Go Back

Last Updated :

Last Updated :

Jan 15, 2026

Jan 15, 2026

Reporting Interest Income Correctly: A Founder’s Guide to Form 1099-INT

For founders managing the financial health of startups, e-commerce ventures, or agencies, understanding tax forms like Form 1099-INT is crucial. Properly reporting interest income not only keeps your business compliant but can prevent costly IRS issues down the line.

This guide breaks down everything you need to know about Form 1099-INT so you can make informed decisions—without getting buried in tax jargon.

What is Form 1099-INT and Why Founders Should Care

Form 1099-INT is an IRS tax document used to report interest income of $10 or more paid to you or your business within a calendar year. Sources might include interest from bank accounts, loans you’ve extended, bonds, or other interest-generating investments. For founders, knowing when this form applies has direct implications for accurate bookkeeping and tax liability.

Why Accurate Reporting Matters

Avoid IRS penalties: The IRS cross-checks your tax return with the 1099-INT forms they receive. Missing income can trigger fines or audits.

Improve tax planning: Interest income adds to your total taxable income, influencing tax brackets and potential deductions.

Maintain credible records: Precision in tracking revenues such as interest builds trust with investors, lenders, and potential partners.

Startup founders often overlook how easily interest income can accumulate—from holding large cash reserves in interest-bearing accounts to issuing private loans or purchasing bonds.

Common Sources of Interest Income Entrepreneurs Should Track

To report interest income correctly, you need to identify all the places it might originate within your operations. Below are sources founders often encounter:

Source | Description | Examples |

Bank and Money Market Accounts | Interest earned on checking/savings balances | Business savings account interest |

Bonds and Debentures | Earnings from corporate or government bonds | Municipal bonds held by your startup |

Loans to Others | Interest on loans your business has extended | Private loan to a contractor or client |

Notes Receivable | Interest included in installment payments | Seller financing payments received |

CD and Time Deposits | Interest earned on Certificates of Deposit | Interest on CDs used as corporate reserve assets |

Monitoring each of these categories helps prevent underreporting, which could invite IRS scrutiny.

How to Handle Form 1099-INT for Your Startup: Step-by-Step

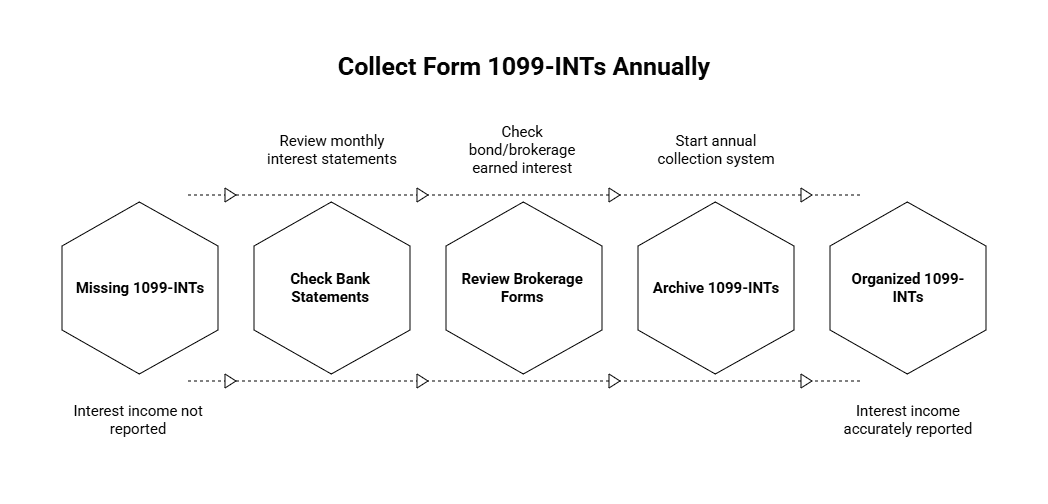

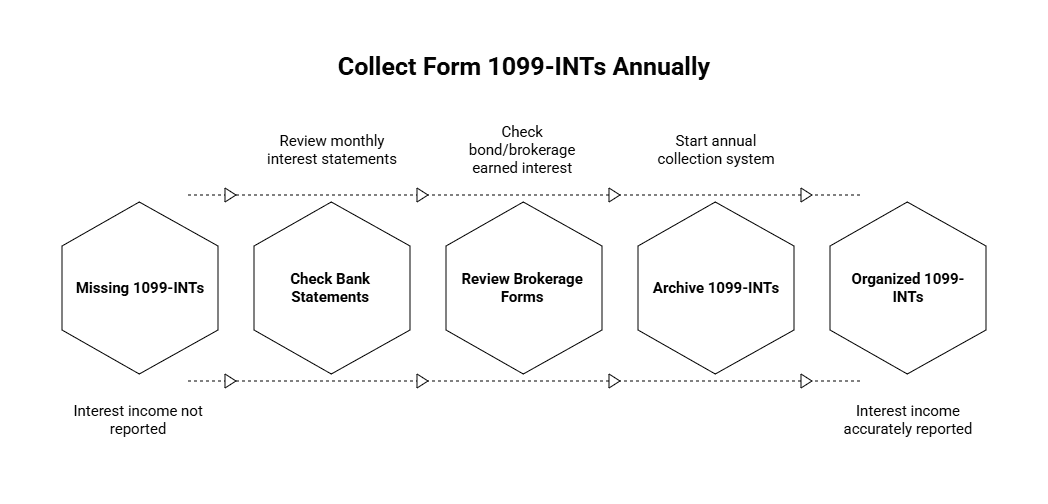

1. Collect Form 1099-INTs from Payers

Banks, bond issuers, and anyone who’s paid your business $10 or more in interest must send you a Form 1099-INT by January 31. Look in these places:

Monthly or annual bank interest statements

Bond/brokerage forms for earned interest

Interest-bearing customer payment contracts

Start a system to collect and archive them annually.

2. Reconcile Your Books to Your 1099-INT Forms

Compare the received 1099-INT amounts with your general ledger or accounting software. This helps catch:

Missed journal entries

Payment misclassifications

Underreported or mistakenly categorized income

Create a dedicated interest income account in your chart of accounts to make this easier.

3. Include Interest Income in Your Tax Filings

Where you report this income depends on your business structure:

Business Entity Type | Where to Report Interest Income |

Sole Proprietor/Single-Member LLC | Schedule B (Form 1040) |

Partnership/Multi-Member LLC | Schedule K-1 and Form 1065 |

C Corporation | Report directly on Form 1120 |

S Corporation | Schedule K-1 and Form 1120-S |

Consult your tax advisor to ensure everything is placed on the right forms.

4. Issue Form 1099-INT When You’re the Payer

If your startup paid $10 or more in interest to lenders, contractors, or other recipients, you're required to issue Form 1099-INT by January 31. This applies when you’ve:

Taken loans from individuals

Paid investors a set return with interest

Held notes payable with legally defined rates

Filing mistakes are common here, so our guide on Form 1099 requirements for startups can help if you’re unsure when this reverse-reporting applies.

Additional Tax Considerations for Founders Handling Interest Income

Impact on R&D Spend and Engineering Budgets

Interest income changes your total taxable income, which can impact eligibility and calculations for R&D tax credits. For example, if you’re deferring revenue but receiving passive interest income, your year-end tax position might shift. Coordinate with your controller and CPA to factor this in when applying for credits.

For support, Haven offers strategic tax planning that brings together R&D credit optimization, grant eligibility, and tax compliance.

Coordination with Payroll and Annual Tax Filings

Staying on top of Forms 940, W-2s, and 1099 filings ensures consistent and complete documentation for regulators. Consider integrating interest income checks into your tax calendar alongside other annual compliance deadlines. Our Form 940 guide walks through these filings in a startup-friendly format.

Practical Tips to Simplify Interest Income Reporting for Founders

Automate accounting tasks: Use platforms like QuickBooks, Xero, or similar to classify and track interest automatically.

Centralize document storage: Keep all 1099-INT forms (both received and issued) saved to a shared folder.

Mark deadlines on a founder tax calendar: Key dates include January 31 (send/receive 1099s) and April 15 (standard tax day).

Perform quarterly reconciliations: Saves time and catches problems early.

Enlist startup-savvy advisors: Work with tax professionals experienced in early-stage company finances and investor documentation.

Where to Find Official IRS Instructions

Founders can refer directly to the IRS Instructions for Form 1099-INT for full legal definitions and procedures on interest reporting. While the content is thorough, it’s often best interpreted with input from a CPA who participates in founder advisory or startup tax services.

Mastering Form 1099-INT to Protect and Grow Your Startup

Smart founders treat compliance not just as a requirement, but as a growth tool. By mastering Form 1099-INT, you streamline year-end workflows, avoid regulatory pitfalls, and can optimize tax deductions and credits more confidently. And as your business scales, clean financial documentation gives stakeholders greater confidence to invest or partner.

If your team could use support automating bookkeeping, staying compliant, or claiming startup-specific tax credits like R&D, we’re here to help.

For founders managing the financial health of startups, e-commerce ventures, or agencies, understanding tax forms like Form 1099-INT is crucial. Properly reporting interest income not only keeps your business compliant but can prevent costly IRS issues down the line.

This guide breaks down everything you need to know about Form 1099-INT so you can make informed decisions—without getting buried in tax jargon.

What is Form 1099-INT and Why Founders Should Care

Form 1099-INT is an IRS tax document used to report interest income of $10 or more paid to you or your business within a calendar year. Sources might include interest from bank accounts, loans you’ve extended, bonds, or other interest-generating investments. For founders, knowing when this form applies has direct implications for accurate bookkeeping and tax liability.

Why Accurate Reporting Matters

Avoid IRS penalties: The IRS cross-checks your tax return with the 1099-INT forms they receive. Missing income can trigger fines or audits.

Improve tax planning: Interest income adds to your total taxable income, influencing tax brackets and potential deductions.

Maintain credible records: Precision in tracking revenues such as interest builds trust with investors, lenders, and potential partners.

Startup founders often overlook how easily interest income can accumulate—from holding large cash reserves in interest-bearing accounts to issuing private loans or purchasing bonds.

Common Sources of Interest Income Entrepreneurs Should Track

To report interest income correctly, you need to identify all the places it might originate within your operations. Below are sources founders often encounter:

Source | Description | Examples |

Bank and Money Market Accounts | Interest earned on checking/savings balances | Business savings account interest |

Bonds and Debentures | Earnings from corporate or government bonds | Municipal bonds held by your startup |

Loans to Others | Interest on loans your business has extended | Private loan to a contractor or client |

Notes Receivable | Interest included in installment payments | Seller financing payments received |

CD and Time Deposits | Interest earned on Certificates of Deposit | Interest on CDs used as corporate reserve assets |

Monitoring each of these categories helps prevent underreporting, which could invite IRS scrutiny.

How to Handle Form 1099-INT for Your Startup: Step-by-Step

1. Collect Form 1099-INTs from Payers

Banks, bond issuers, and anyone who’s paid your business $10 or more in interest must send you a Form 1099-INT by January 31. Look in these places:

Monthly or annual bank interest statements

Bond/brokerage forms for earned interest

Interest-bearing customer payment contracts

Start a system to collect and archive them annually.

2. Reconcile Your Books to Your 1099-INT Forms

Compare the received 1099-INT amounts with your general ledger or accounting software. This helps catch:

Missed journal entries

Payment misclassifications

Underreported or mistakenly categorized income

Create a dedicated interest income account in your chart of accounts to make this easier.

3. Include Interest Income in Your Tax Filings

Where you report this income depends on your business structure:

Business Entity Type | Where to Report Interest Income |

Sole Proprietor/Single-Member LLC | Schedule B (Form 1040) |

Partnership/Multi-Member LLC | Schedule K-1 and Form 1065 |

C Corporation | Report directly on Form 1120 |

S Corporation | Schedule K-1 and Form 1120-S |

Consult your tax advisor to ensure everything is placed on the right forms.

4. Issue Form 1099-INT When You’re the Payer

If your startup paid $10 or more in interest to lenders, contractors, or other recipients, you're required to issue Form 1099-INT by January 31. This applies when you’ve:

Taken loans from individuals

Paid investors a set return with interest

Held notes payable with legally defined rates

Filing mistakes are common here, so our guide on Form 1099 requirements for startups can help if you’re unsure when this reverse-reporting applies.

Additional Tax Considerations for Founders Handling Interest Income

Impact on R&D Spend and Engineering Budgets

Interest income changes your total taxable income, which can impact eligibility and calculations for R&D tax credits. For example, if you’re deferring revenue but receiving passive interest income, your year-end tax position might shift. Coordinate with your controller and CPA to factor this in when applying for credits.

For support, Haven offers strategic tax planning that brings together R&D credit optimization, grant eligibility, and tax compliance.

Coordination with Payroll and Annual Tax Filings

Staying on top of Forms 940, W-2s, and 1099 filings ensures consistent and complete documentation for regulators. Consider integrating interest income checks into your tax calendar alongside other annual compliance deadlines. Our Form 940 guide walks through these filings in a startup-friendly format.

Practical Tips to Simplify Interest Income Reporting for Founders

Automate accounting tasks: Use platforms like QuickBooks, Xero, or similar to classify and track interest automatically.

Centralize document storage: Keep all 1099-INT forms (both received and issued) saved to a shared folder.

Mark deadlines on a founder tax calendar: Key dates include January 31 (send/receive 1099s) and April 15 (standard tax day).

Perform quarterly reconciliations: Saves time and catches problems early.

Enlist startup-savvy advisors: Work with tax professionals experienced in early-stage company finances and investor documentation.

Where to Find Official IRS Instructions

Founders can refer directly to the IRS Instructions for Form 1099-INT for full legal definitions and procedures on interest reporting. While the content is thorough, it’s often best interpreted with input from a CPA who participates in founder advisory or startup tax services.

Mastering Form 1099-INT to Protect and Grow Your Startup

Smart founders treat compliance not just as a requirement, but as a growth tool. By mastering Form 1099-INT, you streamline year-end workflows, avoid regulatory pitfalls, and can optimize tax deductions and credits more confidently. And as your business scales, clean financial documentation gives stakeholders greater confidence to invest or partner.

If your team could use support automating bookkeeping, staying compliant, or claiming startup-specific tax credits like R&D, we’re here to help.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026