates the imputed underpayment plus interest.

Files Form 8978 alongside the 2023 federal tax return.

Submits full payment and retains all supporting documentation.

This process satisfies IRS requirements and prevents double taxation or misallocation.

Why Form 8978 Matters for Startup Founders and Finance Leaders

In closing, Form 8978 is not just a compliance obligation—it’s a key part of startup tax strategy under the BBA audit regime. It ensures that partners, not partnerships, assume audit-related liabilities accurately and efficiently.

For founders and financial leaders steering startups, agencies, or e-commerce companies navigating complex partnership tax landscapes, understanding Form 8978 is critical. This IRS form plays a pivotal role for partners who face audit adjustments under the Bipartisan Budget Act's streamlined partnership audit rules. Mastery of Form 8978 ensures you handle additional tax liabilities appropriately and avoid costly errors or delays.

This article provides a practical, founder-friendly guide to Form 8978. You'll learn who must file, how to complete it accurately, and how to integrate its requirements with your overall tax compliance strategy.

Understanding the Bipartisan Budget Act and Form 8978’s Role

Before diving into the specifics of Form 8978, it’s important to grasp the legislative backdrop that created it. The Bipartisan Budget Act of 2015 (BBA) revolutionized how the IRS audits partnerships.

The Centralization of Partnership Audits

Historically, audits were conducted at the partner level or involved multiple layers of reporting complexity. The BBA introduced a centralized audit regime for partnerships with two core goals:

Streamline and expedite IRS audits

Simplify adjustments and tax collections post-audit

Instead of recalculating each partner’s tax, the IRS adjusts the partnership return, then ""pushes out"" the resulting tax adjustments to partners via specific reporting requirements, which is where Form 8978 enters the workflow.

Key IRC Sections Involved

Two primary Internal Revenue Code sections govern these rules:

IRC Section 6226: Covers the partnership’s election to ""push out"" adjustments to its partners, enabling partners to report and pay their share independently on amended returns.

IRC Section 6227: Focuses on the partner’s responsibility to report and pay tax liabilities allocated from these adjustments.

Form 8978 facilitates partners’ reporting and payment responsibilities under these provisions.

Who Must File Form 8978?

Form 8978 is intended for non-pass-through partners who receive audit adjustments pushed out by a partnership under the BBA audit regime. Specifically, you must file Form 8978 if:

You received a Form 8986, Notice of Final Partnership Adjustment (NFPA), indicating tax adjustments allocated to you.

The partnership elected to push out audit adjustments under IRC Section 6226.

You are required to report and pay additional tax, including penalties and interest, related to these adjustments.

Note that passthrough partners (e.g., individuals reporting on personal returns) typically do not file Form 8978. This form is primarily relevant for entities or partners that must address audit adjustments at their own tax level.

For a comprehensive overview of tax reporting obligations for partnerships and partners, see Haven’s business tax services.

How to File Form 8978 in 5 Steps

Form 8978 can appear technical, but breaking it down into manageable pieces empowers founders and controllers to file accurately without unnecessary delays or penalties.

Step 1: Gather Your Source Documents

Form 8986 (Notice of Final Partnership Adjustment): This form from the partnership contains the finalized adjustments, tax year in question, and the imputed underpayment amount due from you as a partner.

Schedule A to Form 8978: This schedules details of the adjustments across the relevant years (up to four years).

Your own tax returns and prior payments—ensure these figures align to prevent discrepancies.

Step 2: Complete the Basic Information Section

Enter your partnership and partner identifying information (EIN, name, address).

Specify the tax year of the audit adjustment.

Indicate the relationship type (e.g., corporation, estate, or trust).

Step 3: Fill Out Schedule A Accurately

Input the adjustments for each year as outlined in the Form 8986 and partner statements.

Calculate the imputed underpayment using IRS rules based on allocation percentages and tax rates.

Include self-employment tax adjustments if applicable—a common factor for founder-owners involved in operations.

Step 4: Calculate Additional Taxes, Interest, and Penalties

Compute additional income tax due on the adjustments.

Calculate IRS interest from the year the audit adjustments pertain to. Reference current IRS interest rates.

Record late penalties, if any, under IRC guidance.

Step 5: Submit With Your Tax Return

File Form 8978 with your federal income tax return for the year the final partnership adjustment was issued.

Include payment for any additional tax owed.

Retain documentation, including Form 8986 and related calculations.

Common Challenges and How to Overcome Them

Reconciling Adjustments to Prior Returns

Discrepancies often arise when reconciling pushed-out audit adjustments with previously filed returns. To manage this:

Obtain all supporting schedules from the partnership.

Align your accounting system or ledger with adjustments.

Use tools like Haven’s reporting solutions to simplify reconciliation.

Consult advisors for complex basis or capital account movements.

Adjustments Across More Than Four Years

Schedule A supports four tax years. If adjustments span more:

Attach supplemental statements to include additional years.

Document all adjustments clearly to ensure IRS compliance.

Self-Employment Tax Considerations

If partners materially participate, self-employment tax may apply to increased income due to audit adjustments. A collaborative review between finance and payroll is key to addressing:

Revised SE tax obligations

Additional Medicare or Social Security contributions

Integrating Form 8978 Reporting with Finance Operations

Proactive finance leadership plays a vital role in managing Form 8978 obligations without derailing startup operations.

Best Practices for Founders and Controllers:

Create Seamless Data Flows: Confirm timely delivery of Form 8986 from partnerships. Build tracking processes to ensure prompt reporting.

Leverage Expert Assistance: Involve tax advisors experienced in the BBA regime to avoid misinterpreting audit data.

Upgrade Accounting Infrastructure: Adopt systems that monitor partner basis, capital accounts, and K-1 distributions over time.

Forecast Cash Needs Early: Plan for possible additional liabilities related to audit adjustments before filing deadlines hit.

Stay Informed: Refer to the IRS partnership audit program page for real-time updates.

Relationship Between Form 8978 and Form 8986

These two forms are closely tied, and understanding their functions is essential for compliance.

Key Differences

Aspect | Form 8986 | Form 8978 |

Issued By | Partnership | Partner |

Purpose | Notify partners of audit adjustments | Report tax liabilities from adjustments |

Submission Timing | Sent post-audit finalization | Filed with current partner’s tax return |

Key IRC Sections | Section 6226 | Section 6227 |

Partners receiving Form 8986 must use it to populate and file Form 8978.

Example: Form 8978 in Action for a Startup Partner

Imagine a startup with three partners is audited for underreported revenue in 2019 and 2020. The partnership opts for a push-out election and issues each partner a Form 8986.

Partner A, a corporate partner, proceeds as follows:

Retrieves Form 8986 and supporting schedules.

Finance lead compiles Schedule A data and calculates the imputed underpayment plus interest.

Files Form 8978 alongside the 2023 federal tax return.

Submits full payment and retains all supporting documentation.

This process satisfies IRS requirements and prevents double taxation or misallocation.

Why Form 8978 Matters for Startup Founders and Finance Leaders

In closing, Form 8978 is not just a compliance obligation—it’s a key part of startup tax strategy under the BBA audit regime. It ensures that partners, not partnerships, assume audit-related liabilities accurately and efficiently.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026